Having the Best Forex Cent Account Brokers for swap-free trading to choose from will help traders achieve their goals more effectively. Traders Union analysts have prepared an article to help you choose the best option. The experts selected 5 companies, compared them between each other and gave scores. Using the results of the analysis, traders can find the information they need about the Best Forex Cent Account Brokers for swap-free trading in 2024.

1

RoboForex - Best Forex Cent Account Broker in 2024

RoboForex bonus programs are the company's strong points. Every trader gets a $30 Welcome Bonus, if they deposit $10 or more to their account. Additional bonuses include 5%-15% cash back on the fees depending on the trading volume, as well as additional 10% extra funds for more than 1,000 traded.

The minimum deposit on all accounts except R StockTrader is $10. The minimum deposit for trading stocks on the R StocksTrader and copying trades on the CopyFx platform is $100. The spread on Prime and ECN accounts is floating, from 0 pips, on Pro and ProCent accounts – floating from 1.3 pips. You can trade 36 currency pairs, metals and CFDs on this type of account.

For trading, RoboForex has available the following applications: MetaTrader 4, MetaTrader 5, and R StocksTrader, as well as its web terminal, on which you can work on real and demo accounts.

Leverage is up to 1:300-1:500 depending on the account type, as required by the regulatory authorities. The leverage on the cent account is up to 1:2000. On standard accounts, manual increase of leverage to 1:2000 is possible during registration, but this option is subject to certain rules. This parameter is appreciated by experienced traders and amateurs of aggressive trading. With RoboForex, you can earn not only on trading but also on the affiliate program, making a profit from users you have referred to a broker. Multilingual support helps market participants solve their pressing problems 24/7.

2

Exness - Best Forex Cent Account Broker in 2024

Due to an expanded range of trading accounts, Exness is suitable for both professionals and novice traders with little or no experience. The former trade on Pro accounts, and the latter trade on standard and cent accounts. Occasionally, Exness pays bonuses to its new and existing clients.

Not every broker can compete with the range of trading instruments offered by Exness. The company provides 5 classes of CFDs. Commodities can be split into two more groups — metals and energies. The choice of currency pairs is one of the widest on the market. There are over 100 pairs, including majors, minors, and exotics. Leverage is up to 1:2,000 on all account types. Further, active traders can use unlimited leverage subject to requirements for the number of traded lots. The requirements for standard and professional account types are 5 lots, for the cent account, it is 500 lots. The swap-free option is available for all account types.

Market execution is available for trades with currency pairs, indices, stocks, and commodities. Trades on the Pro account are executed instantly. This rule doesn’t apply to cryptocurrencies. Only market execution is available when trading those. Trading conditions on one account type on different platforms are similar. That is, swaps and spreads for Standard account types on MT4, MT5, or Exness in-house platforms are the same.

3

FBS - Best Forex Cent Account Broker in 2024

The FBS brokerage company offers very attractive trading conditions for traders living all over the world. The minimum trade volume is 0.01 lot for all trading accounts. The minimum deposit is EUR 10 and the spread is 1 pip. Traders can connect an Islamic account option to all live accounts, allowing them to trade according to Sharia law. Popular and exotic currency pairs, indices, futures, and metals are offered as trading instruments.

4

TNFX - Best Forex Cent Account Broker in 2024

TNFX clients can trade by using their own funds and high leverage. The broker offers accounts with different types of fees, the amount of which also varies depending on the class of assets and trader’s deposit. The money is credited to the account balance within 24 hours, with some payment systems (for example, Perfect Money) supporting instant deposits. TNFX does not charge deposit and withdrawal fees.

5

HFM - Best Forex Cent Account Broker in 2024

HFM trading conditions can be attributed to a high level of competitiveness. A low minimum deposit and a leverage of up to 1:2000 provide opportunities for clients to use several highly profitable strategic models and test the functionality of the account and terminal. The spread floats according to the trading conditions and the minimum spread is equal to 1 pip. However, for a Zero account, its minimum value is zero.

