Bitcoin, Stocks, Or Gold: What’s The Smart Choice?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Bitcoin vs stocks vs gold and real estate – which is better:

Bitcoin offers high volatility and is less regulated. Potential for large short-term gains.

Stocks provide steady growth and dividends. Lower volatility with consistent returns.

Gold is a safe haven. Protects against inflation and economic downturns.

This article takes a deep dive into Bitcoin, stocks, gold, and other assets, analyzing their returns, market capitalizations, and other factors that influence their investment potential.

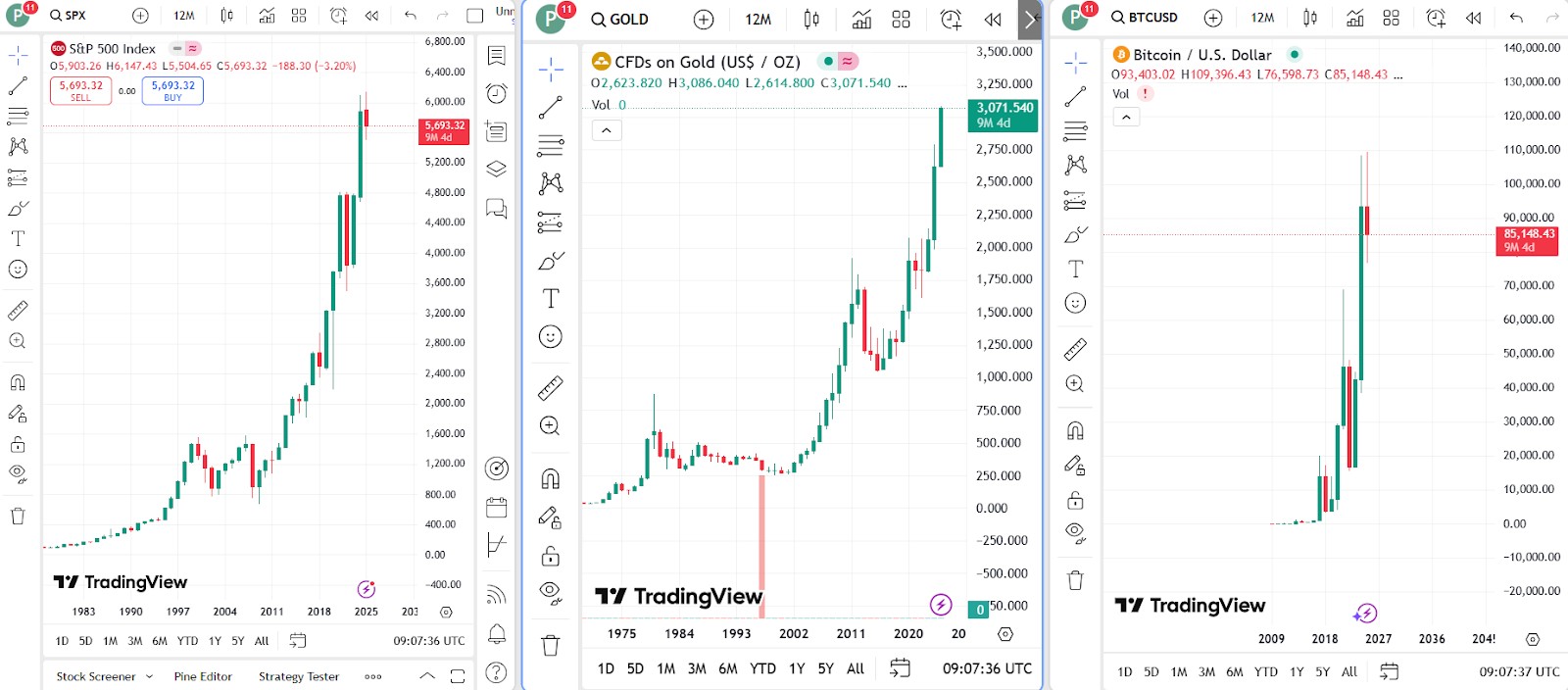

Comparison of asset returns over the last 10 years

Bitcoin: price growth and volatility analysis

Over the past decade, Bitcoin has shown impressive growth, delivering a 26,931% return from 2014 to 2024. In 2024 alone, its return was 120.8%, significantly outperforming traditional assets. However, its significant price swings are a key characteristic, with annualized volatility around 47%, requiring investors to be prepared for substantial price fluctuations.

