Forex Trading for Beginners Explained

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

For Forex trading beginners, these steps summarize all key considerations around Forex trading:

Set up a trading account - Find a reliable broker and fund your account.

Choose a trading platform - Download, install, and log in to your trading platform.

Analyze the market - Select a currency pair and conduct technical and fundamental analysis.

Decide on trade parameters - Determine position size, set stop loss, and take profit levels.

Place the trade - Enter trade details and execute the trade.

Monitor the trade - Track market conditions and adjust stop loss and take profit if necessary.

Close the trade - Close manually or automatically and review the trade.

Forex is the world's largest financial market, with a daily trading volume exceeding $7.5 trillion. Forex trading involves buying and selling currencies on the foreign exchange market to profit from changes in their exchange rates. It is popular due to its high liquidity, the ability to trade 24 hours a day, and the potential for high returns. It attracts various participants, from central banks to retail traders.

In this article, we offer comprehensive insights and tips for beginners on Forex trading. You'll learn the basics of Forex trading, how to get started, and the various strategies you can employ to maximize your profits.

Forex trading for beginners explained

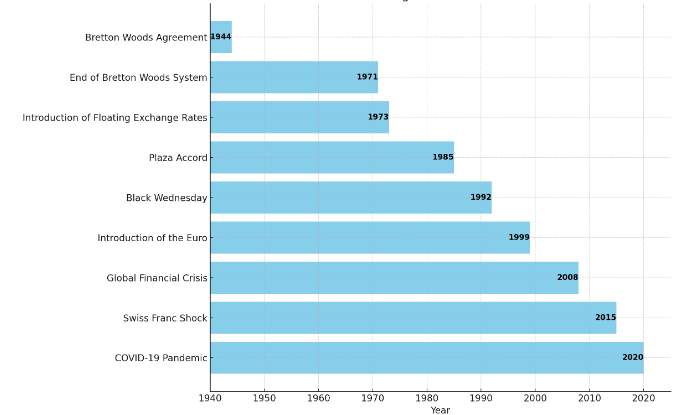

Brief history: Forex began forming in the 1970s after the Bretton Woods Agreement collapsed, leading to floating exchange rates. Key milestones include the introduction of the euro in 1999 and the rise of online trading platforms in the early 2000s.

The Forex market's high liquidity, the potential for substantial profits, and the ability to trade on margin attract a wide range of participants, from central banks and financial institutions to individual retail traders.

| Year | Volume |

|---|---|

2013 | 5.3 |

2014 | 5.5 |

2015 | 5.7 |

2016 | 5.9 |

2017 | 6.0 |

2018 | 6.6 |

2019 | 6.7 |

2020 | 6.6 |

2021 | 6.9 |

2022 | 7.1 |

2023 | 7.5 |

Key players in the Forex market are central banks, commercial banks, financial institutions, hedge funds, corporations, and individual retail traders.

Currency pairs and how they work

Current pairs are generally quoted in relative terms for base and quote currency, such as EUR/USD. The base currency (EUR) is the first currency in the pair, and the quote currency (USD) is the second.

Major pairs involve the most traded currencies, such as EUR/USD and USD/JPY. Minor pairs do not involve USD, like EUR/GBP. Exotic pairs include one major currency and one from a smaller or emerging market.

Fundamental concepts in Forex trading

Lot sizes. Trades are made in lots. A standard lot is 100,000 units, a mini lot is 10,000 units, and a micro lot is 1,000 units.

| Lot size | Units | Pip value (USD) | Used margin (USD, with 1:100 leverage) | Impact |

|---|---|---|---|---|

Standard lot | 100,000 | 10 | 1,000 | Suitable for experienced traders with significant capital. High potential profit and loss. |

Mini lot | 10,000 | 1 | 100 | Suitable for intermediate traders. Lower potential profit and loss than standard lots. |

Micro lot | 1,000 | 0.1 | 10 | Suitable for beginners. Very low potential profit and loss, good for learning. |

Nano lot | 100 | 0.01 | 1 | Suitable for learning and testing strategies with minimal risk. |

Bid and ask price. The bid price is what you can sell a currency for, and the ask price is what you can buy it for.

