Vanguard Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Proprietary web terminal

- Vanguard Mobile

- Vanguard Beacon

- Floating

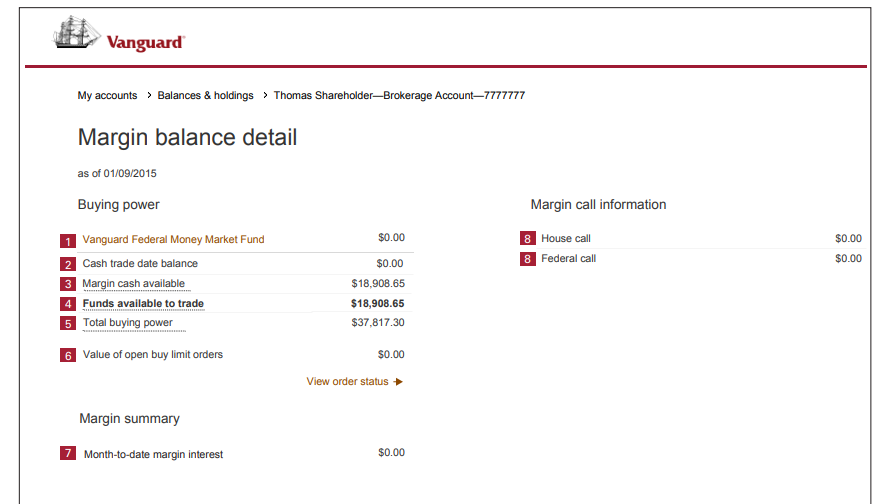

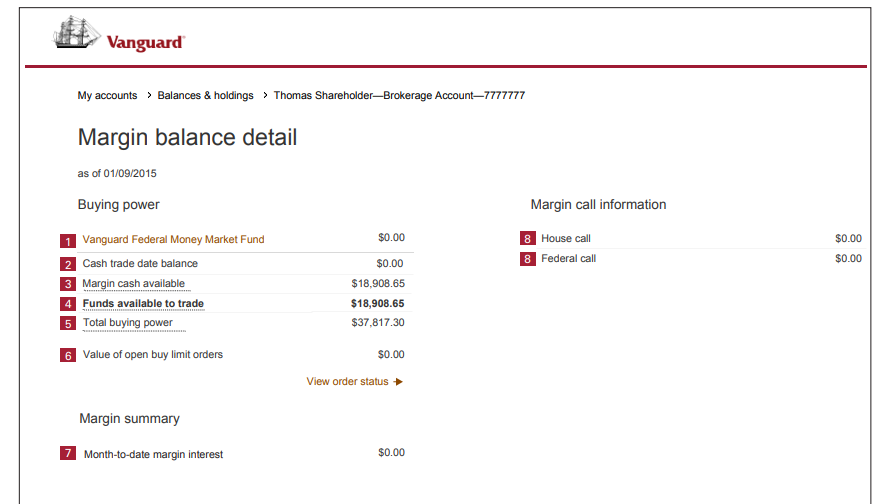

- Margin accounts are available if you have $2,000 on your balance sheet

- to invest in Mutual funds, you need to deposit $1,000 or more

Our Evaluation of Vanguard

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Vanguard is a moderate-risk broker with the TU Overall Score of 5.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Vanguard clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The Vanguard broker is aimed at investors with long-term strategies, not active traders.

Brief Look at Vanguard

Vanguard is a large investment holding company founded back in 1975. Its clients can invest in stocks, bonds, certificates, options, as well as exchange and investment funds of Vanguard and third-party companies. Private and institutional investors have access to financial planning advice, wealth management services, and retirement and savings accounts for education and tuition. Currently, more than 30 million clients from the United States and 23 other countries invest in stock market assets through Vanguard.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- No minimum deposit on investment and retirement accounts.

- Low fees for mutual funds, zero fees for trading stocks and ETFs.

- FINRA regulation and participation in the SIPC insurance fund.

- The ability to trade with margin using funds borrowed from a broker.

- Broad geography of services because all investment products and services are available not only to US tax residents but also to traders from Europe and Asia.

