According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $5

- MT4

- IFSC

- 2008

Our Evaluation of SuperForex

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

SuperForex is a moderate-risk broker with the TU Overall Score of 5.84 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SuperForex clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

SuperForex broker stands out from most competitors. It offers a total of 11 real accounts, over 2,000 financial instruments, and leverage of up to 1:3000. No other platform has similar trading parameters. SuperForex also boasts a free demo account, a wide selection of bonuses for beginners, and regular contests with real cash prizes. It has one of the most comprehensive educational systems, including physical trader training centers and the unique software solution Pattern Graphix. There is no trading commission, but there is a withdrawal fee. The broker can be recommended to traders of any experience level.

Brief Look at SuperForex

The SuperForex broker offers ECN (Electronic Communications Network) and STP (straight-through processing) accounts with access to the following markets: currency pairs, cryptocurrencies, stocks, indices, oil, and metals. The STP protocol is an automated electronic data-transferring process that does not involve manual intervention. There are standard, mini, crypto, and swap-free accounts available. The STP group also has a unique no-spread account where only a trading commission is charged. Depending on the account, the spread is floating or fixed, starting from 0 pips. The account also determines the minimum deposit, maximum leverage, available bonuses, and other parameters. The minimum deposit for the ECN Standard Mini account is $5. The maximum leverage is 1:3000. The broker has its Forex Copy Trading service, which is compatible with most accounts. The partnership is available for legal entities only. Among the key features are powerful and free analytics, comprehensive educational courses, dozens of bonuses, promotions, and regular contests.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A wide selection of real accounts allows traders to find the optimal option according to their preferences.

- There is a free demo account, and the minimum deposit is below the market average, providing an optimal entry threshold for beginners.

- Regardless of the trader's level, educational materials and technical and fundamental analysis tools offered by the broker are beneficial.

- Hundreds of assets from six different groups combined with high leverage provide unprecedented profit potential.

- Traders work through the classic MT4 trading platform, with no trading restrictions, and the platform's operations are 100% transparent.

- The copy trading service allows registration for signal providers and investors to receive additional income.

- Customer support is available via phone, email, LiveChat, and messaging platforms, operating round the clock in multiple languages.

- Clients of the broker can only trade through MetaTrader 4; other trading platforms are not available.

- Traders from Australia, Ukraine, North Korea, and some other countries cannot work with this broker.

- The company's activities are regulated by the International Financial Services Commission of Belize (IFSC), which is not the most popular regulator.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker has been operating for 10 years, which allows for a quality retrospective analysis. Expert research has shown that the company has come a long way and currently offers much more favorable conditions than 3-5 years ago. SuperForex clients have access to over 2,300 assets, one of the highest figures in the segment. No other platform provides trading leverage up to 1:3000. Finally, the variety of account types is a conceptual distinction and, according to many experts, it is the company's main advantage. There are mini-accounts, standard accounts, swap-free accounts, and even no-spread accounts. They differ significantly in trading particulars, allowing SuperForex to personalize its offerings.

Although the broker has developed its simple and transparent copy trading platform, it has not yet launched it. This is a reasonable decision considering that SuperForex clients work with MT4, which most traders and experts consider the best trading platform, at least in terms of functionality and customizability.

A trader who decides to collaborate with SuperForex can choose a floating or fixed spread type, but there is no trading commission in any case. However, there are withdrawal fees, although many brokers have long abandoned them. Nevertheless, these commissions are quite competitive and do not lead to high costs. So, the trading aspects of SuperForex definitely surpass those of many of its competitors.

Currently, the broker offers six bonuses, as well as special offers such as the Membership Club and Account Package. Before registering, it is strongly recommended to thoroughly examine these opportunities, as the right combination significantly reduces the entry barrier and maximizes profit potential at the start due to multiple favorable conditions. The educational courses provided by SuperForex are also noteworthy. The company has a network of online training centers and regularly conducts seminars, which are then reconstituted into educational articles published on its website. All of this is free.

Undoubtedly, SuperForex has its weaknesses. For example, regional restrictions and the unavailability of alternative trading solutions other than MT4. Many also note weak regulation, but this is a contentious issue. IFSC 000160/494 (International Financial Services Commission of Belize), headquartered there, is a well-known regulator, although it is not as highly regarded as the FSA (Financial Service Authority), for example. An important point to mention is that TU’s experts have not found confirmed cases where the broker failed to fulfill its obligations to its clients.

- You prefer the MetaTrader 4 platform, as SuperForex utilizes this popular platform known for its familiarity and features.

- You appreciate around-the-clock customer support, as the same is offered by SuperForex in multiple languages, ensuring continuous assistance.

- If regulatory oversight from established authorities like the FCA or SEC is crucial for you, SuperForex might not be suitable as it lacks such regulation.

- If you are new to trading or have a low risk tolerance. Considering the significant risks associated with CFD and leveraged trading, SuperForex might not be the best choice.

- If you require a broker with a low minimum deposit. SuperForex may not meet your criteria as its minimum deposit is $100.

