How Can I Buy Bitcoin With a Credit Card or Debit Card

How Can I Buy Bitcoin With a Credit Card or Debit Card

Let's face it, the cryptocurrency world is quite confusing, especially for people who have just stepped into it. Learning about different currencies and understanding their buying and selling procedures can get quite daunting and overwhelming.

If you are interested to know the procedure to buy Bitcoin with a credit card, this helpful article has got you covered.

Dig in to explore different ways to buy Bitcoin with a credit card anonymously. Besides, learn a thing or two about popular platforms that may help you accomplish this task.

Start trading cryptocurrencies right now with Coinbase!How to Buy BTC with a Credit Card or Debit Card: Main Options

Bitcoin (BTC) is the most popular currency in the world, and that is clearly visible from its increase in price from $3,237 in 2018 to around $65,000 in 2023. That said, Bitcoin has a speculative nature and is quite volatile. This is why it is wise to invest only 10% or less of your portfolio in risky assets such as Bitcoin.

But to invest in this currency, you should know the different options available for you to buy it. You can buy Bitcoin with a debit card or credit card directly through exchanges. You can use the Mastercard or Visa payment systems to accomplish this purchase.

Buying through exchanges is convenient for those who want to keep their Bitcoins in their exchange account.

Alternatively, you can work with different platforms that have their accounts restored via partners payment providers. This procedure seems convenient when transferring money to hot or cold wallets later.

Best Cryptocurrency Exchange to Buy Bitcoin With a Credit Card

Binance is one of the world leaders when it comes to cryptocurrency exchanges, so if you want to use it to buy Bitcoin with a credit card, follow the steps below.

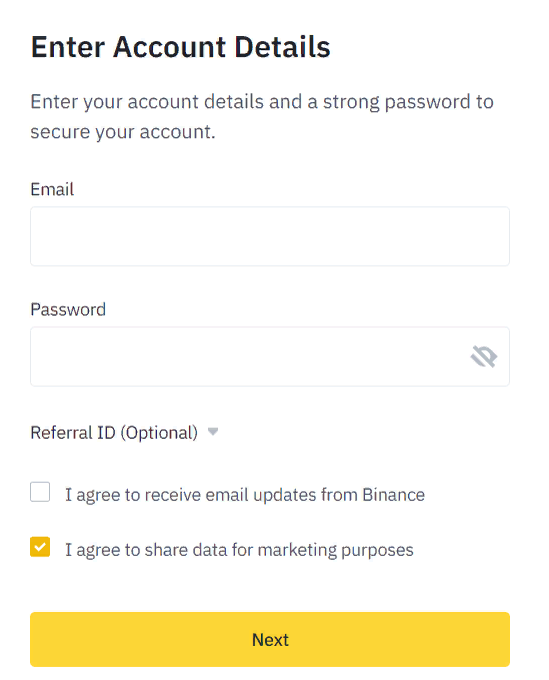

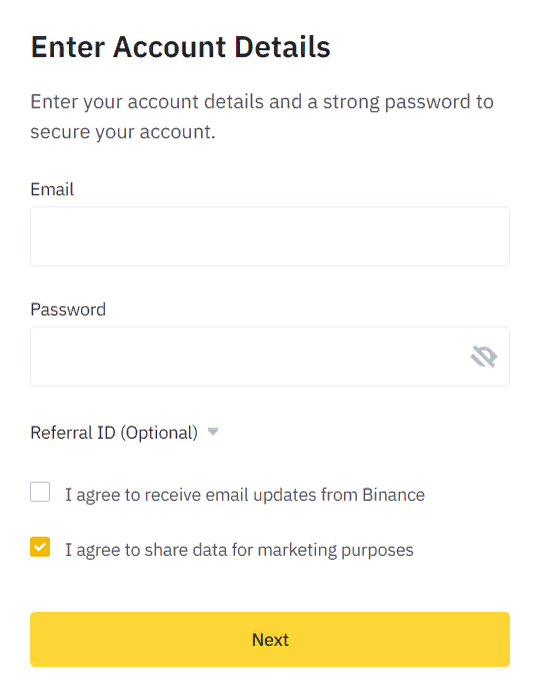

Use the Binance App, Binance Desktop App, or Binance Website to make and register an account. You will have to share your phone number or email address to create your first Binance account.

