Binary Options Expiry Time Types

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Common binary options expiry times include:

60 seconds

2 minutes

5 minutes

15 minutes

30 minutes

1 hour

end of day

1 week

1 month

In binary options trading, selecting the right expiry time is a critical factor that can significantly influence the outcome of a trade. Each trading instrument and asset requires a tailored approach, and expiry time is a key component in deter mining profitability.

It's important to not only focus on the numbers but also consider market sentiment, timing, and external market factors. Expiry times can vary greatly, and understanding how these variations affect risk and reward is essential for all traders.

Key expiry time divisions for binary options

The expiry times offered by brokers are designed to suit various trading strategies. Common expiry times include:

1 minute: This is the shortest expiry time and is commonly used by traders who want quick results. It requires a high level of focus and precise market analysis, as price fluctuations within such a short period can be unpredictable. Traders using this timeframe often rely on micro-movements and must be prepared for rapid decision-making.

2 minutes: A slightly longer short-term option, the 2-minute expiry time offers a bit more breathing room than the 60-second trades. It allows traders to capitalize on short-term market trends while still requiring swift analysis and action.

5 minutes: Popular among traders who prefer short-term strategies but want to avoid the extreme pressure of 60-second trades. The 5-minute expiry time provides enough time for small price trends to develop and can be useful in highly liquid markets where price shifts occur rapidly.

15 minutes: This medium-term expiry time gives traders more time to assess market movements. It strikes a balance between speed and thorough analysis, making it suitable for those who want to react to market news or intraday trends without the pressure of ultra-short expiry times.

30 minutes: The 30-minute expiry time is ideal for traders who prefer to analyze more significant price movements over a half-hour period. It allows for a more comprehensive review of short-term trends and gives traders the opportunity to observe the market without feeling rushed.

1 hour: The 1-hour expiry time is suited for traders who want to base their trades on clear, observable trends. It allows for a more relaxed approach compared to shorter expiry times and is useful for traders following technical analysis over a one-hour timeframe.

End of day: This expiry time spans the entire trading day, making it popular among traders who focus on daily trends and market sentiment. Traders have the opportunity to study the full day's market activity before the trade expires, which provides a broader perspective on price movements.

1 week: A longer-term option, the 1-week expiry time is commonly used by traders looking to capture more substantial market trends. This allows for a wider analysis of factors affecting the asset over a longer period, such as economic news, earnings reports, or geopolitical events.

1 month: The longest of the commonly offered expiry times, a 1-month option is ideal for traders with a long-term outlook. This timeframe is typically used to capture significant market shifts and requires an in-depth analysis of broader economic and financial trends that may impact asset prices over several weeks.

For shorter expiry times, such as 60-seconds or 5 minutes, traders need to conduct thorough research into market sentiment, as small price movements can greatly impact the outcome. Longer expiry times, lasting days or weeks, require a broader analysis of market trends to ensure that the right decision is made.

Best strategies for different binary options expiry time types

Here's a table outlining the best strategies for different binary options expiry time types:

| Expiry Time | Strategy | Key Indicators | Risk Level |

|---|---|---|---|

| 60 Seconds | Scalping | Bollinger Bands, Moving Averages, RSI | High (due to volatility) |

| 5 Minutes | Trend Following with Momentum | MACD, Stochastic Oscillator | Moderate (short-term trends) |

| 15-30 Minutes | Breakout Trading | Support & Resistance Levels, Volume | Moderate |

| 1 Hour - End of Day | Range Trading | RSI, MACD, Bollinger Bands | Lower (steady markets) |

| Daily - Weekly | Fundamental Analysis with News | Economic Reports, Market Sentiment | Medium to High |

