According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- proprietary TradeUltra platform

- FSC Mauritius

- LFSA Malaysia

- 2020

Our Evaluation of TradeUltra

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TradeUltra is a moderate-risk broker with the TU Overall Score of 5.41 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TradeUltra clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

TradeUltra offers Standard, Islamic, and demo accounts. There are no trading restrictions, thus traders can scalp, hedge, trade news, and use advisors. Passive income options are joint accounts, funds, and partnership programs. The costs are low, but the broker lacks transparency since the withdrawal fee is unknown in advance. The broker offers a convenient proprietary platform plus MT4 and MT5, which is an obvious advantage. Unfortunately, the company has regional restrictions and trading CFDs is only available.

Brief Look at TradeUltra

TradeUltra is an STP broker that offers over 3,000 CFDs on currency pairs, stocks, indices, commodities, and precious metals. A minimum deposit of $100 is required to open a live account. A free demo account also exists for exploring the broker and practicing trading strategies. The Islamic account is available upon request. Spreads start from 0 pips, there are no trading fees, and leverage is up to 1:500. Account currency is USD. Passive income options include joint accounts, funds, and partnership programs. The TradeUltra website provides basic technical and fundamental analysis tools, including economic and dividend calendars, statistics on trades and stock markets, and the Forex heat map. Technical support is available 24/5. The broker doesn’t provide training.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Small minimum deposit, free demo account, and quick user account registration;

- Thousands of CFDs from 6 different groups, optimal leverage, and no trading restrictions;

- Tight spreads, no trading fee, and standard deposit and withdrawal options;

- Passive income options are funds and joint accounts;

- The broker provides for trading through MetaTrader 4, MetaTrader 5, and its proprietary platform;

- Order execution is market with no delays in the trading process;

- Several communication channels to contact technical support, available 24/5.

- The broker's website doesn’t provide information on withdrawal fees;

- TradeUltra offers many instruments, but they are all CFDs;

- The company doesn’t provide its services to residents of Canada, Japan, Iran, and a number of other countries.

TU Expert Advice

Financial expert and analyst at Traders Union

TradeUltra has an international office registered in St. Vincent and the Grenadines. Also, there are representative offices in Mauritius and Malaysia. Thus, the broker has three official registrations and the same number of regulators. Reviews on the internet vary, but expert testing and professional trader reviews confirm that the company provides high-quality services and fulfills its obligations to its clients.

The broker’s important advantage for novice traders is the small first deposit and quick registration under the KYC (Know Your Client) procedure. Moreover, traders don’t need to decide on the account type, since there are only Standard and free demo accounts. The broker provides for registering both individual and corporate user accounts with similar trading conditions. Spreads are always floating starting from 0 pips and there is no trading fee. According to these indicators, TradeUltra competes with leading brokers.

The broker’s clients can be investors and fund managers. Also, there are MAM and PAMM accounts. Thus, novice traders can earn passively, and experienced market participants can receive additional income due to their professional level. The broker lacks transparency, however. For example, unregistered users don’t know anything about minimum deposit and withdrawal fees. Yet, tools for technical and fundamental analyses, like the economic calendar and the Forex heat map, are available without restrictions.

There are no other obvious disadvantages for unregistered users except for non-transparency. The fact that TradeUltra provides for trading only CFDs, is not a disadvantage. CFD brokers are a separate type of company, which are quite popular. To sum up, the broker can be recommended for review. At least, it’s worth opening a free demo account to study all the opportunities yourself.

TradeUltra Trading Conditions

| 💻 Trading platform: | MT4, MT5, and the proprietary TradeUltra platform |

|---|---|

| 📊 Accounts: | Demo, Standard, and Islamic |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfers, Visa, and Mastercard |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, commodities, and precious metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account; One live account type + Islamic; Low entry threshold; Over 3,000 assets from 6 different groups; Tight spreads without trading fees; Passive income options; Basic analysis tools; No training. |

| 🎁 Contests and bonuses: | Yes |

As a rule, if a broker offers several trading account types, they differ in the minimum deposit and conditions. TradeUltra offers Standard and Islamic accounts. They differ only in the availability of swaps. Therefore, a minimum deposit for both account types is $100. Leverage is available for all CFDs from the broker’s pool and depends on the asset. The highest trading leverage of 1:500 is available for currency pairs. Yet, traders can trade without leverage or choose a smaller indicator. Technical support is available 24/5 and can be contacted by phone, email, and via a ticket system.

TradeUltra Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with TradeUltra, register on its official website and get a user account. Verification, which is confirmation of personal information, is required. After that, traders make deposits, download a trading platform, and start trading. TU experts have prepared a detailed guide on registration to eliminate any questions and introduce all features of the user account.

Go to the official website of the broker and click the “Open Live Account” button in the top right corner. You can also click any button with a similar name.

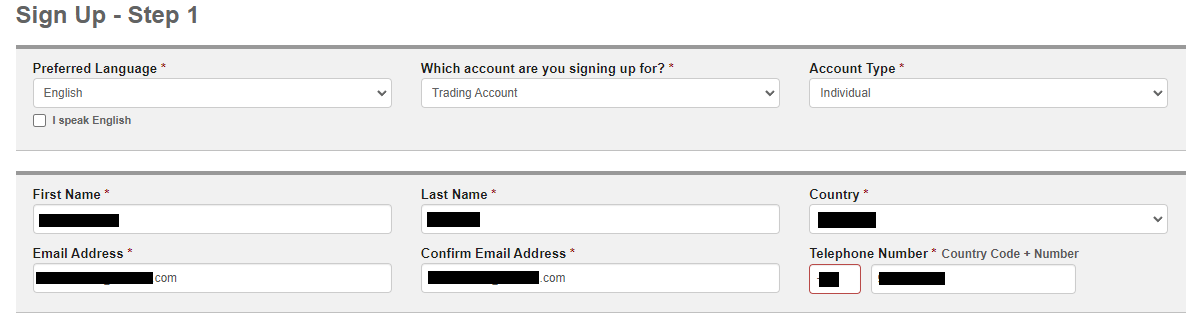

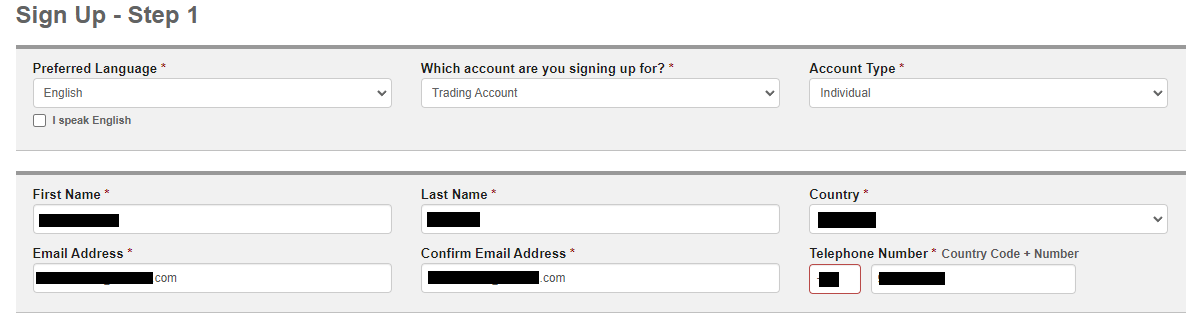

Choose the desired language, account type (trading or managed), and user account type (individual, joint, or corporate). Enter your first and last names, email, phone number, and choose your country of residence. Tick the box to confirm that you are not a bot, and click the “Continue” button.

