Halifax Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Web Trading platform

- 1:1

- Margin trading is not available, transactions can only be made through the web terminal on the site

Our Evaluation of Halifax

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Halifax is a moderate-risk broker with the TU Overall Score of 5.11 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Halifax clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Halifax is a broker for UK residents and residents who are interested in medium- to long-term investment.

Brief Look at Halifax

Halifax is a subsidiary of the British financial conglomerate Lloyds Banking Group, which provides banking and brokerage services to UK tax residents. It was founded in 1852 in Halifax, West Yorkshire as a construction investment company. Halifax has been providing banking services since 1986, and in 1997 it became a public limited company (Plc). Today, the FCA-regulated holding firm offers clients trading in UK and international securities, as well as free access to research tools and investment ideas from global analytics providers.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- There are no minimum deposit requirements for self-investing accounts. Investors who form their own portfolio of assets can start with any amount.

- Wide range of securities: the UK and international stocks, exchange-traded funds (ETFs), investment trusts, and bonds.

- Supervision by the Financial Conduct Authority (FCA, 169628).

- Investment accounts can be opened not only by UK tax residents. Registration is also available to citizens of other countries living in the UK at the moment of opening an account.

- There are no commissions for making a deposit or withdrawing funds.

- Dealing fees are reduced to £3.50 on special offer days.

- High trading fees — £9.5 per trade with all financial instruments.

- Deposit at least £2,000 on the account balance for investments in ready-made portfolios.

- The company doesn’t provide mobile and desktop terminals for trading. Transactions can only be made through the web platform on the site.

TU Expert Advice

Author, Financial Expert at Traders Union

Halifax provides a variety of account type, catering to medium- to long-term investments. The platform offers trading UK and international securities, ETFs, and investment trusts. Investors benefit from FCA regulation and access to a diverse selection of assets without minimum deposit requirements for self-investing accounts. There are no deposit or withdrawal fees, and special offer days reduce trading fees.

Despite these advantages, Halifax has several drawbacks, including high commissions of £9.50 per trade and limited platform capabilities restricted to a web platform. The absence of mobile and desktop trading apps, combined with no margin trading options, may inconvenience active traders. High initial deposits are required for ready-made portfolios. Halifax may be suitable for investors looking for low-risk, long-term investment options rather than day trading.

Halifax Summary

| 💻 Trading platform: | Web trading platform |

|---|---|

| 📊 Accounts: | Investment Account, Share Dealing Account, ShareBuilder, Stocks and Shares ISA, Investment ISA, Self-Invested Personal Pension (SIPP) |

| 💰 Account currency: | GBP |

| 💵 Deposit / Withdrawal: | Debit cards (replenishment only), wire transfer, check from UK bank in the case of the Isle of Man or the Channel Islands |

| 🚀 Minimum deposit: | From £1 for self-investing. From £2,000 for investments in ready-made portfolios |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | From £2 |

| 🔧 Instruments: | Shares (UK and international), mutual funds, exchange-traded funds (ETFs), investment trusts, bonds, gilts, IPOs (through PrimaryBid partner) |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | Margin trading is not available, transactions can only be made through the web terminal on the site |

| 🎁 Contests and bonuses: | Yes |

Clients of Halifax can only trade securities using their own funds and margin trades are not permitted. There is no minimum deposit requirement to open an account. There is no commission for inaction. A subscription fee is charged on all types of investment accounts. Accounts that are not subject to income tax are available. The brokerage commission for online trading is £9.5 per trade. When investing regularly, the fee is reduced to £2 per trade.

