Motley Fool Overview 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Motley Fool is a well-known financial and investment advisory service founded in 1993 by brothers David and Tom Gardner. They offer stock picks, investment research, and educational content through services like Stock Advisor and Epic. Their goal is to make investing simple and accessible for everyone.

The Motley Fool is a multimedia financial services company that provides various investment solutions, including stock recommendations, analysis, and educational resources. Known for its flagship subscription services like Stock Advisor and Epic (last known as Rule Breakers till 7/22/2024). The Motley Fool aims to help investors achieve long-term financial success. In this article, we'll explore what The Motley Fool offers, how to use it effectively, and answer common questions to help you understand the platform and its service offerings better.

What is the Motley Fool?

The Motley Fool, founded in 1993 by brothers David and Tom Gardner, offers investment advice through articles, books, a podcast, radio shows, and premium subscription services. The platform focuses on long-term investing, providing stock recommendations, market analysis, and investment education.

Fool.com homepage

Fool.com homepageAside from catering to individual investors, The Motley Fool also provides resources and insights for institutional investors and financial advisors . The platform covers a wide array of financial topics, from stock market trends and individual stock analysis to broader economic insights and personal finance advice. It offers several premium subscription services, such as Stock Advisor, Epic Plus and Food Portfolios, designed to help investors make informed decisions.

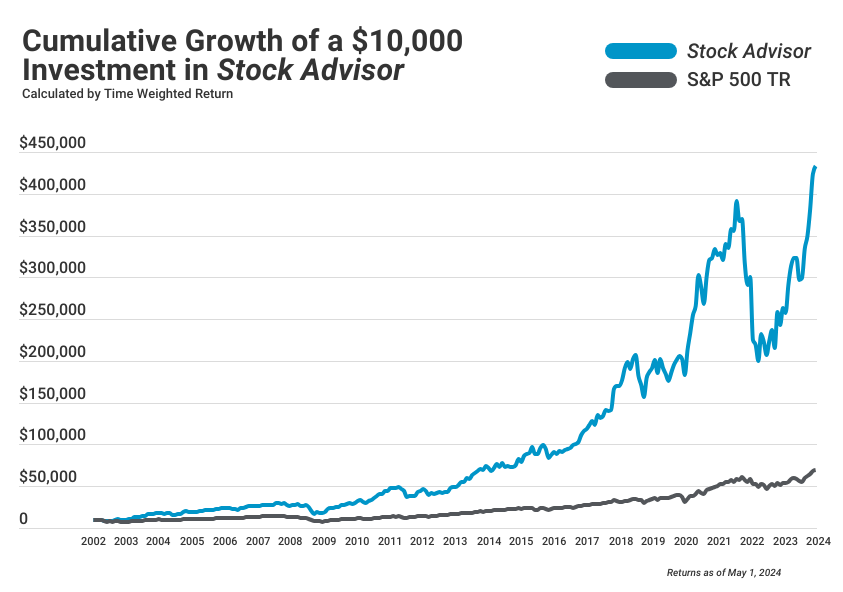

Performance of stock advisor compared to S&P 500

Performance of stock advisor compared to S&P 500One stand-out feature of The Motley Fool is its focus on fundamental analysis and long-term growth potential , rather than short-term market fluctuations. This strategy aims to help investors build wealth over time by investing in high-quality companies with strong growth prospects. Notably, the platform has a track record of identifying successful investment opportunities, with some of its stock recommendations significantly outperforming the market over the years.

Basic features of Motley Fool

The Motley Fool is an investment advice platform that connects individual investors with market insights and stock recommendations. They offer subscription services like Stock Advisor, Epic, Epic Plus and Food Portfolios, where investors get selected stock picks and strategies aimed at long-term growth. Also, you can use additional services, like Top Motley Fool Stock and Stock Recommended by Stock Advisor $100/per 1 report. These services are ideal for those committed to long-term investing and interested in detailed financial analysis. Subscribers receive in-depth research, performance tracking, and various investment strategies tailored to different risk profiles.

The Motley Fool also provides a wealth of educational resources and market analysis through articles, books, podcasts, and other media. This content helps investors of all levels understand market dynamics, economic trends, and effective investment strategies. Prospective investors can explore free content to judge the platform's value before subscribing to premium services.

To subscribe, investors choose a service that matches their investment goals, whether it's growth stocks, dividend stocks, or options trading. Subscribing unlocks detailed stock reports, investment newsletters, and exclusive content. The Motley Fool advocates for a long-term investment approach, encouraging members to stay invested through market ups and downs to achieve significant returns.

When you subscribe to a premium service, you start receiving regular updates and stock picks . The Motley Fool's analysts thoroughly evaluate each recommendation, looking at financial health, competitive advantage, growth potential, and market position. These recommendations come with comprehensive reports and analysis, helping investors make well-thought decisions.