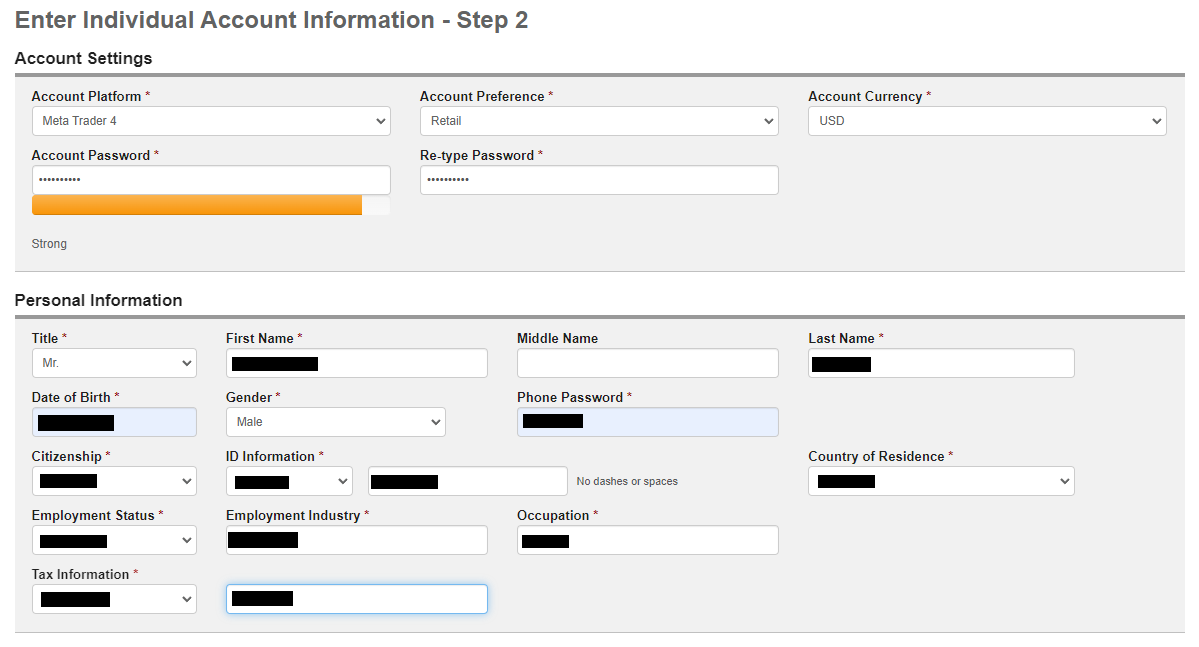

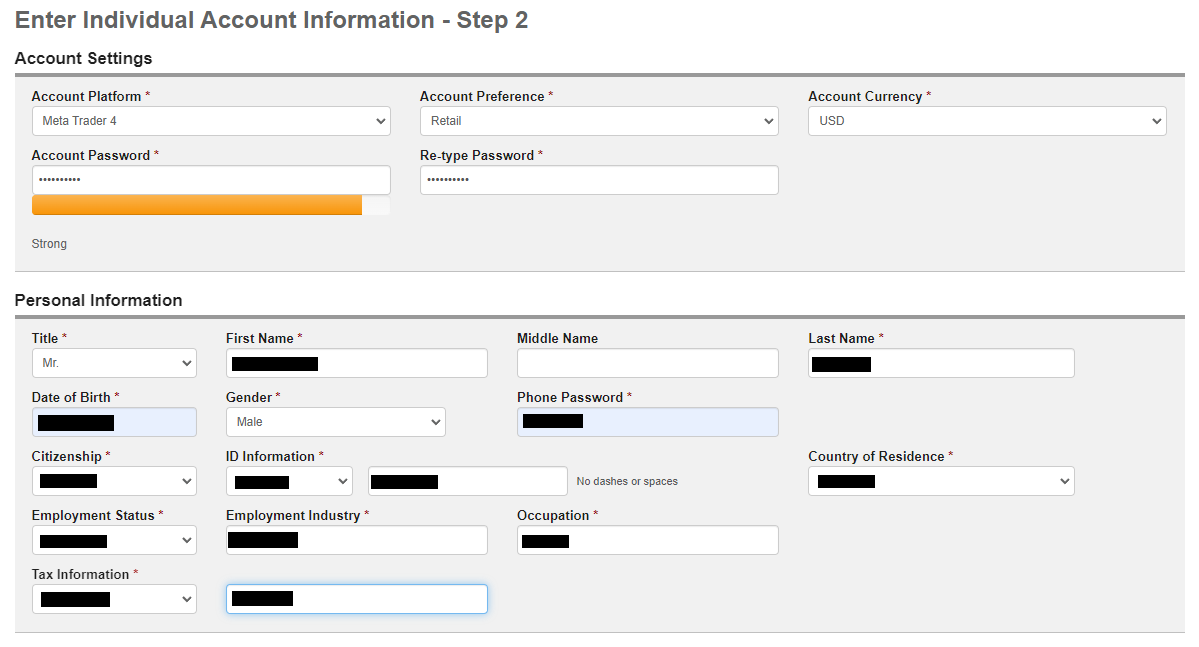

Choose a trading platform and account currency. Create a password and enter it twice. Choose your title. Enter your date of birth, gender, and citizenship. Choose the document confirming your identity and enter its number. Fill in the remaining fields.

