Pepperstone Account Types Compared

Pepperstone is one of the leading Forex trading account platforms. New and experienced traders alike should not hesitate to try Pepperstone simply because it may seem to be a little less known than more popular options. The platform has a lot to offer in terms of assets, functionalities, investment safety, and variety.

Let’s take a look at the different types of Pepperstone accounts as an introduction to this useful platform. Currently, Pepperstone provides its users with two trading account options: the Standard Account and the Razor Account. They also provide a demo account where you can practice for both Standard and Razor live accounts.

Pepperstone Standard Account

The Pepperstone standard account is the most popular among beginner and mid-level traders. It is simple to use and has most of the functionalities of the more advanced Razor account.

The Pepperstone standard account has a minimum deposit of $0, giving it an accessible entry point. It is also worth noting that Pepperstone has relatively low trading fees, and does not charge any trading inactivity or account keeping fees, making it attractive to traders on a budget.

Hedging and even leverage are both allowed on this Pepperstone account, with leverage being allowed a ratio of 500:1. You are also allowed a spread of 0.6 pips, which is decent and a market standard.

Pepperstone Razor Account

The Pepperstone Razor account is popular with scalpers and more experienced traders. It has everything Pepperstone has managed to offer its clients so far and is recommended for the full Pepperstone experience.

Just like the Pepperstone Standard account, the Razor account has a minimum deposit of $0. However, it also has a commission levied on trades, due to the higher volume of trades typically done on this account. This extra charge makes trading on this account significantly higher, even though the trading fees and inactivity fees remain the same.

Hedging and leverage are allowed, with the same ratio of 500:1. But account holders will have a spread of 0.3 pips, not 0.6 like in the standard account.

This smaller pip value will help traders get larger fluctuations in account value, which can be both a good and a bad thing. If you make a profit, the profit will be positively affected and losses will be exaggerated. Therefore, this account is better suited for traders with higher rates of success.

Pepperstone Swap Free Account

A Pepperstone Swap Free account is made for traders who are unable to receive or pay swaps. The trading account pays no interest while allowing traders to access our cutting-edge trading technology and extensive liquidity.

Pepperstone Demo Accounts, and Other Facts

Finally, Pepperstone offers its users a demo account. The demo account is meant for beginners so that they can safely practice their skills. Demo accounts are also useful for experienced traders who would like to practice a new strategy, or see how a new skill works for them. Pepperstone Demo accounts allow you to practice using both Standard and Razor accounts.

Demo accounts provide an opportunity to see all a platform has to offer as well. Get ready to enjoy upwards of 1000 trading instruments spread across commodities, indices, currency pairs, stocks, ETF, and crypto. You will also have access to a wide variety of platforms such as the popular MetaTrader 4, and MetaTrader 5 plus others such as cTrader and TradingView.

Pepperstone is an inclusive platform that also allows Islamic trading so that anyone who wants to trade can do so without worrying about it not being conducive to their beliefs.

Pepperstone Account Types Comparison

Here is a brief comparison of all the Pepperstone accounts.

