How To Track Your Forex Trading Performance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To track your Forex trading performance:

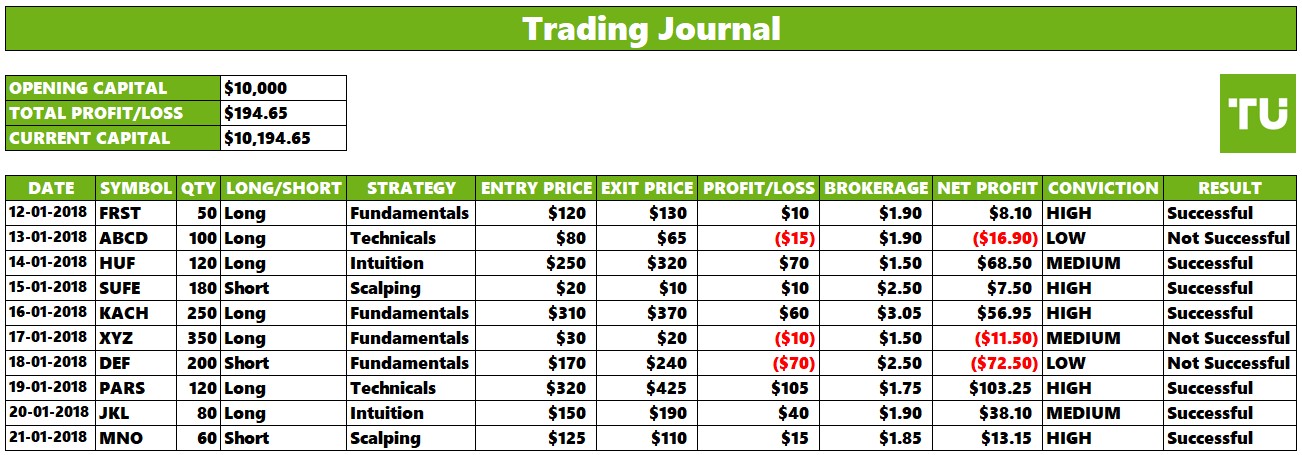

If you are a trader seeking to improve your performance, then a Forex trade journal is a must-have tool. A trade journal is a record of all your trades, including the currency pair traded, trade size, entry and exit prices, profit or loss, and your reasoning for each trade.

By keeping a trade journal, you can identify your strengths and weaknesses, track your progress over time, and improve your overall trading performance. The absence of a trading journal can also hinder long-term improvement, as it becomes challenging to track progress, refine strategies, and achieve consistent profitability.

Basics on tracking trading results

Maintaining a detailed trading journal is essential for new traders to refine their strategies and manage risk effectively. Documenting trade details, analyzing metrics like Profit Factor, and using advanced tools can guide them towards necessary changes required in their trading strategy. Regularly reviewing performance fosters disciplined, data-driven decisions, enabling gradual improvement and consistent profitability in Forex trading.

Plan your goals and performance benchmarks

The first step in creating a Forex trade journal is to plan your goals and performance benchmarks. For example, check out this complete guide to building out a comprehensive trading plan.

Such a plan will help you crystalize answers to key questions. What do you hope to achieve with your trading? Do you have a specific profit target in mind? Do you want to improve your win rate? Once you know your goals, you can set specific performance benchmarks to track and monitor your progress.

For example, you might set a goal of making a profit of 10% per month. To track your progress towards this goal, you would need to track your monthly profits and losses. You could also set a benchmark for your win rate, such as aiming for a win rate of 60%.

Create a trade journal

To create an effective journal, you must record every trade that you make. This includes the following information:

Date and time of trade.

Currency pair traded.

Trade direction (long or short).

Trade size.

Entry price.

Exit price.

Profit or loss.

Reasoning for trade.

You can record your trades in a physical notebook, a spreadsheet, or a dedicated trading journal app. Also, note that most trading platforms provide a built-in trading journal. We have explained the entire process of creating a free trading journal in excel (with template) in this article.