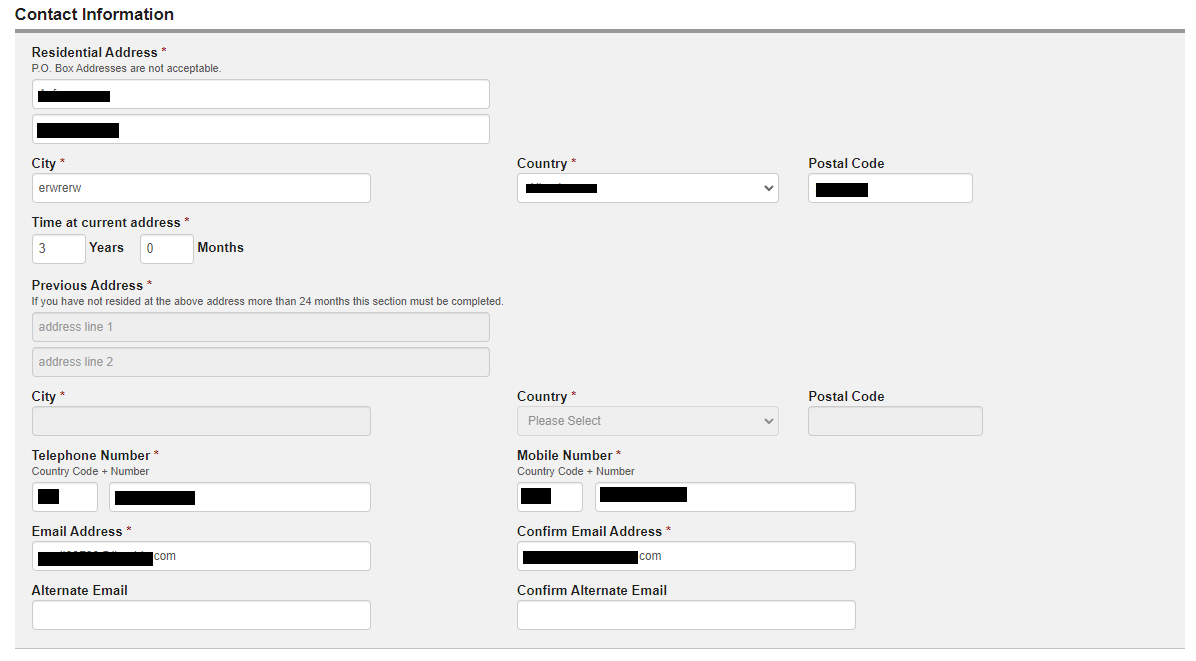

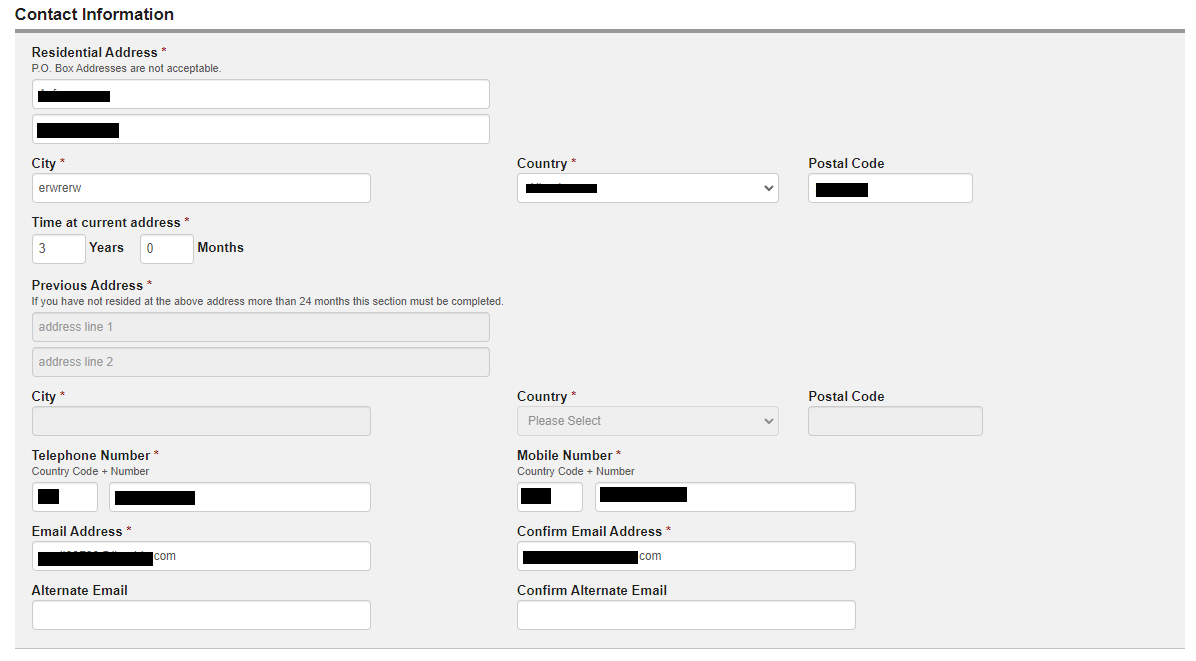

Enter your full registration address with a postal code. If your actual residential address is different from your registration address, enter both of them. Check your phone number and email, and provide your alternative contact details.

