According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €50,000

- XNT

- MiFID

Our Evaluation of XNT

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

XNT is a broker with higher-than-average risk and the TU Overall Score of 4.95 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by XNT clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

The hefty minimum deposit and complete absence of education indicate that XNT is geared towards professional traders. Spreads and trading commissions are below market average, but the withdrawal fee is significant, which makes it unfavorable to frequently withdraw small amounts. The broker provides access to a uniquely wide variety of instruments and doesn’t set limits on lawful trades. Every client gets a personal account manager and can reach technical support around the clock.

Brief Look at XNT

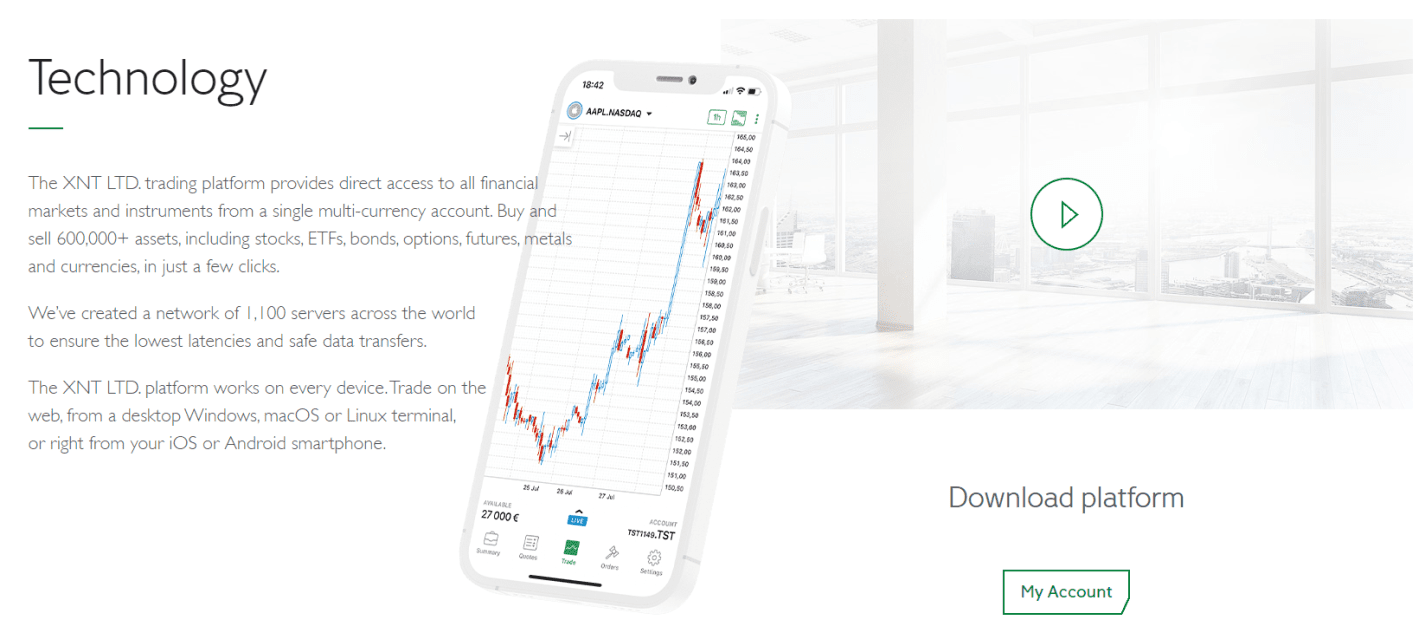

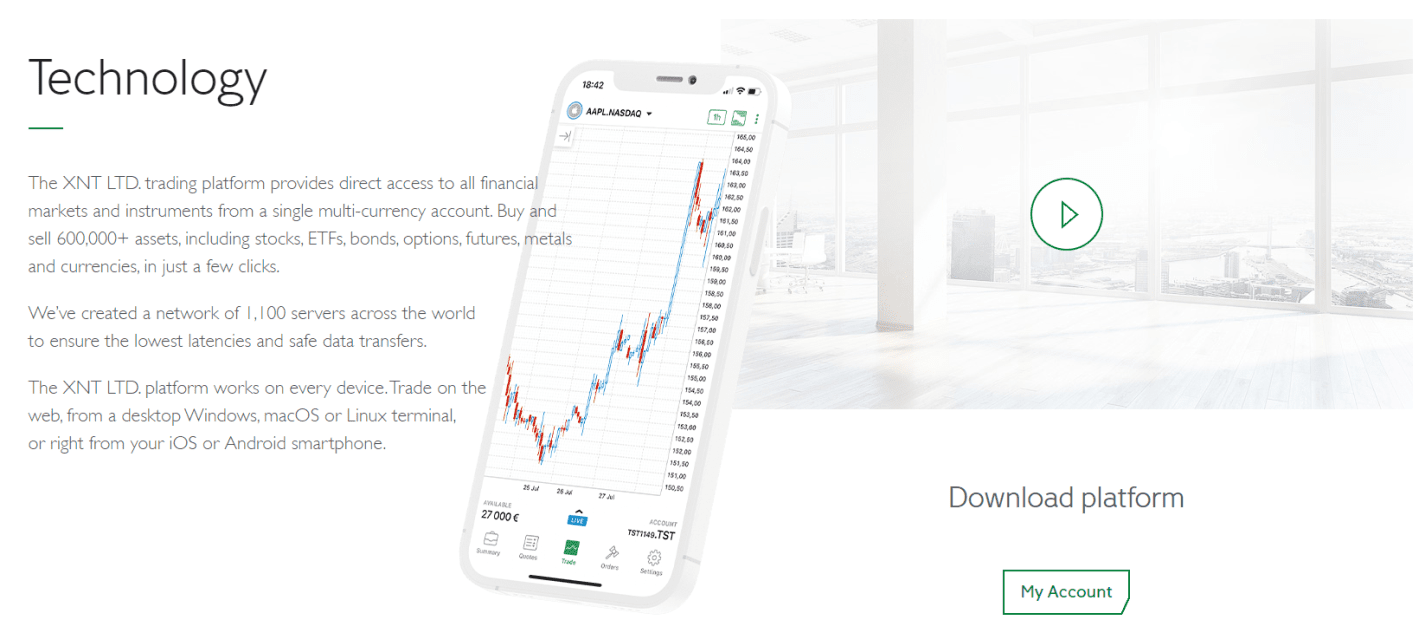

XNT offers over 600,000 trading instruments, including currency pairs, stocks, ETFs, bonds, funds, metals, futures, and options. Traders can open demo accounts for free. The minimum deposit on real accounts is €50,000. The company provides its proprietary trading platform adapted for personal computers and smartphones with all popular operating systems. Spreads for currency pairs are variable and start at 0.3 pips. Commissions on other assets differ and are generally below market average. For example, the fee on U.S. stocks is $0.02 per stock. The fixed fee on withdrawing funds to a bank account is €30 or its equivalent in another supported currency. The broker supports 14 currencies. Every client gets a personal account manager and can contact tech support 24/7.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- clients can open demo accounts for free to explore XNT’s features and experiment with trading strategies;

- the broker has a convenient, intuitive, and multifunctional trading platform that is highly appreciated by users;

- XNT doesn’t restrict its clients in trading methods and provides all-in-one accounts suitable for most goals;

- besides standard individual accounts, traders can open joint, corporate, or family accounts;

- trading fees are below market average. XNT offers 100% transparent cooperation conditions;

- users can trade thousands of assets across 8 groups thanks to permanent access to the world’s 50 largest markets;

- technical support is available around the clock, 7 days a week. Clients are assisted by personal account managers.

- the minimum deposit is €50,000 or the equivalent in another supported currency;

