Tether Review: A Comprehensive Guide For Traders In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Tether (USDT) is a stablecoin pegged to the U.S. dollar at a 1:1 ratio. It is primarily used to mitigate cryptocurrency market volatility and facilitate cross-border transactions. While Tether has been a critical player in the crypto ecosystem, it has also faced controversies regarding the transparency of its reserves.

Tether (USDT) has become one of the most significant assets in the cryptocurrency market, providing traders with stability amid the wild volatility of cryptocurrencies like Bitcoin and Ethereum. Launched as the first stablecoin, Tether offers a unique proposition — maintaining a 1:1 peg with the U.S. dollar, making it an essential tool for anyone involved in crypto trading or decentralized finance (DeFi).

In this article, we’ll look the details of Tether, analyzing how it works, its pros and cons, risks, and practical advice for both beginners and advanced traders. Whether you’re new to cryptocurrencies or a seasoned trader, understanding Tether is crucial for optimizing your trading strategies.

What is Tether?

Type of activity: Cryptocurrency issuance (stablecoin).

Region of operation: Global, with headquarters in the British Virgin Islands.

Market capitalization: Over $120 billion (as of October 2024).

Founder: Tether Holdings Ltd., associated with Bitfinex.

USDT (Tether) – A stable cryptocurrency pegged to the U.S. dollar.

Company history

2014: Launch of Tether as the first stablecoin.

2017: Tether became the standard for trading pairs on major exchanges.

2018: Legal scrutiny regarding reserve transparency.

2021: Paid $42.5 million fine due to reserve misrepresentation.

2023: USDT reached a new peak in usage and market cap.

Tether is a type of stablecoin, a cryptocurrency designed to maintain a consistent value. In Tether’s case, each USDT token is pegged to the U.S. dollar at a 1:1 ratio. This means that for every USDT in circulation, Tether Limited claims to hold an equivalent amount of U.S. dollars or other assets in reserve. Tether plays an essential role in cryptocurrency exchanges, facilitating quick Tether USDT transactions without the volatility typically associated with digital assets.

| Name | Tether (USDT) | USD Coin (USDC) | Binance USD (BUSD) | Dai (DAI) |

|---|---|---|---|---|

| Pegged to | 1 USD | 1 USD | 1 USD | 1 USD |

| Issuer | Tether Ltd. | Circle | Binance | MakerDAO |

| Reserves | Fiat, loans | 100% fiat | 100% fiat | Crypto, fiat |

| Transparency | Medium | High | High | Medium |

Interesting facts

In 2021, Tether paid a $42.5 million fine due to misrepresentation of its reserve backing, which raised widespread concerns about its transparency. This was a pivotal moment, highlighting the need for greater regulatory oversight in the stablecoin industry.

Tether has consistently dominated over 60% of stablecoin trading volume, making it an essential tool for liquidity and stability in the cryptocurrency market.

Despite its controversies, Tether USDT is heavily adopted in Decentralized Finance (DeFi), serving as collateral in lending and borrowing protocols.

Learn more interesting facts in our article about Tether's achievements.

How does Tether work?

Tether operates on blockchain technology, using smart contracts to ensure the issuance and redemption of tokens. When new USDT tokens are issued, Tether Ltd. deposits an equivalent amount of fiat currency or other assets into its Tether stablecoin reserves. Conversely, when USDT is redeemed, the tokens are destroyed, ensuring that supply matches demand. This mechanism allows Tether to maintain its peg to the U.S. dollar, a critical function that ensures stability for traders and investors alike.

Tether’s blockchain is public, meaning transaction history is visible, but questions remain regarding the transparency of its reserves. Despite claims of 100% backing, there have been controversies about whether the reserves fully match the USDT in circulation.

Step-by-step guide to buying Tether (USDT)

Choose a platform. Popular exchanges support USDT trading are:

| Demo account | Min. Deposit, $ | Spot Maker Fee, % | Spot Taker fee, % | Foundation year | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 10 | 0,08 | 0,1 | 2017 | Open an account Your capital is at risk. |

|

| No | 10 | 0,25 | 0,4 | 2011 | Open an account Your capital is at risk. |

|

| No | 1 | 0,25 | 0,5 | 2016 | Open an account Your capital is at risk. |

|

| Yes | 1 | 0,1 | 0,2 | 2018 | Open an account Your capital is at risk. |

|

| No | No | 0 | 0 | 2004 | Open an account Your capital is at risk. |

Sign up and verify. Complete the necessary KYC (Know Your Customer) processes required by the exchange.