TOP 5 Comparison

In order to select the Best Forex Cent Account Broker for swap-free trading in 2024, we first need to compare their main features. TU experts have created a table, where you can find and compare the key features of the best companies for swap-free trading.

| RoboForex | Exness | FBS | TNFX | HFM | |

|---|---|---|---|---|---|

|

Trading platform |

MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader |

Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 |

MT4, Mobile Trading |

MetaTrader4, MetaTrader5 |

MT4, Mobile Trading, MultiTerminal, MT5 |

|

Min deposit |

$10 |

$10 |

$1 |

$100 |

No |

|

Leverage |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:1 |

From 1:400 |

|

Trust management |

No |

No |

No |

No |

No |

|

Accrual of % on the balance |

No |

No |

No |

No |

No |

|

Spread |

From 0 points |

From 1 point |

From 0.2 points |

From 0 points |

From 0 points |

|

Level of margin call / stop out |

60% / 40% |

No |

40% / 20% |

100% / 20% |

50% / 20% |

|

Execution of orders |

Market Execution, Instant Execution |

Market Execution, Instant Execution |

Market Execution |

Market Execution |

Market Execution |

|

No deposit bonus |

No |

No |

$5 |

No |

No |

|

Cent accounts |

Yes |

No |

Yes |

Yes |

Yes |

Best Forex Cent Account Broker for swap-free trading: Investment Programs

Earning passive income is just as important for traders as earning profit by actively trading. Therefore, it is important to consider investment instruments offered by the company. There are different investment programs and their choice strongly depends on a specific broker. TU analysts have prepared a review of investment programs of the 5 best brokers.

1

RoboForex - Investment Programs

Investment Programs, Available Markets and Products of the Broker

RoboForex is the ideal broker for those looking to invest their money in the Forex market. This company has everything to earn a stable income — from professional analytics to technical functionality and optimal trading conditions. It is especially worth noting its investment program like RoboForex CopyFx which allows you to receive passive income without doing anything. According to customer reviews, RoboForex is the most popular brokerage company.

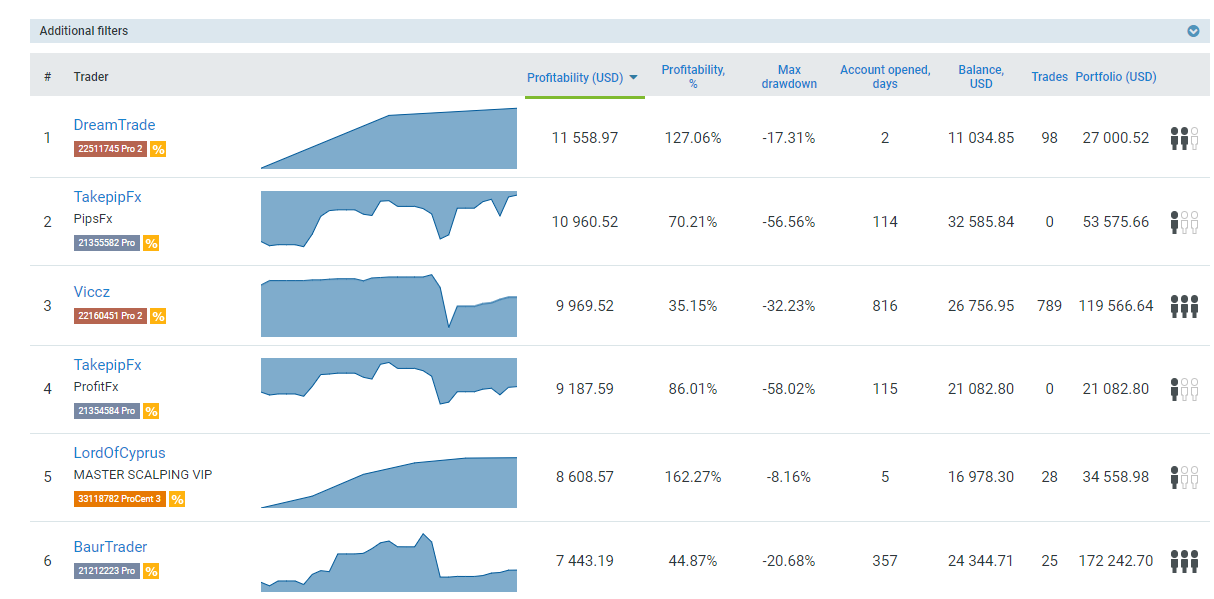

RoboForex CopyFx is a service for copying deals

RoboForex CopyFx is a passive investment option that involves connecting an investor's account to a professional trader's account and then copying his transactions. In this case, all trader's transactions are automatically opened on the investor's account. A specific trader's commission is deducted from the investor's profit in case of a successful transaction. The entire service is fully automated which minimizes your work to almost 0%. Learn More about CopyFX From RoboForex

CopyFX at RoboForex - how to choose a trader | Firsthand experience of Oleg Tkachenko

The minimum deposit is only $100, so everyone can test the waters. Having started working, the investor gets access to professional traders' ratings, which indicates the period of the account's existence, profitability, maximum drawdown level, and other statistics. Also, the investor can contact the trader directly.

