Fake Forex Brokers List in India

Blacklist of Forex Brokers in India:

| Name | Establishment date |

|---|---|

Profit trade |

2017 |

1с Option |

2015 |

Armax Trade |

2019 |

ASIC Trader |

2015 |

CFDS100 |

2018 |

Forex trading in India is popular despite many legal restrictions. In particular, from a technical perspective, local traders can enter into transactions using Indian rupees only in pairs with the US dollar, Japanese yen, and the British pound. There are rumors that soon the Indian authorities are preparing to ease the rules to provide users with more opportunities to earn.

In terms of GDP, the country is in the top ten, which creates favorable terms for trade. In this article, the Traders Union will explore regulatory matters in India, as well as how to avoid scam brokers on the Forex Scam List.

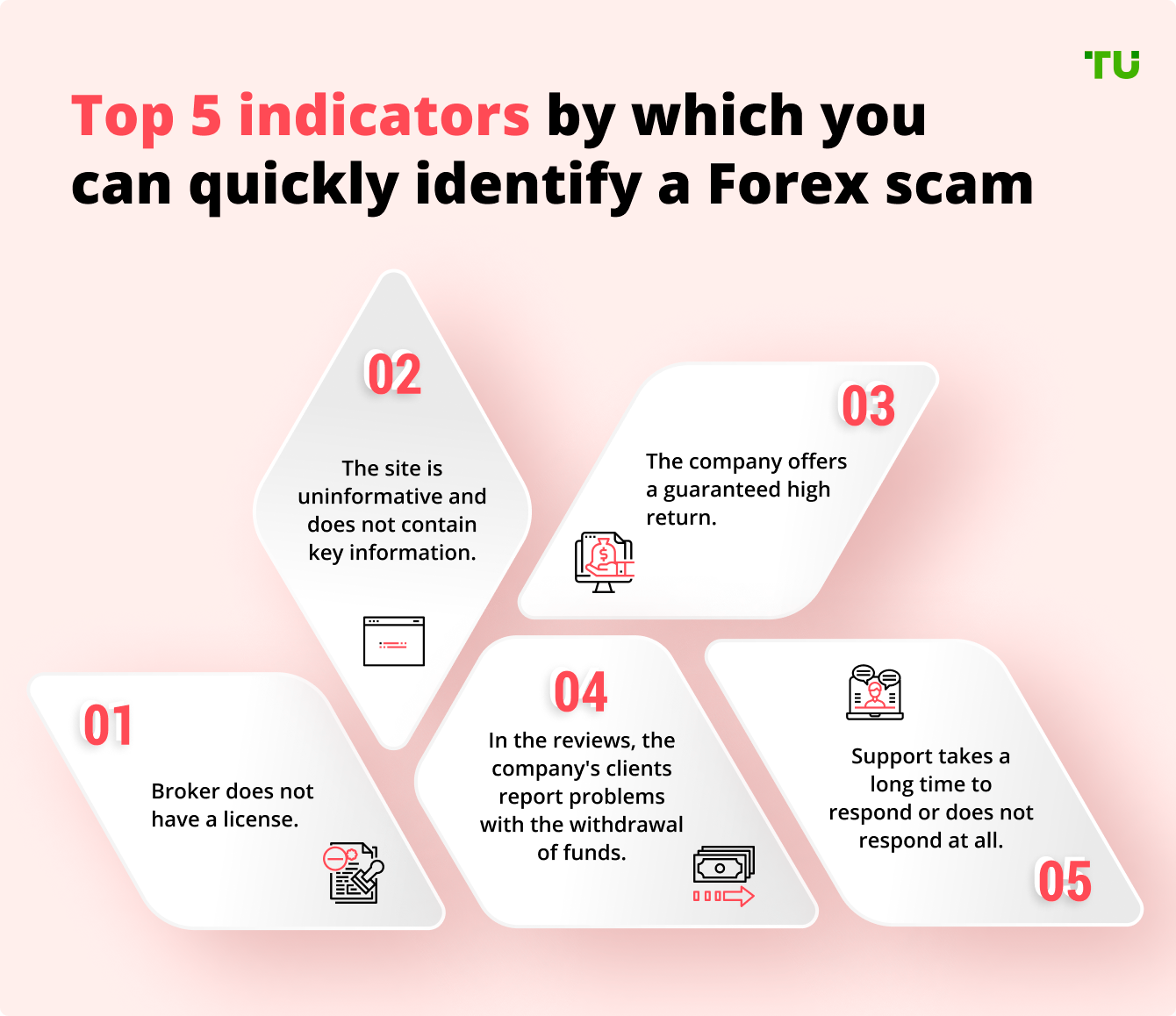

5 Indicators which help you to identify a scam

Is Forex legal in India?