Viewing charts and expiry time

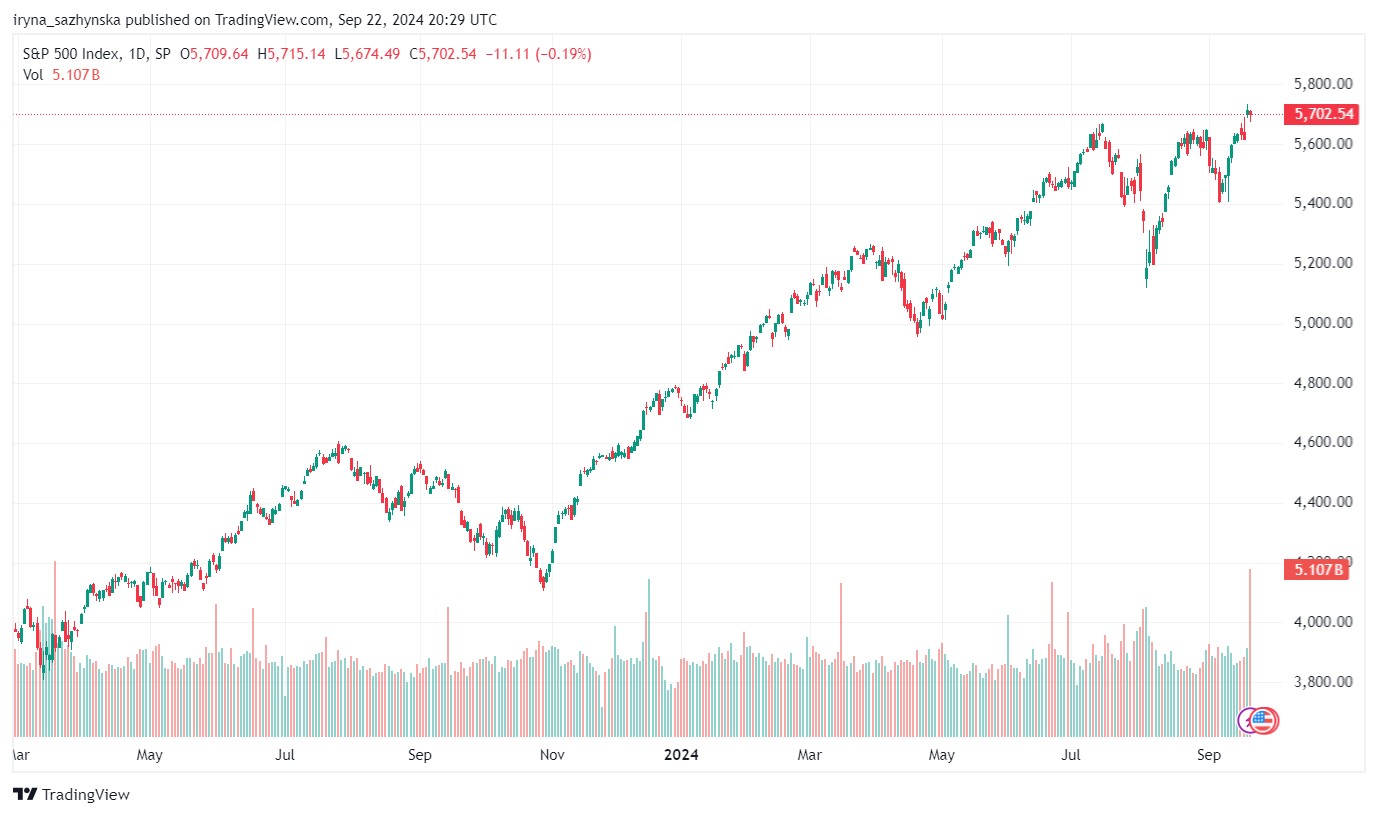

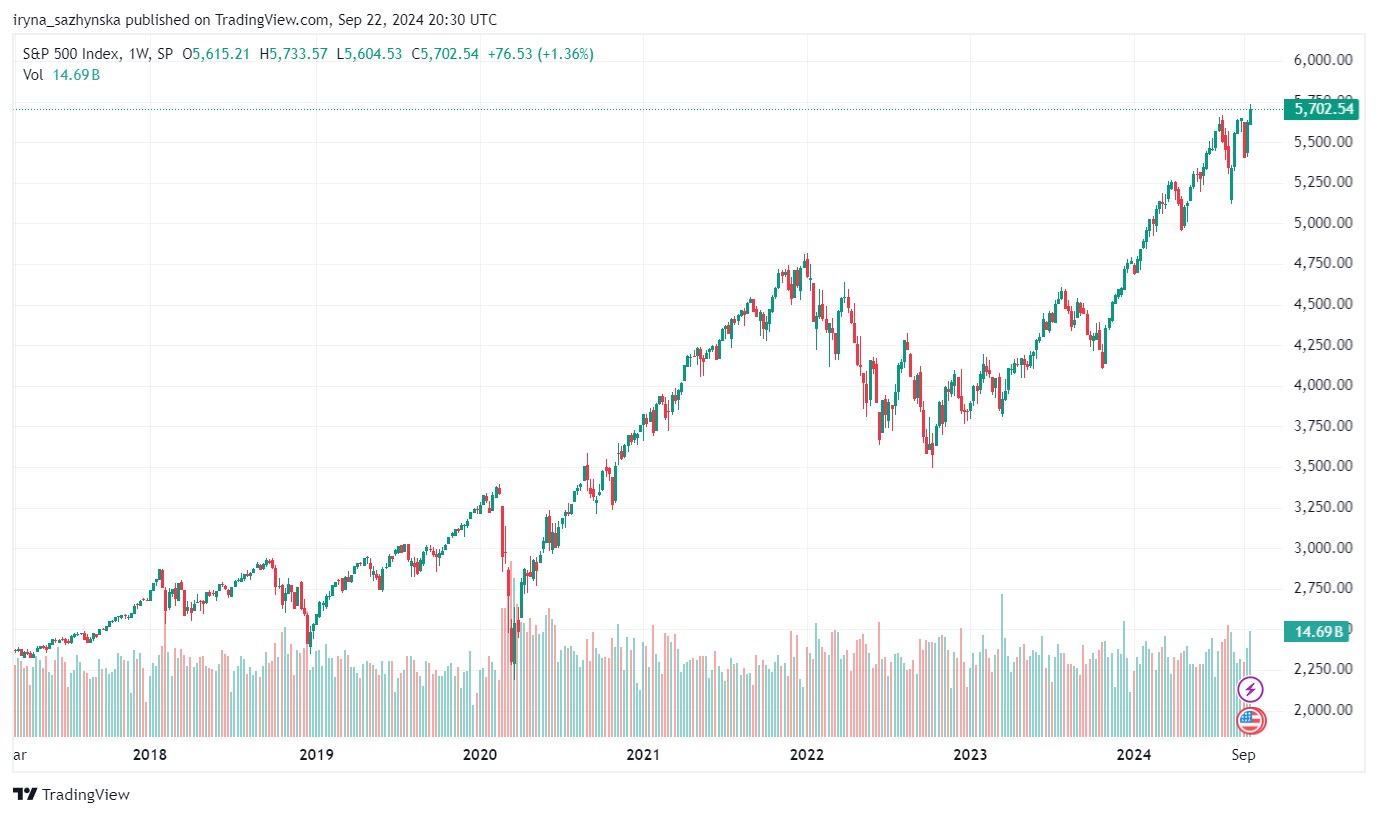

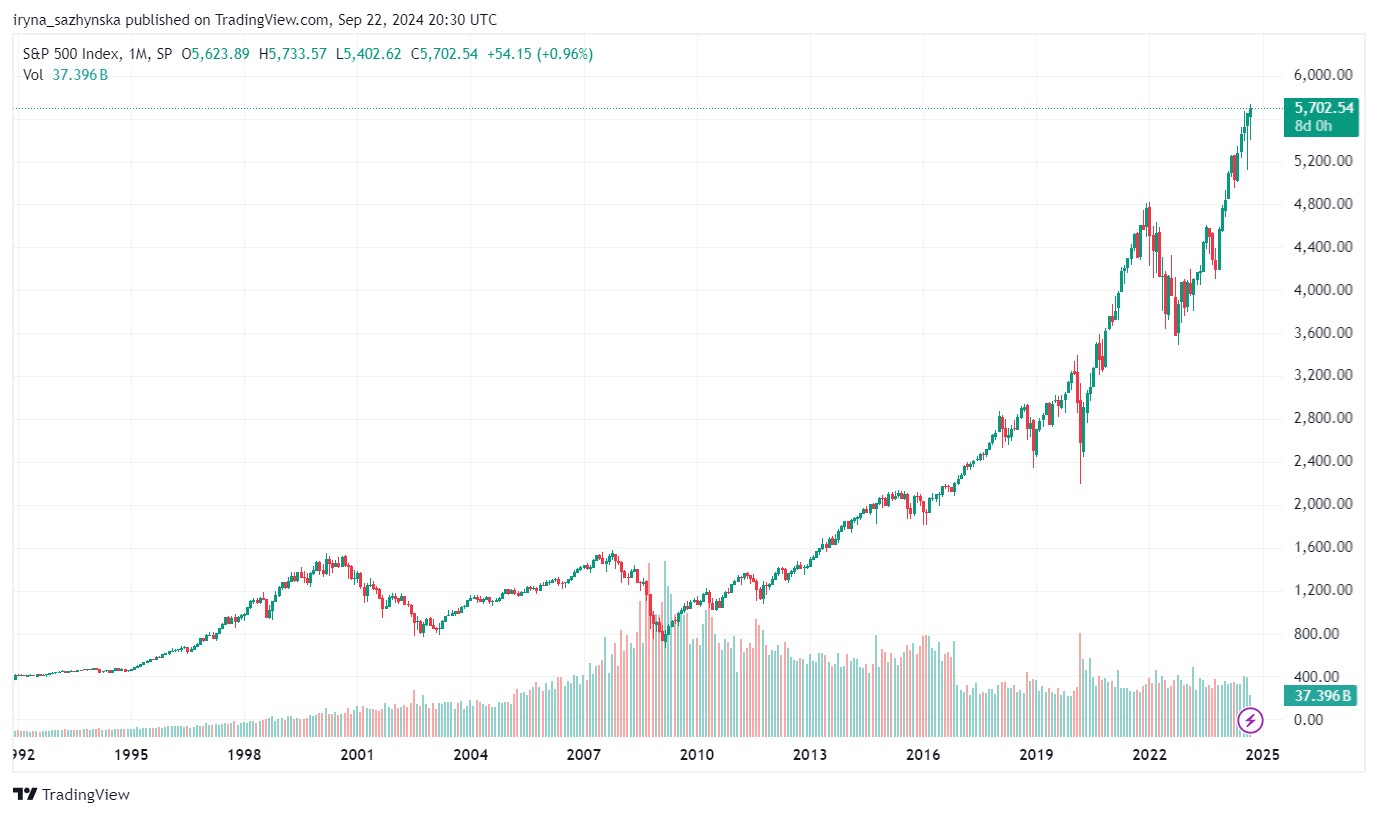

To successfully trade binary options, it’s important to view the charts in line with your chosen expiry time. Professional traders often recommend looking at two timeframes lower than the expiry. This provides a more detailed view of current price action and allows for better decision-making, particularly in terms of how much flexibility the trade has before expiry.

For example, when trading on 30-minute expiries, using 5-minute charts can give a more accurate picture of market trends during that period. Zooming out further provides a broader perspective of market activity, helping to avoid narrow views based on short-term fluctuations.