An investor can connect to an unlimited number of traders, provided that his deposit can withstand such a load. Such diversification of risks makes it possible to form a full-fledged investment portfolio from traders' transactions.

An investor can disconnect from a trader at any time if he doesn't like something in his trading methods. It is a serious tool for protecting a deposit from RoboForex, which not all brokerage companies provide.

Separately, it should be noted that any person can simultaneously act as both an investor and a trader. All statistics on the effectiveness of copying transactions are displayed in the client's account.

Algorithm of working with the CopyFx copy trading platform:

-

Once you register and pass verification, open a trading account. Investors can open any account, except for accounts with the MT5 and R StocksTrader platforms. Traders planning to provide signals open a separate account by choosing Open FxCopy Trader Account.

-

In the Investment menu, open MT4 Trader Rating. Traders must meet minimum requirements of the broker in order to be included in the rating, such as the number of trades, the number of days the account has been active, and profitability. You will need to contact Customer support to learn about specific requirements.

-

You will see main criteria in the list of traders: maximum drawdown, number of copy traders, profitability, account existence period, etc.

-

Click on the profile of each trader to view trading statistics. You can activate the copy trading option in the profile of the trader you’d like to copy.

Copy trading is available on real accounts, subject to the deposit in the amount higher than the one specified in the trader’s profile. You can disconnect from a trader’s account at any time.

How to start investing in copy trading with RoboForex | Firsthand experience of Oleg Tkachenko

RoboForex affiliate program

It is not necessary to be familiar with trading to make money with RoboForex. Attract customers and earn up to 50% of the company's income. It works like this:

-

You register as a partner, after which you receive information materials for posting on your website/blog, forums, or social networks. You also get a referral link.

-

The person follows your referral link and deposits capital in his account.

-

The broker receives the spread and credits a part of his profit to the partner's account in the referral trades.

Also, each partner can participate in the loyalty program with the possibility of receiving up to 20% additional partner remuneration every month.

Depending on the chosen partnership program and account type, the total amount of partner rewards can exceed 50% of the fees paid by the referral. For example, on Affiliate accounts, rewards are up to 70%. Taking into account the general fee of the VIP program with the loyalty reward, the total rewards of a partner could be as high as 84%.

2

Exness - Investment Programs

Investment Programs, Available Markets and Products of the Broker

Exness clients can make passive income on copy and algorithmic trading. Forex novice traders can earn from copying trades of experienced traders with the social trading platform and standard opportunities of MetaTrader platforms. If Exness clients know how to trade, they can make additional income on broadcasting their own strategies.

How to start earning with social trading

Exness clients can choose any convenient method to receive trading signals. These can be signals broadcast directly on MetaTrader or in the Exness in-house mobile app.

-

Strategy copying. This option is available on the Exness proprietary platform. Investors choose the strategy based on important parameters for them, such as income, number of subscribers, leverage, fees, etc. The Most Copied option allows traders to view the most popular strategies among investors.

Who can provide strategies? Experienced traders with effective trading can do that. Currently, Exness offers two account types for providers — Social Standard and Social Pro. The minimum deposit for both of them is $500. Leverage is up to 1:200 and the fee is up to 50% of the investor’s profit.

Who can become an investor? Any Exness client with a verified user account can be an investor. The minimum investment is $10, thus this option is available even to Forex novice traders without big capital. Investors choose strategies and copy them in the social trading mobile app. Install it on your smartphone or tablet and log into your Exness user account. The broker’s website provides a link to download the app from Google Play and the App Store. Also, there is a QR code.

-

Copy trading . To copy trades of other traders, use the MetaQuotes signal service — MQL4 on MT4 and MQL5 on MT5. First, investors pay subscription fees, and later they pay fees to traders for successful trades.

