deposit:

- $20 000

Trading platform:

- CQG

- Trading Technologies

- Oak Web

- Oak Desktop

- Apex

- Cunningham Trading Systems

- NEXUS Portal (Mobile)

- FCM

- CFTC

- NFA

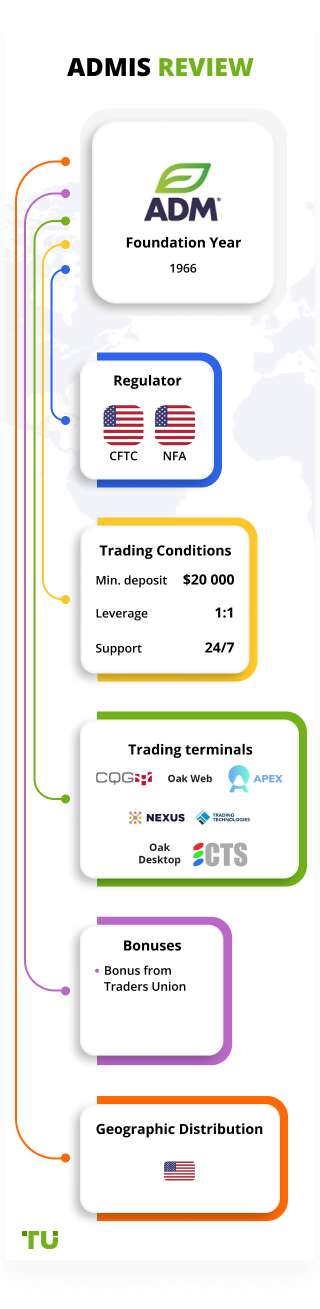

ADMIS Review 2024

deposit:

- $20 000

Trading platform:

- CQG

- Trading Technologies

- Oak Web

- Oak Desktop

- Apex

- Cunningham Trading Systems

- NEXUS Portal (Mobile)

- 1:1

- With an increase in the trade turnover, the size of the commission per trade decreases

Summary of ADMIS Trading Company

ADMIS is a broker with higher-than-average risk and the TU Overall Score of 4.69 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ADMIS clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. ADMIS ranks 65 among 78 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

ADMIS is a professional trading broker that offers futures and options trading on the major US and global exchanges.

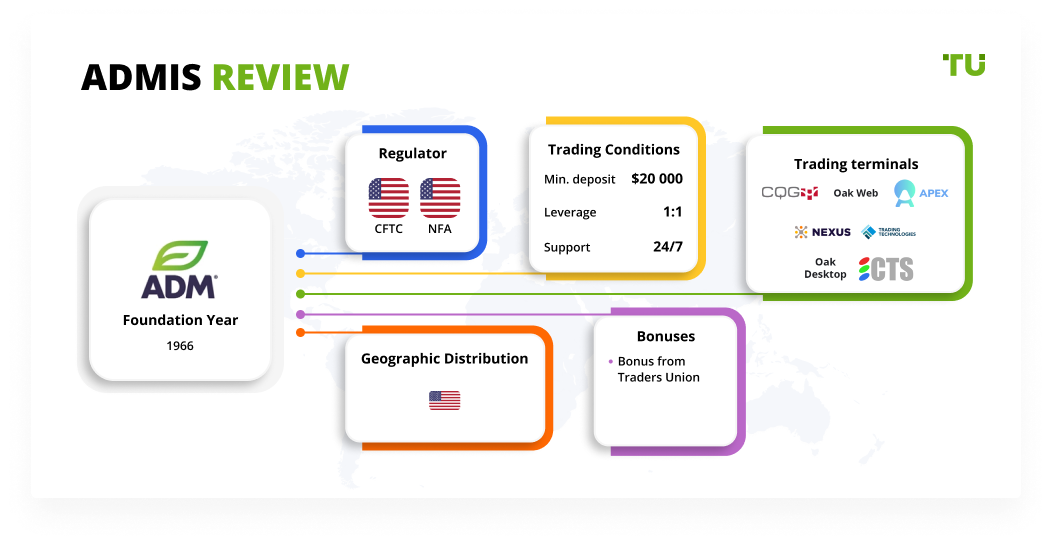

ADM Investor Services — ADMIS — is an American Futures Commission Merchant (FCM) broker that provides execution and clearing services for trading futures and options contracts. In 1966, the company became a member of the Chicago Chamber of Commerce. ADMIS in the United States is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA 0000360). Five subsidiaries in Asia and Europe, as well as ADM Investor Services representative brokers, serve traders around the world.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | from $20,000 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | Absent |

| 🔧 Instruments: | Futures, futures options |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with ADMIS:

- The excellent reputation of the company in the USA and globally.

