Collective2 Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- WebTrader

- MetaTrader4

- MetaTrader5

- NinjaTrader 7

- NinjaTrader 8

- TradeStation 9.5

- TradeStation 10.0

- Up to 1:1000

- Access to auto copying of transactions made by the clients on the partner brokers’ accounts

Our Evaluation of Collective2

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Collective2 is a moderate-risk broker with the TU Overall Score of 5.89 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Collective2 clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Collective2 is a reliable brokerage company providing professional trading opportunities in the stock markets. Free training videos and articles are available to novice traders.

Brief Look at Collective2

The Collective2 brokerage company started its operations in 2001. It was founded by the American businessman Matthew Klein. It is a member of the NFA 0401602 (National Futures Association) and is regulated by the CFTC (Commodity Futures Trading Commission). The company is headquartered in New York. Today, Collective2 is a global platform that unites successful traders and investors who prefer to make money from sharing trading strategies. The broker provides services for over 100,000 active and passive clients in the stock market.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker is registered with the Commodity Futures Trading Commission that regularly monitors its business transactions concerning its clients.

- The commission paid to the managing traders for their trading strategies is 50%.

- If necessary, you can make trades by phone.

- Collective2 technology is compatible with 16 brokers.

- By popular demand, the broker integrated multiple trading platforms.

- Weekly webinars feature highly topical Forex issues.

- There are no cent accounts.

- You can’t withdraw funds using e-payment systems.

- Sometimes you have to wait for a long time for a response from the support team.

TU Expert Advice

Author, Financial Expert at Traders Union

Collective2 offers a comprehensive range of trading services, including WebTrader, NinjaTrader, MetaTrader, and TradeStation platforms. It provides three account types, catering to different levels of trader expertise. Leverage up to 1:1000 and low minimum deposit requirements make it attractive for traders seeking flexibility. Additionally, Collective2 enables traders to benefit from automated copy trading strategies and offers access to a wide array of stock and commodity markets.

However, there are drawbacks, such as the lack of cent accounts and the inability to use e-payment systems for withdrawals. Client support can be slow at times. While Collective2 is well-suited for automated trading enthusiasts and skilled traders looking for innovative strategies, it may not be ideal for those who value prompt support or prefer e-payment systems.

Collective2 Summary

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

| 💻 Trading platform: | WebTrader, NinjaTrader 7, NinjaTrader 8, MetaTrader 4, MetaTrader 5, TradeStation 9.5, and TradeStation 10.0 |

|---|---|

| 📊 Accounts: | Demo, Starter, Basic, Premium |

| 💰 Account currency: | EUR, USD |

| 💵 Deposit / Withdrawal: | PayPal, bank transfers, bank cards |

| 🚀 Minimum deposit: | From $0; subscription costs start at $19 per month |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | No commissions for stock market instruments |

| 🔧 Instruments: | Currencies, assets of stock and commodity markets |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Access to auto copying of transactions made by the clients on the partner brokers’ accounts |

| 🎁 Contests and bonuses: | Yes |

Collective2’s trading terms are some of the most attractive among the securities offered on the market. But several profitable packages depend on the instrument or function selected. There is a 15% discount if you pay for the annual plan all at once. Subscription prices for copy strategies range from $20 to $200 per month. A lot of strategies offer free trial periods. Monthly plans are priced at $19, $39, or $99 per month.

Collective2 Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

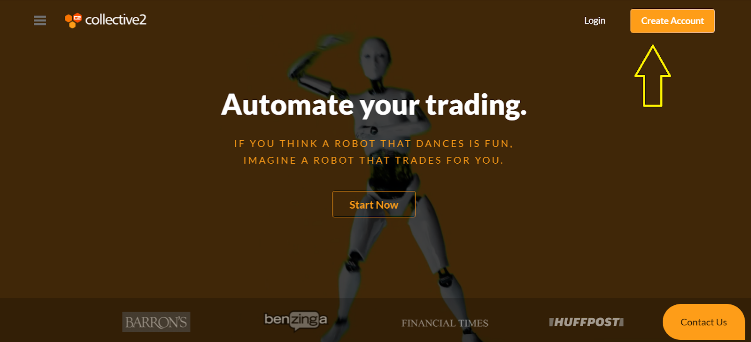

To start working with Collective2, go to the broker's website and follow these steps:

Click the Create Account button in the upper right corner.

