deposit:

- $15

Trading platform:

- WebTrader

- MetaTrader4

- CMA

- FCA

- 0%

EGM Securities Review 2024

deposit:

- $15

Trading platform:

- WebTrader

- MetaTrader4

- CMA

- FCA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of EGM Securities Trading Company

EGM Securities is a broker with higher-than-average risk and the TU Overall Score of 4.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by EGM Securities clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. EGM Securities ranks 140 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The EGM Securities broker offers favorable trading conditions to all clients, regardless of their income or strategies used.

EGM Securities (EGMSecurities) is an STP, NDD, and ECN broker that is part of the International Equity Group of companies. It offers trading in five asset classes (currency pairs, ETFs, CFDs on stock indices, stocks, and commodities) through the classic MT4 terminal, as well as the MAM system for passive investing. The company is headquartered in Nairobi and is licensed by the Kenyan government regulator Capital Markets Authority (CMA, 107). According to the World Economic Magazine Awards, EGM Securities was named Best Forex Broker Kenya in 2021.

| 💰 Account currency: | USD, AED, KES |

|---|---|

| 🚀 Minimum deposit: | From USD 15 |

| ⚖️ Leverage: | Up to 1:400 for currency pairs and precious metals; 1:200 for CFDs and 1:20 for shares |

| 💱 Spread: | From 1.6 pips (Executive), from 0.2 pips (Premiere) |

| 🔧 Instruments: | Currency pairs (62), CFDs on stocks (240), indices (37), metals (6), and ETFs |

| 💹 Margin Call / Stop Out: | Stop out: 30% |

👍 Advantages of trading with EGM Securities:

- Licensed by the state regulator of Kenya.

- Execution of orders using Non-dealing Desk technology, which eliminates a conflict of interest between the broker and its clients.

- The available minimum deposit is USD15 or 100, depending on the type of account.

- A wide range of assets (over 300), high leverage (up to 1:400 for trades with currency pairs and metals).

- No restrictions on the use of automated expert advisors.

- Tight floating spreads on all account types.

- Ability to open a demo or swap-free Islamic account.

👎 Disadvantages of EGM Securities:

- The broker does not offer any bonuses to its clients.

- There is no affiliate program for retail traders. The Company pays fees only to IBs (Introducing Brokers).

- There are no cent accounts in the line of available trading accounts.

Evaluation of the most influential parameters of EGM Securities

Trade with this broker, if:

- You're interested in copy trading, as this broker offers social trading and copy trading features. This allows you to follow and replicate the trades of experienced traders, potentially enhancing your trading performance.

- You want to practice trading strategies risk-free with a demo account or require a swap-free Islamic account compliant with Shariah law, as this broker provides these options to cater to different trading preferences and needs.

Do not trade with this broker, if:

- You rely heavily on advanced trading tools and research features for complex trading strategies, as their platform might not offer the advanced features and research tools needed to execute sophisticated trading strategies effectively.

- You're interested in trading bonuses such as welcome bonuses or account replenishment bonuses, as you may be disappointed by the absence of such incentives with this broker.

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest EGM Securities News

- Analysis of EGM Securities

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of EGM Securities

- User Reviews of EGM Securities

- FAQs

- TU Recommends

Geographic Distribution of EGM Securities Traders

Popularity in

Video Review of EGM Securities i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of EGM Securities

EGM Securities is primarily known to African traders as it is a leading Forex broker regulated by the Kenyan Capital Markets Authority. The company cooperates not only with the residents of the African continent but also with the ones of Europe and Asia. However, traders from several countries (including the United States) are not able to register with EGM Securities.

The broker offers a wide selection of assets and tight spreads. Here you can also trade ETFs and CFDs on stocks with almost zero commissions. The minimum deposit is only $15. EGM Securities does not charge any additional fees (for example, for maintaining an account, providing quotes, or for using its terminal). All this attracts experienced traders and also beginners.