Forex is the most active and highly liquid financial market, whose participants are banks from different countries, large funds, and companies, as well as private investors with large personal capital. Transactions in this market start from $1 million.

For an average person, access to Forex is open only through brokers acting as intermediaries. Such financial partners provide trading software (browser, desktop, and mobile versions of the terminal), and analytical and training tools.

The essence of earnings is that traders are trying to forecast further changes in the exchange rate of a certain asset (these may be currency pairs, stocks, spot metals, etc.). If the transaction is profitable, the broker is obliged to pay the money. Otherwise, a certain amount will be charged to the user's account.

In India, trading on the international currency market is regulated and legal.

The activities of FinTech companies in the country are controlled by the following authorities:

-

Reserve Bank of India (RBI);

-

Securities and Exchange Board of India (SEBI);

-

Insurance Regulatory and Development Authority of India (IRDAI).

The RBI regulates the activities of brokers by the rules and requirements established in the country. In particular, this includes the "Foreign Exchange Management Act".

Blacklist of Forex Brokers in India

In the developing Indian market, there are both faithful brokerage organizations and financial scammers. Such scammers "hunt" for newcomers who are ready to believe in empty promises. Novice traders do not go into legal nuances and lose four-digit amounts due to their blind confidence.

You can see the Fake Forex Brokers List for India in the table below The companies have acquired negative goodwill, as they violate the requirements of local and international legislation, engage in financial extortion, and do not allow withdrawals. The Traders Union will focus in detail on the main facts that TU uncovered about these fraudulent brokers, as well as indicators of their scams.

| Name | Establishment date | Minimal losses |

|---|---|---|

Profit trade |

2017 |

$250 |

1с Option |

2015 |

$250 |

Armax Trade |

2019 |

$400 |

ASIC |

2015 |

$200 |

CFDS100 |

2018 |

$100 |

SkyFX |

2011 |

$100 |

High Tech Trade |

2021 |

$500 |

Investing Capital |

2014 |

$250 |

CFreserve |

2018 |

$250 |

Libra Markets |

2019 |

$250 |

FVP Trade |

2019 |

$5 |

Ibell Markets |

2021 |

$100 |

Profit Trade

Profit Trade claims to provide services from 2017, but its domain history has been recorded since 2011. The company does not provide legal documents supporting its legal operation. It is known that the company is registered in Bulgaria and the Marshall Islands.

The financial partner gives a lot of promises of comfortable trading and a variety of assets. Trading in currency pairs, precious metals, cryptocurrencies, and stocks is available. You can choose from several tariff plans and opportunities for margin trading with leverage up to 200x.

The main signs of its scam:

-

absence of legal protection (because the broker operates illegally);

-

trading without liquidity providers, which is conventional for second-rate activities;

-

bonuses with enslaving terms for their processing;

-

unreasonable account blockages;

-

exhausting user deposits by quotes manipulation;

-

many negative reviews.

1с Option

Although 1c Option presents itself as a reliable binary options broker that holds a leading position in the market, the client reviews don't speak in its favor. The company has been providing services since 2015 and managed to defraud many. It is registered in the Marshall Islands and is silent about having a license. This financial partner attracts you with offers of profitable terms. Among the main advantages, it indicates access to 200+ assets, trading signals, training, bonus rewards, and insurance. There is an opportunity to practice on a demo account. The entry barrier is $250.

The 1c Option got onto the Forex Scammer List for several reasons, including:

-

offshore registration and violation of the requirements of international law;

-

absence of a brokerage license;

-

obsessive managers who extort new investments under the pretext of "guaranteed profit";

-

spoiled reputation;

-

issues with the withdrawal of funds.