Photo: create your first Binance account

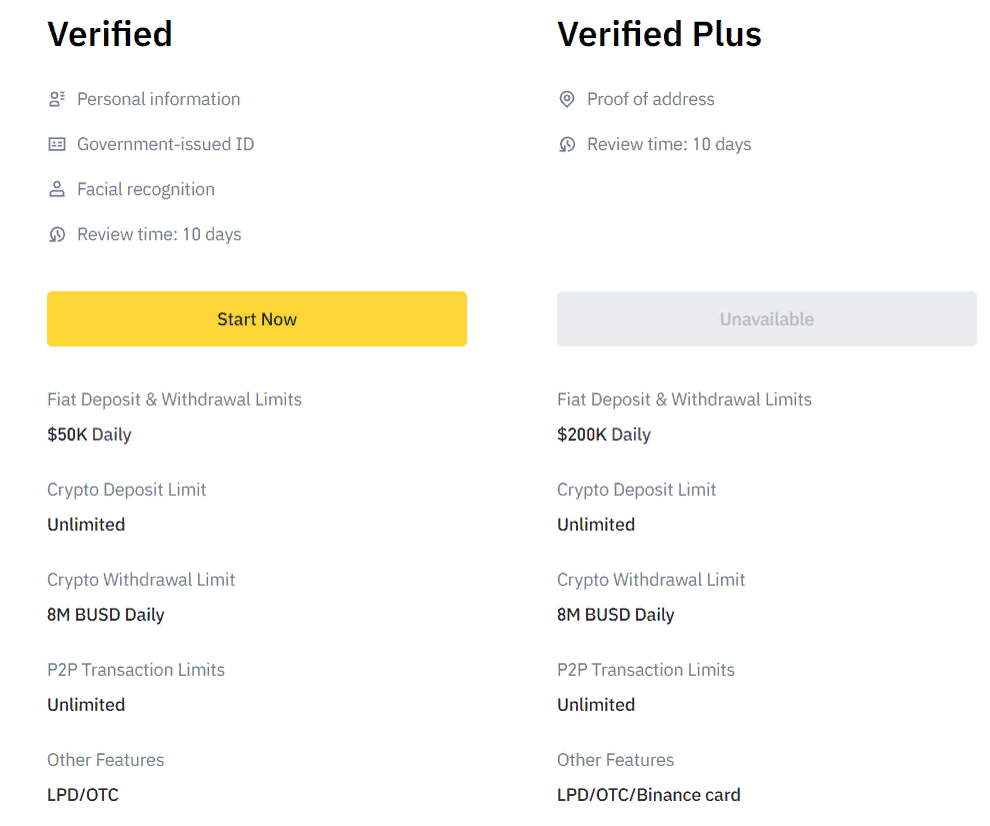

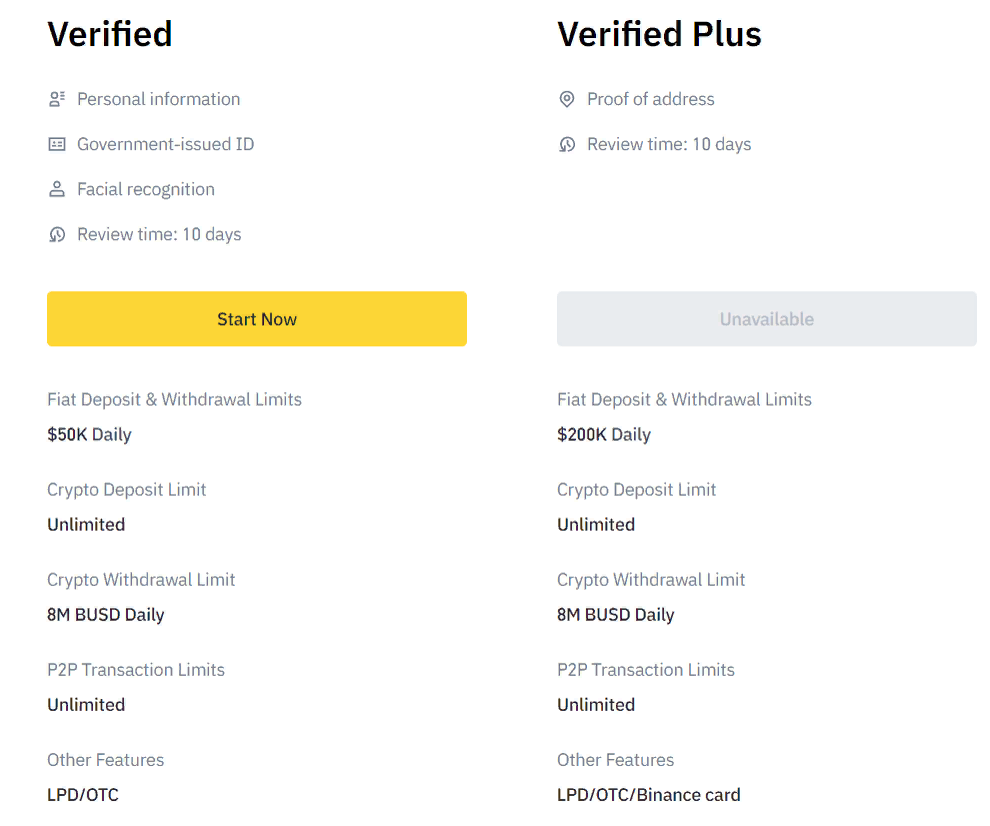

Once done, complete the verification. It is imperative to complete Identity Verification to unlock any withdrawal limits and fiat deposits. You will be asked to provide your ID documentation and a portrait to complete this step.

Photo: verification on Binance

After completing the steps above, deposit fiats in your newly-created Binance account. The number of deposited fiats depends on your country, but you can easily deposit almost 50 plus at a time. Once deposited, these fiats can be used to buy your Bitcoin.

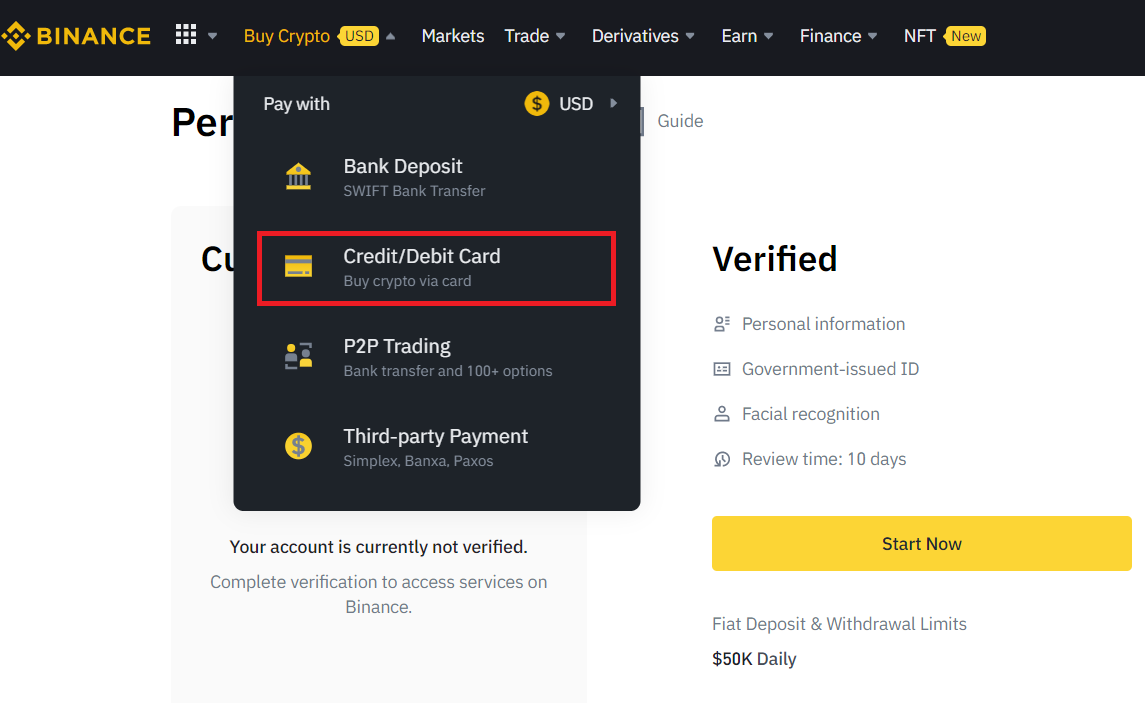

Alternatively, you can also buy Bitcoin with a credit card or debit card. Navigate through the Binance website and make a payment. Also, you can use the Lite Mode available on the Binance App for quick payment through either of these cards.

