According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- VFSC

- 2022

Our Evaluation of ThreeTrader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ThreeTrader is a moderate-risk broker with the TU Overall Score of 5.3 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ThreeTrader clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ThreeTrader features competitive trading conditions such as tight spreads and low fees. Traders work through the universal MT4 platform, and the broker does not set restrictions on strategies or trading methods. Four groups of assets and high leverage are available. Also, there is negative balance protection. All this comprises trading with maximum comfort. In addition, the broker has joint accounts, which can be considered a profitable investment. Unfortunately, there is no referral program, technical support is not available 24/7, and there are regional restrictions.

Brief Look at ThreeTrader

ThreeTrader offers two types of trading fees, namely raw spreads plus a fee and regular floating spreads with no fee. There is also a demo account available for 30 days. The broker provides access to currencies, indices, metals, and contracts for difference (CFDs). The minimum deposit is $100. In addition to dollars, the Japanese yen can be used as the basic currency. Spreads start from 0-0.5 pips and the fee is $2 per lot. Leverage depends on the asset, and the maximum for currency pairs is 1:500. Also, there are trades from 0.01 lots, market execution, and retail or institutional swaps. Only MetaTrader 4 (MT4), including its mobile version, is available. ThreeTrader has neither a referral program for private traders nor a copy trading service, but it does have MAM and PAMM accounts. Most major deposit/withdrawal options are available, including bank cards, crypto wallets, and online transfer systems. There are no withdrawal fees.

We've identified your country as

GB

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

GB :

- Traders decide whether they pay regular spreads without a fee or raw spreads with a fee;

- The broker offers several hundred assets from different groups, which expands the profit potential and helps to diversify risks;

- Traders work through MT4, which is the simplest, most convenient, and customizable platform using available plugins;

- The most popular withdrawal options are available, and the broker does not charge any fees for the withdrawals;

- The broker is officially registered and is regulated by the Vanuatu Financial Services Commission (VFSC, 40430), which guarantees the legality and transparency of its operations;

- MAM and PAMM accounts allow managers to earn extra money, and provide investors with passive income;

- Technical support is highly efficient, competent, and is available 12/5.

- Only one trading platform is available;

- There are no other options for passive income except for MAM and PAMM accounts, and the broker does not have a referral program;

- Residents of Iran, North Korea, and some other countries cannot become ThreeTrader’s clients.

TU Expert Advice

Author, Financial Expert at Traders Union

ThreeTrader provides trading currencies, indices, metals, and CFDs on the MetaTrader 4 platform with two account types. Traders can select raw spreads with a fee or floating spreads without any fee. The platform supports high leverage up to 1:500 for currency pairs and employs no restrictions on trading strategies. Other features include MAM and PAMM accounts and negative balance protection, contributing to a flexible and tailored trading experience.

On the downside, ThreeTrader is regulated by VFSC, which is not Tier-1 regulation, potentially concerning for security-conscious traders. The absence of a comprehensive referral program and limited passive income tools may not appeal to traders seeking these features. Regional restrictions also limit accessibility. ThreeTrader may be better suited for experienced traders who are comfortable with the available financial oversight and platform offerings.

ThreeTrader Trading Conditions

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Demo, Pure spread, and Raw Zero spread |

| 💰 Account currency: | USD and JPY |

| 💵 Deposit / Withdrawal: | Visa/MasterCard, BTC and Tether crypto wallets, bank transfer, and bank wire |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, indices, metals, and CFDs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: |

Demo account is available for 30 days; Two live account types which differ in spreads and fees; Many assets from four groups; Trading through MT4; Several deposit/withdrawal options without fees; Convenient PAMM and MAM account service; No copy trading |

| 🎁 Contests and bonuses: | Bonuses in the form of rebates from Traders Union |

The minimum deposit is determined by the spread type. If it is the Pure spread account, the deposit is $100. If the trader chooses the Raw Zero option, at least $1,000 will be required. Trading leverage is available on both accounts for all assets. The maximum is 1:500 for currency pairs. However, traders can trade without leverage if they wish. Technical support works 12/5. Therefore, support is not available at night and on weekends. It can be contacted by phone, email, or live chat.