Key facts:

Investment Advice Platform: The Motley Fool provides investment advice, market insights, and stock recommendations.

Subscription Services: Offers services like Stock Advisor, Epic, Epic Plus and Food Portfolios for selected stock picks and long-term growth strategies.

Target Audience: Ideal for long-term investors interested in detailed financial analysis and various investment strategies.

Educational Resources: Provides articles, books, podcasts, and other media to help investors understand market dynamics and effective strategies.

Service Selection: Investors choose services based on their goals, such as growth stocks, dividend stocks, or options trading.

Premium Content: Subscribers get detailed stock reports, newsletters, and exclusive content.

Long-Term Approach: Advocates for staying invested through market fluctuations to achieve significant returns.

Analyst Recommendations: Thoroughly evaluated stock picks based on financial health, competitive advantage, growth potential, and market position, accompanied by comprehensive reports and analysis.

How to earn with the Motley Fool

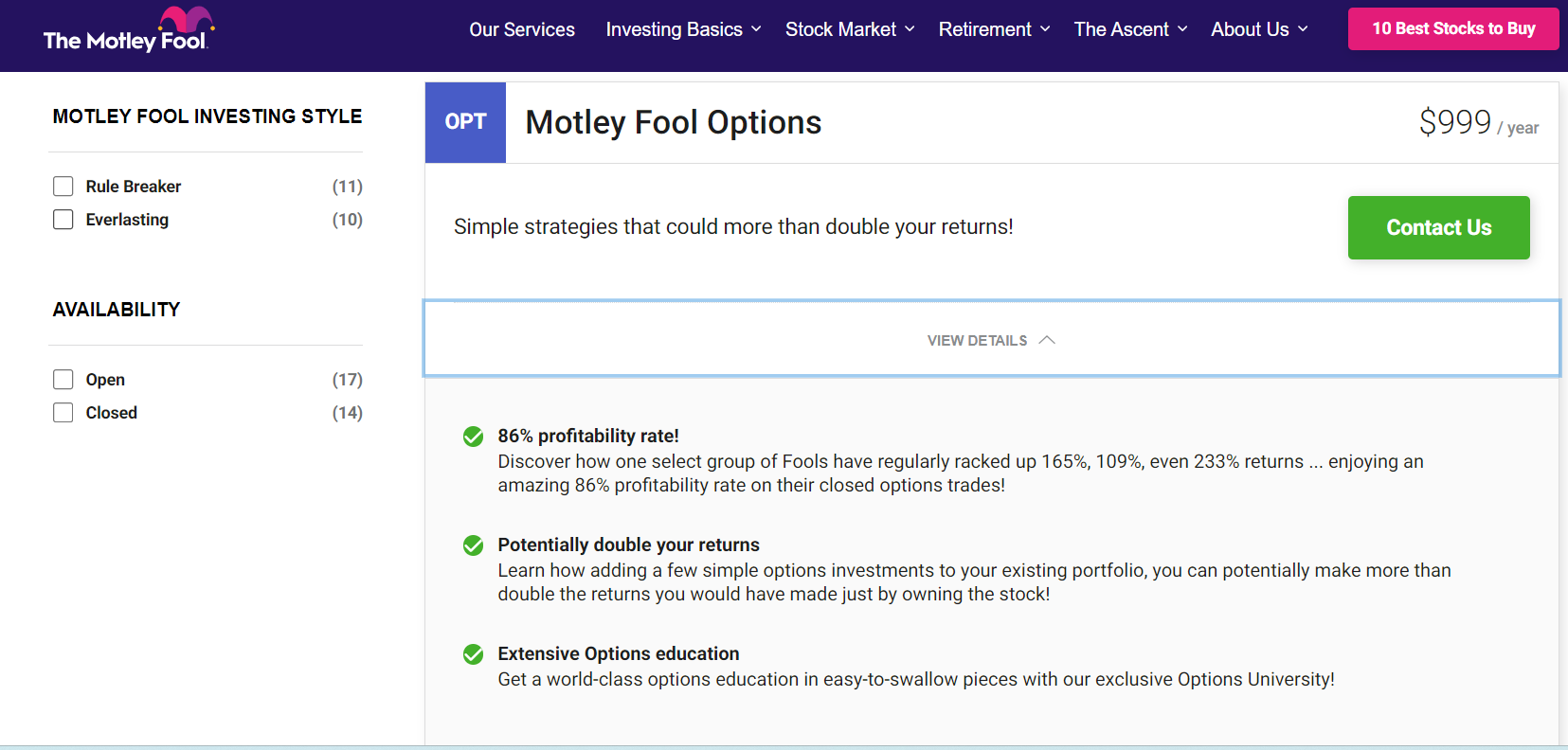

The Motley Fool helps investors make smarter decisions by offering expert stock tips, market insights, and educational materials. Here's a look at how you can benefit from their main services, Stock Advisor, Epic, Epic Plus and Food Portfolios.