Photo: buy Bitcoin on Binance

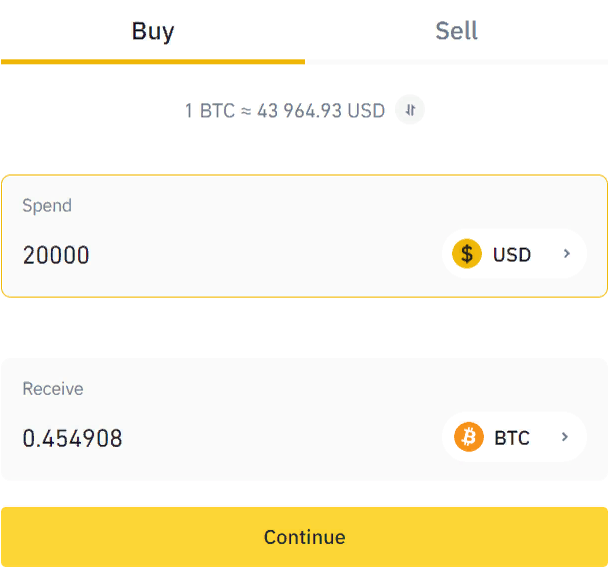

Simply enter the amount of fiats you want to spend, and the system will automatically let you know the cryptocurrency amount you will get in return.

Photo: buy Bitcoin on Binance

Enter your card details. Ensure that Binance won't allow you to use anyone else's credit or debit card.

Place your billing address, and finally click on "Add Card."

Check all the details, and once you do, the system will recalculate your crypto amount. Click "Refresh" to know the latest prices.

This step will take you to your bank's OTP Transaction Page. Verify your payment by following all the on-screen instructions.

Once you have your first cryptocurrency, don't hesitate and explore different trading products on Binance.

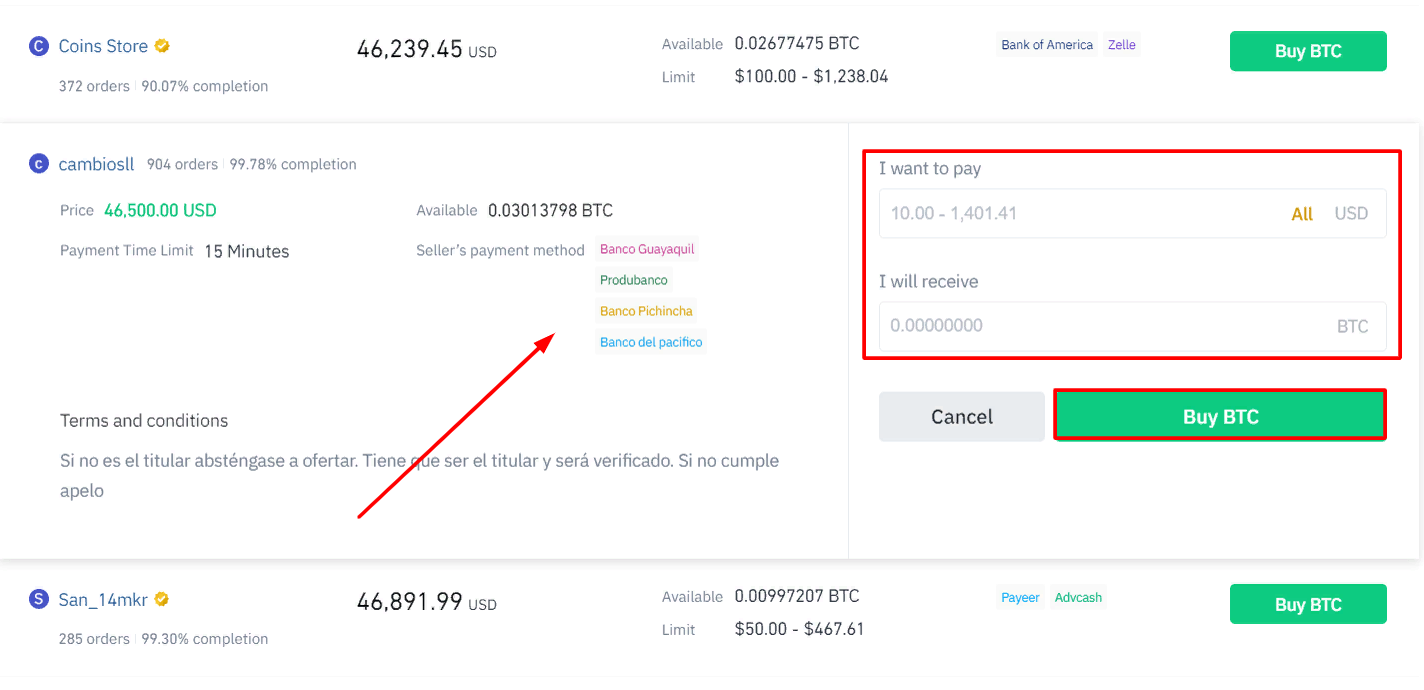

How to Buy BTC with a Credit Card or Debit Card With a Р2Р Platform

Interestingly, many exchanges allow you to buy BTC through P2P or (peer to peer) platforms. In this method, you don't buy the currency from an exchange. Instead, you get it from private traders available on a specific platform.

