How To Buy U.S. Stocks In Pakistan: A Comprehensive Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Here’s how you can buy U.S. stocks in Pakistan:

Investing in U.S. stocks has become a go-to option for many Pakistani investors. The idea of owning a piece of companies like Apple, Microsoft, and Amazon, combined with the potential for good returns, has many people looking to get involved. But buying U.S. stocks from Pakistan isn’t as simple as clicking a button — you need to understand the regulations, pick the right platforms, and plan your approach. This guide will walk you through how to buy U.S. stocks in Pakistan, whether you’re just starting out or already have some trading experience.

Investing in U.S. stocks from Pakistan

Step 1. Research the market

Start by understanding the U.S. stock market’s basics, including its major indices like the Dow Jones, S&P 500, and NASDAQ. Familiarize yourself with market hours, which differ due to time zone variations.

Step 2. Choose the right broker

Opt for a broker that provides access to U.S. markets. Consider both local and

Regulation. Ensure the broker is regulated by a credible authority.

Fees. Compare transaction costs, spreads, and account maintenance charges.

Account types. Look for options like Islamic or swap-free accounts if needed.

| Available in Pakistan | U.S. Stocks | Demo | Account min. | Min. stock/ETF fee | Withdrawal fee | Foundation year | Regulated | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | 10 | 0,02% | USDT (TRON) - 4 USDT USDT (Ethereum) - 10 USDT | 2020 | No | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | No | £1.00 in the UK, €1.00 in the Eurozone | No charge up to a limit | 2015 | FCA | Study review | |

| Yes | Yes | Yes | No | $1,00 | No | 1978 | SEC, FINRA, CFTC, NFA, IIROC, Central Bank of Ireland (CBI), Central Bank of Hungary (MNB), Securities and Exchange Board of India (SEBI), Japan Securities Dealers Association (JSDA), Monetary Authority of Singapore (MAS) | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | No | Zero Fees | ACH withdrawals are free; domestic wire transfers are $30, international wire transfers cost 30 units of the originating currency | 2003 | CFTC, NFA | Study review | |

| Yes | Yes | No | No | Zero Fees | No | 2013 | SEC, FINRA, Securities Investor Protection Corporation (SIPC) | Study review |

Step 3. Open a trading account

Submit the necessary documentation, such as:

A valid CNIC or passport.

Proof of address (utility bill or bank statement).

Bank details for funding and withdrawals.

Step 4. Fund your account

Deposit funds using methods like bank transfers, credit cards, or digital wallets. Be mindful of exchange rate fluctuations when converting PKR to USD.

Step 5. Research and select stocks

Analyze stocks based on:

Financial metrics such as P/E ratio and dividend yield.

Industry trends and company performance.

Your risk tolerance and investment goals.

Step 6. Execute your first trade

Use your broker’s platform to place an order. Choose between market orders (immediate execution) and limit orders (specific price execution). Start small to minimize risks.

Step 7. Monitor and adjust your portfolio

Regularly review your investments. Use trading apps to track performance and rebalance your portfolio as needed.