SuperForex Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | STP (6 accounts), ECN (5 accounts), demo |

| 💰 Account currency: | USD, EUR, GBP, CNY, MYR, IDR, RUB, ZAR, NGN, INR, THB, BRL, BDT, EGP, CHF, MXN, JPY, PHP, HKD, SGD, PEN, CLP, TZS, KES, UGX, ZMW, RWF, AED, VND, XAF, PLN, AUD, CAD, JOD, GHS |

| 💵 Deposit / Withdrawal: | Visa, MasterCard, UnionPay, Skrill, STICPAY, Neteller, FasaPay, Perfect Money, OnlineNaira, BitWallet, AstroPay, M-Pesa, MTN, Zamtel Vodacom, cryptocurrency wallets BTC, LTC, DOGE, PPC, DASH, RDD, ZEC, BLK, USDT, and bank transfers |

| 🚀 Minimum deposit: | $5 |

| ⚖️ Leverage: | Up to 1:3000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, oil, metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Free demo account, 11 real accounts, narrow floating/fixed spreads, no trading commissions, medium withdrawal fees, over 2300 trading instruments from 6 groups, transparent copy trading service, trading only through MT4 trading platform, plenty of bonuses, special offers and contests, free fundamental analysis, and technical analysis |

| 🎁 Contests and bonuses: | Yes (6 bonuses and 6 special offers, as well as rebates from TU) |

If a broker offers multiple account types, it almost always means that each account has its unique conditions regarding the deposit and leverage. SuperForex fully corresponds to this rule. For example, to open a Standard STP account (including the swap-free option), you only need as little as $5, while registering for STP Crypto and Pro accounts, requires a minimum of $1,000. For Mini and Mini Swap-Free ECN accounts, the minimum deposit is also just $5, while for Standard and Standard swap-free ECN accounts, it is $100. The lowest leverage is 1:10 for STP and ECN Crypto accounts, while the highest leverage is 1:3000 for STP Pro accounts. A higher leverage level increases profit potential but also raises trading risks. Customer support operates 24/5 and is available through several major communication channels such as its call center, email, LiveChat, and messengers.