Here are the steps that can help you buy Bitcoin with your credit or debit card with Binance P2P.

If you have an account with Binance, leave the registration step, and jump directly to the P2P Trading option. However, if you don't, follow each step below.

Register yourself after entering your details and reading all the terms and conditions. Once done, click on "Register."

Photo: create your Binance account

Now fill in all your details for Identity Verification, and also set your payment method, which could be either debit or credit card.

Photo: verification on Binance

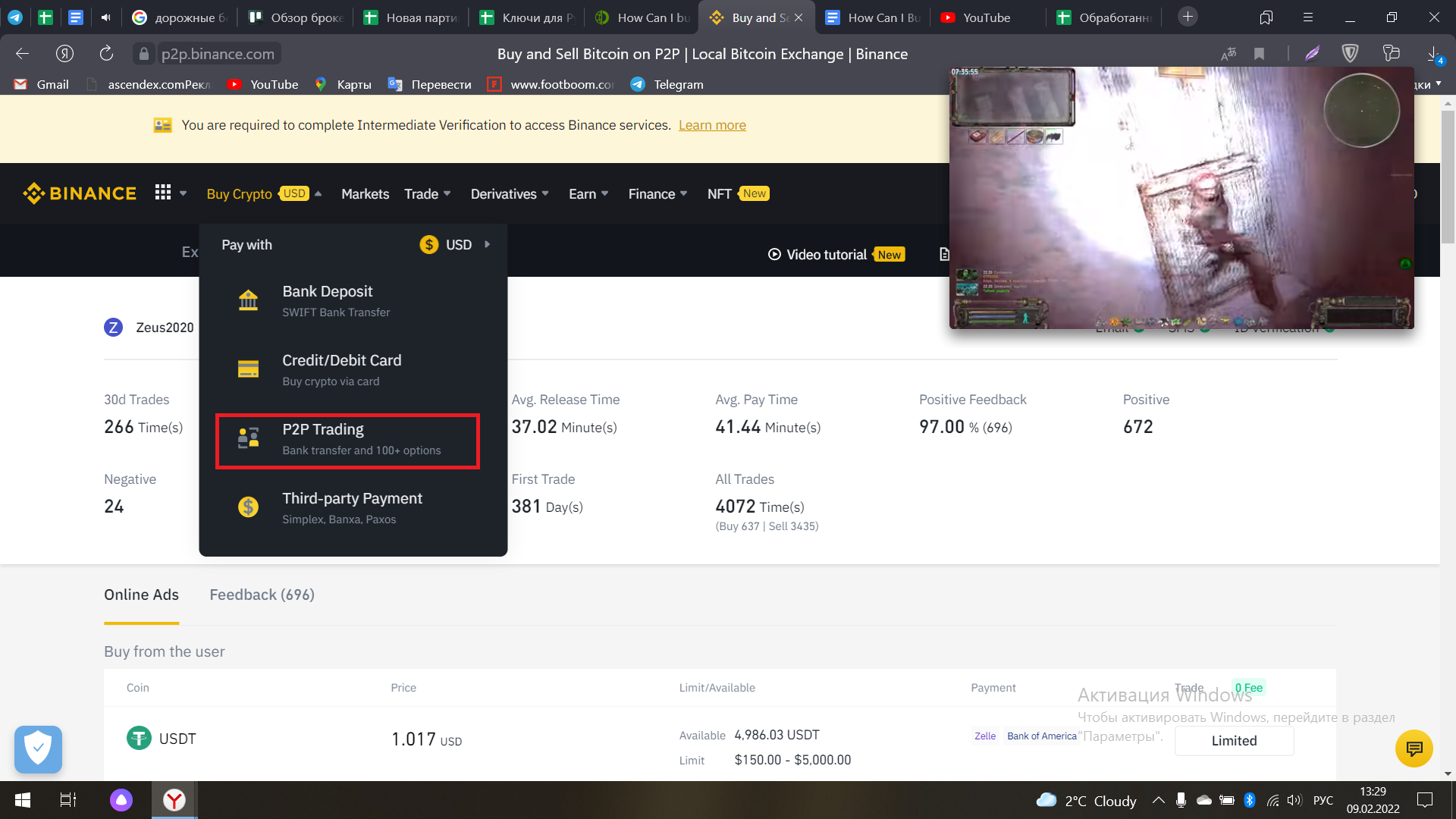

Now select "Buy Crypto" and move to P2P Trading on the top bar.