- Availability of accounts for investment and financial planning with tax incentives.

- Top-notch tutorials for beginners and cutting-edge research tools for seasoned investors.

- Options fees are far cry from the lowest among US brokers.

- There is no online chat or chatbot on the official website. Also, no email is specified for sending emails.

- Clients do not have access to any bonuses and partner rewards.

TU Expert Advice

Author, Financial Expert at Traders Union

Vanguard provides diverse trading and investment services, including stocks, bonds, options, mutual funds, and ETFs. These are accessible through a proprietary web platform and Vanguard Mobile. The company offers a robust suite of educational tools, enabling its clients to benefit from comprehensive investor education. Trading advantages at Vanguard include no minimum deposit requirements, zero fees on stocks and ETFs, and access to a broad array of financial planning and wealth management services, making it well-suited for investors particularly interested in long-term strategies.

However, Vanguard's offerings may pose drawbacks, such as relatively high options fees and limited client support channels, lacking live chat. The absence of bonuses and a demo account, as well as annual account maintenance fees, may not appeal to short-term or highly active traders. Given these considerations, Vanguard is ideally suited for long-term investors and those who prioritize comprehensive retirement planning over fast-paced trading activities.

Vanguard Summary

| 💻 Trading platform: | Proprietary web terminal, Vanguard Mobile, Vanguard Beacon (test version) |

|---|---|

| 📊 Accounts: | Brokerage Individual & Joint Accounts (Margin Account, Cash Account), Roth IRA, Traditional IRA, SEP-IRA, SIMPLE IRA, 529 plan, Individual 401 (k), and 403 (b) plans |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Mobile check deposit, ebanking, debit cards, ACH, asset transfer from another brokerage firm, personal, cash, bank, certified check, treasury, business, and U.S. Federal Reserve checks |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 EUR/USD spread: | Absent |

| 🔧 Instruments: | Stocks, CDs, bonds, mutual funds, ETF, options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | Margin accounts are available if you have $2,000 on your balance sheet; to invest in Mutual funds, you need to deposit $1,000 or more |

| 🎁 Contests and bonuses: | No |

Vanguard offers its clients a wide range of financial instruments for trading and medium- and long-term investments. Assets available include stocks, certificates of deposit, options, and bonds. However, the broker specializes in fund trading and offers 3,000 mutual funds and 70 exchange-traded ETFs.

In January 2020, Vanguard abolished commissions for trades in stocks and ETFs, and in 2021 introduced Beacon, an advanced mobile trading platform powered by Vanguard Mobile.

Vanguard Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

The clients of Vanguard can be residents of the USA, Canada, Mexico, as well as the countries of the Asia-Pacific region and Europe. Opening an account with Vanguard is available after registering on the company's website. This is the procedure:

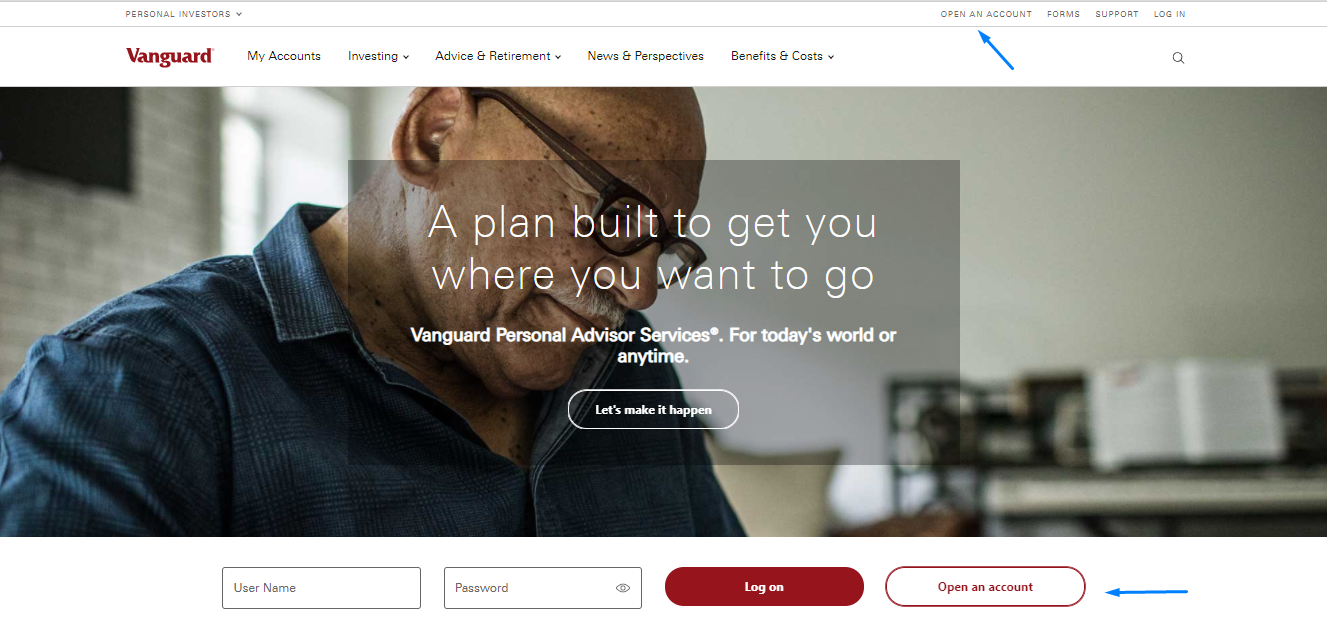

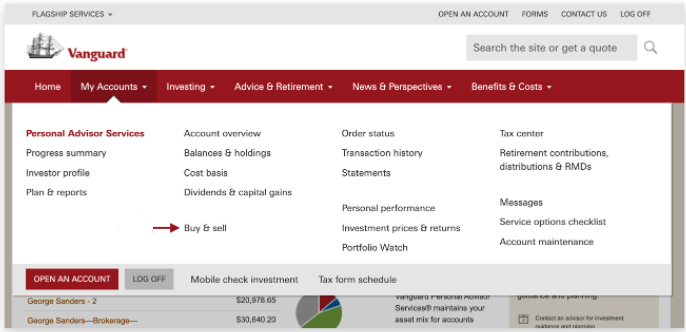

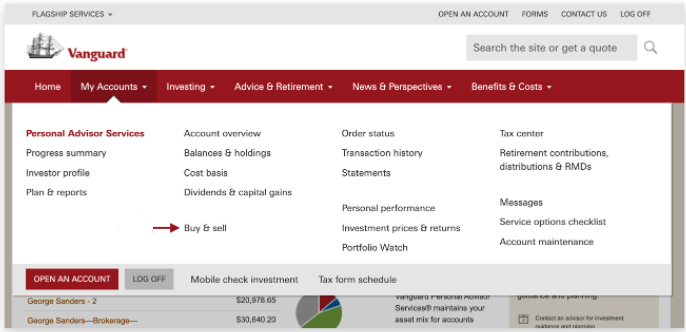

Go to the official website of the broker and click the Open an Account button on its main page.