SuperForex Key Parameters Evaluation

Video Review of SuperForex

Share your experience

- Best

- Last

- Oldest

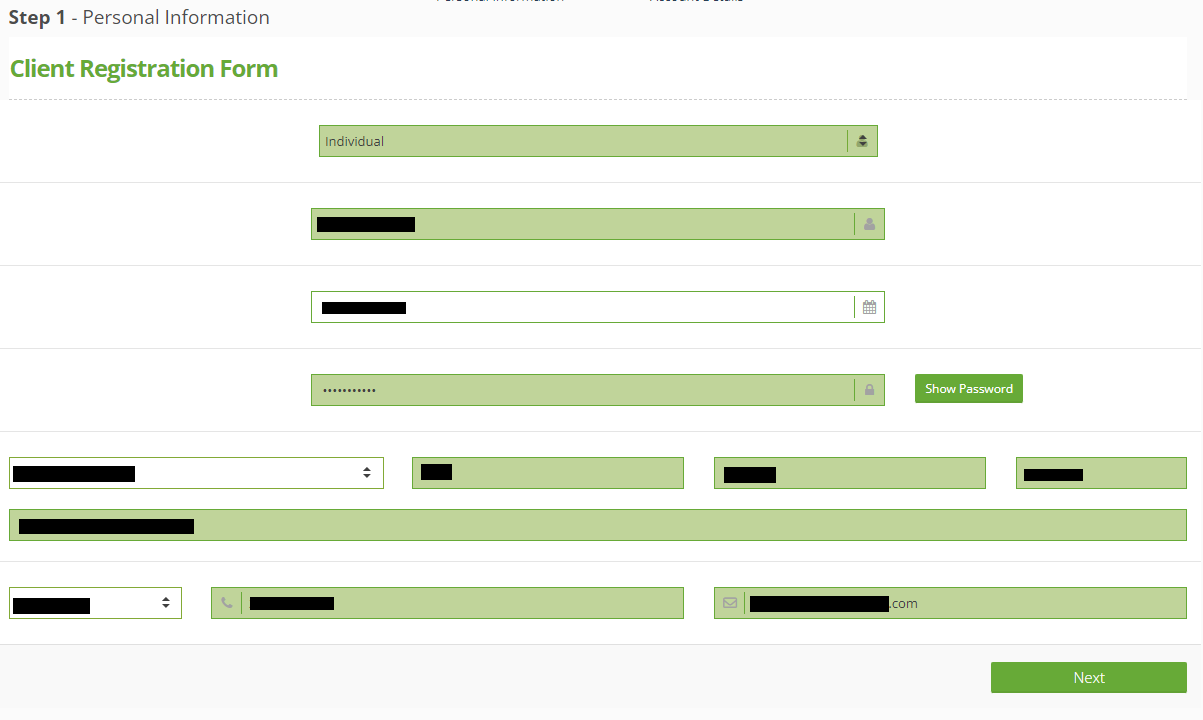

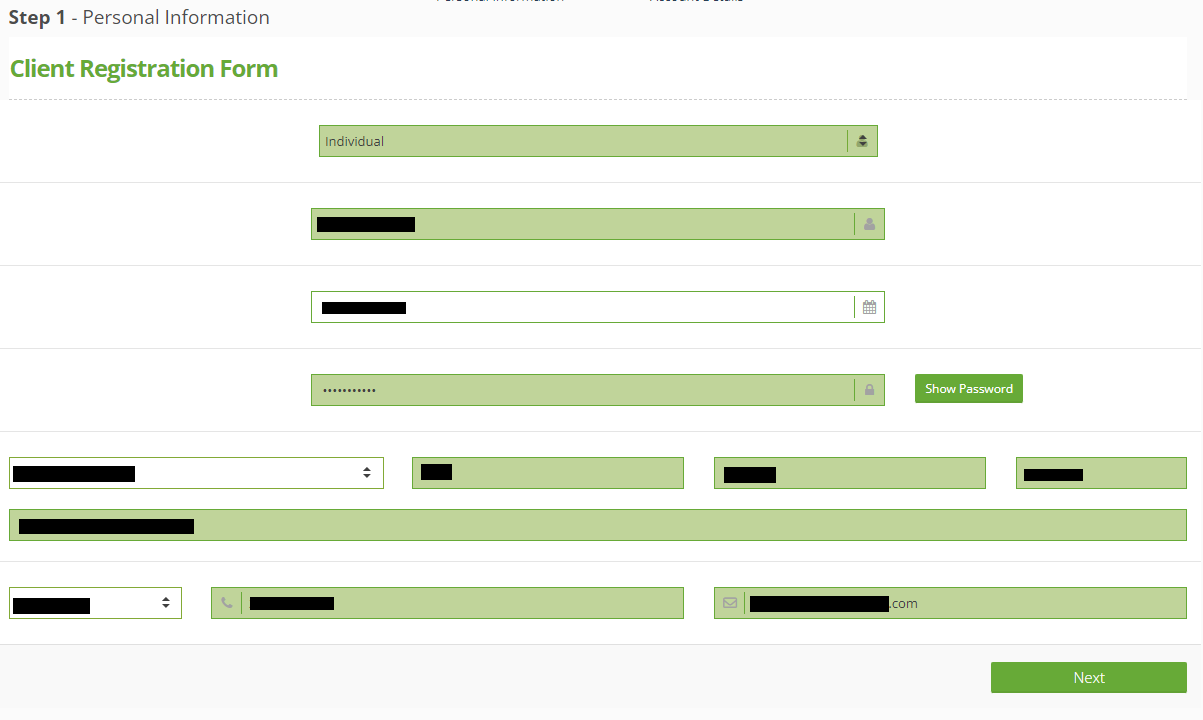

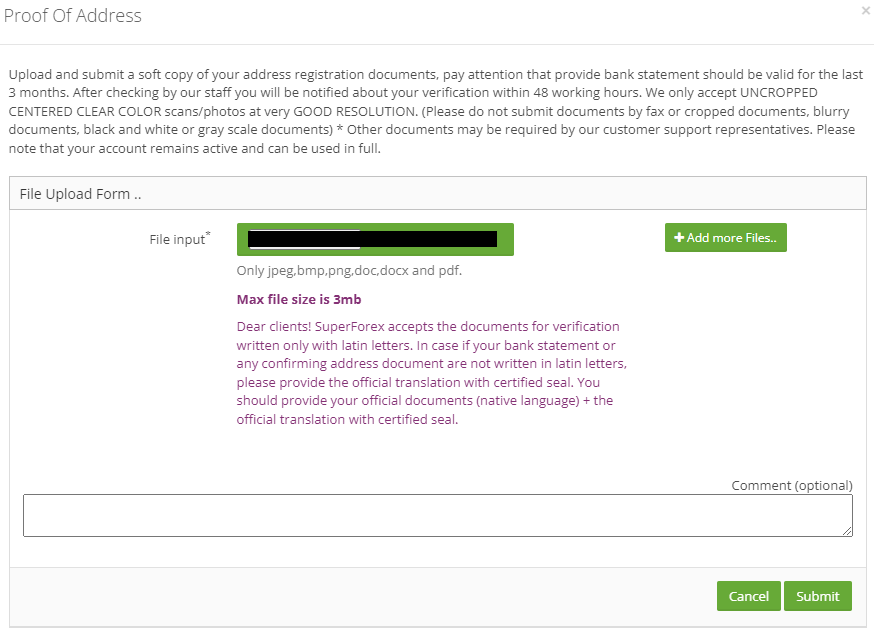

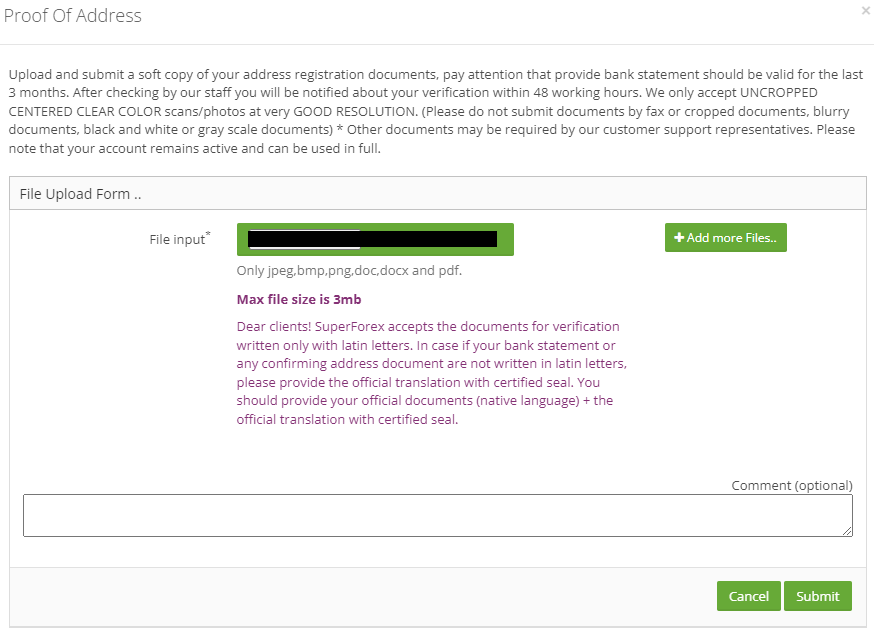

Trading Account Opening

To start collaborating with the broker, register on their website and verify your personal information. Then, you can open a demo or real account, make a deposit, and start trading through the MetaTrader 4 trading platform. TU’s experts have prepared the below step-by-step guide for registration and working within the SuperForex user account.

Go to the official broker's website. In the top right corner, select the interface language. Click on “Open Account”.

Read the public offer agreement. Agree to its terms by ticking the checkbox. Click on “Open Account”.

Choose the individual or corporate account type. Enter your full name, date of birth, email address, and phone number. In the corresponding fields, provide your country of residence and registration address with the postal code. Click on “Next”.

