How to Invest in Stocks: A Detailed Guide for Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To invest in stocks:

- Set your financial goals and strategy.

- Market research and selection of securities.

- Choose a broker.

- Opening a brokerage account.

- Make a stock purchase.

- Portfolio monitoring and management.

Investing in stocks is an active way to grow your wealth and achieve your financial goals. Whether you're saving for retirement, making a large purchase, or just looking to supplement your income, understanding the basics of investing can never hurt. This guide will walk you through the key steps and strategies needed to start investing in the stock market with confidence.

Stocks are equity securities that give owners the right to part of a company's ownership and, often, a share of its profits. When you buy shares of a company, you become a shareholder, which means you own part of that company. On trading platforms, shares are one of the most common financial instruments and are extremely popular among investors.

Investing in shares is the purchase and/or trading of shares in order to profit from their growth and/or dividends . Check out the basic steps to get started investing in stocks:

Set your financial goals and strategy

Before you begin investing, define your financial goals. Are you looking for long-term capital growth, regular income from dividends, or short-term profits from price changes? Your goals will shape your investment strategy and the types of stocks you should buy.

Long-term Growth: Focus on companies with strong growth potential.

Dividend Income: Look for companies with a history of paying dividends.

Short-term Profit: Engage in trading based on market trends and price movements.

Market research and selection of securities

Research is crucial in stock investing. Understand the companies you're interested in, their financial health, and the broader economic factors that could influence their stock prices. Use both fundamental and technical analysis. Use the financial reporting calendar to track trends and analyze the bigger picture. This involves reviewing reports from other companies in the same industry and comparing their performance. It helps understand market trends and investor sentiment, which is crucial for making strategic decisions.

Fundamental analysis: Examine a company's financial statements, management team, industry position, and growth prospects.

Technical analysis: Study past market data, including price and volume, to forecast future price movements.

Choose a broker

A broker is an intermediary who executes your stock trades. Choosing a broker is one of the most important steps in the investing process. When choosing a broker, consider the trading conditions they offer:

Research the cost of trades, including commissions for buying and selling shares.

Make sure the broker provides a user-friendly trading platform and stock analysis tools.

Choose a broker that provides quality service and support.

We have selected several brokers which offer trading in a wide range of assets, including shares. These companies provide access to best stocks to invest in companies from different sectors of the economy.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

ECN commission, $ per lot |

No | 3 | 3,5 | 5 | 2 |

|

Investor protection |

€20,000 £85,000 SGD 75,000 | £85,000 €20,000 €100,000 (DE) | £85,000 SGD 75,000 $500,000 | £85,000 | $500,000 £85,000 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Opening a brokerage account

Once you've selected a broker, you'll need to open a brokerage account. This usually involves:

Application: Filling out an online application form.

Verification: Providing identification to verify your identity.

Funding: Making an initial deposit to start trading.

Make a stock purchase

With your brokerage account set up, you're ready to buy stocks. Follow these steps:

Select Stocks: Choose the stocks you want to buy based on your research.

Place an Order: Specify the number of shares and check the current market price.

Execute the Trade: Confirm and execute your trade.

Portfolio monitoring and management

After purchasing a stock, it is important to regularly monitor stock prices and economic news that may affect its price. Review your investment strategy regularly and make any necessary adjustments.

Types of investment strategies for buying stocks

Profitable investments require a clear strategy. Let's take a closer look at the main investment strategies for novice investors.

Long-term investment strategy

Involves buying shares and holding them for several years or decades. Here you should focus on companies with sustainable growth and stable financial performance. Such securities include shares of large technology companies and dividend stocks.

