What Are Stocks? How Do They Work?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Stocks, also known as shares or equities, represent ownership in a company. When you buy a stock, you purchase a small piece of that company, entitling you to a portion of its profits and assets. The price of a stock is influenced by supply and demand, company performance, and broader economic factors. Investors typically buy stocks hoping that the price will increase over time, allowing them to sell at a profit.

Investing in stocks is one of the most powerful ways to build wealth over time. But for many, the stock market remains a mysterious and intimidating realm. This article aims to demystify stocks, explaining their function, advantages, and risks, and providing practical advice for both beginners and advanced traders.

What are stocks and how do they work

Stocks represent ownership in a company. When you buy a stock, you purchase a small piece of that company, entitling you to a portion of its profits and assets.

There are two main types of stocks: common and preferred. Common stockholders can vote on company issues and receive dividends, but they are last in line for assets if the company goes bankrupt. Preferred stockholders get fixed dividends and have a higher claim on assets but usually don’t have voting rights.

How do stocks work?

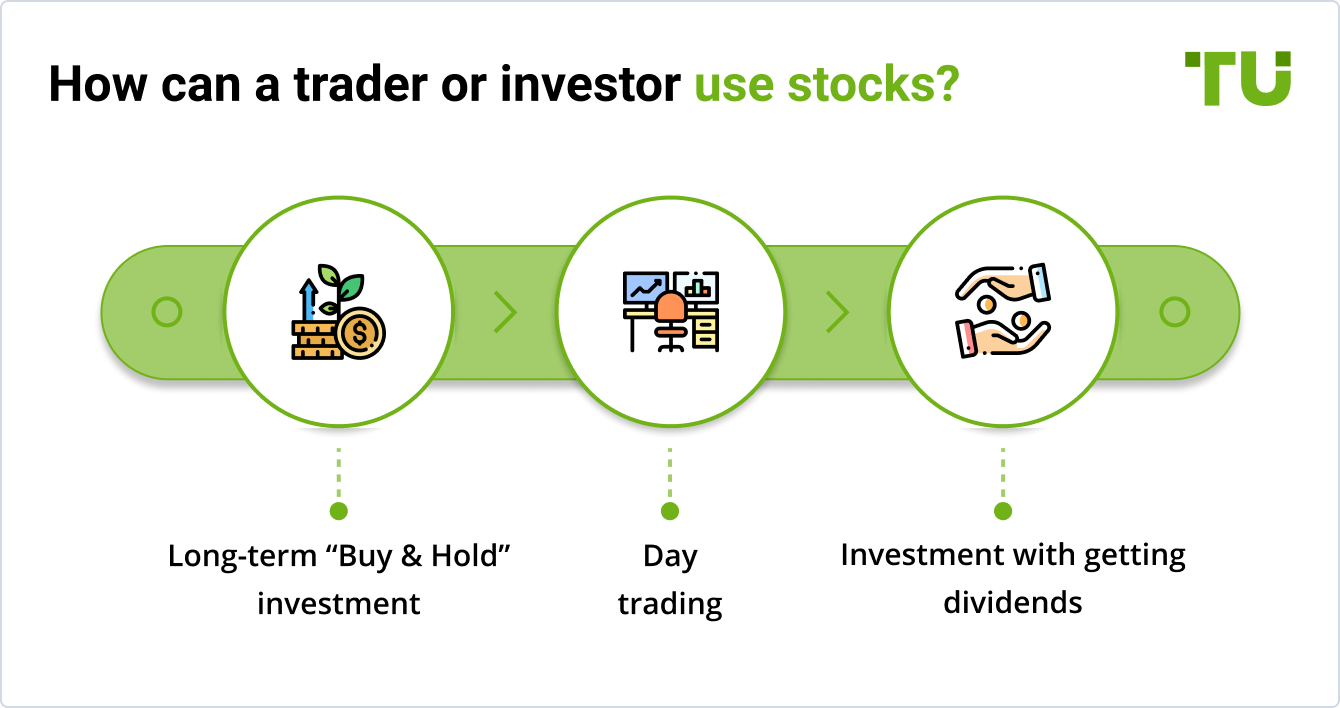

Stocks are traded on stock exchanges, where prices fluctuate based on supply and demand, company performance, and broader economic factors. Investors buy stocks hoping that their value will increase over time, allowing them to sell at a profit or earn dividends.