| Standard | Razor | Swap Free account | |

|---|---|---|---|

Minimum deposit |

$0 |

$0 |

$0 |

Base currencies |

USD, GBP |

EUR, USD, GBP, AUD |

AUD, EUR, GBP, USD |

Trading instrument |

FX, indices, equities, commodities, energy, crypto and currencies. |

FX, indices, equities, commodities, energy, crypto and currencies. |

FX, indices, equities, commodities, energy, crypto and currencies. |

Max leverage |

500:1 |

500:1 |

500:1 |

EURUSD average spread |

0.6 pips |

0.3 pips |

0.3 pips |

Forex Fee (if any) |

None |

$3.50 commission per lot per trade |

None |

Forex Swap |

Yes |

Yes |

No |

| Pepperstone | Forex.com | eToro | |

|---|---|---|---|

Standard account |

Yes |

Yes |

Yes |

Pro Account |

Yes |

Yes |

No |

Islamic (swap-free account) |

Yes |

Yes |

Yes |

Cent Account |

No |

No |

No |

Demo |

Yes |

Yes |

Yes |

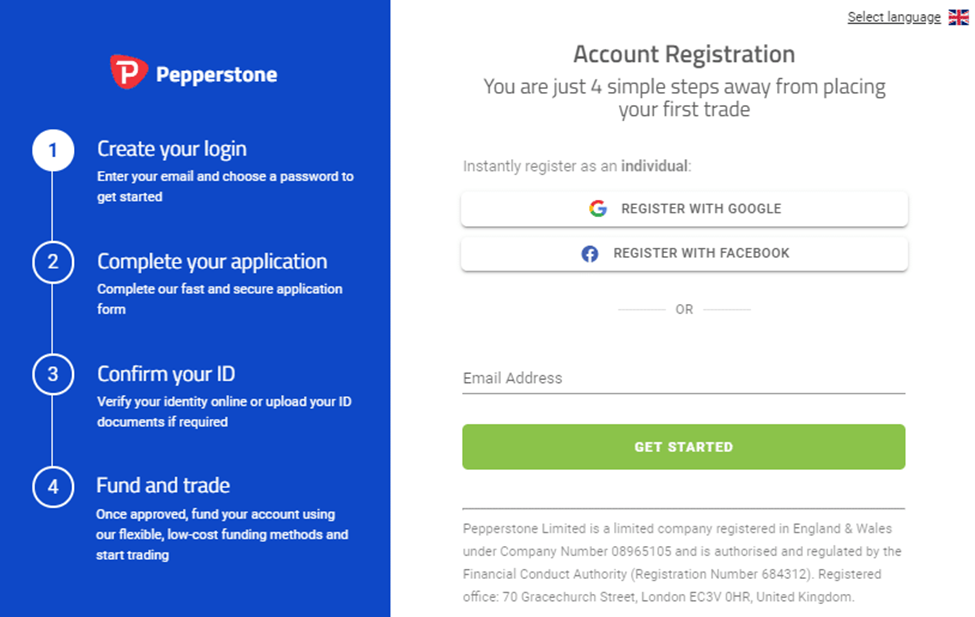

How to Open Pepperstone Account

To open a Pepperstone account;

Create your login

Pepperstone Account Registration

Take the suitability test

Answer the brief 7-question test to assess your suitability to trade derivative assets.

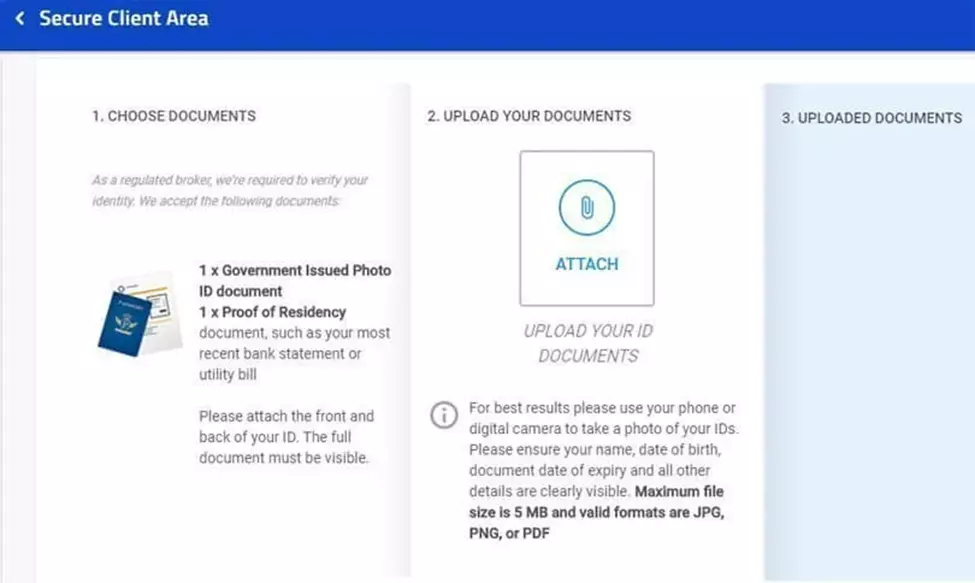

Confirm your ID

Fund your account and start trading

FAQ

Is Pepperstone a Regulated Trading Platform?

Yes, Pepperstone is regulated by ASIC, BaFin, CMA, CySEC, DFSA, FCA, and the SCB. It is a safe and trustworthy platform to trade on.

Is Pepperstone Compatible with MetaTrader 4 and Metatrader 5?

Yes, Pepperstone is compatible with both of these platforms.

Can I Change the Leverage on my Pepperstone Account?

Yes, you can change your Pepperstone account leverage in your account settings.

How Long Do Demo Accounts Last?

Demo accounts are automatically terminated after 30 days. If you have a live funded account and request that it be set to non-expiry, this term can be extended.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!