Best Free Tools For Beginners In Day Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best free day trading sites and resources:

TradingView – a powerful charting platform with real-time market data, technical analysis tools, and a large trader community.

Trading Economics – provides macroeconomic data, financial news, and historical charts to help traders make informed decisions.

Forex Factory – a hub for Forex traders featuring an economic calendar, real-time market analysis, and a highly active forum.

StockCharts.com – offers free technical charts, stock screeners, and market analysis tools for traders of all levels.

Learn 2 Trade – a trading education platform with free signals, strategy guides, and insights into Forex and crypto markets.

ZIGDAO – a decentralized finance (DeFi) platform providing trading analytics, community-driven insights, and real-time data.

ForexSignals.com – features live trading rooms, market analysis, and educational content for Forex traders.

FXPremiere.com – delivers free and premium Forex signals, along with trading insights to help traders navigate the market.

Day trading success depends on having access to reliable market data, robust trading platforms, timely news updates, and quality educational materials. However, many brokerages offering these tools often require account minimums, charge subscription fees, or impose commissions, making trading less accessible for beginners with limited funds.

Fortunately, several free online resources now provide essential tools for aspiring day traders, eliminating the need for hefty upfront investments. In this guide, we’ll explore the best free platforms, websites, and communities that can support your trading journey.

These free resources cover everything from executing trades and testing strategies to conducting in-depth market analysis and networking with other traders. With the right tools in hand, you can develop your trading skills and participate in the markets without stretching your budget.

Best free day trading sites and resources

TradingView

TradingView offers a clean and user-friendly interface that makes it easy to read Forex charts. Their charts are community-driven, and they provide technical analysis by giving traders a choice to use annotations on each chart.

You can also access more detailed charts as well as advanced features and real-time data. Overall, TradingView is likely the best website for free stock charts.

It’s also the largest network of self-directed traders since it provides access to advanced features. In addition, you can find real-time quotes, draw your charts testing many indicators, and watch expert trading ideas. You can also share your content and discuss it with other traders to improve your day trading strategies.

