Between 70 and 80% of retail investors are losing money when trading forex instruments and CFDs.

Swissquote Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1000

- Advanced Trader

- MetaTrader4

- MetaTrader5

- FCA

- FINMA

- DFSA

- MFSA

- MAS

- 1996

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1000

- Advanced Trader

- MetaTrader4

- MetaTrader5

- FCA

- FINMA

- DFSA

- MFSA

- MAS

- 1996

Our Evaluation of Swissquote Bank SA

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Swissquote Bank SA is a moderate-risk broker with the TU Overall Score of 6.78 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Swissquote Bank SA clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Swissquote is a broker that targets primarily large investors. The company is licensed by the reputable regulator FINMA and that ensures reliable protection of funds and interests of clients or investors in the event of disputes and conflicts. But for ordinary traders, Swissquote is not very convenient due to its unattractive working conditions. Swissquote is worth considering for those looking to invest from $1 million. If you are one of them, send us an email, and we will consult with you separately and help you do everything as quickly and reliably as possible. For ordinary traders, however, Swissquote is significantly inferior to its competitors in all respects.

Brief Look at Swissquote Bank SA

The Swissquote brokerage firm has been operating in the Forex market since 1996. The company is regulated by the Swiss Financial Markets Authority (FINMA). The company is a member of the Swiss Bankers Association. It has offices in many financial capitals of the world: Zurich, London, Dubai, Hong Kong and is moderately popular among traders. The company falls short in the category of customer service when compared to other top companies and is significantly inferior to popular Forex brokers in many other respects also. This is reflected in its place in the Forex broker ratings. Swissquote has prioritized reliability, while paying less attention to indicators that are important for each trader, such as the size of the minimum deposit, trading conditions, deposit conditions, and its rules on withdrawing funds. The quality of Swissquote Bank's customer support is also at a satisfactory level, but lower than that of the top brokers.

- availability of a license from an authoritative regulator;

- a wide range of financial services;

- a large selection of deposit currencies.

- not very informative and slow working site;

- high spreads and commissions;

- large deposit;

- lack of multilingual support in the live chat;

- few promotions, bonuses, contests, or other special offers;

- a very complicated registration procedure that requires mandatory verification.

TU Expert Advice

Financial expert and analyst at Traders Union

Swissquote a/k/a Swissquote Bank is a Forex broker that has been operating in the financial markets since 1996. During this time, the company was able to earn a good reputation. But in the last few years, Swissquote has received more and more claims from its clients. This has led to a loss of its status as a broker. Swissquote Bank primarily targets large investors and ignores the needs of the average trader. This is evidenced by the lack of accounts for beginners and the large size of the deposit.

The main advantage of the Swissquote broker is its license. You can also note a fairly large selection of trading instruments. When working with Swissquote, traders can use a wide variety of currency pairs (including exotic ones), commodities, stock indices, cryptocurrencies, and a number of other popular assets. Another advantage of Swissquote can be stated with confidence is the presence of an affiliate program, which provides an opportunity for additional earnings, but it, again, is significantly inferior in terms of income generation compared to similar programs of other brokers.

Swissquote, like its numerous competitors, offers a range of standard trading platforms. You can choose from both classic terminals, MetaTrader 4 and 5, and the company's own Advanced Trader.

Swissquote Bank SA Summary

Your capital is at risk. Between 70 and 80% of retail investors are losing money when trading forex instruments and CFDs. Trading foreign exchange, spot precious metals and any other product on the Forex platform involves significant risk of loss and may not be suitable for all investors. Prior to opening an account with Swissquote, consider your level of experience, investment objectives, assets, income and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not speculate, invest or hedge with capital you cannot afford to lose, that is borrowed or urgently needed or necessary for personal or family subsistence. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, Advanced Trader |

|---|---|

| 📊 Accounts: | Standard, Premium, Professional, Prime |

| 💰 Account currency: | EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK |

| 💵 Replenishment / Withdrawal: | eBanking, Visa, Mastercard |

| 🚀 Minimum deposit: | From $1,000 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.1 p |

| 🔧 Instruments: | Currencies, CFD, precious metals, stock indices, bonds, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100/30% |

| 🏛 Liquidity provider: | 17 liquidity providers including UBS Bank, Integral, Prime XM, OneZero, FxCubic, Gold-I and cTrader |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant Execution, Market Execution, Spot, Market Best |

