According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $0

- MobileTrading

- WebTrader

- MetaTrader4

- MetaTrader5

- HFM Platform

- FCA

- DFSA

- FSCA

- FSA

- CMA

- 2010

Our Evaluation of HFM

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

HFM is a reliable broker with the TU Overall Score of 7.09 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by HFM clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

The HFM broker focuses on traders from Europe. The company offers a variety of investment options and is suitable for both novice and professional traders.

Brief Look at HFM

HFM is a broker owned by the HF Markets Group, offers a wide variety of account types, and has the widest selection of trading assets and high-quality software. HFM also has favorable trading conditions and instant execution of orders. Plus, a solid list of tools and services allow everyone to choose the best option. The broker's reliability is confirmed by the license of several regulators. The company's work experience in the financial, brokerage and other services market is over 10 years. Within that time, HFM has received 35 prestigious awards. For trading, MetaTrader 4 and MetaTrader 5 trading terminals are used.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- favorable trading conditions and low spreads - from 0 pips;

- controlled by several regulators;

- no commissions for account replenishment and bank transfers.

- Withdrawal terms do not always correspond to those indicated;

- Few account currencies, which is why some clients have to pay for double conversion;

- The choice of electronic payment systems for replenishment/ and withdrawal is rather modest;

- Registration is quite easy, but while it is in progress, you cannot learn the conditions on other types of accounts;

- Customer support is closed on weekends.

TU Expert Advice

Financial Markets Expert

HotForex is now known as HF Markets, and refers to itself on its website as HFM (the website address is HFM.com). The

name change may simply be due to the fact that HFM offers multi-market access, that it isn’t just limited to trading the

forex market. Still, it can be a little confusing, as the company is still listed as HotForex on some websites.

A primary draw at HotForex is the multi-market exposure it offers. About three dozen cryptocurrencies are available to

trade. That’s in contrast to many forex brokers that only offer trading in a handful of cryptos. In addition to about 75

of the most widely traded stocks, HotForex clients also have exposure to approximately 30 ETFs and about a dozen market

indexes. Bond trading is severely limited – only the Euro Bund, the UK Gilt, and the US 10-year Treasury Note.

Here are three things I like about HotForex:

1. Choice of Spread or Commission Fees - A choice of spread-fees-only or

commission-fees-only accounts; Commission fees are on the low end of industry averages, at $6 per standard forex lot

round turn trade.

2. Tier 1 Regulated - Security for traders is enhanced by the fact that HotForex is

regulated by multiple Tier 1 financial regulators, including the UK’s Financial Conduct Authority (FCA).

3. Strong Trader Education - HotForex provides beginning traders with extensive trader

education resources, including video tutorials, webinars, and a full forex trading course; It also gives clients daily

fundamental and technical market analysis reports.

- You prefer not to make a large initial deposit but still expect professional conditions. HFM is one of the few brokers that doesn't require a mandatory deposit for three of its accounts, and for the fourth (Pro), it's only $100. Given the advantageous trading parameters of these accounts, this is an excellent offer.

- Your strategy involves generating profits through avenues other than just active trading. Among the integrated services offered by HFM is its proprietary copy trading platform. Additionally, the broker's clients can join PAMM accounts.

- Swiftly depositing and withdrawing funds via online systems is of great importance to you. HFM supports only specific bank cards, a few cryptocurrency wallets, and international bank transfers. Popular options like Neteller and Skrill are not available.

HFM Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, Webtrader, Mobile Trading and HFM Platform |

|---|---|

| 📊 Accounts: | CENT, ZERO, PREMIUM, PRO |

| 💰 Account currency: | USD, EUR, NGN, JPY |

| 💵 Deposit / Withdrawal: | Wire Transfer, Visa/MasterCard, Crypto, Fasapay, Neteller, PayRedeem, Perfect Money, Skrill, Bitpay |

| 🚀 Minimum deposit: | USD 0 |

| ⚖️ Leverage: | Up to 1:2000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Forex, Metals, Energies, Stocks, Indices, Bonds, Commodities, ETFs, Cryptocurrencies |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution, Instant Execution |

| ⭐ Trading features: | Hedging; Account for scalping; Trading on the news. |

| 🎁 Contests and bonuses: | Yes |

HFM trading conditions can be attributed to a high level of competitiveness. A low minimum deposit and a leverage of up to 1:2000 provide opportunities for clients to use several highly profitable strategic models and test the functionality of the account and terminal. The spread floats according to the trading conditions and the minimum spread is equal to 1 pip. However, for a Zero account, its minimum value is zero.

