Top 7 Forex Trading Apps For Beginner Traders

Best Forex trading app for beginner traders - RoboForex

RoboForex - best cent account for beginners

IC Markets - beginners who want to earn passively

Exness group - set of tools for beginners

Pepperstone - beginners who want to gain trading experience

The world of digital finance is expansive and ever-changing. Among the many investing options available today, Forex trading apps have risen to prominence as a gateway for newcomers to gain exposure to currency trading. These intuitive platforms remove hurdles for those eager to learn and compete in global markets. But for those drawing their first steps into this challenging domain, guidance is a must.

As a beginner trader, it can be difficult to know where to start. With so many forex trading app options, which one should you choose? In today's post, we'll be highlighting six of the best Forex trading apps for beginners in 2023 to set you off on the right foot. Let's get straight into it.

-

Is Forex trading profitable?

With proper strategy, risk management and discipline, Forex can be consistently profitable over the long run. But many traders lose money due to using leverage as an excuse to take unwise risks or trading without an edge.

-

What is the best currency pair for beginners?

Traditionally EUR/USD is recommended due to its high liquidity and trading volume. But simpler range-bound pairs like USD/CHF can also be good starting points.

-

Is day trading or swing trading better in Forex?

Both styles can work but swing trading may be better suited for beginners as positions are held for multiple days or weeks, requiring less market monitoring than day trading.

-

How can I learn to use the trading app?

Most offer tutorials and guides. Don't be afraid to experiment on demo before live trading.

Forex Trading Apps for Beginners Compared

| App | Minimum deposit | Account for beginners | Copy trading | Education | Regulation |

|---|---|---|---|---|---|

RoboForex |

$100 |

Demo, Cent |

Yes |

Video tutorials, Blog |

FCA, CySEC, FSC, IFSC |

IC Markets |

$200 |

Demo |

Yes |

Educational videos, Educational guide |

ASIC, FSA, CySEC |

EXNESS Group |

$10 |

Cent account |

Yes |

Video tutorials, Blog |

CBCS, CySEC, FCA, FSA, FSC, FSCA |

Pepperstone |

AUD $200 |

Demo |

Yes |

Trading guides, webinars |

FCA, ASIC, DFSA |

eToro |

$50 ($10 US & UK) |

Demo |

Yes |

Social trading, Webinars Courses, Trading school, Trading encyclopedia |

FCA, CySEC, US Regulation |

Admiral Markets |

$100 |

Demo |

Yes |

Articles, Courses, Webinar |

EFSA, FCA, JSC, CySEC |

XM |

$5 |

Demo |

Yes |

tutorials, educational videos, webinars |

ASIC, CySEC, IFSC |

Top 7 Best Forex Trading Apps — Reliable and Free

1. RoboForex

RoboForex is a brokerage firm that facilitates trading in various financial instruments, including Forex, cryptocurrencies, stocks, and ETFs. Beginners will appreciate the low minimum deposit of just $10 to start. The platform offers a demo account for practice trading, helping newcomers to get a feel for trading without risking real money. The user interface is designed to be intuitive, making it easier to navigate for people new to trading.

RoboForex boats a comprehensive Forex trading guide for beginners

👍 The Pros

•Access to a diverse range of financial instruments

•Affordable minimum deposit requirement

•User-friendly interface

•Swift trade execution

•Competitive spreads

•Copy trading available

•Spreads from 0 pips

•Well regulated

👎 The Cons

•Limited educational materials

•Absence of negative balance protection

•Limited research tools

How to Start Trading on the Platform

Head over to the RoboForex website and click on the "Open Account" button to begin the registration process, where you'll provide personal details and verify your identity with the necessary documents. Following a minimal deposit of $10, you can download the trading platform or opt for the web-based version to kickstart your trading endeavours. Starting with the demo account is advisable to get acquainted with trading dynamics before risking real money. Note that trading involves substantial risks, and acquiring a robust understanding of the financial instruments is essential before investment.