In addition to copying trades and strategies, Exness clients can use bots and expert advisors, which are available in app stores on the MQL4 and MQL5 websites. There are paid and free plug-ins. Also, you can ask an experienced trader to develop an advisor to fit your trading goals. Algorithmic trading is not available for Exness proprietary platforms.

How to copy signals from traders to your account. | Firsthand Experience of Oleg Tkachenko by TU

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

Partnership programs

Partner rewards are another type of passive income available to Exness clients. Any broker’s client can receive these rewards, regardless of their trading activity and deposits. The main condition to receive fees is to comply with the partnership program requirements.

Rewards for Exness partners:

-

From $880 to $31,200 per month under the Introducing Broker (IB) program;

-

From $10 to $1,850 for each client who makes the first deposit under the Affiliate Program.

Rewards for IBs depend on the number of referred clients — the more of them there are, the higher the fee. The maximum rate is 40% of Exness income from referral trading. Participants in the Affiliate Program receive fees subject to the first referral deposits.

3

FBS - Investment Programs

Investment Programs, Available Markets and Products of the Broker

FBS is the right company for those traders who prefer to trade manually and use expert advisors. However, the broker does not offer passive investment options other than trading robots. The company does not provide for the possibility of investing in PAMM accounts or automatic copying of trading operations of experienced traders.

However, the lack of investment programs is more than offset by the abundance of trading instruments. Thus, FBS clients can trade currency pairs, including exotic currencies, trade indices, metals, and CFDs. In addition, the brokerage company offers quite lucrative affiliate programs. With their help, traders, as well as SEO specialists and influencers can easily generate additional income. There is also a program for novice businessmen.

FBS’s affiliate program

-

Cooperation. This is a classic affiliate program that provides a reward for each attracted client. The amount of income from the affiliate program depends on the amount that the attracted client has deposited. There is also an option to receive a percentage of trades. FBS provides partners with convenient tools, including traffic analysis and promotional materials.

-

CPA. This program is suitable for bloggers, SEO specialists, and marketers. By placing the broker's banners and advertising on its website page on a social network or YouTube channel, the affiliate earns income. Profit, as in the previous case, depends on the amount of the attracted client's deposit. FBS provides the affiliate with marketing tools for promotion and also allows consulting with a personal manager.

-

Introducing Broker (IB). In this case, the affiliate opens a branch of the brokerage company and manages the business processes. The amount of income depends on individual conditions. The broker provides developmental support.

The terms of affiliate programs offered by the brokerage company allow you to choose the best option and form your own referral system, from which you can provide yourself a stable income.

4

TNFX - Investment Programs

Investment Programs, Available Markets and Products of the Broker

There are several ways TNFX clients can earn passive income. The broker allows traders to copy trades of MQL5.community members, or, conversely, provide signals to other traders at a small fee. Traders can also invest in PAMM accounts of experienced managers and use EAs for algorithmic trading. Partnership program rewards are available only to institutional clients.

PAMM account mechanism

The PAMM account service allows investors to follow the trading strategy of a chosen manager. The broker acts as a middleman between the PAMM manager and investors, but does not interfere with trading and profit distribution. All conditions (percentage of the manager’s reward, assets available for trading) of a specific PAMM account are provided in its offer. You can start investing on TNFX with $100, but there are accounts that require investment amounts from $1,000 or even $20,000. The profile of each manager contains the following information:

Number of investors;

Total managed amount;

Free margin;

Leverage;

Minimum investment amount.

A manager can initiate liquidation of a PAMM account by sending a request to the broker via email, and also notifying investors thereof. In case of account liquidation, all pending orders are canceled and all open market orders are closed automatically at the current price, and the balance of funds is distributed among the account participants proportionally to their deposits. The liquidated PAMM account is removed from the PAMM rating.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

TNFX Partnership Program:

Introducing Brokers is an offer for qualified entities and companies that want to represent TNFX interests in their country. IB reward is $5-10 per standard lot traded by referred clients.

White Label & Liquidity Provider is a program for institutional clients interested in providing brokerage services under their own brand, while employing TNFX technologies.

PAMM Manager is a solution for experienced traders willing to manage investor funds through PAMM accounts.

All partnership programs of TNFX are designed for experienced market players, companies and organizations. The broker does not offer a referral program for retail investors, which is why they cannot earn a little extra by referring new clients.