Why do companies issue stocks?

Companies issue stocks to raise capital. By selling shares to the public, they can obtain funds without taking on debt. This capital can be used for various purposes, such as expanding operations, developing new products, or paying off existing debt.

Are stocks risky?

Yes, stocks can be risky. Their prices can be highly volatile, influenced by market conditions, economic events, and company-specific factors. Stocks offer the potential for high returns, but at the same time they come with the risk of loss of value.

Investors must be prepared for market fluctuations and understand that there are no guarantees of profit. Diversification and thorough research can help manage some of these risks.

How can I buy stocks? Step-by-step guide

To buy stocks, you can follow these simple steps:

Research and choose a stock. Use financial news sites, company reports, and market analysis tools to identify promising stocks.

Open a brokerage account. Choose a brokerage, fill out the necessary forms, and fund your account.

Place a trade. Decide on the number of shares, choose an order type (market or limit), and execute the trade.

Monitor and manage investments. Regularly review your portfolio, track performance, and make adjustments as needed.

For point number 2, this table provides a comparison of the best stock brokers for trading, highlighting their key features, trading platforms, commission fees, minimum deposit requirements:

| Broker | Demo account | Account minimum | Interest rate | Stocks/ETFs Fee per share basic | Foundation year | |

|---|---|---|---|---|---|---|

YES | $0 | $0 | $0 | 2007 | Open an account Your capital is at risk.

| |

YES | £500 | 4.56% | U.S. Stocks: start from $1. European Stocks: start from €3/ UK Stocks: start from £5. | 1992 | ||

YES | $2000 | 3.8% | US Stocks: $0.01 per share; min fee of $2, max of 1% of the trade value. EU Stocks: 0.1% of trade value with a min fee of €4 and a max of €99. | 2001 | Open an account Your capital is at risk.

| |

YES | $0 | 0,15-1% | After exceeding the free trades, the fee is 0.25% of the order amount, with a min fee of £1.00 (or equivalent in other currencies) | 2015 | ||

YES | $0 | 4.83% | $0 | 1978 | Open an account Your capital is at risk. |

Pros and cons of investing in stocks

Investing in stocks is a popular method for building wealth and achieving financial goals, but it comes with its own set of advantages and disadvantages. Understanding these can help you make informed decisions and manage your investments effectively.

- Pros

- Cons

- Potential for high returns - investing in stocks offers the potential for high returns over the long term. Stocks have outperformed other investment vehicles such as savings accounts and bonds. For instance, the average annual return of the S&P 500 has been around 10% over the past several decades.

- Ownership and voting rights - when you purchase stocks, you become a part-owner of the company. This ownership often comes with voting rights, allowing you to have a say in major company decisions, such as electing board members and approving significant corporate policies.

- Liquidity - stocks are highly liquid assets, meaning they can be easily bought and sold in the stock market. This liquidity provides flexibility for investors to quickly access their funds if needed.

- Dividend income - many companies pay dividends to their shareholders, providing a regular income stream in addition to any capital gains from the sale of the stock. Dividends can be reinvested to purchase more shares, further compounding returns over time.

- Diversification - the stock market offers a wide range of companies and sectors to invest in, allowing investors to diversify their portfolios. Diversification helps reduce risk by spreading investments across different industries and markets.

- Volatility and risk - the stock market is known for its volatility, with prices subject to rapid fluctuations due to economic conditions, political events, and company performance. This volatility can lead to crucial short-term losses, making stocks a risky investment compared to more stable assets like bonds or savings accounts.

