What Time Does The Cryptocurrency Markets Open And Close?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

The operating hours of the markets for cryptocurrency trading can vary greatly depending on what assets and on which platform you trade:

- Spot trading: Available 24/7 on centralized and decentralized exchanges like Binance, Gate, Uniswap and PancakeSwap

- CFD trading: Offered by Forex brokers, allowing trading 24/5 with extended hours

- Bitcoin ETFs: Traded during regular market hours, typically mirroring the trading hours of the exchange where they're listed

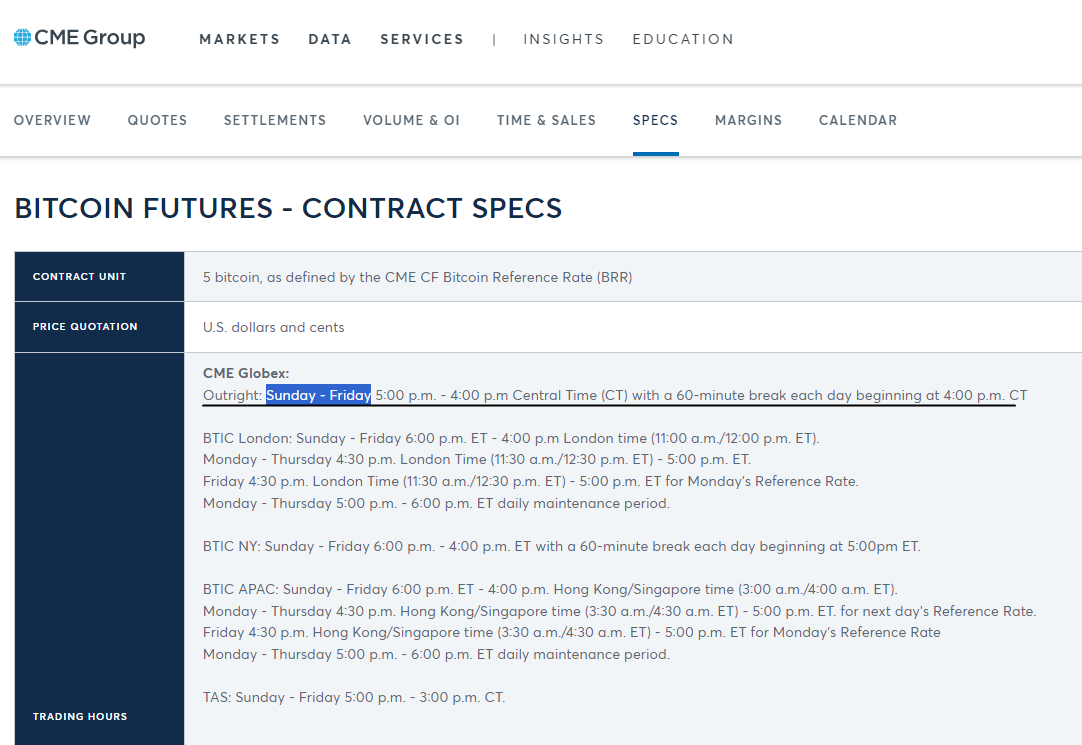

- Derivatives (futures and options): Sunday – Friday, 5:00 p.m. – 4:00 p.m. Central Time (CT) with a 60-minute break each day beginning at 4:00 p.m.

The decentralized blockchain technology that underlies cryptocurrencies allows counterparties to transact at any time. So, yes, initially the cryptocurrency market operates 24 hours a day, seven days a week, without breaks or weekends. This provides long-term investors with additional opportunities to diversify and balance their portfolios, and for active traders - a wide field for applying their strategies at any time 24/7.

However, the gradual penetration of cryptocurrencies into the traditional financial system has led to the emergence of derivative crypto assets that are subject to traditional financial markets and their schedules. Such assets are traded on exchanges with clear hours of operation, which affects trading availability and can create time slots where trading is not possible. This important distinction adds a layer of complexity to trading strategies and requires investors to pay special attention to the details of the operational mode of their investment platforms. To help break down what time frames may apply to your interest in cryptocurrency trading, I wrote this review.

Times When Crypto Markets Open and Close

| Opening | Closing | |

|---|---|---|

| Crypto exchanges | 24/7 | 24/7 |

| CME Derivatives | 5:00 p.m. Central Time (CT), Sunday - Friday | 4:00 p.m Central Time (CT), Sunday - Friday |

| Bitcoin ETF | Opening hour of the stock exchange (if in the US, 9;30am ET) | Closing hour of the stock exchange (if in the US, 4:00pm ET) |

| ICOs / IDOs | These fundraising events typically have set durations during which tokens are offered for sale | |

| Decentralized Exchanges | 24/7 | 24/7 |

Cryptocurrency Exchanges

Binance and similar exchanges operate around the clock

Binance and similar exchanges operate around the clockTraders can buy, sell, and exchange cryptocurrencies at any time of the day or night, providing unparalleled flexibility and accessibility.