Top 5 U.S. stocks for Pakistani traders

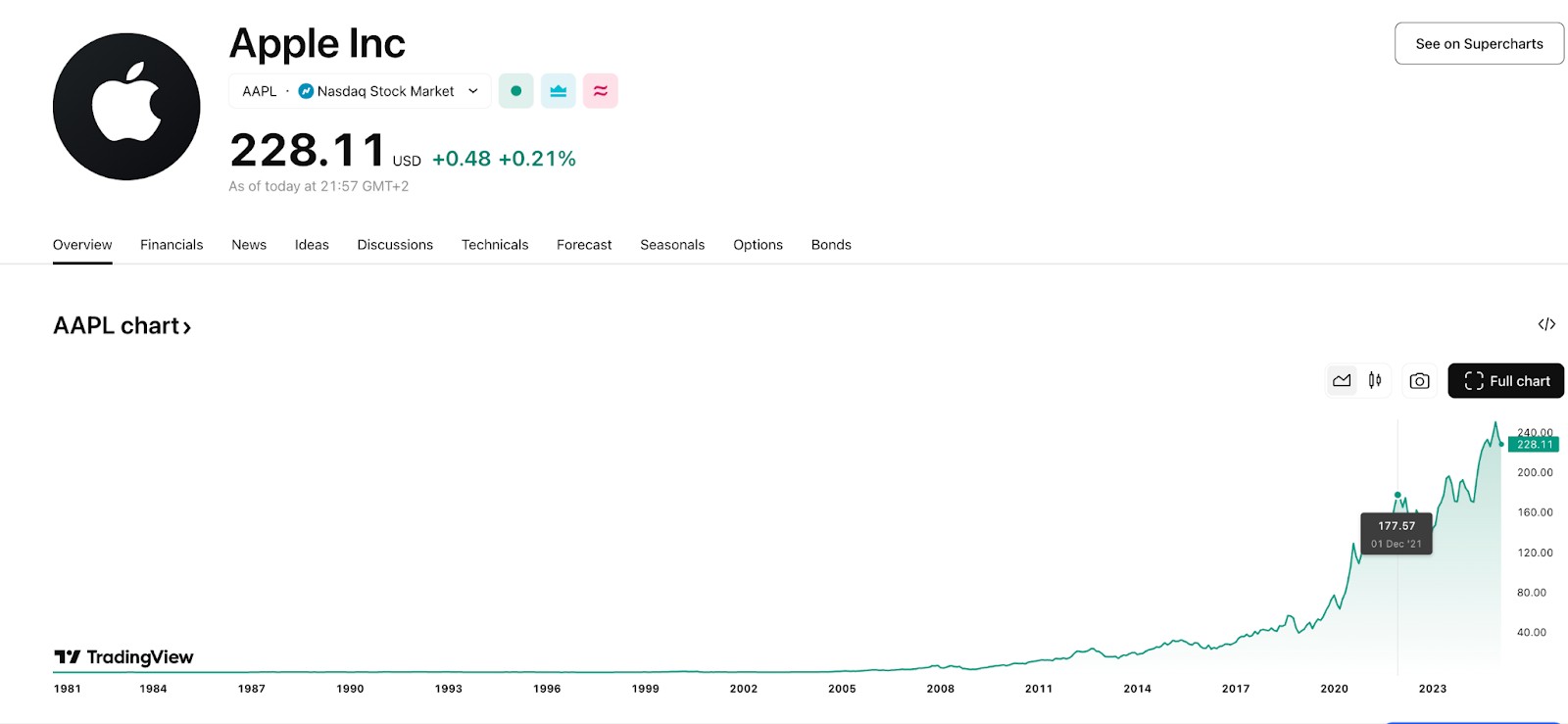

Apple Inc. (AAPL)

Apple Inc. is a well-established name with a market cap over $2.5 trillion, known for its strong product lineup, including the iPhone and Mac computers. The company’s diverse revenue streams, such as the App Store and Apple Music, make it less reliant on a single product, contributing to its stability. Apple also enjoys high customer loyalty, with a retail presence worldwide, ensuring a steady revenue flow.

Why choose Apple:

Diverse income sources. Apple’s income doesn’t just depend on one product; it has a range of hardware, services, and subscriptions to rely on.

Strong customer base. Apple’s customer retention is some of the best in the tech industry, ensuring continued business.

Global reach. With a presence in over 100 countries, Apple’s worldwide reach helps keep revenue consistent.

