Wealthfront Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Wealthfront Mobile&PC

- 1:1

- Trading with robo-advisors without human intervention

Our Evaluation of Wealthfront

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Wealthfront is a moderate-risk broker with the TU Overall Score of 6.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Wealthfront clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Wealthfront is a platform for algorithmic management of investment portfolios with low commissions and a wide range of assets.

Brief Look at Wealthfront

The Wealthfront broker offers free software-based robotic financial planning advice to help clients grow their net worth. A platform designed to help users make personal financial decisions was developed by Benchmark Capital co-founder Andy Rachleff and experienced trader Dan Carroll. Wealthfront is currently a member of FINRA (CRD#:153407/SEC#: 8-68534), SIPC, and FDIC, and over 400,000 US citizens use its services.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Individual selection of diversified portfolios for each investor using automatically configured algorithms.

- A wide variety of portfolios and asset classes available for investment.

- Availability of an affiliate program that helps to reduce trading costs.

- Low brokerage commission compared to other robot advisors.

- An opportunity for a client to combine banking operations, lending, savings, and work with investment accounts within one company.

- No commissions on the part of the broker for making a deposit, withdrawing funds, opening or maintaining accounts.

- Availability of a mobile platform for monitoring the movement of financial flows and investments.

- Serves only US tax residents who reside in the US.

- Quite a high threshold of entry for investors. The minimum deposit is $500.

- Portfolios less than $100,000 are non-customizable, except for risk parameters.

TU Expert Advice

Author, Financial Expert at Traders Union

Wealthfront offers a comprehensive platform for algorithmic portfolio management and investment planning, primarily through its proprietary Wealthfront Mobile and PC platforms. The company provides opportunities to invest in a diversified range of asset classes, including stocks, bonds, and ETFs, with management fees set at a competitive 0.25% per year. Furthermore, it enables its clients to consolidate various banking tasks, savings, and investments within a single account structure, promoting ease of management and strategic alignment for those seeking passive income opportunities.

The drawbacks of Wealthfront include its exclusivity to U.S. tax residents and the high entry point for investment accounts, which require a minimum deposit of $500. Additionally, portfolios with balances under $100,000 lack customization options beyond risk settings. Although suitable for passive investors and those who prefer automated management, Wealthfront may not be ideal for traders seeking active involvement or Forex trading capabilities due to its limitations in currency trading and account flexibility.

Wealthfront Summary

| 💻 Trading platform: | Wealthfront Mobile & PC |

|---|---|

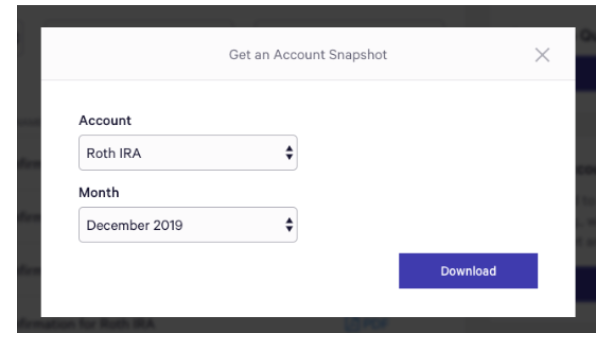

| 📊 Accounts: | Cash (individual, joint and fiduciary), savings (retirement IRA traditional, IRA Roth, IRA SEP, 401k rollover, for college 529), investment |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Checks (US), ACH Clearing House, Debit Cards, Wire Transfers |

| 🚀 Minimum deposit: | From USD 1 (cash account) From USD 500 (investment account) |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | 0.25% of the investment amount |

| 🔧 Instruments: | Stocks, real estate, bonds, treasury securities, natural resources, ETFs, mutual funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Trading with robo-advisors without human intervention |

| 🎁 Contests and bonuses: | Trading the first $5,000 commission-free for partners and their referrals |

The Wealthfront automated platform is a great solution for many types of investors. The broker offers a wide variety of passive assets, including stocks, bonds, and ETFs. Clients are attracted by the existence of low management fees (0.25% per year of the investment amount) and the ability to conduct all banking, savings, and trading operations from a single account. The minimum deposit is $1 for cash accounts and $500 for investment accounts.