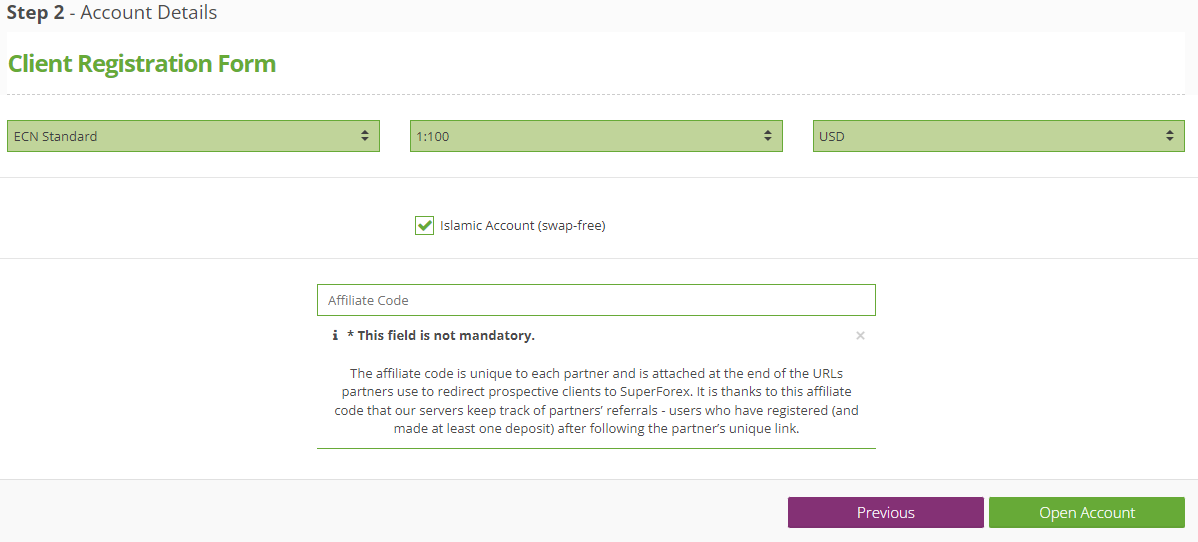

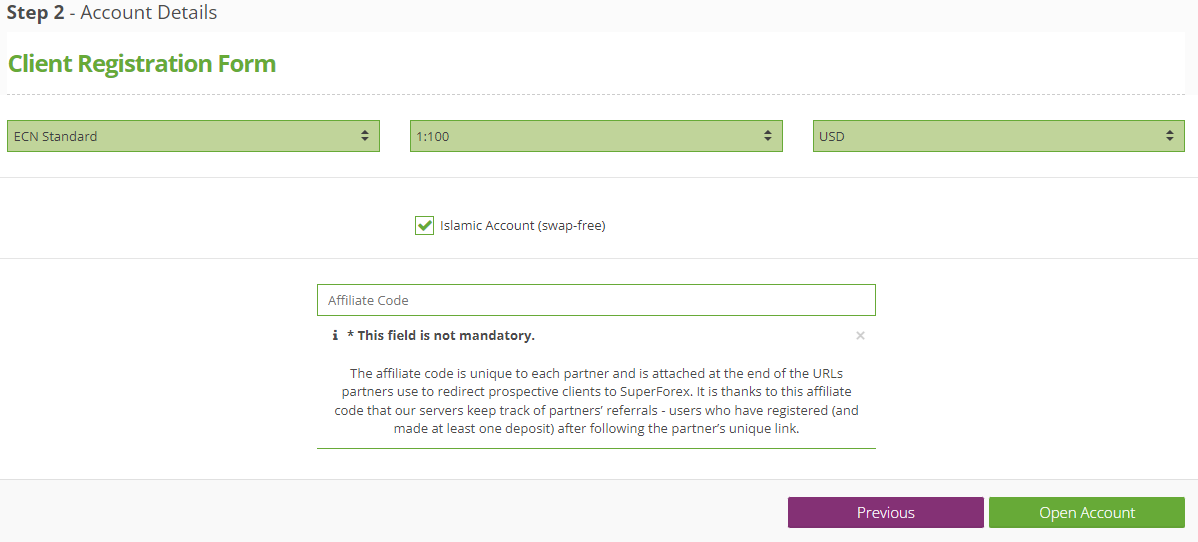

Select the account type (in TU’s example, it’s the ECN Standard), leverage, and account currency. Check the box if you need an Islamic swap-free account. If you have a referral code, enter it. Click on "Open Account.".

You will be directed to the user account in the profile settings section. Next to the full name, email, address, and phone fields, you will see the "Verify" buttons. Sequentially click on each of them and follow the on-screen instructions. You will receive an email and a message with a link on your phone. Additionally, to confirm your identity, you will need to provide photos/scans of the required documents. After completing this process, you will have full access to the features of the user account.