ThreeTrader Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with ThreeTrader, register on its official website, verify, open a live account, and make a deposit. TU experts have prepared a detailed guide on registration and functions of ThreeTrader’s user account.

Go to threetrader.com, select the interface language in the top menu, and click the "Open Account" button.

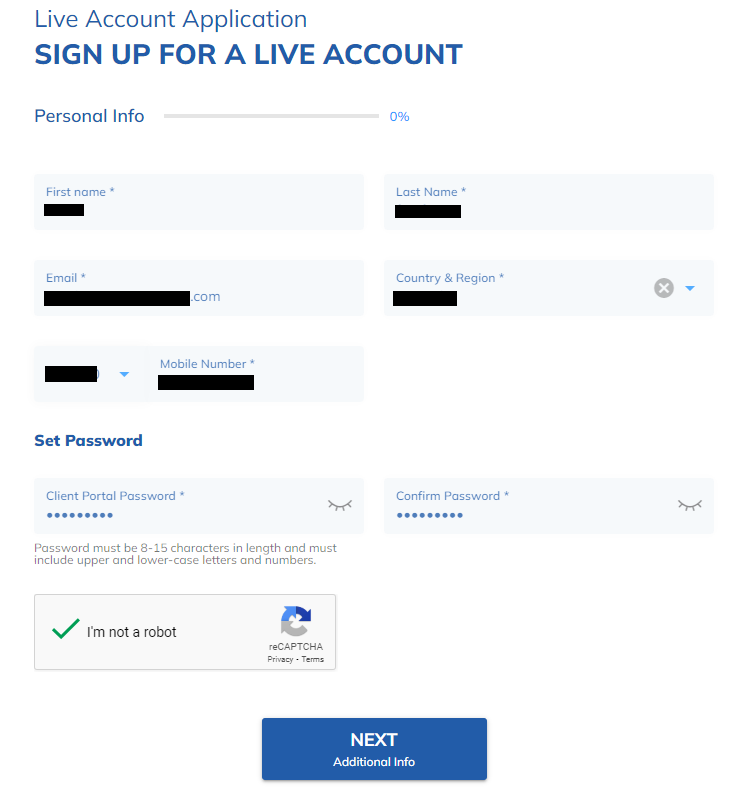

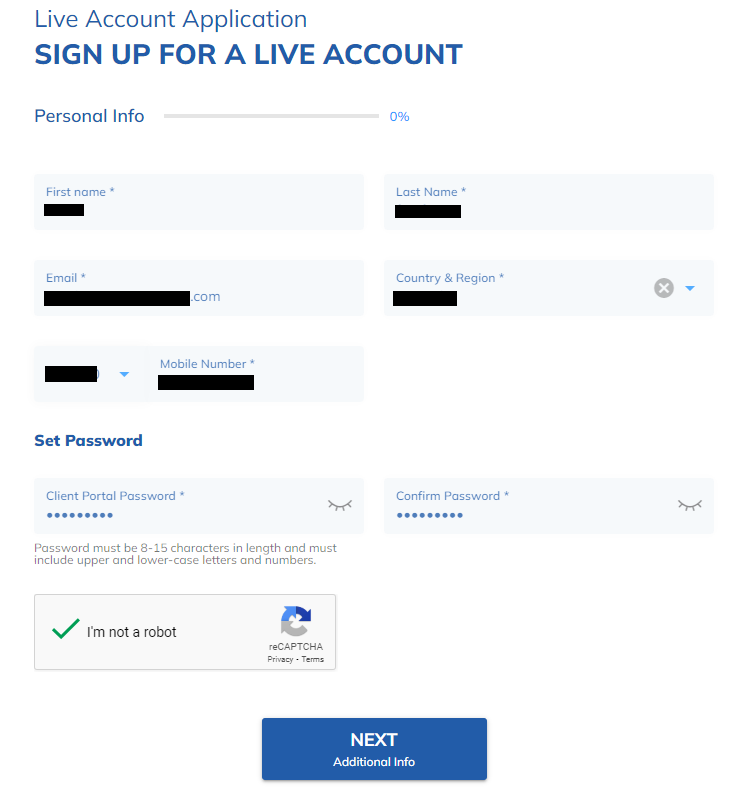

Enter your first and last names, email, and phone number (select your country first). Make up a password and enter it twice. Pass an anti-bot check and click the “Next” button.