- the broker’s website doesn’t have educational content or tools for technical and fundamental analyses;

- the maximum leverage is just 1:30. Joint accounts are the only passive earning method.

TU Expert Advice

Author, Financial Expert at Traders Union

XNT provides a wide array of trading instruments, including over 600,000 currency pairs, stocks, and bonds. The broker's proprietary trading platform is customizable for PCs and smartphones, supporting various operating systems. Its clients benefit from floating Forex spreads starting at 0.3 pips and trading fees below market averages, with round-the-clock technical support and personal account managers enhancing the trading experience. Additionally, XNT offers demo accounts and a robust selection of supported currencies, ensuring a flexible trading environment.

However, XNT’s high minimum deposit of €50,000 and the lack of educational resources present challenges for novice investors. The fixed withdrawal fee and maximum leverage of 1:30 may also limit certain trading strategies. Consequently, XNT is more suited for experienced and high-net-worth traders who prioritize a vast range of products and personal account management over educational support.

XNT Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Trive and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | XNT |

|---|---|

| 📊 Accounts: | Demo and Standard |

| 💰 Account currency: | EUR, USD, GBP, CHF, CZK, JPY, AUD, CAD, HKD, MXN, NOK, SEK, PLN, and SGD |

| 💵 Deposit / Withdrawal: | Bank transfers |

| 🚀 Minimum deposit: | €50,000 |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 1,0-1,0 pips |

| 🔧 Instruments: | Currency pairs, stocks, ETFs, bonds, funds, metals, futures, and options |

| 💹 Margin Call / Stop Out: | No information |

| 🏛 Liquidity provider: | No information |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Free demo accounts; one all-purpose real account; a proprietary trading platform; tight variable spreads; a high minimum deposit; fees are below market average; deposits and withdrawals can be made via bank transfers only; and there is no education or analytics |

| 🎁 Contests and bonuses: | Rebates from TU |

If a broker offers several real account types, minimum deposits on them usually differ because trading conditions are also different. But XNT has only one real account and therefore a trader has to deposit at least €50,000 anyway. Leverage is flexible and fully depends on the trader’s decisions. Its maximum value is 1:30. XNT’s technical support is one of the best in the segment. It works 24 hours a day, 7 days a week, and can be reached by phone or through tickets on the broker’s website.