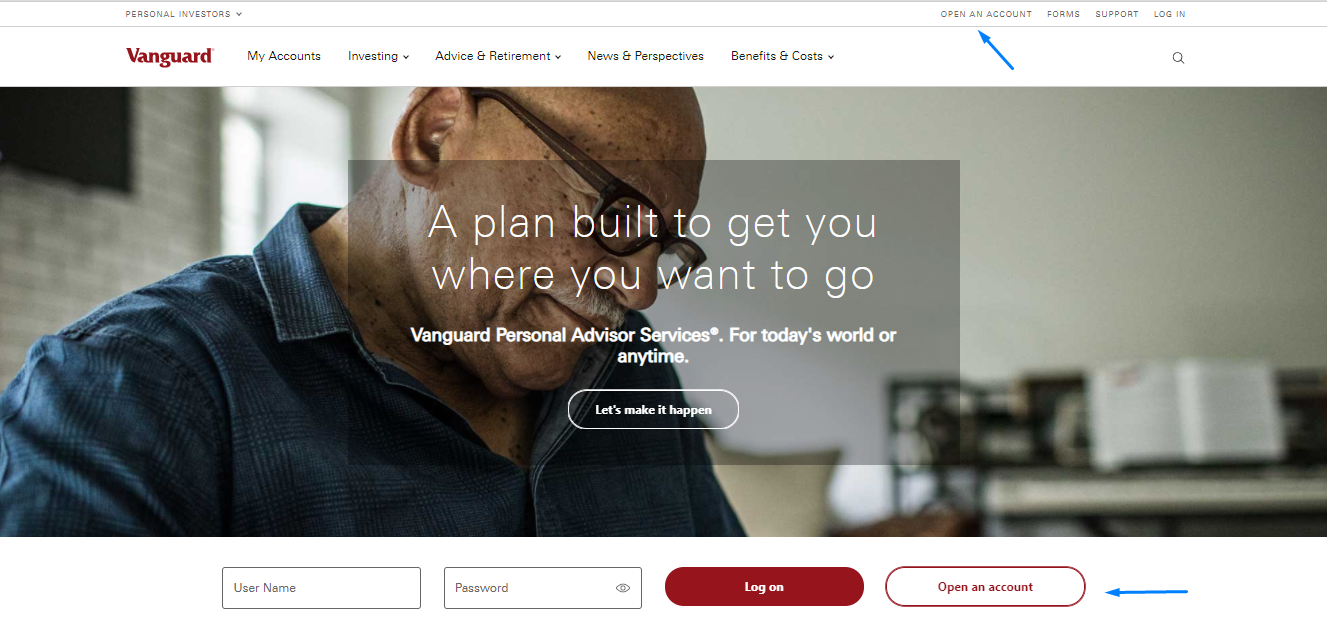

Then choose one of the options offered by the broker: “opening a new account” or “transferring an account from another brokerage company”:

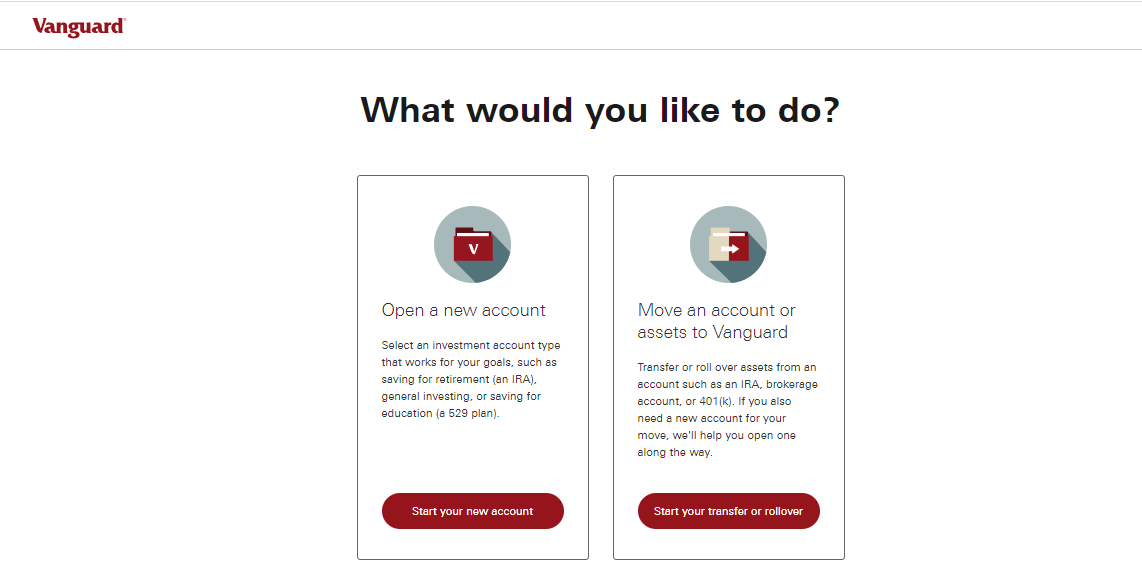

Next, select the type of account, fill out an online application and go through verification. The procedure for creating a new account takes from 3 to 7 days, transfer of an account from another broker takes 4-6 weeks.