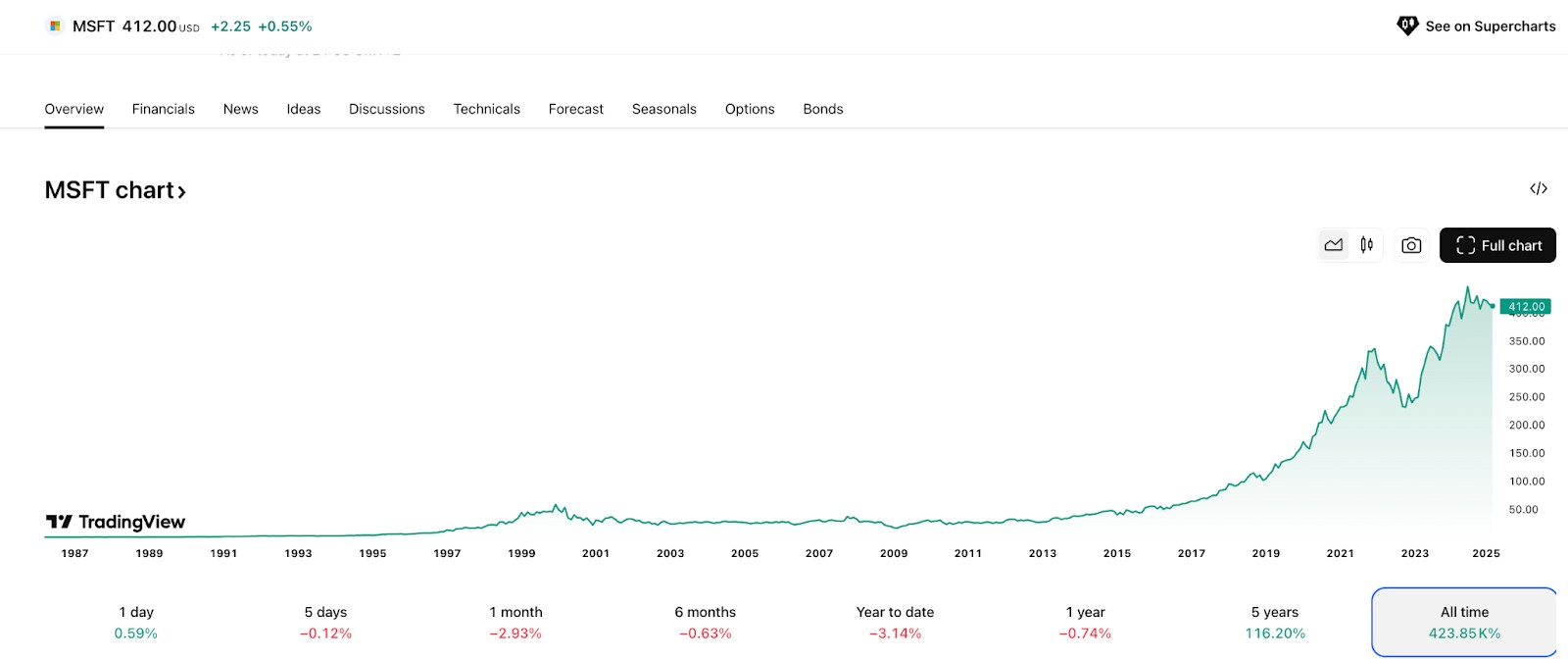

Microsoft Corporation (MSFT)

Microsoft is one of the world’s biggest companies, with a focus on software, gaming, and cloud computing. It leads in cloud services through Azure and offers consistent growth by transitioning many products to subscriptions. With massive investments in AI and cloud technology, Microsoft’s diverse business model continues to show strength, even when other sectors experience difficulty.

Why choose Microsoft:

Cloud services dominance. Azure is a top player in cloud computing, gaining more market share every year.

Steady income from subscriptions. Office 365 and Xbox Game Pass keep Microsoft’s revenue stable over the long term.

Forward-looking AI investments. Microsoft’s heavy investments in AI ensure it remains competitive in the tech space.

