How To Start Trading Stocks

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To start trading on the stock market:

Trading on the stock market can seem challenging for beginners, but with the right knowledge and approach, it becomes accessible and understandable. In this article, we will cover the fundamental aspects of trading, from choosing a broker to developing trading strategies. Our practical tips will help you confidently start your journey in the stock market and avoid common mistakes.

How to start trading stocks

Trading on the stock market offers significant opportunities for increasing capital. Historically, stock prices have risen over the long term, and investors can also benefit from dividends paid by companies, providing an additional income stream. Stock trading helps to diversify an investment portfolio, reducing the risk of losses due to the distribution of funds across different sectors of the economy.

Many people think stock trading is too complicated and needs a lot of knowledge, which can scare away beginners. Others worry about losing money because of the market's ups and downs. But with the right approach and good risk management, these worries can be minimized. You don't need to be an expert to start trading. Begin with the basics and slowly build up your knowledge and experience.

Сhoose a reliable broker

Trading on the stock market is conducted through intermediaries known as brokers. Selecting the right broker is crucial for a smooth trading experience. Here are some tips to help you choose a broker that fits your needs:

Commissions and fees. Trade fees vary between brokers and can have a significant impact on your profits. It is important to consider the cost of each trade, as well as whether there are additional fees, such as account or withdrawal fees or fees for holding a position (overnight or swap).

Services. Brokerages offer a range of services, including access to analytical tools, market research, educational materials and customer support. Choosing a broker with a wide range of services will be useful for new traders, as it will help them get up to speed quickly and improve their skills.

Convenience of the platform. An intuitive and functional trading platform goes a long way. The platform must be easy to use, have all the necessary functions for analysis and trading, and provide fast and reliable access to the market. Having a mobile app can also be an important factor for those planning to trade on the go.

Reputation and Regulation: Ensure the broker is reputable and regulated by relevant financial authorities. This provides a level of security and trust.

We have selected several brokers that open the door to the stock market. Here you will learn how to buy stocks and find the best stocks to buy for beginners from different sectors of the economy.

| Demo | Account min. | Signals | Research and data | Basic stock/ETF fee | Min. stock/ETF fee | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | No | Yes | Yes | $3 per trade | $3 per trade | Open an account Via eOption's secure website. |

|

| No | No | Yes | Yes | Zero Fees | Zero Fees | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Study review | |

| Yes | No | Yes | Yes | 0-0,0035% | $1,00 | Open an account Your capital is at risk. |

|

| No | No | No | Yes | Zero Fees | Zero Fees | Study review |

Learn to do research

Before you start trading stocks, analyze the situation and decide on suitable trading strategies. They help traders make decisions about buying and selling stocks, minimizing risks and maximizing profits.

1. Long-term investments (position trading)

Long-term investments involve holding positions for several months to several years. This strategy relies on the historical expectation of rising stock prices and receiving dividends. It requires patience and strategic thinking, focusing less on short-term market fluctuations.

Key Elements:

Trend Analysis: Investors analyze long-term trends and macroeconomic factors;

Patience: Requires holding onto stocks despite short-term volatility;

Dividends: Investors often benefit from regular dividend payments.

2. Day trading

Day trading focuses on buying and selling stocks within a single trading day. Day traders aim to profit from small price movements and market volatility, requiring quick decision-making and constant market monitoring.

Key Elements:

Technical Analysis: Uses charts and indicators to identify short-term trends;

Market Volatility: Takes advantage of intraday price fluctuations;

High Discipline: Requires strict discipline and a well-defined exit strategy.

3. Swing trading

Swing trading is an intermediate strategy between day trading and long-term investing, involving holding positions for several days to weeks. Swing traders aim to benefit from short-term price swings using both technical and fundamental analysis.

Key Elements:

Flexibility: Allows more time for analysis compared to day trading;

Technical and Fundamental Analysis: Combines both approaches to identify potential trades;

Moderate Stress: Less stressful than day trading, with less frequent position monitoring.