Wealthfront Key Parameters Evaluation

Video Review of Wealthfront

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To invest with Wealthfront, you need to register on the company's website. Customers can be US permanent or temporary residents who have a US Social Security number. Wealthfront does not accept clients currently living outside the United States, even if they are citizens of the country. A quick guide to opening an account looks like this:

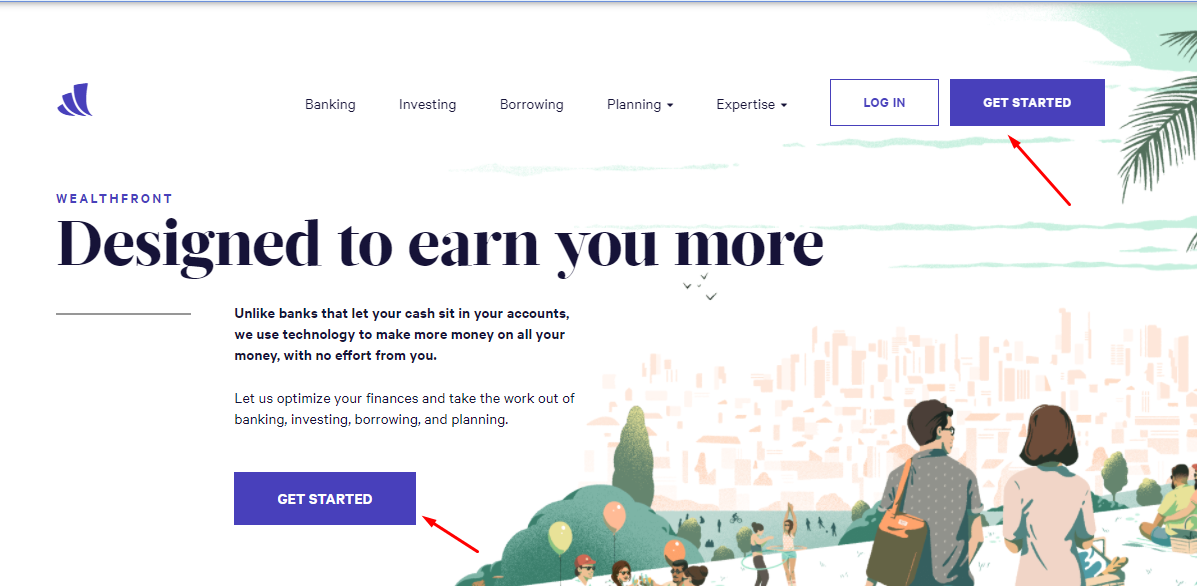

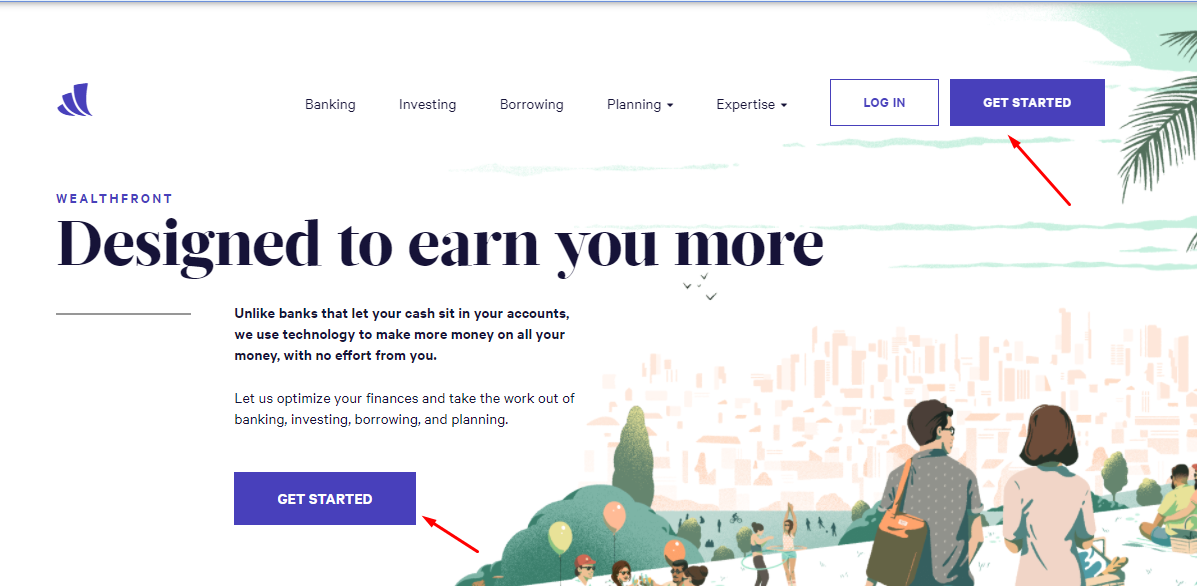

Go to the Wealthfront official website and click Get Started.

Choose an account type — cash account, general long-term investment, retirement savings, or college savings. In the registration form, enter your first name, last name, email address, and create a strong password. Next, you need to specify your phone number (only in America), and then confirm it. After that, log in to the site using your username and password, and answer the questions suggested by the robot. After passing the verification, you can make a deposit and start investing in the assets offered by the advisor.