HFM Key Parameters Evaluation

Video Review of HFM

Share your experience

- Best

- Last

- Oldest

PK Rawalpindi

PK Rawalpindi fast execution, major pairs with low spreads

crypto trading

PH General Trias

PH General Trias ewallets

...

PH General Trias

PH General Trias  TH Bangkok

TH Bangkok Trading Account Opening

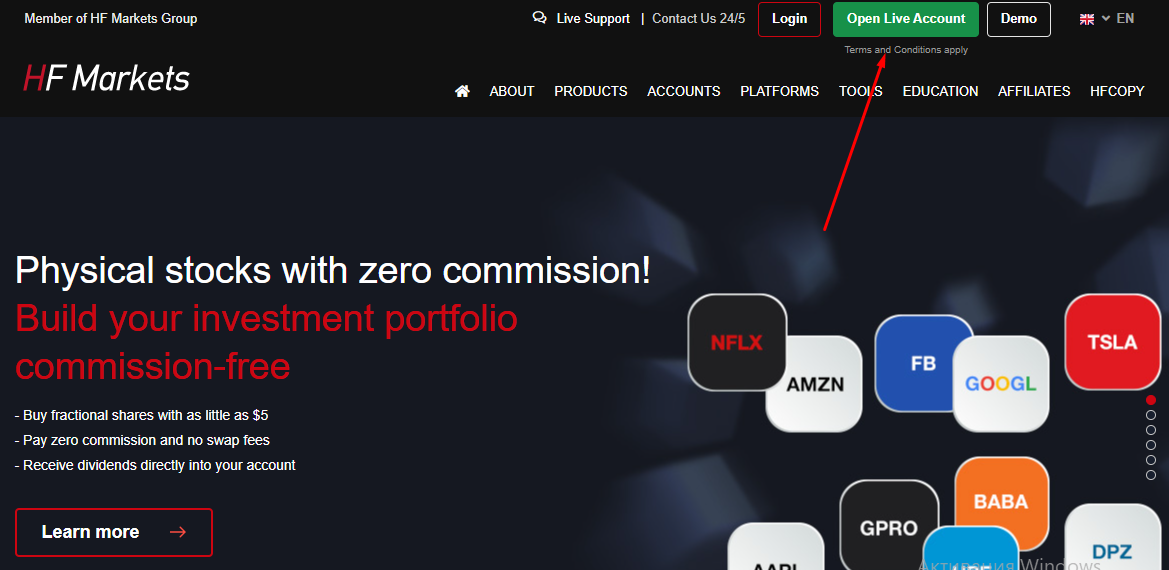

To make it easier for you to open a user account on HFM's website, we have prepared the following instructions:

On the main page of the HFM website, in the upper panel of the website, click the "Open Real Account" button to open a real account. Alternatively, you can use the Demo button.