Examples:

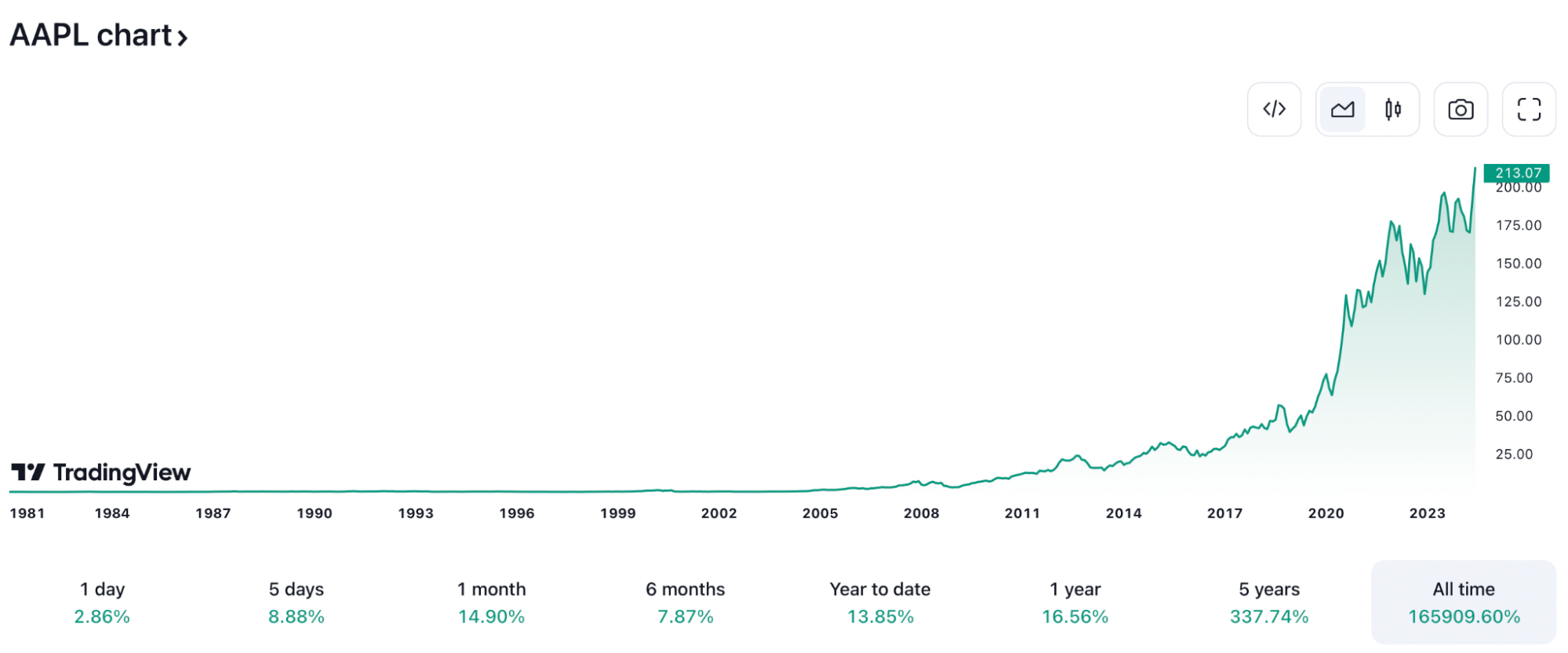

Apple (AAPL): Over the past decade, Apple’s stock has shown a remarkable growth rate, with an average annual return of around 27%. Its consistent innovation and market dominance make it a strong candidate for long-term investment.