However, the broker does not provide cent accounts that novice market participants can use to train and develop practical trading skills. Also, the site has a limited number of training materials and no analytics. Clients of EGM Securities have to pay a commission for withdrawing funds to e-wallets and banks outside Kenya, which is also a disadvantage of this Forex broker.

Dynamics of EGM Securities’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The EGM Securities broker is suitable not only for active trading but also for passive investing. Its clients can use both the functions offered by MetaQuotes (auto copying, advisors, trading signals, etc.) and the MAM system of managed accounts. Also, to generate additional income, the company offers an IB affiliate program.

Multi-Account Managers, expert advisors, and modern investment technologies facilitate the generation of passive income

Working with trust accounts and using robotic advisors allow an investor (a trader who does not actively trade) to receive additional profit. This is how it works in practice:

-

MAM – is a system that allows an investor to automatically copy trades of a selected manager. In the case of a successful trade, the manager receives from 20 to 60% of the profit (the exact amount is indicated in the offer). The funds of the connected subscribers and the manager(s) are held in segregated accounts, which reduces the financial risks of investors, as compared to when working in the PAMM accounts.

-

Expert advisor – They use Forex robots that are installed by the investor in the MT4 terminal. The user can work with different types of advisors such as semi-automatic, which only analyze and provide trading signals, or fully automatic, which opens and closes trades for the investor themselves.

To become an investor in the MAM system, you need to open one of the trading accounts with EGM Securities. Then, after passing the verification, in your personal account, you can select a manager from the rating list and connect to his account. Before connecting, you should carefully read the offer. It necessarily specifies the conditions for copying and the amount of remuneration for the manager of a profitable trade.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

EGM Securities’ affiliate program:

-

Introducing Broker (IB) - is a program by which an affiliate receives income from each trade completed by his partners. IB only provides services to traders, and trades are handled by EGM Securities. The amount of remuneration depends on the country of residence of the affiliate and the degree of his involvement in the financial services business.

The online reporting tool built into your personal account allows the affiliate to track the activity of all attracted clients in real-time. The amount of available remuneration can be found by contacting a company representative by phone.