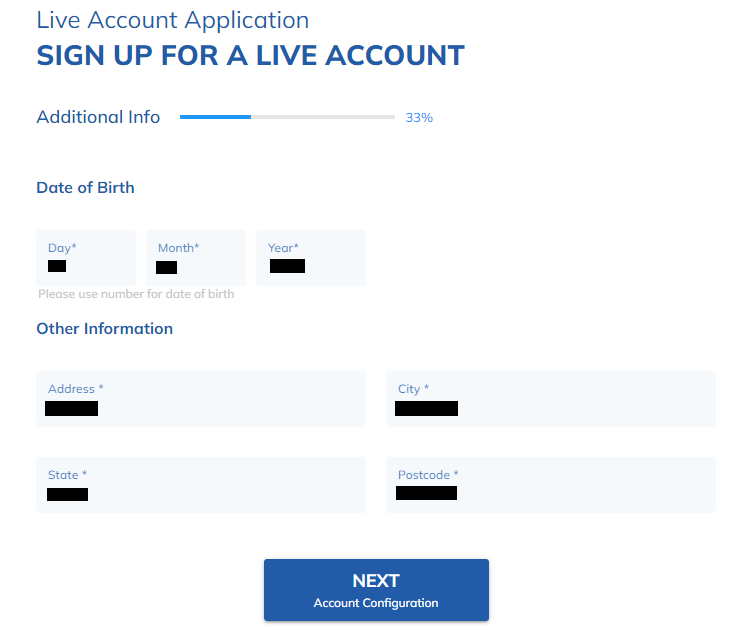

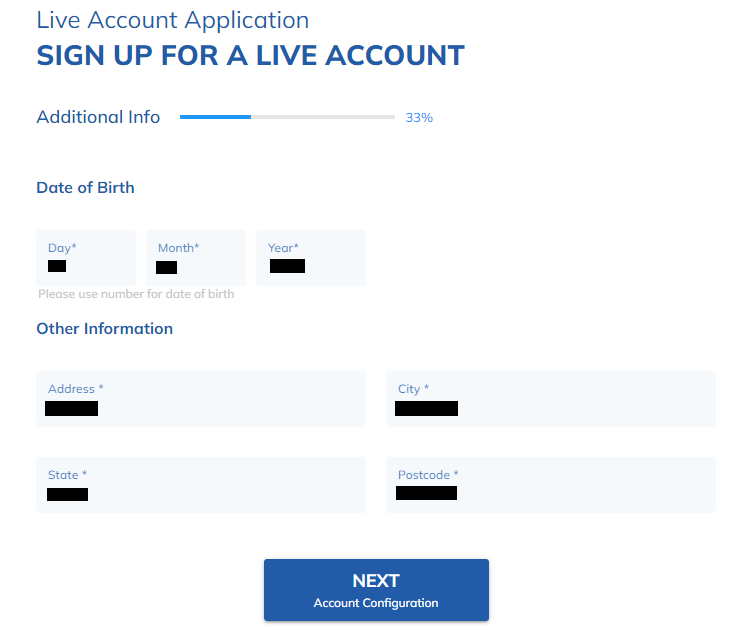

Enter your date of birth and residential address with zip code. Click the “Next” button.