- Market timing challenges - successfully timing the market—buying low and selling high—is extremely difficult and often results in poor returns. Even experienced investors can struggle with market timing, leading to potential losses.

- Emotional investing - the psychological aspect of investing can lead to poor decision-making. Fear and greed can drive investors to buy high and sell low, locking in losses and missing out on potential gains.

- Lack of control - as a shareholder, you have limited control over the company's operations and decisions. The company's management team makes the strategic decisions, and their actions can significantly impact the stock's performance.

- Economic and political risks - stocks are susceptible to economic downturns and political instability, which can negatively impact their value. Factors such as inflation, interest rates, and regulatory changes can also affect stock prices and investor returns.

Tips for beginners

Understanding basics. Before diving into the stock market, beginners should understand fundamental concepts such as stock types, market orders, and how to read stock quotes. Explore interesting stock market facts that will expand your knowledge and deepen your understanding of market trends, history, and investing strategies.

Risk management: Learning how to manage risk is crucial. This includes setting stop-loss orders to limit losses and not investing more than you can afford to lose.

Demo trading. Using demo accounts allows beginners to practice trading without risking real money. This helps build confidence and experience.

Educational resources. Books, online courses, and financial news websites are valuable resources for learning about stocks. Websites like Investopedia and Khan Academy offer comprehensive tutorials.

Starting small. It’s wise to start with a small investment and gradually increase exposure as you gain experience and confidence.

Tips for advanced traders

Advanced analysis techniques. Advanced traders use complex technical and fundamental analysis techniques. This includes studying chart patterns, using indicators like MACD and RSI, and analyzing financial statements.

Algorithmic trading. Algorithmic trading involves using computer programs to execute trades based on predefined criteria. This can increase trading efficiency and reduce emotional decision-making.

Diversification strategies. Advanced traders often employ sophisticated diversification strategies, such as sector rotation and international diversification, to spread risk.

Performance metrics. Tracking performance metrics like Sharpe ratio, alpha, and beta helps advanced traders evaluate their strategies and make necessary adjustments.

Tax implications. Understanding the tax implications of trading is crucial. Different types of trades and investments have varying tax treatments, and advanced traders need to plan accordingly.

Develop a solid trading plan and stick to it

As an experienced stock trader, my first advice to you is to never forget to do your homework. This means thoroughly researching the companies you're interested in. Understand their business models, financial health, competitive positioning, and growth prospects. Look at their earnings reports, balance sheets, and income statements. Pay attention to industry trends and economic indicators that could impact their performance. Knowledge is power in the stock market, and the more informed you are, the better your investment decisions will be.

Staying emotionally detached from your investments is also critical. The market can be a rollercoaster, and emotional trading is often a recipe for disaster. Develop a solid trading plan and stick to it. Discipline and consistency are key to navigating the market’s highs and lows.

Conclusion

Investing in stocks means owning a piece of a company and sharing in its successes. While the stock market can seem overwhelming, understanding how stocks work and the basics of buying them can make it less intimidating. Remember, everyone starts as a beginner. Do your homework, stay patient, and learn from your experiences. With the right approach, you can use stocks to grow your wealth and reach your financial goals.

FAQs

What are the different types of stocks I can invest in?

There are two main types of stocks: common stocks, which provide voting rights and dividends, and preferred stocks, which offer fixed dividends but typically do not have voting rights.

How do dividends work in stock investments?

Dividends are payments made by a corporation to its shareholders, usually derived from profits. They can provide a steady income stream, and the amount is typically based on the number of shares owned.

What is the best way to start investing in stocks as a beginner?

Beginners should start by opening a brokerage account, using demo accounts to practice, and investing in well-known, stable companies while gradually building their portfolio.

How can I determine the right time to buy or sell a stock?

Timing can be influenced by various factors including market conditions, company performance, and technical indicators. Tools like moving averages and MACD can help, but it’s important to conduct thorough research and consider long-term goals.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.