- A wide range of futures contracts in various industries.

- Membership in all major American and international futures exchanges.

- The company is officially regulated by US government commissions.

- The presence of an extensive network of representative brokers and subsidiaries, that gives the possibility to cooperate with ADMIS not only for residents of the United States.

- Free provision of in-depth analytics and high-quality research of the futures markets.

- The company offers many trading platforms that support professional analysis tools.

👎 Disadvantages of ADMIS:

- Strict requirements regarding the minimal deposit.

- Additional non-trading commissions for the deposit and withdrawal of funds and the software provided.

- Absence of training, online chat, and demo accounts.

Evaluation of the most influential parameters of ADMIS

Geographic Distribution of ADMIS Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of ADMIS

ADM Investor Services is a futures clearing firm with a full range of execution and asset management brokerage services. It has a long history and its ancestor Tabor Grain and Feed Company began operations back in the 1930s. Today, ADMIS’s comprehensive services are used by hedge funds, wealth managers, and institutional, commercial, and retail traders globally.

The broker trades on all major US futures exchanges and is regulated by the most reputable market supervisors. One can see a clear focus of ADMIS on professional market participants and wealthy investors. Cooperation with the company is possible only after depositing at least $20,000 US dollars to the trading account.

ADMIS charges average trading fees and it charges a fee for most of the provided trading terminals. There are also non-trading fees, not only for withdrawing funds but also for making deposits by paper check. The broker does not provide 24/7 support, and there is no online chat and training on futures and options trading on their website.

Dynamics of ADMIS’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

ADMIS is aimed at active traders in futures contracts, not passive investors. At the moment, the company offers only one investment solution, which is to work with diversified portfolios of assets.

Managed futures are an investment strategy from ADMIS

ADMIS offers a portfolio management service for futures contracts. They are formed by the so-called Commodity Trading Advisors (CTA) — professional asset managers who are registered with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Key benefits of managed futures for an investor are:

-

Broader Trading Opportunities - CTAs have access to tools from over 150 global markets.

-

The possibility to reduce the overall risk of the portfolio because the manager collects a diversified mixture of futures contracts from various industries.

-

Potential opportunity to make a profit in different economic conditions, unlike other securities (stocks and bonds), because futures are less susceptible to inflation and other acute changes in the market situation.

Managed futures accounts are a basket of investments controlled by a professional manager. In the case of identifying assets that are ineffective in terms of profit, the manager constantly replaces them with those for which higher profitability is expected.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

ADMIS’ affiliate program:

-

Introducing Broker (IB) is a legal entity whose activities are regulated in the jurisdiction of its registration. IB acts as an intermediary between connected clients and ADMIS. At the same time, it transfers client orders to FCM but does not execute them. Introducing Brokers access comprehensive back and middle office tools and have free access to trading platforms and market analysis from ADMIS.

-

Introducing Agent (IA) is an individual or legal entity that introduces potential clients to ADMIS services. Unlike introducing brokers, agents are not subject to regulation and their status is strictly limited by permission to start a business. Also, Introducing Agents do not enter into business relationships between ADMIS and connected investors.

Participation in the Introducing Agent referral program allows retail traders to earn passive income for attracting new clients to ADMIS.

Trading Conditions for ADMIS Users

The broker ADMIS offers its clients to trade futures and options contracts for agricultural commodities, energy carriers, metals, and currencies. The minimum deposit is $20,000. Demo accounts are not available. For trading, the broker provides more than 10 desktop, mobile, and web terminals with and without a monthly fee. You can deposit and withdraw funds using ACH, checks, and bank transfers. Investors can also transfer assets to ADMIS from accounts opened with another brokerage company.

$20 000

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Oak Web, Oak Desktop, Apex, CQG, CTS (Cunningham Trading Systems), TT (Trading Technologies), NEXUS Portal Mobile APP, and others. |

|---|---|

| 📊 Accounts: | Real Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | No |

| 🚀 Minimum deposit: | from $20,000 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 1 contract |

| 💱 Spread: | Absent |

| 🔧 Instruments: | Futures, futures options |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Proprietary agregator |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | With an increase in the trade turnover, the size of the commission per trade decreases |

| 🎁 Contests and bonuses: | No, except for the Traders Union’s rebates |

ADMIS Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real account | from $10 | Charged when using bank transfers, paper checks, and special trading tools |

There is a $25 monthly inactivity fee.