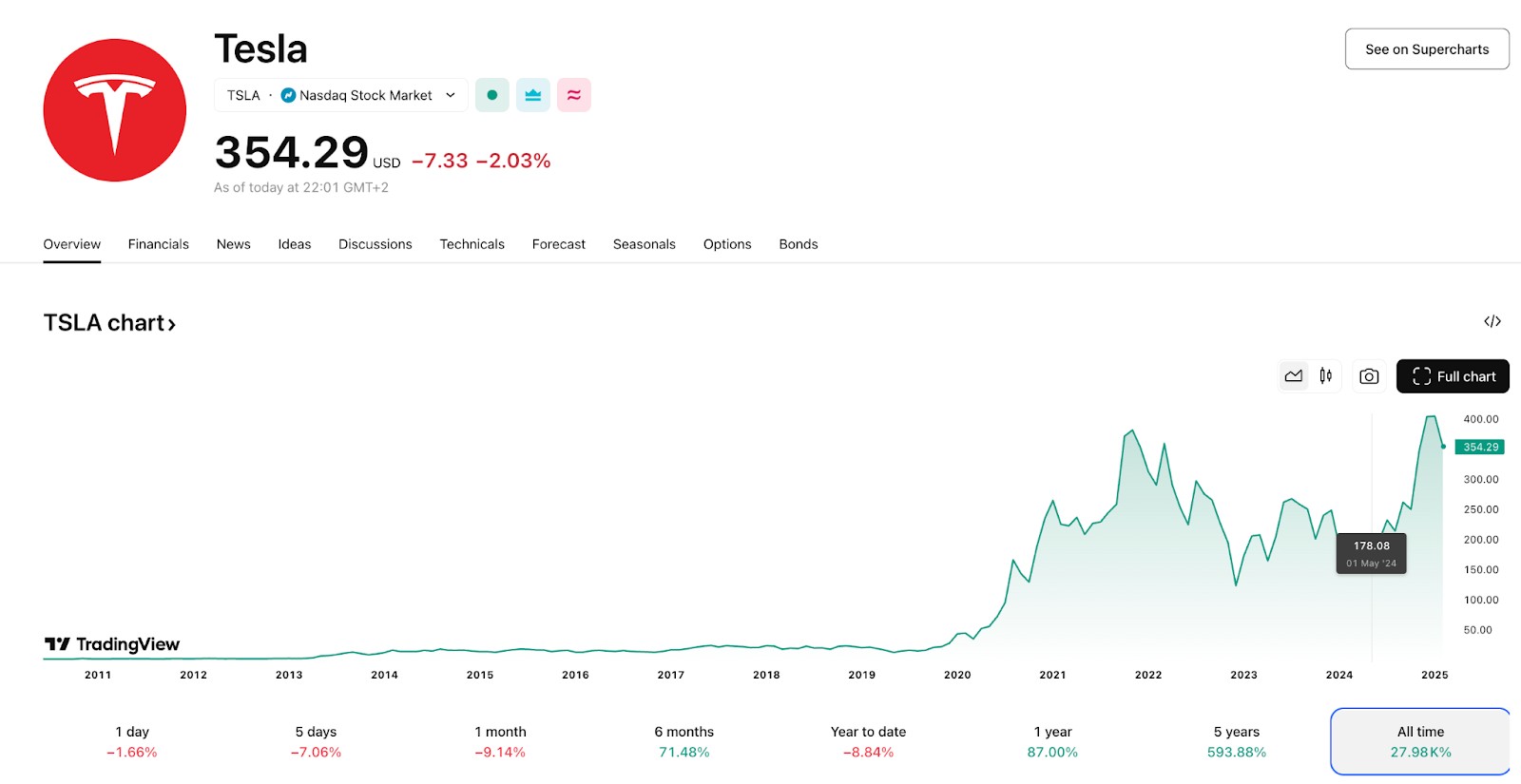

Tesla Inc. (TSLA)

Tesla is a well-known electric vehicle company with a market value of over $800 billion. Its primary growth is driven by innovation, including advancements in energy storage and self-driving technologies. Tesla produces more than 1 million cars annually and continues to expand into clean energy solutions. The stock can be volatile due to external factors such as production challenges, regulatory issues, and competition from other automakers.

Why choose Tesla:

Innovation at the core. Tesla is always ahead with new developments in electric vehicles and energy storage.

Leading the EV market. Tesla dominates the electric vehicle market, making it the go-to choice for many investors.

Revenue growth. Tesla’s diverse income from both cars and clean energy products ensures continued growth.