Sections of the personal account:

The following actions are also available to the user in the personal account:

-

Buying/selling assets, tracking account balances in real-time.

-

View statistics for an account. You can also track performance over the previous 12 months.

-

Adding or editing beneficiaries. They can be spouses, individuals, trusts, or charitable organizations.

-

Setting up automatic attachments. The client can choose a financing method, frequency of investment, start and end dates, dollar amount, or interest rate. This feature is only available for investments in mutual funds.

-

Working with IRA accounts. The account holder can make the payment and also change the Traditional IRA to Roth IRA.

Regulation and safety

The Vanguard Group is monitored by the Financial Industry Regulatory Authority (FINRA) and is also a member of the Securities Investors Protection Corporation (SIPC).

Note that SIPC insurance coverage applies only to assets in brokerage accounts. Client funds held in retirement and savings accounts are not protected by the SIPC.

Advantages

- Keeping funds in segregated bank accounts

- The client can apply to FINRA with a complaint if the broker violates the terms of the offer

- Assets in brokerage accounts are insured against loss in the event of Vanguard bankruptcy

Disadvantages

- SIPC coverage not available for IRA, 529, 401(k), or 403(b)

- Any payments on invoices can be made only after passing the verification

- You cannot deposit and withdraw funds through electronic payment systems

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Brokerage Margin Account | From $1 | No |

| Brokerage Cash Account | From $1 | No |

There is an account maintenance fee of $20 per year for each account opened. Vanguard ditched fees on stocks and ETFs, thus joining other zero-fee stock brokers. For this reason, we compared options trading fees for Vanguard, Ally, and Charles Schwab. The calculations were carried out taking into account that the client is investing up to USD 1 million.

| Broker | Average commission | Level |

|---|---|---|

|

$1 | |

|

$4 |

Account types

Vanguard's portfolio of accounts includes investment, retirement planning, education savings, and small business plans. All of them can be opened for free. The broker has not set a minimum deposit.

Account types:

The broker only provides real investment accounts. A demo account is not available.

Vanguard focuses on clients who prefer medium- to long-term investments, as well as those for whom financial and retirement planning is a priority.

Deposit and withdrawal

-

Before submitting a withdrawal request, you must close all open transactions. Money is credited two working days after the last transaction is completed.

-

Customers can withdraw funds from Vanguard accounts by bank transfer via ACH's automated clearinghouse network and debit cards.

-

Vanguard does not charge fees for wire transfers, however, third-party bank fees may apply.

Investment Options

Vanguard offers over 3,000 mutual funds and 70 ETFs for investors. The specialists at Vanguard Advisers Inc. — a company registered as an investment advisor — assist in the formation of a diversified portfolio.

Portfolio investment: A top-tier method of passive earnings

Vanguard offers investors several portfolios of low-cost mutual funds and ETFs. Assets are grouped by the analytical department according to the needs of a particular client. Portfolios can include equity and bond funds, balanced (stocks + bonds), international, industry, and specialty (energy, real estate, and healthcare) funds. Targeted retirement funds with a fixed maturity are also available. The most popular types of portfolio investments are:

-

ETFs Vanguard Select. These portfolios include renowned low-value exchange-traded funds. An investor can form a portfolio of ETFs of various types: market index, US bond ETFs, US funds, or international ETFs.

-

Select Funds. This portfolio consists of diversified and low-cost mutual funds, which are selected by specialists in the analysis department.

-

All-in-one funds. A versatile portfolio that includes thousands of individual stocks and bonds to help minimize investment risks. Portfolio rebalancing occurs automatically, without investor intervention.

-

ESG funds. ESG or socially responsible investment (SRI) allows one to invest in funds of a specific genre such as environmental, social, and management. The line includes both international and American funds.

