XTB types compared

XTB is a reputed online broker’s platform for Forex and CFD trading. It enables traders to open different accounts, including Demo, Standard, and Swap-free. But how will you create your account on XTB? Which XTB account type is the right choice for you? You can read this blog to know these details.

XTB Demo account

Beginners in the trading world always prefer risk-free trading to practice various strategies. That is why they can use the demo mode of their XTB accounts.

The free XTB demo account is valid for 30 days, and traders can experience trading using virtual funds. No deposit is needed to use the demo account.

You will get access to over 2,000 tradable assets. To let you test the platform's features, your account will be credited with $100,000 in virtual funds.

Best Free Forex Demo AccountsXTB Standard account

With XTB Standard Account; you can access more than 1500 instruments like ETF CFDs, stock CFDs, indices, crypto, commodities, and Forex. The market execution of the Standard Account lets you leverage 1:200.

The minimum order for Standard Account holders is 0.1, while the minimum spread is 0.35. Other features of this XTB live account are automated trading and negative balance warning. Trading instruments accessible to you are:

Forex.

XTB lets you choose from 49 minor and major currency pairs. XTB traders with European entities find a 33% margin for currency pairs. In the case of minor currencies, the margin is 5%.

Commodities and indices.

You do not need to pay a commission for these spread-only products. So, you can lower the trading costs when positions are open for more than 24 hours. You will also get access to 42 indices, which cover the USA, Australia, and other countries. For commodities, you can find eight metals like nickel and zinc.

Cryptocurrency CFDs.

The broker offers 25 crypto CFDs, including Bitcoin Cash, Bitcoin, Ethereum, and Litecoin. However, due to new regulations, UK brokers cannot offer crypto assets to retail traders. You should register with an XTB subsidiary outside the UK to trade cryptocurrencies.

XTB Swap free account

The features of a Swap-free Account are almost the same as Standard Account. But the main difference is that a swap-free Islamic Account does not let you do crypto trading.

Trading instruments available to you are similar to what you find with a Standard Account. Whether you have a Standard, Swap-free or Demo Account, you can use any of these trading platforms.

xStation

It is an intuitive platform that ensures the fastest execution speed. This platform offers:

Advanced chart trading.

Trading calculator.

Market sentiment.

Equity screener.

Top movers.

You can access the platform from any device (tab and desktop). Some features, like bulk order closing, are available to desktop users.

MetaTrader 4

It is another trading platform with a special pattern recognition feature. The tool allows you to identify trends and define entry/exit points. Besides, you can set the stop loss/profit-taking levels. The single-click system has made the platform efficient. There is also a strategy tester for MT4 users. Use MetaTrader 4 from any device, including mobiles and desktops.

Best MetaTrader 4 BrokersXTB account types comparison

| Demo | Standard | Swap Free | |

|---|---|---|---|

| Minimum deposit | No Minimum deposit | No Minimum deposit | No Minimum deposit |

| Platforms | xStation | xStation | xStation |

| Markets | 1500+ global CFD markets | CFD on Forex, commodities, indices, stocks, cryptocurrencies, ETF (more than 2100 under FCA and IFSC and over 5200 assets under CySEC). | CFD on Forex, commodities, indices, stocks, and ETF (over 2100 assets). |

| Trade size | No limit on trade size | 1 micro lot. | One micro lot. |

| Commissions | No commissions | The charge for spreads starts at 0.8 pips. You need to pay the rollover fee for holding a position overnight. | The charge for spreads starts at 0.7 pips |

| Max leverage | No maximum leverage as it is a practice account | up to 500:1 (under IFSC) and 1:30 (under CySEC, FCA); | Up to 1:500. |

| Special features | Similar to Standard and Swap-free accounts | Cash rebates range from 5 to 30% for trading 20 lots in a month (IFSC) | Swap-free trading |

How to open XTB account

A few steps for opening the real XTB account

Step 1- Go to the XTB webpage

How to open an XTB account

Visit the official website and click on the green button (Create Account) at the top corner.