XNT Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

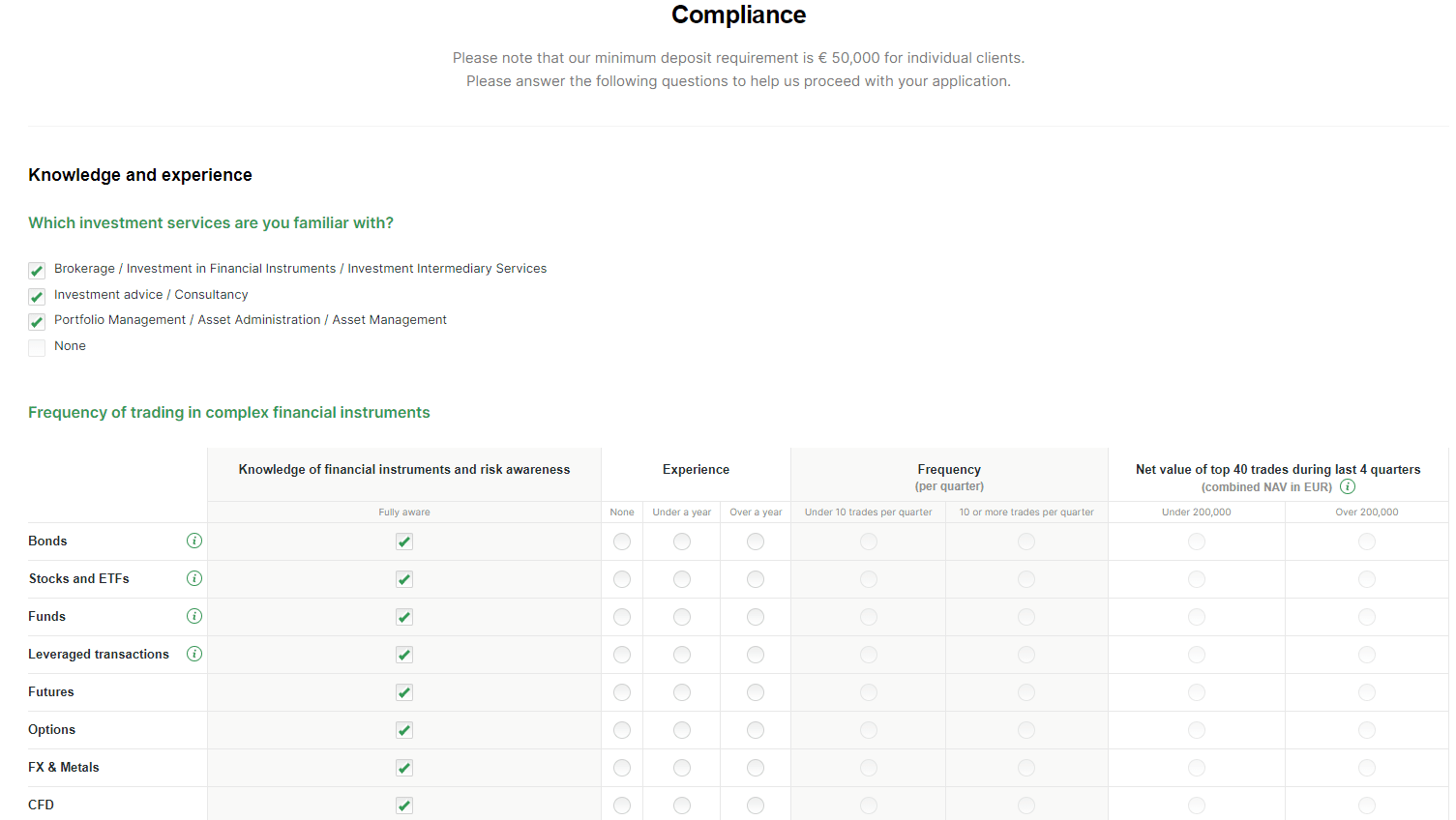

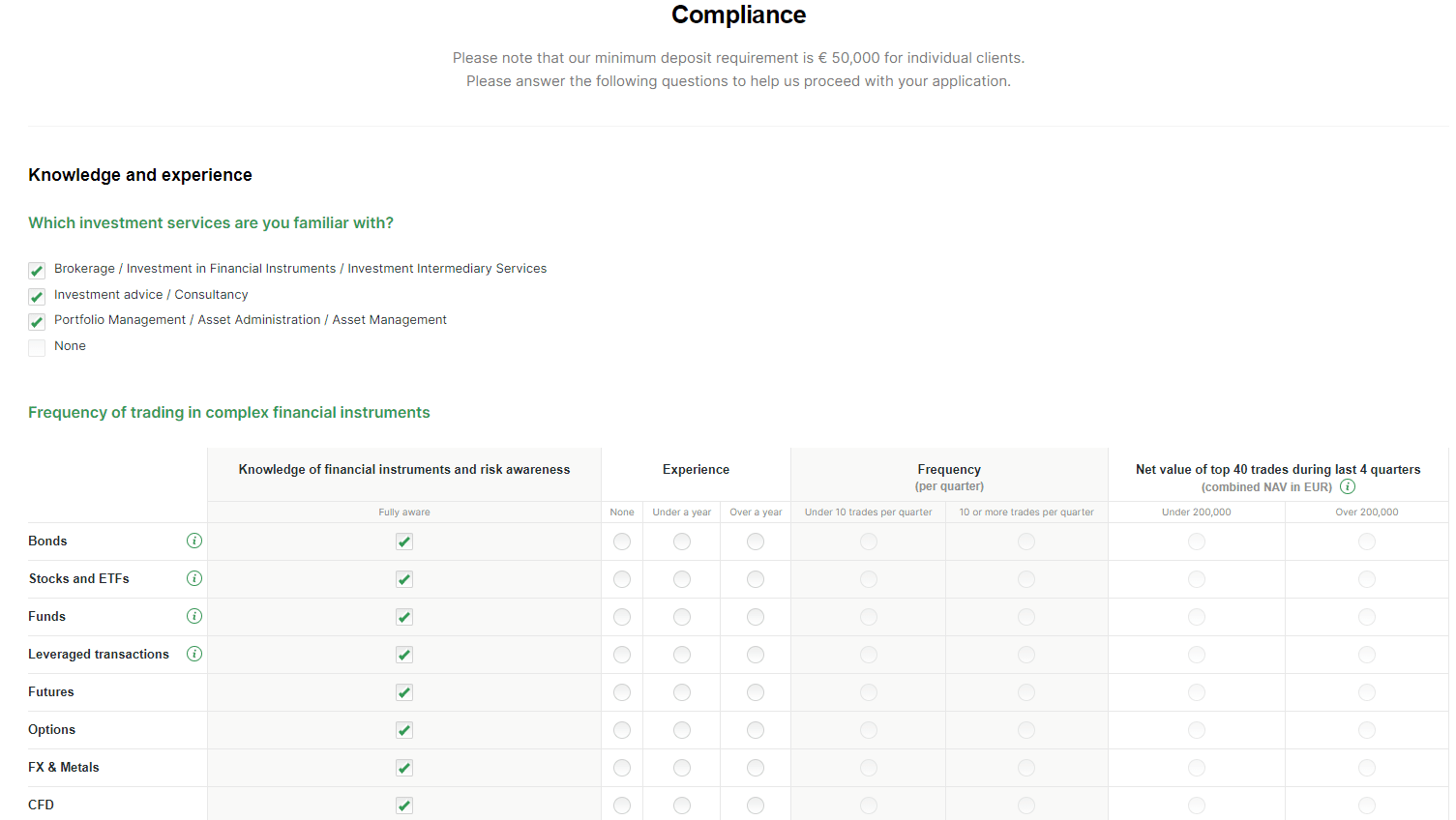

Trading Account Opening

To begin cooperating with the broker, you have to register on the XNT website, get verified, open a real account, and make a deposit. Next, you need to download the trading platform and start trading. TU experts have prepared a guide on all the stages. In this section, you can also review other features of the XNT user account.