Deposit funds. You can deposit fiat currency or other cryptocurrencies into your account.

Buy Tether. Search for USDT trading pairs and execute the purchase.

Store your Tether. For safety, store USDT in secure wallets like hardware wallets, or software wallets such as Exodus.

Pros and cons of Tether

Understanding the pros and cons of Tether will help you make informed decisions about when and how to use it effectively, whether you're seeking to manage risk in volatile markets or streamline cross-exchange transactions.

- Pros:

- Cons:

Stability — pegged 1:1 to the U.S. dollar.

Widely accepted across cryptocurrency exchanges and DeFi.

Fast transactions with minimal fees.

Questions over reserve transparency.

Centralized, controlled by Tether Ltd.

No potential for value appreciation, unlike other cryptocurrencies.

Considerations for beginners

For beginners in cryptocurrency, Tether offers a safe entry point. Since it’s pegged to the U.S. dollar, it protects your assets from the extreme volatility of other digital currencies like Bitcoin or Ethereum. It’s an excellent option for those looking to transfer money or hedge during market downturns.

Tips for beginners:

Understand reserve assurance. Blindly believing that Tether holds enough reserves could be risky. Check out recent third-party audits. Sometimes, Tether’s reserves include stuff like commercial paper, not just cash. Make sure you’re okay with this before diving in.

Keep an eye on regulations. Rules around stablecoins can change fast. Check how your local regulators are treating Tether. A sudden legal change might mess with how easy it is to use USDT.

Liquidity traps during market turmoil. Be cautious about using Tether when the market is crashing. Even if Tether usually stays stable, exchanges might have liquidity issues. Think about a backup plan if things get messy.

Transaction fees vary by blockchain. Tether runs on different blockchains, and fees aren’t the same everywhere. Using Tether on Tron can be cheaper than on Ethereum, but low fees might come with added risks. Pick your network wisely.

Cautiously trust DeFi. DeFi can give you tempting returns when using Tether, but it’s not all sunshine and rainbows. Be on the lookout for smart contract risks. Even popular DeFi platforms can get hacked. Spread out your funds and consider using insurance if you can.

How much can you earn with Tether?