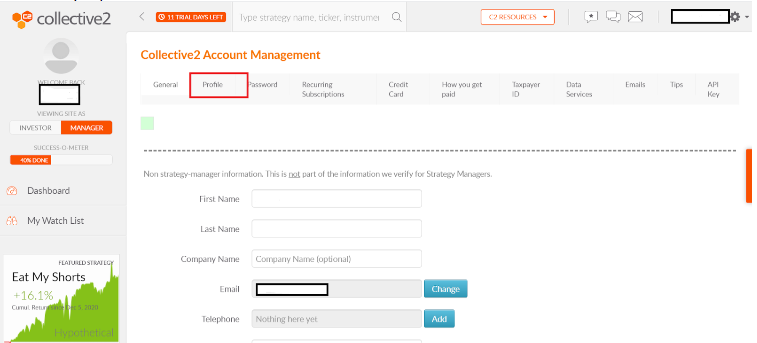

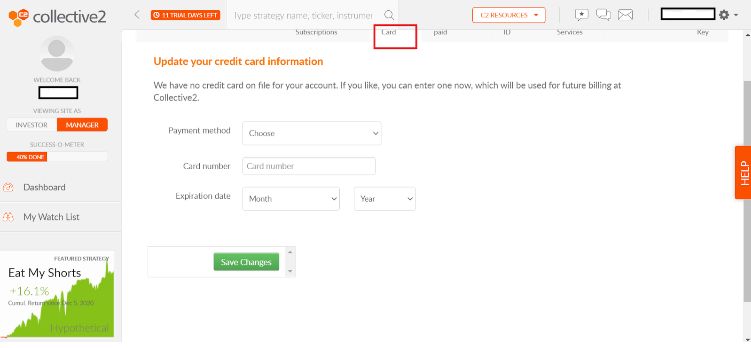

There is an option for quick registration via social media or email. In the second case, enter the address and create a password. Indicate whether you are planning to cooperate as a trader or investor. After receiving the letter, confirm the registration and enter the website using your personal data. Thereafter, verify your account.

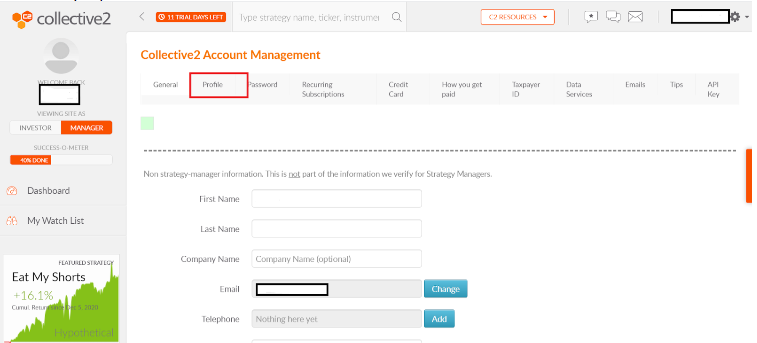

The following settings are available in the Collective2 personal account:

Moreover, in the personal account you can:

-

Manage subscriptions.

-

Connect data transfers from a partner broker.

-

Design a portfolio for investors.

-

Contact a technical support representative.

Regulation and safety

Since 2008, Collective2 has been a member of the National Futures Association (NFA) and is regulated by the Commodity Futures Trading Commission (CFTC) under the commodity exchange laws.

The CFTC is a government body and was created to protect market participants from fraudulent activities of brokers, which ensures that the regulated broker performs its functions properly and lawfully.

Advantages

- Competent methodology for the maximum drawdown calculation

- Most of the clients’ funds are stored in a separate bank account

- Partnerships with regulated brokers only

Disadvantages

- Full identity and billing verification required

- Limited range of available payment systems

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Starter | From $2 | No |

| Basic | From $2 | No |

| Premium | From $2 | No |

Payment systems may charge a withdrawal fee. The fee amount charged by EPS and banks is not indicated on the company's website. We’ve selected several brokers that offer services for trading in the stock market. The results are below:

| Broker | Average commission | Level |

|---|---|---|

|

$2 | |

|

$4 |

Account types

The Collective2 broker offers three types of accounts, which differ in the size of the maximum deposit, the cost of the subscription, and the set of instruments available for trading.

Types of accounts:

Collective2 offers a 14-day free trial to a demo account to test the terms and the broker’s services in real-time.

Collective2 is a company using an innovative approach to trading in the stock market and applies its proprietary developments. It enables traders and investors to make money using auto copying.

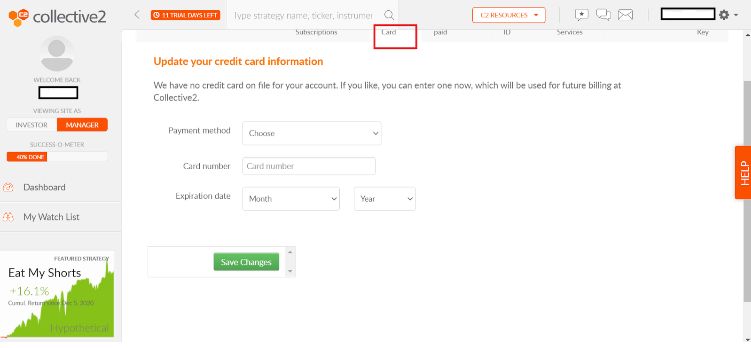

Deposit and withdrawal

-

Account replenishment and the transfer of funds will be made immediately after the request is received. The number of requests is unlimited. In case of funds withdrawn through a payment system, the transaction shall charge the commission established by the payment system.

