Exness FAQs | Help for Traders and Tips

Exness Summary

Which country is Exness from?

Exness originates from Cyprus. Its main office is located at 1, Siafi Street, Porto Bello Business Center, Limassol, 3042, Cyprus. It is licensed (license number 178/12) and is governed by the Cyprus Securities and Exchange Commission (CySEC).

Who is the owner of Exness?

Petr Valov, the founder of Exness in 2008, envisioned a company propelled by robust ethical principles and a scientific, algorithmic approach to its products. With a background in software development dating back to his school days, Valov pursued IT and programming at university. In the nascent stages of Exness, he single-handedly crafted its technological foundations.

How does Exness differentiate itself from other brokers in the market?

Exness, characterized primarily as an Electronic Communication Network (ECN) broker, stands out for its provision of unlimited leverage to traders, a feature uncommon on other trading platforms. Additionally, operating as a market maker, it distinguishes itself from A-book or B-book brokers by offering liquidity for orders and deriving the bulk of its profit from the spread charged on orders.

Are there any educational resources provided by Exness for traders?

Yes. An extra resource available for beginners is the demo account, allowing them to put into practice the knowledge gained from Exness's diverse educational materials aimed at teaching forex trading. A trader can practice trading with a demo account without having to risk any real money.

Is Exness a Good Forex Broker for Beginners?

Yes, Exness is indeed a great Forex broker for beginners. Its standard and standard cent accounts come with a full range of features designed to make it ideal for new traders. With these accounts, novices can better control their risk because the margin call level is set at 60%. Furthermore, the minimum trade size for standard accounts is only 0.01 lots; for standard cent accounts, it is only cent lots.

What kind of bonuses are on Exness?

Exness adheres to its fundamental values by generally abstaining from offering bonuses like sign-up incentives or other promotional schemes. However, within specific campaign parameters, rewards might occasionally be offered. Exness offers the Affiliate and IB programs as respectable choices for individuals seeking commission-based opportunities. The IB program enables participants to get a share of the spread revenue produced by their referred clients, while the Affiliate program gives commissions for each new customer referred.

Regulation and Safety

Is Exness safe? Is Exness legit?

Yes. Exness is a secure online multi-asset broker that incorporates cutting-edge security measures to guarantee the security of its clients' investments. To maintain the security of data and money transfers, Exness uses firewalls, anti-DDoS protection, and encrypted SSL connections. They are governed by several elite financial authorities, including:

South African Financial Sector Conduct Authority (FSCA, 51024)

Seychelles Financial Services Authority (FSA, SD025)

The Financial Conduct Authority in the United Kingdom (FCA, 730729)

Cyprus Securities and Exchange Commission (CySEC, 178/12)

Financial Services Commission (FSC) - Mauritius

Central Bank of Curacao and Sint Maarten (CBCS, 0003LSI)

Financial Services Commission (FSC, SIBA/L/20/1133) - British Virgin Islands

The Capital Markets Authority (CMA, 162) - Kenya

Is Exness a trustworthy broker?

Yes. Exness is a trustworthy broker. This broker is regulated by top-tier regulators like FCA( 730729) and CySEC (178/12) and other popular financial regulators like FSCA (51024), FSA( SD025), CBCS (0003LSI), and CMA (162). In addition to having membership in the Financial Commission, Exness offers insurance coverage up to EUR 20,000 per client in the event of a force majeure. Exness also provides negative balance protection, which guarantees reimbursement for losses if an account balance is exhausted.

Are there any countries that Exness does not accept clients from?

Yes. Exness does not accept clients from the United States, Iran, North Korea, Europe, Baker Island, Kingman Reef, the Northern Mariana Islands, the Marshall Islands, Guam, Howland Island, Puerto Rico, the Midway Islands, Estonia, Bosnia and Herzegovina, and Finland. In addition, Greece, Hungary, New Zealand, Canada, Germany, Australia, Vanuatu, France, Russia, Israel, Iraq, Syria, and Yemen are also on the list of countries where Exness does not accept clients.

Account Types

What types of trading accounts does Exness offer?

The primary Exness accounts are classified as professional (pro, zero, raw spread) or standard (standard, standard cent). There are also options for a demo account, which is a free account provided to inexperienced traders so they can practice trading before using a real one. Additionally, provisions are made for an Islamic account.

Is there a demo account option available for traders to practice with Exness?

