Best Online Forex Trading Courses

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best Forex trading courses online:

Thomas Kralow. Practical course with 200+ lessons for beginners.

Learn to Trade Forex. Intensive, hands-on mentorship program.

Forex Trading A-Z™. Beginner-friendly Forex basics on Udemy.

Traders Academy Club. Daily live sessions for all levels.

Six Figure Capital. Quick, structured 14-day training.

Learning the nuances of the foreign exchange market requires more than just time; it demands structured guidance from experts who’ve mastered the craft. If you're looking to refine your trading skills, avoid costly mistakes, and boost your profits, you’ve come to the right place. This article reviews eight top Forex trading courses, each curated to cater to different experience levels, learning styles, and trading goals.

Best Forex trading courses (2025)

When choosing a Forex course, knowing your goals, skill level, and learning preferences is key. Here’s a rundown of eight highly rated courses that can take your trading skills to the next level.

Thomas Kralow – University Grade Trading Education

Thomas Kralow offers a trading education program aimed at teaching people how to navigate financial markets. The course includes over 200 lessons that cover a range of topics, from basic concepts to more advanced trading techniques, and features quizzes and hands-on assignments to help solidify understanding. There are different versions of the course available, such as Basic, Complete, and Shortened, to suit various levels of experience and learning styles. The cost of these courses varies, starting at $123 for the Basic program and going up to $19,980 for the Assisted Plus option. All courses are conducted online, providing the flexibility to learn at your own pace. Many students have shared positive feedback, noting improvements in their trading skills and a better grasp of market behavior.

Pricing: $19,980 upfront or $6,125/month for four months

Key features:

Certified by the Continuing Professional Development (CPD) organization

Self-paced learning with options for personalized mentorship

Diploma upon completion

Learn to Trade Forex

Learn to Trade, founded by Greg Secker in 2003, offers Forex trading education and has taught over 400,000 people globally. Their courses cover topics like technical analysis, risk management, and trading psychology, aiming to help traders understand the Forex market. The company has received several awards for its programs and operates training centers in various countries. They also offer support and mentorship after the courses to help traders continue learning.

Pricing: £2,000-£3,000

Key features:

One-on-one mentorship and live trading sessions

Quick, focused learning for those wanting immediate results

Forex Trading A-Z™ (Udemy)

The Forex Trading A-Z™ course on Udemy provides a thorough introduction to Forex trading, catering to both newcomers and those with some prior knowledge. The course covers essential topics like currency pairs, how the market operates, and common trading terms, aiming to build a strong understanding of the Forex market. It features practical sessions using the MetaTrader 4 platform, allowing learners to see real-time trading examples. The course also talks about different analysis methods—fundamental, technical, and sentiment—to offer students various strategies for evaluating the market. Risk management is discussed, highlighting the importance of careful trading habits.

Pricing: Typically $89.99 (often discounted to $12.99)

Key features:

Lifetime access to materials

Self-paced learning, ideal for flexibility

Traders Academy Club

The Traders Academy Club, led by Vladimir Ribakov, continues to serve as an online educational platform for Forex traders. The club offers daily live trading sessions, market analysis, and a variety of educational materials aimed at enhancing members' trading skills. Members have access to a community forum for discussions and support, as well as tools and resources designed to assist in developing effective trading strategies. The club emphasizes practical learning through real-time market engagement and provides resources suitable for both novice and experienced traders. Vladimir Ribakov, an experienced trader and mentor, leads the sessions, sharing insights and methodologies based on his extensive experience in the Forex market. The club operates on a subscription basis, with fees applicable for membership and access to its resources.

Pricing: $297/year

Key features:

Twice-daily live sessions with trading experts

Access to a community of traders for knowledge sharing

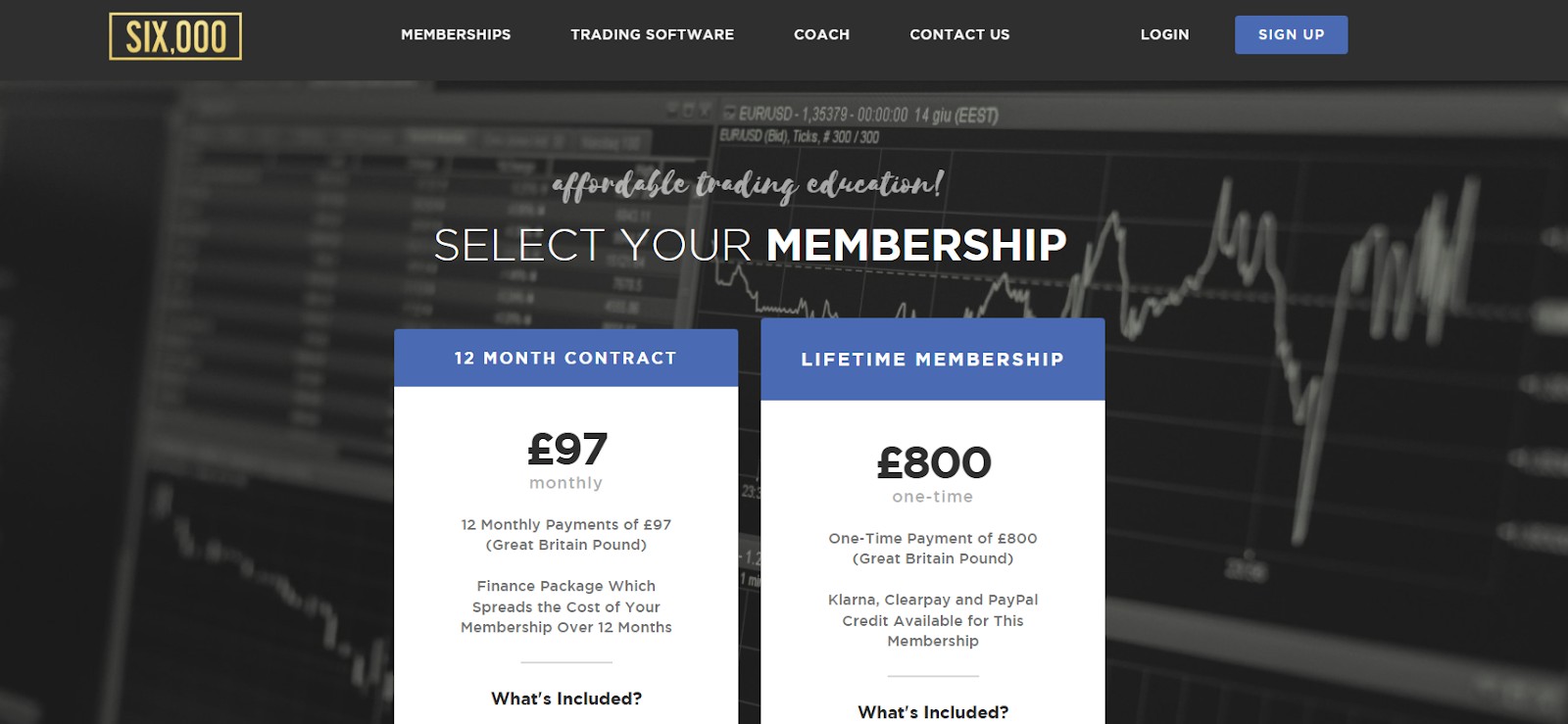

Six Figure Capital

Six Figure Capital offers an online course aimed at helping traders improve their skills in markets like Forex, commodities, and cryptocurrencies. The 14-day program covers key areas such as technical analysis, managing risks, and understanding trading psychology, providing a solid base for both beginners and seasoned traders. Created by Lewis Glasgow, who has been trading since 2014, the course focuses on practical strategies that can be applied in real trading situations. Beyond the main course, there's the Harmonic Mastery Course, which explores more advanced topics, especially harmonic trading patterns. Participants also get access to helpful materials like e-books and spreadsheets to aid their learning. Memberships are available either as a 12-month plan at £97 per month or a lifetime option for a one-time fee of £800. Users have shared positive experiences, noting the course's organized structure and the comprehensive content it offers.

