54.76% of retail investor accounts lose money when trading CFDs / Spread betting with this provider.

ATFX Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- MT4

- Desktop MT4

- Mobile MT4

- Web Trader MT4

- FCA

- CySEC

- FSC (Mauritius)

- 2017

Our Evaluation of ATFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ATFX is a moderate-risk broker with the TU Overall Score of 6.85 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ATFX clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ATFX is a broker for professional traders, who are prepared to invest at least $5,000.

Brief Look at ATFX

ATFX is a Forex and CFD broker and is a part of AT Global Markets, an international investment holding company. The company is licensed by the FCA (UK) 760555, CySEC (Cyprus) 285/15, FSC (Mauritius) C118023331, and FSA (Saint Vincent and the Grenadines) 333 LLC 2020. The broker offers beneficial trading conditions for active traders as well as passive investors. ATFX service quality has been recognized by the many awards the broker has received, including Fastest Growing Forex Broker in Europe in 2017, and a 2018 Best Forex CFD Broker award from UK Forex Awards.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Several licenses from international regulators.

- Beneficial trading conditions for professional traders and large investors.

- Possibility to invest in PAMM accounts and copy trades using the broker’s proprietary platform.

- No cent accounts.

- High minimum deposit on standard accounts.

- Bonuses are not available for all customers.

- Wide market spreads on Standard accounts.

- Limited choice of partnership programs.

TU Expert Advice

Author, Financial Expert at Traders Union

ATFX operates as a Forex and CFD broker, delivering trading across currency pairs, cryptocurrencies, indices, stocks, and commodities via the MetaTrader 4 platform. It provides numerous account types, including demo, Standard, Edge, Premium, and Professional, with a minimum deposit starting at $250. The broker offers leverage up to 1:400 and maintains regulations through the FCA, CySEC, and FSC. With PAMM accounts and technical analysis tools by Trading Central, the broker aims to meet the needs of experienced traders and large investors.

Drawbacks of ATFX include the lack of cent accounts and high initial deposit requirements, which may not suit novice traders looking to minimize financial exposure. Additionally, the Standard account features wide spreads, and the bonus policy is region-specific, potentially limiting broader client incentives. Overall, ATFX appears more tailored for experienced traders who can utilize the extensive analytical resources alongside competitive spreads available on the Professional account. Beginners may find it challenging due to the high entry barrier and limited access to educational resources.

ATFX Trading Conditions

54.76% of retail investor accounts lose money when trading CFDs / Spread betting with this provider. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs / Spread betting work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | МТ4 (desktop, mobile, WebTrader) |

|---|---|

| 📊 Accounts: | Demo, Standard, Edge, Premium, Professional |

| 💰 Account currency: | EUR, USD |

| 💵 Deposit / Withdrawal: | Visa, Mastercard, wire transfer, Neteller, Skrill, Perfect Money, Nganluong, CASH, and M-Pesa |

| 🚀 Minimum deposit: | $250 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,15 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrency, CFDs on indices, stocks, and commodities |

| 💹 Margin Call / Stop Out: | Not specified |

| 🏛 Liquidity provider: | Not specified |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | STP |

| ⭐ Trading features: | Wide range of standard and professional accounts |

| 🎁 Contests and bonuses: | Yes (for customers from specific countries) |

The trading conditions of ATFX are designed for professionals and traders with a sufficient volume of equity. The minimum deposit is $250, which is a rather high entry threshold to the Forex market for novice traders. Also, the broker does not offer cent accounts, which is why the traders cannot test trading conditions while investing a minimum amount. On the standard accounts, the spread is from 1-1.8 pips. For traders who use high-frequency strategies, such a high trading commission is unacceptable.

ATFX Key Parameters Evaluation

Video Review of ATFX

Share your experience

- Best

- Last

- Oldest

PH Kidapawan

PH Kidapawan ATFX offers straightforward profit and loss sharing calculations, allowing for some clarity in how earnings are distributed between clients and attorneys. This simplicity can be easier to understand compared to more complex profit-sharing schemes.

The company has a significant lack of accountability, absolving itself of responsibility when issues arise from partner or attorney actions, leaving clients vulnerable to scams and losses. Additionally, ATFX’s hands-off approach and disconnection from their partners' conduct undermine trust and transparency, making it a risky choice for traders seeking reliable regulation and client protection.