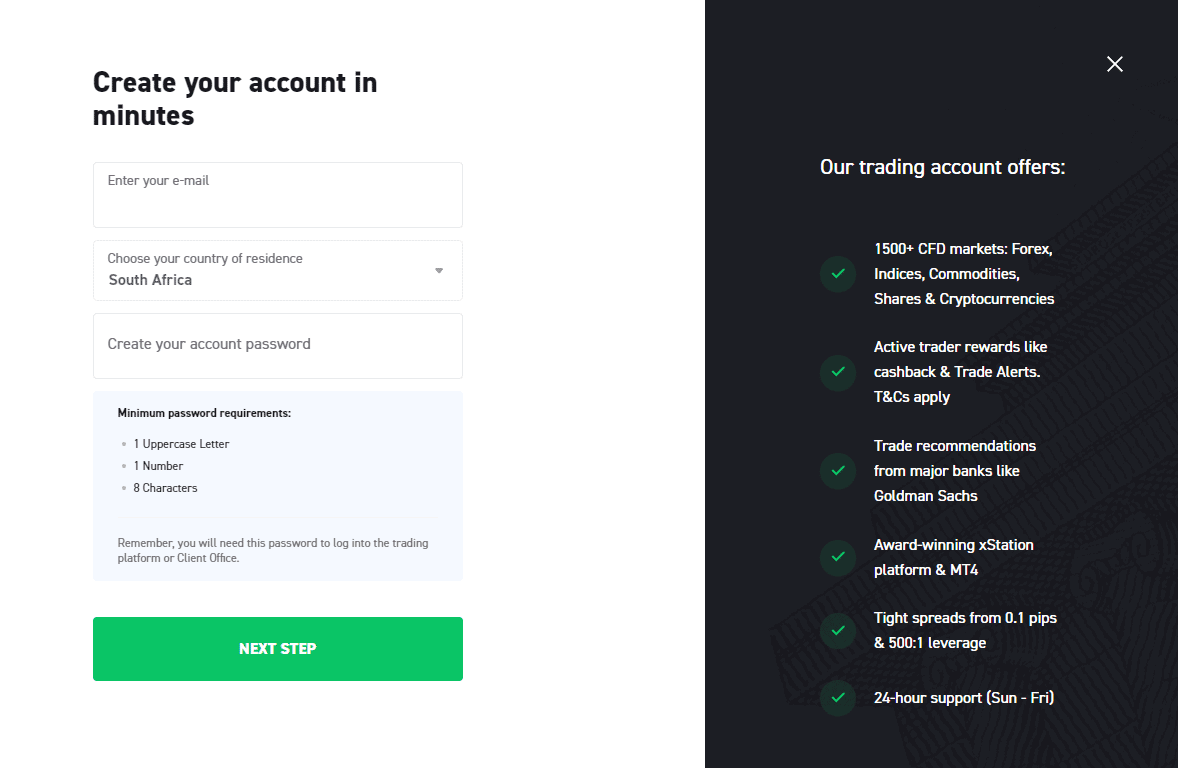

Step 2- Enter your email

How to open an XTB account

You should provide your valid email address for XTB account activation. Set your password to secure your trading account.