Also, the experts at the Traders Union have calculated the average trading fees charged by ADM Investor Services, Ally Bank, and Charles Schwab. The results for this indicator are reflected in the comparative table below.

| Broker | Average commission | Level |

| ADMIS | $10 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of ADMIS

Since 1966, ADMIS has been providing its clients with access to the futures and options markets. It has offices in the United States, United Kingdom, Singapore, Hong Kong, and Taiwan, and serves investors through an extensive network of introducing brokers around the world. The company offers superior execution and clearing, in-depth market analysis and research, and access to industry-leading trading platforms.

ADMIS by the numbers:

-

The history of the company spans 90 years.

-

For over 55 years it has been a clearing member of the Chicago Board of Trade.

-

The staff includes about 1,000 professional futures market managers.

-

It has 6 subsidiaries in Europe, North America, and Asia.

ADMIS is a broker for professional market participants with a solid capital reserve

ADMIS is a Futures Commission Merchants company that accepts orders to buy or sell futures and options contracts, as well as money from clients for their execution. The broker serves various types of investors such as institutional, commercial, and corporate clients. ADMIS also offers services to wealth managers, hedge funds, and high net worth individual traders.

The company offers a wide range of trading platforms for various types of instruments. All of them are designed for professional trading, therefore they display quotes in real-time, have advanced functionality for analysis, and extensive charting capabilities. A limited number of platforms (Oak Web, Apex, Oak Desktop) are provided free of charge, but for most terminals, ADMIS charges a monthly subscription fee.

Useful services offered by ADMIS:

-

Market Information. A section of the website that provides access to several screens for monitoring various markets, the economic calendar, text and video comments from ADMIS specialists.

-

Quotes, Charts & News. It’s a block with quotes, charts, diagrams, and news for the most popular options and futures. The user has the opportunity to create his own lists for monitoring selected types of contracts.

-

Dashboards. Seven dashboards can track market data by industry. Investors can switch between contracts for grain, currency, livestock, energy products, metals, commodities, and finance.

-

Market research. In this section, the company publishes market commentary, daily and monthly market reviews, advice, and recommendations on trading strategies, seasonal charts, and historical charts.

Advantages:

The broker accepts clients not only from the USA but also from all over the world.

Registered traders get free access to professional analytics, research, real-time quotes, and news.

ADMIS clients can receive both active and passive income. The company offers several types of referral programs and managed accounts.

The broker charges a fixed trading commission for all types of contracts. The larger the trading volume, the lower the order execution fee is.

You can go through verification and open a trading account online.

The CFTC regulator requires brokers with FCM status to use segregated bank accounts to keep funds and assets of their clients.

Clients can trade assets through any device. The company provides not only desktop terminals for computers and laptops, mobile applications but also web platforms that do not require the installation of additional software.

How to Start Making Profits — Guide for Traders

ADMIS clients have access to a single type of account with high requirements for the size of the initial funding.

Account types:

The broker does not provide demo accounts, so trading is possible only with real funds.

ADMIS is aimed at professional market participants who are willing to invest large sums in futures and options trading.

Bonuses Paid by the Broker

According to the requirements of its regulators, bonuses or cash incentives are not available to the clients of ADMIS.

Investment Education Online

There is no training section on the ADM Investor Services website. The broker is focused on professional market participants, so it is keen on providing quality analytics and market data, rather than educating newbies. Novice investors may find useful the information presented in the Special Offers block of the Market Information section.

Demo accounts are not available to the company’s clients, but everyone has the opportunity to request a demonstration of trading terminals to get acquainted with their selected interface.

Security (Protection for Investors)

ADMIS is the trade name of ADM Investor Services, Inc. It is registered with the Futures Commission Merchants (FCM) with the Commodity Futures Trading Commission (CFTC) and is a subsidiary of Archer Daniels Midland (NYSE: ADM), and finally, it is part of the CME Group.

ADMIS is a member of all major US futures exchanges and the National Futures Association (NFA). The main requirements of the CFTC are the submission of monthly financial statements by the broker and the keeping of client funds separately from the company’s equity capital.

👍 Advantages

- Investor funds are kept in segregated bank accounts rather than internal company accounts

- Supervisory authorities regularly monitor the broker’s financial performance

👎 Disadvantages

- To open an account, you need to fill out several legal forms

- The company opens an account only after detailed verification of the information provided by the trader

- You cannot deposit and withdraw funds using bank cards and e-wallets

Withdrawal Options and Fees

-

The available methods of withdrawing money from ADMIS accounts depend on the country of residence of the client. US residents can withdraw funds through ACH, checks, and wire transfers. The clients who have opened an account outside the United States, have only one option and that is by crediting funds through a bank account.