Fund market analysis

Fund market analysis play a key role in successful trading. A deep understanding of market conditions, company financial statements and economic indicators allows traders to make informed decisions and minimize risks. When analyzing the stock market, the following tools and resources are used:

News sources such as Bloomberg, Reuters and CNBC provide up-to-date market information and help traders keep up with the latest developments.

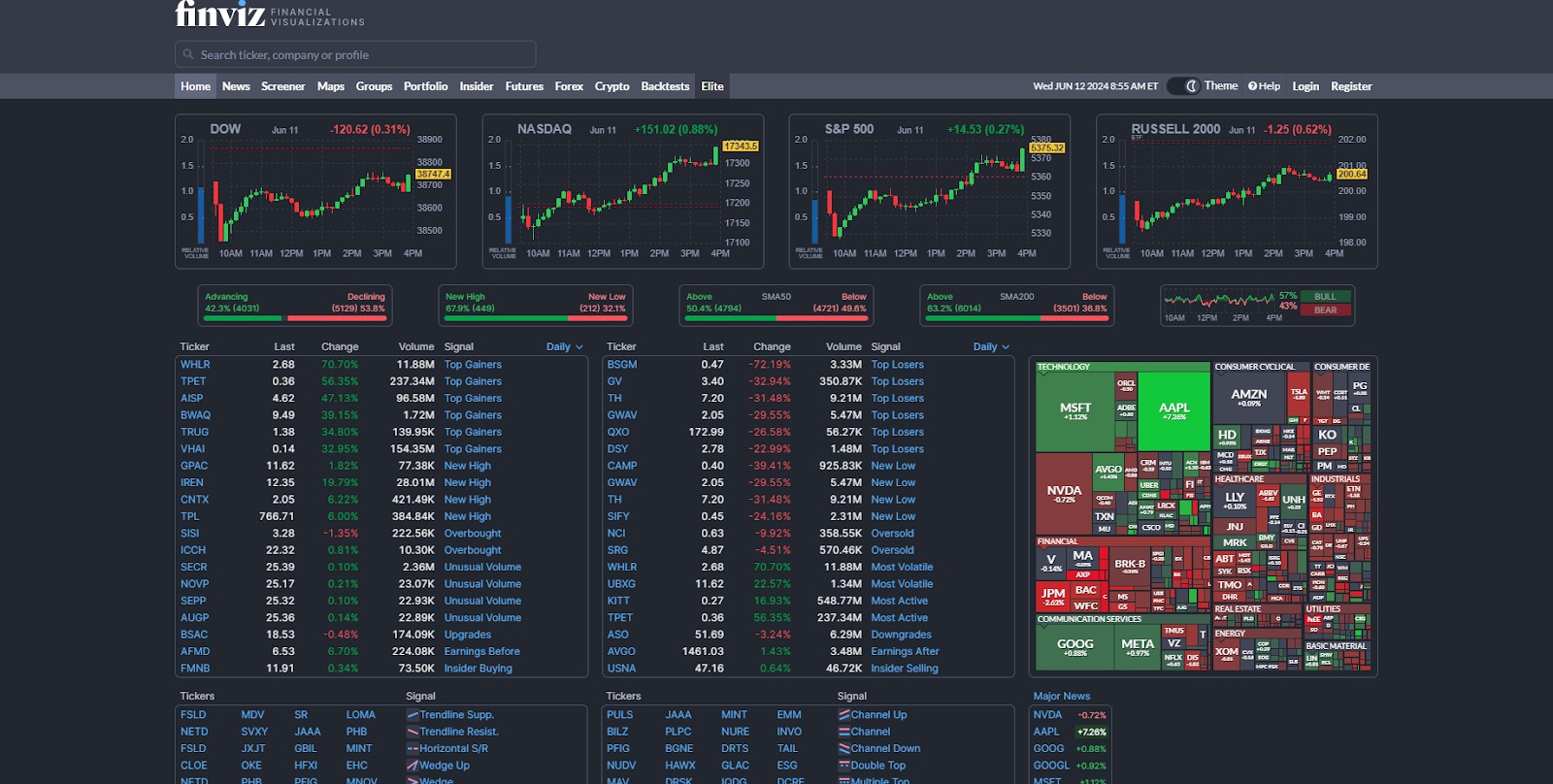

Stock screeners such as Finviz and Yahoo Finance allow traders to filter stocks based on various criteria such as price, volume and performance metrics.