2. IC Markets

IC Markets introduces new traders to a broad spectrum of financial instruments, including the vibrant world of cryptocurrencies. The platform demands a modest minimum deposit of $200, making the entry barrier relatively low for newcomers. Beginners have the excellent resource of a demo account to foster safe and practical learning. The platform's user-friendly interface ensures a smooth first experience with trading dynamics.

Supported trading platforms on IC markets

👍 The Pros

•Access to an expansive portfolio of financial instruments

•Favorable minimum deposit threshold

•Fast trade executions

•Competitive spreads

•User-friendly interface

•Low Forex fees

•Easy and fast account opening

•Offers standard and raw spread accounts

👎 The Cons

•Limited resources for education

•Absence of negative balance protection

•Non-acceptance of US clients, limiting its reach

•Limited product selection

How to Start Trading on the Platform

Kickstart your experience by visiting the official website and initiating the registration via the "Open Account" button. Following a simple registration process that involves ID and address verification, you are invited to fund your account with a minimum amount of $200. The next step is to get acquainted with the trading platform, available for download or accessible through a web interface. It is recommended to exercise your trading strategies on a demo account before venturing into live trades. As a note of caution, it's vital to grasp the inherent risks of cryptocurrency trading and to equip oneself with substantial knowledge in the field before investment.

3. EXNESS - the best set of tools for beginners

Founded in 2008, EXNESS offers its users access to the Forex market and other financial instruments. The platform has become extremely popular, boasting an estimated 281,270 active clients as of 2023.

There are many reasons that make EXNESS one of the best apps for Forex trading. In addition to offering a user-friendly platform, it also provides its clients with a wide range of educational resources. These include video tutorials, webinars, and an extensive FAQ section. The company also offers 24/7 customer support in a variety of languages. All of these features make EXNESS one of the ideal trading apps for beginners

EXNESS is highly regulated by several organizations, including CBCS, CySEC, FCA, FSA, FSC, and FSCA. This ensures that all trades are conducted with integrity and transparency.

Another reason EXNESS is one of the best Forex trading apps for beginner traders is its Cent Account, which allows you to practice in the real market without risking too much capital. The leverage offered on this account is unlimited, so traders can take advantage of more opportunities in the market.

Traders can use the MT4/MT5 trading platform and their proprietary browser terminal. MT4/MT5 are classic platforms used by many traders due to their user-friendly interface and advanced features such as automated trading strategies (EAs). The proprietary browser terminal offers a modern interface with an array of tools, such as charts and indicators, to help traders make informed decisions.

👍 The Pros

•Highly regulated

•Variety of educational resources

•24/7 customer support

•Cent Account for beginners

👎 The Cons

• Educational resources are only available in English

• Multi-currency accounts not available

4. Pepperstone

This Australian Forex broker is among the best in the industry, boasting a wide range of features and materials to help beginners get started. It offers commission-free Forex trading on major, minor, and exotic currency pairs.

What's more, it has a demo account with $50,000 in virtual money to allow you to test out the platform before committing real money. With a whopping 7 regulators, you don't have to worry about any underhandedness that may compromise your profits.