Armax Trade

Armax Trade is another fake broker that has been extorting funds from traders since 2019 through fraud and deception. Its reputation has been destroyed by an abundance of negative reviews. The company changed regulators several times and all the time indicated fake ones, in particular ARCET (Association for Regulation and Certification of Exchange Trading). The entry barrier is $400. When depositing funds, bonuses are imposed on traders in the amount of 100% of the deposit amount.

Among available indicated assets, there are currencies, stocks, indices, and commodities.

The main signs of its scam are:

-

forced bonuses with enslaving terms;

-

junk information instead of training;

-

falsified certificates and absence of regulation;

-

connection to other fraudulent projects;

-

groundless zeroing of deposits;

-

absence of financial liability;

-

inability to withdraw earned funds.

ASIC Trader

ASIC Trader positions itself as a dynamic company whose partners are the largest financial institutions. Unsuspecting traders are promised the use of advanced technologies, high-quality client service, instant settlement of transactions, etc. The initial deposit is $200.

The company was blacklisted for these reasons:

-

absence of guarantees of stable operation of the platform (scammers purposely fabricate a technical failure and steal traders’ funds);

-

changing the terms of cooperation unilaterally;

-

absence of regulation and licenses;

-

theft of users' personal data;

-

negative reviews indicating financial extortion and misrepresentations;

-

the operation of the platform exists only for depositing funds.

