How to Trade Forex on a Demo Account

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To trade on a Forex demo account, follow these steps:

Select a reputable broker

Register for a demo account

Download and install the trading platform

Fund the demo account with virtual money

Start trading

Using a Forex demo account lets traders practice and improve their strategies without any financial risk. It mimics real market conditions, allowing traders to test their methods, make a trading plan, and understand risk management without losing money. This helps traders gain the confidence and skills they need for live trading. This article looks at the benefits, steps, and tips for trading Forex on a demo account.

Steps to start trading on a Forex demo account

Select a reputable broker: Choosing the right broker can lead to a positive demo trading experience. Factors to consider include regulatory status, platform features, and the range of available currency pairs. Below, we have highlighted the top five brokers in 2024, focusing on their demo account features and other available account types. This comparison will help you choose the best broker for your trading needs by understanding what each one offers.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Currency pairs |

60 | 90 | 68 | 80 | 100 |

|

Options |

Yes | No | No | Yes | Yes |

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Futures |

Yes | No | No | Yes | Yes |

|

ETFs |

Yes | Yes | No | Yes | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Register for a demo account: Most brokers have a straightforward registration process. Typically, you need to provide basic personal information and choose your preferred trading platform, such as MetaTrader 4, MetaTrader 5, or a proprietary platform.

Download and install the trading platform: Once registered, download the trading platform provided by the broker. Installation is usually quick and user-friendly.

Fund the demo account with virtual money: Brokers usually provide a sufficient amount of virtual funds (e.g., $10,000) to start trading. This amount can vary, and some brokers allow you to reset the balance if needed.

Start trading: With the demo account set up, traders can begin placing trades, experimenting with different strategies, and utilizing various analytical tools provided by the platform.

Benefits of trading on a Forex demo account

Risk-free learning environment: A demo account allows traders to learn and experiment with no financial risk. This is particularly beneficial for new traders who need to understand the mechanics of trading platforms, order types, and market analysis without the pressure of losing money.

Real market conditions: Demo accounts provide access to real-time market data, enabling traders to experience actual market conditions. This helps in understanding market volatility, liquidity, and the impact of economic events on currency pairs.

Strategy testing: Traders can experiment with various strategies, such as scalping, day trading, swing trading, and long-term investing, to see which ones work best for their trading style. They can also test technical indicators, chart patterns, and risk management techniques to refine their approach.

Platform familiarity: Using a demo account helps traders get to know the trading platform’s features and tools. This knowledge is important when moving to a live account, as it lowers the risk of making mistakes due to not knowing how to work on the platform.

Psychological preparation: Trading is not only about analysis and strategy but also about managing emotions. A demo account helps traders build mental resilience by simulating the emotional aspects of trading. Although no real money is at risk, traders can still feel the excitement of winning trades and the disappointment of losing ones. This helps in developing the discipline and mental toughness needed for live trading.

Effective strategies for demo trading

Technical analysis: Use charting tools, indicators, and oscillators to analyze price movements and identify trading opportunities. Commonly used indicators include moving averages, Bollinger Bands, and the Relative Strength Index (RSI).