Trading Account Opening

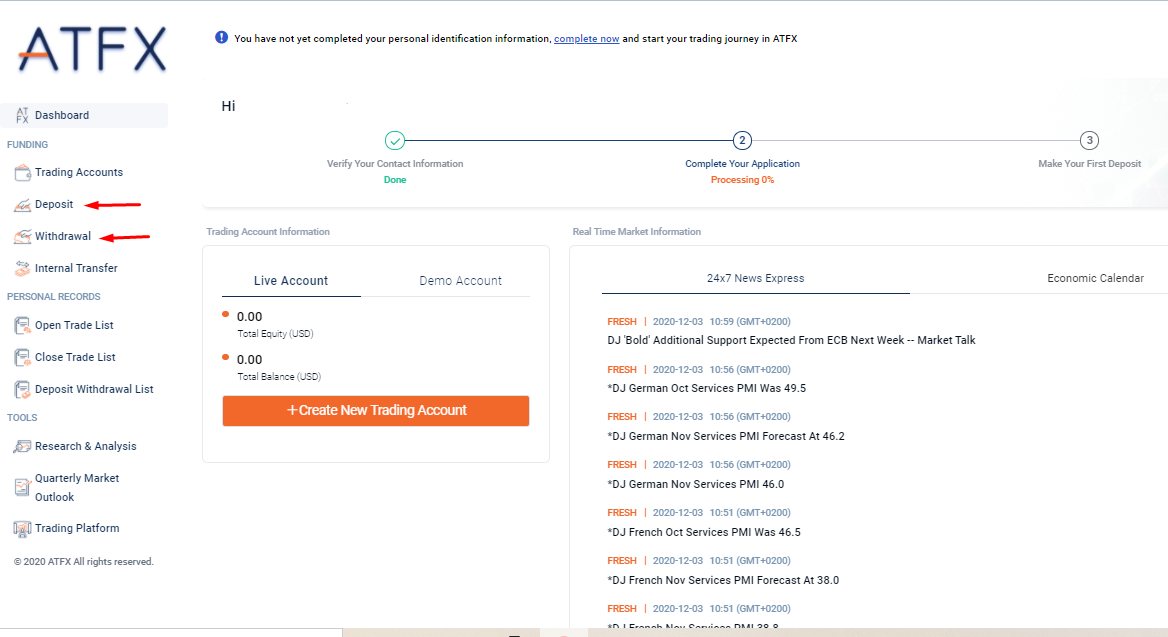

To start trading on ATFX, you need to open a trading account with the broker. For this, you need to:

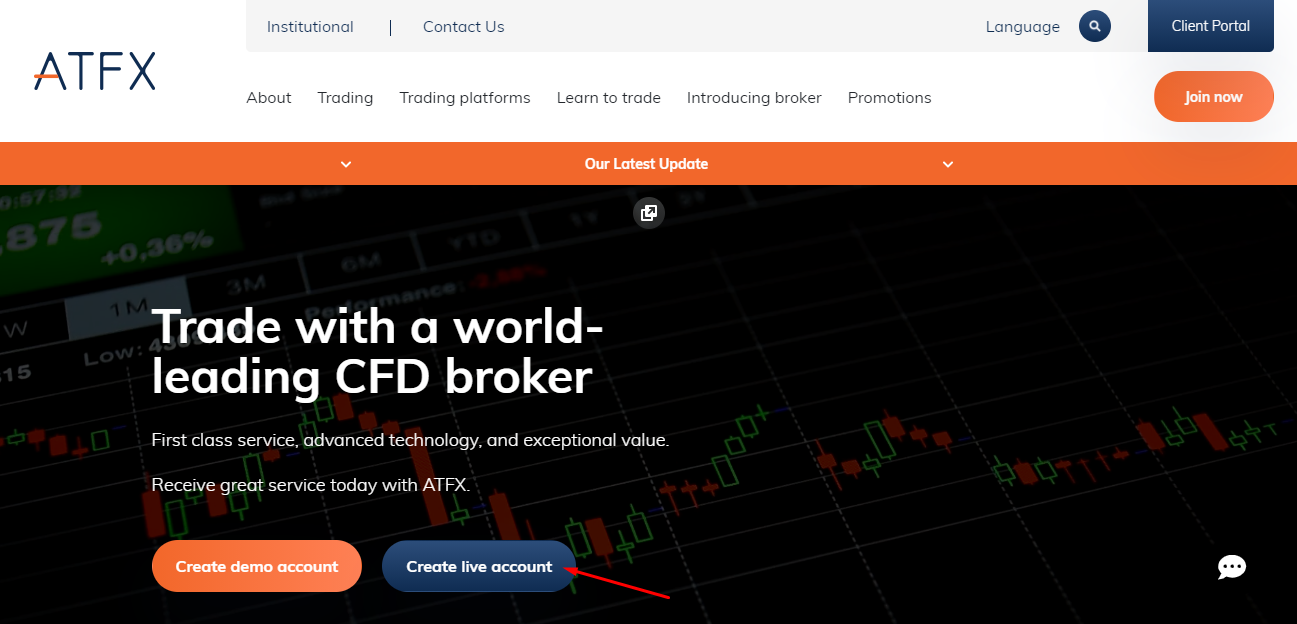

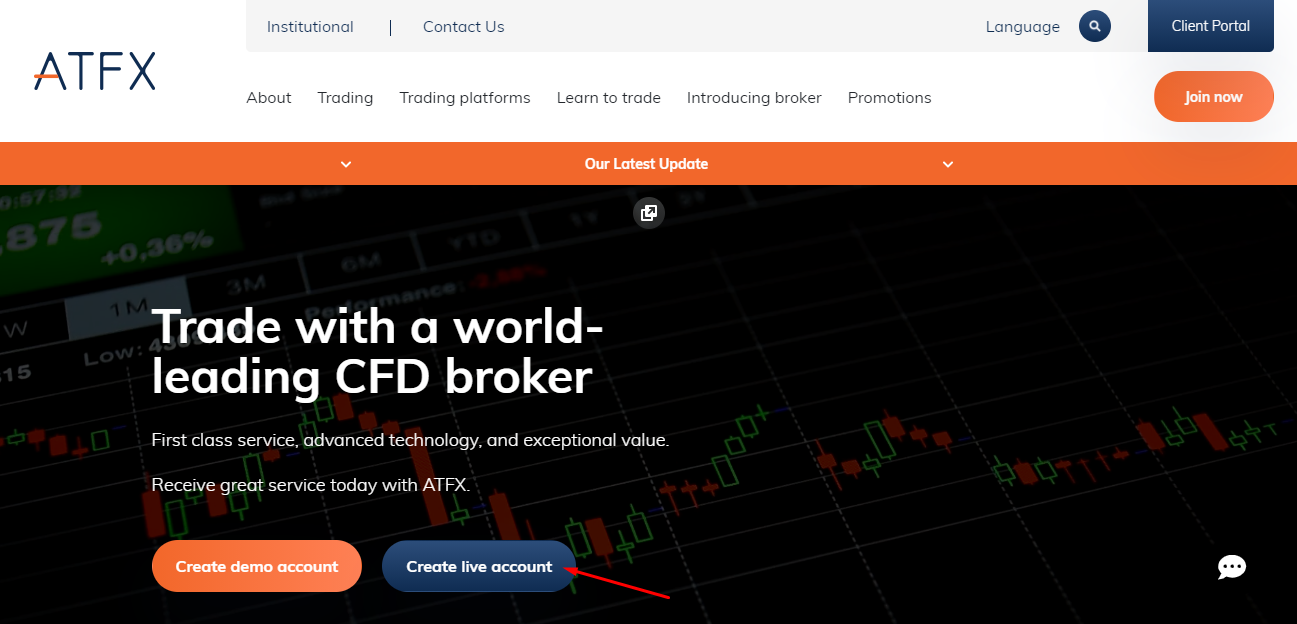

Visit the company’s official website and press Create Live Account on its home page.

Fill out the registration form, provide first and last name, country of residence, phone number, email. Come up with a secure password, enter the captcha code and accept conditions. Confirm email and phone number by entering the codes that were sent by the broker in the pop-down window in the personal account.