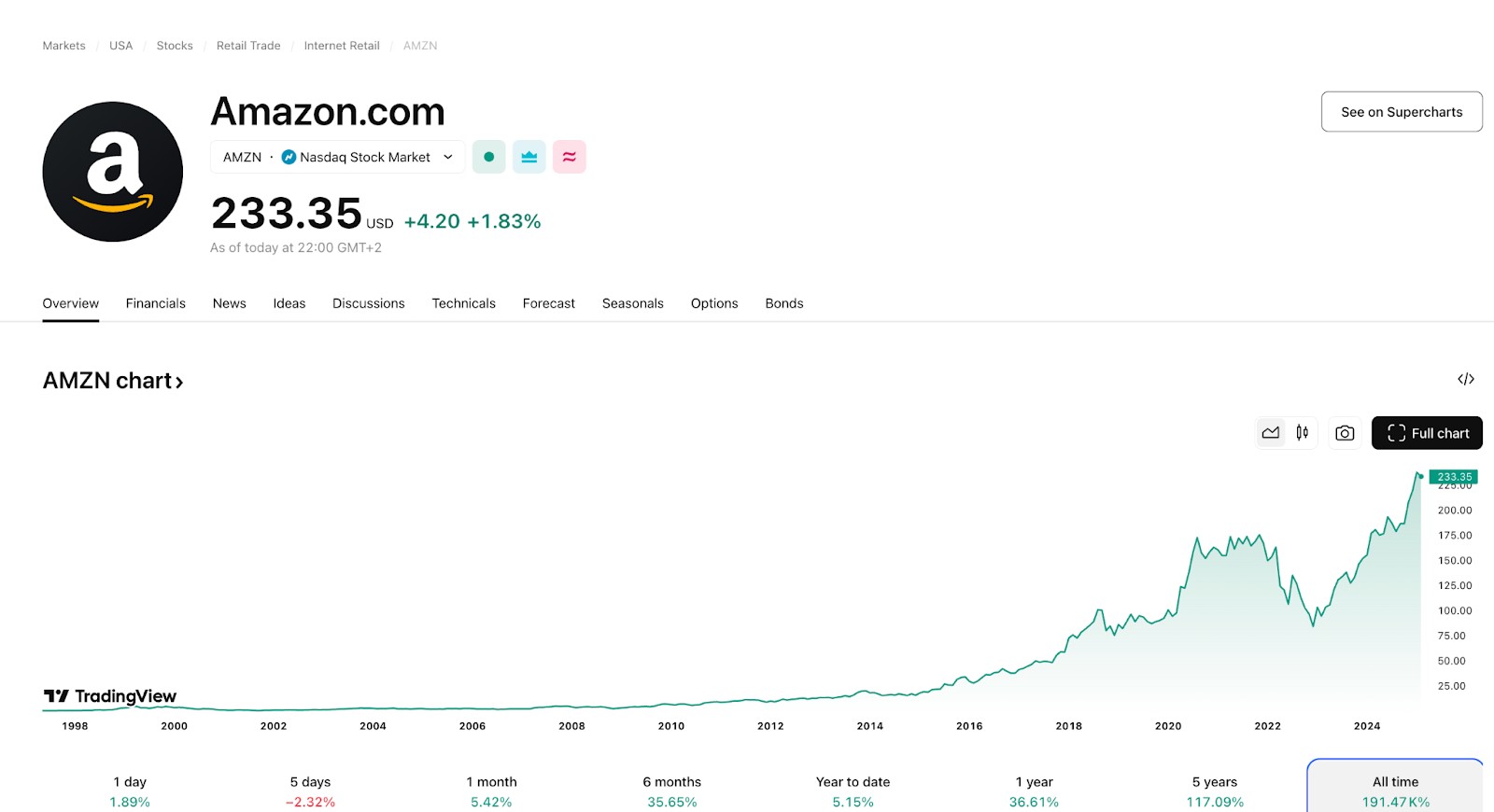

Amazon.com Inc. (AMZN)

Amazon is a global leader in e-commerce and cloud computing, valued at over $1.5 trillion. Amazon Web Services (AWS) generates most of its operating income. In addition to retail, Amazon is expanding into groceries, logistics, and AI. Amazon’s worldwide reach ensures consistent revenue growth, but its business is also under scrutiny for its market power and effect on small businesses.

Why choose Amazon:

E-commerce and cloud powerhouse. Amazon dominates both online retail and cloud computing, giving it a strong revenue base.

Wide market presence. Amazon has global reach, with its retail platform available in over 200 countries.

Consistent revenue growth. Amazon’s multiple revenue streams, including subscriptions and AWS, offer stability.