Stock Advisor

One of The Motley Fool's flagship services, Stock Advisor, is highly regarded for its consistent performance and practical investment advice. This subscription service provides monthly stock picks, in-depth research, and long-term investment strategies aimed at helping investors grow their wealth.

Overview: Stock Advisor offers two new stock recommendations each month, along with ten starter stocks and foundational investing principles to build a robust portfolio.

Benefits: The service focuses on high-quality, high-growth companies with strong fundamentals. Investors receive regular updates and guidance, making it easier to stay informed and make strategic decisions.

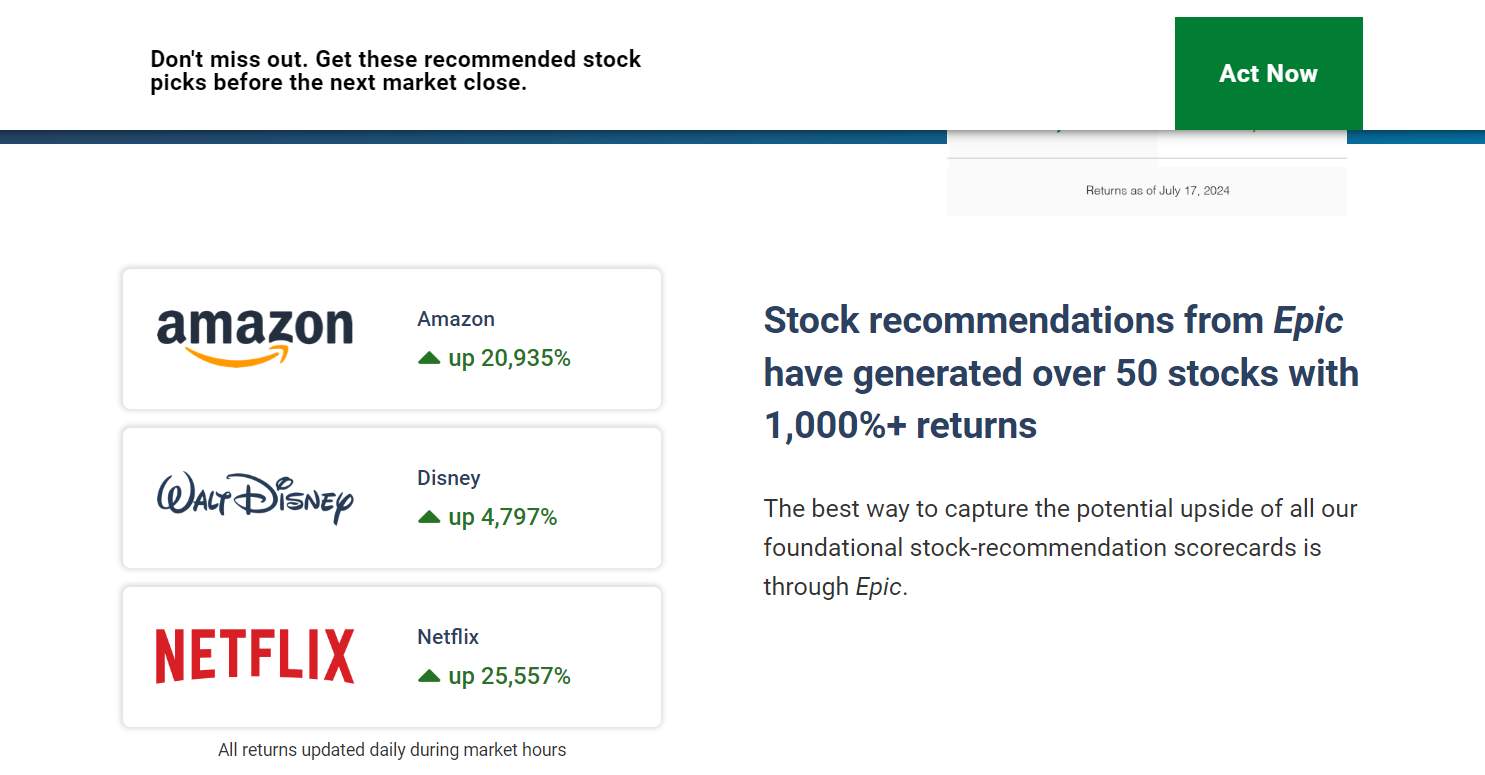

Epic (Rule Breakers)

The Epic service targets high-growth stocks that have the potential to become market leaders. This approach involves identifying and investing in innovative companies that are poised for substantial growth.