Spread and pip. The spread is the difference between the bid price and the ask price in a currency pair. It represents the cost of trading and is typically measured in pips.

Example: Consider the EUR/USD currency pair if bid price - 1.2050, ask price - 1.2053:

Spread=Ask Price−Bid Price

Spread=1.2053−1.2050=0.0003

The spread is 0.0003, which is 3 pips.

A pip is the smallest price move that a currency pair can make, typically 0.0001 for most pairs. If the EUR/USD moves from 1.2050 to 1.2051, it has moved 1 pip. A related concept is the pip value, which denominates a single pip into dollar terms.

Example: For a standard lot (100,000 units), the value of a pip in USD is calculated as follows:

Pip Value=(0.0001 (one pip)×100,000 (units))/Exchange Rate

Pip Value=(0.0001 (one pip)×100,000 (units))/1

Pip Value=10 USD

Essential tools and platforms

Use trading platforms (e.g., MetaTrader) which offer advanced charting tools, automated trading options, and a user-friendly interface. Also, use charting tools to analyze price movements and identify trading opportunities.

Track economic events that can impact currency prices, such as interest rate decisions and employment reports.

How to start trading Forex

For those wondering how to take the very initial steps in their Forex trading journey, we have prepared the following step-by-step guide.

After learning the basics of Forex trading, the next step is to take your first trade. Here’s how you can execute the same:

Step 1: Set up a trading account

Choose a reliable broker. Research and select a reputable Forex broker that is regulated and offers the features you need. We have compared the top options available to help you in this step:

| Min. deposit, $ | Demo | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Trading assets | Deposit fee, % | Withdrawal fee, % | Open account | |

|---|---|---|---|---|---|---|---|---|

| 100 | Yes | 0,4 | 1,5 | 0.00 | No | No | Open an account Your capital is at risk. |

|

| 5 | Yes | 0,7 | 1,2 | 0.00 | No | No | Open an account Your capital is at risk. |

|

| 10 | Yes | 0,5 | 2 | 0.00 | No | 0-4 | Open an account Your capital is at risk. |

|

| 10 | Yes | 0,8 | 1,4 | 0.00 | No | No | Open an account Your capital is at risk. |

|

| 25 | Yes | 0,6 | 1 | 0.00 | No | No | Open an account Your capital is at risk. |

Open an account. Fill out the necessary forms and submit identification documents to open a trading account with your chosen broker.

Fund your account. Deposit funds into your trading account using your preferred payment method.

Step 2: Choose a trading platform

Download and install. Download and install the trading platform recommended by your broker, such as MetaTrader 4 or MetaTrader 5.

Login. Use the credentials provided by your broker to log in to the trading platform.

Step 3: Analyze the market

Select a currency pair. Choose the currency pair you want to trade, for example, EUR/USD.

Conduct technical analysis. Use technical indicators (like moving averages, RSI, MACD, etc) and chart patterns to analyze the currency pair’s price movement.

Conduct fundamental analysis. Consider economic indicators and news events that might impact the currency pair.

Step 4: Decide on trade parameters

Determine position size. Decide the size of your position (e.g., standard lot, mini lot, micro lot) based on your risk management strategy.

Set stop loss. Determine a stop loss level to limit potential losses.

Set take profit. Determine a take profit level to lock in potential gains.

Step 5: Place the trade

Open a new order. In your trading platform, navigate to the order window to place a new trade.

Enter trade details. Select the currency pair, choose the trade type (buy or sell), and enter your position size, stop loss, and take profit levels.

Execute the trade. Click the buy or sell button to execute the trade.