| ⭐ Trading features: | A large selection of currency pairs; Including exotic and minor ones; Cryptocurrencies. |

| 🎁 Contests and bonuses: | NO |

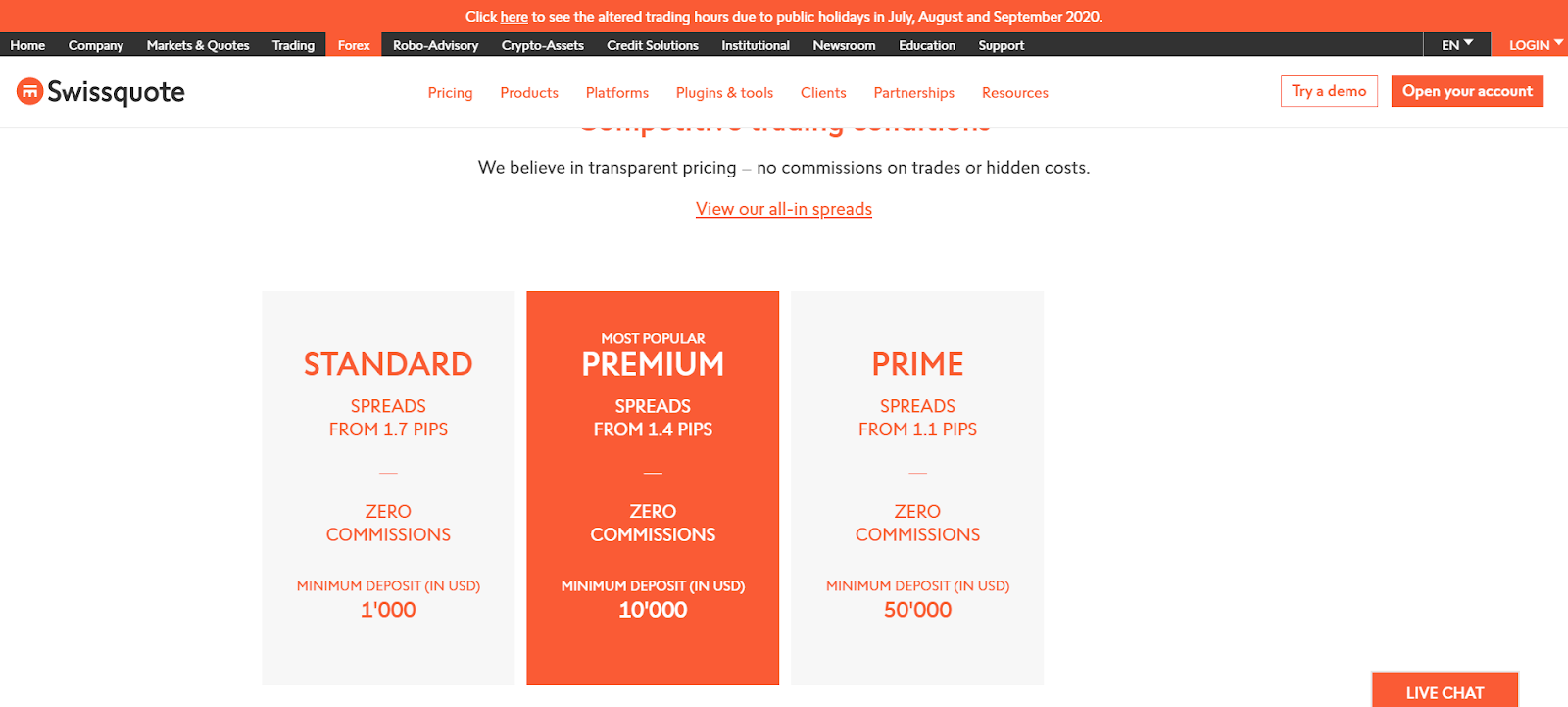

Trading conditions at Swissquote can be hardly called attractive. The size of the deposit is quite high and the maximum leverage is 1:400. On the other hand, it is possible to choose a suitable account currency, thus avoiding conversion costs. Stop Out level is 30%.