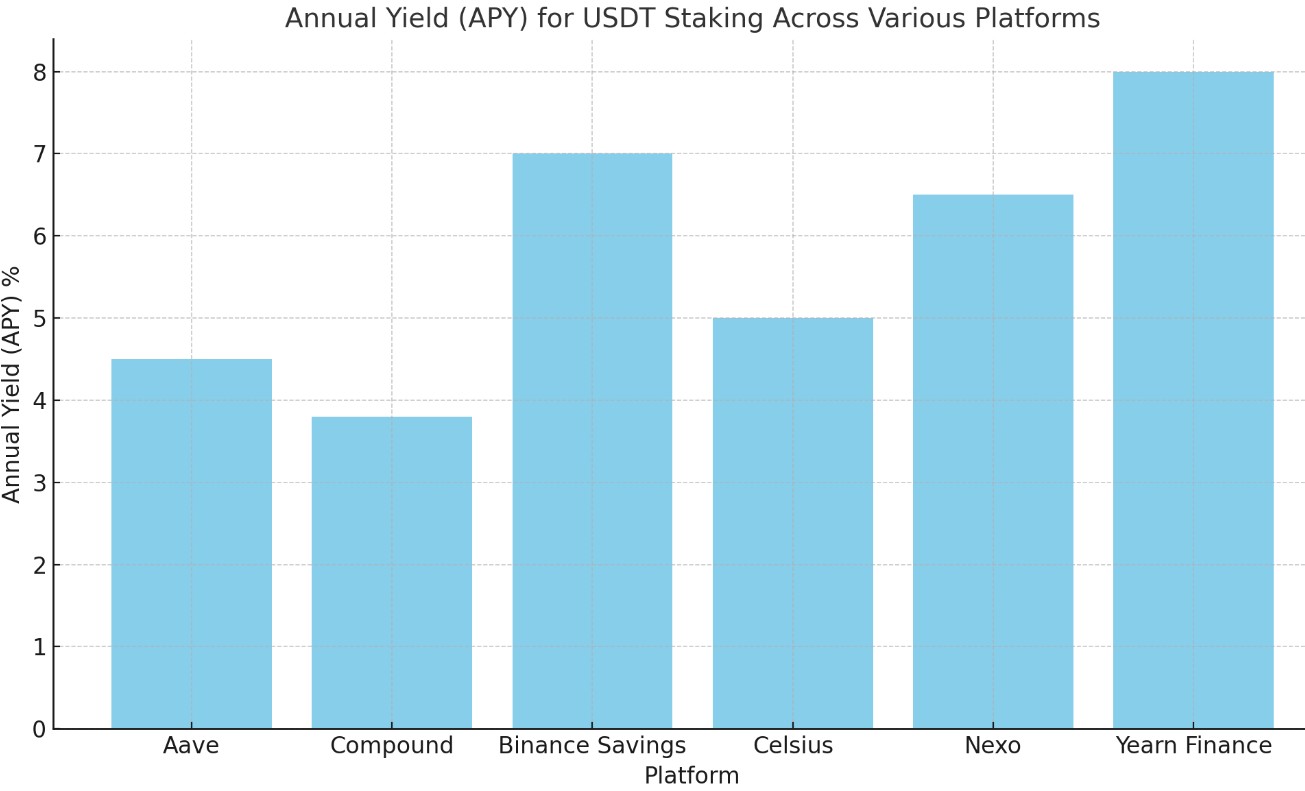

Tether itself doesn’t offer direct profits since it is designed to maintain a stable value. However, traders can still use USDT in a variety of ways to generate income. For example, staking USDT on DeFi platforms like Aave or Compound can yield interest, often ranging between 3-8% annually depending on the platform.

Here is a bar chart showing the annual yield (APY) for USDT staking across various platforms, including Aave, Compound, Binance Savings, Celsius, Nexo, and Yearn Finance. This visual provides a comparison of how much interest you can earn on these platforms by staking your USDT. If you are looking to earn free USDT, USDT faucets provide a fun and easy way to earn crypto for free without any financial investment.

Risks and warnings

Tether presents some risks that all traders should be aware of:

Regulatory scrutiny. Tether has been involved in multiple legal disputes, which have raised concerns about its long-term sustainability. For example, in 2021, Tether was fined for misrepresenting its reserves.

Centralization. Tether is managed by a single entity, which means it doesn’t have the decentralized security advantages of Bitcoin or Ethereum. If Tether Ltd. faces operational issues, USDT’s peg to the dollar could be affected.

Market dependency. Since Tether plays such a massive role in the crypto market, a failure in its stability could have ripple effects on exchanges and DeFi platforms.

Unique insights and key risks every beginner should know

For beginners looking at Tether (USDT) in 2025, here’s something you might not hear every day. Tether isn’t just about being “a stablecoin” — it’s a lifeline in places where regular banking is a mess. If you’re thinking about using USDT, consider how it’s a real financial safety net in regions facing inflation or shaky banking systems. Knowing how and why people rely on Tether, especially in parts of Latin America or Africa, can help you understand how it impacts global markets. This isn’t just about parking your money but being aware of how USDT fills huge financial gaps, which is something that drives its market demand.

Here’s another thing to keep in mind: Tether’s risks go beyond whether it’s fully backed by reserves. What could shake things up faster is how governments worldwide regulate it. Picture this: Tether could be fine one day, then face restrictions the next. So, if you’re using USDT, it’s smart to keep an eye on policy changes. Check Tether’s reports to see what kind of assets back it up — if those assets look risky, think about moving your funds or diversifying before any surprises hit. It’s not just a digital dollar; it’s a tool that could change based on what the world throws at it.

Conclusion

Tether (USDT) is a crucial asset in the cryptocurrency world, serving both beginners and advanced traders with stability and liquidity. With growing Tether stablecoin adoption, it plays a pivotal role in the market. However, it's essential to weigh its benefits against potential risks, particularly surrounding reserve transparency and regulatory scrutiny. For anyone looking to engage with the cryptocurrency market, Tether remains an invaluable tool — just make sure you stay informed about its evolving regulatory landscape and the broader crypto ecosystem.

FAQs

How does Tether maintain its peg to the U.S. dollar?

Tether Ltd. holds reserves in U.S. dollars and other assets that back each USDT token, ensuring a 1:1 peg to the U.S. dollar.

Can Tether be used for everyday payments?

Yes, Tether can be used for peer-to-peer payments, international transfers, and even as collateral in DeFi protocols.

What are the risks of using Tether?

While Tether provides stability, its centralized nature and legal challenges make it riskier than some decentralized alternatives.

What happens if I send Tether (USDT) to the wrong blockchain network?

If you send USDT to the wrong blockchain network (e.g., sending USDT on Ethereum to a Bitcoin address), you risk losing your funds permanently unless the wallet provider supports cross-chain recovery.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.