Regularly monitor how actual results are aligned with planned goals

Once you have a few weeks or months of trades recorded in your journal, you can start to review them regularly. This will help identify trends and patterns in your trading. For example, you may find that you are more profitable when trading certain currency pairs or trading during certain times of day. You may also find that you are more likely to make losing trades when you are feeling stressed or emotional.

By reviewing your journal regularly, you can understand your trading habits and make the necessary adjustments to improve your performance.

Find the causes of problems and correct them

If you find any problems in your trading, you can use your journal to help you identify the causes and correct them. For example, if you find that you are making a lot of losing trades on a particular currency pair, you may need to change your trading strategy or avoid trading that pair altogether.

You can also use your journal to identify any emotional problems that are affecting your trading. For example, if you find that you are more likely to make losing trades when you are feeling stressed, you may need to develop some coping mechanisms to help you manage your emotions.

Important metrics for tracking your Forex trade

Profit factor. The profit factor is a key metric in Forex trading, calculated by dividing total profits from winning trades by total losses from losing trades. A ratio above 1.0 indicates profitability, while a ratio below 1.0 signals losses outweigh profits. It is ideal to aim for a profit factor of above 1.5.

Maximum drawdown (MDD). MDD assesses the risk and potential loss associated with a trading strategy. It is calculated as the largest peak-to-trough decline or loss in the value of a trading account during a specific period, typically expressed as a percentage.

Recovery factor. Recovery factor helps in assessing the risk and profitability of a trading strategy. It quantifies the ability of a trading system or strategy to recover from losses and generate profits. The recovery factor is typically expressed as a ratio and calculated as follows:

Recovery Factor = (Net Profit / Maximum Drawdown)

Profitability. Profitability directly reflects the success and effectiveness of a trading strategy. It measures the ability of a trader or trading system to generate profits from trading activities and is typically quantified as the net profit earned from all trades over a specific period.

Sharpe ratio. The Sharpe Ratio helps in evaluating the risk-adjusted performance of a trading strategy. It was developed by Nobel laureate William F. Sharpe and is used widely in the financial industry to assess the return on investment relative to the risk taken. The Sharpe Ratio is calculated as follows:

Sharpe Ratio = (Average Return of the Strategy - Risk-Free Rate) / Standard Deviation of Returns

Win rate. This is the percentage of winning trades relative to the total number of trades. A high win rate is indicative of a strategy's ability to produce winning trades consistently.

Best Forex brokers for tracking trading performance

Automatic journaling is the most convenient way of tracking trading performance. We suggest opening an account with a broker that offers a MetaTrader 4 Forex platform, as it has a built-in trader’s journal. The top options with this feature are listed below:

| MT4 | MT5 | TradingView | Demo | Min. deposit, $ | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Deposit fee, % | Withdrawal fee, % | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | Yes | No | 0,5 | 1,5 | No | No | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | Yes | No | 0,1 | 0,5 | No | No | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | 100 | 0,7 | 1,2 | No | No | Tier-1 | Study review | |

| Yes | No | Yes | Yes | 1 | 0,6 | 1,2 | No | No | Tier-1 | Study review | |

| Yes | Yes | No | Yes | 1000 | 0,1 | 0,4 | No | No | Tier-1 | Study review |

Tools and software for tracking trading performance

To optimize the process of monitoring trading results, traders can leverage various applications, programs, and platforms. These resources not only save time but also deliver valuable insights into trading patterns and performance metrics. Here are some popular options traders use:

MetaTrader

As already discussed MetaTrader 4 (MT4) and its successor MetaTrader 5 (MT5) include built-in analytical functions allowing traders to watch their performance and analyze their trading history.

Myfxbook

As an online Forex analytics platform, Myfxbook permits traders to track, analyze, and compare their trading outcomes. By linking one's account, users gain access to:

Detailed stats on profit, loss, and risk.

Performance charts and graphs.

Automated system evaluation.

Social and copy trading.