I believe this 24/7 operation is a double-edged sword. On one hand, it allows traders to capitalize on market movements whenever they occur, regardless of the time zone they're in. This flexibility is useful for those who prefer to trade outside traditional market hours or who have busy schedules during the day. However, it also means that the market never sleeps, which can be mentally exhausting for traders constantly monitoring their positions.

Holidays can have a significant impact on crypto market volatility. During holidays, trading volume may decrease as market participants take time off to celebrate or relax. This lower volume can lead to reduced liquidity, making it easier for large orders to cause price swings. Additionally, holidays in different countries can affect trading activity differently, depending on where the majority of market participants are located.

For example, Chinese New Year often sees a decrease in trading volume as many traders in Asia take time off to celebrate.

Trading Crypto as CFDs with Forex Brokers

I’ll be honest, I don’t dabble in CFDs myself. No question - it offers a convenient way to access the crypto market without the hassle of owning the actual assets. But I can’t help but think, why would you not want to own the assets?!

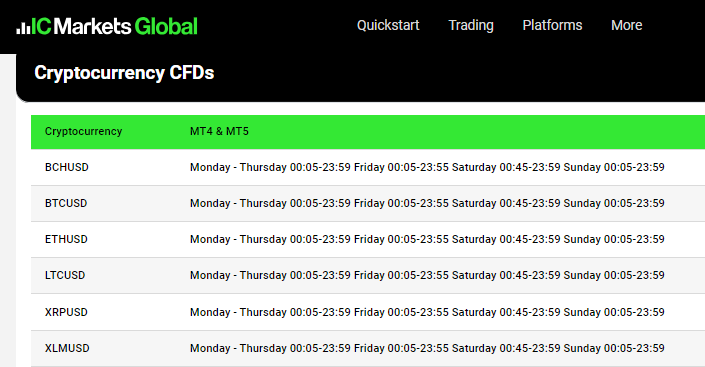

The market hours for different brokers are usually something along the following lines:

Monday to Thursday: 00:05 to 23:59

Friday: 00:05 to 23:55

Saturday: 00:45 to 23:59

Sunday: 00:05 to 23:59

Check Bitcoin CFD trading times on official sources. Example - page on the website of the broker ICMarkets

Check Bitcoin CFD trading times on official sources. Example - page on the website of the broker ICMarketsThe best time to trade crypto is between 3 - 4pm UTC, i.e. 10 - 11am EST, since that’s when most cryptocurrency trading is happening.

I've always been a bit hesitant about diving into crypto CFDs because, for me, crypto represents more than just financial speculation. Trading CFDs, while convenient, feels like I'm relinquishing that control in favor of a more traditional trading model.

I can see the appeal for others, though. The flexibility and accessibility offered by Forex brokers, without having to bother with true ownership, can be beneficial for those who value convenience above all else.

Still it's important to acknowledge the potential drawbacks. Trading outside traditional market hours can lead to liquidity issues and increased volatility, which can impact trading strategies and execution quality. Plus, the varying trading hours among different brokers mean it's essential to do your homework and find one that aligns with your needs.

While I personally choose to steer clear of crypto CFDs, I recognize that they can be a valuable option for those looking for a more traditional trading experience.

If trading crypto CFDs appeals to you, our article

Best Brokers For Crypto CFD Trading can help you choose the best broker for your needs.

Investing in Crypto through ETFs

Investing in crypto through Exchange-Traded Funds (ETFs) offers a straightforward way for traditional investors to dip their toes into the crypto market without diving into the complexities of wallet management and private keys. There’s no denying the convenience ETFs offer to investors who may not be tech-savvy or comfortable navigating the crypto landscape.

The market hours for Bitcoin ETFs are typically aligned with traditional stock market hours in the United States. This means that they are open for trading during the following times:

Monday to Friday: 9:30 a.m. to 4:00 p.m. ET (Eastern Time)

Saturday and Sunday: Closed

BTC ETFs undeniably serve a purpose in the broader investment landscape. They provide an avenue for traditional investors to gain exposure to Bitcoin's price movements without having to directly purchase and store the cryptocurrency themselves. This accessibility opens up the world of crypto to a broader audience and contributes to its mainstream adoption.

Although I will personally probably never get into Bitcoin ETFs (I’m more a hands-on, on-chain, and other “on” expressions kind of guy), I was rooting for Bitcoin ETFs to be approved.