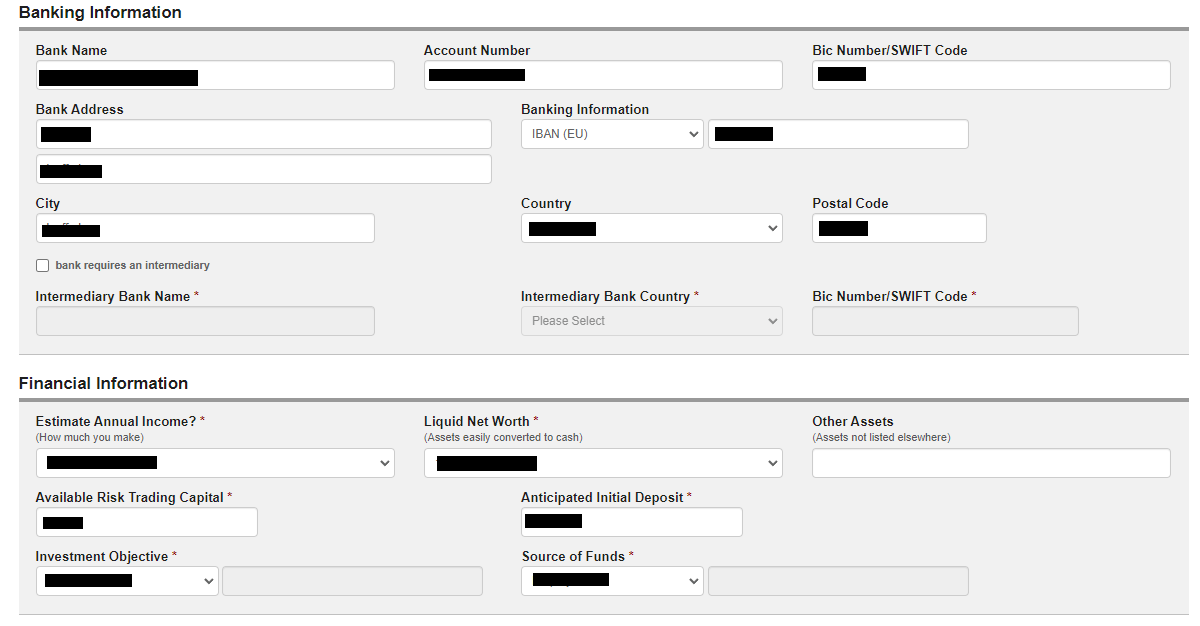

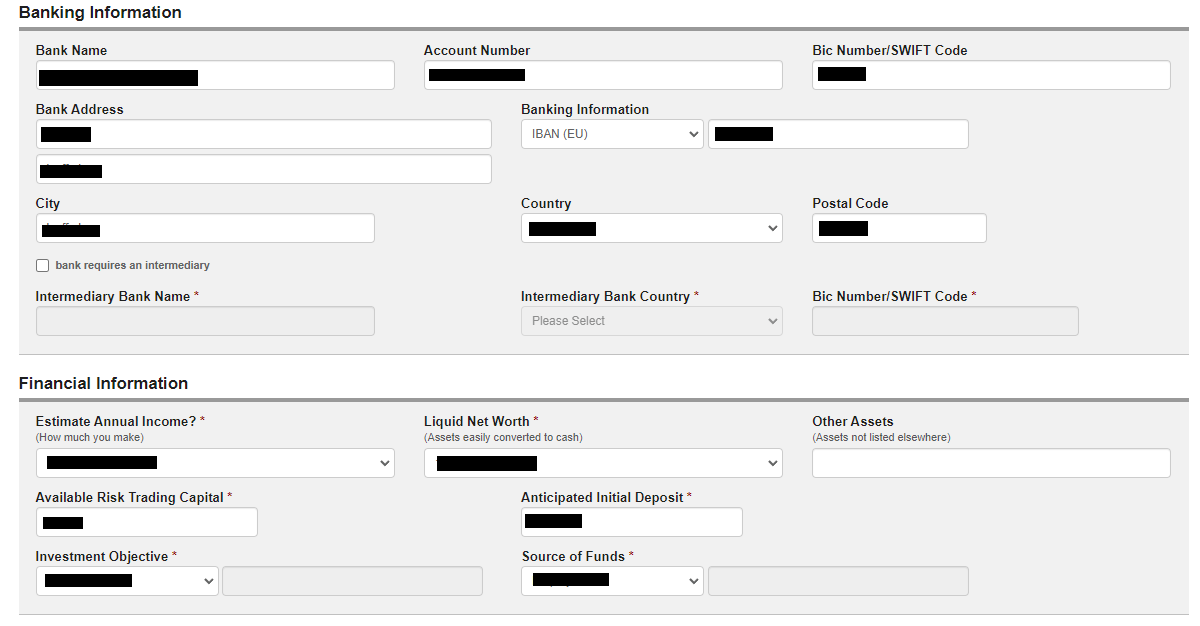

Provide accurate information on your bank, in particular IBAN or its alternative. Answer several questions about your financial capabilities.