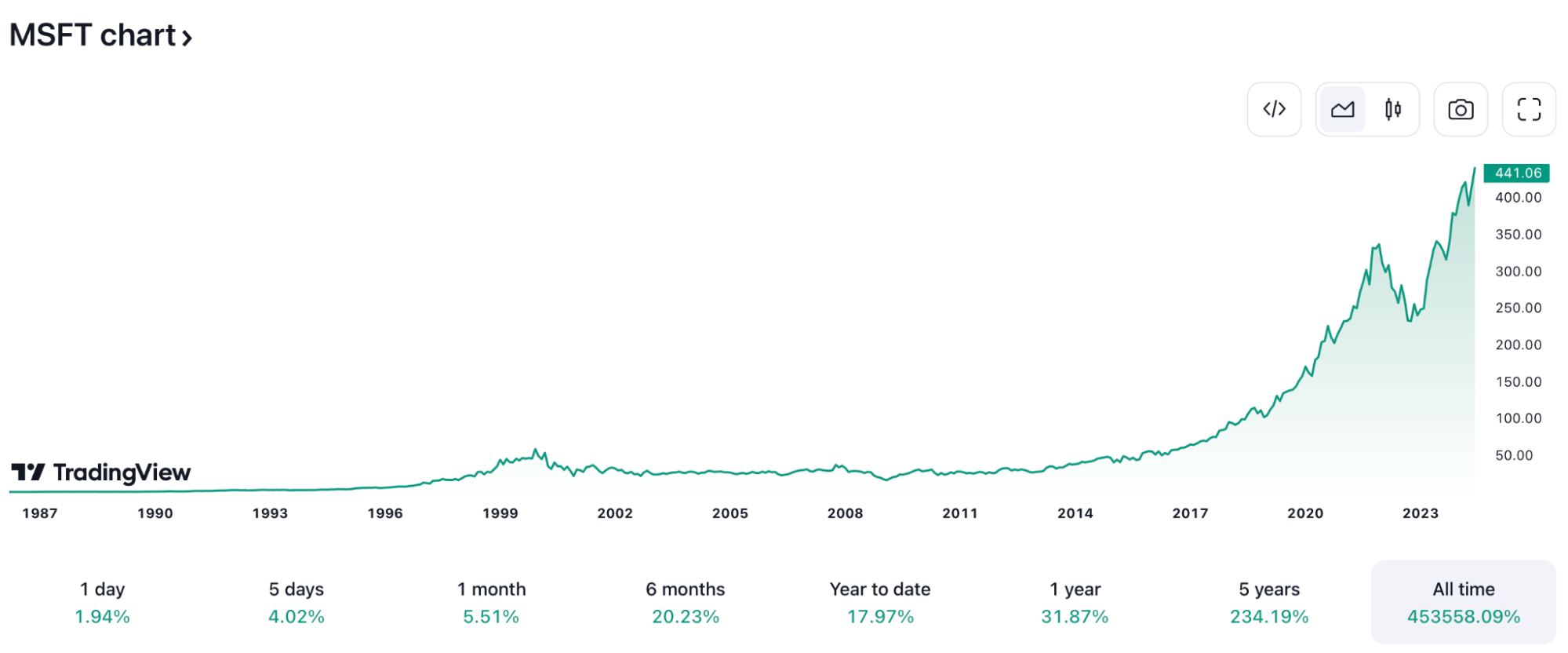

Microsoft (MSFT): With a diverse product range and strong financials, Microsoft has also provided substantial returns to long-term investors, averaging an annual return of about 25% over the last 10 years.

Short-term investing

This is speculative trading and it consists of buying shares with the intention of selling them in the future in a few weeks/months or day trading. Shares of small companies in the early stages of development are ideal here. It is important for a trader to pay special attention to technical analysis and market trends.

Examples:

Zoom Video Communications (ZM): During the early stages of the COVID-19 pandemic, Zoom’s stock surged from $70 in January 2020 to over $500 by October 2020, offering substantial short-term gains.

Tesla (TSLA): Known for its volatile stock price, Tesla has provided numerous short-term trading opportunities, with significant price swings based on news and quarterly reports.

Dividend investing

This is the purchase of shares of companies that regularly pay dividends. Ideal for investors looking for a stable income stream. Utilities, large corporations with high returns, the financial sector, and companies in the medical and consumer goods sectors are perfect candidates for this investment strategy. For those who want to increase their investment income through regular dividend payments, we suggest you consider the dividend harvesting strategy (also known as dividend capture strategy).

Examples:

Procter & Gamble (PG): Known for its reliable dividend payments, P&G has a dividend yield of around 2.5% and has increased its dividend for 65 consecutive years.