Market Analysis Tools – platforms such as TradingView and MetaTrader offer a wide range of technical analysis tools, including charts, indicators and analytical tools. Stock trading software streamlines market analysis, strategy development, and trade execution. Platforms like RoboForex, and eToro offer diverse tools for all experience levels, empowering traders to refine strategies, improve skills, and achieve trading success efficiently.

Creatе a trading plan

The next step is to create a trading plan. To do this, follow these rules:

1. Define your trading goals - clearly outline your financial goals and the purpose of your trading activities.

Short-term Goals: E.g., generating extra income, learning the market, etc;

Long-term Goals: E.g., building wealth over time, retirement planning, etc.

2. Determine your risk tolerance - assess how much risk you are willing and able to take.

Factors to Consider: Age, financial stability, investment horizon, and psychological comfort with risk;

Risk Management: Decide on stop-loss levels and the maximum amount you are willing to lose on a single trade.

3. Develop entry and exit rules - establish clear criteria for when to enter and exit trades.

Entry Criteria: Identify signals that prompt you to buy, such as moving averages, breakout patterns, or earnings reports;

Exit Criteria: Define when to sell, whether to lock in profits or cut losses.

4. Plan for diversification - spread investments to reduce risk.

Asset Allocation: Decide on the proportion of funds to allocate to different sectors, industries, or asset classes.

Diversification: Avoid over-concentration in a single stock or sector.

5. Review and adjust regularly - continuously evaluate and refine your trading plan.

Performance Review: Regularly assess your portfolio’s performance against your goals;

Adjustments: Make necessary changes to your strategies based on market conditions and personal circumstances.

Master emotional control and avoid impulsive trading

As an expert in the field of the stock market, I will emphasize the importance of understanding the basic principles for investment beginners. The most important thing is to learn the basics of stock trading and how the stock market works.

You also need to develop and stick to a clear and realistic investment strategy. New investors often make the mistake of looking for quick profits and ignoring long-term prospects. I recommend focusing on portfolio diversification and regularly reviewing your investments. It is important to remember that the stock market is highly dynamic and patience is the key to successful investing. Investing in stable companies with a good reputation and long-term growth potential can significantly reduce risk.

Finally, don't underestimate the importance of self-education. Reading specialized literature, attending seminars and participating in webinars will expand your knowledge in trading. Continuous improvement and adaptation to changing market conditions is the key to success for any investor, whether a beginner or an experienced professional.

Conclusion

Trading on the stock market for beginners requires a cautious approach and continuous learning. Start with small investments and gradually increase them as you gain experience. Diversifying your portfolio and choosing stocks based on fundamental and technical analysis can help mitigate risks. Avoid trading based on emotions and adhere to a disciplined approach. Constantly study market conditions and adapt to changes to improve your chances of success.

FAQs

How much money do I need to start trading stocks?

You can start trading with any amount of money, but it is generally recommended to start with at least $500 to $1,000. Some brokers have no minimum deposit requirements, while others might. Starting with a larger amount can help you diversify your investments and manage risks better.

What is the difference between trading and investing?

Trading involves buying and selling stocks frequently to capitalize on short-term market fluctuations. Investing, on the other hand, focuses on long-term growth and holding stocks for extended periods, often years, based on the company's fundamentals and potential for growth.

What are the risks involved in stock trading?

Risks include market risk (the risk of the entire market declining), individual stock risk (specific to the company), liquidity risk (difficulty in buying or selling stocks without affecting their price), and emotional risk (making poor decisions based on emotions). Proper risk management strategies are crucial to mitigate these risks.

How can I research and choose stocks to trade?

Research stocks using fundamental analysis (evaluating a company's financial health, earnings, revenue, and growth prospects) and technical analysis (examining price charts, patterns, and indicators). Use resources like financial news websites, stock screeners, and analyst reports to gather information.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.