-

Withdrawals via ACH are made without charging a commission. Fees for wire transfers to an account in US banks, the client pays $20; to banks in other countries, the fee is $30.

-

If a client issues a request for the delivery of a paper check by mail, then the broker charges $15.

-

Withdrawals are made in US dollars.

-

Withdrawal requests can only be submitted by verified clients.

Customer Support Service

You can send a question by email 24/7, but managers answer them only during company working hours.

👍 Advantages

- Technical support representatives give detailed answers

👎 Disadvantages

- There is no online chat

- Email responses come within 6-24 hours

- Operators do not respond on weekends and holidays

This broker provides the following communication channels for its clients:

-

by phone - local and free international;

-

by email;

-

using a ready-made contact form (it can be found in the Contact Us section of the website).

Not only clients but also unregistered ADMIS users can ask a question to a company representative.

Contacts

| Foundation date | 2007 |

| Registration address | 141 W. Jackson Blvd., Suite 2100A, Chicago, IL 60604, US |

| Regulation |

FCM, CFTC, NFA |

| Official site | https://www.admis.com/ |

| Contacts |

Email:

sales@admis.com.

Phone: 1.800.243.2649 |

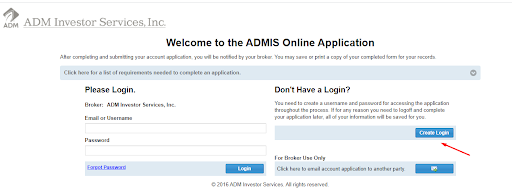

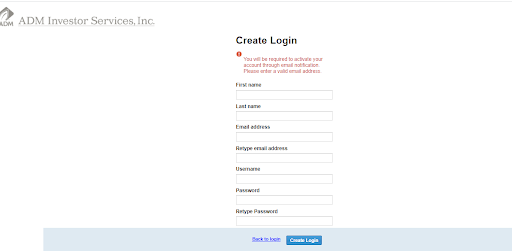

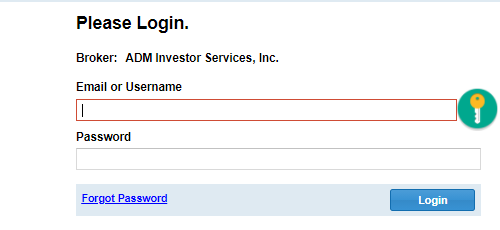

Review of the Personal Cabinet of ADMIS

To open an account with an ADMIS broker online, follow these steps:

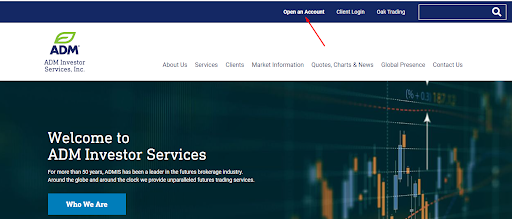

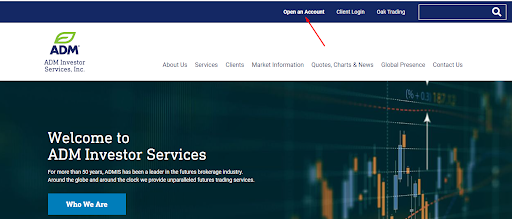

Go to the official website of the company and at the top of the main page, click the Open an Account button.

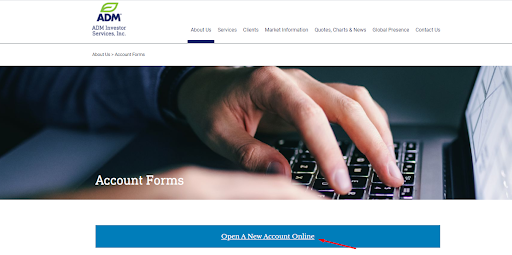

Click Open A New Account Online.

After that, choose Create Login.

Fill out the registration form, indicating your name, surname, and email address. You also need to create a username and password.

Now enter your personal account. To do this, enter the username (or email) and password specified in the registration form.

In the personal account of ADMIS, the client will have access to:

-

The section with the history of financial transactions.

-

The trade history section.

-

The educational and analytical sections.

-

The Portal for contacting support.

-

Legal documentation and broker contacts.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the ADMIS rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about ADMIS you need to go to the broker's profile.

How to leave a review about ADMIS on the Traders Union website?

To leave a review about ADMIS, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about ADMIS on a non-Traders Union client?

Anyone can leave feedback about ADMIS on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.