Photo: Buy crypto

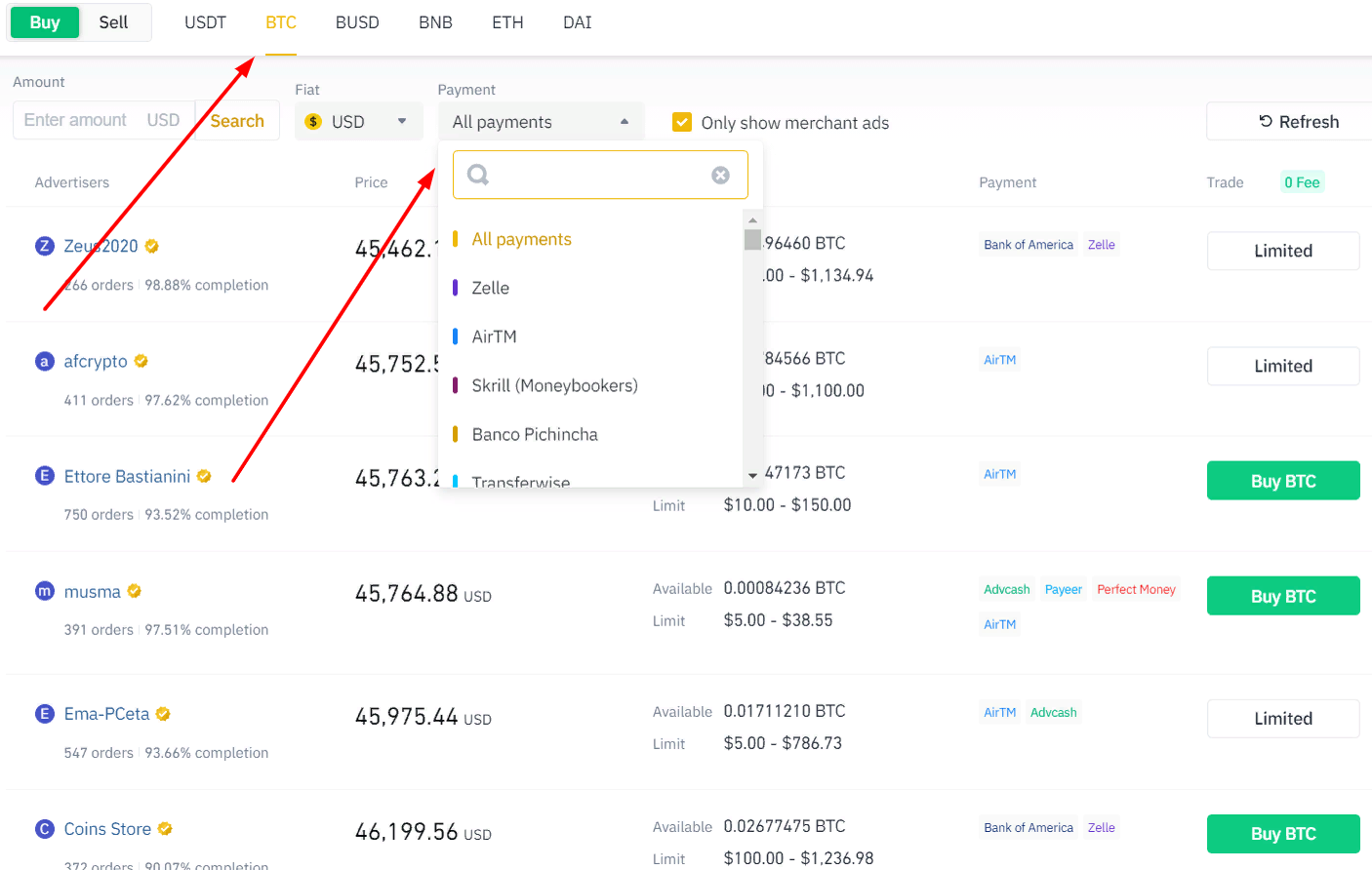

Click on "Buy" and select your preferred currency (BTC in this case). Filter the price and payment and then simply click on "Buy."

Photo: Buy crypto

Enter the fiat currency amount and the cryptocurrency that you want to purchase, and then click on "Buy."

Photo: Buy crypto

Now move to the Order Detail page, and complete your payment method. Once done, click on "Transferred, Next" and "Confirm."

Your transaction will be complete as soon as the seller releases your currency. If you want to confirm the amount of Bitcoin you have just bought, click on "Check my Account" and view all your digital assets.

In some circumstances, you might not receive your cryptocurrency within 15 minutes of clicking "Transferred, Next." In that case, don't delay and click on "Appeal" and connect with a customer service representative. They will then help you with completing your order.

How to Buy BTC with a Credit Card or Debit Card Through a Broker

If you find exchanges too technical, you can always opt for a broker to help you buy BTC with a credit card or debit card. Lucky for you, most forex brokers have low brokerage costs in order to attract more clients to their platform. Moreover, these brokers give you a sense of financial security while buying or selling your cryptocurrency.

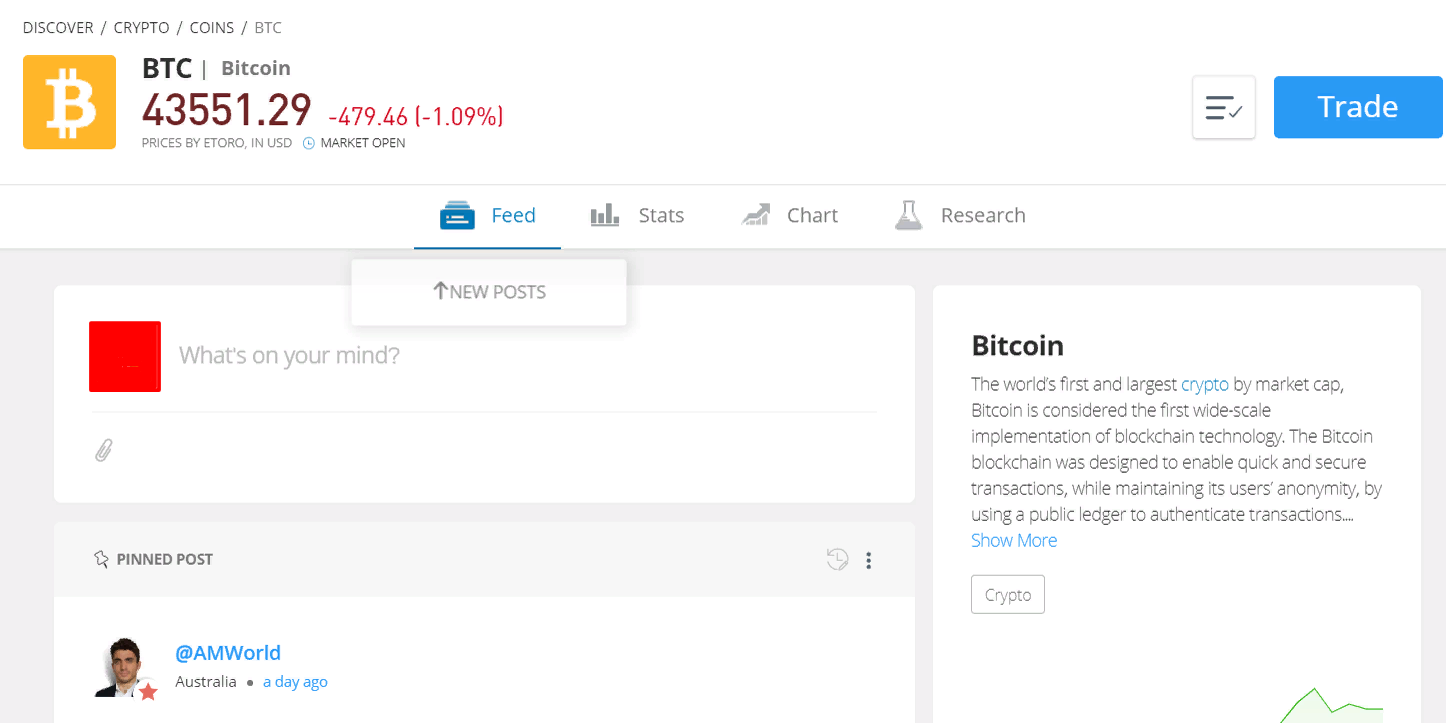

If you are a beginner, we can't recommend eToro enough. It is one of the best crypto brokers and copy trading platforms that many people love. Besides, it allows you to make your first crypto purchase using as low as $50.

