Where Is The Best Place To Set Your Stop Loss?

The best place to put a stop loss depends on your trading strategy and the asset you're trading.Common stop loss placement strategies using support and resistance levels, Bollinger bands, Average True Range (ATR), and trendlines.

When trading stocks, having a stop loss is a necessary risk management tool. A stop loss is an order placed with a broker to sell a security when it reaches a certain price.

Where is the best place to put a stop loss is important to know how in order to maximize profits and limit losses. In this article, we will look at the various strategies for stop loss placement, how to calculate your stop loss and where to avoid placing it.

Key takeaways

-

Stop losses help traders manage risk and limit transaction losses

-

Proper placement of stop losses is crucial to maximize profits and avoid losses

-

Resistance and support levels, Bollinger bands, ATR, trendlines, and mathematical stops are common stop loss placement tactics

-

Avoid placing stop losses where the majority does to avoid large liquidations and price reversals

Why you should place stop losses

Stop losses are predefined orders set by traders to automatically sell a security when it reaches a specified price.They are designed to limit an investor’s losses by providing an automatic exit from the position if the stock drops to a certain price. This helps to protect the investor’s capital and reduce the risk of incurring excessive losses.

Setting a stop loss too low will be essentially worthless as the losses will still be catastrophic before the stop loss sets in. Setting it too high and you are reducing your potential rewards. This is why knowing where exactly to put a stop loss is very beneficial for traders.