Stocks: returns of the S&P 500 and other key indices

The S&P 500 Index, which tracks the performance of the 500 largest U.S. companies, has shown strong growth over the past decade. As of January 31, 2025, the 10-year return is around 202.8%, indicating a solid annual growth rate of about 12.8%. In 2024, the S&P 500 had a total return of 23.3%, continuing a two-year streak of over 20% returns.

These figures highlight the S&P 500's strong performance in recent years, making it an attractive choice for long-term investors looking for growth opportunities.

Gold: price trends and stability

Gold has traditionally been regarded as a safe-haven asset. Over the last decade, its value has increased by approximately 90%, reaching an all-time high of $2,427 per ounce in May 2024. In 2024 alone, gold delivered a 27.54% return, with an average annual growth rate of 9.8%, reflecting its stability during periods of economic uncertainty.

In contrast, U.S. stocks had an average 10-year return rate of 13.1% as of December 2024, while gold had a return rate of 8.33%.

Other Bitcoin alternatives

Real estate: property price growth in major cities

The real estate markets in Israel, Switzerland, and Germany have seen significant changes over the past decade. Here’s a breakdown:

Israel. Property prices in Israel jumped by about 345.7% from 2010 to 2020, marking the biggest rise among these countries. In early 2023, the average price of homes in Tel Aviv hit over 4.2 million Israeli shekels (around 1.13 million USD).

Switzerland. From 2010 to 2020, Swiss property prices grew by about 165.5%. In the second quarter of 2024, prices for high-end residential properties rose by 3% compared to the previous year.

Germany. German home prices climbed by roughly 162% from 2010 to 2020. However, in the second quarter of 2024, prices dropped by about 2.6% year-over-year, though there are signs of stability.

This shows that while Israel has experienced the largest price jumps, Switzerland's market has seen steady increases, and Germany's market has recently cooled off but is starting to stabilize. Keep in mind that local economic policies, interest rates, and other factors will continue to shape how these markets perform in the future.

Oil: price fluctuations and investment impact

Crude oil prices have been quite unpredictable over the past decade, with significant rises and falls influenced by global events, economic factors, and market trends. In 2024, the average price of Brent crude oil was about $80.53 per barrel, lower than the previous year's average of $100.53 per barrel.

Overall, the average price of Brent crude oil in 2024 was about $80.53 per barrel, lower than the previous year's average of $100.53 per barrel. These ups and downs show how volatile the oil market can be, affected by a mix of global events, economic factors, and market trends.

Pros and cons of different assets

Despite differences in market capitalization and liquidity, each asset has its strengths and weaknesses.

Bitcoin (BTC) pros and cons

- Pros

- Cons

Decentralization, independence from central banks and political decisions.

High mobility – you can trade 24/7, seven days a week.

Limited emission (21 million BTC) reduces the risk of inflationary depreciation.

High volatility, sharp fluctuations in the exchange rate in a short time.

Unlike stocks, does not generate passive income (dividends).

Regulatory risks may affect the availability of trading.

We’ve selected top brokers that provide secure, high-liquidity platforms for trading Bitcoin with competitive fees and fast execution.

| Foundation year | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | Deposit fee | Withdrawal fee | Demo account | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2017 | 10 | 0,1 | 0,08 | No | 0,0004 BTC 2,6 USDT | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | 10 | 0,4 | 0,25 | No | 0,0005 BTC | No | No | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | 1 | 0,5 | 0,25 | No | 0,0005 BTC | No | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | 1 | 0,2 | 0,1 | No | 0-0,1% | Yes | No | 7.41 | Open an account Your capital is at risk. |

|

| 2004 | No | 0 | 0 | No | No | No | No | 7.3 | Open an account Your capital is at risk. |

Gold pros and cons

- Pros

- Cons

Historically stable asset that retains value.

Low correlation with the stock market, useful for diversification.

Physical storage reduces the risk of cyberattacks and technical failures.

Does not generate passive income, unlike stocks and bonds.

Costs of storing physical gold (safes, insurance).

Limited growth opportunities compared to stocks or bitcoin.

Explore trusted platforms that make gold investing simple — offering stable pricing, high liquidity, and flexible investment options.

| Foundation year | Account min. | Metals | Deposit Fee | Withdrawal fee | Inactivity fee | Demo | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | No | No | No | $25 for wire transfers out | $50 | Yes | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| 2014 | No | No | No | No charge | No inactivity fees | No | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| 1919 | No | Yes | No | $25 | No | No | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| 2015 | No | No | No | No charge up to a limit | Not specified | No | FCA, SEC, FINRA | 7.69 | Study review | |

| 1978 | No | Yes | No | No | No | Yes | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Stock market (S&P 500, company stocks) pros and cons

- Pros

- Cons

Ability to receive dividends and participate in company profits.