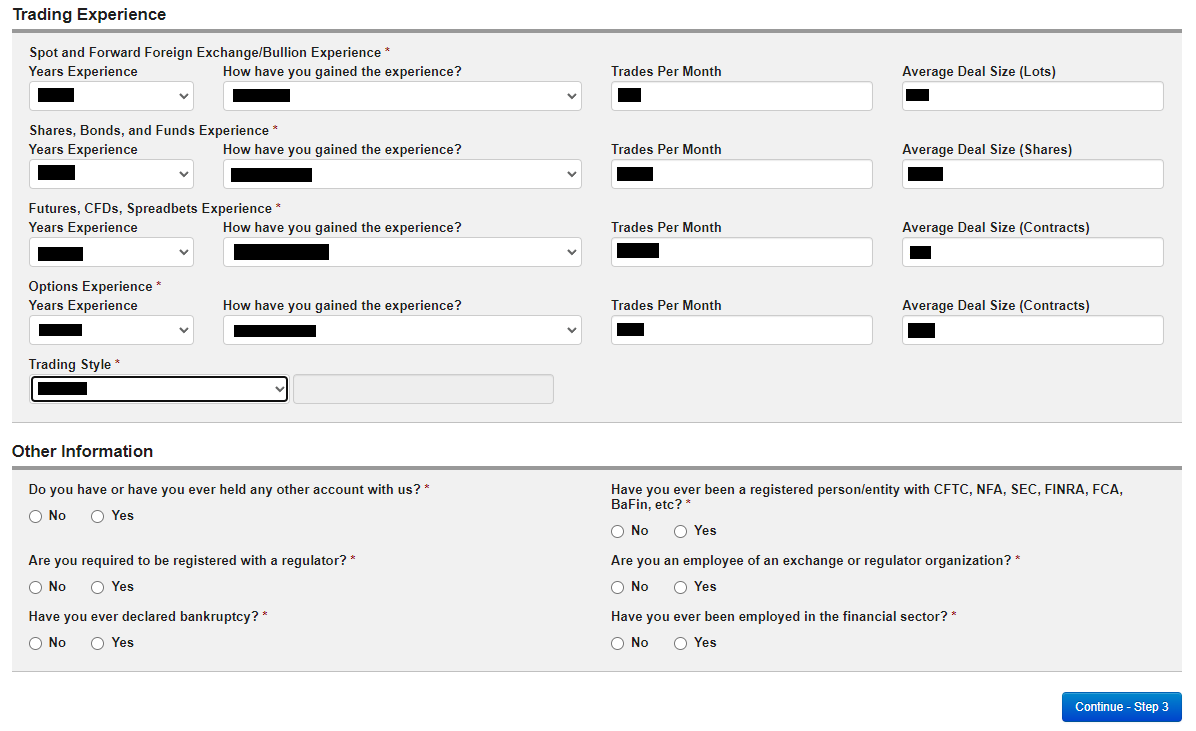

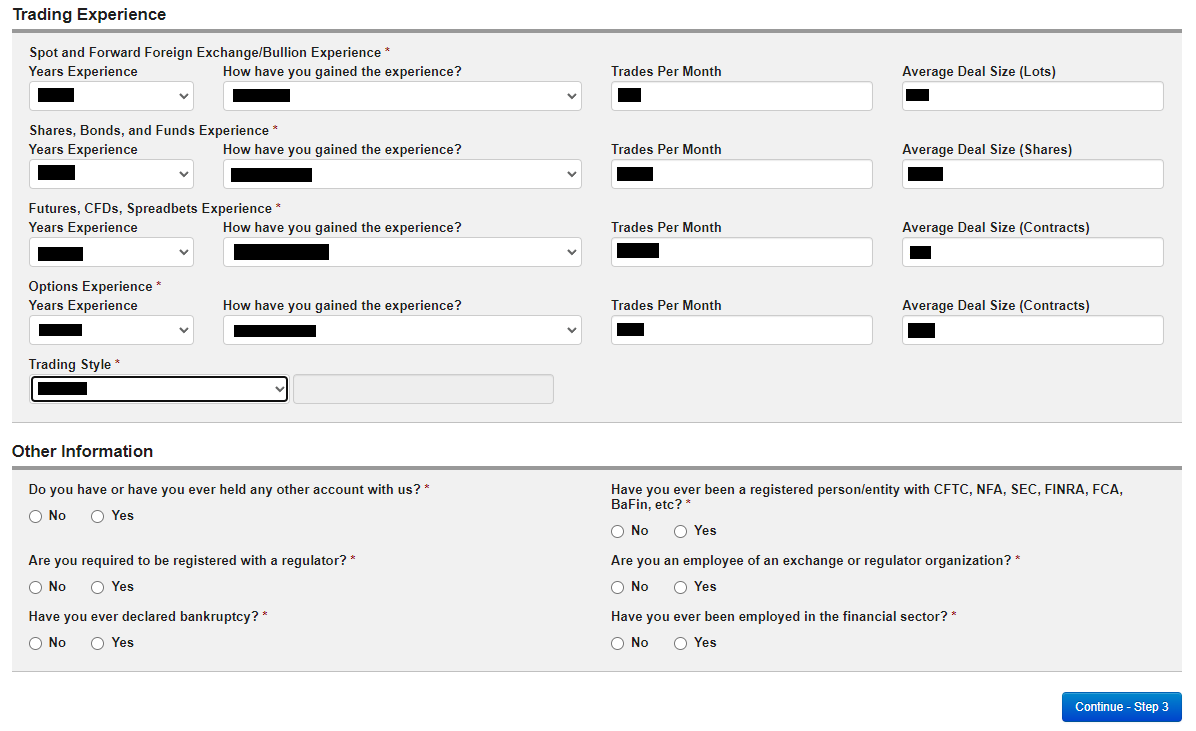

Answer a few questions regarding your trading experience. Fill in the last block and click the “Continue” button.

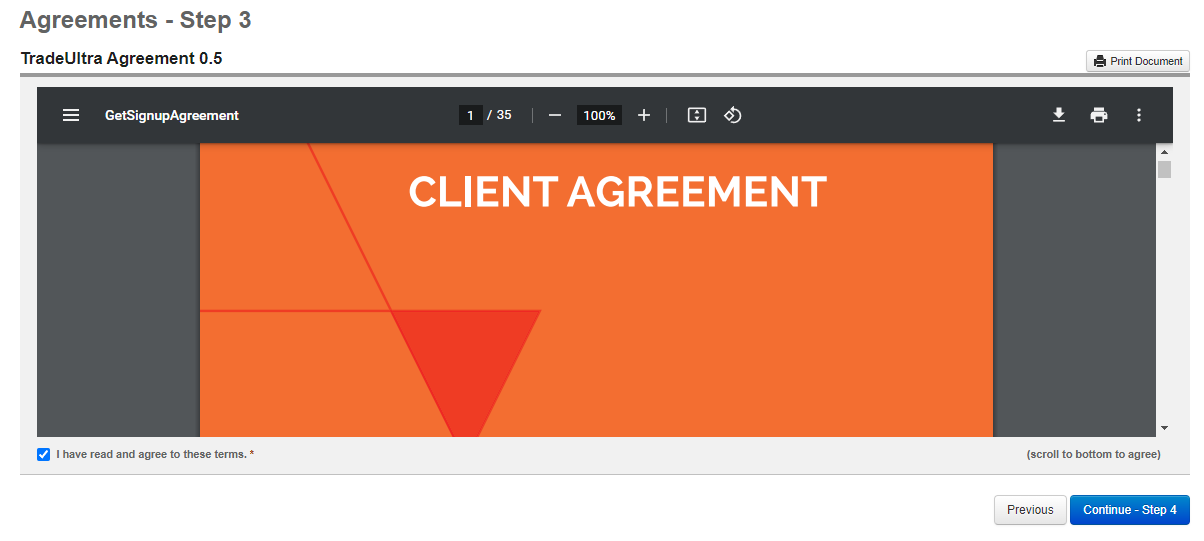

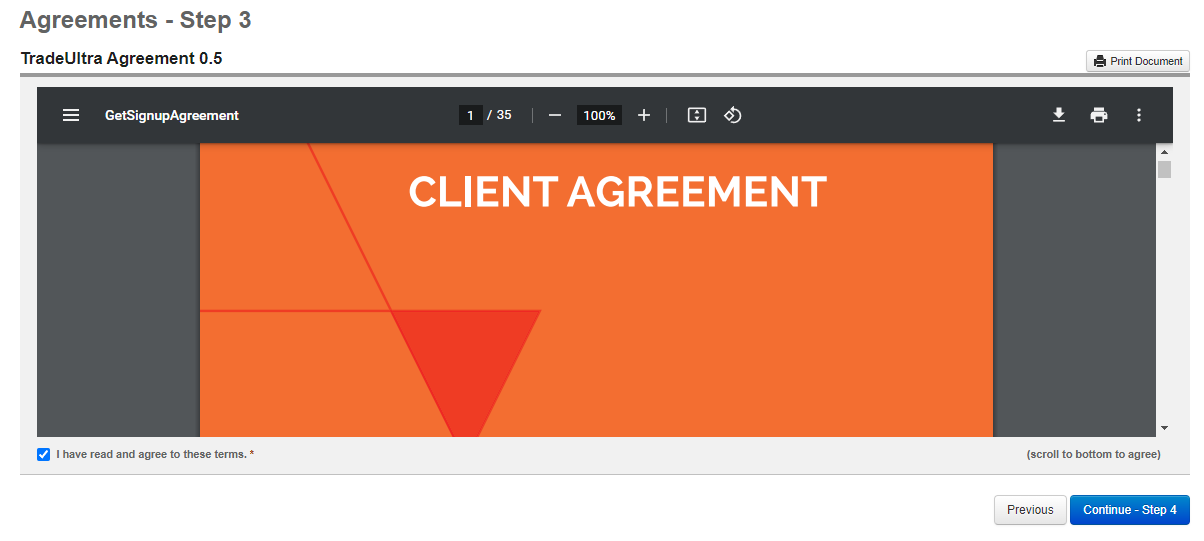

Read the client agreement, accept its terms by ticking the box at the bottom of the page, and click the “Continue” button. Check the provided information and click the “Submit” button.