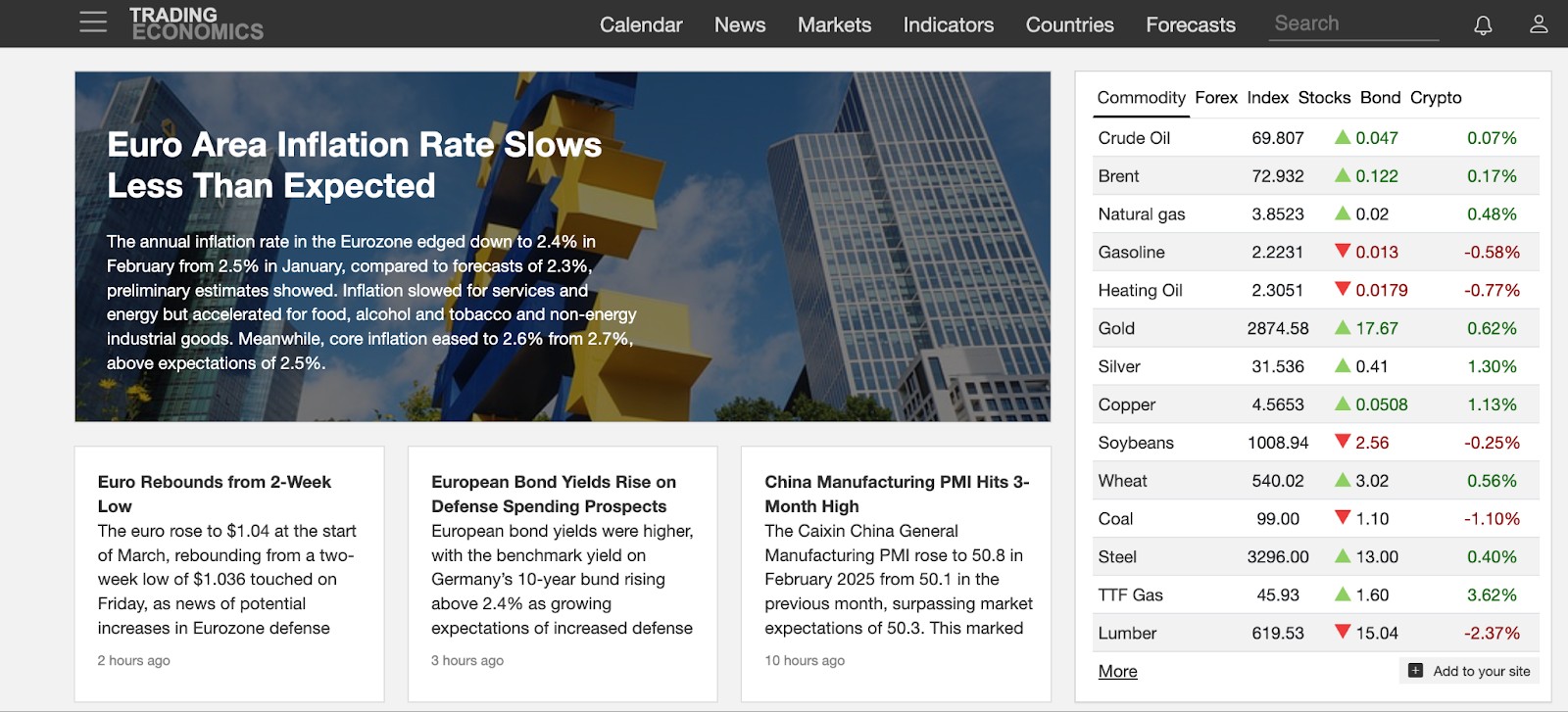

Trading Economics

Trading Economics is a highly useful Forex website that offers tools for day trading. It offers exchange rates and over 20 million economic indicators. Their data is based on official sources, not third-party data providers. Plus, their facts are regularly checked for inconsistencies. Their website has received more than 1.3 billion page views from more than 200 countries.

Forex Factory

Forex Factory is a great website for day traders who are looking for useful tools to help with their trading strategies and success. It provides an economic calendar with valuable information for all types of traders, whether you’re a beginner or more experienced trader, of the most popular sites for Forex traders online today. Using their calendar will give you the ability to understand how the news impacts the market. Ultimately, you can increase your profits.

The Forex Factory calendar includes significant news releases like:

Housing data.

Employment data.

Inflation data.

Interest rates.

When using the platform, you’ll find that the different news releases are posted for many countries at different times and dates. And one of the best features of Forex Factory is that you won’t have to download anything onto your computer to use the calendar. All you need is to go to the website and access the calendar.

StockCharts.com

StockCharts.com offers day traders a simple and clean user interface, providing some of the most useful trading tools on the market, including indicators for calculating support and resistance levels and an economic calendar. These tools will be quite helpful in helping traders analyze any financial markets chart. However, if you want to access historical charting and do further analysis, you’ll have to upgrade to a paid subscription.

Learn 2 Trade

Whether you’re an experienced investor or you’re just learning the ropes of trading, you may enjoy using Learn 2 Trade. The platform is a highly useful daily signal provider for both Forex and cryptocurrencies.

While the platform mostly focuses on Forex day trading signals, its indicators and signals can be useful for any kind of day trader. Users can receive Learn 2 Trade’s signals via a Telegram channel, often between three and five times a day.

When you access the site online, you’ll also get real-time day trading signals.

This is alongside real-time day trading signals available online.

Zignaly

Cryptocurrencies, NFTs, and the metaverse are growing in popularity at a rapid pace. However, because the industry is so volatile and new, it’s a good idea for traders to get signals to help with their success.

As a social trading platform, Zignaly shares signals and functions through profit-sharing incentives that enrich all users.

The platform functions without fees. And crypto day traders only have to pay for ZIGDAO’s trading indicators when they actually make a profit.

HowToTrade

HowToTrade is trusted by tens of thousands of traders all over the world. A combination of experienced traders and beginner investors use the platform for day trading signals.When using this website, you’ll be a part of an active and dynamic trading community. So, you can find the best technical indicators for day trading easily by interacting with other members.

FXPremiere.com

FXPriemiere.com offers up to 15 day trading signals a day through an exclusive Telegram channel. It’s also popular with beginners, becoming a core component of many investors’ strategies over the long-term.

Their indicators promise 90% accuracy in day trading signals, which involves using low-risk investment. So, whether you’re new to trading or have been trading for a while, you can lower your risk when using FXPremiere’s indicators.

Best day trading news websites

CNBC Markets

CNBC Markets is a great website that contains a lot of useful information. We have to say that this website contains a lot of information. So, you get plenty of insight to help you make the right trading decisions. Plus, the site aggregates news from credible sources like Reuters, giving you access to the most reliable and latest news on financial markets. You may also enjoy that CNBC Markets is a business news broadcaster. So, they have a reliable network of reporters and a good number of viewers.