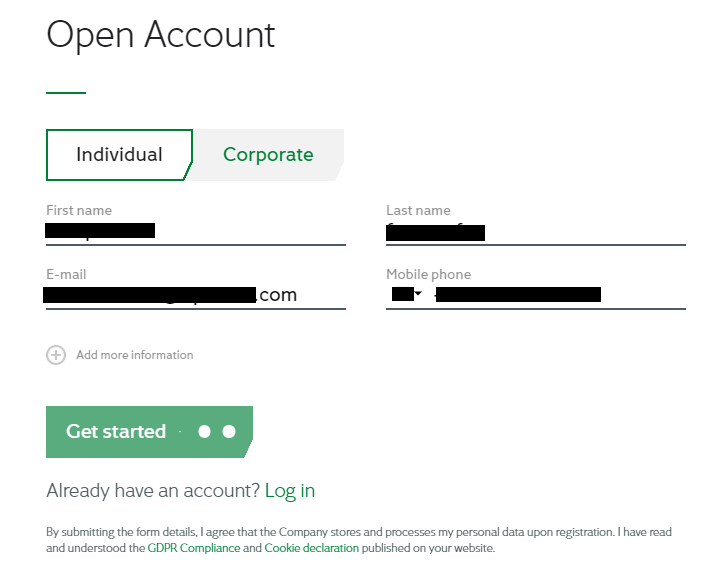

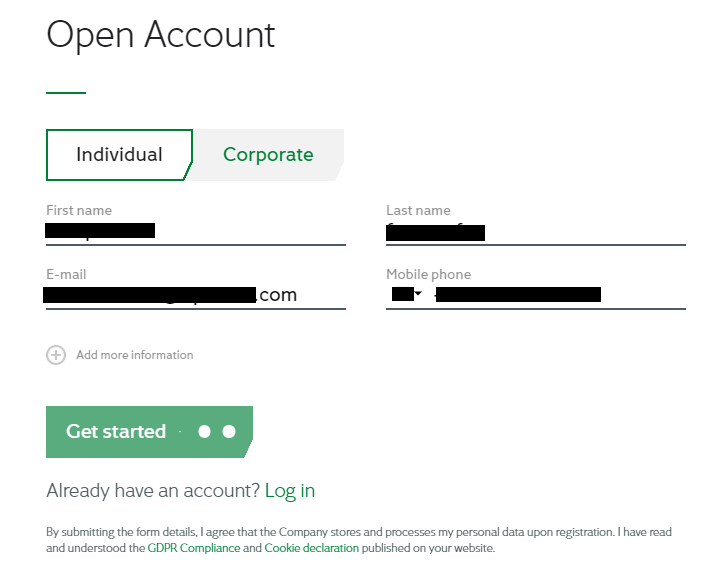

Go to the broker’s website. In the top right corner, click “Open Account”.

Choose an individual or corporate account type. Enter your first and last names, email, and phone number. Click “Get started”.

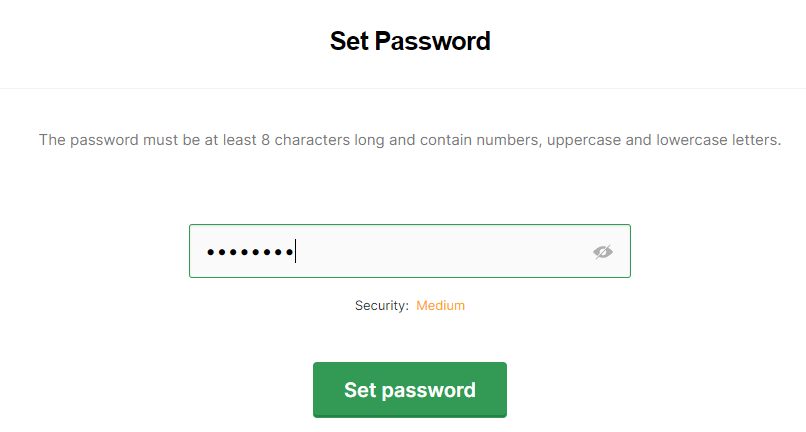

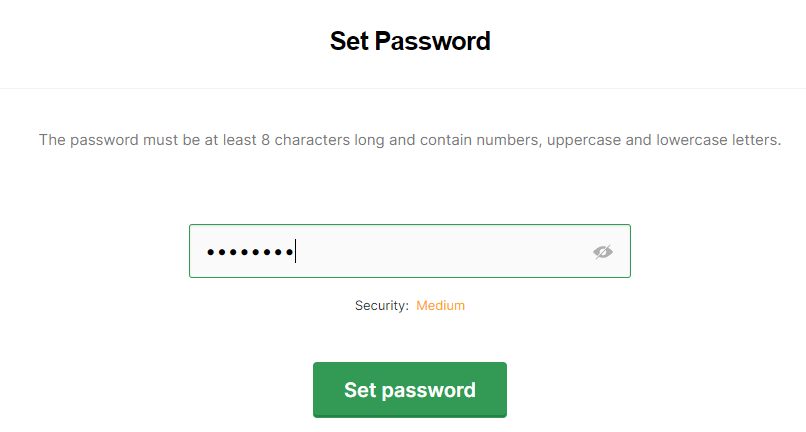

Create a password. Its complexity must be at least medium and it has to include numbers and upper and lowercase letters. Click “Set password”.