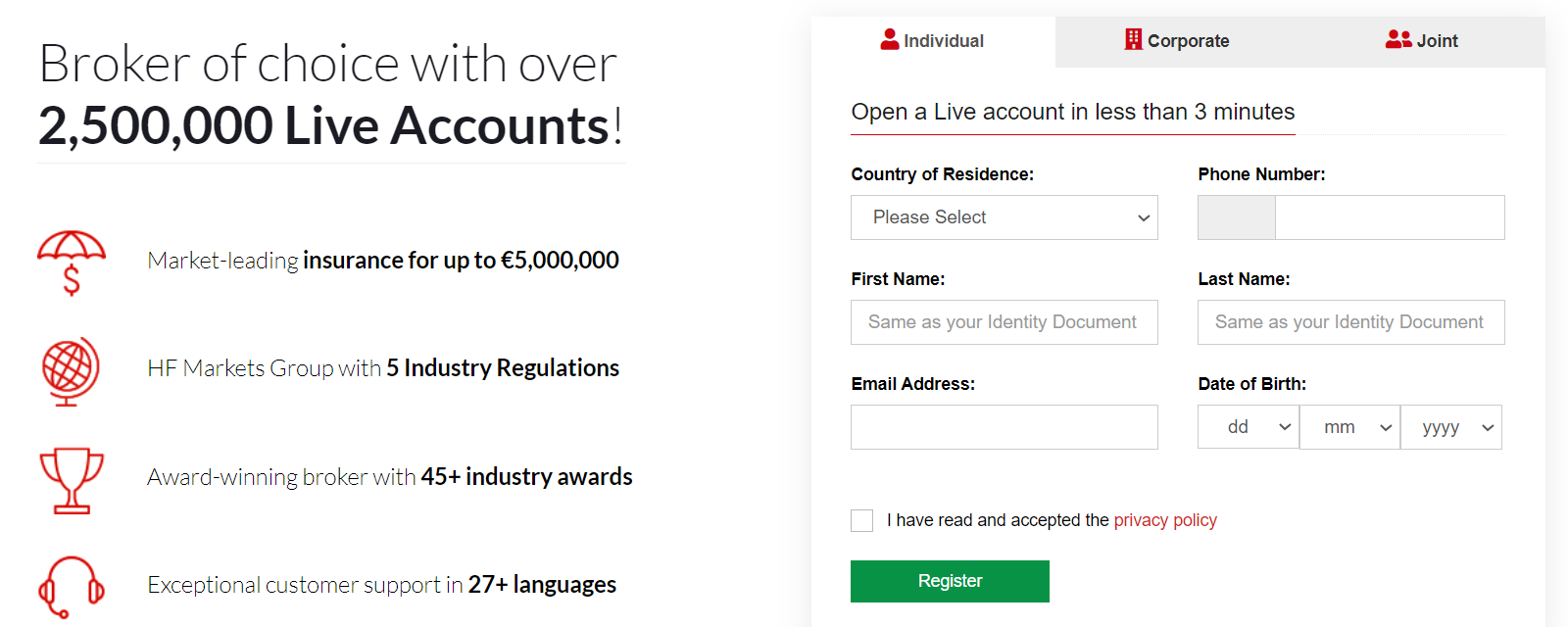

To register, you must fill in all the questionnaire fields with the requested information including: type of client, name, surname and date of birth, country, email address, and phone number.

After filling in all the required information, you will need to confirm the registration by clicking the appropriate button.

The following functions are available in the HFM user account:

There are other useful functions and features here, such as:

-

analytical tools;

-

transaction history;

-

educational information.

Regulation and safety

HFM has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 15 years

- Strict requirements and extensive documentation to open an account

HFM Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

DFSA DFSA |

Dubai Financial Services Authority | Dubai | No specific fund | Tier-2 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

| CMA (Kenya) | The Capital Markets Authority | Kenya | KES 50,000 | Tier-2 |

HFM Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker HFM have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of HFM with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, HFM’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

HFM Standard spreads

| HFM | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

HFM RAW/ECN spreads

| HFM | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,4 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with HFM. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

HFM Non-Trading Fees

| HFM | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

HFM offers 6 types of live accounts, aside from the swap-free Islamic account and demo account. The minimum initial deposit is only USD 5. A PAMM account is also provided for investors. Also, for those who wish to focus on social (mirror) trading, the HFM platform offers HFcopy.

HFM account types are summarized below:

Regardless of the selected account type, a floating spread is provided, the size of which starts from 1 point. An exception is the Zero Spread account, in which the starting spread value is equal to zero.

Before opening a real trading account, novice traders can learn the features of trading via a free demo account.

Deposit and withdrawal

HFM received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

HFM provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- USDT (Tether) supported

- Supports 5+ base account currencies

- Bank wire transfers available

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

What are HFM deposit and withdrawal options?

HFM provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, BTC, USDT.

HFM Deposit and Withdrawal Methods vs Competitors

| HFM | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are HFM base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. HFM supports the following base account currencies:

What are HFM's minimum deposit and withdrawal amounts?

The minimum deposit on HFM is $0, while the minimum withdrawal amount is $5. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact HFM’s support team.

Markets and tradable assets

HFM offers a limited selection of trading assets compared to the market average. The platform supports 500 assets in total, including 50 Forex pairs.

- Crypto trading

- ETFs investing

- Commodity futures are available

- Regional restrictions are possible

Supported markets vs top competitors

We have compared the range of assets and markets supported by HFM with its competitors, making it easier for you to find the perfect fit.

| HFM | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 500 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products HFM offers for beginner traders and investors who prefer not to engage in active trading.

| HFM | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

HFM received a score of 9/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Proprietary platform with unique features

- Free VPS for uninterrupted trading

- MetaTrader is available

- One-click trading

- No access to cTrader and its advanced tools.

