According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- Zeal MT4 Desktop

- Zeal MT4 Mobile

- FCA

- FSA

- 2019

Our Evaluation of ZFX Broker

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ZFX Broker is a moderate-risk broker with the TU Overall Score of 6.48 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ZFX Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The ZFX broker offers tight spreads only to owners of ECN accounts. However, the minimum deposit size is $1,000 on accounts of this type. For this reason, beginners and investors without a capital reserve have to trade from standard accounts with high spreads, which does not make ZFX the best choice for beginner traders.

Brief Look at ZFX Broker

The ZFX is an NDD, STP, and ECN broker headquartered in London. It has been providing online FX and CFD trading services since 2016. It is regulated by the British FCA (768451) and Seychelles supervisory authority FSA (SD027). Traders from Europe, Asia, and Africa can trade currency pairs, indices, stocks, and commodities on the ZFX platform. The broker is part of the Zeal Group of fintech companies specializing in liquidity solutions for regulated markets in major regions of the world.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Execution of trades without going through a dealing center and liquidity from major financial institutions.

- Regulation by the FCA (UK) and the FSA (Seychelles).

- Mini Trading Account with a minimum deal size of 0.1 lot and deposit from $50.

- A humongous array of accounts for retail and professional clients.

- Tighter spreads (from 0.2 pips) on ECN accounts.

- Ability to trade over 100 assets, including Forex, stock indices, commodities (precious metals and crude oil), and stocks.

- High leverage (up to 1:500) on standard and ECN accounts.

- Lack of a web-based trading platform.

- Hefty $1,000 deposit for retail traders on ECN accounts.

- The maximum number of open positions in Standard and ECN accounts is limited and cannot exceed 200.

TU Expert Advice

Author, Financial Expert at Traders Union

ZFX Broker provides Forex and CFD trading services through a range of account types, including Mini, Standard STP, and ECN. It offers the MetaTrader 4 platform for both desktop and mobile devices. The company is regulated by the FCA and the Seychelles FSA, featuring high leverage up to 1:2000 for retail traders and tight spreads, particularly for the ECN account. The broker supports trading currency pairs, stock indices, commodities, and stocks, ensured by liquidity from major financial institutions.

However, ZFX has some drawbacks, such as the lack of a web-based trading platform and a high minimum deposit requirement of $1,000 for the ECN account. Furthermore, the maximum number of open positions is capped at 200 for some account types. Hence, while ZFX Broker may be well-suited for experienced and professional traders looking for direct access to the market, beginners or those seeking low deposit options may find it less accommodating.

- You prefer direct trade execution, bypassing intermediaries like dealing centers. This ensures faster execution and potentially lower costs.

- You want an access to liquidity from significant financial entities, competitive pricing, and reliable order execution. These features are crucial for active traders.

- You expect tighter spreads on ECN accounts starting from 0,2 pips on ECN accounts, enhancing your trading efficiency and potentially maximizing your profits.

- You prefer the convenience and accessibility of a web-based trading platform, as this broker may not be able to provide that to you.

- You are searching for brokers having low deposits as retail traders might find the $1,000 deposit requirement for ECN accounts prohibitive, especially if they prefer a lower initial investment or want to manage risk more cautiously.

ZFX Broker Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Zeal MT4 Desktop, Zeal MT4 Mobile (iOS and Android) |

|---|---|

| 📊 Accounts: | Demo, Mini Trading Account, Standard STP Trading Account, ECN Trading Account, and Professional Account |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Credit and debit cards, bank transfer, electronic payment systems such as Neteller, Perfect Money, and Skrill |

| 🚀 Minimum deposit: | From $50 for retail clients, from $10,000 for professional clients |

| ⚖️ Leverage: | Up to 1:100 for professional clients, up to 1:2000 for retail traders |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, commodities (oil, gold, silver, copper) |

| 💹 Margin Call / Stop Out: | Stop out: 20%/30%/50% |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market, buy limit, buy stop, sell limit, sell stop, trailing stop |

| ⭐ Trading features: | ECN accounts for currency pairs may incur additional commissions per trade |

| 🎁 Contests and bonuses: | Yes |

The ZFX broker offers cent, professional, STP, and ECN accounts with diverse leverage levels and trading fees. Retail traders can start with a deposit of $50 and professional traders from $10,000. Transactions with currency pairs and CFDs on stocks, indices, and commodities are available to the clients via MetaTrader 4 desktop and mobile terminals. You can test the broker’s trading conditions using a demo account; the conditions are identical to those of ZFX’s real accounts.