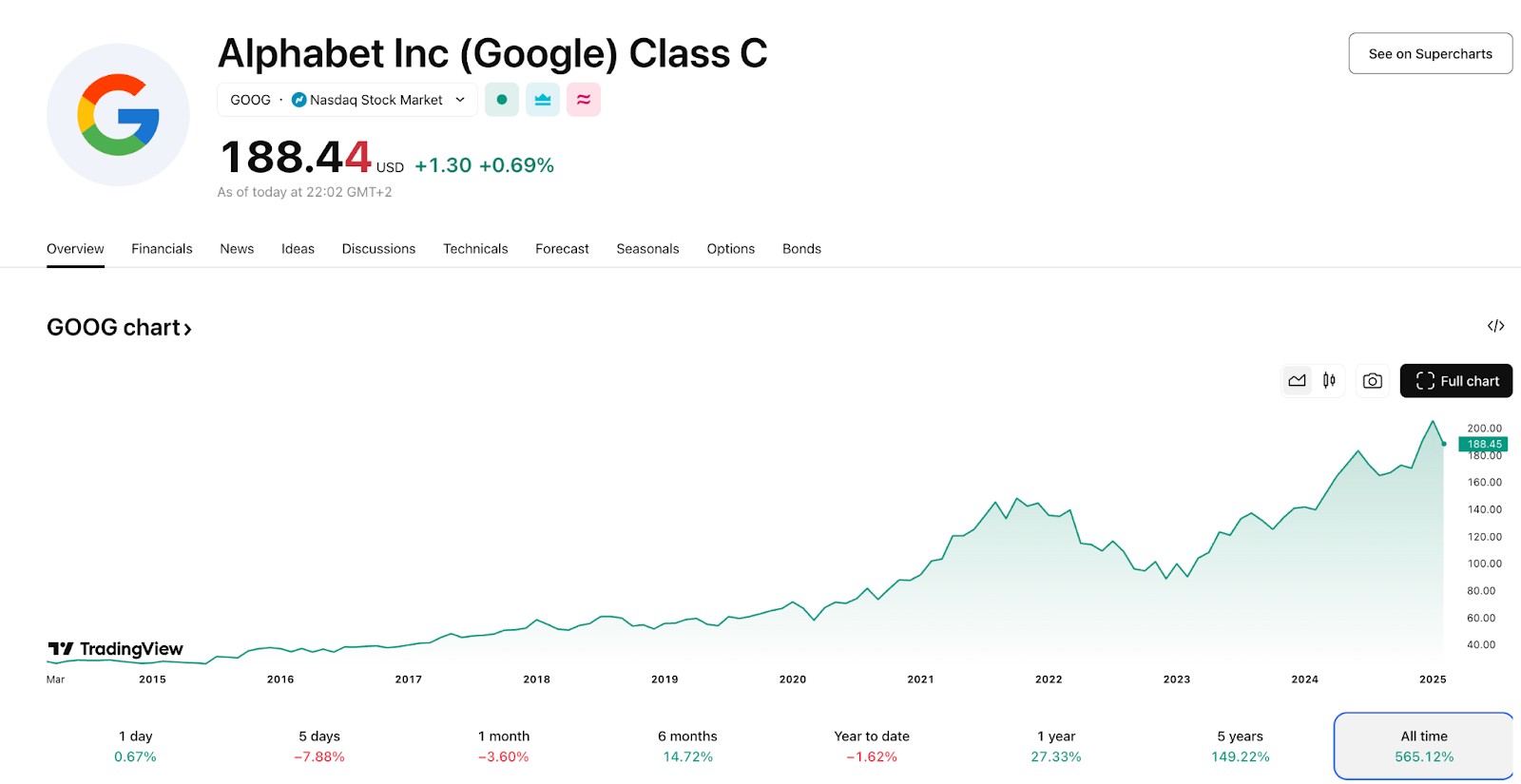

Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, is a key player in digital advertising and cloud computing, with a market cap of over $1.8 trillion. Alphabet owns YouTube, Google Cloud, and Waymo (self-driving cars), ensuring steady revenue. However, its dominance in search and advertising faces antitrust scrutiny, especially in Europe and the US.

Why choose Alphabet:

Ad revenue dominance. Google remains the leading player in the digital ad space.

Strong growth in cloud. Google Cloud continues to gain market share, providing another stable revenue stream.

Diversified investments. Alphabet invests heavily in future technologies like AI and self-driving cars.

Why invest in U.S. stocks?

Investing in U.S. stocks is attractive for the following reasons:

Be part of cutting-edge industries. The U.S. is home to some of the most innovative companies in the world. By investing in U.S. stocks, you get to ride the wave of industries that are changing how we live, work, and interact with technology.

Earn in a strong currency. U.S. stocks are traded in U.S. dollars, which is one of the world’s most stable currencies. This offers an extra layer of protection from currency devaluation in your home country, keeping your returns steady.

Benefit from long-term growth. Over the years, the U.S. market has consistently provided solid returns. By investing, you’re tapping into a system that has proven its ability to bounce back and grow over time.

Get exposure to a variety of industries. The U.S. stock market covers everything from tech to healthcare. This allows you to build a diverse portfolio, so you don’t have to limit yourself to one type of investment.

Collect dividends. Many U.S. companies regularly pay out dividends, meaning you can earn passive income while your investments grow. This is a strong feature for long-term investors who want steady returns.

