Fake Forex Brokers List | Pakistan

Pakistan is a state in South Asia that is considered one of the largest in the world by population. In the 2000s, the economy of this country showed significant growth – 7% annually, but now the situation is not so rosy. People are forced to look for ways to earn money. One of the most popular is Forex trading, as it can bring more profit than when making bank deposits at low interest.

The legislative framework of Pakistan allows investors to trade on the international currency market legally and have an honest income. However, concerning earnings, it is important not to fall into the trap of the financial scammers on the Forex Scammer List. In this article, the Traders Union describes in detail how not to become a victim of scammers, and also presents a list of second-rate agencies that you should avoid.

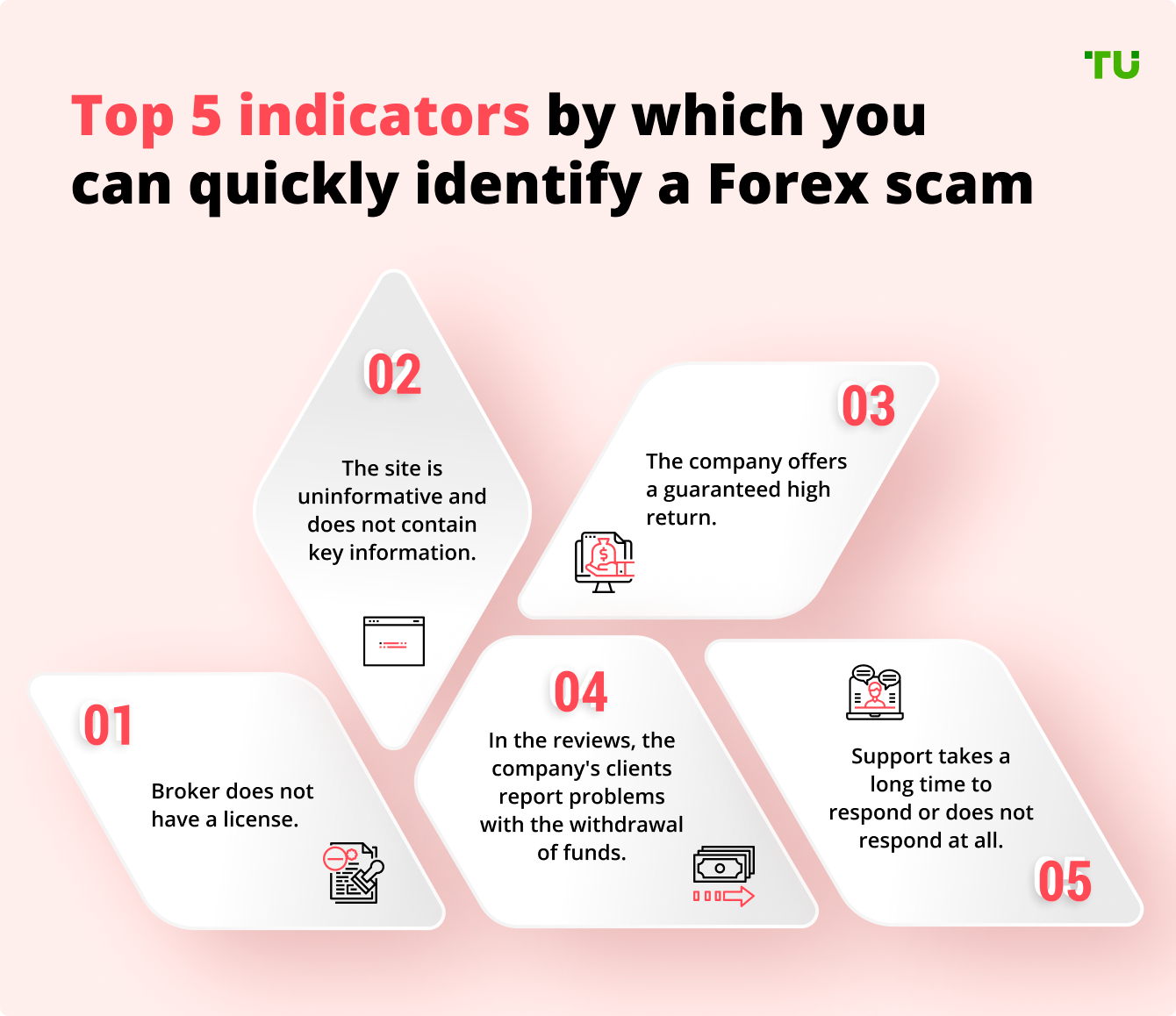

5 Indicators which help you to identify a scam

Is Forex legal in Pakistan?