Halifax Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Access to the Halifax personal account is available after opening one of the company's accounts. To open an investment account, follow these steps:

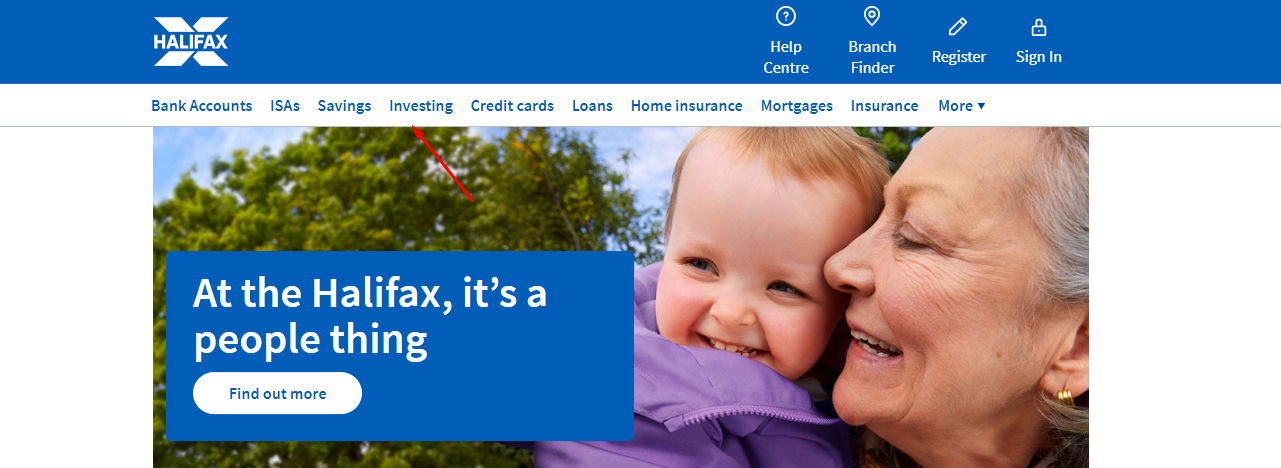

On the main page of the official website, follow the Investing section:

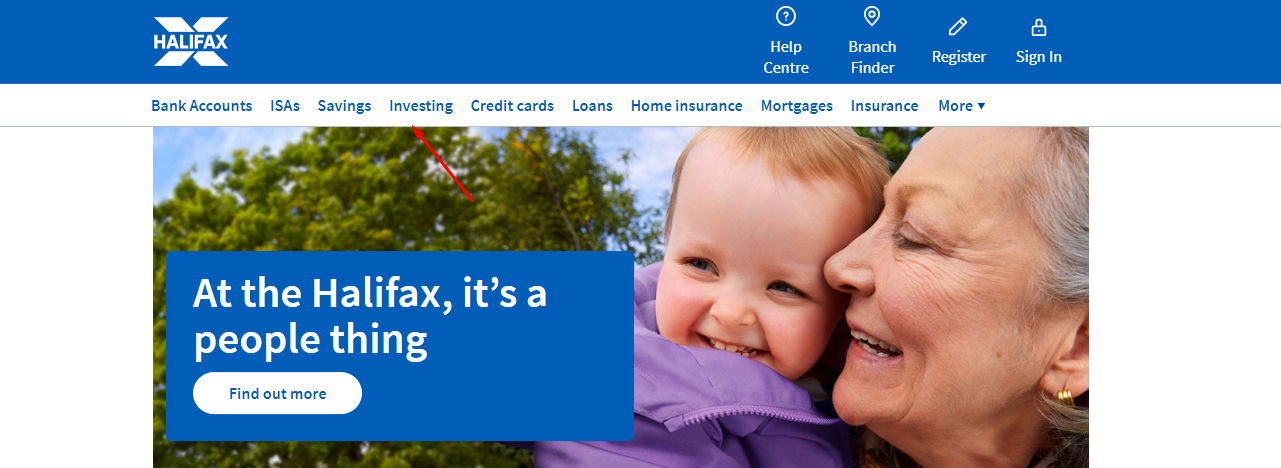

Then click Open an Account:

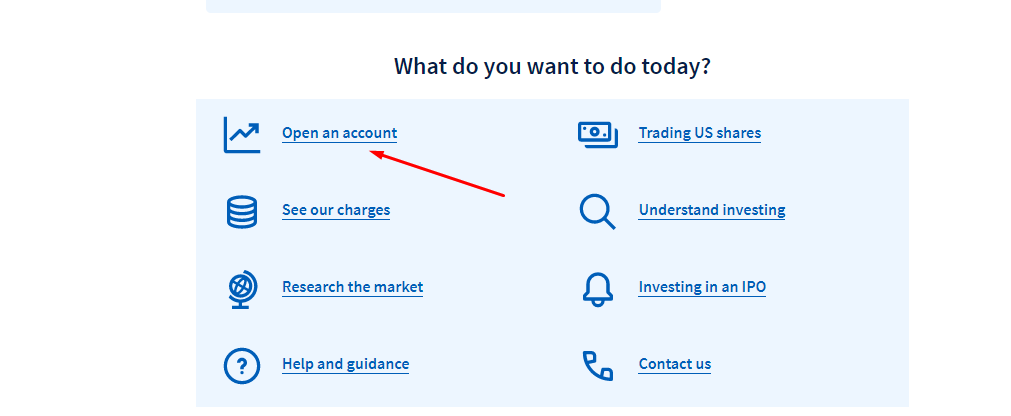

Select the type of account you want to open, apply for its registration, and then fill out the form with personal and tax data:

In the personal account you can:

Also, in the user's personal account you can:

-

Set up recurring investments. After activating the option, the balance of the investment account will be automatically replenished by the specified amount by crediting from the client's bank account monthly.

-

Get quotes in real-time. The current stock prices shall be displayed in the trades tab on the right navigation panel after you select the investment amount and number of units.

-

View reports. The Evaluation and Reports section displays TradePlan's transaction and recurring investment histories, as well as dividends, earnings, administration fees, commissions, and taxes.

-

Configure TradePlan. You can connect or disconnect TradePlan (if its expiration period has not expired yet) in the Trades section.

Regulation and safety

Halifax is registered in England and Wales under the trademark Halifax Share Dealing Limited (No. 3195646). The company is a member of the London Stock Exchange and is regulated by the Financial Conduct Authority (registration number — 183332).

All investment accounts opened with Halifax are protected by the Financial Services Compensation Scheme (FSCS), a UK deposit guarantee scheme. You can file a claim under this scheme if the company authorized by the FCA does not fulfill its obligations. The FSCS can only compensate for financial losses. The coverage is limited to £85,000 per applicant.

Advantages

- The broker is regulated by the UK's most reputable financial supervisory authority

- Each investor in case of violation of the contract by the broker can file a complaint with the FCA

- Clients' investments are protected by a financial services compensation scheme

Disadvantages

- Deposit and withdrawal methods are strictly limited

- When registering, an account in a UK bank, it shall be linked to an investment account

- You cannot open an account without providing detailed personal and tax documents

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Stocks and Shares ISA | From £2 | No |

| Share Dealing Account | From £2 | No |

| ShareBuilder | From £2 | No |

| Investment ISA | From £9.5 | No |

| Investment Account | From £9.5 | No |

| SIPP | From £9.5 | No |

All transactions in UK securities are subject to a 0.5% stamp duty (excluding AIM stocks). Some Spanish stocks are subject to a transaction tax of 0.2% of the trade amount.

We compared Halifax fees to those of other stockbrokers to determine the level of Halifax UK brokerage fees. The fee for trading in shares listed on national exchanges was analyzed. As for Halifax, we analyzed the commission for transactions with UK stocks, and with US stocks for Ally and Charles Schwab.

| Broker | Average commission | Level |

|---|---|---|

|

$5.75 | |

|

$4 |

Account types

For individual clients, the Halifax stockbroker offers 6 types of accounts, which are designed for medium- and long-term investments. Broker margin trading is not supported.