ZFX Broker Key Parameters Evaluation

Video Review of ZFX Broker

Share your experience

- Best

- Last

- Oldest

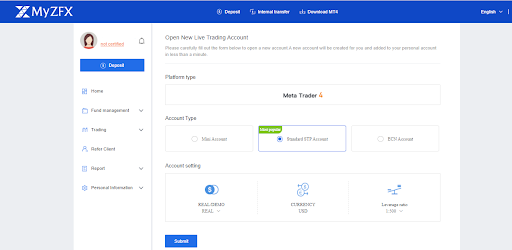

Trading Account Opening

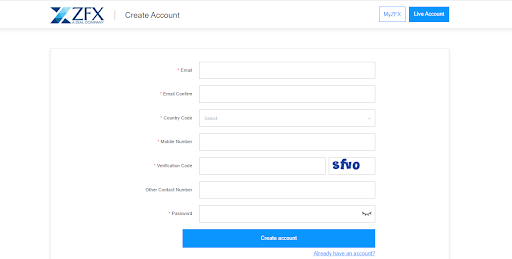

There are several steps to register as a ZFX customer. Follow the instructions below:

Visit the official ZFX website and at the top of any of its pages, click the “Open an account” button.

In the registration form that opens, enter your personal information, email address, phone code of your country of residence, and mobile number. Next, devise a strong password.

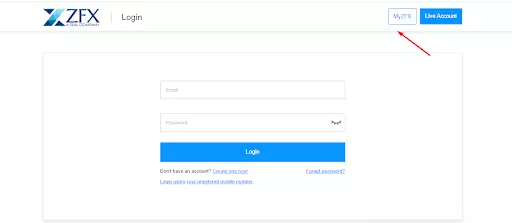

Then go to your personal account and click MyZFX and provide your email address and password.

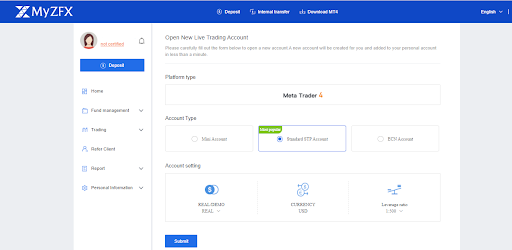

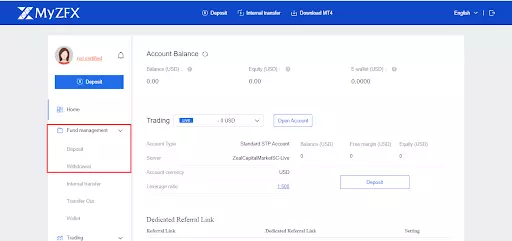

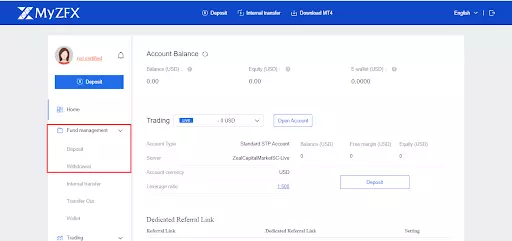

The following functions are available to the owner of a ZFX personal account:

These functions are all possible from the trader’s personal account:

-

Fund management such as payment operations and account management.

-

Trading such as balance inquiry, equity, and placing leverage on open accounts.

-

Request a different leverage level, and access to open live, and demo accounts.

-

Referred client data such as information on the number of attracted clients, their trading volumes, the amount of available and previously withdrawn bonuses.

-

Reports such as the history of all deposits and withdrawals, open and closed orders for a selected period, and changes in leverage.

-

Personal Information — edit personal data, details of your verification.

Regulation and safety

ZFX Broker has a safety score of 8.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record of less than 8 years

ZFX Broker Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

ZFX Broker Security Factors

| Foundation date | 2019 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ZFX Broker have been analyzed and rated as Low with a fees score of 9/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ZFX Broker with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ZFX Broker’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ZFX Broker Standard spreads

| ZFX Broker | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,9 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ZFX Broker RAW/ECN spreads

| ZFX Broker | Pepperstone | OANDA | |

| Commission ($ per lot) | 2 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ZFX Broker. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ZFX Broker Non-Trading Fees

| ZFX Broker | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

This broker offers four types of accounts that differ in deposit size, maximum leverage, and spread. To trade on any of the accounts, the MetaTrader 4 terminal integrated with ZFX is used. Mini, Standard, and ECN accounts can be opened at the division regulated by the Financial Services Authority of Seychelles. Professional Accounts are handled by the UK branch, which operates under the supervision of the FCA.

Account types:

Demo Accounts are available on both desktop and mobile terminals.

ZFX is a broker that offers services to different types of clients. At the same time, accounts for retail traders are serviced by the division with offshore registration. Only the products regulated by the FCA division are available to professional clients.