Forex trading in Pakistan is legal. Local traders are advised to work with licensed brokers who have obtained permission from the Securities and Exchange Commission of Pakistan (SECP). At the time of this writing, there are already more than 200 brokerage organizations in the database of this financial regulatory authority. The full list can be found on the official SECP website:

Securities and Exchange Commission of Pakistan (SECP)

It should be noted that the Securities and Exchange Commission of Pakistan does not provide a blacklist of brokers violating the rights of traders. However, you can contact the regulator directly and check whether the company has a permit if you cannot find the required information yourself.

SECP operates under the Securities Act, 2015, through which brokers are licensed. Provisions of this Act set out the procedure of selection, the consequences of refusal to cooperate with the regulator and other obligations. Also, Pakistani investors can choose brokers with licenses obtained from other reputable regulators.

The Securities and Exchange Commission of Pakistan (SECP) has issued warnings and notices against unregulated brokers over the years. However, lack of strong enforcement powers limited effectiveness. In 2015, the SECP made it mandatory for brokers to register and be licensed to operate in Pakistan, however many dodgy brokers still operated without license.

In 2020, new legislation gave more teeth to the SECP to act against unregulated entities - gave power to raid offices, seize assets etc. The SECP has created a special department focused on investigating illegal Forex and commodity trading. It raided over a dozen unlicensed brokerages. Brokers are now required to maintain minimum liquid assets and submit financial reports.

But critics say sanctions and fines issued to fake brokers are still too low. Punishments don't act as a strong deterrent.

Remember that Forex trading is a high-risk activity. The right choice of a financial partner is 50% of one’s success. The broker must act as a reliable intermediary in concluding transactions on the international currency market, and observe fair trading and payment discipline so that the trader can earn.

Is Forex Legit? Forex Scam ExplainedBlacklist of Forex brokers in Pakistan

When choosing a brokerage organization, it is necessary to pay attention to many points such as the actual operation period, the availability of legal grounds to engage in financial activities, a proper commercial offer, etc. However, you should first check the Fake Forex Brokers List Pakistan.

In the table below you will find a list of fraudulent companies, the date of their foundation, and the amount of a firm’s minimal losses. You will also see why these projects were blacklisted and are not worthy of trust.

| Name | Establishment date | Minimal losses |

|---|---|---|

Miki Forex |

1998 |

$20 |

NetoTrade |

2011 |

$500 |

Opteck |

2011 |

$250 |

Real Trade Group |

2003 |

$20 |

Vertical Markets |

2015 |

$30 |

YoutradeFX |

2007 |

$100 |

ZarFx |

2013 |

$500 |

Adamant Finance |

2014 |

$10 |

AXEForex |

2017 |

$100 |

Circle Markets |

2016 |

$50 |

InvesTeck |

2006 |

N/A |

Aduno Capital |

2019 |

N/A |

Ultrontradefx |

2019 |

N/A |

UproFx |

2018 |

EUR 250 |

WandaFx |

2019 |

$1000 |

Miki Forex

Miki Forex states that the management of the company consists of highly qualified specialists who have trading experience since 1998. At the same time, the company does not indicate how long it has been providing services or what kind of success it has had. The Mobius Trader 7 terminal, which is unfamiliar to many traders, is used as trading software. Beginners are attracted by the provision of training materials and a low entry barrier. Judging by the data published on the platform, the broker has an Israeli registration, but it does not show a certificate of incorporation or a license. It is also unknown in which countries this company has representative offices. The company pursues a policy of hidden activity and got onto the Forex Scam List for many reasons.

The main signs of its scams:

-

absence of legal grounds for operation;

-

issues with withdrawing funds;

-

manipulated software that works with bugs;

-

forcing bonuses on depositors;

-

super high leverage is used to put traders into a black hole of debt.

NetoTrade

NetoTrade positions itself as a global brokerage and investment company that promises profitable Forex trading, advanced technologies, and the best client support. However, it is an offshore organization registered in Saint Vincent and the Grenadines. The broker promises access to trading in currency pairs, commodities, stock indices, and CFDs.

The main signs of its scams:

-

unregulated brokerage activities;

-

financial extortion;

-

client support issues;

-

offshore registration;

-

a lot of negative reviews;

-

absence of possibilities to withdraw funds;

-

blocking accounts of unwanted clients.

Opteck

Opteck has been operating for more than 10 years but has received many negative reviews. The company offers access to trading currency pairs, stocks, metals, indices, etc. The proprietary terminal is contained in its software. Judging by the reviews, this is controlled software that works exclusively for the benefit of the broker. The minimum losses in this project are $250, but in the reviews, clients write that the scammers are trying to get many more funds from them.

The main signs of its scams:

-

the total absence of legal protection;

-

issues with the fulfillment of financial obligations;

-

abnormal widening of spreads and technical issues with the terminal;

-

absence of acceptable client service;

-

mismatch of quotes with charts of most companies;

-

termination of cooperation unilaterally;

-

a lot of negative reviews on various web resources;

-

fake advice that leads to the loss of funds.