Yes. Traders on Exness can open and trade with a demo account on the Exness platform. A demo account is known to be a virtual account funded by Exness, but the funds and profits made trading on this account cannot be withdrawn.

Does Exness offer Islamic trading accounts?

In fact, Exness offers Islamic trading accounts, also known as swap-free accounts, to Muslim traders who follow Sharia law in the financial industry. These accounts ensure that positions held overnight are not subject to swap charges. Notably, clients can apply for swap-free status automatically through their area. This is because Exness' automated system flags accounts of clients who live in countries where Islam is the predominant religion.

Which account type is best on Exness?

Depending on their trading experience and style, two traders may have different preferences among the trading accounts available on Exness. However, given its low minimum deposit, high leverage, and fixed spreads, the standard account is the best trading account for novice traders. The Pro, Zero, and Raw Spread accounts have lower spreads and faster execution times, making them attractive options for novice traders.

Exness Trading Features

What financial instruments can be traded with Exness?

Potential and existing traders on Exness can trade the following instruments:

Forex

Indices

Stocks

Cryptocurrencies

Does Exness offer leverage?

Yes. Exness offers unlimited leverage to its clients, allowing them to trade with higher volumes and potentially make larger profits. This feature is available for all account types, including Standard, Pro, and Raw Spread accounts. The maximum leverage offered by Exness is up to 1:unlimited, which is ideal for professional traders and scalpers. However, to access unlimited leverage, traders need to have a minimum equity of $1,000.

Does Exness allow scalping?

Yes. Traders who prefer scalping can rely on the Exness trading platform, considering the features scalpers can find on the Raw Spread, Zero, and Pro accounts. For experienced traders, Exness Pro accounts offer low-spread or spread-free options with execution designed for scalpers, day traders, and algorithmic traders. The Exness platform will draw scalpers with its additional features, such as competitive spreads, the VPS that guarantees consistent execution speed and consistency, and the Exness stop-out protection feature that protects Exness traders from up to 30% of stop-outs.

Can clients trade cryptocurrencies with Exness?

Certainly, Exness provides round-the-clock cryptocurrency trading across various account types such as Standard, Pro, Raw Spread, and Zero. While traders benefit from this uninterrupted access, scheduled weekly breaks and server maintenance are occasionally required; traders are given notice before these events. Specifically, during Sunday's trading hours (20:35–21:05) some cryptocurrency pairs, such as BTCAUD, BTCJPY, BTCCNH, BTCTHB, BTCZAR, BTCXAU, and BTCXAG, may be momentarily unavailable. Notably, trading cryptocurrency is forbidden with Standard Cent accounts.

Can clients set up automated trading systems with Exness?

Certainly. Exness allows clients to establish automated trading systems, leveraging EAs (Expert Advisors). These EAs are programs designed to operate within a trading terminal, executing trades autonomously without direct intervention from the trader. Upon installing an EA, users must configure specific parameters, including trigger alerts, notifications, and trading actions, tailored to the market conditions they wish the EA to monitor. It's important to note that EAs are exclusive to desktop trading terminals for MT4 and MT5; they are incompatible with the mobile or web iterations of these terminals. How to Use Exness Web Terminal for Trading.

Why do you need to use Exness strategies?

Exness strategies provide a structured framework that helps traders adhere to predefined rules, ensuring consistency and discipline in their trading approach. Moreover, Exness strategies are designed to minimize the risk of losing out on trades, thereby safeguarding the trader's capital. Through careful consideration of risk management techniques and the implementation of stop-loss orders, traders can limit potential losses and protect their investments. Among the various Exness strategies available, scalping is particularly noteworthy for its ability to generate daily results through quick, short-term trades.

Are there any restrictions on the trading strategies clients can use with Exness?

While Exness does not impose significant restrictions on trading strategies, it categorically forbids manipulative acts like insider trading, market manipulation, and price fixing. Exness's guidelines, which include strategy testing, minimizing latency, and continuous algorithmic activity monitoring, must be adhered to by traders utilizing automated or algorithmic strategies. Traders need to remain mindful of the margin requirements and ensure that their strategies remain within the limits of available margins to avoid potential margin calls.

Exness Deposit, Withdrawal and Fees

What is the minimum deposit for Social accounts?

For Social Standard and Social Pro accounts, the initial deposit minimum is $500.

How to withdraw funds from Exness?