Deposit and withdrawal

ZFX Broker received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

ZFX Broker provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- BTC available as a base account currency

- Bank card deposits and withdrawals

- Bank wire transfers available

- Only major base currencies available

- PayPal not supported

- Wise not supported

What are ZFX Broker deposit and withdrawal options?

ZFX Broker provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

ZFX Broker Deposit and Withdrawal Methods vs Competitors

| ZFX Broker | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are ZFX Broker base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ZFX Broker supports the following base account currencies:

What are ZFX Broker's minimum deposit and withdrawal amounts?

The minimum deposit on ZFX Broker is $50, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ZFX Broker’s support team.

Markets and tradable assets

ZFX Broker offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 40 Forex pairs.

- 40 supported currency pairs

- Indices trading

- Copy trading platform

- Limited asset selection

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by ZFX Broker with its competitors, making it easier for you to find the perfect fit.

| ZFX Broker | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products ZFX Broker offers for beginner traders and investors who prefer not to engage in active trading.

| ZFX Broker | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

The UK branch answers questions from Monday to Friday from 09:00 to 18:00 (UK time). Retail traders serviced by the Seychelles office have 24-hour support available any day of the week.

Advantages

- Retail traders are serviced 24/7

- Online chat is available in 8 languages

Disadvantages

- Only professional clients can contact the broker by phone

- Call-back orders are not possible

The list of available channels of communication with broker representatives depends on the client's status and the selected unit. They are:

-

professional clients can use phone and email to contact them;

-

retail traders can use online chat, request by email directly or through the ready-made contact form in the Contact us section.

Company representatives answer unregistered users' questions via chat, phone, email, as well as via the messenger services of Facebook, Instagram, Twitter, or LinkedIn.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | 4 Lombard Street, London, EC3V 9HD |

| Regulation | FCA, FSA |

| Official site | https://www.zfx.co.uk/ |

| Contacts |

Education

The Zeal Capital Market (UK) website has no training because it is designed for professionals who have substantial experience in the Forex market. On the Zeal Capital Market (Seychelles) website, training is presented in the Academy and FAQs sections. The information in the Academy block is divided into three levels: Beginner, Intermediate and Advanced.

The broker offers cent accounts that allow you to practice trading on the financial markets with minimal risk. Traders who don't want to risk their funds can practice on demo accounts.

Comparison of ZFX Broker with other Brokers

| ZFX Broker | Eightcap | XM Group | RoboForex | VT Markets | Kama Capital | |

| Trading platform |

Zeal MT4 Desktop, Zeal MT4 Mobile | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MetaTrader5 |

| Min deposit | $50 | $100 | $5 | $10 | $50 | No |

| Leverage |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:400 |

| Trust management | Yes | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.2 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | No | Yes |

Detailed Review of ZFX

The ZFX brokerage is an STP and ECN intermediary which offers non-dealer executions, competitive spreads, and the full range of classic MetaTrader 4 features. The company is headquartered in London but has offices worldwide such as in Moscow, Abu Dhabi, Hong Kong, Bangkok, Taipei, Ho Chi Minh City, and Jakarta. ZFX has a relentless focus on finding the best prices in the institutional markets by using cutting-edge technology and guaranteeing clients transparent pricing.

The ZFX broker by the numbers:

-

Has provided online FX and CFD trading services for over 5 years.

-

Has 8 offices worldwide.

-

Offers more than 100 financial instruments for trading.

ZFX is a multi-purpose broker for FX and CFD trading

The company seeks to provide favorable trading conditions for beginners and professionals, private and institutional clients, and active traders and passive investors. Its clients can trade currency pairs (major, minor, and exotic) and CFDs on shares and indices. Transactions with CFDs on commodities, including oil and precious metals, are also available. The terminal provided by the ZFX broker supports not only market orders, but also trailing stop, buy limit, buy-stop, sell limit, and sell-stop indicators.

ZFX offers MetaTrader 4 desktop and mobile platforms that support a wide range of technical indicators, including charting, and one-click trading. Automated trading managed by expert advisors is also available. The broker does not provide web terminals, so its clients must download and install MT4 on a PC, laptop, or mobile device to start trading.

Useful services of ZFX:

-

Economic Calendar.

-

Financial news that is contextualized for the Forex market.

-

Current market overviews including analytics, daily forecasts, stock, Forex, gold, and oil market analysis.

Advantages:

Low margin rates for hedged positions.

Broker does not charge fees for deposits or withdrawals.

Only on its Mini Account and Standard STP Account are commissions charged against the spreads.

Retail traders can trade with leverage up to 1:2,000.

The company provides a powerful trading platform that processes an average of 50,000 orders per second.

The minimum deposit to start trading is $50.

All ZFX accounts are traded at the best bid and ask prices obtained from institutional liquidity providers.

Latest ZFX Broker News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i