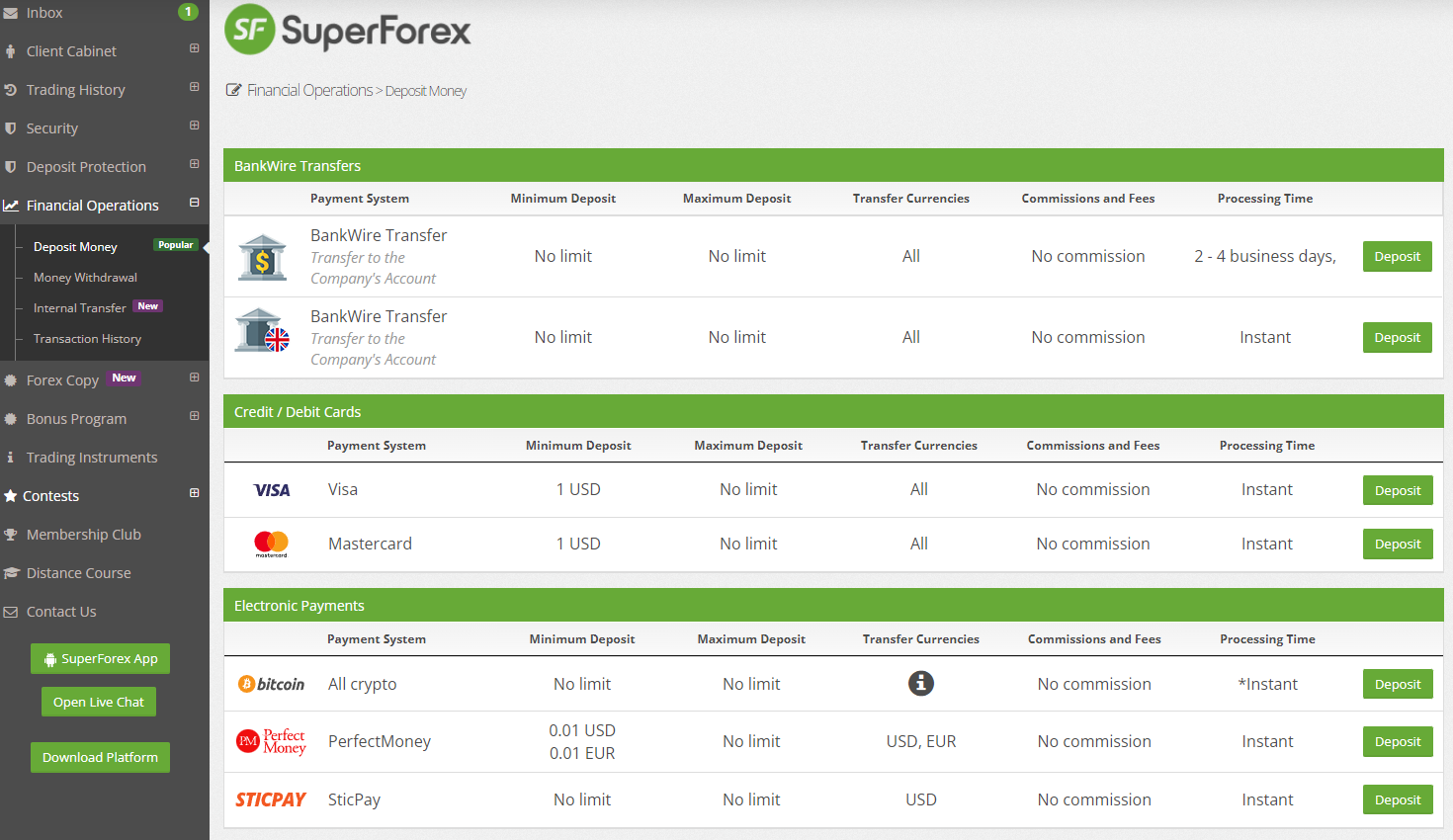

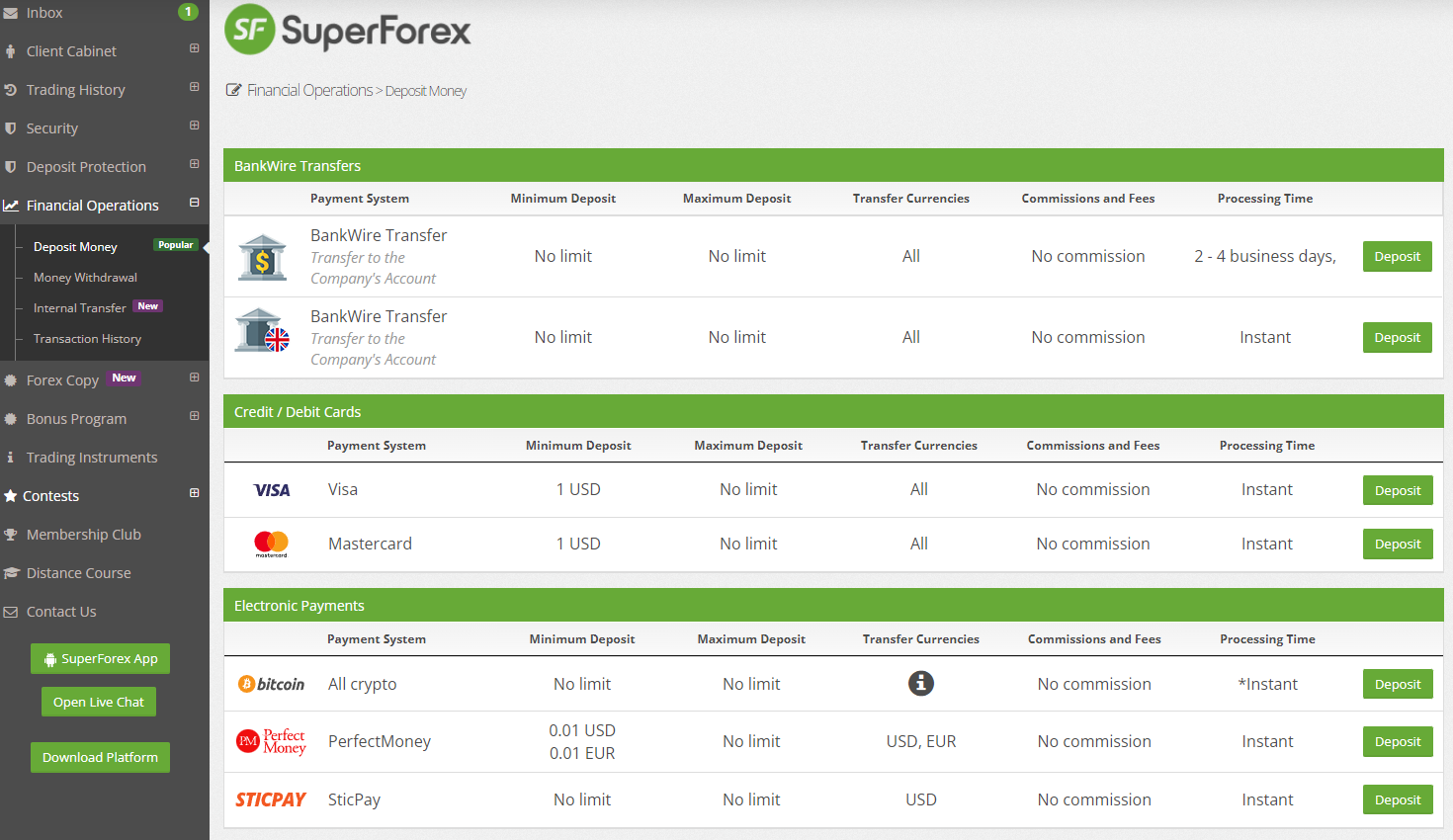

Go to the "Financial Operations" section and select the "Deposit Money" subsection. Choose the preferred deposit method. Follow the on-screen instructions to make a deposit. Once the funds are credited to your account balance, you can start trading. You can also download the MT4 trading platform directly from the user account.