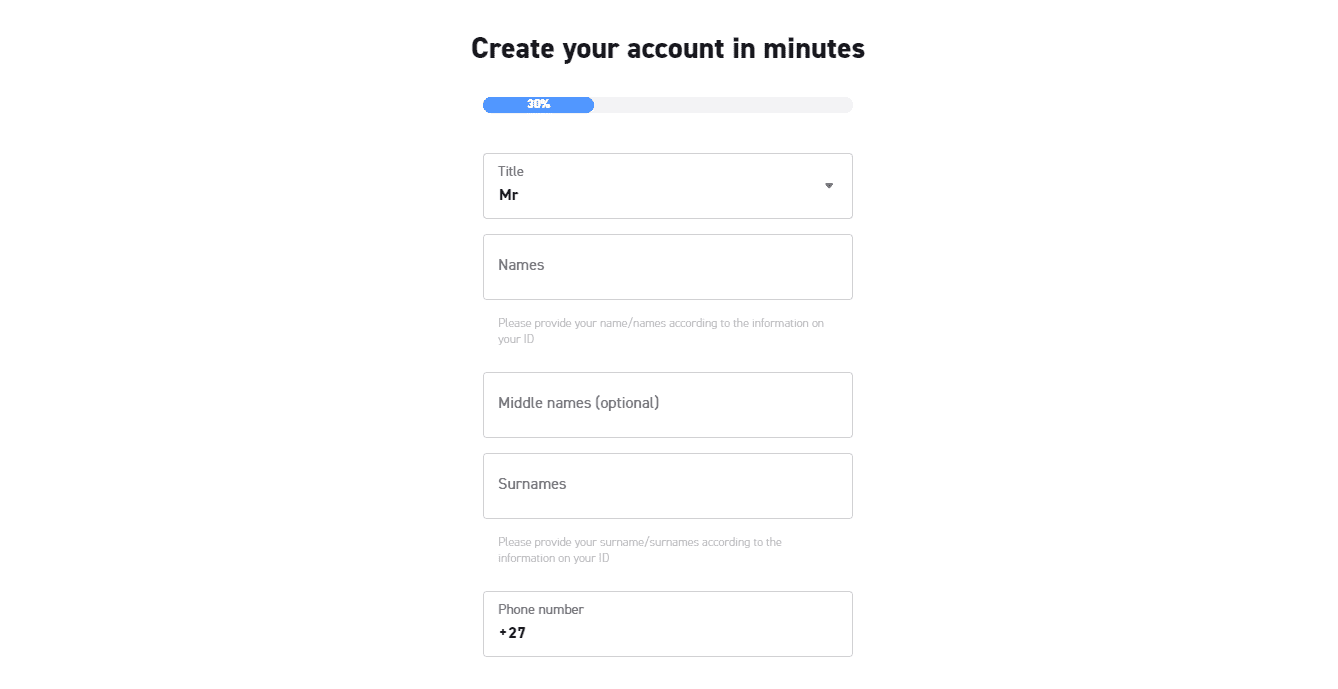

Step 3 - Add other general information

How to open an XTB account

Enter your nationality and date of birth in the given fields.

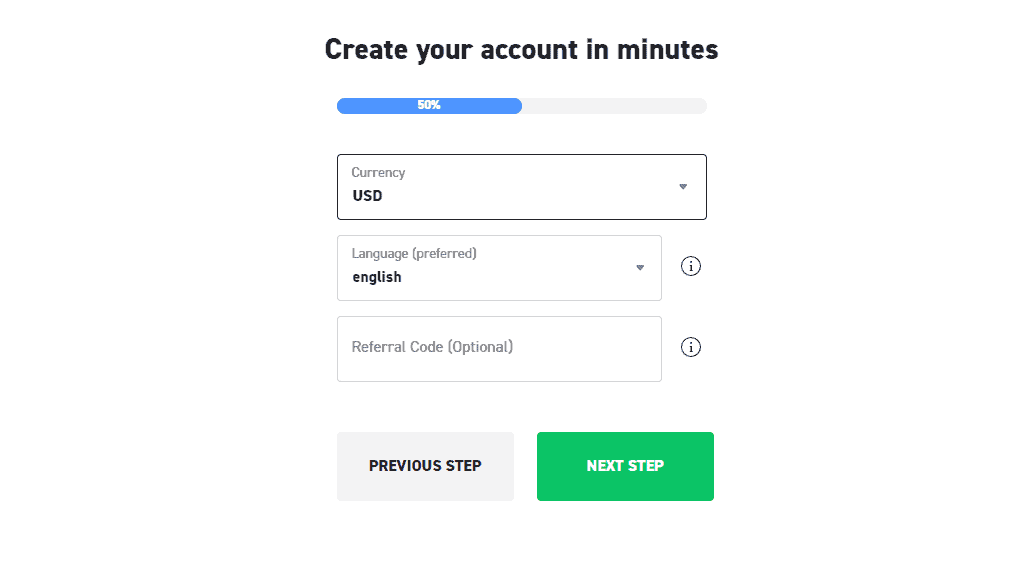

Step 4 - Get ready to finalize your details

How to open an XTB account

The last step is to select the currency and language for opening the XTB trading account. Tick the boxes to ensure that you accept the terms.

FAQs

How much time does it take to create my XTB account?

You need only 15 minutes to fill out the registration form. After receiving your documents and information, XTB will send approval in less than 24 hours.

How will I add funds to my XTB account?

The broker’s platform lets you add an amount through Client Office or xStation via different methods like debit/credit cards, bank transfers, and Paysafe.

How will I know that XTB has approved my account?

You will receive a notification via email after XTB has activated your account. You may also access the Client Office and know about the account status.

Is XTB the right choice for long-term trading?

XTB is best for those who like to invest in ETFs and real stocks. But, only traders from European countries can access real assets. If you invest in CFDs and hold them overnight, it will lead to a charge.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.