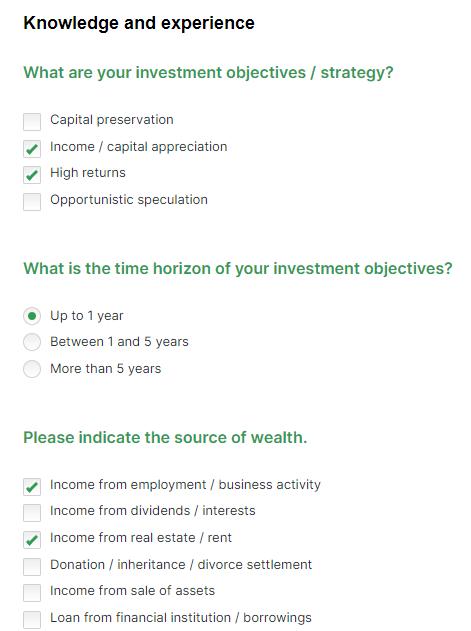

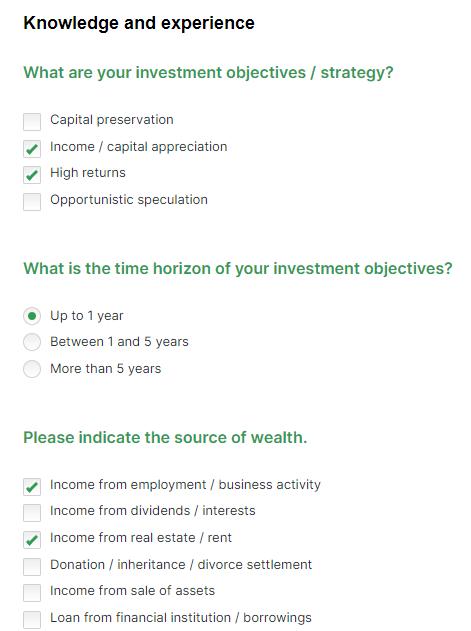

Tell the broker about your trading and investing experience. Answer several questions regarding your education, place of work, and financial resources. Click “Next”.

Answer a few more questions so the broker can better complete your trader profile. Click “Next”.

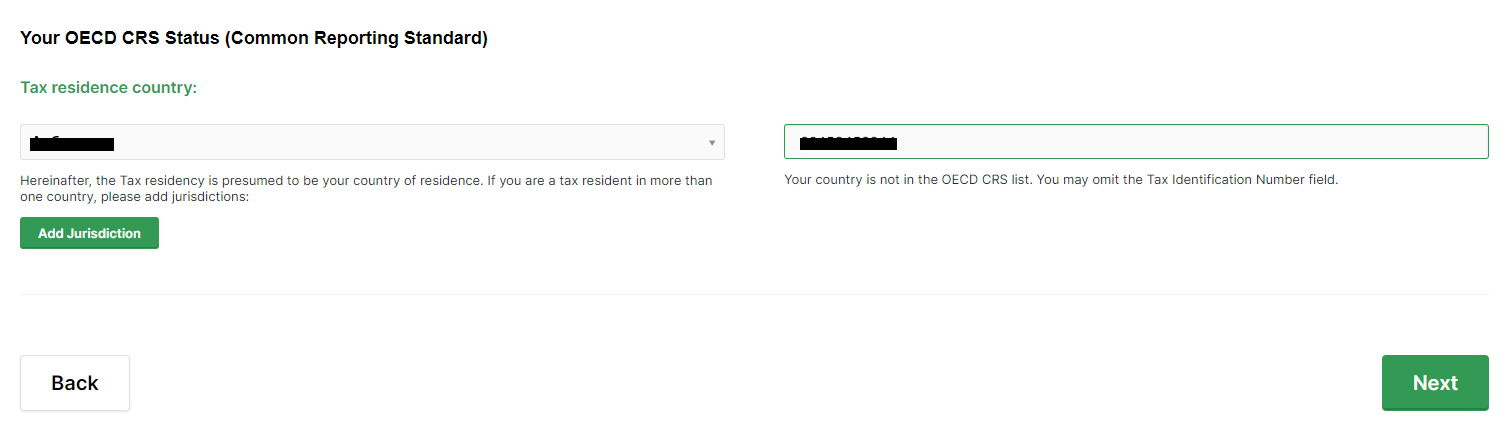

Indicate your country of residence. For some countries, a tax identification number is required. Click “Next”.