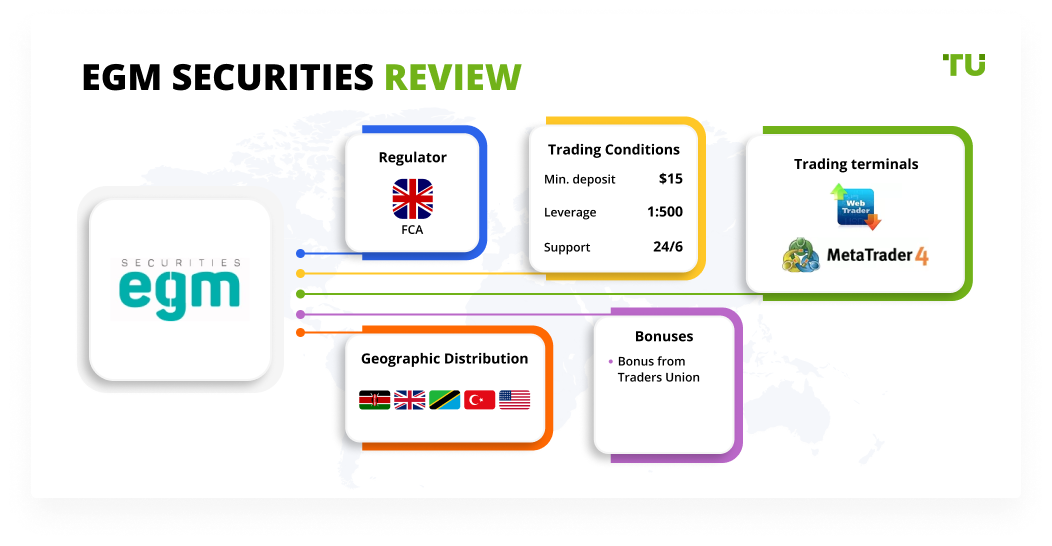

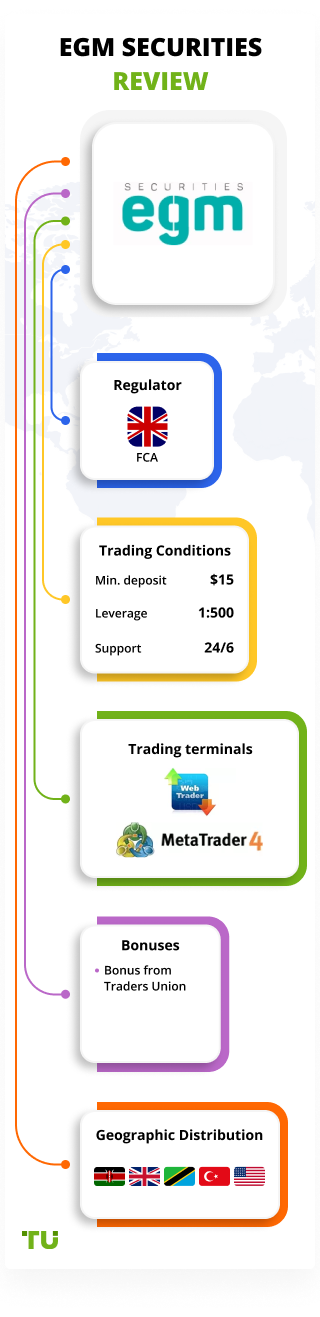

Trading Conditions for EGM Securities Users

EGM Securities enables traders to trade over 300 Forex instruments from ECN accounts. The leverage varies depending on the asset class. The available trading platform is MT4. Spreads start at 0.2 pips. The minimum deposit is $15. The broker provides demo analogs of real accounts, as well as Islamic accounts, on which there is no swap commission.

$15

Minimum

deposit

1:500

Leverage

24/6

Support

| 💻 Trading platform: | MetaTrader 4 (mobile, desktop), WebTrader |

|---|---|

| 📊 Accounts: | Demo Account, Executive Account, Premiere Account |

| 💰 Account currency: | USD, AED, KES |

| 💵 Replenishment / Withdrawal: |

Deposit and withdrawal: Domestic and international bank transfers, such as Neteller, Skrill, Mobile Money Payments (MPesa, Lipa na Bonga, Airtel money, eLipa, MTNMoney). Top-up only: Visa/Mastercard credit and debit cards, Vodacom, Tigo, and Airtel mobile payments. |

| 🚀 Minimum deposit: | From USD 15 |

| ⚖️ Leverage: | Up to 1:400 for currency pairs and precious metals; 1:200 for CFDs and 1:20 for shares |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.6 pips (Executive), from 0.2 pips (Premiere) |

| 🔧 Instruments: | Currency pairs (62), CFDs on stocks (240), indices (37), metals (6), and ETFs |

| 💹 Margin Call / Stop Out: | Stop out: 30% |

| 🏛 Liquidity provider: | More than 35 large banks and leading brokerage companies |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution ECN |

| ⭐ Trading features: | You can open swap-free accounts, advisors are allowed, but cryptocurrency trading is not available |

| 🎁 Contests and bonuses: | No |

Comparison of EGM Securities with other Brokers

| EGM Securities | RoboForex | Eightcap | Exness | TeleTrade | IC Markets | |

| Trading platform |

MetaTrader4, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, cTrader, MT5, TradingView |

| Min deposit | $15 | $10 | $100 | $10 | $1 | $200 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.6 point | From 0 points | From 0 points | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

No / 30% | 60% / 40% | 80% / 50% | No / 60% | 70% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| EGM Securities | RoboForex | Eightcap | Exness | TeleTrade | IC Markets | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | Yes | No |

| Options | No | No | No | No | No | No |

EGM Securities Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Executive Account | From $16 | Available for international wire transfer and EPS withdrawals |

| Premiere Account | From $2 | Available for international wire transfer and EPS withdrawals |

There are swaps (commission for transferring a position to the next day). The company also provides an opportunity to open swap-free accounts.