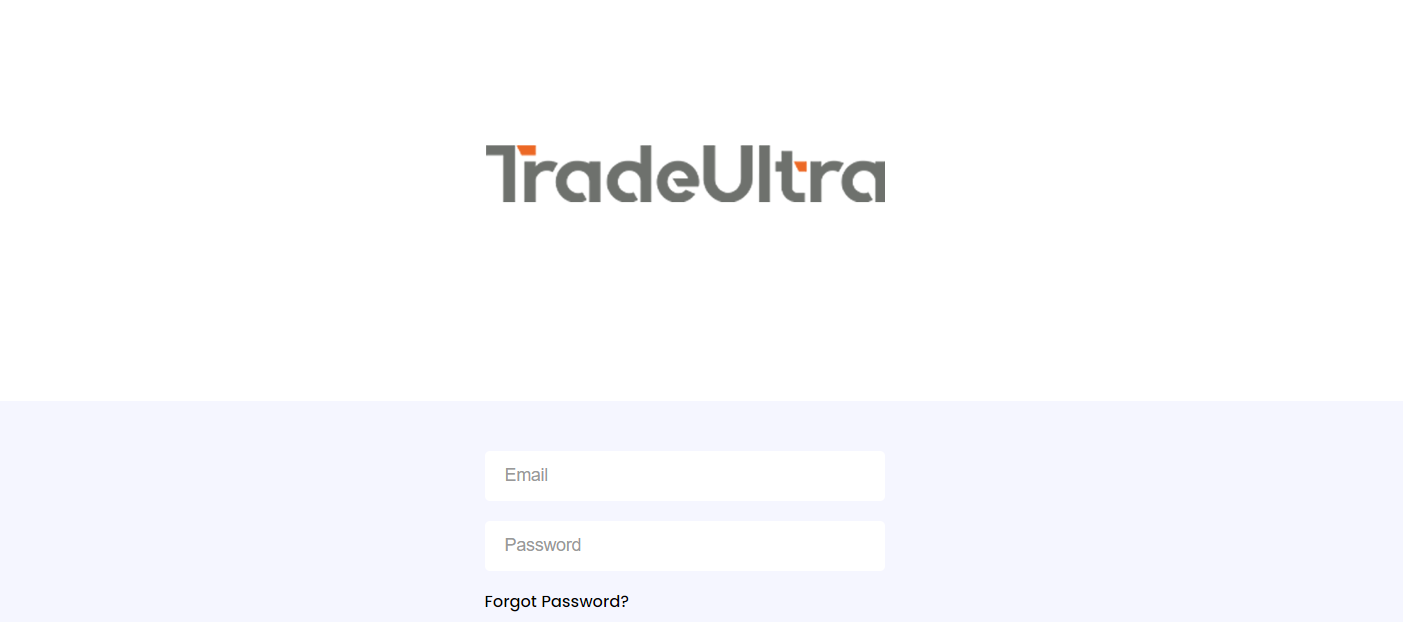

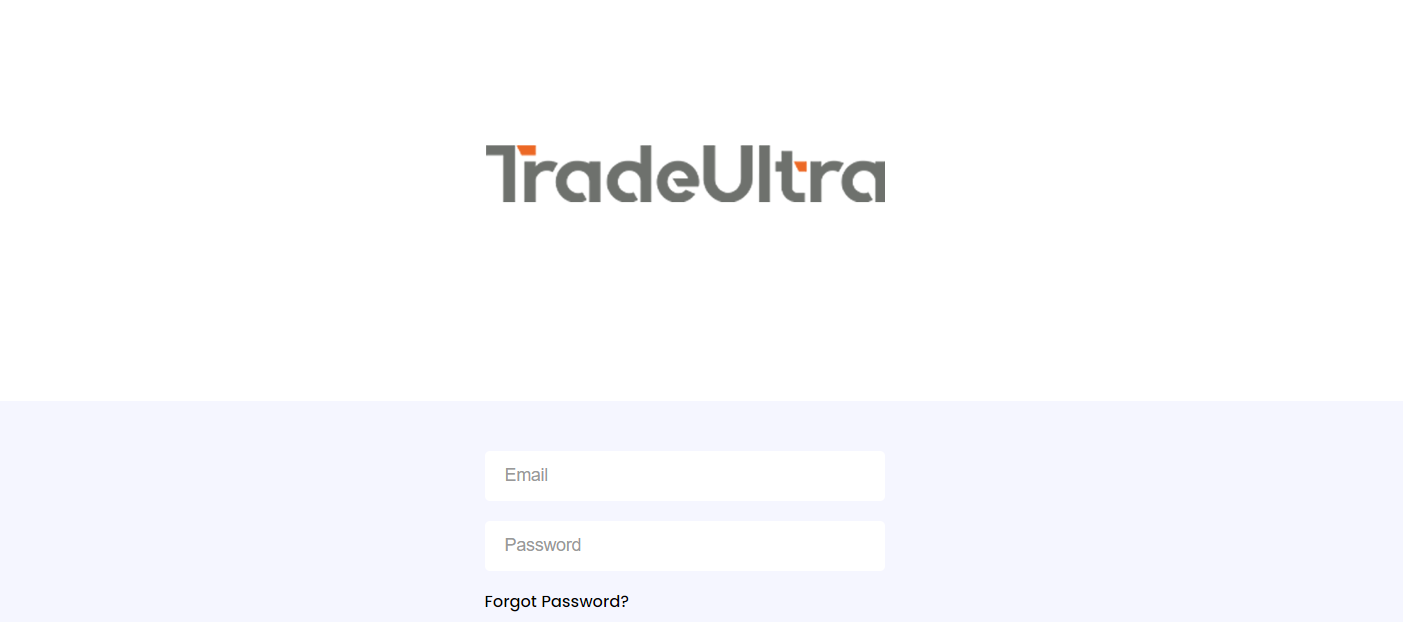

Use your email and password to log into your user account.