Overview: Epic provides monthly stock picks focused on companies that break the traditional rules of investing but show immense growth potential. These are typically disruptive businesses in emerging industries.

Benefits: This service is ideal for investors looking to diversify their portfolios with dynamic, high-potential stocks. Epic emphasizes companies with strong competitive advantages, visionary leadership, and substantial market opportunities.

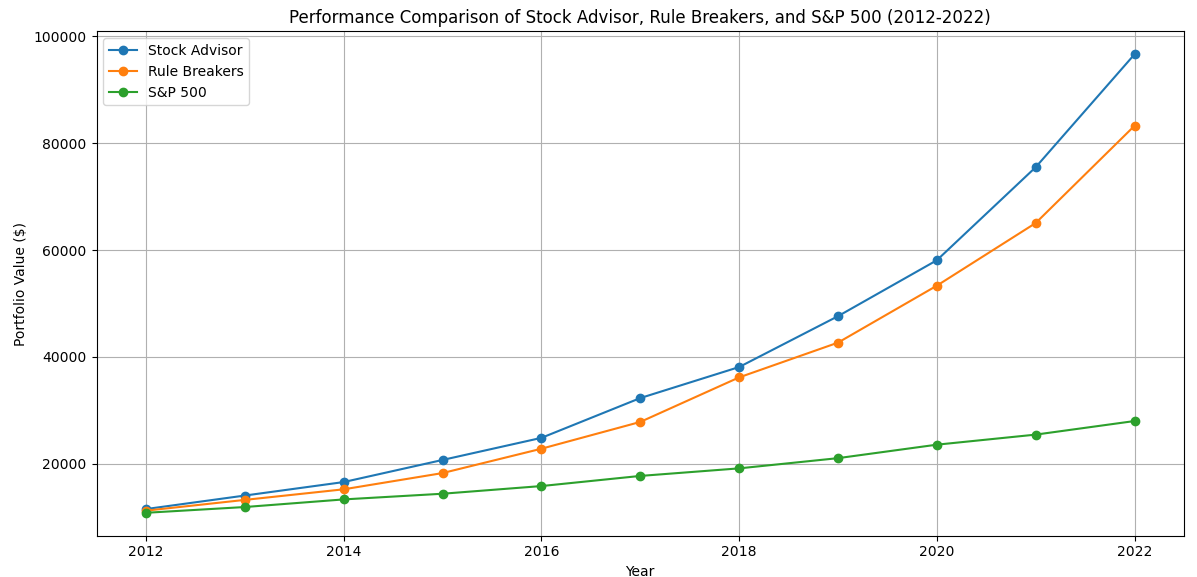

To illustrate the effectiveness of The Motley Fool’s services, consider the following hypothetical chart showing the growth of a $10,000 investment in Stock Advisor and Epic compared to the S&P 500 over the past decade. This visual representation helps visualize and better compare the potential benefits of following The Motley Fool’s expert recommendations.