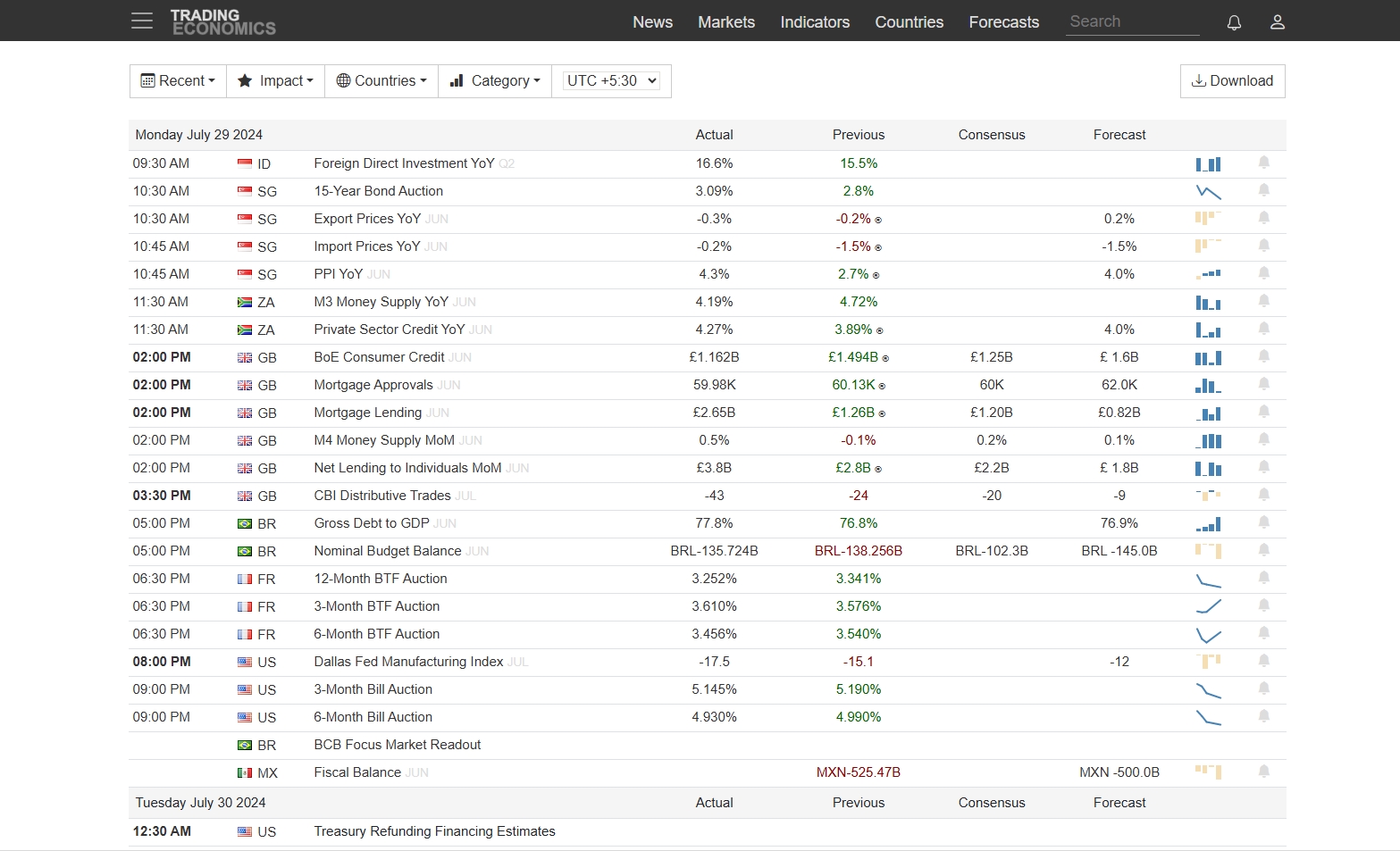

Fundamental analysis: Keep track of economic news, central bank announcements, and geopolitical events that impact currency prices. A robust economic calendar is essential for staying informed about significant market-moving events.

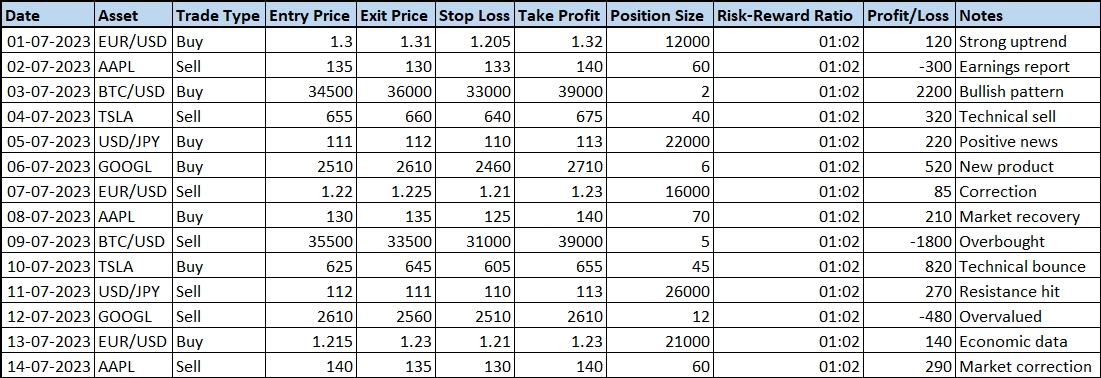

Risk management: Implement risk management strategies such as setting stop-loss and take-profit levels, using appropriate position sizing, and maintaining a balanced risk-to-reward ratio.