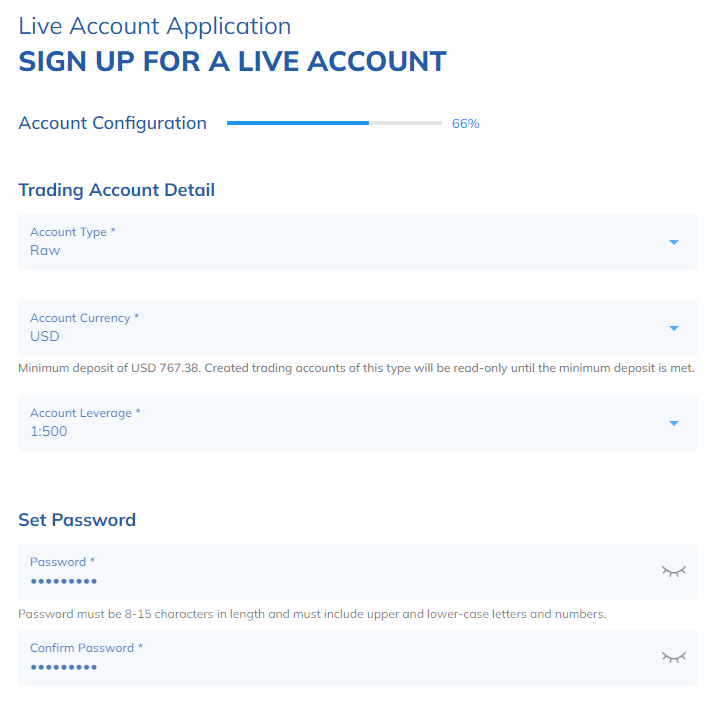

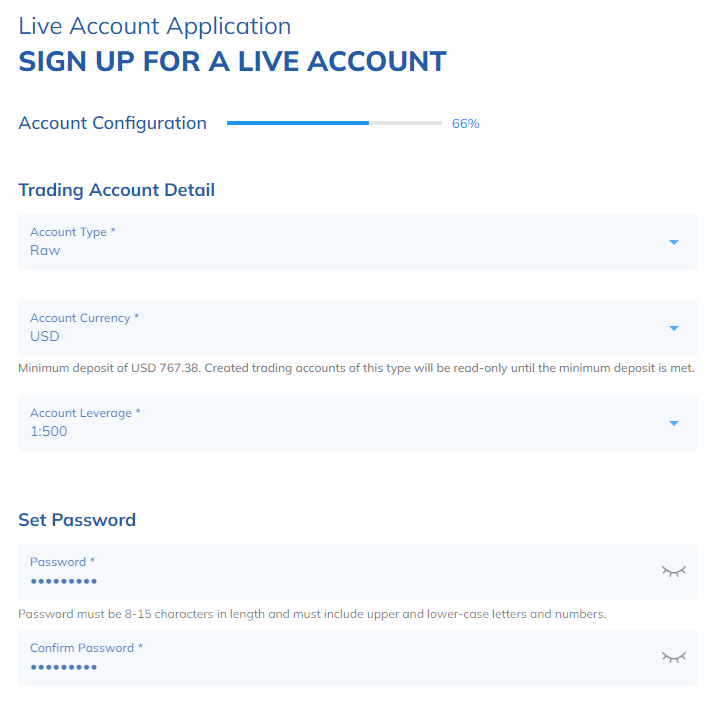

Select a Pure or Raw account type and the USD or JPY currency Specify the required leverage from 1:1 to 1:500. Create a password to the trading account, but not to the user account. Agree to the terms of service by ticking the two boxes and click the “Confirm” button.