Account types:

Potential Halifax clients can’t practice trading with virtual money before opening an account since the broker doesn’t provide a demo account.

Halifax offers accounts for self-investing and investing in ready-made portfolios, as well as retirement plans with tax benefits.

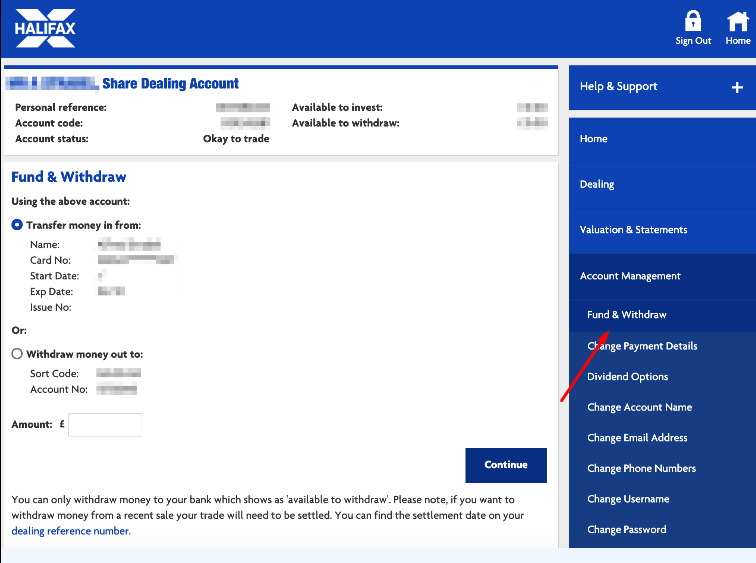

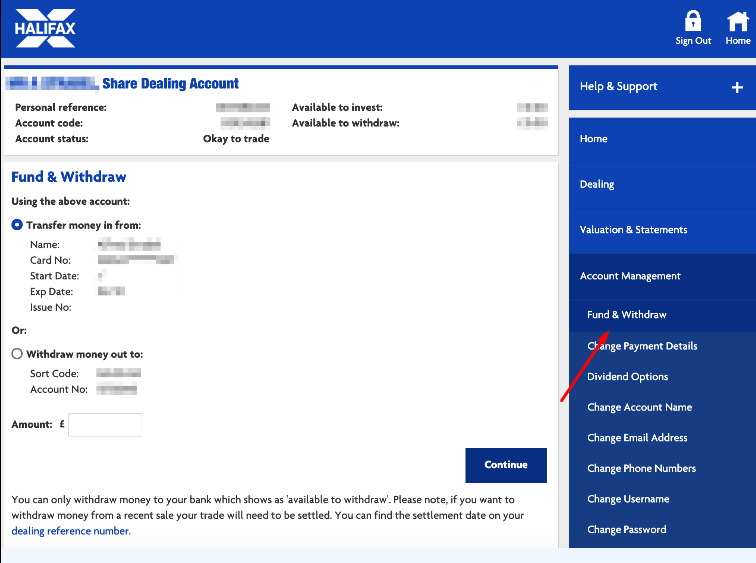

Deposit and withdrawal

-

All income is credited to investment accounts within 10 business days from the date of receipt. You can withdraw funds by bank transfer.

-

The broker credits the money to the bank account specified during registration within three business days.

-

Halifax does not charge withdrawal fees; however, banks may charge them. For this reason, if the broker is unable to complete the transfer of funds to the client's bank account for any reason (including if the transfer cost is equal to or exceeds £25), it withdraws the money by check.

-

Cards can only be used to make a deposit. Withdrawals to cards are not available. Credit to e-wallets is not available.

Investment Options

Halifax is focused on investors, not active traders, and therefore offers products for medium- and long-term investment. You can choose an acceptable scheme of work for yourself, or create your own portfolios, or invest in ready-made diversified funds.