Performance Comparison Chart

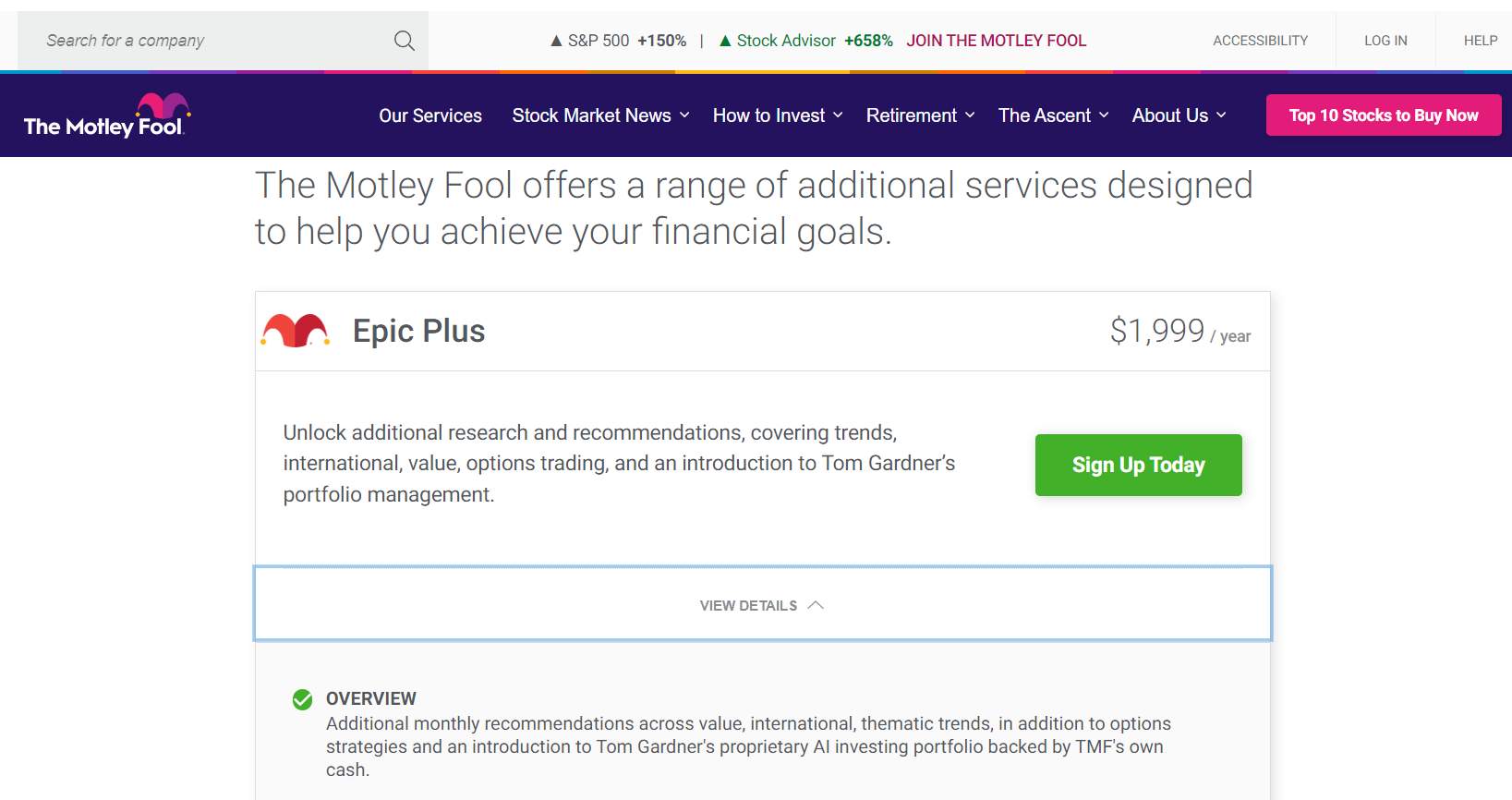

Performance Comparison ChartEpic Plus

Everlasting Stocks is designed for investors looking for durable, long-term investment opportunities in companies with proven track records and sustainable growth prospects. This service provides recommendations for stocks that are expected to deliver consistent returns over extended periods, making it ideal for those who prefer a more stable investment approach.

Key features:

Monthly Stock Picks: 9

Includes everything in Stock Advisor & Epic

Monthly recommendations and rankings across Trends, Value Hunters, Global Partners

Real Money Portfolios: Tom Gardner’s portfolios in Moneymakers

Option Trades

Additional articles and earnings coverage

Fool Portfolios

Fool Portfolios offers full access to Tom Gardner’s suite of portfolios, additional real-money portfolios, and ongoing research on microcaps and digital assets.

Key features:

Monthly Stock Picks: 11+

Includes everything in Stock Advisor, Epic, & Epic Plus

Additional Real Money Portfolios managed by top advisors

Monthly recommendations and rankings across Firecrackers and Digital Explorers

Investor Solutions Team Access

Additional articles and earnings coverage

Fool One

Fool One provides a comprehensive view of all Motley Fool recommendations and research with the One Portfolio, exclusive events, early access to new tools, and wider access to the Investing Team.

Key features:

Monthly Stock Picks: 11+

Includes everything in Stock Advisor, Epic, Epic Plus, & Fool Portfolios

Quarterly Rebalancing: Access to the One Portfolio

All Access: Full access to reports

Member Event Access: Preferred access to events and experiences

Investor Solutions Team Access

Full Industry Research: Regular in-depth reports and full company and market coverage

| Service name | Overview | Suggested Portfolio Size | Monthly stock picks | Key features | Price |

|---|---|---|---|---|---|

| Stock Advisor | Introduction to investing philosophy with monthly stock recommendations and financial planning guidance | $25,000+ | 2 | Monthly stock picks, recommendations for long-term holding, financial hub, planning articles | $199 / year |

| Epic | Mix of growth, dividend, and under-the-radar stocks with additional analytics and research tools | $50,000+ | 5 | Monthly picks from multiple services, Fool IQ, financial hub, quant scoring system, members-only podcast | $499 / year |

| Epic Plus | Expanded recommendations covering trends, international, value, options trading, and proprietary AI investing portfolio | $100,000+ | 9 | Includes everything in Stock Advisor & Epic, additional value and international stocks, options trades | $1,999 / year |

| Fool Portfolios | Full access to Tom Gardner’s portfolios and specialized research on microcaps and digital assets | $250,000+ | 11+ | Includes everything in Stock Advisor, Epic, & Epic Plus, additional real money portfolios, white-glove service | $3,999 / year |

| Fool One | Comprehensive view of all recommendations and research, exclusive events, early access to tools, and full team support | $500,000+ | 11+ | Includes everything in Stock Advisor, Epic, Epic Plus, & Fool Portfolios, quarterly rebalancing, full access to reports | $13,999 / year |

Is the Motley Fool safe?