Real Trade Group

The Real Trade Group says that it has an unchallenged reputation, but this statement is far from the truth. Scammers only know how to provide empty promises about professionals, false information about many positive reviews, and a low entry barrier and high profitability. However, it all comes down to taking possession of traders’ funds through misrepresentation and constant extortion.

The main signs of its scams:

-

absence of financial liability;

-

illegitimate activity;

-

numerous complaints of fraud;

-

abnormal spreads and their widening even outside of peak hours;

-

issues in the operation of the terminal, for which no one is ultimately responsible;

-

constant extortion of funds;

Vertical Markets

Although Vertical Markets positions itself as an international broker, this company has a lot of skeletons in its closet. This organization attracts newcomers with a low entry barrier and generous leverage but judging by the reviews, it does not fulfill its obligations. The company offers to trade in currency pairs, raw materials, stocks, etc. The broker pursues a policy of hidden activity and when you start asking additional questions, it quickly evades answering.

The main signs of its scams:

-

lies regarding faithfully operating in financial markets;

-

a large number of negative reviews;

-

non-fulfillment of financial obligations;

-

fraudulent trading operations;

-

refusals to withdraw funds without giving any reason;

-

a large number of complaints.

YoutradeFX

Although YouTradeFX positions itself as a British broker that promises faithful cooperation, all this is a barefaced lie. This can be confirmed by the reviews from real users, as well as the results of checking legal documents. The company operates illegally and does not fulfill its obligations.

The main signs of its scams:

-

many problems with regulators;

-

non-fulfillment of agreements and financial fraud;

-

provides fake trading advice;

-

telephone scam and the forced imposition of brokerage services;

-

mediocre reputation on the internet;

-

non-payment of earnings.

ZAR FX

The ZAR FX Company has been known in the financial markets since 2013. However, a long-term operation doesn't prove anything. The broker is accused of violating agreements, financial fraud, and refusing to pay earnings. Although there are a lot of negative reviews, the company continues to provide services and mislead people. It lures beginners with favorable terms of cooperation, the best prices, ultra-narrow spreads, and the availability of a qualified support team.

The main signs of its scams:

-

imposing the services of a personal manager, who then gives fake advice;

-

disclaiming a financial liability;

-

manipulation of the trading process;

-

non-provision of legal protection;

-

indifference by the support team;

-

negative reviews from real clients;

-

non-compliance with payment discipline;

Adamant Finance

Adamant Finance defines itself as a faithful brokerage company that provides stable access to Forex. The broker states that it has been operating since 2014 and has a low entry barrier. However, according to the feedback, users note that this is only bait. This agency does not fulfill financial agreements, and instead of high-tech trading technologies, it provides a manipulated terminal.

The main signs of its scams:

-

issues with legal documents;

-

exhausting user deposits;

-

difficulties in communicating with support;

-

fictitious claims about the company;

-

financial extortion;

-

non-compliance with payment discipline;

AXEForex

Although the AXEForex claims to be registered in the UK, that's not saying much. The company promises uncompromising service, the confidentiality of information, and the security of trade; but instead, it takes possession of traders’ money through fraud. The company does not fulfill its agreements, as evidenced by the reviews from real users.

The main signs of its scams:

-

absence of legal documents allowing access to the interbank market;

-

refusal to make payments of traders’ earnings;

-

fake trading advice;

-

issues with the execution of transactions;

-

absence of acceptable client service;

-

telephone spam.

Circle Markets

Circle Markets is a brokerage company based in New Zealand that does not provide clear information about itself. There is no data on the legitimacy of operation on the platform, and as judged from the reviews, real clients talk about the broker’s many legal problems. The broker attracts newcomers with promises of qualified support and training, ultra-narrow spreads, and low commissions. At the same time, the company does not keep its commitments and engages in financial extortion.

The main signs of its scams:

-

providing fake information;

-

absence of legal grounds for operation;

-

issues with payments;

-

complete absence of trade discipline;

-

rude attitude by support;

-

manipulation of user funds.

InvesTeck

Fraudsters are constantly improving their tactics, making it harder for unsuspecting traders to identify them. Many of these scammers camouflage themselves as legitimate brokers, as is the case with InvesTeck. The company passes off as the legitimate firm Investec and even provides legitimate regulatory licenses to cement its ruse.

To unsuspecting clients, it is impossible to figure out that this company is illegitimate. They have managed to fool several clients and steal their hard-earned money. We advise all traders to take extra precautions before investing with any brokerages. Check and counter check any information from websites, especially when the brokers don’t have an app. Any discrepancies in information might be an indicator of a scam company.

Aduno Capital

Aduno Capital makes false claims that the company is located in Stuttgart, Germany. However, this has not been confirmed since the company that the broker claims to operate under – ADUNO Capital Group Ltd. – doesn't seem to exist.