Swissquote Bank SA Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

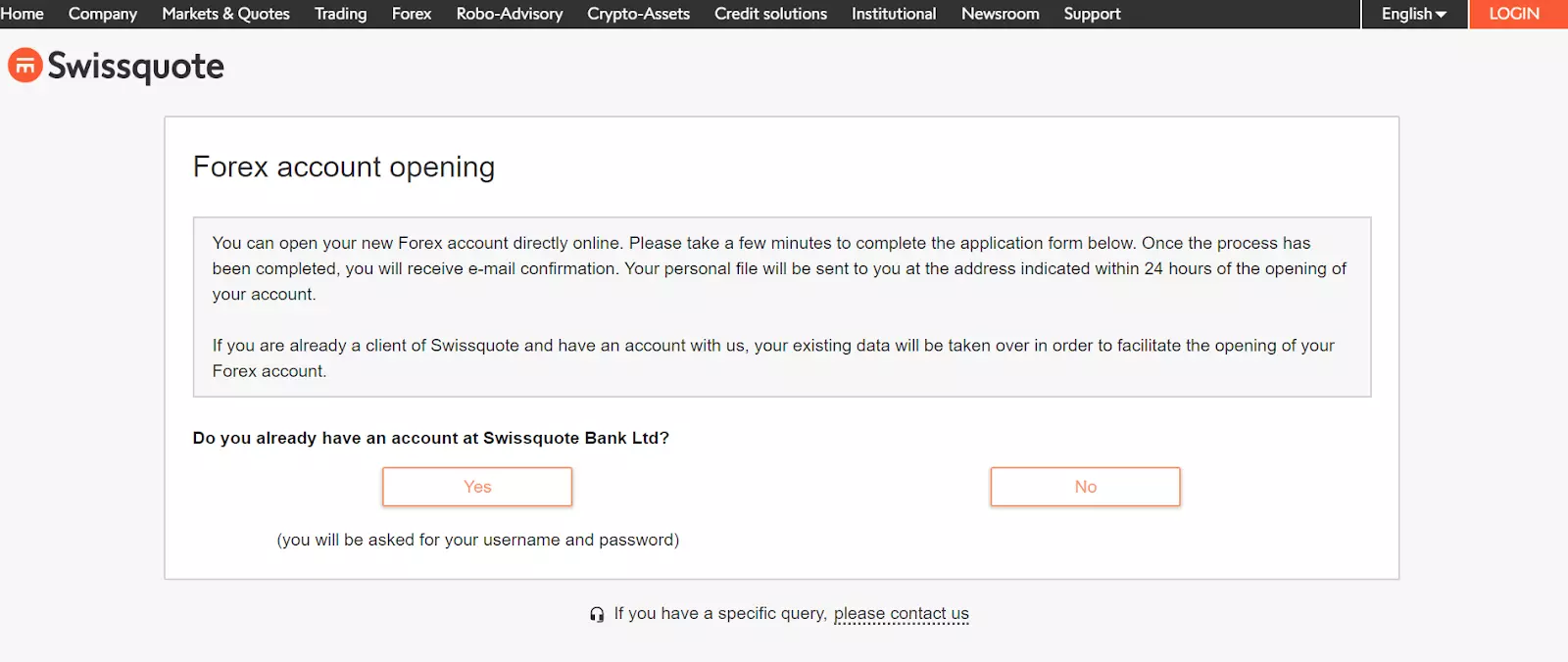

Trading Account Opening

To start making money with Swissquote, you need to:

Go through the lengthy registration process on the Traders Union website by entering your email address. Then follow the affiliate link to the website of the brokerage company and press the "Start trading" button.

Choose a suitable account type.

Indicate if you already have an account with this company.

Go through verification, indicating gender, last name and first name, marital status, date of birth, country of residence and address, email, and mobile phone. It is necessary to fill out a client profile with the entry of financial data. Access to the trading account will be provided only after passing the verification procedure via video communication or sending documents to the company's office.

The following functions are available in your Swissquote account:

-

Account replenishment and withdrawal.

-

Viewing statistics on bonus funds.

-

Possibility to contact support.

-

News section.

Registration on the Swissquote website takes a long time. The broker requests all sorts of personal data at once. Requires confirmation of the client's contact information, his or her identity and complete detailed financial statements. In order to start trading, you need to go through a complex and lengthy verification procedure, including sending personal documents to the company's office.