The Motley Fool has built a reputation for reliability and transparency over the years. While no investment platform is entirely without risk, The Motley Fool's emphasis on research and long-term investing reduces the likelihood of significant losses.

- Pros

- Cons

- Extensive research and analysis

The Motley Fool is known for its comprehensive research and detailed analysis of stocks. This approach aims to identify high-quality investment opportunities, helping to mitigate risks associated with impulsive or uninformed trading. - Long-term investment focus

The platform advocates for long-term investing, which historically has shown to reduce the impact of market volatility. This strategy helps investors ride out short-term market fluctuations and potentially achieve substantial returns over time. - Transparent record

The Motley Fool maintains a high level of transparency regarding its stock recommendations and performance. With a strong track record of outperforming the market, the platform demonstrates its reliability and effectiveness.

- Market risk

Like any investment, recommendations from The Motley Fool are subject to market risks. Economic downturns, company-specific issues, and other market factors can impact the performance of the recommended stocks. - Subscription costs

Access to premium services like Stock Advisor and Epic requires a subscription fee. While these services provide valuable insights, the cost may be a barrier for some investors. - Not a guaranteed success

Despite the thorough research and historical success, The Motley Fool's recommendations are not a guarantee of success. Investors should perform their own due diligence and consider their individual risk tolerance.

How much money do I need to start?

The Motley Fool's subscription services vary in price. For example, Stock Advisor is priced at $199 per year and the One: Full Access pack costs $13,999 per year, though they often offer discounts. There's no minimum investment amount required to use their services, but you will need to have capital to invest in the recommended stocks.

How to start using Motley Fool: a step-by-step guide

By following these steps, you'll be on your way to using Motley Fool's advice to make smart investment choices.

Step 1: Visit the Motley Fool website

Open your web browser and go to the Motley Fool's official website. Familiarize yourself with the homepage and the various sections available, such as Stock Advisor, Epic, and other investing services.