Many people have zero confidence or experience in digital currency and its trading. However, eToro's copy trading facility gives you an opportunity to trade with limited skills.

eToro is crypto custody and is entirely centralized. However, it has many holding and investment products for both crypto dealers and owners. So even if you want to use dollar-cost averaging to buy Bitcoin, eToro will be more than happy to meet your requirements.

Below are all the steps that you should take when buying Bitcoin with a credit card or debit card through eToro:

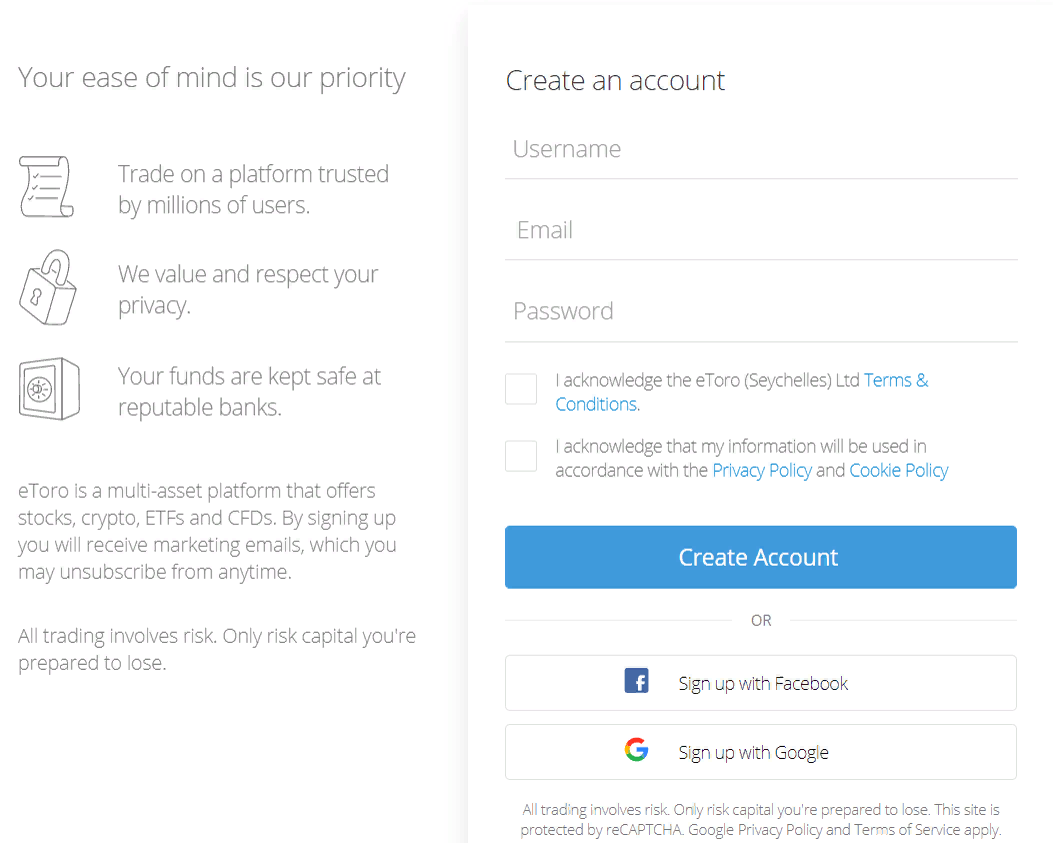

Register and create an account with eToro.