A comparison of the average commission of EGM Securities with the indicators of other brokers, which also provide access to Forex, is presented in the form of the below table. The Traders Union analysts compared the Kenyan broker with its competitors.

| Broker | Average commission | Level |

| EGM Securities | $9 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of EGM Securities

EGM Securities is Kenya's leading online broker offering CFD and Forex trading to clients. It provides liquidity from the world's largest banks, competitive spreads, and fast execution speeds on ECN accounts. Regulated by the government supervisor CMA, the company keeps money in segregated accounts, provides 24/6 support, and offers a wide range of assets.

EGM Securities’ trading instruments:

-

62 currency pairs.

-

6 CFDs on precious metals.

-

37 CFDs on stock indices.

-

Over 240 CFDs on US, UK, and EU stocks.

EGM Securities is a broker specializing in serving African traders

This broker offers a wide range of currency pairs (major, minor, exotic), indices (including futures), gold, silver, platinum, Brent, and WTI. In addition, it provides its clients with access to trading CFDs on American, British, and European stocks with zero commissions, as well as ETFs with a fee of 0.01% per trade. EGM Securities is a Non-dealing Desk (NDD) brokerage firm that provides end-to-end processing (STP) and direct market access (DMA). All client positions are sent directly to liquidity providers (large banks and top brokers) and are never held internally.

EGM Securities provides its clients with the MetaTrader 4 trading platform. Its desktop version will allow trades from desktop computers and laptops with Windows operating system, and the web version (WebTrader) works on any device with internet access. Traders can also download special mobile applications from the App Store or Google Play.

Useful services of the EGM Securities broker:

-

Trading is open on holidays. All trading instruments are grouped by asset class in a convenient table. It indicates London time.

-

Expiry dates. The duration of the current contracts and the trading dates for future contracts.

-

Daily email distribution. Every weekday morning, the client receives reports on the main economic and fundamental events over the past day.

-

Support Guide. Section with answers to frequently asked questions (FAQs) about services, trading conditions, terminals, and functionality of the personal account.

Advantages:

This broker executes trades using ECN technology, which completely excludes interference in the process of a dealing center.

Segregated accounts in major banks around the world are used to store customer funds.

Premiere Account holders can trade with spreads from 0.2 pips and virtually zero commission on ETFs and CFDs on stocks.

The company offers a wide range of payment systems. Its clients can deposit and withdraw funds using cards, bank transfers, electronic wallets, and mobile payment systems.

Traders can trade from any device. Also, Webtrader allows you to make trades via an internet browser without installing additional software.

This broker makes it possible to earn additional passive income through MAM accounts and an affiliate program.

Online chat operators are in touch 24/6, the help of a virtual bot on the site is available around the clock, any day of the week.

The maximum number of open trades (including pending orders) is 500.

How to Start Making Profits — Guide for Traders

EGM Securities offers two types of accounts with ECN market execution and a minimum lot size of 0.01. Both accounts can trade all available currency pairs, metals, stocks, and indices with leverage from 1:20 to 1:400.

Account types:

Traders who are interested in the conditions stated on the site can open a demo account with a validity period of up to 90 days.

The EGM Securities broker offers accounts for both experienced traders who trade professionally on Forex and beginners without capital stock.

Bonuses Paid by the Broker

It is not company policy to provide bonuses to customers. Therefore, promotions and discounts are not available here.

Investment Education Online

There is a training section on the EGM Securities website called Academy, but access to it is open only after registration. In this block, you can find video tutorials and trading guides, but at the moment their number is limited.

Beginners who are just learning to trade and are not yet ready to invest real money in the Forex market can practice on a demo account. Trades on it are made using virtual funds, therefore, in the event of a losing trade, the trader does not lose his money.