Step 6: Monitor the trade

Track market conditions. Continuously monitor the market conditions and news that might affect your trade.

Adjust stop loss and take profit. If necessary, adjust your stop loss and take profit levels based on market movements.

Step 7: Close the trade

Close manually or automatically. Close the trade manually through your trading platform, or let it close automatically when it hits the stop loss or take profit levels.

Review the trade. Analyze the outcome of the trade to understand what worked and what didn’t, and document it in your trading journal.

The Forex market attracts scammers and fraudulent schemes promising high returns with little risk. Traders should be vigilant and avoid offers that seem too good to be true. Conduct thorough research, verify broker credentials, and rely on reputable sources to protect against scams and fraud.

Key risk management tools

Risk management is an important aspect of Forex trading, aimed at protecting your capital and minimizing losses. Common risk management strategies include:

Stop loss orders. Automatically close a trade at a predefined loss level to prevent further losses. Learn more about stop loss orders in the article Stop-loss order: should I use?

Take profit orders. Automatically close a trade at a predefined profit level to lock in gains.

Leverage and margin. Leverage allows you to control large positions with a small amount of capital. While it can amplify profits, it also increases risk.

Trading strategies for beginners

The four key trading strategies are:

Day trading. Engages in short-term trades within a single day, taking advantage of small price movements.

Swing trading. Holds trades for several days to capture medium-term market moves.

Scalping. Make numerous small trades throughout the day, aiming for small profits on each trade.

Position trading. Maintain trades for weeks or months, based on long-term market trends.

Pros and cons of being a full-time Forex trader

If you’re looking to become a full-time Forex trader, you are likely to encounter the following pros and cons in your journey:

- Pros

- Cons

- Flexibility and independence. Enjoy the freedom to work from anywhere and set your own schedule.

- Potential for high earnings. Benefit from the potential to earn significant profits through successful trading.

- Ability to work from anywhere. Trade from any location with an internet connection.

- No commute: Save time and reduce stress by working from home.

- Complete control over trading decisions. Full autonomy over trades and risk management.

- High risk and stress. Be prepared for the high levels of risk and stress involved in full-time trading.

- Financial instability. Understand the potential for financial instability and the importance of having a financial safety net.

- Requires significant time commitment. Extensive time needed for analysis and trade execution.

- Emotional and psychological pressure. High emotional toll from trading-related decisions and outcomes.

- No guaranteed income. Lack of financial security with the potential for losses.

Focus on being consistent

If you want to build a successful trading career, focus on being consistent. More importantly, I would suggest you aim for steady, small gains rather than big wins every time.

Based on my experience, at this stage in your trading journey, the most important aspect is deep learning and updating your strategies. For this, you can join trading communities and forums. They will also help you share experiences and get new ideas.

Lastly, make sure to balance your trading with other parts of your life to avoid burnout and stay focused.

Conclusion

Mastering Forex trading is a process. Start by practicing with a demo account to get comfortable with the trading platform and strategies. Develop a robust trading plan, stay informed about market trends, and continuously seek to improve your knowledge and skills. Remember, staying cautious against scams and effective risk management are your best allies. With dedication and perseverance, you can work your way up in the Forex market successfully and achieve your trading goals.

FAQs

How do I start Forex trading as a beginner?

To start, choose a reputable broker, open a trading account, and use a demo account to practice. Learn about the market and develop a trading strategy.

Can I trade Forex full-time?

Yes, many people trade Forex full-time. However, it requires a deep understanding of the market, a solid trading plan, and the ability to manage risks and emotions effectively.

How important is risk management in Forex trading?

Risk management is crucial to protect your capital and minimize losses. Use tools like stop-loss orders and set risk limits to ensure long-term success.

What are currency pairs in Forex trading?

Currency pairs compare the value of one currency to another. Major pairs include EUR/USD and USD/JPY, while minor and exotic pairs involve less traded currencies.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.