Pepperstone has a straightforward sign up process

👍 The Pros

•Superb customer service

•Straightforward account opening processv

•Plenty of learning tools and educational materials

•Free demo account for beginner Forex traders

👎 The Cons

•Learning materials are average at best

•Subpar website quality

•Doesn't accept US residents

•Stop loss isn't guaranteed

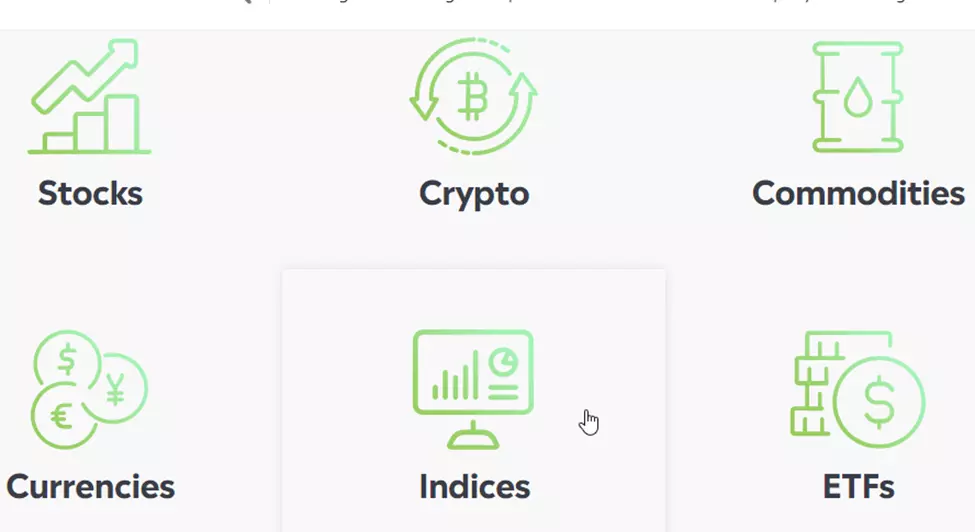

5. eToro

eToro is our top pick for the best Forex trading app for beginners. It boasts a seamless account opening and setup process for beginners to sail through. What's more, it has stellar customer support to answer any queries or complaints users might have with the platform.

The Forex trading app is packed with tons of features for new traders, including a demo account, educational material, social trading (copy trading), and more. Plus, it has a low minimum deposit amount of just $50.

The broker is regulated by top-tier financial authorities, such as the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This instills a high level of trust in the broker among beginner traders.

Lastly, eToro offers a wide range of payment methods, including credit/debit cards, bank transfer, PayPal, and more. This makes it easier for beginner traders to fund their accounts and start trading. With all these, it's easy to see why eToro is number one.

Commodities you can trade with Etoro’s demo account

👍 The Pros

•Seamless account opening and setup process

•Tons of educational materials and features for new traders

•Low minimum deposit amount

•Great customer support

👎 The Cons

•Some features may be overwhelming for beginners

•Single base currency

•High non-trading fees

6. Admiral Markets (Admirals)

Like RoboForex, Admiral Markets offers a free demo account, allowing traders to test the waters before they go all in. The platform is excellent for beginners because of its fast and easy deposit and withdrawal process. What's more, it has a wide range of educational resources to help you get started.

The Forex broker is regulated by big names like the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). This adds an extra layer of safety for beginner traders.

Admiral Markets allows trading on both the MetaTrader 4 and MetaTrader 5 platform

Admiral Markets has a low minimum deposit amount of just $50, making it one of the most affordable Forex brokers around.

👍 The Pros

•Free demo account

•Easy to open an account

•Seamless deposit and withdrawal process

•Low trading fees

•Variety of learning materials available

👎 The Cons

•Charges an inactivity fee

•Limited customer support hours

•No copy trading feature

7. XM Group

XM Group is the brainchild of Trading Point Holdings and is regulated by three financial authorities, namely the UK's Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the International Financial Services Commission of Belize.

With low trading fees, a wide array of educational materials, and stellar customer service, XM Group is definitely a must-have for any Forex beginner.

XM Group boasts stellar customer service

👍 The Pros

•Low minimum deposit of $5

•Wide range of tradable assets

•Excellent customer service

•Free and unlimited demo account

👎 The Cons

•No copy trading feature

How to Choose the Best Forex App for Beginners

As mentioned earlier, there's a plethora of forex trading apps at your disposal. Here are a few tips for ensuring you pick the best one for your needs.

Check the Minimum Deposit Amount

When you're starting out, you won't have a lot of money to deposit into your trading account. Therefore, it's important to check the minimum deposit amount required by the app before signing up. This way, you can be sure that the app is within your budget and won't drain your pockets.

