According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- MT4

- WebTrader

- 2016

Our Evaluation of IGM FX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

IGM FX is a broker with higher-than-average risk and the TU Overall Score of 4.77 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by IGM FX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

IGM FX is a broker that is more suitable for professional traders. But there are also educational materials for novice traders.

Brief Look at IGM FX

IGM FX is a brokerage company that has been providing services since 2016. The broker offers instruments for trading over 15 classes of assets, including cryptocurrencies and contracts for differences (CFDs). The official representative offices of the broker are located in Cyprus. The company's activities are regulated by CySEC (Cyprus Securities and Exchange Commission) under license number 309/16.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Various trading platforms. Traders get the option to choose between MT4 (MetaTrader 4) for automated trading and its web version;

- 11 trading markets;

- Fast execution of trades;

- Over 160 CFDs on popular assets;

- Trading accounts that can be customized for different trading areas;

- 4 trading account types;

- Availability of margin trading.

- No PAMM or MAM accounts for passive investing;

- Only clients from the European Economic Area are served. Traders from the UK and the U.S. will not be able to trade;

- No Islamic accounts.

TU Expert Advice

Financial expert and analyst at Traders Union

IGM FX has been in the trading market for 7 years, and since then the company has made over 160 CFD trading instruments available to its clients. The brokerage company provides the opportunity to trade cryptocurrencies, commodities, shares of companies, and energies. IGM FX developers regularly update the platform, due to which traders always receive advanced instruments for their activities.

There are two types of accounts, namely Professional and Trading. To create a Pro user account, you must meet a number of criteria. The first criterion is to trade with an equivalent value of €25,000 per transaction without leverage. Or the nominal value of the transaction should be €100,000 in the Forex market, bonds, or commodities; €50,000 for indices; and €10,000 for CFDs. The second criterion is a trading portfolio of at least €500,000 in the form of cash deposits or financial instruments. The third one is experience in the financial segment or CFDs for more than one year.

Trading accounts are divided into Classic, Silver, Gold, and VIP. These differ from Professional accounts in stop outs. For Professional accounts, stop outs are 20%; for Trading accounts, it is 50%. Spreads are flexible, and the basic parameter is from 0.9 pips. For the EUR/USD pair, the spread is 2.5 pips. Trading CFDs on stocks carries a spread of 0.21 pips.

IGM FX Trading Conditions

| 💻 Trading platform: | МТ4 (desktop, mobile, and web versions) and WebTrader |

|---|---|

| 📊 Accounts: | Trading (Classic, Silver, Gold, and VIP);Professional |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Deposit / Withdrawal: | Bank cards, bank transfers, Neteller, cryptocurrencies, and Skrill |

| 🚀 Minimum deposit: | $250 or the equivalent |

| ⚖️ Leverage: | Up to 1:30 for retail trading;up to 1:400 for professional traders |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3-1,7 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, energies, and cryptocurrencies |

| 💹 Margin Call / Stop Out: |

100%/50% for retail traders; 100%/20% for professional traders |

| 🏛 Liquidity provider: | Over 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market maker |

| ⭐ Trading features: | Fee for an inactive account after 30 days is €10. Fee for withdrawals without prior making of definite number of trades is charged |

| 🎁 Contests and bonuses: | No |

IGM FX provides traders with more than 160 trading instruments. There are both the classic MetaTrader 4 platform and WebTrader. A minimum leverage of 1:30 is available for retail traders. For professional traders, the maximum leverage is up to 1:400. There is no demo account, so you won't be able to test all the functions using virtual money. Islamic accounts are also not available.