5

HFM - Investment Programs

Investment Programs, Available Markets and Products of the Broker

The HFM platform offers its clients options in investment trading to make trades on their own. Traders can also earn additional income by copying trades. It is also possible for HFM traders to invest in PAMM accounts.

Option for auto-copying deals

HFM’s service of automatic copying of trade operations allows providers of trading strategies to invite other traders to copy their trade strategies.

To participate in this option, the minimum deposit is $500 for a strategy provider and $100 for a subscriber.

Forex currency, bitcoin, and gold are among the available trading assets for automatic copy trading.

The maximum leverage is 1:400, and the minimum trading volume is 0.01 lot.

The number of traders from whom a subscriber can copy trades is unlimited. This allows copy traders an opportunity to form their own portfolio while also diversifying their overall risk.

Copying speed takes a few milliseconds, which is beneficial for efficiency while also reducing risks and errors.

All of this provides traders — both suppliers and subscribers — the opportunity to ear profits using their preferred trading strategy.

Using PAMM as an investment program

Investing in a PAMM account allows traders to generate profits on the foreign exchange market without initiating your own trades. Furthermore, the program provides additional opportunities to generate earnings for professional traders who want to try their hand at becoming managers.

Features of the HFM PAMM system

The minimum deposit is $250. This is a relatively small amount for PAMM accounts, which allows everyone to try this investment option;

The maximum leverage is 1:300 and the spread starts from 0.3 pips;

A wide assortment of trading instruments is available such as Forex, metals, oil, and various indices.

Investors can invest in several PAMM accounts simultaneously, allowing investors to diversify their risk.

Conveniently, traders who act as fund managers can manage multiple accounts simultaneously.

The Trader Union website provides trader ratings thereby enabling investors to be able to choose a manager that is optimal for the trader’s trading strategy.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of thedeal and all the steps from signing up to withdrawal of profits.

HFM affiliate program

Affiliate Partners and Introducing Brokers (IB) program is available to organizations and individuals around the world. It provides for making a profit in the form of a reward for attracting new customers to the broker. Under the terms of agreement, the company provides support by assigning a manager to each introduced broker. Also, the broker can assist in performing calculations, provide the necessary software, and guarantee a high level of service.

Regional representative positions are available for trading professionals who help promote HFM at a regional level. These trading professionals will take on the responsibilities of managing an office in the region, while providing brokerage services on behalf of HFM.

HFN’s White Label program is especially geared towards financial institutions and consulting firms. This program makes it possible to provide services under its own brand while enabling individual partnerships.

What Is A Forex Swap Free Account?

A Forex swap-free account, also known as an Islamic account, adheres to Islamic religious principles by neither charging nor earning interest on trades.

How Does A Forex No-Swap Account Work?

In a standard Forex account, traders often hold positions overnight, which involves the exchange of one currency for another. When this happens, there is typically a swap charge (or interest) applied, as the positions are subject to the difference in interest rates between the two currencies being traded. This charge is either paid or earned by the trader.

In a no-swap account, these interest charges are eliminated, and instead, the account may involve other fees or charges to compensate for the absence of swap charges. Some swap-free brokers may widen the spreads or charge a commission to cover the costs associated with offering swap-free accounts.

It's important to note that Islamic accounts are not exclusively for Muslim traders. Non-Muslim traders who wish to avoid swap charges for other reasons can also opt for a swap-free account.

Why Are Islamic Accounts Swap Free?

Islamic accounts are swap-free to comply with the principles of Islamic finance, which are guided by Sharia law. Sharia law is the legal framework derived from the religious precepts of Islam. It governs various aspects of life, including economic and financial activities.

One of the key principles of Islamic finance is the prohibition of riba. Riba is the interest charged on loans or deposits. Riba is considered unjust and exploitative because it lead to wealth accumulation by the lenders at the expense of the borrowers.

In a standard Forex trading account, when a trader holds a position overnight, they either earn or pay a swap charge (interest). This practice is in direct conflict with the prohibition of riba in Islamic finance.

To accommodate the needs of Muslim traders who want to participate in Forex trading without violating their religious beliefs, some brokers offer swap-free or Islamic accounts.

Are Forex Halal Or Haram?

The acceptability of Forex trading from an Islamic perspective is a topic of debate. The main reason being it depends on the trading approach. The main concerns revolve around the concepts of riba (interest), gharar (excessive uncertainty), and speculation.