Long-term growth: S&P 500 has grown by 202.8% over the past 10 years.

Regulated environment, investor protection in developed markets.

Susceptible to crises and economic downturns.

Highly dependent on the macroeconomic situation (Fed, inflation, rates).

Risk of devaluation of individual companies in case of poor management

Market capitalization alone does not determine an asset’s investment attractiveness. Liquidity, risk levels, and income potential are crucial factors for investors. Stocks and gold remain the most liquid assets, while Bitcoin offers high returns but comes with significant volatility. Investors should consider these factors when building their portfolios, aligning their choices with their investment goals and time horizon.

Our list features reliable brokers that offer access to global stock markets, dividend-paying shares, and user-friendly investing tools.

| Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | No | No | $3 per trade | $3 per trade | 7.63 | Open an account Via eOption's secure website. |

|

| No | No | 1 | Zero Fees | Zero Fees | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Zero Fees | Zero Fees | 6.61 | Study review | |

| No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | 7.69 | Study review | |

| Yes | No | 4,83 | 0-0,0035% | $1,00 | 7.45 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

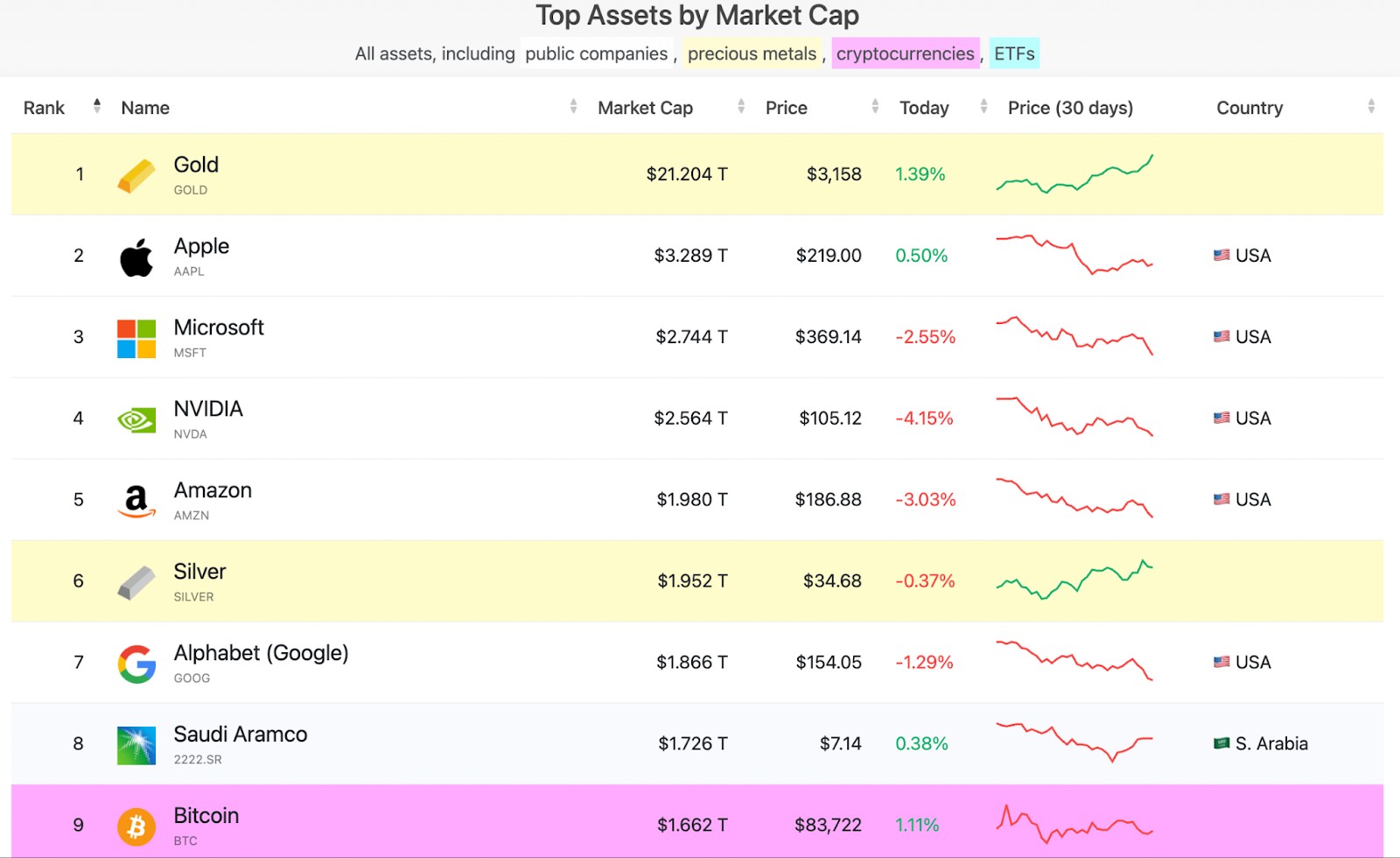

Comparison of market capitalization

Market сapitalization

Gold is the largest asset ($21.204T), significantly surpassing both stocks and cryptocurrencies.