IGM FX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

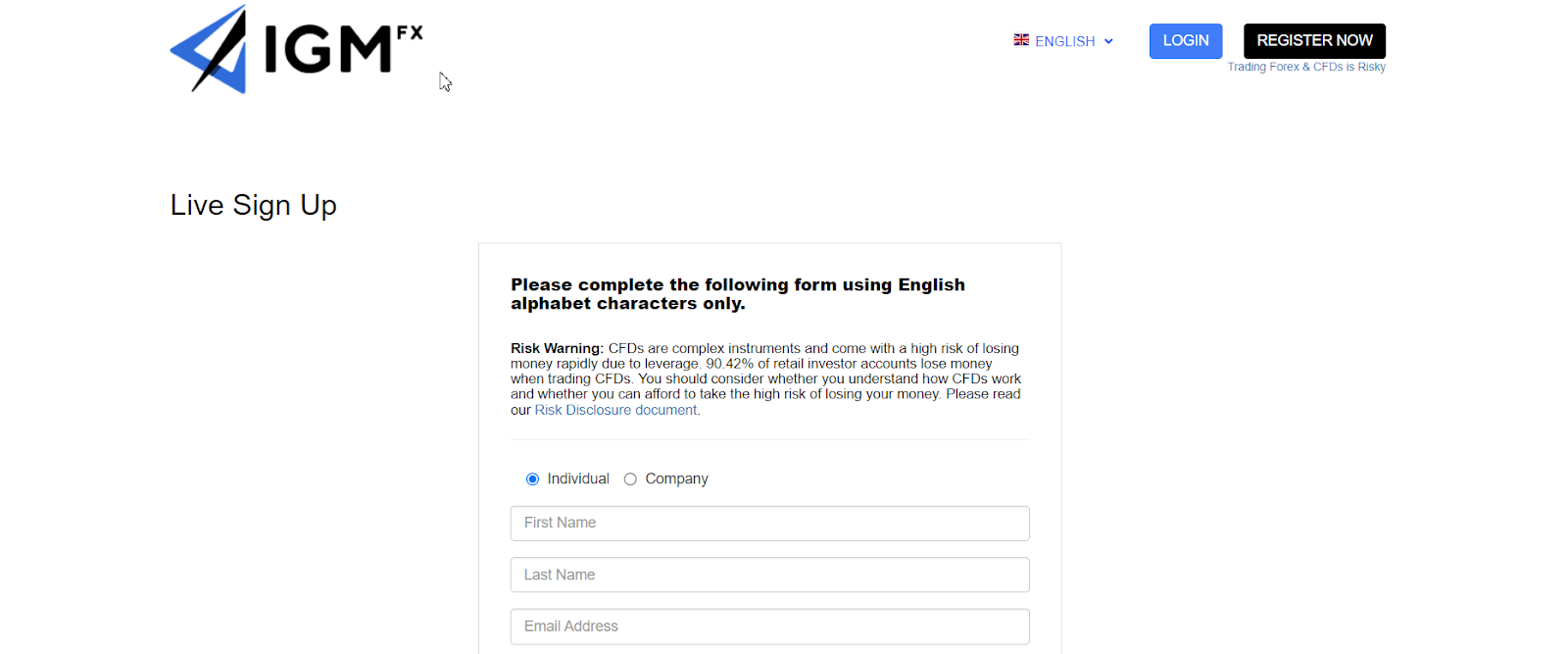

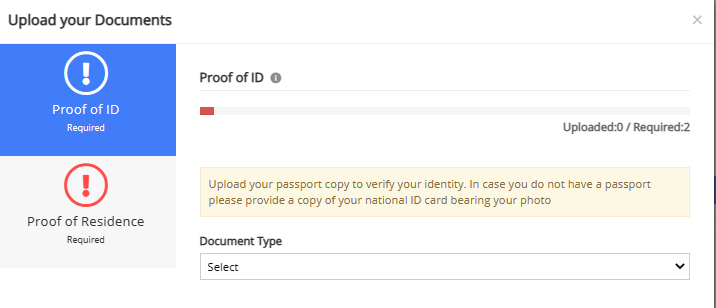

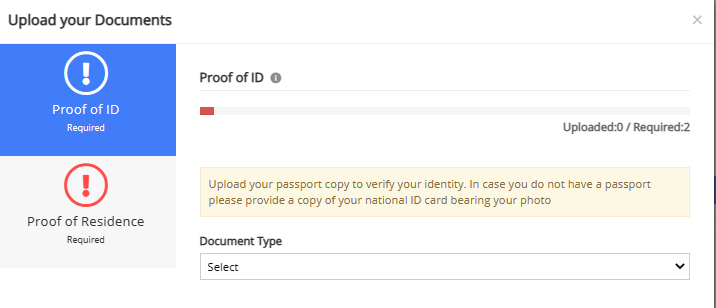

Trading Account Opening

To start trading, create a user account with IGM FX. Some brief instructions on how to register an account are as follows:

On the official website of IGM FX, click the Open Account button. The system will offer to create an account for an individual or a company.

Once the account type has been selected, the registration form must be completed. Depending on the account, the broker requires not only your contact details but also the origin of funds and your trading experience.

Next, to make a deposit, you need to verify your IGM FX user account. Without verification, the main features of the broker will not be available, so uploading scanned documents is mandatory.

Additional functions of the user account are:

Dashboard, where information about the trading account is displayed;

Wallet, which shows the total balance and results of trading sessions;

List of trading accounts;

Tickets;

Trading instruments;

A section where you can contact IGM FX client support.