The withdrawal algorithm is as follows:

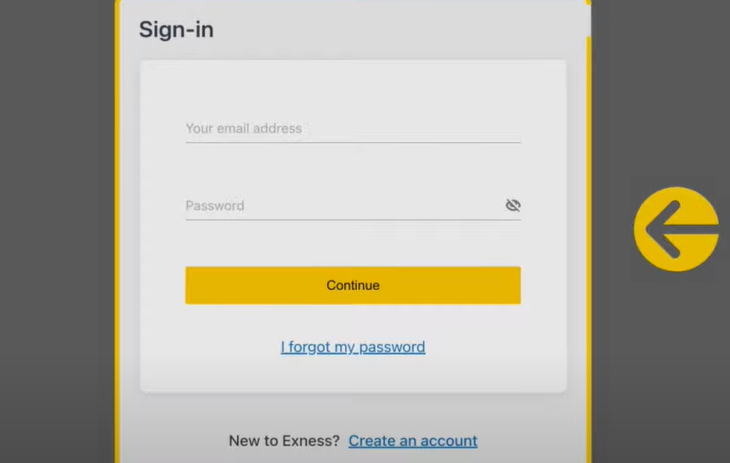

First, to begin the withdrawal process, sign into your Exness account.

After logging in, go to the withdrawal section and choose your preferred payment method (make sure it is the same as the one you used to make the deposit).

Next, provide the necessary withdrawal details as prompted and confirm the transaction; Exness processes all withdrawal requests immediately.

However, please note that the time it takes for the funds to reflect in your account can vary from one to thirty business days, contingent upon your bank and country of residence, following the submission of your withdrawal request to our card processors and banks.

How much does it cost to trade on Exness?

Depending on the type of account, Exness has different trading costs. The minimum deposit for trading with a professional, zero, or raw spread account is $200, and the trading commissions on these accounts are:

Professional - $0

Zero - From $0.05 on each side per lot

Raw spread - Up to $3.50 each side per lot

Standard accounts have no trade commission and a minimum deposit that varies based on the payment method used.

Are there any fees associated with depositing or withdrawing funds from an Exness account?

No charges are attached to making deposits into or withdrawals from an Exness account, meaning that Exness does not charge for these transactions. However, it's important to note that while Exness doesn't levy fees, third-party entities such as banks or e-wallet providers may have their fee structures. Additionally, most payment methods have a minimum withdrawal limit of $1, except for bank transfers, which require a minimum withdrawal of $50.

Can I trade with $10 on Exness?

You can commence trading with as little as $10 on Exness, provided you opt for standard accounts. The minimum deposits for Exness standard accounts differ based on the chosen payment method. On the other hand, professional accounts need to have $200 to start trading.

Getting Started

How to start trading on the Exness platform?

The algorithm is as follows:

Your journey starts with registering, completing account verification, and making your first deposit on the Exness platform.