Developing a trading plan: Create a detailed trading plan that includes your trading goals, strategies, risk tolerance, and how you will evaluate your trades. Following a trading plan helps you stay disciplined and consistent.

Keeping a trading journal: Document all trades, including entry and exit points, the rationale behind the trade, and the outcome. Reviewing the trading journal helps in identifying strengths and weaknesses in your trading approach.

Transitioning to a live account

Assessing readiness

Before moving to a live account, judge your demo performance:

Consistent profits: Achieve consistent profitability over several months.

Risk management: Show effective risk management, including setting stop-loss levels and maintaining a favorable risk-to-reward ratio.

Plan adherence: Consistently stick to your trading plan and adapt to different market conditions.

Starting small

Minimize risk by starting with a small balance:

Micro or mini accounts: Begin with smaller position sizes to reduce potential losses.

Incremental increases: Gradually increase investment as you gain confidence.

Emotional management

Live trading introduces real emotions. Manage them by:

Meditation and mindfulness: Reduce stress and improve focus. Techniques like meditation can help maintain emotional control.

Regular breaks: Prevent burnout and reduce emotional fatigue. Taking breaks can help clear your mind and keep emotions in check.

Continuous learning

Keep your knowledge base updated through:

Market trends: Follow current trends and news. Keeping up with the market ensures you’re informed about potential opportunities and risks.

Educational resources: Use webinars, tutorials, and articles. Continuous learning helps improve your trading skills and knowledge.

Strategy adaptation: Adjust your strategies based on new information. Being flexible and adaptable to market changes is essential for long-term success.

Demo accounts give you the ability to experiment

Starting with a demo account lets you play around with different trading methods without risking any real money. Instead of sticking to the usual buy-and-hold strategies, you can try out more advanced techniques like using trading algorithms or making quick trades within seconds. This kind of hands-on practice helps you get better at using these methods and also teaches you how to stay calm during big market changes, like sudden price jumps or drops. By treating your demo account like a practice field, you can fine-tune your strategies and gain confidence, so you're well-prepared when you start trading with real money.

A demo account also helps you create a trading routine that suits you personally. Beyond just making trades, use the demo to figure out your daily trading habits, set up your workspace comfortably, and build routines that help you succeed in the long run. For example, try trading at different times of the day to find when you're most alert or practice using various charting tools to make a trading dashboard that works for you. This way, when you switch to a live account, you're not only technically ready but also mentally and physically prepared to handle the ups and downs of real trading.

Summary

Trading Forex on a demo account is a crucial step for any aspiring trader. It offers a risk-free environment to learn, practice, and improve trading strategies using real market data. By experimenting with different methods and understanding market dynamics, traders can gain the confidence and skills needed for live trading. Starting with a demo account helps build a solid foundation, develop a trading routine, and manage emotions effectively. While it doesn't replicate every aspect of live trading, it significantly prepares you for the real experience. The key to success in trading lies in continuous learning, disciplined practice, and effective risk management, all of which can be honed through demo trading.

FAQs

How long should traders use a demo account before switching to a live account?

Traders should use a demo account until they consistently achieve profitable results over several months. This period varies for each individual, depending on their learning curve and trading experience.

Can demo account performance guarantee success in live trading?

While demo trading helps build skills and confidence, it doesn’t guarantee success in live trading. Emotional factors and real money risk in live trading can impact decision-making and performance.

Are there any limitations to using a demo account?

Demo accounts may not replicate all aspects of live trading, such as slippage, order execution speed, and market depth. However, they still provide a valuable learning experience.

Do all brokers offer demo accounts?

Most reputable brokers offer demo accounts to their clients. It’s advisable to choose a broker with a well-reviewed demo trading service to ensure a comprehensive learning experience.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Bollinger Bands (BBands) are a technical analysis tool that consists of three lines: a middle moving average and two outer bands that are typically set at a standard deviation away from the moving average. These bands help traders visualize potential price volatility and identify overbought or oversold conditions in the market.