Photo: create an account with eToro

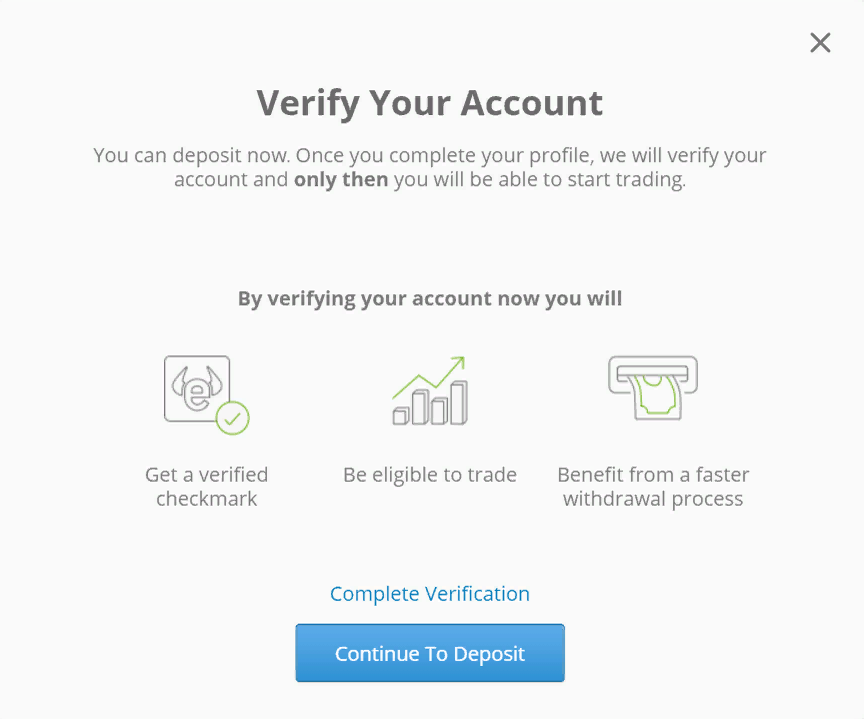

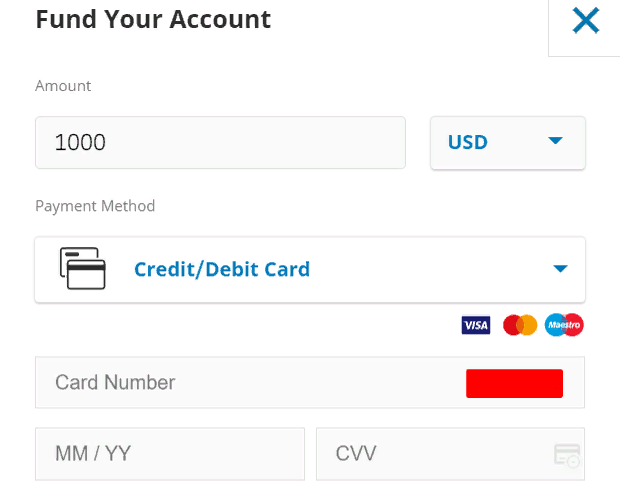

Now verify your account and link your credit or debit card with the platform.

Photo: verify your account

Photo: fund your account

Once done, check your portfolio.

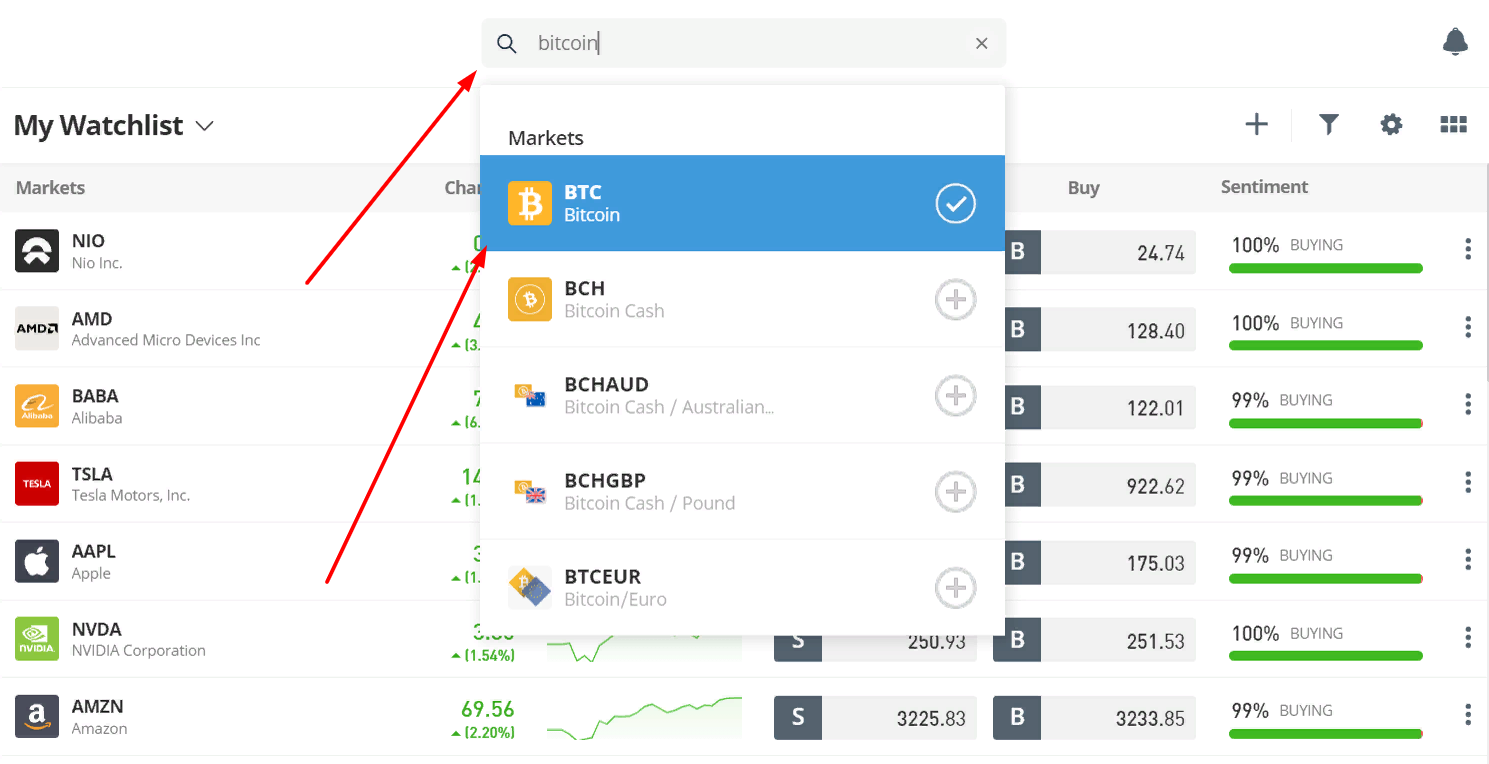

Now go to the "Buy page" on eToro, choose Bitcoin to put in the amount of this currency you need, and click "Buy".

Photo: “buy page”

Once done, recheck your portfolio and start trading.

Photo: start trading Bitcoin

Here are some important points to note.

eToro charges a crypto conversion fee of 0.005 units of crypto.

If you opt to make a payment through your credit or debit card, you will be charged 0.75% to 5% of the total amount.

The trading fee for Bitcoin is around 0.75% right now. But this percentage may vary for every cryptocurrency.

If you want to know more about eToro or want to create an account with this broker, visit the website and start trading.

Fees for Buying Bitcoin with a Credit Card or Debit Card

Since everyone these days is buying Bitcoin, you might be lured to jump on the bandwagon and get your hands on this cryptocurrency. And to make things easy, you may want to consider your debit or credit card to make all the required payments.

However, you may not be aware that there are many fees or commissions that you might have to pay while making a payment through your credit card. For example, you may have to pay 7% extra fees after using your credit card to buy BTC.