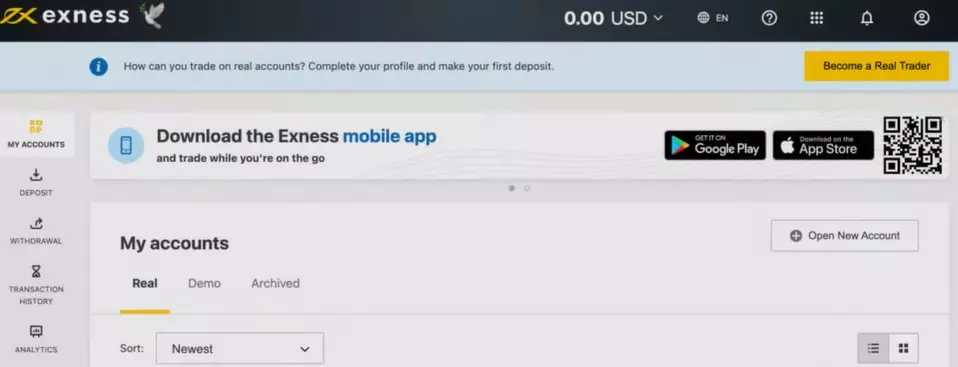

Exness website

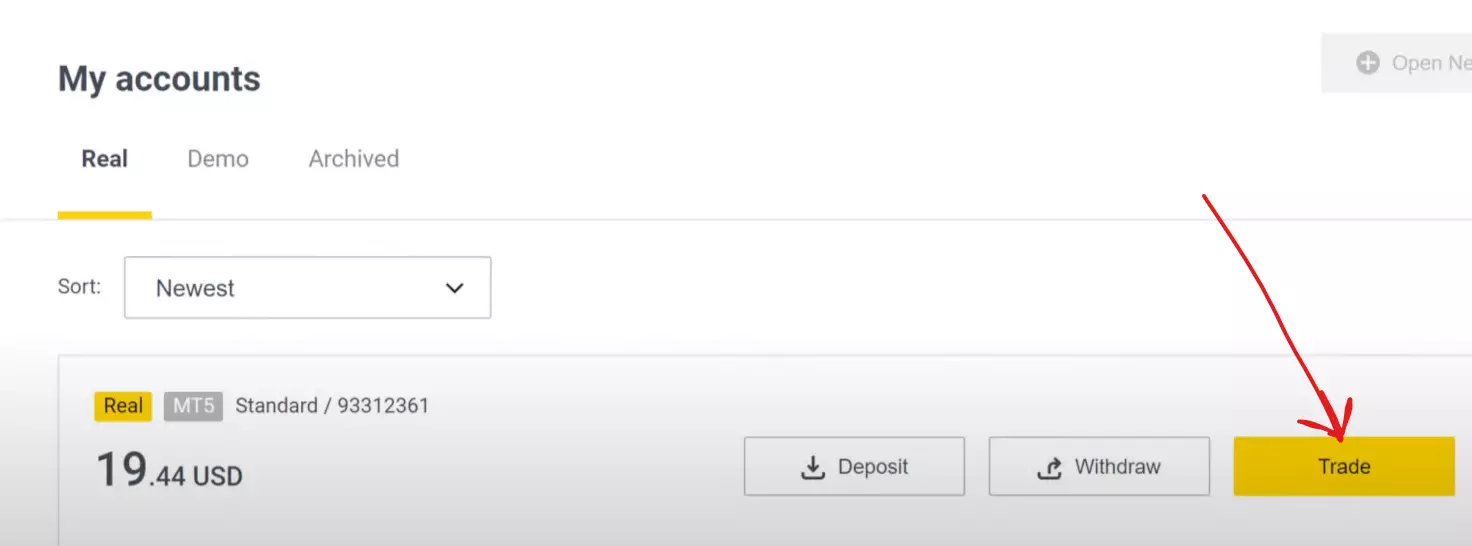

The next step is to start trading after the money has been deposited into your trading account. This entails adding trading instruments after choosing your favorite platform by going to the Trade option in the Exness account section. Before clicking "buy" or "sell," you should first configure the assets you want to trade.

Exness website

Then, you should calculate the margin, double-check the market hours, and apply your risk management plans.

How to download and set up the Exness app?

To begin, familiarize yourself with the range of Exness applications accessible for download in both the iOS app store and Android Google Store.

How to download Exness app:

Get the Exness mobile app from Google Play or the App Store.

Exness website

Launch the app, log in (or select register).