TradingView

A popular charting and social media site for traders, TradingView supplies a range of performance tracking functions, such as:

Advanced charts across timeframes with customizable indicators.

Real-time market data and news.

Social features for sharing ideas and strategies.

Price, volume, and technical alerts and notifications.

Paper trading to test without risk.

Edgewonk

Designed to enhance decision-making and pattern identification, Edgewonk is a trading journal and analysis software offering:

Customizable journals for recording and reviewing trades.

Visual representations of stats and metrics.

Identification of strategy strengths and weaknesses.

Simulation for testing and modifying plans.

TradeBench

As a cloud-based analytics platform, TradeBench allows performance tracking, analysis, and optimization via imported trade data from various brokers, including:

Comprehensive reporting and analytics.

Journaling and note-taking.

Risk management tools and review.

Trade simulation and backtesting.

Each tool caters to different needs, so incorporating one or more into one's routine can effectively monitor and dissect performance for improved decisions and outcomes.

How journaling decisions and risk-to-reward analysis can enhance your Forex performance

One smart way to track your Forex trading performance is by paying attention to why you make certain decisions, not just focusing on profits or losses. Many traders only track the results, but noting down your trade entries, exits, and the reasoning behind each move is just as important. Were you following a solid strategy, or did you act on a hunch? By maintaining a journal that captures the why behind each trade, you can spot habits in your decision-making and refine your strategy over time. This helps you see if you’re following a disciplined approach or if emotions are guiding your trades.

Another key method is evaluating your risk vs reward with every trade. Instead of focusing only on the profit, calculate the potential reward for the amount you're risking. For example, if you’re aiming for a 3:1 ratio, you’re looking to gain three times what you risk on each trade. Tracking this helps you see if you’re consistently choosing trades that give you a good risk/reward balance. It also helps you recognize when you’ve risked too much for a smaller potential reward, refining your strategy and minimizing emotional, short-term decisions.

Conclusion

The advantages of maintaining a trading journal for Forex traders cannot be overstated. It serves as a powerful tool for self-improvement, offering insights into one's trading habits, strategies, and emotional responses. By documenting each trade, traders can identify patterns, strengths, and weaknesses, ultimately making better decisions. A well-maintained trading journal generates accountability, discipline, and continuous growth, helping traders gain greater confidence and success.

FAQs

How do I track my trading progress?

A Forex trade journal is essential because it helps traders systematically record, track, and analyze their trading progress. This allows Forex traders to identify strengths and weaknesses in their strategies. It provides valuable insights into trading decisions, emotional reactions, and overall performance, leading to continuous improvement and better risk management.

How do you know if you are a good Forex trader?

Evaluate your trading consistency by analyzing your track record over a significant period. For example, you can use a Forex trade journal to enhance your trading to promote discipline, objectivity, and self-awareness. Then, reflect on your emotional control and discipline during trades. A good trader can maintain composure and stick to their trading plan even in volatile markets.

What should I include in my Forex trading journal?

Your Forex trading journal should include essential details such as entry and exit points, position size, reasons for taking the trade, stop-loss and take-profit levels, as well as emotional notes. Additionally, record the market conditions, timeframes, and any external factors influencing your trades.

How often should I update my Forex trading journal?

It's recommended to update your Forex trading journal after every trade, as this ensures accuracy and immediate reflection on your trading decisions. Regular journaling enables real-time learning and the ability to make necessary adjustments to your trading approach. Updating your trading journal after every trade is essential for any Forex trader who wants to improve their performance.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The deviation is a statistical measure of how much a set of data varies from the mean or average value. In forex trading, this measure is often calculated using standard deviation that helps traders in assessing the degree of variability or volatility in currency price movements.

Paper trading, also known as virtual trading or simulated trading, is a practice where individuals or traders simulate real-life trading scenarios without using real money. Instead of placing actual trades with real capital, participants use a simulated trading platform or keep track of their trades on paper or electronically to record their buying and selling decisions.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.