However, there is a limit to what you can access on this website. If you want access to all content, you’ll have to pay $29.99 per month. When you subscribe, you’ll be able to access three major live streams with region-personalized information from Europe, America, and Asia. With the subscription, CNBC Markets also provides data trends that can help you trade better.

Seeking Alpha

Seeking Alpha is the world’s biggest financial analysis website. On the website, analysts have the ability to post their analysis on companies, commodities, Forex, and other asset classes.

Popular investors like Bill Ackman have shared content on Seeking Alpha. In fact, he published one article on Seeking Alpha that led to Valeant losing more than 50% of its value after the article was published.

MarketWatch

MarketWatch is a well-established day trading news site that’s been around for a long time. It is part of the Dow Jones business network which includes the BigCharts, Barrons, and Wall Street Journal.

The website allows traders to access updated news on the financial markets for free. Investors can also use the site to view stock information and trade their portfolios. Surprisingly, the platform offers news for free and this allows investors to go about their usual tasks of viewing standard stock information and tracking their portfolios using their free accounts.

You can also leverage MarketWatch News Viewer, with the ability to rapidly scan the latest news. While this feature isn’t perfect, it doesn’t take away from the fact that MarketWatch is one of the best free real-time trading news tools available.

MetaStock

If you’re looking to access large stock systems, comprehensive real-time news, and technical analysis, MetaStock may be a perfect choice. Or even if you just want to access their news, you’ll enjoy that the website offers reliable, up-to-date information about what’s going on in the world and how it can affect the financial markets.

In addition to news articles, MetaStock also offers special news features, such as comprehensive financial information on companies, charts, stock quotes, analyst estimates, and more.

| Signals | TradingView | Demo | Min. deposit, $ | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investors protection | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 100 | 0,5 | 0,9 | €20,000 £85,000 SGD 75,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | No | 0,5 | 1,5 | £85,000 €20,000 €100,000 (DE) | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | No | 0,1 | 0,5 | £85,000 SGD 75,000 $500,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 100 | 0,7 | 1,2 | £85,000 | Tier-1 | Study review | |

| Yes | Yes | Yes | No | 0,2 | 0,8 | $500,000 £85,000 | Tier-1 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

When selecting a free day trading platform, look at the platform’s backbone

When selecting a free day trading platform, look at the platform’s backbone and how it handles real-time market data. Many beginners miss the importance of speed in order execution and how accurate data is delivered. While some platforms offer free services, they often hide costs like historical data access or extended trading hours. Understanding these hidden fees is crucial. A platform marketed as "free" should show its true price to traders, especially when using premium features like real-time data or extended access.

Another important factor is how the platform performs under pressure, particularly during volatile market conditions. Free platforms can lag or crash, which is a huge risk for day traders needing fast and accurate execution. Test the platform in real conditions — many platforms allow paper trading with live market data, which simulates real trades without risking capital. This gives you a chance to practice strategies, especially fast ones like scalping or using leverage, without limitations. Your platform should help you refine your strategies in a real-time environment, not just provide basic tools.

Conclusion

Day trading requires not only skills and discipline, but also the use of reliable tools and platforms. The right choice of platform helps traders quickly analyze the market, effectively manage trades and minimize risks. Beginner traders especially benefit from testing the functionality on demo accounts and focusing on basic technical analysis tools. It is also worth monitoring current economic data and news to adapt to market changes. Combining high-quality analysis and a convenient platform will allow traders to improve their results and achieve stable profits in short-term trading.

FAQs

What platform features are especially useful for day trading?

A day trading platform should offer the ability to customize charts, quick access to indicators and technical analysis tools, and a multi-stream asset monitoring function. Having hot keys for quickly placing orders and changing trade parameters significantly speeds up the trading process.

How can a beginner trader minimize risks when using platforms?

It is recommended that beginner traders use demo accounts to test strategies and master the platform’s functionality. In addition, stop losses should be set to limit losses and start with small positions to avoid large losses at the initial stage.

What data should a trader monitor in real time?

The most important data for day trading is current quotes, trading volumes, changes in volatility, and economic news. Tracking these indicators allows you to quickly respond to market movements and avoid unexpected risks.

How to choose a platform if a trader has a limited budget?

If you have a limited budget, it is worth choosing platforms with free access to basic functions: charts, indicators and analytics. A trader should test several options on demo accounts to determine the most suitable in terms of interface convenience and functionality for his trading style.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.