Visit the Motley Fool website

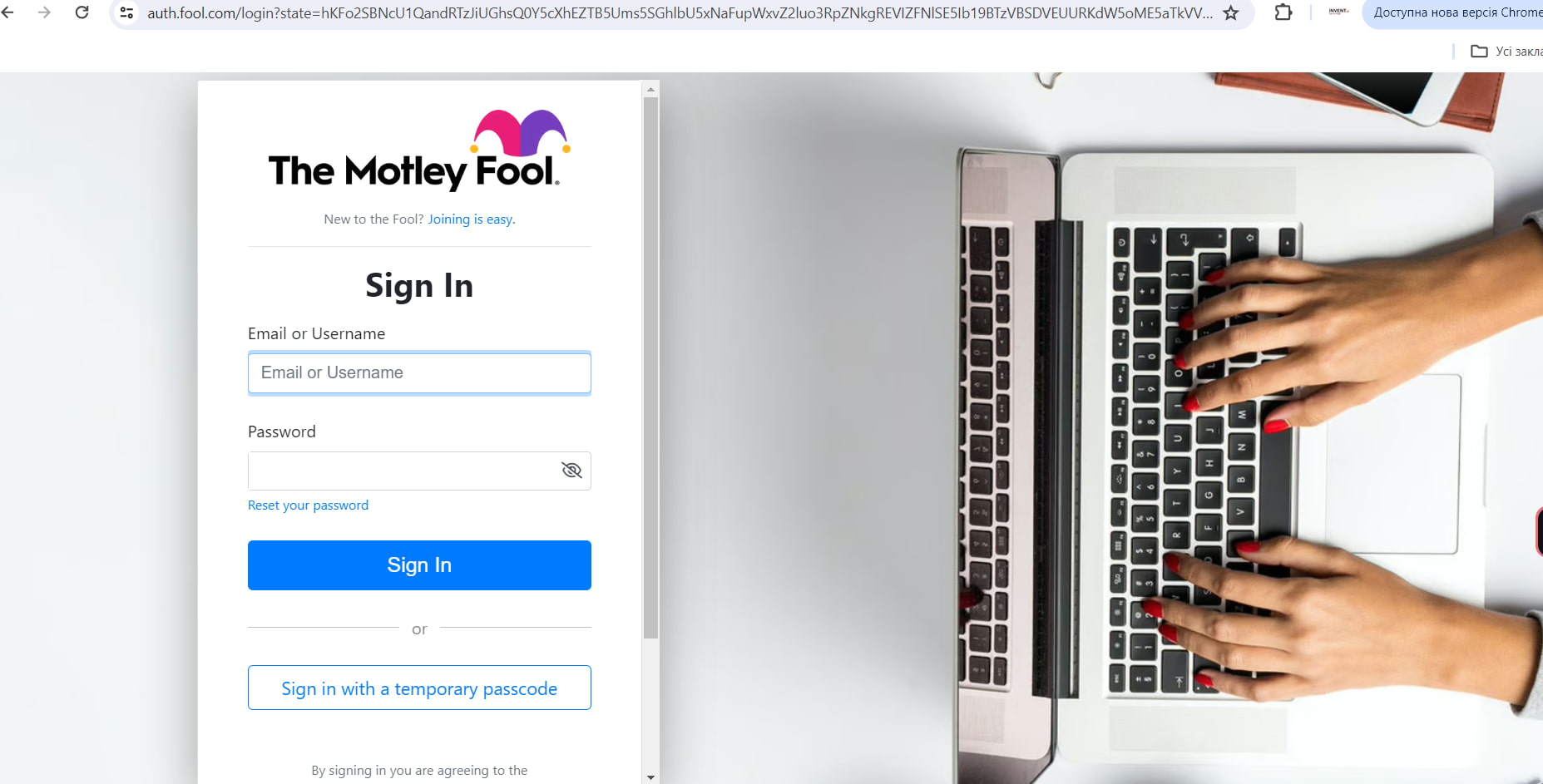

Visit the Motley Fool websiteStep 2: Create an account

1. Click on the "Join" or "Sign Up" button, typically located at the top right corner of the homepage.

Create an account

Create an account2. Fill in the required information, such as your name, email address, and password.