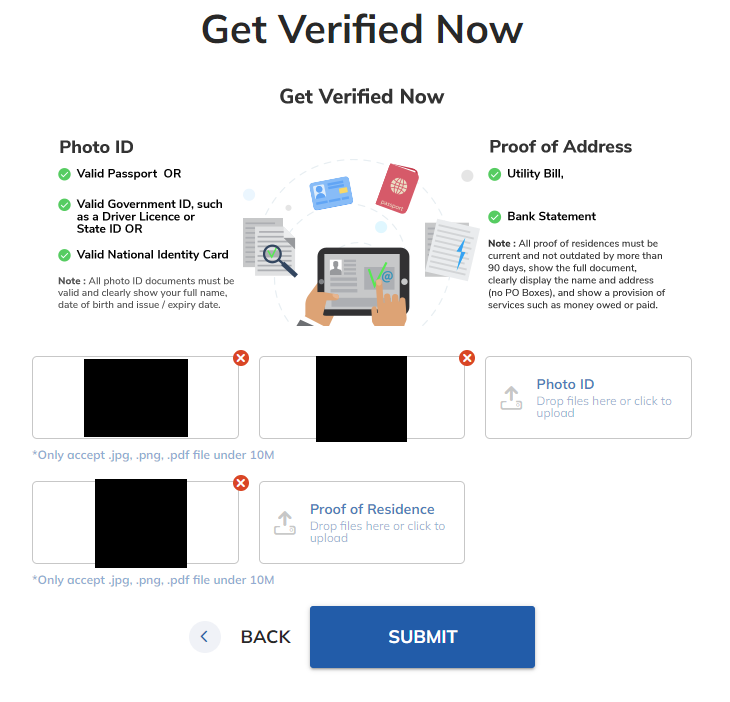

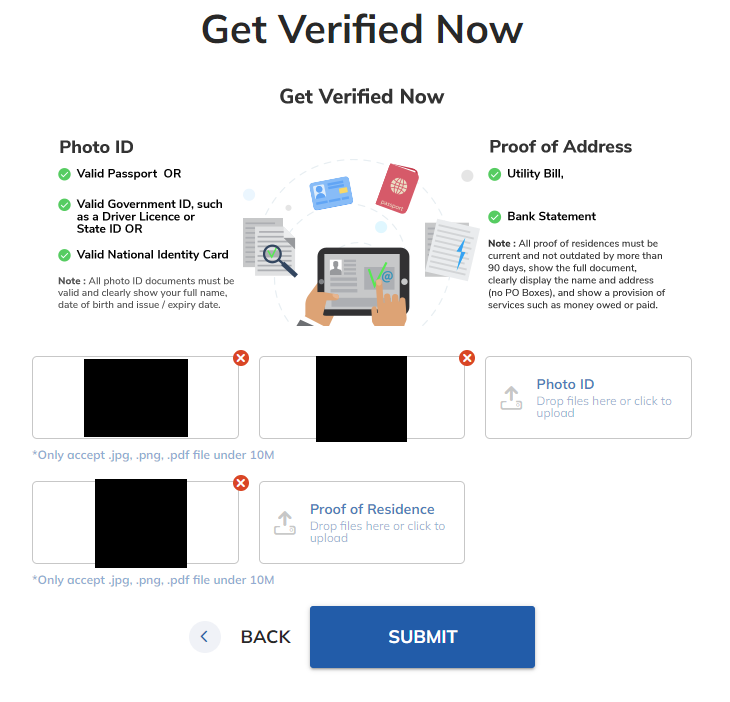

Upload scans/photos of documents confirming your identity. Follow the comments on the screen and then click the "Submit" button.