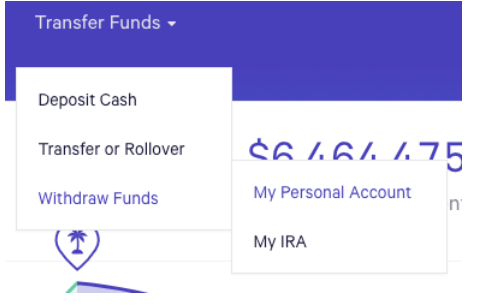

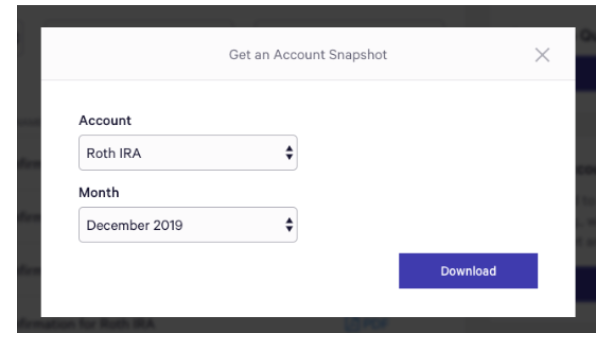

In the personal account, a Wealthfront client can perform the following actions:

Also in the personal account, there are other useful sections, namely:

-

History of completed transactions for all accounts available in Wealthfront.

-

Legal documentation with full disclosure of information on commissions for certain types of accounts.

-

Affiliate program statistics showing the number of attracted referrals and available trading volumes without charging a brokerage commission.

Regulation and safety

Investment advisory services are provided by Wealthfront Advisors, a division that is registered with the SEC as a financial advisor. Brokerage products and services are offered by Wealthfront Brokerage LLC, a member of FINRA and SIPC.

Thanks to membership in the SIPC (Securities Investor Protection Corporation), investment accounts are protected up to USD 500,000. Customers' cash accounts are insured by the Federal Deposit Insurance Corporation (FDIC). The coverage amount is up to USD 250,000 to the account of a qualified client in each banking institution. FDIC insurance covers customer losses if Green Dot Bank (the partner in whose accounts the customers' money is kept) goes bankrupt.

Advantages

- Customer funds are in segregated accounts that are separate from the company's capital

- Two-factor authentication

- FDIC and SIPC insurance coverage

Disadvantages

- Only US residents can open an account

- Investment account at Wealthfront is linked to a bank account

- Investment income is taxable

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Investment | From 0.25% of the investment amount | No |

The specificity of long-term investment does not provide for the accrual of swap - a commission for transferring positions to the next day. The experts compared the size of the average commission for Wealthfront and brokers popular among other traders such as RoboForex and EXNESS, which are Forex brokers. Therefore, they withhold the spread as a trading commission. The Wealthfront platform does not provide access to the foreign exchange market and therefore charges different types of fees. Thus, the assignment of levels in the table below can be considered conditional.

| Broker | Average commission | Level |

|---|---|---|

|

$41.6 | |

|

$4 |

Account types

Wealthfront offers cash, investment, and savings accounts. Account selection is carried out during registration on the company's website. However, in order to be able to cooperate with Wealthfront, a potential client must have an account with a US bank.

Account types:

Due to the specifics of how this broker operates, it does not have a demo account.

Wealthfront is a passive investing and financial planning company that only provides services to US residents.

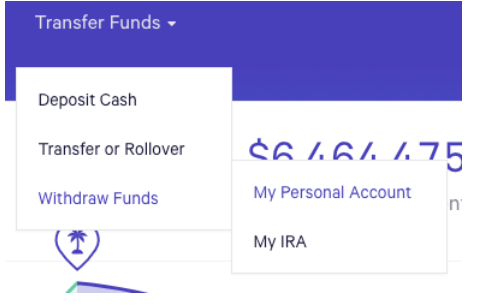

Deposit and withdrawal

-

The minimum withdrawal amount is $250. There are no limits on the number of requests, provided that the account maintains a minimum balance of $500.

-

Money can be withdrawn by check through the United States Postal Service (USPS), bank transfer, or ACH to debit cards. Withdrawals to e-wallets are not supported.

-

Withdrawals to cards take up to three business days, to a bank account in Green Dot Bank; and 1-3 days, to an account in other banks. Checks will usually arrive within 5-7 business days of being posted.

-

All financial transactions are carried out in US dollars.

-

Verification is a prerequisite for making a deposit and withdrawing funds.

Investment Options

Wealthfront does not offer customers self-service trading. The platform is specially designed for passive investors who do not want or do not know how to analyze the market situation. The broker makes it possible to invest in diversified investment portfolios with automated planning tools. The formation of a portfolio of securities and asset management is carried out by a robo-advisor. Human intervention is completely ruled out.