3. Confirm your email address through the verification link sent to your email.

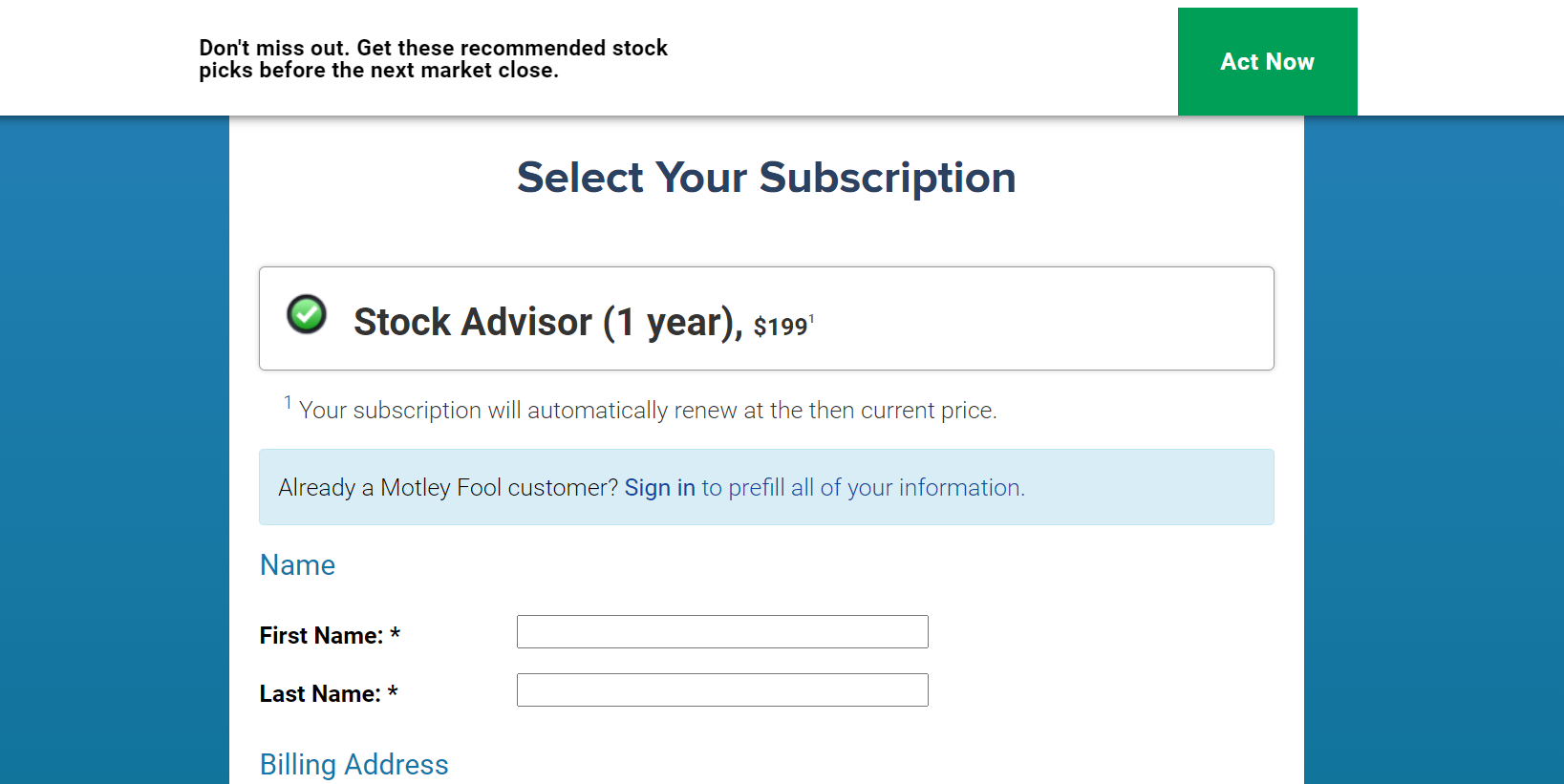

Step 3: Choose a subscription plan

1. Browse through the available subscription plans, such as Stock Advisor, Epic, Epic Plus or Food Portfolios.

Choose a subscription plan

Choose a subscription plan2. Select the plan that best fits your investment goals and budget.

3. Click on the "Subscribe" button for your chosen plan.

Step 4: Complete the payment process

1. Enter your payment information, such as credit card details or PayPal account.

2. Review your order to ensure all details are correct.

3. Click on the "Submit" or "Complete Purchase" button to finalize your subscription.

Step 5: Access your subscription content

1. Once your payment is processed, log in to your Motley Fool account.

2. Navigate to the "My Services" section to access your subscribed content.

3. Explore the stock recommendations, research reports, and other resources available to you.

Step 6: Set Up email alerts

1. Go to the "Account Settings" or "Preferences" section of your profile.

2. Enable email alerts for stock recommendations, market updates, and other notifications.

3. Customize your alert preferences to suit your information needs.

Step 7: Start researching and investing

Use Motley Fool’s stock picks and insights to shape your investment portfolio. Check out their articles and resources to get a better grasp of investing techniques. Keep an eye on new updates and stock suggestions to stay up-to-date.

Step 8: Join the community

Participate in Motley Fool's online forums and discussion boards to connect with other investors. Share your insights, ask questions, and learn from the experiences of fellow members.

Step 9: Use additional tools and resources

Explore additional tools and resources offered by Motley Fool, such as stock screeners, investment calculators, and webinars. Take advantage of any free trials or promotional offers for other Motley Fool services to further enhance your investing knowledge.

Expert opinion

In my experience, Motley Fool is a great resource for investors looking for reliable stock advice and analysis. The platform offers valuable insights and expert tips that can help both beginners and experienced investors diversify their portfolios. Services like Stock Advisor and Epic provide stock picks that could potentially bring good returns.

However, it's crucial to remember that stock market investments come with risks. Even though Motley Fool's recommendations are well-researched, they can't guarantee profits, and market fluctuations can affect stock performance. To manage these risks, it's wise to diversify your investments, including stocks, bonds, and ETFs.

Motley Fool excels with its detailed analysis and supportive community, which can guide you in making better investment decisions. Still, it's important to approach any investment strategy thoughtfully and do your own research. Using Motley Fool's advice can be helpful, but knowing your risk tolerance and financial goals is key to achieving long-term success.

Summing up

In conclusion, Motley Fool is a great platform for investors wanting to improve their stock market strategies with insights and recommendations from experts. Their services, like Stock Advisor and Epic, offer valuable tips that can help both newbies and seasoned investors make smart decisions and possibly see good returns.

However, while The Motley Fool can be a fantastic tool for building and managing your investment portfolio, it’s important to invest thoughtfully. Make sure to do your own research, and match your investment strategies with your personal financial goals and risk tolerance. By doing this, you can get the best out of Motley Fool’s resources while successfully tackling the stock market’s ups and downs.

FAQs

What is the Motley Fool?

The Motley Fool is an investment advisory service providing stock recommendations and financial advice.

How does the Motley Fool make money?

They make money through subscription services, advertising, and affiliate partnerships.

What services does the Motley Fool offer?

They offer Stock Advisor, Epic, and various premium investment advisory services.

How much does the Motley Fool cost?

The price varies by service, but Stock Advisor is typically $199 per year.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.