Check whether the App Offers a Demo Account

A demo account is a great way to test out an app before committing to it. It allows you to get a feel for the interface and how the app works without risking any real money. Most reputable forex trading apps will offer a demo account, so be sure to check for this before signing up.

Check for Copy Trading Capabilities

Copy trading is a handy feature that allows you to copy the trades of successful traders. This is a great way to learn from the best and make profits even when you're starting out. Not all apps offer this feature, so be sure to check for it before making your final decision.

Check for the Passive Income Capability

If you're looking for an app that will allow you to earn money passively, then you'll want to check for apps that offer this capability. Not all trading apps offer this feature, so it's worth checking out before settling on one.

Check Whether the App Offers Educational Material

If you're new to forex trading, then you'll want an app that offers educational materials like guides and tutorials. This will help you learn the ropes and understand how the forex market works. Most reputable apps will offer some form of educational material, so be sure to check for this before making your final decision.

Top 25 Trading Books for Novice TradersHow to Start Forex Trading

Forex trading is a lucrative venture and a way of life for millions of people across the world. If you're looking to hop on the forex trading bandwagon, here's how you get started.

Step 1: Learn the Fundamentals of Forex Trading

Before you start forex trading, it's important that you have a solid understanding of the basics. This includes everything from learning about the different types of currency pairs to familiarizing yourself with Forex jargon.

Luckily, there are plenty of resources available online that can help you get up to speed quickly and easily. What's more, some forex trading platforms offer tutorials and other learning materials to help beginners get started.

Step 2: Find a Reputable Forex Broker

There are countless forex brokers out there, but not all of them are created equal. Make sure to do your due diligence and find a broker that's regulated by a financial authority and has a solid reputation. Use the information above to help you make the right choice.

10 Best Forex Brokers for BeginnersStep 3: Get a Demo Account

Most reputable forex brokers offer demo accounts that allow you to trade with virtual money. This is an excellent way to get a feel of the market and test out your strategies without risking any real money. What's more, these brokers will give you a magnanimous amount of virtual money to learn the ropes.

Step 4: Create a Trading Strategy

A trading strategy is a set of rules that you follow when entering and exiting trades. These rules take into account things like the currency pair you're trading, the time frame, your risk tolerance, and your overall goals. Without a trading strategy, it's easy to get caught up in the excitement of forex trading and make impulsive decisions that can lead to big losses.

Step 5: Open a Brokerage Account

Once you've found a reputable broker and created a trading strategy, it's time to open a brokerage account. This is where you'll deposit your real money and execute trades. Make sure to fund your account with enough money to cover your losses, if any.

Step 6: Stay Up-to-Date on Forex News

The forex market is constantly changing, so it's important to stay up-to-date on the latest news and events. This includes things like economic data releases, political events, and central bank announcements.

By keeping an eye on the news, you can make more informed trading decisions and avoid making costly mistakes.

Step 7: Master Your Emotions

Last but not least, it's important to master your emotions when forex trading. This can be difficult, as the market can be volatile and unpredictable. However, it's important to remember that you should never trade with money you can't afford to lose.

Additionally, don't let your emotions influence your trading decisions or you'll lose everything.

How Much Money Do I Need to Start Forex Trading?

The amount of money you need to start forex trading will depend on a few factors, including your broker's account requirements and the type of trading account you open.

However, most brokers allow you to open an account with as little as $50 or even $5. So, if you're starting with a small budget, don't worry — you can still get in on the action and make a killing eventually.

Check the minimum deposit your broker allows to know how much you can start with. We recommend starting with about $200. This isn't too much to hurt your pockets but is enough to earn some good money.

Top Trading Tips for Beginners

It's no secret, forex trading is super risky; you can make some serious cash or lose it all in a flash. However, this shouldn't discourage you from getting your foot in the door. Here are a couple of tips to set you on the right path.

Understand the Markets

The first step to successful forex trading is to have a clear understanding of the markets. This means knowing things like how currency pairs work, what factors influence them, and what time frames are best for trading. Without this knowledge, making profits with your trade will be almost impossible.