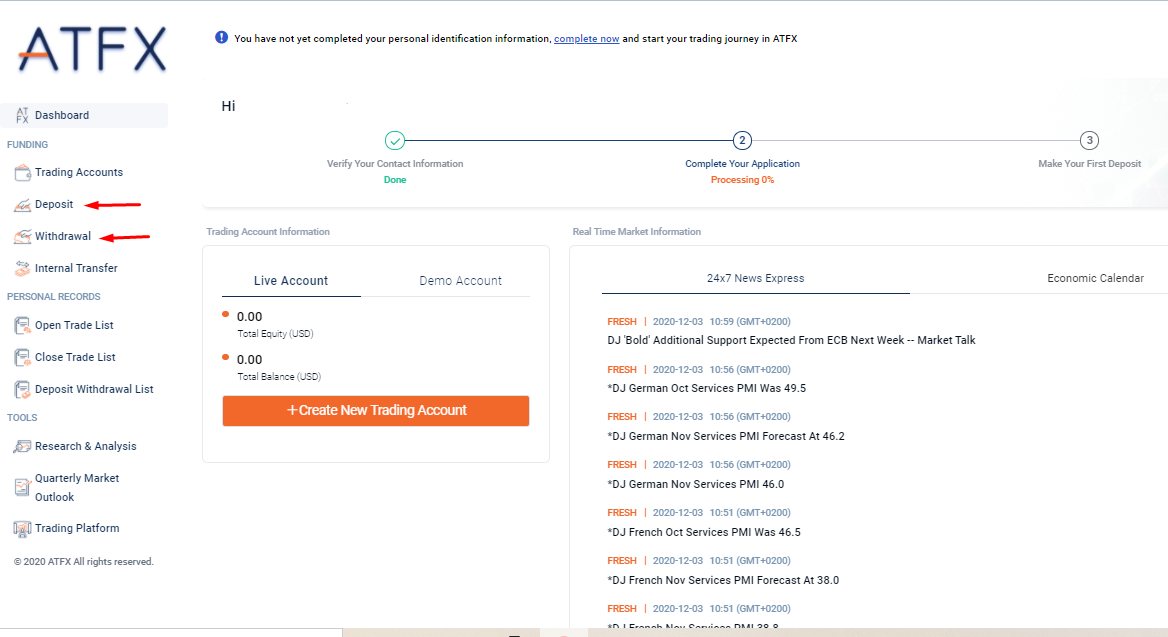

The following features are available in ATFX personal account:

In the personal account, a trader can also perform the following actions:

-

Download MT4 platform or gain access to the web version of the platform.

-

Read quarterly market reviews.

-

Trace the number of open and closed orders.

-

View withdrawal transaction history.

-

Transfer funds between the internal accounts.

-

Contact the broker’s representatives in online mode.

Regulation and safety

ATFX has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 8 years

- Strict requirements and extensive documentation to open an account

ATFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

The Financial Commission The Financial Commission |

The Financial Commission | International | Up to €20,000 | Tier-3 |

ATFX Security Factors

| Foundation date | 2017 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ATFX have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ATFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ATFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ATFX Standard spreads

| ATFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ATFX RAW/ECN spreads

| ATFX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,15 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ATFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ATFX Non-Trading Fees

| ATFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

ATFX offers standard and professional accounts. To be given the Professional status, a trader must close at least 10 trades with large amounts quarterly for the past year and own equity of over EUR 500,000.

Account types:

The company provides an opportunity to test trading conditions and the platform features using a free demo account with identical conditions to the live accounts.

ATFX offers a wide choice of accounts for traders with any level of trading skills. Customers can open standard and professional accounts with conditions that are best suited for their strategy.

Deposit and withdrawal

ATFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

ATFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank wire transfers available

- No withdrawal fee

- No deposit fee

- Bank card deposits and withdrawals

- Only major base currencies available

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are ATFX deposit and withdrawal options?

ATFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, M-Pesa.

ATFX Deposit and Withdrawal Methods vs Competitors

| ATFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are ATFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ATFX supports the following base account currencies:

What are ATFX's minimum deposit and withdrawal amounts?

The minimum deposit on ATFX is $200, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ATFX’s support team.

Markets and tradable assets

ATFX offers a limited selection of trading assets compared to the market average. The platform supports 150 assets in total, including 44 Forex pairs.

- Indices trading

- Crypto trading

- ETFs investing

- Limited asset selection

- Futures not available

ATFX Supported markets vs top competitors

We have compared the range of assets and markets supported by ATFX with its competitors, making it easier for you to find the perfect fit.

| ATFX | Plus500 | Pepperstone | |

| Currency pairs | 44 | 60 | 90 |

| Total tradable assets | 150 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products ATFX offers for beginner traders and investors who prefer not to engage in active trading.

| ATFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

Online chat operators provide support 24 hours a day, 7 days a week.