Exchange Platform Commission

This is the first commission that you will most probably pay while buying Bitcoin through your credit card. This fee amounts to 2% or sometimes higher and is charged by exchanges to overcome the fee that credit card issuers charge while processing a transaction.

In a few cases, an exchange may charge you a fee way above the processing fee charged by card issuers. The exchange commission can easily go to 3% or more. These charges put a lot of pressure on the crypto buyer and discourage them from buying their preferred currency.

Payment System or Card Issuer Commission

Unfortunately, you may also be charged a certain amount of fee from your card issuer or payment system. This fee is far more than exchange platforms charge you. It is because many card issuers consider crypto transactions similar to cash transactions.

Simply put, your payment processor might consider your crypto purchase as taking cash in advance. However, cash advances have many drawbacks.

For starters, there is a fee for cash advances which is around 3% to 5% of the total amount of transaction. So, for instance, you want to buy crypto with your $100. In that case, you will have to pay $5 for cash advances.

Additionally, there is no grace period for cash advances. This means that you will accrue interest on your purchase right after the transaction gets into your account. Also, cash advances come with high interest rates, so the fee will accumulate quite fast.

These charges are unacceptable, so you should find ways to minimize these commissions. Here are some ways in which you can do that:

Use debit cards instead. Some debit cards also help you earn rewards, and that may help you earn some cash back.

You can always opt for the ACH transfer method. It transfers your funds directly from the bank account to the exchange account. This method has very low processing fees, so that is a plus.

Finally, if you want to use your credit card, consult your card issuer for ways to mitigate the commission. If you have been a part of a certain bank for a long time and have a good credit history, you may receive some support.

What You Need to Know Before Buying Bitcoin

Investing in Bitcoin may seem daunting, but if you have prepared yourself, every step starts getting simple and easy. So, here are a few things that you should already know before you plan to buy your first Bitcoin.

If you plan to buy BTC through an exchange, keep in mind that you might be asked to share your personal details for account verification. Your reluctance to reveal that to a platform may not work for you. From your email address to phone number and bank details, all personal information is imperative for identity verification.

Unfortunately, there are many phishing sites that you might come across while trading Bitcoin. They may succeed in getting your personal data, which might create further issues for you. This is why it is imperative to choose a reputable exchange platform and do lots of homework before making an account.

If you are using a credit card to buy Bitcoins, you should know that you will have to repay the funds to keep your credit history clear. Unfortunately, trading at the expense of credit money can end up quite costly, and many traders don't take that seriously.

What to Do After Buying Bitcoin?

Once you have bought your Bitcoins, you can either use them to pay for different trading products or trade them for other currencies. Alternatively, you can keep them safe and wait for their price to rise before you sell them away.

The table below shows different ways in which you can utilize Bitcoins for your benefit.

We have discussed the advantages and drawbacks of each method.

| Advantages | Flaws | |

|---|---|---|

Active Trading |

1. Bitcoin trading is far cheaper than bank transactions. 2. Blockchain has great potential, and you can avail that with trading. 3. Active trading helps you become a professional trader, which works great when working with other currencies as well. |

1. There is a high risk involved. 2. Unfortunately, trading Bitcoin increases the uncertainty related to hard forks. 3. In addition, a frequent change in Bitcoin regulations increases trading risks. |

Earnings on staking, DeFi |

1. DeFi reduces human error and eliminates mismanagement. 2. Loan accessibility is just a click away. 3. DeFi is a healthier system, not too vulnerable to global shocks. |

1. Transactions take time to approve. 2. There is a high vulnerability associated with small contracts. 3. Insurance is rare with DeFi. 4. Only you are responsible for losing funds. |

Hot wallet storage |

1. They are convenient to use. 2. As they are connected to the internet, assessing crypto every time becomes hassle-free. 3. You can easily find a hot wallet that is compatible with Bitcoin or other currencies. |

1. Unfortunately, hot wallets are pretty vulnerable to crimes, mainly cyber. 2. In addition, you don’t have full control of your wallet, as many wallets fail to give you access to your private keys. |

Cold wallet storage |

1. You can carry them with you at all times, and they only require a USB to connect to a computer. 2. They are much more secure than hot wallets. |

1. Unfortunately, they are not available for free, so you will need funds to buy one. 2. Without technical know-how, you may find it hard to set up a wallet. |

Summary

If you want to buy Bitcoin with a credit card or debit card, you can do so and then use it for active trading or buying other financial products. That said, make sure that you are aware of extra charges that your crypto exchange or card issuer may implement on you while you make a transaction.

This article covers all the guidance you may require to buy BTC with a credit card or debit card. We hope you won't have any problems while making your first transaction via a bitcoin card.

FAQ

Here are some common questions that may help you to buy Bitcoins with a credit card or debit card.

Can I Buy Bitcoin With Credit Card?

Yes, you can. However, to sell or buy it, you should join an exchange first. There are many exchanges that support credit card transactions.

Is It Important to Buy Bitcoin With Verification?

Identity Verification is one of the most crucial parts of purchasing or selling Bitcoin on any platform. However, if you don't want to reveal your identity to any platform, there are a few exchanges that let you proceed with cryptocurrency transactions without requiring your identity details.

What Are the Problems Associated with Credit Cards When Buying Bitcoin?

You might be charged a foreign exchange fee if your chosen exchange is located outside the USA. This fee is typically around 3%.

Additionally, if you fail to select a reputable exchange, you may be prone to scam by sharing your credit card details with a fraudulent platform.

Are There any Benefits of Using Credit Cards to Buy Bitcoin?

Yes. For starters, the payment procedure is quite simple. Moreover, you can make a payment without leaving your comfort zone. Lastly, paying from a credit card is secure, provided you choose a reliable exchange platform.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

The area of responsibility of Mikhail includes covering the news of currency and stock markets, fact checking, updating and editing the content published on the Traders Union website. He successfully analyzes complex financial issues and explains their meaning in simple and understandable language for ordinary people. Mikhail generates content that provides full contact with the readers.

Mikhail’s motto: Learn something new and share your experience – never stop!

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.