Practice With a Demo Account First

It takes a ton of practice before you can conquer the world of forex. Thankfully, demo accounts offer a risk-free environment for you to test out your strategies and get a feel for the markets. Once you're confident in your abilities, you can start trading with real money.

Keep Your Emotions in Check

As we mentioned earlier, emotions can be your worst enemy when forex trading. So, it's important to keep them in check and only trade with money you're comfortable losing. This way, even if you do make some bad decisions, you won't be putting your financial future at risk.

Trading psychology: how to achieve successStart Small and Grow From There

When starting out, it's important to keep your expectations reasonably low. You're not going to become a millionaire overnight — that's just not how trading works. However, if you're patient and consistent, you can slowly grow your account and eventually start earning some serious profits.

Understand Your Limits

No matter how much money you have to start with, it's important to trade within your limits. This means only taking on trades that you're comfortable with and always using stop-loss orders to protect your capital. By doing this, you'll limit your losses and give yourself a better chance at making profits in the long run.

Don't Be Afraid to Explore

Finally, don't be afraid to explore different trading strategies and try new markets and currency pairs. The forex market is always changing, so you need to be adaptable in order to succeed. By experimenting, you'll eventually find a style of trading that suits you best.

How to Develop a Forex Trading Strategy in 5 Steps

Developing a successful Forex trading strategy is essential for any trader looking to maximize their profits. A good strategy should be easy to understand and implement, and it should also be flexible enough to adapt to changing market conditions. Here are five steps you can take to develop an effective Forex trading strategy.

Step 1: Identify Your Goals

The first step in developing a successful Forex trading strategy is to identify your goals. Are you looking for short-term gains or long-term stability? Do you want to focus on one currency pair or multiple pairs? Answering these questions will help you determine the type of strategy that best suits your needs.

Step 2: Analyze the Market

Once you have identified your goals, the next step is to analyze the market. This involves studying historical data, analyzing current trends, and researching news events that could impact currency prices. By understanding how different factors affect currency prices, you can better predict which direction they may move in the future.

Step 3: Choose Your Strategy

Now that you have analyzed the market, it's time to choose your strategy. There are many different strategies available, such as trend trading, scalping, and swing trading. Each has its own advantages and disadvantages, so it's important to do some research before deciding which one is right for you.

Step 4: Test Your Strategy

Before implementing your strategy in real-time trading, it's important to test it out on a demo account first. This will allow you to see how well your strategy works without risking any of your own money. You can also use backtesting software or paper trade using historical data if necessary.

Step 5: Monitor Your Performance

The final step in developing a successful Forex trading strategy is monitoring your performance over time. This will help you identify areas where improvements can be made and ensure that your strategy remains profitable in the long run. It's also important to keep up with news events and adjust your strategy accordingly when necessary.

Is Forex Trading Good for Beginners?

Forex trading can be a great way for beginners to get started in the financial markets. However, it is important to understand that there are risks involved, and these should not be taken lightly.

To minimize the risks associated with forex trading, it is important to have a good understanding of the market before getting started. This includes researching different strategies, understanding how different currencies move against each other and learning about risk management techniques such as stop-loss orders and leverage. It is also important to practice with a demo account before investing real money into the market. By doing this, traders can get an idea of what works best for them and become familiar with the platform they are using.

Additionally, it is beneficial to use the best trading apps for beginners as they offer the guidance novices need to succeed.

Summary

Whether you're venturing into forex trading as a side hustle or to earn a living, nothing is stopping you from reaping a fortune with the forex market. However, ensure you pick the best forex trading apps for beginners to help you on your journey to prosperity. The information above is just a guide to get you started. The rest is up to you. Good luck!

By following the tips above and using one of the best forex trading apps for beginners, you're sure to have a prosperous journey in forex trading. So, what are you waiting for? Start your forex trading journey today.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.