-

The broker does not set minimum deposit requirements for investing in ETFs. Investments in mutual funds are possible if you have $1,000 to $100,000 on your account. The exact amount depends on the type of mutual fund traded.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Vanguard’s affiliate program

Vanguard currently does not provide affiliate rewards or free promotions for connecting new customers.

Customer support

Company representatives provide customer support from Monday to Friday. Investors are served from 8:00 to 20:00, retirement account holders, and institutional clients — from 8:30 to 21:00. Financial advisors are available from 8:30 am to 7:00 pm. Specified Eastern time.

Advantages

- A separate telephone number is allocated for each service

Disadvantages

- Absence of online chat

- It’s impossible to get in touch using email

- Return call option is not available

This broker provides the following three communication channels:

-

phone via the numbers indicated in the Contact us section;

-

send a message using social networks;

-

send a letter to this address: P.O. Box 982902 El Paso, TX 79998-2902.

The company has social media profiles on Facebook, Twitter, Google+, LinkedIn, and a YouTube channel.

Contacts

| Foundation date | 1975 |

|---|---|

| Registration address | 5951 Luckett Court, Suite A1 El Paso, TX 79932-1882 |

| Official site | https://investor.vanguard.com/home |

| Contacts |

877-662-7447

|

Education

Vanguard has an Investor Education section that provides information on the basics of investing. Podcasts, research, and articles on securities trading, retirement, and financial planning can be found in the News and Perspectives section. Most of the tutorials are articles, but the site also has video tutorials.

In the Investor Education section, there is not only information for beginners, but also in-depth expert analysis and economic research for advanced traders.

Detailed Review of Vanguard

The Vanguard broker has been providing investment services for over 45 years and since the day of its formation, it has been committed to improving corporate governance in the market. The company signed the United Nations Principles for Responsible Investing in 2005, thereby supporting the call to conduct business with integrity and transparency. Vanguard is currently used by over 30 million customers worldwide, which is a testament to investor confidence.

Vanguard's success in numbers:

-

The first deal was carried out by a broker on May 1, 1975.

-

The company employs approximately 17,300 people in the United States and abroad.

-

Vanguard's clients have invested about $4 trillion in mutual funds and ETFs.

-

Approximately 7.2 trillion US dollars in global assets are under Vanguard's management.

Vanguard is a broker focused on cooperation with traders who prefer investing in finance and exchange-traded funds

Through Vanguard's brokerage accounts, its clients can buy and sell ETFs and mutual funds online without a fee. In total, the broker opens access to more than 160 Vanguard-free mutual funds and more than 3,000 funds from other companies. Vanguard provides comprehensive support to its customers. So, for investors who need professional advice, the broker provides Personal Advisor Services. To receive recommendations from a personal advisor, the client's account must contain $50,000 or more.

The annual cost of the service is 0.3% of the balance, in terms of dollars it is about $150 per year for a portfolio of $50,000.

The broker offers clients a web-based trading terminal and Vanguard Mobile, which can be downloaded for free in the App Store for iPhone or Google Play for Android. The broker also launched an improved mobile platform called Vanguard Beacon, which at the time of this writing was in beta test mode. Both mobile apps allow you to transact trades, view assets and personal performance, conduct research, receive news, and use a mobile checking deposit. Beacon also supports fingerprint recognition.

Useful Vanguard services:

-

Mutual fund & ETF screener. An instrument for selecting assets according to certain criteria: types and categories of funds, cost ratio, expected total income for 1, 5, or 10 years.

-

Stock screener. It allows you to sort shares by several parameters: volume, percentage of growth, capitalization of companies, industries, and price.

-

My Watch List. A service with which the user can track changes in selected and priority assets.

-

More instruments. Investment calculators, retirement planning tools, and savings plan planners for college admissions.

Advantages:

The presence of a mobile application with a full set of functions for trading and analysis.

Absence of non-trading fees for withdrawing funds via ACH.

Zero fees for trading stocks and ETFs.

A vast array of mutual funds and exchange-traded funds - both international and the United States.

Top-notch educational resources for long-term investment.

For clients with over $50,000 on their balance sheets, the services of a personal advisor, financial advisor, or wealth management specialist are available.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i