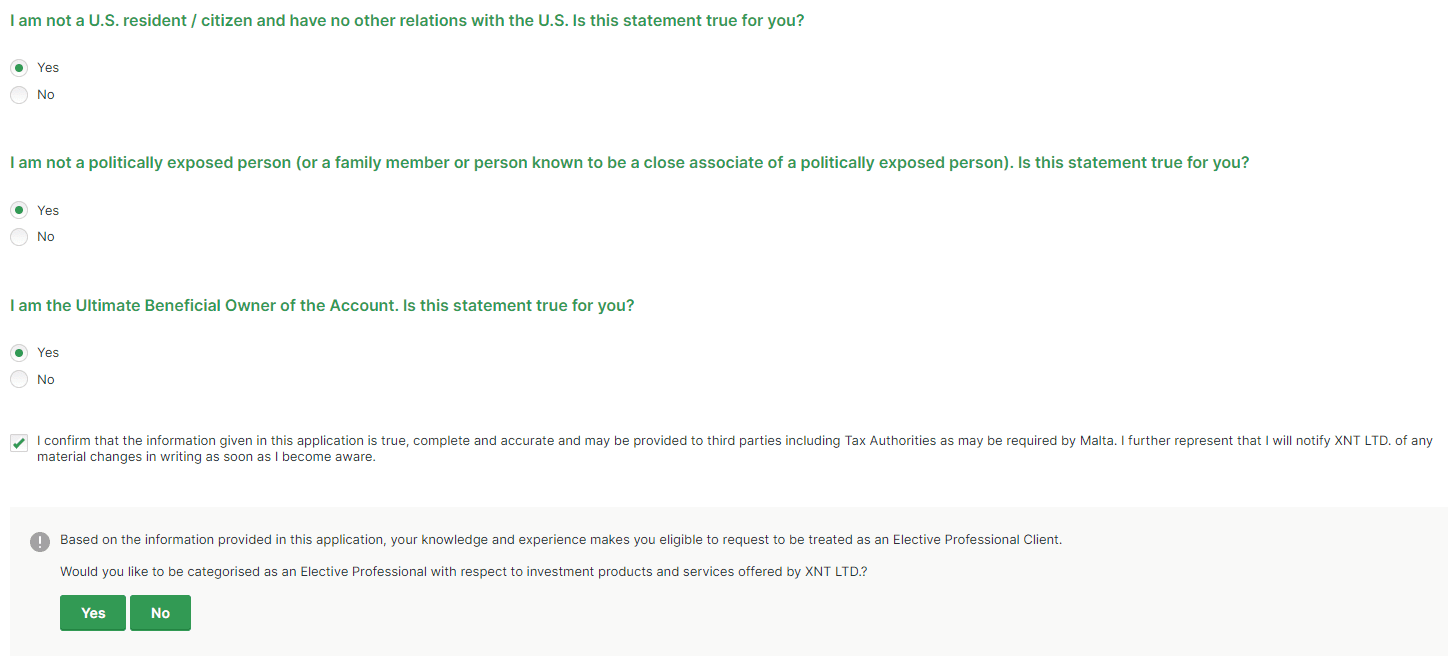

Continue answering the questions until you complete all sections. Click “Next”.

Read the broker’s official documents and accept them by ticking the respective boxes. Click “Next Step”.

Choose an issuing country and the type of document that confirms your identity. Upload a scan/photo of this document and click “Next”.

Upload a scan/photo of the document that confirms your residential address. Wait until verification is complete.

Once the broker confirms your details, select account parameters in your user account and follow the on-screen instructions to make a deposit. Download the XNT Ltd trading platform and get to trading.

What a trader can do in his XNT user account:

-

Check his account balance, get account breakdowns, generate reports, and view current trades and archives.

-

Deposit funds from a connected bank account, submit profit withdrawal requests, and make internal transfers.

-

Open joint accounts as a manager or join them as an investor.

-

Edit personal details and adjust account security settings.

-

Communicate with the broker’s support service through live chat in the bottom right corner.

Regulation and safety

XNT has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

XNT Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

XNT Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | No |

Commissions and fees

The trading and non-trading commissions of broker XNT have been analyzed and rated as High with a fees score of 4/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of XNT with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, XNT’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

XNT Standard spreads

| XNT | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

Does XNT support RAW/ECN accounts?

As we discovered, XNT does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with XNT. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

XNT Non-Trading Fees

| XNT | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 30 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

If a broker offers several types of real accounts, choosing the most suitable one can be challenging. However, many companies, including XNT, provide all their clients with equal and optimal conditions. XNT’s all-in-one account eliminates the choice problem. The same goes for the trading platform, as the broker only offers its own solution, which, according to user reviews, is as good as MT and other popular software. Traders need to clearly understand that XNT will not teach them anything or give them unique tools to get analytics. Users can only count on their own experience and, if they need market analysis or other information, they have to look for it in other sources. The broker ensures fast order execution, a wide selection of instruments, and a complete absence of trading restrictions. Earning under such conditions is really comfortable, especially for passive earning through joint accounts.

Account types

If you have never cooperated with XNT, it would be reasonable to try a demo account first. It enables you to explore the platform and experiment with trading strategies without financial risks. Then, if you are satisfied with everything, you can open a standard account and start making real trades.

Deposit and withdrawal

XNT received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

XNT offers limited payment options and accessibility, which may impact its competitiveness.

- No deposit fee

- No withdrawal fee

- Low minimum withdrawal requirement

- Bank wire transfers available

- Minimum deposit above industry average

- Limited deposit and withdrawal flexibility, leading to higher costs

- BTC payments not accepted

What are XNT deposit and withdrawal options?

XNT offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making XNT less competitive for those seeking diverse payment options.

XNT Deposit and Withdrawal Methods vs Competitors

| XNT | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are XNT base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. XNT supports the following base account currencies:

What are XNT's minimum deposit and withdrawal amounts?

The minimum deposit on XNT is $50000, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact XNT’s support team.