Your SuperForex user account also provides access to:

Inbox. This block receives notifications about all events related to the trader's account.

User account (“Client Cabinet”). Here, you can find information about your account, open/close accounts, and undergo verification.

Trading History. Provides a complete archive of all transactions ever conducted on the account.

Security. In this section, clients can configure the parameters for protecting their funds and data.

Deposit Protection. A unique option that allows the exclusion of losses for a certain period.

Financial Operations. In this block, you can deposit/withdraw funds and make internal transfers.

Forex Copy. Access to the copy trading service, where traders register and configure the copying process.

Bonus Program. A list of current bonuses, each with its conditions and an activation button.

Trading Instruments. This section provides useful tools for technical and fundamental analysis.

Contests. Displays all active contests and their conditions.

Membership Club. Here, the requirements for joining the club are described, and the trader's status is displayed.

There is a LiveChat in the user account, as well as buttons to contact support and download the MT4 trading platform.

SuperForex - How to Open an Account | Firsthand Experience of Traders Union

Regulation and safety

SuperForex has a safety score of 4.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 17 years

- Not tier-1 regulated

SuperForex Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Belize) FSC (Belize) |

Financial Services Commission of Belize | Belize | No specific fund | Tier-3 |

SuperForex Security Factors

| Foundation date | 2008 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker SuperForex have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of SuperForex with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, SuperForex’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

SuperForex Standard spreads

| SuperForex | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 2,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 2,1 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

SuperForex RAW/ECN spreads

| SuperForex | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with SuperForex. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

SuperForex Non-Trading Fees

| SuperForex | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0,5-5,5 | 0 | 0 |

| Withdrawal fee, USD | 0-35 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Since the broker offers 11 real accounts, making the right selection at the beginning is crucial. STP accounts use the straight-through processing protocol, where orders are sent directly to liquidity providers. ECN accounts utilize an Electronic Communication Network, eliminating intermediaries in the information exchange chain between the trader and other market participants. Mini accounts have the lowest minimum deposit and allow trading with the smallest trades. Standard accounts offer universal trading parameters and are suitable for most traders. Swap-free accounts are designed for the broker's clients who adhere to Islamic principles. Crypto accounts enable trading on cryptocurrency markets. Finally, the Pro accounts involve substantial investments from the trader and provide access to an extended range of trading opportunities. When choosing an account, the trader should consider their available capital, trading preferences, and actual experience.

Account types:

Typically, traders start by opening a demo account, which allows them to familiarize themselves with the platform and practice preferred strategies. Afterward, they move on to a real account, choosing one that aligns with their trading preferences.

Deposit and withdrawal

SuperForex received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

SuperForex provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank card deposits and withdrawals

- Minimum deposit below industry average

- Bitcoin (BTC) accepted

- BTC available as a base account currency

- USDT payments not accepted

- Withdrawal fee applies

- Limited deposit and withdrawal flexibility, leading to higher costs

What are SuperForex deposit and withdrawal options?

SuperForex provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, M-Pesa, BTC.

SuperForex Deposit and Withdrawal Methods vs Competitors

| SuperForex | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are SuperForex base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. SuperForex supports the following base account currencies:

What are SuperForex's minimum deposit and withdrawal amounts?

The minimum deposit on SuperForex is $1, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact SuperForex’s support team.

Markets and tradable assets

SuperForex offers a limited selection of trading assets compared to the market average. The platform supports 250 assets in total, including 40 Forex pairs.

- 40 supported currency pairs

- Copy trading platform

- Indices trading

- Bonds not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by SuperForex with its competitors, making it easier for you to find the perfect fit.

| SuperForex | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 250 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products SuperForex offers for beginner traders and investors who prefer not to engage in active trading.

| SuperForex | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

SuperForex received a score of 5.45/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- Trading bots (EAs) allowed

- MetaTrader is available

- One-click trading

- Strategy (EA) Builder is available

- No access to Free VPS

- No access to API

- No TradingView integration

Supported trading platforms

SuperForex supports the following trading platforms: MT4. This selection covers the basic needs of most retail traders. We also compared SuperForex’s platform availability with that of top competitors to assess its relative market position.

| SuperForex | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key SuperForex’s trading platform features

We also evaluated whether SuperForex offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 30 |

| Tradable assets | 250 |

Additional trading tools

SuperForex offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

SuperForex trading tools vs competitors

| SuperForex | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

SuperForex supports mobile trading, offering dedicated apps for both iOS and Android. SuperForex received 4.2/10 in this section, which suggests limited user interest or weak performance of the apps.

- Mobile alerts supported

- Mobile 2FA not supported

We compared SuperForex with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| SuperForex | Plus500 | Pepperstone | |

| Total downloads | 100,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | 3.4 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

Traders can expect success only when they constantly practice and progress in a theoretical sense. This implies studying articles on specialized portals, reading expert analytics, and participating in seminars and webinars. Ignoring theory, a trader will not be able to keep up with the market and will make fewer profitable trades. It is optimal when all the necessary information, presented in various formats, is available on one website. Understanding this, some brokers try to organize comprehensive educational courses on their platforms. SuperForex is one such company. The “Education” section offers specialized materials conveniently grouped into learning modules. The broker also regularly conducts seminars. The website features a glossary, educational videos, a unique tool called Pattern Graphix, and separate news sections for fundamental and technical analyses.