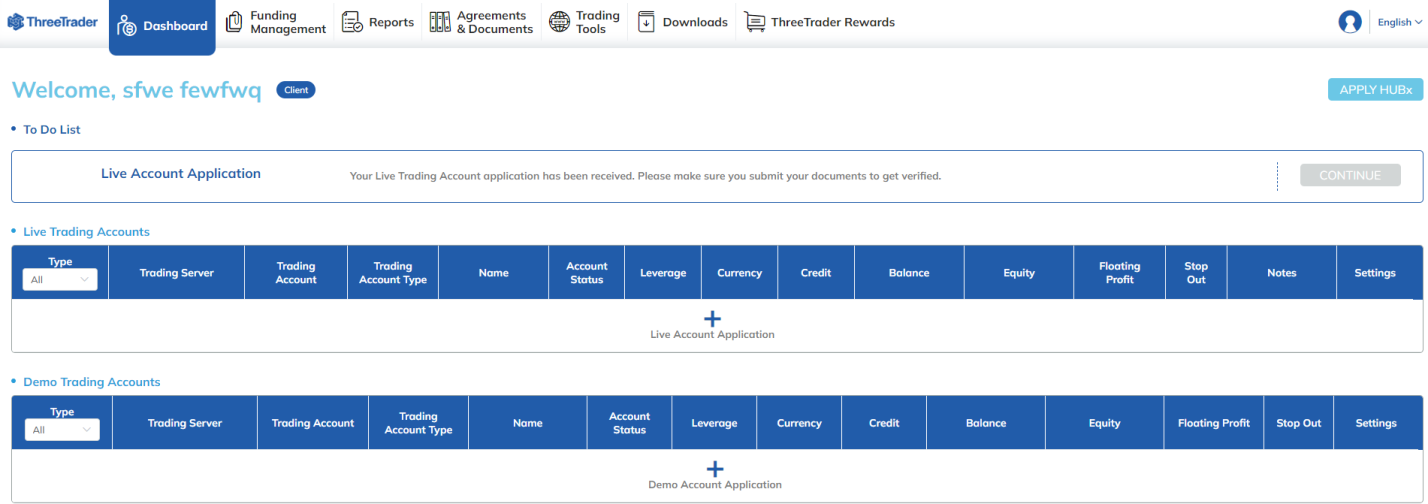

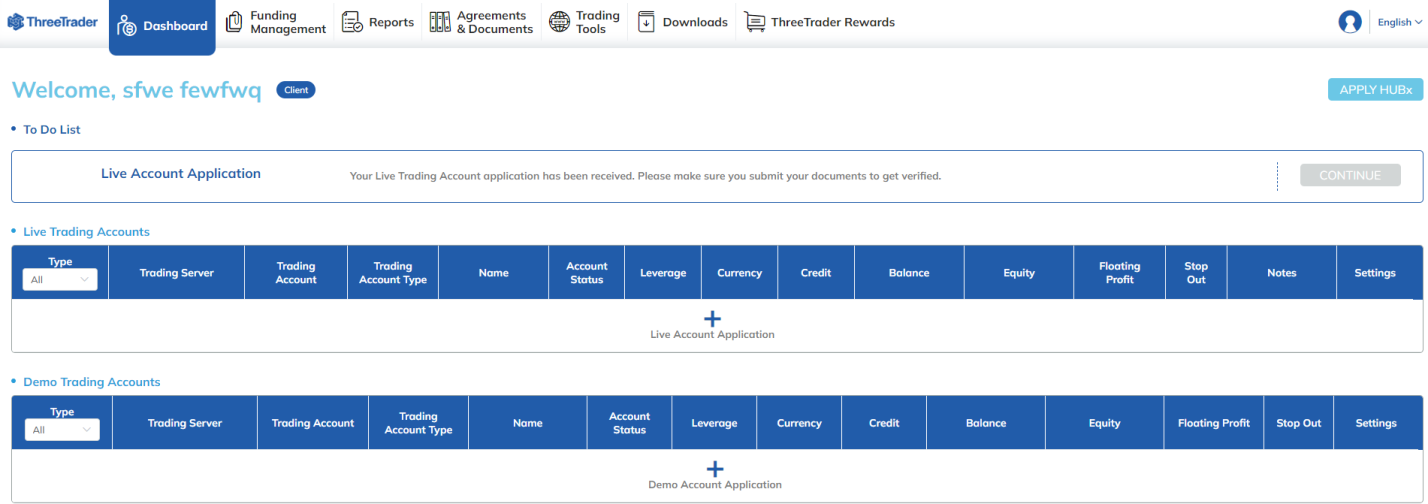

Now you are in your user account, but you will get access to your trading account only after the broker's specialists check your documents. When verification is complete, click the "Funding Management" button and make a deposit following the on-screen instructions. Next, you can download the MT4 distribution kit in the "Downloads" menu and start trading.

Additional features of the user account:

Dashboard. This is the main menu, which displays all the information on the traders’ active accounts;

Funding management. In this block, traders make deposits and submit withdrawal requests;

Reports. Here you can get a list of current or archived transactions with details;

Agreements and documents. Here all documents and forms that a trader may need are available;

Trading tools. This block allows traders to connect to the HUBx portal;

Downloads. In this block, you can download MT4 distributions and its desktop and mobile versions;

ThreeTrader rewards. This section will display information on the broker's loyalty program.