Security (Protection for Investors)

EGM Securities is a trade brand of EGM Securities Limited, which is registered under the number PVT-AAAAFF7 and is regulated by the Capital Markets Authority (CMA). This office is Kenya's main government financial supervisor and is responsible for the licensing and regulation of capital markets.

EGM Securities Limited is part of the international holding company Equity Group, which consists of eight regulated divisions. They operate under the supervision of regulators from the United States, Jordan, the United Arab Emirates, Seychelles, and Armenia. Equity Capital UK operates under the supervision of the Financial Conduct Authority (FCA, 528328).

👍 Advantages

- All clients' money is kept in segregated bank accounts and is not part of the broker's assets or funds

- Clients with an account balance of more than $25,000 participate in the insurance program with maximum coverage of $1 million per trader

- The regulator ensures that the broker properly fulfills its obligations to its clients

👎 Disadvantages

- Under the requirements of the CMA, the company does not cooperate with traders from 27 countries of the world, including the USA

- You cannot replenish your account without providing detailed information about yourself and scans of documents

- No negative balance protection

Withdrawal Options and Fees

-

Money from the company's accounts can be withdrawn by bank transfer to banks around the world, using Neteller, Skrill, Mobile Money Payments (MPesa, AirtelMoney, MTN). Withdrawal requests made before 3:00 pm (EST) are processed the same day.

-

The minimum withdrawal amount depends on the payment system selected. With Neteller and Skrill, you can withdraw at least USD30; via mobile payments, it is KES 100 or UGX 3000; via domestic bank transfers it is USD20; for international transfers, the minimum withdrawal amount is USD50 or its equivalent in local currency.

-

The maximum withdrawal amount to Skrill and Neteller wallets is USD5,000, via MPesa, AirtelMoney, and MTN, it is KES 150,000 per transaction (but not more than KES 300,000 per day), or UGX 5,750,000. You can withdraw any available amount by bank transfer, without restrictions.

-

Available withdrawal currencies to a bank account and e-wallets, are USD, KES; via mobile payments, they are KES, UGX, and TZS.

-

Time it takes to credit funds: The funds transferred via Skrill, Neteller, MPesa, Lipa na Bonga, Airtel money, eLipa, and MTNMoney are received within 3 hours; via wire/bank transfer are received within 3-5 business days.

-

Bank transfers within Kenya and mobile withdrawals are free of charge. Withdrawals to electronic wallets will cost the trader 1% of the transaction amount, but not more than USD30 or its equivalent. The commission for international wire transfer is USD15 / KES 1650.

Customer Support Service

The broker's website has a chatbot, a question to which you can ask any day and time. Live chat and telephone support operators are available 24 hours a day from Sunday to Friday.

👍 Advantages

- The virtual assistant on the site is available 24/7

- Chat operators answer questions even from unregistered users

👎 Disadvantages

- Sometimes you have to wait for a specialist's answer from 30 minutes to 1 hour

This broker provides the following communication channels for its clients:

-

online chat within the site;

-

free calls (numbers for Kenya and in international format are indicated);

-

sending an email to support@EGM Securities.com;

-

request via a chatbot on the site;

-

sending a message to WhatsApp (the service is available only to registered customers).

You can also reach out to company representatives via Facebook and Twitter.

Contacts

| Foundation date | 1995 |

| Registration address | EGM Securities Limited, 12th Floor, Tower 2, Delta Corner Towers, Waiyaki Way, Westlands, Nairobi, Kenya |

| Regulation |

CMA, FCA |

| Official site | https://www.egmsecurities.com/ |

| Contacts |

Email:

support@egmsecurities.com,

Phone: 0 800 211 185 |

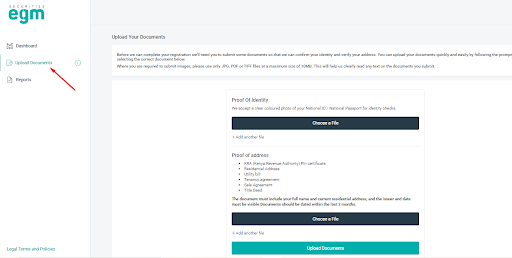

Review of the Personal Cabinet of EGM Securities

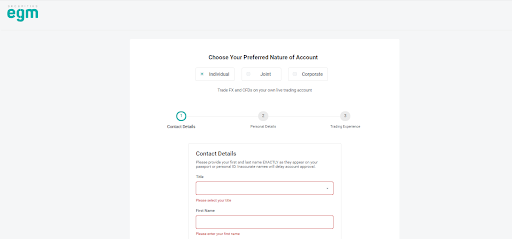

To start trading with EGM Securities, open a trading account and make a deposit. These operations are performed in the Trader's personal account. Follow these steps to create it:

Go to the official website of EGM Securities and click Open Account as shown in the screenshot below.

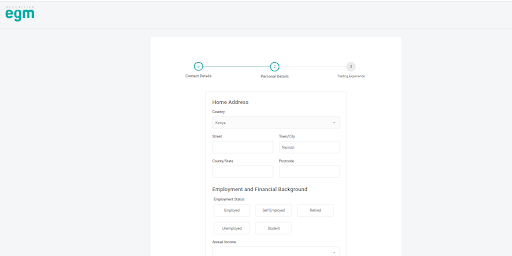

After that, a standard registration form will open. Indicate your name, surname, country of residence, date of birth, and phone number.

Next, you need to enter the exact address, and then indicate the amount of capital available, trading experience, and source of income.

After completing registration, enter your personal account. To do this, enter the username and password specified when filling out the form.

In your EGM Securities personal account, you can perform the following actions:

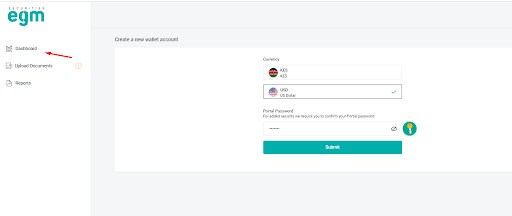

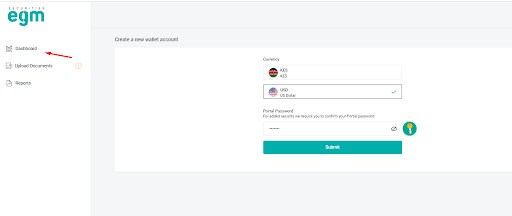

1. Open a new trading, training, or target (for storing funds) account:

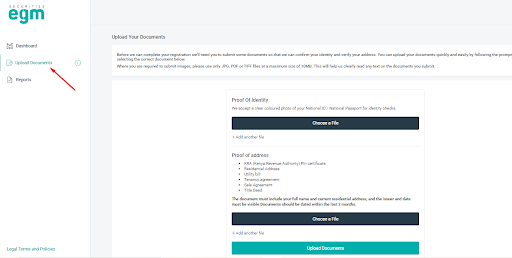

2. Verify:

1. Open a new trading, training, or target (for storing funds) account:

2. Verify:

Additional features of the personal account:

-

Deposit and withdraw funds.

-

Launch WebTrader to execute trades.

-

Work with MT4 to adjust settings and revise passwords.

-

Generate reports (account statements, summaries of the account for the day, transaction histories) with the ability to export data to Excel.

-

Connection to the Multi-Account Manager system.

-

Transfer of funds from target to trading accounts.

-

Quick connection with a company representative via online chat.

Articles that may help you

FAQs

Do reviews by traders influence the EGM Securities rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about EGM Securities you need to go to the broker's profile.

How to leave a review about EGM Securities on the Traders Union website?

To leave a review about EGM Securities, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about EGM Securities on a non-Traders Union client?

Anyone can leave feedback about EGM Securities on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.