Halifax’s ready-made investment funds

Halifax offers clients to invest in its ready-made portfolios, which consist of investment funds. Professional fund managers merge investors' money and invest on their behalf in various assets such as stocks, real estate, bonds, and cash. Halifax-ready investments portfolios are available to all existing internet banking customers who have opened an Investment Account or Investment ISA. The broker offers investors three types of portfolios with different levels of risk:

-

Steady. A low-risk portfolio with 60.5% bonds, 25% equities, 8.5% real estate, 6% other assets. Commission fees are 0.61% per year.

-

Balanced. A balanced portfolio with an average level of risk is achieved through equitable investment between assets with lower risk (i.e., bonds) and assets with higher risk (i.e., stocks). The portfolio includes 49% of stocks, 36.5% of bonds, 8.5% of real estate, and 6% of other assets. The investor pays 0.61% of the invested funds for management. The commission is charged once a year.

-

Dynamic. A high-risk portfolio that potentially offers the highest returns. It is formed with a focus on equity investments (75% of all assets). It also includes bonds (15%), real estate (5%), and other assets (5%). The annual management fee is 0.62% of the investment amount.

The investor should replenish the account balance for £2,000 or more to invest in ready-made portfolios. You can start investing from £100 per month. Halifax's ready-made investments are designed for the medium and long terms, so the investor should plan to hold them for at least 5 years.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Halifax’s affiliate program

The company doesn’t offer partner remuneration to a private investor.

Customer support

Support is available by phone (Monday to Friday, 8:00 am to 5:00 pm) and in the mobile banking app (24/7) for online investment accounts.

Advantages

- Wide range of communication methods

- You can contact the support team by phone

- There is a communication channel for people with disabilities

- Company representatives are available via popular messengers

Disadvantages

- Support by phone and in Mobile Banking is available only to users registered on the company's website

- There is no online chat.

- 24/7 support is only available to Bank of Scotland Plc customers via its mobile app

Clients of the broker can:

-

request support from within your personal account;

-

call by phone numbers indicated on the website;

-

message in the Mobile Banking app;

-

send an email using a ready-made feedback form;

-

call from the Mobile Banking application;

-

write a message in Facebook Messenger or Twitter.

-

use the SignVideo service (an online translator for people using the British Sign Language (BSL));

-

send a letter to PO Box 548, Leeds, LS1 1WU;

-

visit a branch.

The fastest way to get an answer to a question is to ask it in the Help&Support section of your personal account.

Contacts

| Foundation date | 2057 |

|---|---|

| Registration address | Trinity Road, Halifax, West Yorkshire, HX1 2RG |

| Regulation | FCA, FSCS |

| Official site | https://www.halifax.co.uk/ |

| Contacts |

0800 500 3973

|

Education

There is a lack of educational information on the Halifax UK website. In the Investing and Help Center sections, you can find articles on the basics of investing without a detailed analysis of each concept and term covered. To make it easier to start trading, the site has published guides and FAQs.

The training published on the company's website provides an overview of investing.

Detailed Review of Halifax

Halifax is a stockbroker for investors with different levels of trading knowledge and capital. Its services are used by clients who invest in securities at their own discretion, as well as those who prefer ready-made portfolios of assets, compiled by professionals taking into account the level of risk and the amount of potential income. Halifax provides wealth management services to investors who own capital exceeding £100,000.

Data on the Lloyds Banking Group holdings as of the first quarter of 2021:

-

27 million people — the number of active clients.

-

£1.4 billion in profit after taxation.

-

£3.7 billion - net income.

-

13.9% — Return on Tangible Equity (RoTE).

Halifax UK is a reliable broker focused on medium- and long-term investment

Being a client of the company, you will get free access to a research center with tools for advanced market research and investment performance tracking. Halifax also provides investment insights such as research and articles from Morningstar, the world's leading independent analysis provider.