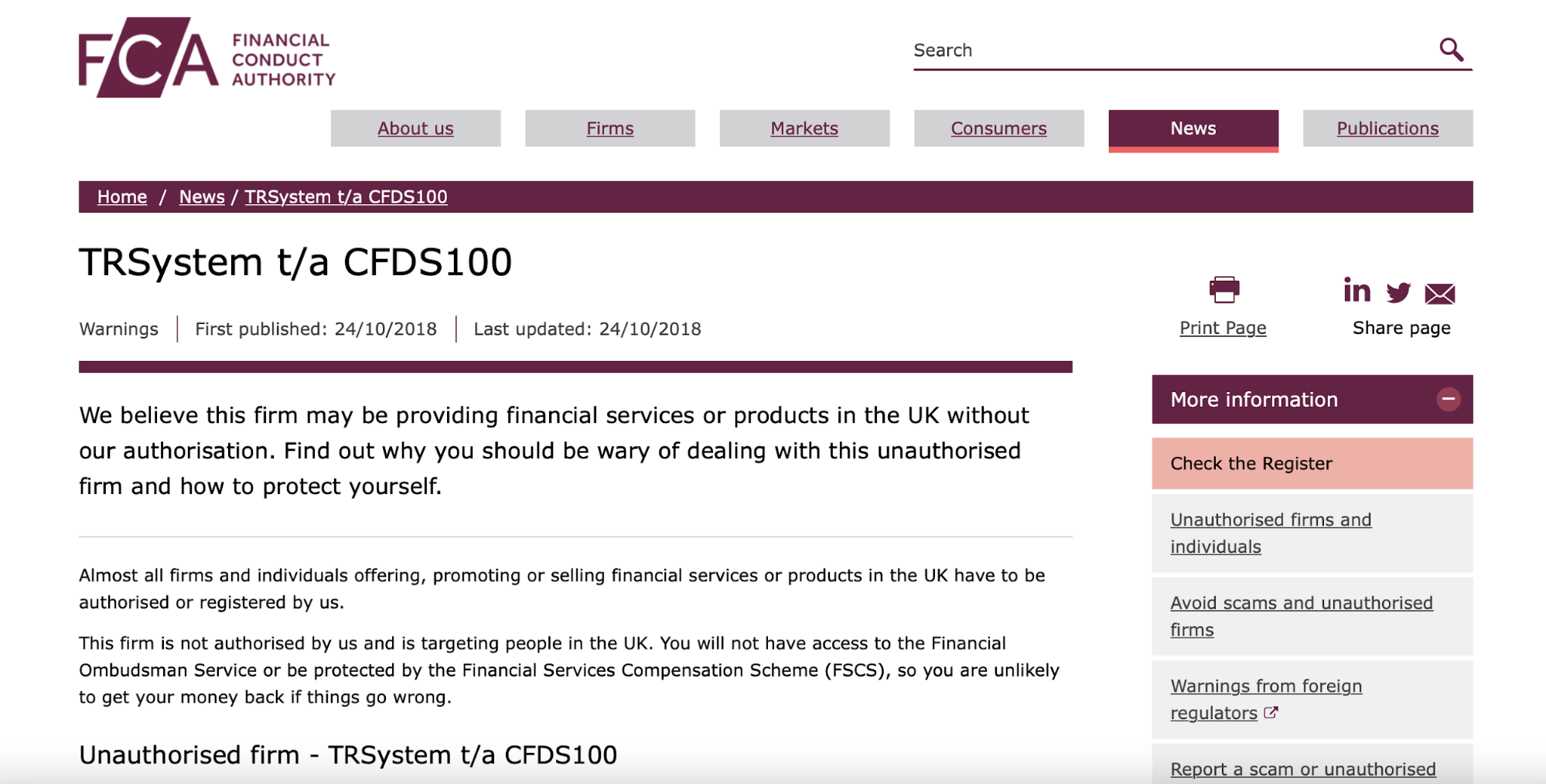

CFDS100

CFDS100 has been known since 2018. The company attracts users with a variety of trading tools, access to margin trading (leverage up to 1:200), and a simple terminal with many functions. The minimum deposit is $100, which is reasonable even for beginners.

According to legend, CFDS100 is a broker with an office in Estonia. However, the company does not provide any proof of registration in that country; and there is no certificate of incorporation or license on the platform. Moreover, Estonian, Australian and British regulators have already added it to their blacklists. You can see the FCA warning is below:

the FCA warning

The main signs of the CFDS100 scam include the following:

-

a warning about financial fraud from multiple regulators;

-

refusal to withdraw funds;

-

absence of legal documents supporting lawful operation;

-

manipulating the terminal;

-

no service from support.

SkyFX

SkyFX is a brokerage organization that has been providing services since 2011. According to legend, the project team consists of professional traders and financial experts, but the company does not mention a single name. This financial partner states that it operates under European legislation and has received a license from CySEC (Cyprus). The company does not give any confirmation about this, and SkyFX is not listed in the database of the local regulator, which means that it is an unregulated broker.

The main signs of its scams are as follows:

-

fake quotes; the broker plays unfairly;

-

absence of regulation;

-

fabricated analytical and statistical information;

-

refusal to pay profit;

-

issues with support;

-

an abundance of negative reviews on various web resources.

Hightech Trade

Hightech Trade is a brokerage organization registered in the Marshall Islands. The company has been in existence since 2021. It does not provide legal documents (certificate of incorporation, license, etc.) to support its claim of lawful operation. According to legend, more than 700,000 users are registered on the platform, including from India. There is no evidence for such impressive statistics. As for trading terms, the broker offers to work with Forex/CFDs. The entry barrier is $500, and there is also access to margin trading with a leverage of up to 1:500.

The main signs of its scam are:

-

manipulated terminal with fake quotes and charts;

-

offshore registration in the Marshall Islands;

-

absence of legal grounds for operation;

-

issues with the withdrawal of funds;

-

constant extortion of funds;

-

anonymity of the project creators and a policy of hidden activity.

Investing Capital

The Investing Capital broker is registered in Bulgaria. However, the above is only a legend, and the company even has a fake address. The situation is similar to other contact details. This organization adheres to a policy of hidden activity, and its top managers are anonymous scammers who only know how to spread empty promises. The company claims safe and comfortable trading on MT4 and offers to download software directly from the fake broker's website. In the reviews, traders complain about the manipulated terminal and the theft of money when installing a remote access program.

The main signs of its scam are:

-

fake contact details;

-

fraudulently controlled software;

-

the actual period of existence is very short, as indicated by the results of checking the domain history;

-

many negative feedbacks from the traders;

-

fake advice given by its analysts only results in exhausting the deposit;

-

complete absence of financial liability;

CFreserve

A glance at CFreserve might give you glossy promises of financial reward in forex trading, but let's cut through the smoke and mirrors. Many regulators like UK FCA, FSMA, and the CNMV have blacklisted CFreserve and user feedback is generally negative.