Advantages

- 24-h online chat

- Possibility to contact your personal manager

Disadvantages

- Only general questions can be asked in the online chat

- Detailed information about trading conditions is not provided to unregistered users.

The following methods of contacting customer support are available:

-

via phone at the numbers specified in the Contact Us section;

-

email;

-

online chat on the broker’s website;

-

Messenger Facebook.

Online chat for contacting the broker’s representatives can be found both on the website and in the personal account.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | 1st Floor, First St. Vincent Bank Bldg, James Street, Kingstown, St. Vincent and the Grenadines |

| Regulation |

FCA, CySEC, FSC (Mauritius)

Licence number: 760555, 285/15, C118023331 |

| Official site | atfx.com |

| Contacts |

+44 203 957 7777, 0800 279 6219

|

Education

There is a rather extensive Learn to Trade section on the broker’s website, featuring instruments for analysis and also useful information on trading on the financial markets for beginners and experienced traders.

Using a demo account will help consolidate the acquired knowledge and test it.

Comparison of ATFX with other Brokers

| ATFX | Bybit | Eightcap | XM Group | TeleTrade | Markets4you | |

| Trading platform |

MT4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, MobileTrading, MT5 |

| Min deposit | $500 | No | $100 | $5 | $10 | No |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:10 to 1:4000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0.1 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 100% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | Yes |

Detailed Review of ATFX

ATFX is a reliable Forex and CFD broker, introducing the latest technologies and offers solutions for retail and institutional investors. The company provides services globally, although, at the moment, the broker is working on expanding its presence in Europe. For this purpose, AT Global Markets developers have created ATFX Connect, a unique product for institutional investors. Simplicity, speed, security, and adaptability make ATFX one of the top platforms in the industry.

Several figures about ATFX published on the broker’s official website:

-

The broker employs 450 people.

-

The broker has branches and offices in 14 countries.

-

Over 100 trading instruments are available to customers.

ATFX is a broker for active traders of all levels of trading experience

ATFX is a reliable institutional platform, providing access to first-level bank and non-bank liquidity. The broker offers competitive spreads, high order execution, and access to the most popular trading platform. The company uses HTML5 protocols to make the user interface as efficient as it can be. A functional client portal allows ATFX customers to manage their risks, view opened positions and trades, and also control their equity in real-time.

ATFX provides the MT4 platform for Forex trading. The broker’s customers can work from any device – PC, laptop, tablet, or smartphone. A web version that does not require the installation of additional software is also available. All versions of the platform offer a wide range of analytical instruments, including over 30 indicators.

Useful services offered by ATFX:

-

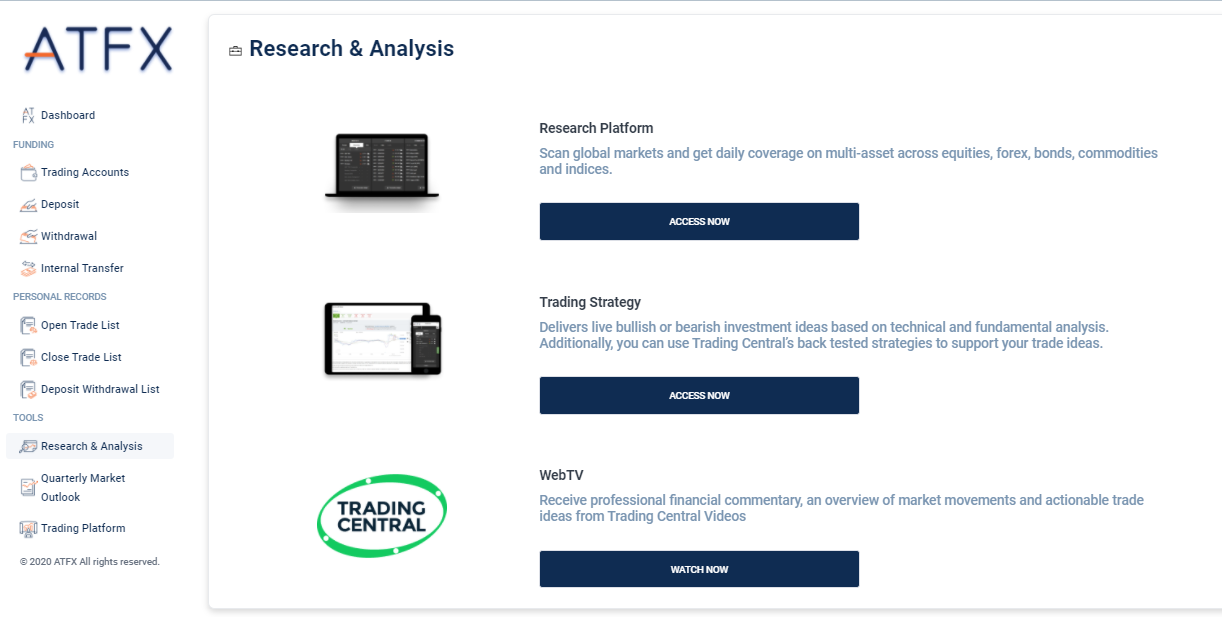

Autochartist is an instrument for market analysis, which builds charts based on trading indicators such as pivot points, moving averages, Bollinger Bands, Fibonacci Retracements, MACD, and others.

-

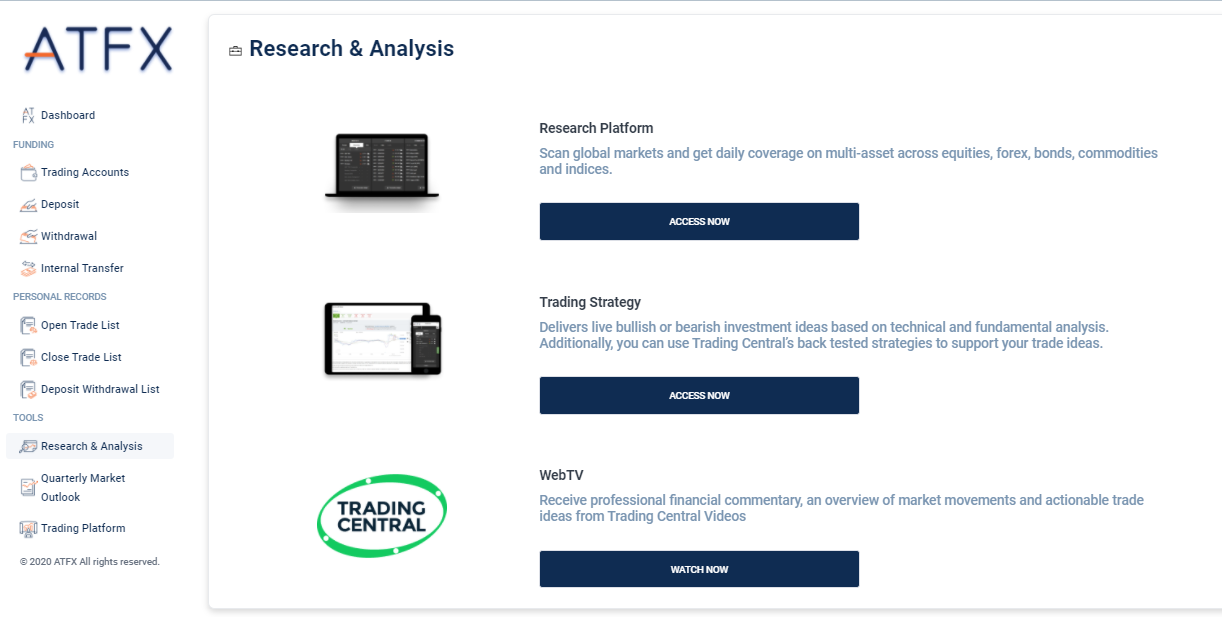

Trading Central is a customizable review of over 8,000 instruments, including Forex, indices, and commodities.

-

Dow Jones News is a service for receiving financial information, which serves as a fundamental analysis instrument from a top world agency.

Advantages:

There is negative balance protection on all standard and professional accounts.

There are accounts with tight market spreads from 0.1-0.6 pips.

A trader can choose accounts with the best-suited leverage – from 1:30 to 1:400.

The broker provides an opportunity to invest in PAMM accounts.

ATFX is a part of a large holding company, which holds licenses issued by international regulators.

The company provides the latest analytical information, trading signals from Trading Central, and quality educational materials.

Scalping, trading with algorithmic advisors (EAs), creation of user indicators in MQL are allowed.

Latest ATFX News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i