Bitcoin ($1.662T) is much smaller than gold (over 12 times less) but comparable to leading tech companies.

Stocks of major tech giants range from $3.289T (Apple) to $1.866T (Google), showcasing strong market capitalization.

Price trends

Gold is rising (+1.39%) and shows a steady upward trend over the past 30 days.

Bitcoin is also increasing (+1.11%) but with more volatility in its price chart.

Stocks of most companies are declining (Microsoft -2.55%, NVIDIA -4.15%, Amazon -3.03%), reflecting current market pressures.

Volatility and investment appeal

Gold remains stable, with slow but consistent growth, reinforcing its status as a safe-haven asset.

Bitcoin has high growth potential but is significantly more volatile than gold and stocks.

Stocks are under pressure but remain a key long-term investment vehicle.

Factors influencing value

Bitcoin: demand, regulation, and technology

Bitcoin’s value is driven by limited supply (21 million coins), investor demand, and adoption as a store of value. Government regulations can either boost confidence and participation or restrict demand. Technological advancements, such as network upgrades and integration with financial systems, further impact its market price.

Stocks: corporate performance and economic conditions

Stock prices depend on earnings, revenue growth, and industry positioning. Companies in high-barrier sectors (e.g., pharmaceuticals, tech) are more resilient to downturns, while competitive industries face greater volatility. Interest rates, inflation, and geopolitical trends also shape stock market performance, influencing investor sentiment and risk exposure.

Gold: inflation, geopolitics, and commodity demand

Gold acts as a hedge against inflation, but its price reacts to real interest rates rather than inflation alone. Geopolitical instability, trade wars, and central bank gold purchases increase its demand as a safe-haven asset. Additionally, global commodity trends, such as oil price fluctuations, can indirectly affect gold’s value.

Bitcoin’s volatility offers unique growth potential compared to stocks and gold

When comparing Bitcoin to stocks and gold, it's essential to understand that Bitcoin isn’t just a digital asset; it’s a financial revolution. Unlike stocks that represent ownership in companies and gold which is a centuries-old store of value, Bitcoin provides a hedge against both inflation and traditional financial systems. Bitcoin’s decentralized nature means it operates independently of government regulations, offering the potential for unparalleled growth in the future.

But what truly sets it apart is its volatility, which can be seen as an opportunity for those willing to manage risk. For a beginner, learning how to navigate this volatility with proper risk management strategies can unlock the potential for exponential gains — something neither stocks nor gold offer in such a short time span.

Conclusion

Investing in Bitcoin, stocks, and gold requires taking into account their characteristics and role in the portfolio. Bitcoin has high growth potential, but its volatility requires careful management. Stocks provide stable capital growth and the possibility of passive income through dividends. Gold protects against inflation and market shocks, but its long-term profitability is lower. The best option is to combine assets taking into account the investment horizon and risk level. Proper capital allocation reduces risks and makes the portfolio sustainable in different economic conditions.

FAQs

How to determine how much Bitcoin to include in a portfolio?

The optimal share depends on the level of risk. For a balanced portfolio, 5-10% is often used to benefit from growth without excessive volatility. Aggressive investors can increase the share, but this increases the risk of short-term drawdowns.

When does gold show the best returns?

Gold grows during low interest rates, economic instability, and a falling stock market. Examples are the 2008 crisis and the 2020 pandemic, when its price reached new highs. During periods of economic growth, gold usually shows weak dynamics.

Why are stocks historically considered the most reliable asset?

The stock market shows an average annual return of 7-10% over long periods of time, including crises. Companies develop, pay dividends, and the value of shares grows along with the economy. It is important to choose assets based on fundamental analysis, not short-term trends.

How to minimize risks when investing in Bitcoin?

Risks can be reduced by using cost averaging (buying in small parts) and a fixed percentage in the portfolio. It is also worth keeping some assets in stable instruments to compensate for possible falls in the crypto market.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.