Zooming out, in general, is an essential practice to get a broader picture of the asset’s behavior over time. Many traders make the mistake of focusing too closely on recent price movements, missing the overall trend. A zoomed-out view provides a clearer understanding of longer-term price patterns, helping traders to make more informed predictions.

The importance of expiry time in binary options trading

Binary options brokers offer a wide range of expiry times, from as short as 60 seconds to trades that last over a weekend or even a month. Shorter expiry times tend to attract traders looking for quick returns, but they also present greater risks due to the unpredictability of short-term market fluctuations. These rapid trades may not provide enough time for significant price movements to occur, making it challenging to predict the market accurately.

In contrast, longer expiry times provide more opportunity to assess broader market trends and often involve more thorough analysis. However, they are not without risk, as market reversals can occur unexpectedly before the trade concludes.

Traders must carefully evaluate their risk tolerance and strategy when selecting an expiry time. Beginners often gravitate towards shorter times for quick profits, but experts suggest starting with longer expiry times to reduce impulsive decisions and gain a better understanding of market movements.

But before that, it is important to choose a binary broker that suits you. We have analyzed the advantages of several brokers, and here are their conditions.

| Foundation year | Min. deposit | Min. trade size | Min. Payout (%) | Max. Payout (%) | Demo | Copy trading | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 2013 | 5 | 1 | 17 | 95 | Yes | No | Open an account Your capital is at risk. |

|

| 2017 | 100 | 0.01 | 70 | 95 | Yes | Yes | Open an account Your capital is at risk. |

|

| 2017 | 5 | 1 | 50 | 128 | Yes | Yes | Open an account Your capital is at risk. |

|

| 2009 | 250 | 1 | No | 100 | Yes | No | Study review | |

| 2014 | 250 | 0.01 | 70 | 95 | Yes | Yes | Open an account Your capital is at risk. |

The importance of choosing the right expiring time

From my point of view, one of the most important aspects of choosing an expiry time is ensuring that it aligns with your trading strategy. For example, if you’re a beginner, starting with longer expiry times allows you to familiarize yourself with market movements and reduce the risk of losing money on quick, impulsive trades.

An often-overlooked technique is using two chart timeframes lower than the expiry time. This gives you a precise view of both current price action and how much room your trade has before expiration. If you’re trading on a 30-minute expiry, for instance, viewing 5-minute charts will give you the clarity needed to make well-informed decisions.

Conclusion

The choice of expiry time can make or break a binary options trade. Success in binary options trading isn’t just about making quick decisions — it's about understanding the asset, reading market sentiment, and timing your trades strategically. By zooming out, using the right charts, and aligning expiry times with your trading style, you increase your chances of making profitable trades.

For traders, understanding how to manage expiry times is essential to mastering binary options. As you progress, you’ll find that the right expiry time, coupled with careful market analysis, can lead to more consistent results.

FAQs

What is the best expiry time for beginners?

Beginners should consider longer expiry times, such as one hour or end-of-day, as they provide more time to analyze market trends and reduce the risk of impulsive trading.

How do I choose the right expiry time?

The right expiry time depends on your trading style and risk tolerance. Short-term traders may prefer shorter times like 5 minutes, while long-term traders might opt for expiry times lasting a day or longer.

Why is zooming out important in binary options trading?

Zooming out gives you a broader perspective of market trends, allowing you to make more informed decisions. It helps avoid the pitfalls of focusing too narrowly on short-term price movements.

Can I use the same expiry time for all assets?

No, different assets behave differently based on market conditions. It's important to tailor your expiry time to the specific asset and its typical price movements.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

The Stochastic Oscillator is a technical indicator used in financial analysis to gauge the momentum of a security's price and identify overbought or oversold conditions by comparing the closing price to a specified price range over a defined period.

Bollinger Bands (BBands) are a technical analysis tool that consists of three lines: a middle moving average and two outer bands that are typically set at a standard deviation away from the moving average. These bands help traders visualize potential price volatility and identify overbought or oversold conditions in the market.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.