The main signs of its scam are:

-

Lack of transparency. CFreserve operates without transparency. Lack of clear information about their team and operations? Red flag alert.

-

Exaggerated returns. They promise you financial returns that sound too good to be true. Spoiler alert: They usually are. If it sounds like a financial fairy tale, it probably is.

-

Lack of regulation. Legitimate brokers are regulated by relevant authorities. CFreserve? Not so much. The absence of proper regulatory oversight is a glaring warning sign.

-

Withdrawal troubles. Numerous complaints about withdrawal issues scream caution. A broker that makes it hard for you to withdraw your profits, is one to avoid.

-

Unresponsive support. The customer support at CFreserve is not responsive to inquiries. When you're in trouble, a reliable support system is your lifeline – don't count on it here.

A close look at CFreserve reveals the deceit. If you value your hard-earned money, this is one territory you might want to steer clear of.

How to Avoid Forex Trading Scams?Libra Markets

Libra Markets presents itself as a platform for online trading, focusing on various financial instruments, including Forex. The company asserts to offer a range of services to traders, allowing them to participate in the global financial markets. However, there are notable concerns.

The main signs of its scam are:

-

Cryptic operation. The lack of transparency about Libra Markets’ operations and team is alarming. The lack of transparency about ownership and even the trading platform in use, does not inspire confidence.

-

Lack of regulation. Reputable brokers flaunt their regulatory status. Libra Markets? Not so much. The absence of proper regulation is an alarming sign.

-

Withdrawal challenges. Withdrawal issues are common with Libra Markets, and a broker playing games with your money is never a good sign.

-

No live support. Libra Markets' customer support does not support live responses, meaning traders have to wait for long before getting any feedback on issues.

-

Exaggerated claims. Libra Markets claims to have served over 225,000 dealers and to have over 1,000 new users daily. These claims cannot be validated and only serve to entice new traders.

Libra Markets is unregulated and behind the polished façade lies a web of deception. The negative feedback from users is a warning sign to avoid investing your money with them.

FVP Trade

FVP Trade is a forex broker established in 2019, providing trading services for forex, commodities, indices, and cryptocurrencies. Based on certain reviews, the platform is deemed suitable for beginners, offering favorable spreads and a lack of slippage. It's worth mentioning there is a lot of negative feedback, highlighting concerns regarding potential manipulations by the company. Note that FVP Trade operates without a license or regulation, which may raise apprehension among certain traders.

The main signs of its scams are:

-

Has removed its FCA regulation as it didn't cover CFD trading

-

Unlicensed and unregulated broker

-

Deceptive marketing

-

Unsolicited phone calls and emails

Ibell Markets

Ibell Markets is an online forex trading broker that operates on the MetaTrader 5 platform. The broker offers a wide range of trading instruments, including forex, commodities, indices, shares, cryptocurrencies, and futures. However, it's worth noting that Ibell Markets is an unregulated offshore broker, which may raise concerns for traders.

As an offshore broker, there is a risk involved in investing with them. While the broker claims to maintain high standards of governance, compliance, and customer protection through various regulations and fund segregation, these claims lack regulatory backing. Additionally, Ibell Markets presents an inconsistency by claiming its headquarters in London while being incorporated as an International Business Company (IBC) in St. Vincent and the Grenadines. This inconsistency raises doubts about the credibility and trustworthiness of the broker.

The main signs of its scams are:

-

Lack of regulation and safety of funds

-

Ibell Markets is an unregulated offshore broker

-

Inconsistent information

-

Negative reviews

-

Automated trading software, which is another red flag

Most common scams schemes in India

Forex mutual fund (PAMM) scams

PAMM accounts allow investors to allocate their funds to a specific trader or money manager who then trades on their behalf. PAMM schemes turn out to be more smoke and mirrors than genuine opportunity. Managers often abuse this system and disappear with the money.

EA/Trading robots scam

These are automated trading systems designed to execute and manage trades on behalf of traders in the financial markets. Some strategists can manipulate these systems to yield fake results while allowing them to skim off funds.