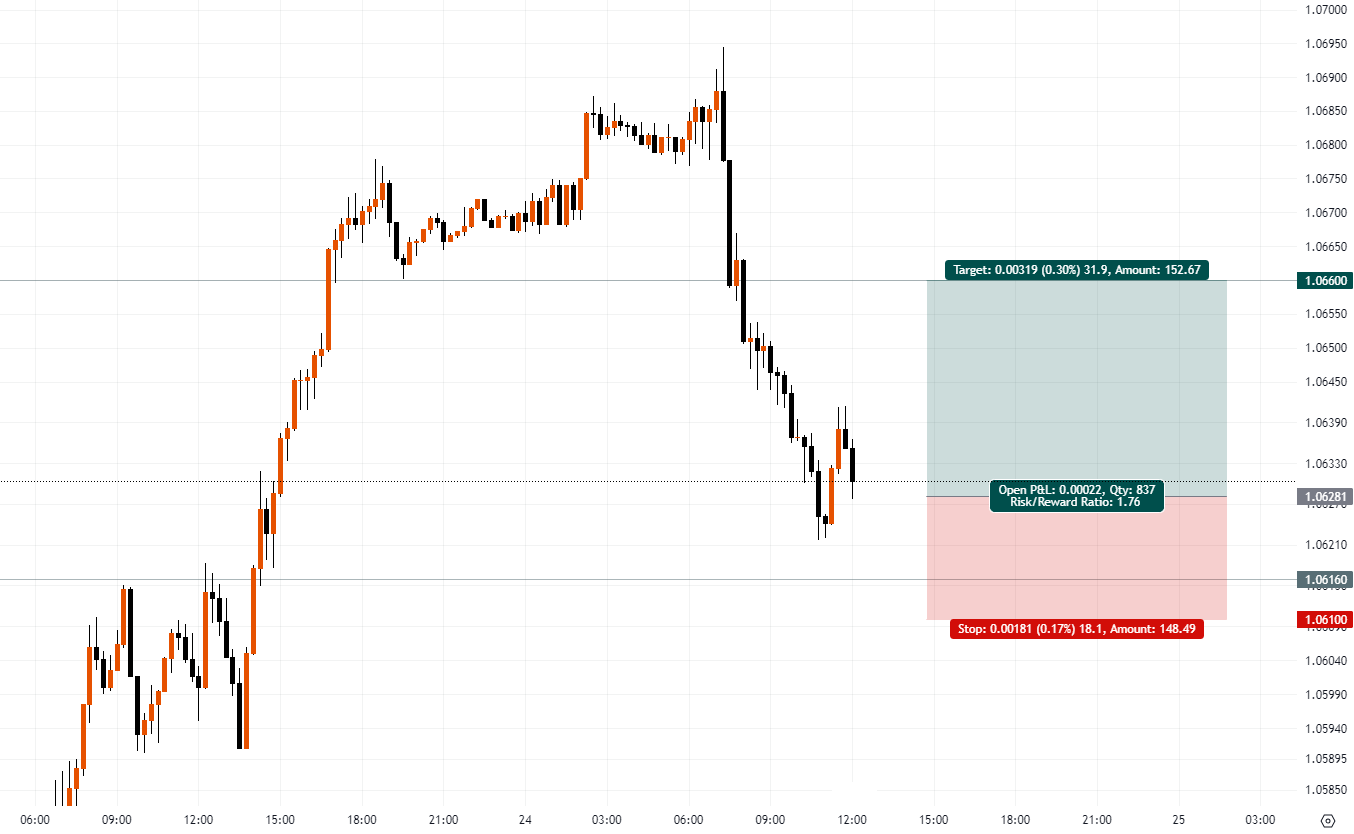

Source: Tradingview.com

Referencing the chart above, we can observe sharp downturns in price movements. Imagine entering a trade, anticipating a price rise, only for it to drop suddenly. Without a stop loss in place, the losses can be catastrophic, wiping out significant chunks of your investment.

To see the importance of using stop losses, check out our survey of 1,500 professional traders: Stop-loss order: should I use?

But let's say you believe that the downward momentum has been exhausted, and you are ready to open an intraday long trade. In the chart, the green represents the potential profit target, while the red indicates the potential loss. This visualization perfectly captures the risk-reward balance that traders aim for.

Best Forex brokers

Common stop loss placement strategies

When it comes to placing a stop loss in Forex trading, there are common strategies that traders can use to help manage risk. These strategies include using resistance and support levels, Bollinger bands, ATR, trendlines, and mathematical stops.

Each of these strategies has its own advantages and disadvantages that should be thoroughly analyzed before making a decision. To learn how to set a stop-loss order in the trading terminal, read this guide: Stop Loss Order - How to Use It Correctly to Earn More?

Resistance and support

Resistance and support are fundamental concepts in trading, denoting levels where prices typically stall or reverse due to supply and demand dynamics. They act as invisible barriers, preventing the prices from moving further in a specific direction.

These are many ways to identify resistance and support, including:

-

Round numbers: prices often stall or reverse at round numbers, e.g. $50, $100, $500, $1000. Psychologically speaking, traders often assign more importance to these figures

-

High volume levels: using the market profile indicator and Depth of Market can reveal areas where trading activity is concentrated. High volume areas often act as key support or resistance zones

-

Swing highs and lows: These are local peaks and bottoms (highs and lows) in price charts. A swing high acts as resistance, while a swing low acts as support. They represent points where the momentum in price direction has changed

To trade effectively, it’s important to incorporate these methods in tandem, fine-tuning entries and exits based on the confluence of support and resistance indicators.

Where do you put stop loss on Bollinger bands?

A common stop loss placement strategy when using Bollinger bands is to place it outside the outer band. This method is based on the idea that the outer band will act as a resistance or support level. If the price breaks through the outer band, it is a sign of a strong move and the stop loss should be placed outside the band to give the trade room to move.

An alternative option is to place the stop loss just inside the outer band, giving the trade more room to move but also reducing the risk of a false break.

Another strategy is to use a trailing stop loss. This involves setting the stop loss at a certain percentage below the current price level. This strategy works well when the market is trending and allows the trader to benefit from the trend while minimizing risk.

How do you place a stop loss with ATR?

Another popular stop loss placement strategy is to use Average True Range (ATR). ATR is a measure of volatility that indicates how much an asset moves in a given period. This can be used to determine the best place to place a stop loss.

-

1

Estimate the ATR for a particular security over a given time period

-

2

Determine the maximum amount of risk that is tolerable for the trade

-

3

Calculate the stop loss level by multiplying the ATR value by a factor, such as 2 or 3

-

4

Place the stop loss order at the calculated level

Using ATR as a stop loss placement strategy can help traders protect their capital while still allowing them to take advantage of price movements. It also helps to ensure that the stop loss is placed at the right distance, so that the trade has a greater chance of success.

Trendlines

Trendlines are often used to identify entry and exit points, as well as to set stop losses.

A trendline is drawn by connecting two or more points that indicate a trend in the direction of the security. A stop loss order can be placed just above or below the trendline in order to limit risk and protect profits. Here are some benefits of using trendlines:

-

Easy to identify

-

Clear entry/exit points

-

Set stop loss

-

Can be used in all markets

-

Requires technical analysis

How to calculate stop loss?

The most precise way to calculate a stop loss is by considering the risk/reward ratio. This involves the calculation of the amount of capital to be placed at risk, depending on the expected return of the trade.

Let's walk through an example.