Pricing: £97/month or a one-time fee of £800

Key features:

Intensive learning structure suited for fast learners

Emphasis on structured trading strategies

Asia Forex Mentor – One Core Program

The Asia Forex Mentor – One Core Program, created by trader Ezekiel Chew, offers a detailed course on Forex trading. It includes 26 lessons with 63 videos, starting from the basics and moving to advanced topics like price action strategies and market correlations. A key part of the course is the AFM Proprietary Point Calculation System, which helps assess trade probabilities. The program also features live trading sessions to provide practical experience. The course costs $2,497 for lifetime access, with a seven-day free trial for those interested. While the content is mainly based on Chew's own trading methods, it has been praised for its organized structure and real-world relevance.

Pricing: $2,497 one-time

Key features:

Lifetime access and adaptable strategies

Used by banks and financial institutions for training

Zen Trading Strategies

Zen Trading Strategies provides tools and educational materials to help traders create and automate their own trading strategies. They offer customizable strategies and indicators for TradingView, such as the Ultimate Trend Following Strategy and the Extreme Breakouts and Price Action Strategy, which are available through monthly subscriptions. These tools are adaptable to different assets and timeframes, offering on-chart buy and sell signals, along with settings for stop losses and take profits. Additionally, Zen Trading Strategies offers a Master Course in Automated Algorithmic Trading, guiding users in building and implementing trading algorithms without requiring coding knowledge. The course covers areas like backtesting, risk management, and refining strategies. Support is provided via email and a members-only Telegram group, which includes weekly live Q&A sessions.

Pricing: $67/month

Key features:

Focus on algorithmic and data-driven trading approaches

Frequent updates to strategies and techniques

Forex Trading Coach by Andrew Mitchem

Andrew Mitchem started The Forex Trading Coach in 2009 to share his approach to Forex trading. Having traded full-time since 2004, he created a system that he believes works well for him and his students. The program includes online videos, personal coaching, and tools to help traders improve. The website mentions that over 4,000 people from more than 100 countries have taken the course. The training focuses on strategies that aim for low risk and high reward, which may be suitable for those trading with proprietary firms. Mitchem also shares daily insights on currency strengths and weaknesses after the New York trading session ends.

Pricing: Variable; inquire for details

Key features:

Personalized guidance and practical trading support

Suitable for traders looking to build sustainable, consistent skills

| Course Name | Overview | Pros | Cons | Pricing |

|---|---|---|---|---|

| Thomas Kralow – University Grade Trading Education | Structured program covering beginner to advanced levels, focusing on technical analysis. | Well-organized, expert analysis, covers full trading scope. | Expensive, diploma may lack traditional recognition. | One time payment:$2170 and $2870 |

| LearnToTrade | Structured mentorship and trading strategies with a free 7-day trial. | One-on-one mentorship, practical trading experience, condensed learning. | High cost (~£2,000-£3,000), potentially overwhelming for some. | £2,000-£3,000 |

| Forex Trading A-Z™ (Udemy) | Introductory course covering Forex basics and MetaTrader 4 with live examples. | Affordable, beginner-friendly, lifetime access. | Limited depth for advanced traders, self-paced. | Varies, often discounted. Now 16,99 $ |

| Traders Academy Club | Daily live sessions with trading tools for all skill levels by Vladimir Ribakov. | Regular live sessions, suited for all levels. | Annual cost, may not suit all budgets. | $297/year |

| Six Figure Capital | 14-day program for beginner/intermediate strategies with intensive training sessions. | Rapid training, structured, suitable for quick learners. | High cost, fast pace may overwhelm beginners. | £97/month or £800 one-time |

| Asia Forex Mentor – One Core Program | Ezekiel Chew’s course on Forex, stocks, crypto, and trade selection strategies. | Lifetime access, used by institutions, comprehensive strategies. | Higher upfront cost, no live instruction. | $2,497 one-time fee |

| Zen Trading Strategies | Focuses on various strategies, including algorithmic approaches for advanced traders. | Algorithmic strategy access, frequent updates. | Subscription-based, not beginner-focused. | $597 |

| Forex Trading Coach by Andrew Mitchem | Personalized webinars and support aimed at building consistent trading practices. | Practical guidance, ongoing support, focus on consistency. | Webinar timing may vary, higher cost. | Variable; inquire for details |

Step-by-step guide to choosing a Forex trading course

Define your goals. Ask yourself what you aim to achieve. Are you interested in day trading, swing trading, or longer-term strategies?

Research instructor experience. Look into the background of the instructors to ensure they have proven industry experience.