Regulation and safety

ThreeTrader has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

ThreeTrader Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

ThreeTrader Security Factors

| Foundation date | 2022 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ThreeTrader have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Eightcap and XM Group, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ThreeTrader with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ThreeTrader’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ThreeTrader Standard spreads

| ThreeTrader | Eightcap | XM Group | |

| EUR/USD min, pips | 0,5 | 0,4 | 0,7 |

| EUR/USD max, pips | 0,7 | 1,5 | 1,2 |

| GPB/USD min, pips | 0,5 | 0,8 | 0,6 |

| GPB/USD max, pips | 0,9 | 1,5 | 1,2 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ThreeTrader RAW/ECN spreads

| ThreeTrader | Eightcap | XM Group | |

| Commission ($ per lot) | 2 | 3,5 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,2 |

| GBP/USD avg spread | 0,2 | 0,3 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ThreeTrader. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ThreeTrader Non-Trading Fees

| ThreeTrader | Eightcap | XM Group | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Account types

If a broker offers multiple account types, it is important for a trader to make the right choice for him, because accounts differ in trading conditions. ThreeTrader offers only one live account type. However, traders can choose a trading cost option, such as low spread with no fee or a more profitable raw spread with a fee. The fee of $2 is one of the lowest rates on the market, only a few brokers have a $1 fee, but they are not that profitable to work with, considering other trading factors. Thus, the task for new clients is greatly facilitated, because they receive a profitable offer. Further, traders work with all available assets with high leverage. There are no restrictions on methods, styles, or strategies. MT4 allows you to install a huge number of plugins to automate technical analysis.

Account types:

It is standard practice to open a demo account first. A trader can work on it for free for a whole month. This time is enough to get to know the broker and even try some strategies. Thereafter, traders will likely open live accounts with suitable conditions for trading fees.

Deposit and withdrawal

ThreeTrader received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

ThreeTrader provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- USDT (Tether) supported

- Low minimum withdrawal requirement

- BTC available as a base account currency

- Wise not supported

- Only major base currencies available

- PayPal not supported

What are ThreeTrader deposit and withdrawal options?

ThreeTrader provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, BTC, USDT, Ethereum.

ThreeTrader Deposit and Withdrawal Methods vs Competitors

| ThreeTrader | Eightcap | XM Group | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| BTC | Yes | Yes | Yes |

What are ThreeTrader base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ThreeTrader supports the following base account currencies:

What are ThreeTrader's minimum deposit and withdrawal amounts?

The minimum deposit on ThreeTrader is $100, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ThreeTrader’s support team.

Markets and tradable assets

ThreeTrader offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 60 Forex pairs.

- Crypto trading

- Indices trading

- 60 supported currency pairs

- Bonds not available

- Copy trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by ThreeTrader with its competitors, making it easier for you to find the perfect fit.

| ThreeTrader | Eightcap | XM Group | |

| Currency pairs | 60 | 40 | 57 |

| Total tradable assets | 100 | 800 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | No |

Investment options

We also explored the trading assets and products ThreeTrader offers for beginner traders and investors who prefer not to engage in active trading.

| ThreeTrader | Eightcap | XM Group | |

| Bonds | No | No | No |

| ETFs | No | No | No |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | No |

| Managed accounts | Yes | No | No |

Customer support

Technical support of any broker is extremely important for ensuring the comfort and peace of mind of traders. Sooner or later all users face situations that they cannot solve on their own. In this case, they contact technical support, where they are provided with fast qualified assistance. If support managers are not quick enough or they are having difficulty solving the problem, traders may be disappointed with their broker and go to a competitor. To prevent this from happening, ThreeTrader has a special department that works 12/5. Support specialists are available by phone, email, and live chat. These are universal communication methods that are convenient for the vast majority of people. Unfortunately, assistance is not available at night and on weekends.

Advantages

- Non-clients can contact technical support

- There are several communication channels, which are equivalent in terms of the quality of assistance

- Support works 12/5

Disadvantages

- Technical support is not available at night and on weekends

Whether you are a client of the broker or are just about to become one, you can contact support using these methods:

-

Local and international call centers;

-

email;

-

live chat;

-

tickets.

All communication channels operate in the same mode. However, responses by phone and live chat are much faster than by email. Also, the answers to questions asked by tickets will be sent by email as well.