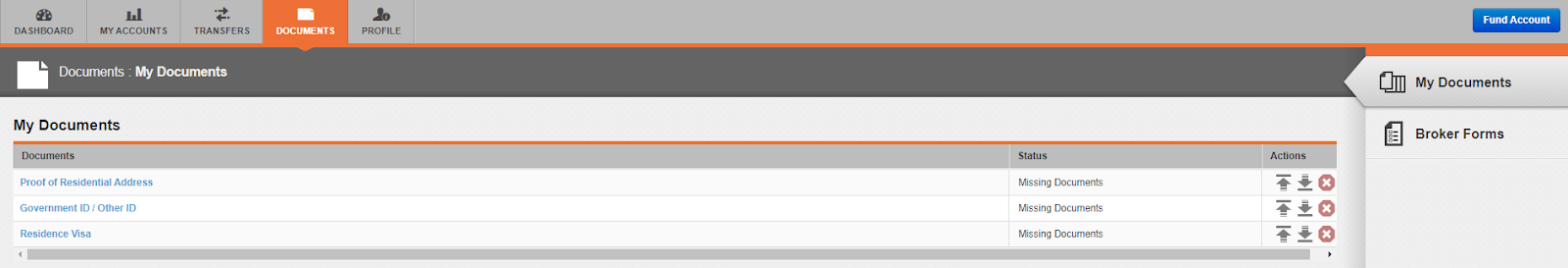

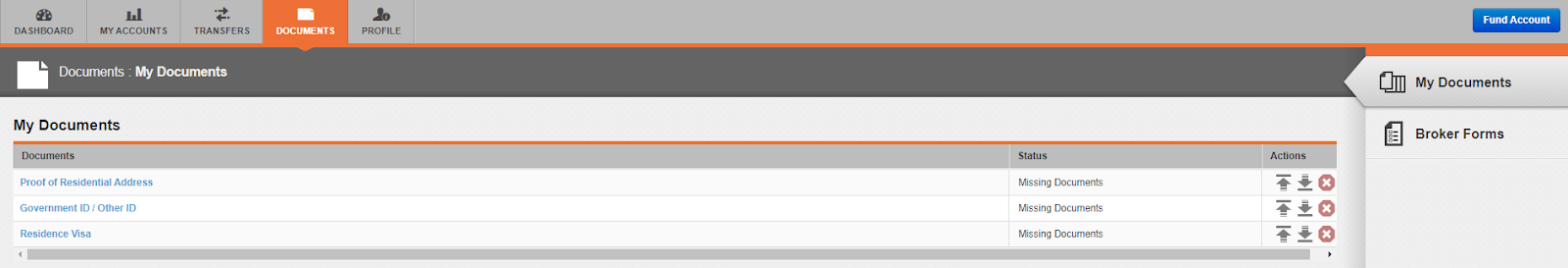

Go to the Documents section and choose the My Documents subsection. Upload scans or photos of the required documents to get verified (i.e., confirm your personal information). Wait for the verification to complete.

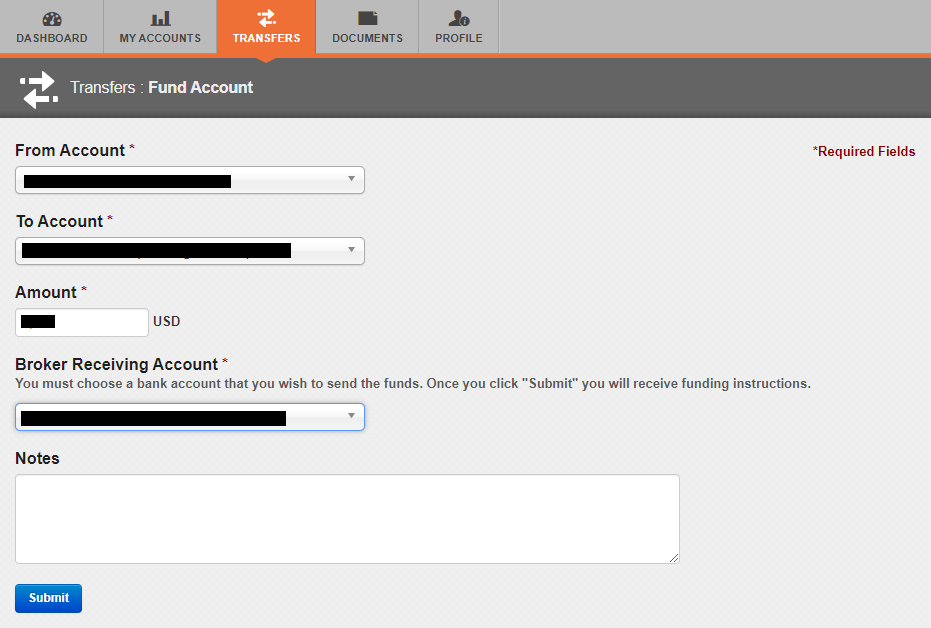

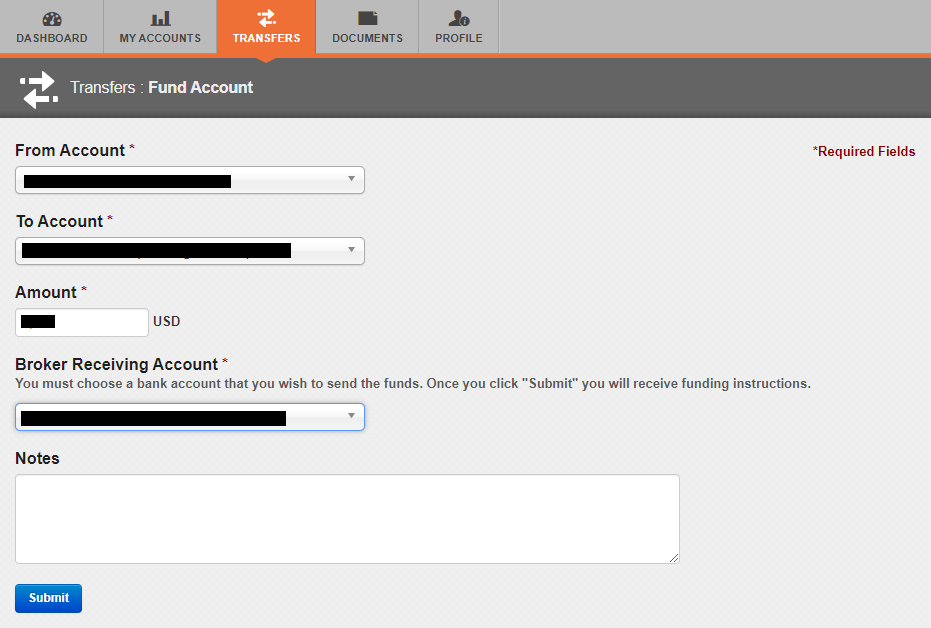

Go to the Transfers section. Choose your live account type and indicate the deposit method and the amount. Click the “Submit” button and follow the instructions on the screen. Wait for the balance to be replenished.

On the broker’s website or in the MetaTrader portal, download MetaTrader 4 or MetaTrader 5. Also, you can choose the proprietary TradeUltra platform. Install the platform, enter your registration data, and start trading.

Features of TradeUltra’s user account:

-

Dashboard. It provides consolidated information on traders’ active accounts;

-

My accounts. Here traders can open and close live or demo accounts;

-

Transfers. Make deposits, withdrawals, and internal transfers;

-

Documents. Upload documents required for verification;

-

Profile. Edit personal information and security settings here.