Suppose you buy a stock at $100 (entry price). You are willing to risk $10 (2% of your $500 portfolio). You've decided on a risk/reward ratio of 1:3, meaning for every dollar risked, you expect three dollars in potential profit.

Steps to Calculate Stop Loss with Example:

-

1

Identify the Entry Price: Your entry price is $100

-

2

Determine the Amount of Capital to be Placed at Risk: You've decided to risk $10

-

3

Decide the Acceptable Risk/Reward Ratio: You've chosen a 1:3 ratio. This means if you're risking $10, you're expecting a potential profit of $30

-

4

Calculate the Stop Loss Level from the Risk/Reward Ratio: Subtract the amount you're willing to risk from the entry price: $100 - $10 = $90. Thus, your stop loss should be set at $90

By setting your stop loss at $90, you ensure you only lose $10 if the trade goes against you. Simultaneously, with a 1:3 risk/reward ratio, your target profit is $130 ($100 + $30). This strategy helps balance potential losses with potential gains.

Can I change the position of the stop loss

Once the stop loss has been placed, the position can be changed depending on the risk-reward ratio of the trade. This can be done for:

-

1

Breakeven trades

-

2

Trailing stops

-

3

Adjustments in volatile markets, and

-

4

Re-entries in a position

Be aware of the potential impact of changing the position of the stop loss. For instance, if the stop loss is moved too close to the current price of the asset, a trader could end up with a smaller position size and a lower potential reward. On the other hand, if the stop loss is moved too far away, the trader might be exposed to more risk than desired.

As such, it is important to carefully consider the risk-reward ratio before changing the position of the stop loss.

Where you should NOT place stop losses

Knowing where to place your stop loss is crucial. Equally important, however, is knowing where NOT to place them. Let's explain this aspect using the following image as a guide.

Source:Coinglass.com

Looking at the graph, you'll notice a significant dip marked by a sharp vertical green bar under “CoinGlass Aggregated Liquidations”. This is a representation of mass liquidation of positions. It's the financial equivalent of a domino effect, where the trigger might very well be stop losses getting hit en masse.

What’s noteworthy here? The price swiftly reversed upwards post this liquidation. For traders who had their stop losses clumped with the majority, this would mean an unnecessary exit from their position, only to watch the price rebound. This is a trader’s nightmare.

The key takeaway? Place your stop losses where the majority does not. By doing so, you shield yourself from being part of that domino effect. Instead of getting caught in the whirlwind of a mass sell-off, you give your trade breathing room to recover.

To pinpoint such optimal placements, it’s essential to study market behavior, historical data, and the psychology driving other traders. Understand that the market is a collective of individual decisions. By thinking differently from the majority, you insulate your trades from herd-driven volatility.

Remember, in the world of trading, sometimes it’s not just about following best practices but also understanding and outthinking the crowd.

If you want to learn more, our in-depth guide: Do Brokers Really Hunt Down Client Stop Loss Orders?

Conclusion

Stop losses can be a useful tool for limiting losses when trading. Placing stop losses correctly is an important part of successful trading, and there are multiple strategies for doing so.

When calculating stop losses, it is important to consider factors such as market volatility and risk tolerance. It is also important to avoid placing stop losses too close to the current market price, as this may lead to premature liquidation.

Ultimately, understanding the fundamentals of stop losses and using appropriate strategies can help traders manage their risk and protect their investments.

FAQs

What is the best stop loss point?

The best stop loss point varies for each trade and depends on factors such as the asset's volatility, trading strategy, and your risk tolerance. Generally, it's set at a price where the initial trade rationale is invalidated.

Where should I place my stop loss and take profit?

Place your stop loss where the market's recent behavior suggests your trading premise might be wrong, like below a recent low for long positions. Take profit should be set based on a favorable risk-reward ratio, typically at key resistance or support levels.

What is the 7% stop loss rule?

The 7% stop loss rule suggests that if a stock drops 7% below your purchase price, it's a trigger to sell and cut your losses. It's a conservative strategy used by some investors to protect against larger declines.

How to set a stop loss strategy?

First determine the amount of risk you're willing to take on a trade. Then, analyze the asset's historical data, volatility, and recent price action to identify a price point where your trade premise would be invalidated.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

4

Bollinger Bands

Bollinger Bands (BBands) are a technical analysis tool that consists of three lines: a middle moving average and two outer bands that are typically set at a standard deviation away from the moving average. These bands help traders visualize potential price volatility and identify overbought or oversold conditions in the market.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).