Here's a list of some of the largest BTC ETFs, along with their assets under management (AUM):

Grayscale Bitcoin Trust (GBTC): $25.7 billion in AUM

iShares Bitcoin Trust Registered (IBIT): $8.9 billion in AUM

Fidelity Wise Origin Bitcoin Fund (FBTC): $9.1 billion in AUM

ProShares Bitcoin Strategy ETF (BITO): $2.5 billion in AUM

Bitwise Bitcoin ETF Trust (BITB): $1.4 billion in AUM

If investing in a Bitcoin ETF strikes your fancy, our in-depth article Bitcoin Spot ETF Explained: What Investors Need to Know will tell you everything you need to know to get started.

Crypto Trading on CME

For me, trading on the Chicago Mercantile Exchange (CME) has always been a bit of a mixed bag. Sure, it's a respected platform offering futures and options contracts for various assets, including cryptocurrencies like Bitcoin. These financial instruments allow traders to speculate on crypto price movements without actually owning the assets.

However, I've always had a slight reservation about it, mainly because it feels like it goes against the decentralized spirit of crypto.

That said, I can't deny the advantages it offers. The regulated nature of the CME platform provides a level of security and transparency that's often missing on unregulated crypto exchanges. Plus, the structured trading sessions with specific market hours for CME crypto futures provide a sense of order in what can sometimes feel like a chaotic market.

Check BTC derivatives trading times on CME Group's official website

Check BTC derivatives trading times on CME Group's official websiteOptions on Bitcoin futures can be traded on weekdays on a 24/5 basis with a one-hour break. With that said, I've always leaned more towards spot trading in the crypto world. Options and futures just feel a bit too traditional for me when it comes to such an innovative and decentralized asset class.

But hey, different strokes for different folks, right? While it might not be my cup of tea, trading crypto options and futures on CME is a great option (ha, get it?) for those who prefer a more structured approach.

Best crypto exchanges

Considerations for Trading Across Different Time Zones

Navigating global market hours and time zone differences has been an interesting challenge without a doubt. With markets operating around the clock and spanning multiple time zones, you must make sure to plan your trading activities carefully to capitalize on optimal trading times and avoid potential pitfalls.

Here's how I approach trading across different time zones:

Utilize Tools and Resources:

World clocks and economic calendars help me stay informed about market hours and upcoming events

Specialized trading software and mobile apps provide real-time data on market hours, trading volumes, and price movements across different asset classes

Understand Major Trading Sessions:

Identify Overlaps:

Look for overlaps between major trading sessions where liquidity tends to be highest and price movements are more pronounced

Optimal trading times often coincide with these overlaps, providing opportunities for more significant trades

Following these strategies and staying connected to the right tools and resources, you’ll be better able to make informed decisions and adapt to changing market conditions across different time zones with confidence.

Expert Opinion

I remember before 2020, the cryptocurrency market was quite active over the weekend. However, then (probably as the market became more mature and more institutional participants entered the market), the character changed - Bitcoin trading volume decreases on weekends, and volatility decreases accordingly.

Summary

Grasping market hours is the cornerstone of navigating the dynamic crypto trading landscape. From juggling decentralized exchanges to regulated platforms like CME and Forex brokers offering CFDs, understanding when to trade is paramount. Leverage tools, understand major trading sessions, and identify overlaps. It’ll let you fine-tune your strategies and seize opportunities while mitigating risks.

While Bitcoin ETFs offer accessibility to traditional investors, my heart lies in the decentralization of crypto. Despite my personal preferences, BTC ETFs play a vital role in bridging the gap between traditional finance and crypto. Ultimately, whether trading spot, futures, or ETFs, stay informed and adapt to global market hours.

FAQs

Can I trade crypto 24 hours?

Yes, you can trade crypto 24 hours a day, seven days a week, as cryptocurrency markets operate non-stop due to their decentralized nature.

What time zone is crypto in?

Cryptocurrency trading doesn't adhere to a specific time zone since it's traded globally across various exchanges, making it accessible to traders from different regions.

Why is the BTC market closed?

The BTC market doesn't close because it operates on decentralized exchanges worldwide, allowing trading to continue uninterrupted. If you think the Bitcoin market is closed, the following situations are possible: perhaps you are trying to trade Bitcoin futures on the CME exchange (it closes for the weekend and has a short break at night for clearing), your forex broker doesn't allow CFDs on the cryptocurrency to be traded over the weekend, or other.

When is the best time of day for crypto trading?

The best time for crypto trading can vary depending on individual preferences and market conditions. However, many traders find high liquidity and increased volatility during session overlaps, such as during the Asian-European or European-North American trading sessions, to be optimal times for trading.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.