Riba (interest)

As mentioned earlier, Islamic finance prohibits charging or receiving of interest. In standard Forex accounts, traders holding positions overnight may earn or pay swap charges (interest), which goes against this principle. However, swap-free or Islamic accounts address this issue.

Gharar (excessive uncertainty)

Some scholars argue that Forex trading involves a high degree of uncertainty due to the rapid fluctuations in currency values, making it haram (forbidden). However, others argue that not all forms of uncertainty are prohibited. Since currency exchange is a necessity in global trade, Forex trading can be considered halal (permissible) if conducted without excessive speculation.

Speculation

Forex trading can involve a high degree of speculation. Some scholars argue that this speculative aspect makes Forex trading akin to gambling, which Islam prohibits. However, others contend that if traders approach Forex trading with proper analysis, risk management, and avoid excessive speculation, it can be considered halal.

Is Forex Trading Halal or Haram? - Halal Investment GuideHow to Choose a Swap-Free Account?

It can be challenging to choose the right swap free forex broker due to the many options available. Consider the factors below to choose the right swap-free account for your forex trading needs.

1. Broker's reputation and regulation

Research the broker's background, customer reviews, and check whether they hold licenses from reputable regulatory authorities like the FCA, ASIC, CySEC, or others.

2. Additional fees or charges

Swap-free accounts may have alternative fee structures to compensate for the absence of swap charges. Brokers may widen spreads or charge a commission on trades. Analyze and compare the fee structure among various brokers to determine which one offers the most cost-effective option.

3. Customer support

A broker with a dedicated support team for swap-free account users will be better equipped to address your concerns and provide guidance on maintaining Sharia compliance.

4. Demo Accounts

A demo account allows you to practice before going live. Find a swap-free broker with a functional demo account to learn the basics before you finally invest your real money.

5. Trading platform and tools

Evaluate the broker's trading platform and tools to ensure they are user-friendly. They should provide essential features like charting, technical analysis, and risk management. A reliable platform, such as MetaTrader 4 or 5, is preferred by many traders.

Summary

Choosing a good broker for swap-free trading is not a simple task. To make it easier, TU experts have prepared this review. Based on the collected information, we have given scores to each company. In the Overall score table, you will learn about the best Forex Cent Account Broker for swap-free trading in 2024, and also advantages and disadvantages of its closest competitors.

Overall score of the best Forex Cent Account Brokers for swap-free trading

| RoboForex | Exness | FBS | TNFX | HFM | |

|---|---|---|---|---|---|

|

Overall score |

8.61 |

7.58 |

8.28 |

6.65 |

8.09 |

|

Execution of orders |

8.95 |

9.6 |

9.5 |

4.63 |

9 |

|

Investment instruments |

8.2 |

8.79 |

6.96 |

4.3 |

8.91 |

|

Withdrawal speed |

9.71 |

8.79 |

9.57 |

8.63 |

8.86 |

|

Customer Support work |

9.17 |

9.29 |

7.58 |

4.82 |

5.42 |

|

Variety of instruments |

8.75 |

8.02 |

7.02 |

9.27 |

7.37 |

|

Trading platform |

6.86 |

1 |

9.03 |

8.23 |

8.95 |

|

|

|||||

|

|

|

|

|

|

|

FAQ

Why is a license important for a broker?

License is the key document testifying to the broker’s reliability. It means that the company complies with the requirements of the financial regulatory authority that issued it. It is recommended that you choose brokers with licenses from top financial regulators: the USA, European Union, the UK, as these jurisdictions have the strictest licensing requirements.

What commissions and fees should I take into consideration when I am choosing a broker?

The commissions and fees in the financial markets are divided into trading and non-tradings ones. Trading fees are the fees that are charged directly during trading (spread, commission per lot, etc.), while non-trading fees are the ones charged outside the trading process (for example, account fee, inactivity fee, deposit and withdrawal fee).

What factors are important when you are choosing a broker?

When you are choosing a broker, it is important to make sure it is a reliable company, consider its fees, the list of trading instruments, deposit and withdrawal methods and other factors. It is important to study a broker in detail, before opening an account with it.

What is a demo account and why is it important?

On a demo account, you trade by using virtual funds. It is important to choose a broker offering a demo account both for beginners, who are only learning, and for experienced traders, who can use this account type to test new strategies or EAs risk-free.

Best Forex Cent Account Broker for swap-free trading by Countries

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.