Trading signals Forex scams

Trading signals are supposed to help traders take advantage of opportunities in the forex market. However, many end up being inaccurate leading to financial loss.

“Holy Grail” Forex scams

The “Holy Grail” promises unbeatable strategies, but it's often a sly illusion In the forex world, there's no magic potion for guaranteed success. Avoid anyone trying to sell you this “magic strategy”.

Price manipulation

Brokers manipulate prices by intentionally interfering and distorting the normal price movements of stocks, commodities, or currencies, within a market. It's a deceptive practice that creates a false or artificial perception of supply and demand.

5 steps to help verify if a Forex broker is legitimate

Conducting proper due diligence protects you from falling prey to broker scams and sets you up for a transparent, ethical trading experience. Follow these tips before committing funds to any Forex broker:

Check if the broker is regulated - Legitimate brokers are registered with financial regulators like the NFA, FCA, CySEC, ASIC etc. Verify the broker's registration on the regulator's website.

Read reviews and check forums - Search online to see what current/past clients say about the broker. Beware of fake reviews. Check scam reporting forums.

Check trading conditions - Legit brokers offer fair trading conditions like tight spreads, no hidden fees, and prompt order execution. Beware of brokers advertising unrealistic returns that sound too good to be true.

Verify company information - Check if the company details like address, ownership, management team etc. can be verified. Be wary of offshore brokers with little information.

Test customer service - Contact customer support and assess their responsiveness and knowledge. Good brokers offer 24/5 support across phone, email and live chat.

How To Avoid Forex Scams?

To avoid falling victim to forex scams, it is crucial to follow these guidelines:

Avoid high-risk brokers

Be cautious of brokers that offer excessively high returns or promises of guaranteed profits. Such claims often indicate unrealistic and potentially fraudulent schemes. Choose brokers that prioritize transparency and realistic trading expectations.

Work with regulated companies

It is crucial to collaborate with forex brokers that are regulated by reputable financial authorities. Regulation ensures that the broker operates under specific rules and guidelines, providing a higher level of protection for your funds.

Don't choose a broker that offers automatic trades

Be wary of brokers who claim to have foolproof automated trading systems that generate consistent profits. Successful forex trading requires a combination of analysis, trading strategy, and decision-making skills, which cannot be entirely replaced by automated systems.

Watch out for false promises

Be skeptical of brokers making extravagant promises or guarantees of overnight wealth. Legitimate brokers understand the risks involved in forex trading and emphasize responsible trading practices.

Verify that the broker's website is secure

Before providing any personal or financial information, ensure that the broker's website is secure. Look for indicators such as a secure SSL connection and a padlock icon in the browser address bar.

When you follow these guidelines, you can significantly reduce the risk of falling victim to forex scams. Remember to conduct thorough research, read reviews from reliable sources, and seek advice from experienced traders or financial professionals.

The best Forex brokers in India

FAQs

How to detect if a broker is operating fraudulently?

Fraudulent companies often get blacklisted by reputable regulators, and also receive negative feedback. You can find out about the disadvantages of cooperation from the comments of real clients on independent feedback platforms. In particular, the main signs of second-rate activities include: the absence of regulation, promises of high profitability, and lies about work experience and success.

How to check if a broker is licensed?

Blacklisted brokers often indicate that they operate within the legal framework and provide fake license numbers. However, it is not recommended to trust their bare word. It is necessary to verify the authenticity of the documents. This can be done on the official websites of regulators. In general, the information there is open for public access. Brokers providing services in India may have a license from a local regulator or others among the reputable ones.

Where can I find information about verified brokers in India?

You can read reviews on unbiased websites such as the Traders Union. All the pros and cons of cooperation with companies, the main trading opportunities, the availability of legal documents, etc., are described in detail on the TU platform.

What is the danger of cooperation with scammers?

Fake brokerage organizations only talk about the benefits of cooperation, but they are not going to fulfill their promises. The whole matter comes down to the extortion of your money, manipulation of the trading process, and simulation of profitable transactions. Scam platforms work exclusively for the deposit of funds, and don't plan to pay out profits. Even initial deposits are not refunded to clients.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.