Regulation and safety

IGM FX has a safety score of 8.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 9 years

- Strict requirements and extensive documentation to open an account

IGM FX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

IGM FX Security Factors

| Foundation date | 2016 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker IGM FX have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of IGM FX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, IGM FX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

IGM FX Standard spreads

| IGM FX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,7 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

Does IGM FX support RAW/ECN accounts?

As we discovered, IGM FX does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with IGM FX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

IGM FX Non-Trading Fees

| IGM FX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 20 | 0 | 0 |

Account types

The brokerage company provides 4 types of accounts. For Trading accounts, leverage is 1:30, Pro clients trade with leverage of 1:400; and stop outs are 100/20%. Additionally, Pro clients get access to VIP education and training.

Trading account types:

IGM FX provides favorable trading conditions for both novice and professional traders.

Deposit and withdrawal

IGM FX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

IGM FX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- USDT (Tether) supported

- No withdrawal fee

- No deposit fee

- Limited deposit and withdrawal flexibility, leading to higher costs

- Only major base currencies available

- Wise not supported

What are IGM FX deposit and withdrawal options?

IGM FX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

IGM FX Deposit and Withdrawal Methods vs Competitors

| IGM FX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are IGM FX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. IGM FX supports the following base account currencies:

What are IGM FX's minimum deposit and withdrawal amounts?

The minimum deposit on IGM FX is $250, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact IGM FX’s support team.

Markets and tradable assets

IGM FX offers a limited selection of trading assets compared to the market average. The platform supports 160 assets in total, including 50 Forex pairs.

- Copy trading platform

- 50 supported currency pairs

- Indices trading

- Crypto trading not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by IGM FX with its competitors, making it easier for you to find the perfect fit.

| IGM FX | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 160 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products IGM FX offers for beginner traders and investors who prefer not to engage in active trading.

| IGM FX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support managers are available 24/5. Clients can apply for assistance from Monday to Friday.

Advantages

- Technical support can help solve any technical issue related to the use of trading instruments

- Tech support answers quickly

Disadvantages

- Support is available 24/5 only

- Communication is possible in English only

Ways to contact IGM FX technical support:

-

by phone. The number is posted in the Contact Us section of the website;

-

by email;

-

through the feedback form.

Only verified clients can communicate with technical support through their user account.

Contacts

| Foundation date | 2016 |

|---|---|

| Registration address | 1 Agias Zonis, No. 504, Block B, 5th Floor, Nikolaou Pentadromos Center Building, 3026 Limassol, Cyprus. |

| Official site | https://www.igmfx.com/en/ |

| Contacts |

+357 25252371

|

Education

IGM FX provides an opportunity to learn how to trade currency pairs and cryptocurrencies. Novice traders will be able to get acquainted with the features of trading.

The brokerage company does not provide demo or cent accounts.

Comparison of IGM FX with other Brokers

| IGM FX | Eightcap | XM Group | RoboForex | Vantage Markets | LiteFinance | |

| Trading platform |

MT4, WebTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $250 | $100 | $5 | $10 | $50 | $10 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | 7.00% |

| Spread | From 0.9 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.5 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 50% / 20% |

| Order Execution | Market Maker | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of IGM FX

IGM FX is a brokerage company providing the highest quality services. Its work is based on such principles as the best pricing policy, protection of clients' funds, insurance of clients against losses and violations, and compliance with the rules of the European Economic Area. Traders have access to convenient automated trading. The broker does not limit the number of trading indicators. Also, it provides training materials for novice traders.

IGM FX by the numbers:

-

7 years in the brokerage market;

-

Over 15 classes of assets.

IGM FX is a broker for active trading only

The brokerage company does not provide instruments for passive investment. But this does not prevent the broker from consistently getting new clients. Active trading is represented by various assets, including cryptocurrencies, currency pairs, indices, and CFDs on stocks and energies. Liquidity providers are such large banks from Cyprus and the United Kingdom as PAYABL. CY LIMITED, Nuvei Limited, and Skrill Limited.

Trading can be carried out through the web, desktop, and mobile versions of MetaTrader 4. Also, the brokerage company has its own trading platform. The use of external trading advisors is allowed.

Useful services offered by IGM FX:

-

Real-time market data;

-

Weekly/monthly overview of a trading account;

-

Personal number of a user account;

-

Dashboard with up-to-date information on trades, markets, and trading strategy performance.

Advantages:

Clients’ funds are insured. In case of violations on the part of the broker, traders are paid monetary compensation in the amount of €20,000;

Over 15 classes of assets and over 160 CFDs;

Spreads are from 0.9 points; in some cases, they are from 0.21 pips;

Fast execution of orders;

Possibility of independent planning of trading sessions;

Traders can choose a convenient platform.

The above list of advantages is available to traders regardless of the chosen type of account.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i