- Strategy (EA) Builder is not available

- No access to API

Supported trading platforms

HFM supports the following trading platforms: MT4, MT5, Proprietary platform, WebTrader. This selection covers the basic needs of most retail traders. We also compared HFM’s platform availability with that of top competitors to assess its relative market position.

| HFM | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | Yes | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key HFM’s trading platform features

We also evaluated whether HFM offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 130 |

| Tradable assets | 500 |

Additional trading tools

HFM offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

HFM trading tools vs competitors

| HFM | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

HFM supports mobile trading, offering dedicated apps for both iOS and Android. HFM received 3/10 in this section, which suggests limited user interest or weak performance of the apps.

- Mobile alerts supported

- Indicators supported

- Weak user feedback on Android

- Mobile 2FA not supported

We compared HFM with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| HFM | Plus500 | Pepperstone | |

| Total downloads | 1,000,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

The HFM platform provides an abundance of useful educational information. What’s more, for quick answers to the most popular questions, there is a FAQs section.

All these tools can be used to build a trading system.

Customer support

HFM's support service is ready to assist clients around the clock on weekdays.

Advantages

- 24\5 support

- Quickly answers any questions

- Multiple languages

Disadvantages

- Not available on weekends

There are several ways to contact support:

-

by the phone number indicated on the website;

-

by email; and

-

in online chat.

Customer support is also available via the company's website and from the user account.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines. |

| Regulation | FCA, DFSA, FSCA, FSA, CMA |

| Official site | https://www.hfm.com/ |

| Contacts |

+442030978571

|

Comparison of HFM with other Brokers

| HFM | Eightcap | XM Group | RoboForex | Octa | AMarkets | |

| Trading platform |

MT4, MobileTrading, MultiTerminal, MT5, HFM Platform | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, OctaTrader | MT4, MT5, AMarkets App |

| Min deposit | No | $100 | $5 | $10 | $25 | $100 |

| Leverage |

From 1:400 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.6 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 25% / 15% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | No | No |

Detailed review of HFM

HFM was registered in Saint Vincent and the Grenadines in 2009 and belongs to the HF Markets Group. (Registration number - 22747 IBC 2015). HFM is licensed to offer a wide range of services, which includes any commercial, financial, and trading activities. The license also covers activities in the field of lending, borrowing and customer service, participation in other enterprises, and the provision of brokerage services. Additionally, HFMis authorized to provide educational and account management services using currencies, commodities, indices, CFDs, and financial instruments. The company's activities are currently vetted by several regulators including the following: FCA (UK Financial Conduct Authority, 801701), DFSA (Dubai Financial Services Authority, F004885), FSCA (South African Financial Services Authority, 46632), and FSA (Seychelles Financial Services Authority, SD015), CMA Capital Markets Authority.

A few important statistics regarding HFM and its current customer base:

-

over 2,000,000 active real accounts;

-

more than 10 years in the market;

-

over 200 employees worldwide;

-

35 awards;

-

supported by more than 27 languages;

-

6 types of accounts plus a demo and Islamic account.

HFM is a broker for professional trading in the exchange and off-the-counter markets

HFM is a broker providing competitive trading conditions with tight spreads. There is a Zero Spread account, where the spread size starts at 0 pips. However, it should be noted that the spread is floating on 6 types of accounts, so the actual spread may be higher. The HFM platform offers a broad range of trading assets including currency pairs, CFDs, indices, and commodities.

As for terminals, HFM offers MT4 and MetaTrader 5 to clients in various versions, including mobile applications for iOS and Android devices. A proprietary terminal designated HFM FIX / API is also available. This proprietary terminal provides clients with advanced order types and routing management systems as well as PBX.

In addition, HFM provides many useful trading tools including:

-

Autochartist is a customizable market scanner that acts as an effective analytical tool;

-

Premium Trader Tools package is a set suitable for MT4/5 terminals and provides new trading opportunities, regardless of the trading strategies used by the client;

-

Advanced Insights is an effective analytical tool that is used when processing large amounts of information related to market volatility;

-

Clients can also receive trading signals via SMS messages.

Advantages:

stable operation of terminals and services;

wide functionality of trading platforms;

low spreads;

reliability;

provides algorithmic trading and scalping.

The HFM platform does not issue any restrictions on trading strategies: locking and hedging are allowed and there are no time limits.

Latest HFM News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i