Exness website

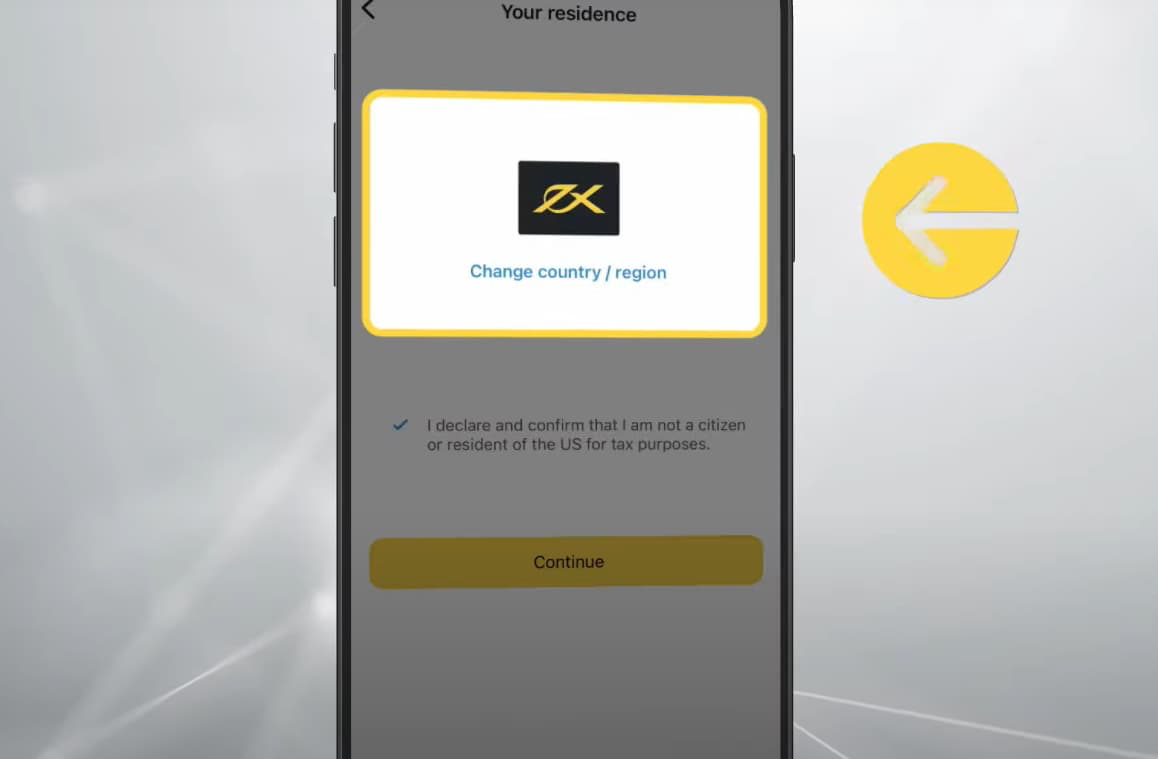

Choose your country.

Exness website

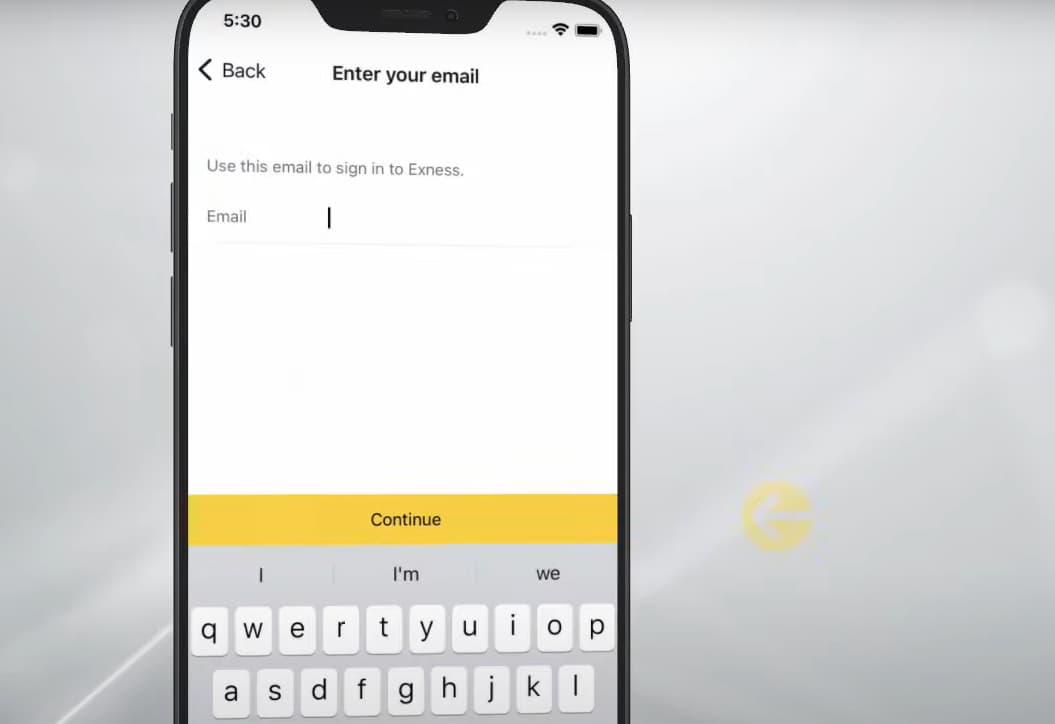

Enter your email, and make a password.