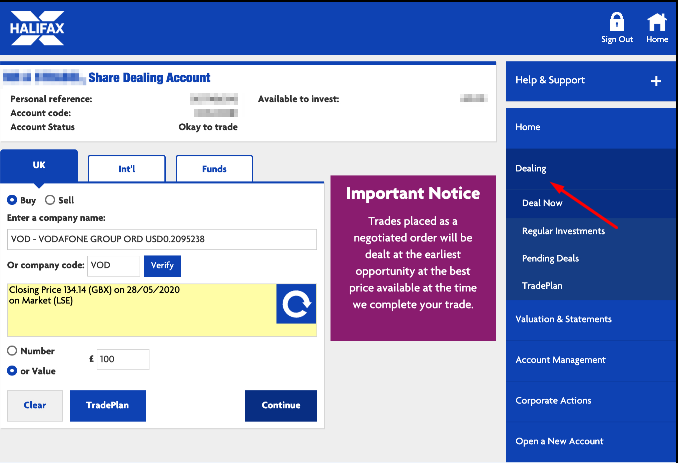

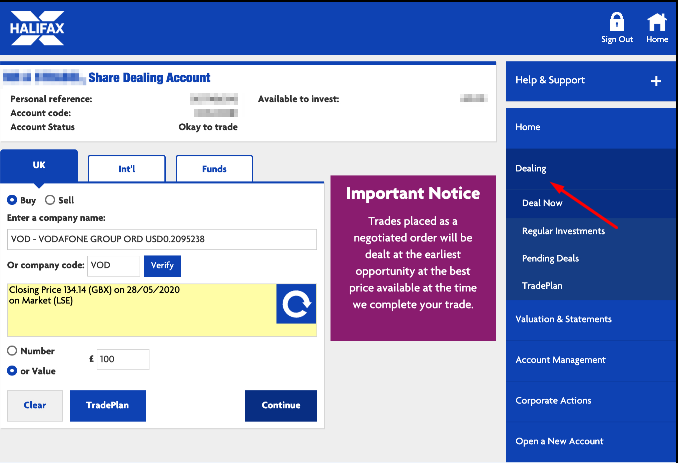

The broker's clients make transactions with securities in the web terminal. These can be found in the personal account. Investment account summaries are also available in online banking. The broker doesn’t provide mobile applications or desktop trading terminals. The web platform capabilities are limited such that you cannot customize it for yourself. At the same time, its functionality allows you to search for securities by ticker or name, set price alerts and notifications, and create your own Watchlist.

Useful Halifax services:

-

TradePlans. Automated trading tools executing a request to buy or sell an investment at a price set by the investor. The broker offers limit order, stop loss, target setting, range trading, and price locking.

-

Investor Meet Company. A service that allows private investors to view financial statements, as well as live interactive presentations and interviews with CEOs of UK-listed companies.

-

Search for shares. Search tool for UK, US, and European stocks. The following filters are available: by name, alphabet, index, sector, market capitalization.

-

Funds Center. The service for a detailed search of funds by name, sector, management company, annual profitability for 5 years, and current expenses, etc.

-

ETF Center. A page for searching for ETFs by name, supplier, region, price, level of risk, 5-year return, size of current expenses.

-

Investment Trust Center. Selection tool for investments by name, provider, AIC sector, previous close, risk level, 5-year return and current expense.

-

Market News. A page for searching current events: news (market, company, economy) and information summaries from the News Service agency.

Advantages:

There are 4 types of screeners on the broker's website to search for potentially profitable investment assets.

Access to stocks listed on the stock exchanges of London, New York, Amsterdam, Paris, Brussels, Frankfurt, and Milan.

Wide range of funds: over 500 ETFs, 2,000 mutual funds, and 200 investment trusts.

Support for different types of orders such as market, limit and stop loss.

Access to IPO trades through partner platform PrimaryBid.

The broker doesn’t charge a fee for using the terminal or research tools. Investment ideas and news are also completely free of charge.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i