Choose a learning format. Decide if you prefer live sessions with real-time feedback or a self-paced structure.

Look for trial options. Whenever possible, opt for courses that offer free trials so you can get a feel for the content and teaching style before committing.

Consider certification. If your goal includes career advancement, consider courses that offer certificates recognized in the industry.

Considerations for traders

For beginners, a course with clear foundational topics, like Forex terminology, market mechanics, and simple strategies, is essential. Look for programs that offer structured introductions and demo trading options for risk-free practice. Avoid courses that overload with complex topics and instead focus on those that allow you to build confidence and understanding gradually.

Advanced traders benefit from courses that emphasize sophisticated strategies such as algorithmic trading and in-depth technical analysis. Networking opportunities within these courses can be a major boost for experienced traders, as they can learn from peers and exchange ideas. Choose courses with industry-recognized instructors and up-to-date content.

After completing the training, we recommend starting trading on those platforms that have a demo account for risk-free training:

| Demo | Min. deposit, $ | Min Spread EUR/USD, pips | MAX Spread GBP/USD, pips | Open an account | |

|---|---|---|---|---|---|

| Yes | 100 | 0,5 | 1,0 | Open an account Your capital is at risk. |

|

| Yes | No | 0,5 | 1,4 | Open an account Your capital is at risk.

|

|

| Yes | No | 0,1 | 0,5 | Open an account Your capital is at risk. |

|

| Yes | 100 | 0,7 | 1,4 | Study review | |

| Yes | No | 0,2 | 1,5 | Open an account Your capital is at risk. |

Pros and cons of Forex trading courses

- Pros:

- Cons:

Structured learning with expert guidance

Access to peer networks and experienced mentors

Long-term skill development for consistent results

High costs for some advanced courses

Limited depth in certain beginner courses

Requires a time commitment to fully benefit from the material

Risks and warnings

When selecting a course, be cautious of programs that promise guaranteed success or profits, as these can be indicators of scams. It's also essential to set realistic expectations — no course can replace practice and patience. Be prepared for the financial and time commitment necessary to achieve meaningful results.

Maximizing the benefits of a Forex course

When selecting a course, start by honestly assessing where you are as a trader. Are you a complete beginner, or do you already have some experience but want to deepen your skills? Beginners often benefit most from courses that focus on foundations, giving them a solid understanding of market mechanics, terminology, and the basics of strategy. Advanced traders, on the other hand, might look for courses that explore algorithmic trading, technical analysis, or complex risk management strategies.

Also, prioritize courses with hands-on, practical elements. Theories and strategies are valuable, but nothing replaces real-time practice. Courses that offer demo trading, live sessions, or even case studies allow you to see strategies in action, apply them, and understand why they work (or don’t) in various market conditions. In my experience, these practical components are where the real learning happens.

Conclusion

Finding the right Forex trading course can make all the difference in your progress, but it's about choosing one that truly fits your specific trading needs and the way you learn. The courses mentioned each bring their own advantages, designed for various skill levels—from beginners to those with more experience looking to sharpen their strategies. What really stands out is how these courses help turn theoretical concepts into practical trading knowledge. By thoughtfully evaluating these options and committing to your education, you can build a strong, knowledgeable approach to trading that makes you better prepared for the market’s challenges.

FAQs

I work full-time. Can I still manage to complete a Forex trading course?

Yes, many courses are self-paced, allowing you to study at your own convenience. Look for courses with flexible schedules and lifetime access to make it manageable.

I’ve taken a few courses but still struggle with consistent profits. What should I do?

Consider a course with personalized mentorship or live trading sessions. These can help you apply strategies in real-time and adjust based on expert feedback.

I only want to focus on Forex day trading. Are these courses suitable?

Yes, but ensure the course includes a strong focus on day trading strategies, as not all Forex courses are tailored to this style.

I’m worried about scams. How can I verify if a course is legitimate?

Look for courses with transparent instructor credentials, real testimonials, and a trial period. Avoid programs that promise guaranteed profits or have vague descriptions.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Price action trading is a trading strategy that relies primarily on the analysis of historical price movements and patterns in financial markets, such as stocks, currencies, or commodities. Traders who use this approach focus on studying price charts, candlestick patterns, support and resistance levels, and other price-related data to make trading decisions.