Few brokers can compete with SuperForex’s education and training center. At present, SuperForex has eight such centers where anyone interested can learn trading under the guidance of experienced mentors. The broker's educational system has no conceptual drawbacks and covers most topics and areas.

Customer support

Technical support is necessary for every broker because even the most experienced traders sometimes encounter situations they cannot resolve on their own. The reason help is needed may be simple or complex. Moreover, no platform is 100% immune to malfunctions. If a trader does not receive prompt and qualified assistance, they may become disappointed in the broker and switch to a competitor. That's why SuperForex offers the opportunity to contact support around the clock. Specialists are proficient in multiple languages, and they work day and night without breaks. You can reach them by phone, email, LiveChat, and messengers. The only nuisance is that SuperForex's Customer service operates 24/5 only for regular traders but 24/7 for club members.

Advantages

- You can contact support without being this broker's client.

- Specialists are available day and night, without breaks 24/5 and 24/7 for club members.

- Managers answer promptly and are competent.

Disadvantages

- Only SuperForex club members can get help on weekends.

If you need consultation or have trade related questions, you can contact technical (customer) support through the following communication channels:

-

Call center;

-

Email;

-

Skype;

-

WhatsApp1;

-

WhatsApp2;

-

Telegram.

For legal entities that want to become or are already partners of the broker, there are separate contact options through email and messengers. Details can be clarified on this page: superforex.com/ru/contacts. The broker is also present on social media platforms, and the list of their profiles with links can be found in the website footer. There, you can also get in touch with the managers. It is recommended to subscribe to the broker to stay updated with their latest news.

Contacts

| Foundation date | 2008 |

|---|---|

| Registration address | Second Floor, No 24, Albert Hoy Avenue, Belize City, Belize |

| Regulation | IFSC |

| Official site | superforex.com |

| Contacts |

+442045771579, +44 7393882842

|

Comparison of SuperForex with other Brokers

| SuperForex | Bybit | Eightcap | XM Group | FxPro | AMarkets | |

| Trading platform |

MT4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MT5, AMarkets App |

| Min deposit | $1 | No | $100 | $5 | $100 | $100 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 2 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

30% / 40% | No / 50% | 80% / 50% | 100% / 50% | 25% / 20% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | $100 | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of SuperForex

This broker has been in the market for 10 years and is officially registered and regulated in Belize. Traders from most regions of the world are its clients. The website, user account, and customer support are available in multiple languages. No bugs or performance issues have been reported, and execution time is around 30-50 ms. The company collaborates with first-tier liquidity providers. Their technological stack and client service meet advanced standards. The broker uses virtual dedicated servers and offers special features to its clients, such as deposit insurance against financial losses. Clients can also enable a 5% annual interest rate on funds reserved in the trader's balance.

SuperForex by the numbers:

-

On offer in 150 countries.

-

It takes 1 second to open a new trade.

-

Some clients earn over $100,000 in daily profits.

-

Minimum deposit is $5.

-

There are 11 types of real accounts and a demo account.

SuperForex is a broker with versatile trading conditions

For many traders, the diversity of trading instruments is one of the essential criteria. It is crucial because the more assets are available, the broader the strategic possibilities. Additionally, a deep pool of instruments allows for the formation of a diversified portfolio, which is critical for every trader, especially those who trade with leverage. SuperForex offers leverage of up to 1:3000, which increases the risk to unimaginable heights. SuperForex allows trading with the following instrument groups: currency pairs, cryptocurrencies, stocks, indices, energies, and metals. In total, the broker offers over 2,300 assets. This is more than sufficient for any trader, regardless of their activity, strategic preferences, and professionalism. Moreover, trading is conducted through MetaTrader 4, the most customizable trading platform.

SuperForex’s analytical services:

-

Copy trading. A service for copying trades developed and maintained by the broker's expert signals providers. It allows signals providers (masters) to earn additional income, while investors (followers) can profit without trading themselves.

-

Negative balance protection. An integrated option that terminates trades if they could lead to the trader's balance dropping below zero.

-

Membership Club. Club members trade with reduced spreads, receive a 100% deposit bonus, and have access to 24/7 technical support. The broker does not charge club members for fund withdrawals and ensures the protection of their deposits.

Advantages:

The broker offers a free demo account and numerous bonuses to enhance the profit potential of new clients.

A wide range of account types individualizes offerings, plus there are average or below-average spreads and no trading commissions.

Thousands of instruments and high leverage allow the application of various trading strategies.

Traders can trade without restrictions using the user-friendly and convenient MT4 trading platform, and additional profits can be earned through trade copying.

The platform operates with 100% transparency, without hidden fees, and multilingual customer support is available up to 24/7 through multiple communication channels.

Latest SuperForex News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i