Portfolio Construction - automated portfolio investing

Wealthfront’s clients have access to 20 different portfolios, consisting of 11 asset classes. The broker follows modern portfolio theory (MPT) when allocating assets in a portfolio and mainly uses inexpensive exchange-traded funds (ETFs). The composition of the portfolio is formed taking into account the level of risk specified by the investor and the timing of the placement of investments. Key features of Portfolio Construction:

-

Clients who have deposited more than $100,000 in an investment account can choose a portfolio of stocks over an ETF.

-

You cannot change the structure of the portfolio offered by the robot. If an investor does not want to invest in securities of certain companies, he can add them to the list with restrictions.

-

The annual management fee for ETFs, which make up the majority of portfolios, is 0.07% - 0.16% of the investment amount. However, the fee increases for larger portfolios with a balance of $500,000 or more.

To become an investor, you need to register on the Wealthfront website and answer a few questions. The system will ask for information about your attitude to risk and how urgently a potential investor may need money. After analyzing the answers, the robot constructs (forms) a portfolio. After that, you can replenish your account and start investing.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Wealthfront’s affiliate program

-

Referrals – There is a cancellation of the commission for consulting services (within the first USD 5,000) for a partner and a referral connected to his link. To connect to commission-free trading, the referred friend must make a deposit of $5,000 or more.

Each Wealthfront client who connects a new user can lower the trading commission. The company does not accrue any monetary remuneration to partners.

Customer support

Wealthfront provides customer support by phone Monday through Friday, 8:00 am to 5:00 pm.

Advantages

- You can ask a question over the phone

Disadvantages

- Closed on weekends

- No online chat

- You cannot order a callback

You can ask a question to a technical support specialist in the following ways:

-

call by phone (his number is displayed only after registration on the broker's website);

-

fill out the feedback form;

-

write a message via Twitter.

The feedback form is available on devices with operating systems Chrome, Firefox, Safari, Internet Explorer, and Edge.

Contacts

| Foundation date | 2011 |

|---|---|

| Registration address | 261 Hamilton Avenue Palo Alto, CA 94301, USA |

| Official site | wealthfront.com |

Education

The Education Center’s help section provides useful information on investing and savings accounts. The site also has an Expertise section with guides on financial planning, real estate trading, stocks, and IPOs.

The posted information will help determine the optimal time to enter the market.

Detailed Review of Wealthfront

Wealthfront is a platform for profitable financial planning and algorithmic investment portfolio management, which is currently one of the most competitive robot consultants in the United States. Its services are used because of its ability to manage funds using an autopilot programmed for certain parameters of risk and profitability. Wealthfront investors can regularly contribute to the portfolio without having to worry about rebalancing it.

Some figures published by Wealthfront on its official website:

-

More than 400,000 clients have opened accounts.

-

Payments on bank deposits amount to $115 million.

-

There are over 19,000 ATMs available for free debit card withdrawals.

-

The company charges 0.35% per annum on the cash account balance, which, according to FDIC.gov, is eight times more than the US average (0.04%).

Wealthfront is a robo-advisor for long-term investment

Wealthfront offers a complete package for goal setting, planning, banking, and investing, as well as solutions for minimizing taxes and increasing equity through working with savings accounts. Investors can invest in 11 asset classes, including: stocks (US, foreign, emerging markets, dividend), real estate, treasury securities with inflation protection, bonds (municipal, corporate, government, developing countries), and natural resources. Wealthfront prefers ETFs because of their tax efficiency, but also offers mutual funds.

Wealthfront has developed its own trading platform for investors. It is compatible with PCs and mobile devices based on iOS and Android operating systems. Initially, the terminal was designed for smartphones and tablets, so the functionality of the desktop version is more improved and allows you to use additional features.

Useful services of Wealthfront investment:

-

Autopilot. This program monitors bank accounts and, if the amount specified by the client to meet the monthly needs is exceeded, it auto transfers funds to an investment or high-yield savings account.

-

Financial planning tools. These allow a potential client to receive a free and comprehensive analysis of all available investments even before making a deposit.

-

Self-Driving Money. A service for optimizing cash expenditures, savings, and investments, which involves the client's payment of wages to the Wealthfront account.

Advantages:

Availability of two insurance coverages - from SIPC (Securities Investor Protection Corporation) and FDIC (Federal Deposit Insurance Corporation).

Accounts with balances over USD 25,000 have access to a line of credit at relatively low-interest rates.

When depositing $100,000, the investor gets access to additional securities.

The selection of assets for the formation of the portfolio is fully carried out by the robot advisor. Human intervention is excluded.

The minimum deposit for a cash account is $1.

Portfolios are automatically rebalanced without the investor's personal intervention.

The company does not set restrictions on the minimum and maximum amount of investment, and also offers partners to trade without commission if certain conditions are met.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i