Regulation and Safety

Information

Swissquote Bank is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

FINMA — a reliable government regulator that checks the activities of its licensees, and also controls their work.

Advantages

- Licensed by a reputable government regulator

Disadvantages

- The broker solves all controversial issues independently, the regulator does not accept claims from traders

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $17 | Yes |

| Premium | From $14 | Yes |

| Professional | Individual | Yes |

| Prime | From $11 | Yes |

Also, a comparative analysis of trading commissions in Swissquote Bank with the indicators of competitors was carried out. Based on this analysis, each broker was assigned a level according to the specified criterion - from low to high.

| Broker | Average commission | Level |

|---|---|---|

|

$17 | |

|

$1 | |

|

$8.5 |

Account Types

Swissquote offers four account types for professional traders. They differ in the size of the minimum deposit, the type/level of the spread, and the minimum trade size.

Important! Swissquote is a company that does not provide trading accounts for novice traders, which exposes the inexperienced trader to great risks.

Deposit and Withdrawal

-

Swissquote allows withdrawals of funds only at the specific request of the client and does not have electronic systems in the list of methods. The commission for withdrawing money depends on the region to which the transfer is made, as well as on the selected withdrawal method.

-

There are two options for depositing and withdrawing money: bank transfer and bank cards (Visa and Mastercard).

-

When withdrawing to Visa and Mastercard bank cards, crediting occurs instantly or within two hours from Monday to Friday from 8:00 to 22:00 CET.

-

Withdrawal and replenishment currencies: AED, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RUB, SEK, SGD, THB, TRY, ZAR, EUR, USD, CHF и GBP.

Investment Options

Swissquote's automatic Robo-Advisor

The Robo-Advisor service deserves special attention in the Swissquote portfolio. It is an automatic investment manager that creates an individual investment portfolio and monitors it around the clock, constantly optimizing it to maintain the desired level of risk. However, judging by the feedback from investors, technical failures in the operation of this service are often recorded, which sometimes leads to a loss of cash investments.

The service is fully automated and works according to this scheme: the client indicates an acceptable level of risks, selects trading instruments or sectors (optional), and after that, the robot-consultant manages the investments. Its advanced algorithms analyze thousands of securities and generate offers for the ideal portfolio, but in practice, many of these offers turn out to be unprofitable.

Robo-Advisor requires less initial investment than traditional asset management services and is much more cost-effective. At the same time, the risk of losing investments increases much more due to possible algorithmic errors or technical failures. Despite this, Swissquote positions this service as completely transparent, although it does not give full control over investments.

Also, Swissquote provides MAM, LAMM and PAMM systems for the MetaTrader and Advanced Trader trading terminals. PAMM is a classic trust management system, where investors' funds are concentrated in one trading account, which is managed by a trader (account manager). LAMM is a social trading service where the trader is not the account manager, but only opens his trades, which are automatically copied by other investors. MAM can be safely called one of the varieties of LAMM. In this case, transactions are automatically copied to the investor's account, but at the same time, if necessary, he can independently change their volumes, close positions, and make a number of other adjustments. Similar investment programs are provided by more popular brokers. An important difference is the availability of competent managing traders with stable key trading indicators: growth rate, drawdown level, account profitability, etc.

Important!

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Swissquote Bank affiliate program

Swissquote provides an opportunity to generate an additional source of income by attracting new clients. At the same time, the broker offers several cooperation formats. The most popular among them are:

-

Bring a friend. Recommend Swissquote Bank and receive cash bonuses of up to CHF 800 for every customer you refer. To do this, share your affiliate code in your personal account with the users you are referring to Swissquote. It is noteworthy that both the attracted client (referee) and the referrer receive financial rewards. The disadvantage of the program is that bonuses are credited after the referral refills the account. Their bonus depends on the amount of the deposit, but cannot exceed 800 Swiss francs.

-

Introducing Broker Solutions. An excellent opportunity to create your own client base and receive commissions on every transaction made by referred users. The disadvantage of the program is that Swissquote Bank is not very popular among traders due to the lack of loyal trading conditions for beginners. This factor significantly complicates the process of attracting new customers to the company. It is more advisable for a potential partner to work with a popular Forex broker and get more profit from attracting new members due to the flow of clients.