Regulation and safety

TradeUltra has a safety score of 4.4/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

- No negative balance protection

- Track record of less than 8 years

TradeUltra Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

TradeUltra Security Factors

| Foundation date | 2020 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TradeUltra have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TradeUltra with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TradeUltra’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TradeUltra Standard spreads

| TradeUltra | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,1 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,2 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TradeUltra RAW/ECN spreads

| TradeUltra | Pepperstone | OANDA | |

| Commission ($ per lot) | 5,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TradeUltra. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TradeUltra Non-Trading Fees

| TradeUltra | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 1,5 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Standard and Islamic accounts don’t differ in their parameters, except for swaps. Therefore, the choice isn’t complicated. Professional traders can also register joint accounts or funds, and become managers. Traders are recommended to try all available options of the trading platforms. Most users choose MetaTrader 4, since it is easy to use, intuitive, and can be deeply customized. MetaTrader 5 is similar to the 4th version to some extent, but there are essential differences in its interface and features. And finally, the broker’s clients can use its proprietary trading platform. Many users prefer this solution, as it has all the necessary options for comfortable trading in any market.

Account types:

If traders haven’t worked with this broker before, they are recommended to open a demo account first. It provides for exploring the company’s possibilities and practicing without risks of financial losses. Then they are to open Standard or Swap-free (Islamic) accounts subject to their own trading preferences.

Deposit and withdrawal

TradeUltra received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

TradeUltra offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- No deposit fee

- Minimum deposit below industry average

- Bank wire transfers available

- Limited deposit and withdrawal flexibility, leading to higher costs

- Withdrawal fee applies

- PayPal not supported

What are TradeUltra deposit and withdrawal options?

TradeUltra offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire. This limitation may restrict flexibility for users, making TradeUltra less competitive for those seeking diverse payment options.

TradeUltra Deposit and Withdrawal Methods vs Competitors

| TradeUltra | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are TradeUltra base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TradeUltra supports the following base account currencies:

What are TradeUltra's minimum deposit and withdrawal amounts?

The minimum deposit on TradeUltra is $100, while the minimum withdrawal amount is $25. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TradeUltra’s support team.

Markets and tradable assets

TradeUltra offers a wider selection of trading assets than the market average, with over 3000 tradable assets available, including 200 currency pairs.

- Copy trading platform

- 200 supported currency pairs

- 3000 assets for trading

- Crypto trading not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by TradeUltra with its competitors, making it easier for you to find the perfect fit.

| TradeUltra | Plus500 | Pepperstone | |

| Currency pairs | 200 | 60 | 90 |

| Total tradable assets | 3000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TradeUltra offers for beginner traders and investors who prefer not to engage in active trading.

| TradeUltra | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Traders can have various questions due to their inattention or absence of necessary information on a broker’s website. Also, atypical situations and real problems with trading or making deposits/withdrawals may occur. TradeUltra’s clients can contact its support service with any relevant questions. Support is available 24/5. Current communication channels are call centers, email, and tickets on the website.

Advantages

- Managers respond round the clock on weekdays

- All main communication channels are provided

Disadvantages

- Technical support is not available on weekends

Whether you have already registered with the broker and opened an account or just intend to do so, you can contact technical support with any relevant question. Current communication channels are:

phone;

email;

tickets on website.

The company has profiles on Facebook, X (formerly Twitter), YouTube, LinkedIn, and Instagram. They are also available for contacting support. Subscribe to one of them to stay up to date on the broker’s latest news.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address |

Office 11, Jamie Business Centre 1, Unit F10, 1st Floor Paragon Labuan Jalan Tun Mustapha, 87000 F.T. Labuan, Malaysia; 33, Edith Cavell Street, Port Louis, 11324, Mauritius; Euro House, Richmond Hill Road, P.O. Box 2897, Kingstown, St. Vincent and the Grenadines |

| Regulation | FSC Mauritius, LFSA Malaysia |

| Official site | https://www.tradeultra.com/ |

| Contacts |

+60 3 3099 5585; +230 212 9800; +971 4 293 6900; +44 20 3885 0799

|

Education

Sometimes traders come to brokers with a minimum trading background and no practical experience. However, even traders with intermediate experience and professional players must constantly learn. Otherwise, they will not be successful. That is why some companies offer basic and extended educational programs. TradeUltra doesn’t offer any of those.

TradeUltra assumes that if traders register with it, they have minimal knowledge of financial markets. Plus, they can open a demo account and practice without risks.

Comparison of TradeUltra with other Brokers

| TradeUltra | Eightcap | XM Group | RoboForex | VT Markets | TeleTrade | |

| Trading platform |

MT4, MT5, proprietary TradeUltra platform | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4, MT5 |

| Min deposit | $100 | $100 | $5 | $10 | $50 | $10 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | 1.00% |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.2 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 70% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of TradeUltra

The broker has been operating for over 10 years. There are no confirmed facts of its non-fulfillment of its obligations and open conflicts with its clients. TradeUltra is licensed by three regulators. It uses an advanced technology stack, including micro-service architecture and virtual servers. Protection is ensured by modern solutions, like SSL-protocols. Moreover, client funds are insured. Order execution speed is within 30 ms, which speaks of a high optimization level. The broker’s pool includes 3,000 financial instruments. Successful support for infrastructure, supplemented by joint accounts, managed funds, and partnership programs for individuals and legal entities, shows a strong basis and the innovative nature of TradeUltra.

TradeUltra by the numbers:

Minimum deposit is $100;

3,000+ CFDs from 6 groups;

Minimum spread is 0 pips;

3 confirmed regulators;

Insurance is up to $1,000,000.

TradeUltra is a CFD broker for novice traders and professionals

Novice traders will appreciate the low entry threshold, as opening a demo account is free, and to activate a live account, only $100 is required. Registration takes only several minutes, and the KYC verification usually takes 1-3 days. There are no restrictions; traders can trade on news events, scalp, hedge, copy trades, and use algorithmic trading and advisors. The broker’s pool includes 3,000 financial instruments, such as CFDs on currency pairs, stocks, commodities, and precious metals. A wide choice of assets is an important advantage for traders. It provides for building a diversified investment portfolio and using different strategies. Moreover, professional traders can become joint account or fund managers to receive additional income or advance their status.

Useful services offered by TradeUltra:

Economic calendar. It is a table of the main economic and political events that can influence quotes. An affected asset and forecasts for its price change are provided for each event.

Stock markets. This service includes popular stocks and indices; and quotes for them are displayed in dynamics. The data is received online, and the detailed asset card can be seen in TradingView. Various time frames are available.

Forex heat map. This is a table with ratios for currency pairs that show their current percentages relative to each other. Currency crossing cells with negative ratios are highlighted in red and other shades, and green and similar shades reflect positive ratios. The analysis is conducted relative to the previously received data.

Advantages:

Demo account is free, while to open a live account, a minimum deposit of only $100 is required;

Leverage is flexible up to 1:500, and there are no restrictions on trading strategies;

Popular MT4 and MT5, as well as the broker’s proprietary solution, are available;

Floating spreads start at 0 pips; no trading fees are charged;

Multilingual 24/5 technical support.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i