Exness website

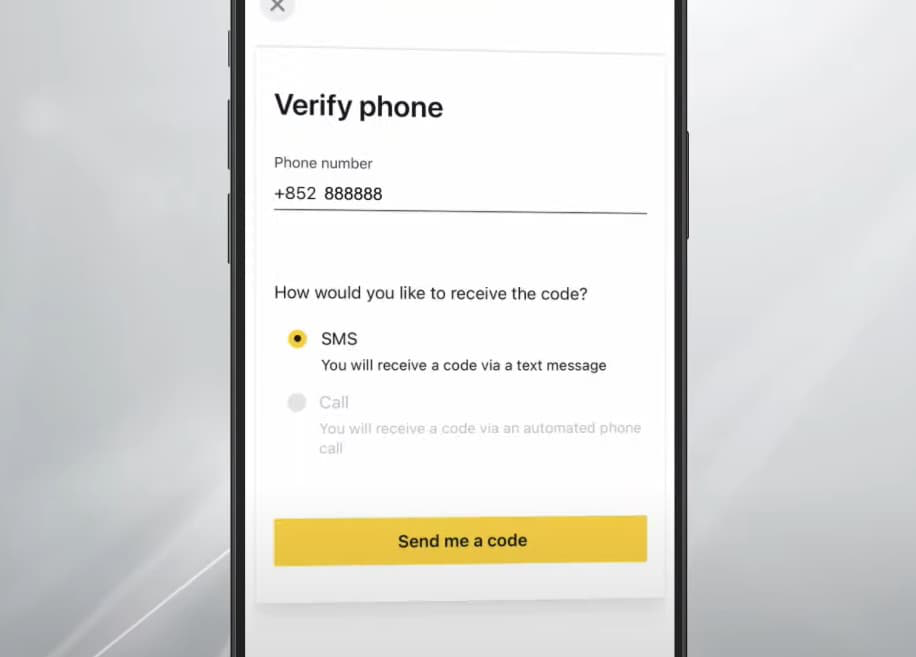

Enter your phone and wait for Exness to send a code.

Exness website

After entering the six-digit verification code click "continue".

Confirm the passcode.

How To Verify Exness Account

How To Verify Exness Account:

Login and navigate to the verification section.

Exness website

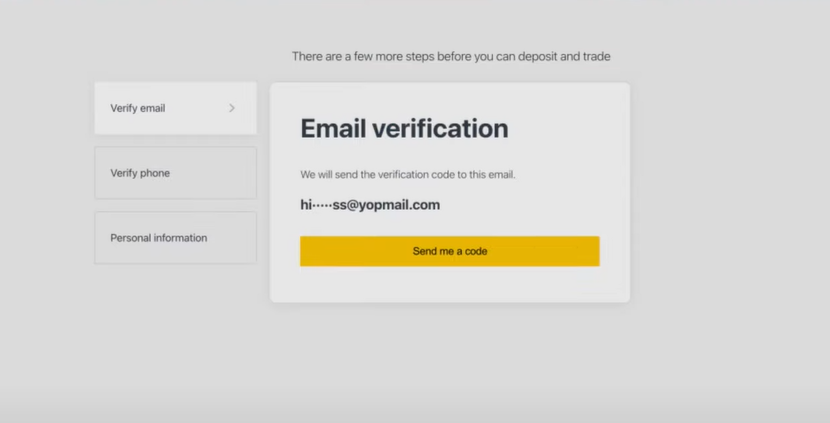

Completing an economic profile (survey), along with submitting proof of residence (POR) and proof of identity (POI) verification documents.

Exness website

Verify your email and phone number.

Exness website

Verification of proof of identity and proof of residence.

Investment Options

What are the investment programs of Exness?

Exness offers a range of investment programs catering to different needs and preferences. Among these is social trading, which proves advantageous for both investors and strategy providers. Additionally, Exness provides an Affiliate program, incentivizing investors who successfully persuade potential traders to register and commence trading on the platform. Moreover, users can engage in cryptocurrency trading and explore staking opportunities for generating passive income. When selecting a strategy, investors have various options to consider.

How To Become An Exness Social Trading Investor

To embark on your journey as a social trading investor with Exness, you need to:

Download the Exness “Social trading” application.

Create an account.

Find the right strategy provider to copy.

Fund your account.

Enhance your portfolio diversification by replicating trades from multiple traders employing varying strategies and risk profiles. Existing Exness clients can seamlessly access the Social Trading app through their current accounts, choosing to participate either as investors or strategy providers. Find out how Exness social trading works.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).