Regulatory and legal considerations

Understanding the regulatory and legal landscape is crucial for Pakistani investors entering the U.S. stock market. Here’s what you need to consider:

Tax compliance

When investing in U.S. stocks, it’s essential to adhere to local Pakistani tax laws. Income earned from dividends or capital gains on U.S. stocks is subject to taxation. Failure to declare these earnings can lead to legal penalties and complications with tax authorities. Make sure to file taxes correctly, reporting all foreign earnings. Consulting a tax advisor experienced in international investments can help simplify this process.

Double tax treaties

Pakistan has a double taxation agreement with the United States. This treaty ensures that you won’t be taxed twice on the same income in both countries. For example, if you pay withholding tax on U.S. dividends, you may be eligible for a tax credit or deduction in Pakistan. However, understanding how to claim these benefits can be complex, so seeking guidance from a professional is advisable.

Regulatory challenges

Investors must ensure that their chosen broker complies with regulations in both the U.S. and Pakistan. For example:

In the U.S. The broker should be regulated by authorities like the SEC (Securities and Exchange Commission) or FINRA (Financial Industry Regulatory Authority).

In Pakistan. Ensure that investments comply with the State Bank of Pakistan’s foreign exchange regulations. Some brokers may also require you to provide proof that your funds are legally sourced.

Key considerations for beginners

Know how U.S. tax rules affect you. Investing in U.S. stocks comes with its own set of tax rules, so it’s important to understand how dividend taxes and capital gains taxes work for non-U.S. investors.

Check for hidden fees. Many new investors overlook hidden fees that can slowly eat into their profits. Beyond trading fees, be aware of charges like account maintenance or currency conversion when moving money internationally.

Consider ETFs or index funds. If you’re unsure about picking individual stocks, start with U.S.-based ETFs or index funds. These let you invest in a variety of companies, which helps you spread the risk and still tap into the U.S. market’s potential.

Watch out for currency swings. As a Pakistani investor, you’ll need to be mindful of currency fluctuations between the U.S. dollar and the Pakistani rupee.

Look for fractional shares. Not every investor has enough capital to buy expensive stocks like Apple or Tesla. Some platforms let you buy fractional shares, so you can still invest in big companies without needing to buy a full share.

Risks and warnings

Know your taxes. Investing in U.S. stocks means you might face taxes on your dividends from the IRS. It’s important to understand these taxes and how they’ll impact your profits, so you’re not caught off guard.

Watch the exchange rate. The value of the Pakistani Rupee can change, and this impacts your profits when converting your U.S. stock earnings back into Rupees. Keep an eye on currency fluctuations to manage this risk.

Look out for extra fees. International transactions can come with high fees that add up quickly. Always check the fine print before choosing a platform to avoid fees that eat into your earnings.

Pros and cons of buying US stocks from Pakistan

- Pros

- Cons

Access to a broader market.

Potential for higher returns.

Diverse investment opportunities.

Higher transaction costs and currency conversion fees.

Regulatory and tax complexities.

Lack of local support for some platforms.

Buying US stocks from Pakistan: fractional shares, transfer costs, and tax considerations

Buying U.S. stocks from Pakistan isn’t as straightforward as just opening an account and buying shares. A game-changer for beginners is choosing platforms that offer fractional shares. This allows you to get into expensive stocks like Amazon or Tesla without needing to buy a full share. You can also look for platforms that offer U.S.-based ETFs (Exchange-Traded Funds), so you can invest in a bunch of companies at once and lower your overall risk. Always double-check which stocks and funds are available to make sure the platform has what you want to invest in.

Another thing to keep in mind is the cost of transferring money from Pakistan to your broker. Different platforms offer different ways to send money, and each comes with its own fees. Make sure you know exactly what you’re paying in transfer fees before you move your funds. Also, take some time to learn about the tax rules on both sides of the border — U.S. and Pakistani tax laws on capital gains and dividends can take a chunk out of your returns if you’re not prepared.

Conclusion

Investing in U.S. stocks from Pakistan offers exciting opportunities for diversification and growth. By following a systematic approach and leveraging the right tools, you can build a robust portfolio aligned with your financial goals. Start small, stay informed, and always trade with discipline. The U.S. market awaits — are you ready to take the plunge?

FAQs

Can I buy U.S. stocks directly from Pakistan?

Yes, through international brokers.

What is the minimum investment required?

Many brokers allow starting with as low as $10.

Are there any local brokers offering U.S. stock trading?

Few local brokers partner with international platforms.

How does currency fluctuation affect my investments?

Exchange rate changes can increase or decrease your returns.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.