Markets and tradable assets

XNT offers a wider selection of trading assets than the market average, with over 1000000 tradable assets available, including 50 currency pairs.

- 50 supported currency pairs

- Passive income with bonds

- ETFs investing

- Copy trading not available

- Indices not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by XNT with its competitors, making it easier for you to find the perfect fit.

| XNT | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 1000000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | No | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products XNT offers for beginner traders and investors who prefer not to engage in active trading.

| XNT | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Does XNT have a list of banks with which it does not work? What is the average spread for USD/JPY? What order types can be placed on the broker’s proprietary trading platform? Some traders ask questions wanting to know how favorable it is to cooperate with the broker. The clients may be simply inattentive or the XNT website may lack important information. And finally, users sometimes encounter unusual situations when trading or depositing/withdrawing funds. To resolve traders’ problems as quickly as possible, XNT offers a client support service that works around the clock, seven days a week. Also, a personal account manager is assigned to every client.

Advantages

- There are several communication channels

- Support is available 24/7

Disadvantages

- Unregistered users do not have access to online chat

It doesn't matter if you are the broker’s client or not. Technical support can also be approached by users who haven’t yet opened an account with XNT.

Only live chat is unavailable to them. Here are the communication channels:

-

call center;

-

email for all relevant questions;

-

on-site tickets;

-

live chat in the user account.

Note that tickets are answered by email, which can be used for further conversations with tech support.

Contacts

| Registration address | Portomaso Business Tower, Level 18, St. Julian's, STJ 4011, Malta |

|---|---|

| Regulation | MiFID |

| Official site | https://xnt.mt/ |

| Contacts |

+356 2015 0000

|

Education

Most brokers provide a FAQs section, articles on various topics, and video guides, but some offer full-fledged educational courses. XNT ignores education, given that the minimum deposit of €50,000 is only acceptable for experienced traders. Nevertheless, every client of the company gets a personal account manager who not only answers basic questions but also gives advice on various market situations, if necessary.

The broker is focused on providing favorable trading conditions and does not aim to tutor its clients. So, it’s difficult for beginners to start cooperating with XNT. They have to use other resources to acquire theoretical knowledge. And for professionals, the absence of unnecessary information is a plus.

Comparison of XNT with other Brokers

| XNT | Bybit | Eightcap | XM Group | TeleTrade | Markets4you | |

| Trading platform |

XNT | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5 | MT4, MobileTrading, MT5 |

| Min deposit | $50000 | No | $100 | $5 | $10 | No |

| Leverage |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

From 1:10 to 1:4000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0.3 points | From 0 points | From 0 points | From 0.8 points | From 0.2 points | From 0.1 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | 70% / 20% | 100% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | Yes |

Detailed review of XNT

The broker has been operating for more than 12 years and, during this time, traders have developed a steady opinion of it. The reviews are mostly positive and primarily emphasize the high-quality trading platform, as well as prompt and competent tech support. But few people note the company’s technology stack. XNT has over 1,100 servers worldwide. The broker ensures one of the fastest order executions and steady operation of the system. XNT cooperates with top-tier liquidity providers and opens accounts for private individuals and legal entities. It has a powerful IT infrastructure that ensures compliance with top trading standards.

XNT by the numbers:

-

€50,000 is the minimum deposit;

-

over 600,000 trading instruments;

-

1:30 maximum leverage;

-

variable spreads from 0.3 pips;

-

$0.02 fee on trading U.S. stocks.

XNT is a broker intended for large investors

This statement is based not only on the hefty minimum deposit of €50,000 but also on the absence of education and FAQs on the XNT website. In other respects, the company offers optimal conditions that can interest any trader. For example, there are over 600,000 instruments across 8 asset groups. The broker enables its clients to trade in the world’s 50 largest markets without any restrictions. Traders can apply advisors, scalping, hedging, trading on news events, and algorithmic trading, including keeping positions open overnight. The platform is available 24/7. Moderate leverage is another advantage. The 1:30 value is quite enough to significantly increase the profit potential and still keep risks reasonable.

XNT’s useful features

-

Joint account. If a trader is qualified enough, he can become a joint account manager and receive commissions paid by investors. The latter earns 100% passive income.

-

Family account. This is a special type of corporate account suitable for families that do international business. Such an account has various investment and savings features. Trading conditions are individual.

-

Proprietary trading platform. XNT developed its own trading solution that, in many users’ opinions, matches MetaTrader 4/5 for intuitiveness, convenience, and customization features.

Advantages:

The broker guarantees transparent and cooperative conditions. All charges are known in advance, and there are no hidden payments.

Demo accounts are free. Every client gets a personal account manager.

XNT provides access to trading hundreds of thousands of instruments from various asset classes. There are no limits on lawful trading strategies and methods.

The company has a proprietary trading platform. Users can create joint accounts and connect to them.

Trading costs are below market average. Commissions on trading popular currency pairs are especially favorable.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i