Aduno Capital also claims to be licensed and regulated by some of the most reputable European regulators, including the FCA, CySEC, MFSA, Hong Kong SFC. A deep dive into these licenses reveals that they are genuine, but belong to a Maltese Foreign exchange company Exante (XNT Ltd.).

Unsurprisingly, the broker has gotten under the radar of the Austrian Financial Markets Authority, and the German Federal Financial Supervisory Authority (BaFin). Bafin confirms that the licenses belong to XNT Ltd. In short, Aduno Capital is a clone firm that is illegally using the details of a licensed company with which it isn’t affiliated.

Offering misleading information and purporting to be legitimately licensed while using other company licenses shows a lack of integrity.

Ultrontradefx

Ultrontradefx.com promises their users daily profits for using the platform. Research shows that promises of assured profits are what usually drive investors to deposit money into brokerages without conducting proper research.

Ultrontradefx is not licensed or regulated by any regulatory body. There is also no conclusive information regarding their physical location. They state that their offices are in the United States, but then they give two different addresses; one in New York, while the other in California. This lack of transparency also carries on to the ownership and management of the brokerage.

There is no information about the founders, owners, management, etc. Anonymity is often a trait of scam brokerages. We have this firm on our blacklist of fake forex brokers because of the red flags highlighted above. Work only with regulated and trustworthy brokers to ensure the safety of your funds.

UproFx

UproFx is owned and operated by Yield Enterprise Currency Software OU, a company based in Estonia. However, after conducting some further research on the brokerage, it is clear that they are not regulated. Without a financial watchdog regulating a brokerage, then your funds are unprotected, and the firm doesn't have to comply with any ethical or financial rules.

Starting 2018, brokerages operating on EU soil are only allowed a capped leverage of 1:30 as stated by the European Securities and Markets Authority (ESMA). Nonetheless, UproFx offers leverages of up to 1:500. Keep in mind that, although higher leverage can result in high profits from a relatively small deposit, it can also result in massive losses.

Their lack of regulation and evident rogue characteristics earns UproFx a spot on our blacklist. Avoid brokers who aren’t regulated and don’t adhere to any set guidelines.

WandaFx

When browsing the broker’s website, there is no information regarding their physical address. This raises suspicion because, as we mentioned before, anonymity is often a sign of scam brokerages. The firm states that they are regulated by the VFSC. However, this is not a reputable regulatory body.

Moreover, there have been numerous complaints by traders who have been unable to withdraw funds from their WandaFx accounts. Victims are often lured to deposit more funds while their original funds are still being “processed”. This is a characteristic of several unregulated and scam brokers.

Avoid brokers such as WandaFx who claim they are regulated, yet they are as good as unregulated exchanges. Only work with brokers who are regulated by reputable bodies.

How to Check if a Forex Broker is Legitimate: 5 Steps

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in Pakistan. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not.

3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5 Tips to Avoid Forex Scams

Forex scams can lead to tremendous losses of your hard-earned money to fraudsters. Avoid falling victim to scammers by following these 5 simple tips:

1. Work only with regulated brokers. Ensure that the brokers you are working with are licensed and regulated by reputable bodies.

2. Confirm any information on broker websites. Scammers often entice their victims by providing convincing, but false information. However, ensure that the information is genuine by conducting research and background checks.

3. Look for multiple reviews apart from those on the broker’s website. If a company has many negative reviews from its clients, then we don't advise working with them.

4. Gauge their customer support. If you have a concern or issue that you need addressed, yet the firm takes ages, or doesn't respond at all then we advise you to cut ties with them. Good customer support is characteristic of top brokerages.

5. Avoid brokerages with overzealous promises. Some brokers promise users guaranteed returns. However, forex trading is risky and can involve both profits and losses.

The Best Forex Brokers in Pakistan

FAQs

How to verify that the broker is faithful?

Companies that are focused on faithful and long-term cooperation operate legally. They provide services under the license of a Pakistani regulator or another reputable regulator. The availability and authenticity of documents must be verified directly on the websites of unbiased regulatory authorities.

How do fake brokers commit fraud?

Most fraudulent brokers count on snagging beginners who have little financial knowledge. Such users do not check legal documents and trust the broker’s bare words. The scammers put on for them a cheap trading show to divest traders of their deposits.

How to recognize a fraudulent broker?

Before registering on the platform of a brokerage and depositing funds on its account, it is necessary to analyze the quality of the website’s structure, as well as to verify the authenticity of documents and reviews from real clients. This will allow you to learn the basic facts about the company and not make a mistake.

Which authority regulates Forex trading in Pakistan?

Forex trading in Pakistan is legal. Local traders are advised to work with licensed brokers who have received permission from the Securities and Exchange Commission of Pakistan (SECP) or other reputable regulators.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.