Contacts

| Foundation date | 2022 |

|---|---|

| Registration address | 1276, Government Building, Kumul Highway, Port Vila, Republic of Vanuatu |

| Regulation | VFSC |

| Official site | https://www.threetrader.com/ |

| Contacts |

+612 8039 9099, 02 8039 9099

|

Education

If traders do not use all the opportunities for learning, they will not be able to remain successful and progress in profit for a long time, as the market does not stand still, and new methods, tricks, and life hacks appear all the time. It is important to read the latest research, articles from professionals, and attend webinars that are periodically held by financial experts. Some brokers offer tutorials, courses, or useful materials. There is nothing like that on the ThreeTrader website. There are only basic FAQs on the terms of cooperation.

As you can see, ThreeTrader does not provide its clients with information on the theory of trading. There aren’t any training materials, glossaries, articles, or blogs. The broker assumes that traders who intend to work with it are already familiar with financial markets, and have at least basic knowledge and minimum trading experience. There is nothing unusual in this approach, as among top brokers there are many companies without any educational opportunities. In any case, self-study remains the responsibility of each trader.

Comparison of ThreeTrader with other Brokers

| ThreeTrader | Bybit | Eightcap | XM Group | TeleTrade | AMarkets | |

| Trading platform |

MetaTrader4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, MT5, AMarkets App |

| Min deposit | $100 | No | $100 | $5 | $10 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 50% / 20% |

| Order Execution | No | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of ThreeTrader

ThreeTrader Global Limited was incorporated by financial experts and has demonstrated a high level of a client-oriented approach since its launch. The broker's user account is integrated with MetaTrader 4, which is generally recognized as the easiest to learn and most functional solution. The broker does not offer many account types. In fact, there is only one account, with universal trading conditions, which differ only in spreads and fees. This approach is optimal for most traders. Also, the broker provides high performance, as it uses advanced methods to protect users’ funds and data. That is why verification can sometimes take several days, as experts carefully check traders to prevent scammers and dishonest users from accessing the platform.

ThreeTrader by the numbers:

-

Minimum deposit is $100;

-

Spreads start from 0 pips;

-

Maximum leverage is 1:500;

-

4 groups of financial instruments;

-

Technical support works12/5.

ThreeTrader is a broker for working on different markets

There are quite a few brokers that focus on specific groups of assets, such as currency pairs. There are also CFD brokers that offer only one type of financial instrument, which is CFDs. Each approach has its own advantages, but the average trader benefits when assets are numerous and various. ThreeTrader fully meets this requirement, providing the ability to trade currency pairs, indices, metals, and CFDs. This is beneficial because assets of different types open up more opportunities in terms of trading methods and strategies. Plus, a variety of trading instruments allows traders to diversify risks by designing a portfolio in which the negative trend of one asset is compensated by the stable and progressive position of others. Moreover, ThreeTrader offers leverage up to 1:500 and sets no limits on its clients’ trading strategies. And since trading is conducted through MetaTrader 4, the workflow is very comfortable.

Useful services offered by ThreeTrader:

-

MAM and PAMM accounts. These joint account services allow traders to become either managers or investors. Managers increase their profits by charging a percentage on successful trades, and investors earn passively with reduced risk;

-

Asset options. This integrated service makes it possible to track the trading performance of each financial instrument available for work. Information like contract size, margin currency, trading step size, working hours, etc., is available in a visual table;

-

Introducing Broker (IB). This is a service for corporate clients, which provides for establishing a brokerage company by gaining access to the quotes of tier-1 liquidity providers through ThreeTrader. The IB program is optimal for startups.

Advantages:

This broker offers one account type with a choice of spreads and trading fees. In any case, traders receive conditions more favorable than market average;

The broker’s clients can trade hundreds of assets from four groups with leverage up to 1:500. There are no restrictions, thus scalping, hedging, and use of advisors are available;

Joint accounts are optimal for experienced market participants because they allow them to earn more. Investors, for their part, reduce risk and make a profit without trading;

ThreeTrader works with MetaTrader 4. This is an advantage, because MT4 is considered one of the most convenient and functional trading solutions with wide customization options;

Although the broker’s technical support does not work at night and on weekends, managers provide prompt and competent assistance during weekdays. You can contact them in several convenient ways.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i