-

Withdrawals are available via PayPal, bank transfer, and bank cards.

-

Withdrawals and deposits shall be made in EUR and USD.

-

Withdrawals via PayPal are made within a few minutes; bank transfers take from 3 to 5 business days.

-

Go through verification to deposit and withdraw funds.

Investment Options

Collective2 employs a team of professionals. The company's website offers dozens of successful traders’ strategies with the ability to monitor and copy trades automatically. Just choose a suitable strategy, apply on the trade.collective2.com website, and Collective2 will contact the broker specified during registration to activate the trading account.

Collective2 is a unique broker from which to copy trades

Collective2 invites traders to get income via public trading in real-time. If the results are impressive, then you can subscribe to auto copying trades for the percentage set by the profitable strategy developer.

Investment features of Collective2:

-

You don’t have to trust the trader with your capital, but decide when to trade and what instruments to use.

-

Copy trading is conducted on your account.

-

You can evaluate the profitability of the trading strategy chosen and the trader's tactics using the online monitoring system.

-

Most of the popular partner broker platforms can be connected to the Collective2 terminal.

You can start your own trade at any time. To do this, just change the settings in your personal account, name your strategy, and register it. If the publicly available results are very good, the other traders will soon flock to your strategy and copy trades.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate program from Collective2

-

“Member gets member”. You will get a free service during the month for each new client who has been invited by you, has registered, and has started cooperation. Also, the referral can work without a monthly fee during the first month.

Thus, novice and existing customers of the company can reduce trading fees for copying trades and by participating in the Collective2 affiliate program.

Customer support

Customer service is available Monday through Friday from 9:00 AM to 4:00 PM (EST).

Advantages

- You can ask a question on Twitter

- Email support is available

Disadvantages

- Working hours with breaks and days off

- There’s no a call back option

Depending on the account type chosen, the available communication channels with customer support specialists include:

-

via email;

-

via online chat (for Basic and Premium packages);

-

via phone call (only for Premium account holders);

-

via Twitter.

If there are no operators in the chat room, summit a written question and a response will be sent by email.

Contacts

| Foundation date | 2016 |

|---|---|

| Registration address | 228 Park Ave S #93926 New York,10003-1502 |

| Regulation | NFA, CFTC |

| Official site | trade.collective2.com |

| Contacts |

Education

The company's website provides novice traders and investors a series of training videos, professional analytics, and regularly scheduled webinars. Also, there is a forum to get advice from experienced traders.

All presented material can be tested on a demo account.

Detailed Review of Collective2

Since its first days, Collective2 has been a leader among brokers that provide services in the stock markets. Tools for market analysis and successful trading are constantly being introduced and updated based on proprietarily developed Smart Portfolios. With its help, you can monitor the trading strategies of successful traders and conduct automated trading. An API interface has been created especially for software developers.

Some useful information on Collective2 for those who have not yet decided to cooperate with this broker. It has:

-

About 100,000 active clients.

-

Over 20 years on the market.

-

Over $90 million in investments.

The Collective2 broker is the best choice for auto trading

The company's website allows you to copy trades from experienced traders in automatic mode. Choose one strategy from the many available strategies, pay the subscription fee, and get access to the platform’s system of monitoring and its analytics. The uniqueness of the offer lies in the fact that you can remain a client of your broker and work on your usual trading platform, where the trades will be copied.

You can manage your capital yourself and can stop trading at any time since all transactions are made directly on your account. Collective2's proprietary developments allow you to instantly copy trades to the client's account. If it is more convenient for you to use mobile devices, the versions based on iOS and Android are also available. Clients can use the WebTrader, NinjaTrader 7/8, MetaTrader 4/5, and TradeStation terminals.

Extra services from Collective2:

-

A forum for traders and investors, where you can discuss current issues with colleagues.

-

A set of charting tools from the company's developers.

-

The ability to get trading signals via SMS.

Advantages:

Free access to fundamental analysis.

A set of extra tools for technical analysis.

A demo account is available.

You can study strategies online in detail before connecting to the copying app.

Access to an unlimited number of strategies.

You do not need to trust your capital to a managing trader since you manage your own funds and set acceptable risk parameters yourself.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i