Johnson & Johnson (JNJ): With a dividend yield of approximately 2.6%, J&J is another strong contender for dividend investors, boasting over 50 years of consecutive dividend increases.

Index investing

Involves purchasing shares that are part of a stock index, such as the S&P 500 or Nasdaq Composite. Allows you to diversify your portfolio and reduce risks. For such investments, you should choose index funds (ETFs). which your broker offers.

Examples:

Vanguard S&P 500 ETF (VOO): This ETF tracks the S&P 500 index, providing exposure to 500 of the largest U.S. companies. It has an average annual return of about 10% over the past decade.

Invesco QQQ ETF (QQQ): This ETF tracks the Nasdaq-100 Index, offering exposure to 100 of the largest non-financial companies listed on the Nasdaq. It has delivered an average annual return of around 20% over the last 10 years.

Stock investment tips for beginners

Start with education. Before investing money, it's essential to understand the basics of stock investing. Learn terms like stocks, dividends, market capitalization, P/E ratio, and other important indicators. It's recommended to read books, take online courses, or use educational materials on specialized websites.

Define your goals and strategy. Decide what goals you want to achieve with your investments. These could be long-term goals, like saving for retirement, or short-term goals, like making a major purchase. Define your strategy—whether you will invest in individual stocks or prefer diversified funds, such as ETFs or mutual funds.

Diversify your portfolio. One of the key principles of successful investing is diversification. Spread your investments across different sectors and companies to reduce risks. If one stock performs poorly, others may offset the losses.

Avoid emotional decisions. Financial markets can be volatile, and stock prices can fluctuate significantly. It's important not to give in to panic or greed. Make investment decisions based on analysis and your strategy, not on short-term market movements.

Regularly review and adjust your portfolio. Investments require periodic monitoring and adjustments. Regularly review your portfolio to ensure it aligns with your financial goals and strategy. Make changes as needed to optimize your investments.

Proven strategies for successful stock investing

As an experienced investor, I can give you some valuable advice.

First, continuous learning is the key to success. Regularly updating your knowledge about the market and investment strategies will allow you to always be aware of innovations and events.

Secondly, always manage risks. Use stop losses and rebalance your portfolio regularly to minimize losses. Diversification should include not only stocks from different industries, but also different asset classes, such as bonds or digital assets.

Third, discipline and emotional control play a big role. Follow your investment plan and avoid emotional decisions.

Finally, remember the long term and the power of compound interest. Patience and commitment to strategy are the keys to successful investing. If you find it difficult to understand, do not hesitate to seek professional advice . By following these principles, you can manage your investments more confidently and effectively.

Conclusion

Investing in stocks can be a rewarding endeavor if approached with the right knowledge and strategy. This guide outlines the basic steps to get started, from understanding basic investment concepts to developing a diversified portfolio and managing risk effectively. Remember that continuous learning and staying informed about market trends is critical to long-term success. By avoiding emotional decisions and taking a disciplined approach, you can confidently navigate the ups and downs of the stock market. Whether you're looking for long-term growth or short-term profit, having a clear investment plan and sticking to it will help you achieve your financial goals. With patience and persistence, you can build a strong foundation for your financial future through stock investing.

FAQs

What are the tax implications of stock investing?

Stock investments can lead to capital gains taxes on profits and dividends, and it's important to understand how they affect your overall tax liability.

Why is portfolio diversification important?

Diversification is important because it reduces risks. By spreading investments across different sectors and companies, you minimize the impact of negative events on any one particular stock or sector, helping to protect your capital.

How can you avoid emotional decisions when investing?

To avoid emotional decisions, follow a pre-developed plan, base your actions on analysis and strategy rather than short-term market fluctuations. Regularly reviewing your portfolio and maintaining discipline will also help you stay on track.

How often should you review and adjust your investment portfolio?

It is recommended to review and adjust your portfolio regularly, such as quarterly or when there are significant market changes. This ensures that your portfolio continues to align with your financial goals and strategy.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

The dividend capture strategy is a trading technique used to profit from dividend payments issued to shareholders of companies.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.