-

CPA Marketing Forex. Traders have the chance to monetize their traffic with a profitable CPA program. The broker guarantees a progressive system for calculating CPA remuneration, provides detailed statistics on attracted clients, makes monthly payments, and provides a number of other benefits. The amount of remuneration for each attracted client can reach US$800. The disadvantage of the program is the reduced interest of traders to the broker, which significantly reduces the chances of getting the desired income.

Customer Support

Information

The broker's customer support service works only from Monday to Friday.

Advantages

- The ability to hold an online meeting

- There are online chat and telephone support

- Multilingual support (English, Arabic, Spanish, Italian, Chinese, German, Russian, Serbian, Slovak, French)

Disadvantages

- Closed on weekends

- The phone line often does not answer or answers after a long waiting time

- Long response time across all communication channels. If there is a problem, then it takes a long time to resolve

- Email responses are sent within 2-3 days. Often managers do not delve into the essence of the issue and answer with standard phrases

There are several ways to contact Customer support:

-

via phone numbers indicated on the website;

-

by email;

-

via chat on the broker's website;

-

using the feedback form;

-

make an application for an online meeting.

Contacts

| Foundation date | 1996 |

|---|---|

| Registration address | Löwenstrasse 62, P.O. Box 2017, 8021 Zürich |

| Regulation |

FCA, FINMA, DFSA, MFSA, MAS

Licence number: 562170, F001438, 57936, 201906194G |

| Official site | swissquote.com |

| Contacts |

+41 44 825 87 77, +41 44 825 88 88

|

Education

Information

Videos, e-books, and training webinars are available on the Swissquote website.

All these instruments can be tested only on a real trading account before use, which is a disadvantage and may result in losses.

Comparison of Swissquote Bank SA with other Brokers

| Swissquote Bank SA | RoboForex | Pocket Option | Exness | TeleTrade | IC Markets | |

| Trading platform |

MT4, MobileTrading, WebTrader, Advanced Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, cTrader, MT5, TradingView |

| Min deposit | $1000 | $10 | $5 | $10 | $1 | $200 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.4 point | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

1% / 100% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 100% / 50% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed Review of Swissquote

Swissquote Bank is an international company focused on cooperation with large European traders. The main disadvantage of the broker is the lack of loyal trading conditions for novice traders. Swissquote aims to work with large investors. Swissquote Bank is trying to implement new technologies. The broker's average execution speed is 27 ms, which is a very good indicator. Swissquote offers a standard set of trading instruments that does not cover all possible trading directions, which is why traders cannot implement non-standard trading strategies. Swissquote provides traders with the opportunity to make money trading cryptocurrencies.

A few facts about Swissquote that will be of interest to clients choosing this broker:

-

more than 320 thousand clients;

-

more than 24 years on the market;

-

15 deposit currencies;

-

CHF 32.2 billion in company assets.

Swissquote meets the best Swiss traditions

Swissquote is one of the top brokers in terms of reliability, but at the same time, Swissquote is inferior to many of its competitors due to the increased complexity of the client's identity and account verification procedures. The company offers several types of accounts. A professional trading account deserves special attention. Most of the trading conditions are determined on an individual basis.

Traders are provided with access to the most popular trading terminals: MetaTrader 4 and MetaTrader 5. Also, clients have access to the proprietary Advanced Trader platform, which features a fully customizable interface, automatic pattern detection, and a wide selection of order types. But some reviews say that technical failures are recorded on the platform when there is a heavy workload or Advanced Trader.

Swissquote Services:

-

Autochartist. A popular market scanner that provides automated trading alerts, volatility analysis, event impact analysis, price range forecast, execution statistics. Thanks to filters, as well as individual search queries, traders have the opportunity to adapt the instruments to their own trading style;

-

Trading Central. An excellent instrument for recognizing chart patterns that allow you to build trading strategies and identify opportunities for opening profitable positions online;

-

FIX API. Financial information exchange protocol is an international standard for online trading. It is designed to ensure active interaction between market participants. The Swissquote API can connect to the trader's trading platform and exchange trading information with the company's server based on the FIX 4.4 protocol. With this service, a trader can independently configure access to real-time quotes, as well as historical data, and place orders via secure communication channels.

Advantages:

good selection of educational materials;

a moderate choice of trading instruments, including cryptocurrencies;

availability of an affiliate program;

free analytics;

own trading platform.

User Satisfaction