According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $25

- MT5

- FSA Seychelles

- 2021

Our Evaluation of TenTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TenTrade is a moderate-risk broker with the TU Overall Score of 5.61 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TenTrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Forex and CFD broker TenTrade (former brand 10TradeFX) possesses a range of constructive advantages over its competitors. The company offers a diverse assets pool, narrow spreads, and below-average commissions. The copy trading service is implemented at a high-quality level. The opportunity to provide capital for trading is also a conceptual advantage that attracts more clients. The indisputably strong broker’s aspect is its Ten Academy with up-to-date and useful materials. Unfortunately, traders can only work through the MT5 trading platform, there are regional restrictions, and the most efficient way to contact client support is through live chat in the absence of a call center.

Brief Look at TenTrade

In addition to a free demo, a trader can open one of three real account types — Pro, ECN, or Bonus. The accounts differ in spreads and commissions. Spreads start from 0 pips, and the trading fee is either absent or amounts to $3.5 per full lot. This broker provides access to the following markets: currency pairs, NFTs, CFDs on indices, stocks, commodities, and cryptocurrencies. The leverage ranges from 1:1 to 1:500, with no trading restrictions; and scalping, hedging, news trading, and the usage of advisors are all allowed. The company offers a proprietary copy trading service for passive user earnings. TenTrade also provides traders with its prop capital for trading after they pass the evaluation. There are five tariffs with a one-time fixed fee starting from $300, and the company provides up to $500,000. A unique service is the Ten Academy, which includes dozens of tools for technical and fundamental analyses and plenty of educational materials. The platform regularly hosts lectures and seminars, and there is a personal coach service available.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- There is a free demo account, and the minimum deposit for a real account is only $25.

- Three account types with different trading conditions allow traders to work at their own pace with complete freedom of action.

- Hundreds of trading instruments combined with moderate leverage provide high-profit potential.

- The social trading service enables traders of any level to earn through investing.

- The prop-trading feature allows experienced players to start trading with larger capital and minimal investment.

- The Ten Academy includes a significant volume of helpful information and analytical tools, making trading more accessible.

- Traders work through the MT5 trading platform, including web, desktop, and mobile versions of the software.

- Traders do not have access to other trading platforms besides MetaTrader 5.

- There are some regional restrictions, and residents of certain countries cannot become this broker’s clients.

- Client support operates 24/5 and lacks a call center.

TU Expert Advice

Author, Financial Expert at Traders Union

TenTrade provides a wide range of trading instruments, including Forex and CFDs on indices, stocks, commodities, and cryptocurrencies, accessible through the MT5 platform. Traders can choose from three account types: Pro, ECN, and Bonus, with a minimum deposit of $25. The broker offers competitive trading conditions, with leverage up to 1:500 and no fees on some accounts. Other advantages include the Ten Academy, which provides a wealth of educational materials, and its proprietary copy trading and prop trading services.

However, TenTrade is solely limited to the MetaTrader 5 platform, which may not meet the preferences of all traders. The absence of a call center in client support could be a disadvantage for those who prefer phone assistance. Additionally, TenTrade operates under the regulation of the Seychelles FSA, which may not be stringent for traders who prioritize heavy regulatory oversight. Overall, TenTrade could be suitable for traders attracted by broad asset availability and advanced educational resources, but less appealing for those needing diverse platform options and higher-tier regulation.

- You seek diverse trading opportunities with a broker that offers Forex, CFD, and stock trading, supporting leverage up to 1:500.

- You are looking for a broker which enables automatic replication of successful traders' strategies for learning and potential profit enhancement.

- Having a fully regulated broker is a priority for you. TenTrade's Seychelles FSA license may be considered less stringent compared to some other regulatory bodies.

- You prefer access to trading platforms beyond MetaTrader 5, as this broker may not meet your platform diversity preferences.

TenTrade Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. TenTrade Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT5 |

|---|---|

| 📊 Accounts: | Demo, Pro, ECN, Bonus |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Deposit / Withdrawal: | Bank transfer, Visa, Mastercard, wire, Neteller, and Skrill |

| 🚀 Minimum deposit: | $25 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,10 pips |

| 🔧 Instruments: | Currency pairs, NFTs, CFDs on indices, stocks, energies, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Free demo account, three real accounts, tight spreads and low commissions, moderate leverage, many tools for market analysis and training materials, standard copy trading service, possibility to provide funds to traders after they successfully pass the test, and only one trading platform. |

| 🎁 Contests and bonuses: | Yes |

Usually, if a broker offers multiple real accounts, the minimum deposit for each account differs. In the case of TenTrade, it is the same. Consequently, to open a Pro account, at least $25 is required, while ECN and Bonus accounts require a minimum of $100. The trading leverage does not depend on the account type. The leverage is determined solely by the asset and the trader's choice. You can trade with leverage of 1:500, 1:200, or even without leverage (1:1). Technical support is available 24/7 via live chat, email, and tickets. Managers do not work on weekends.

TenTrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

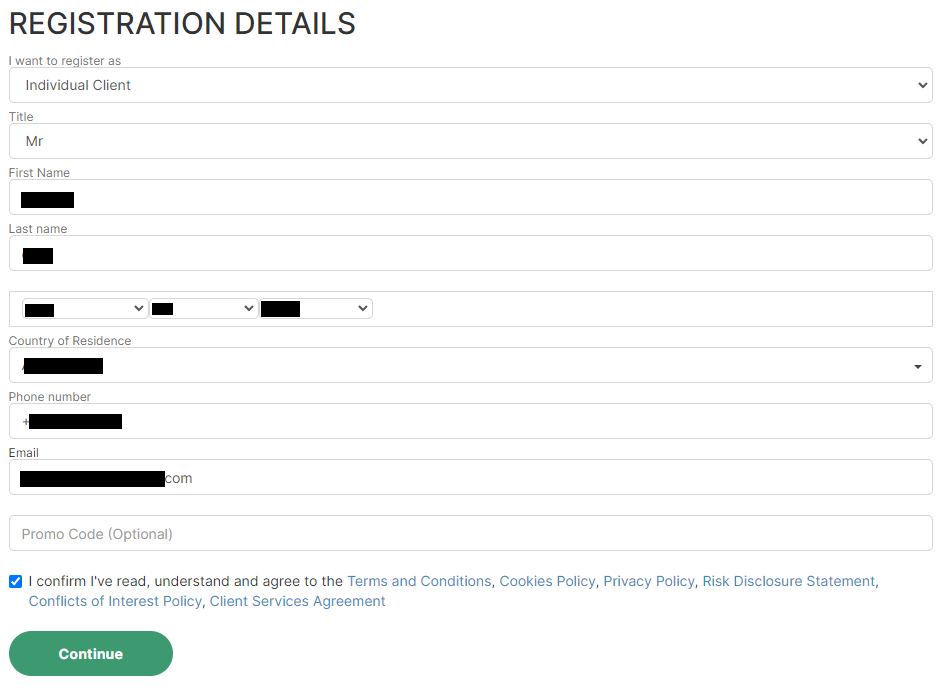

Trading Account Opening

To start a partnership with this broker, you need to register, undergo verification, open a real account, make a deposit, and download the trading platform. The experts at TU have prepared a guide that describes the entire process step by step and presents the features of the user account.

Go to this broker's official website. In the top menu, select your preferred language interface. Click on "Register" or "Trade Now".

Indicate whether you are an individual or a corporate client. Choose your salutation. Provide your date of birth and country of residence. Enter your email address and phone number, as well as any available promo code. Agree to the terms of service by checking the box. Click on "Continue".

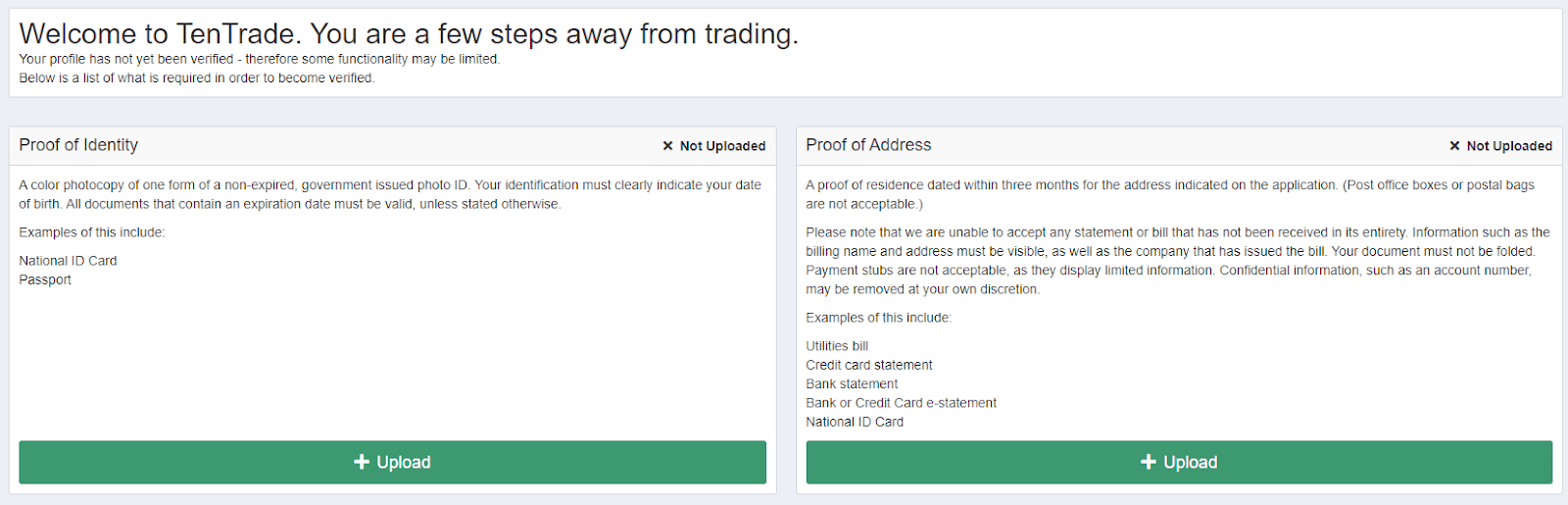

You have entered the user account, and now it's time to undergo verification. Follow the instructions on the screen. Provide scans/photos of documents that verify your identity.

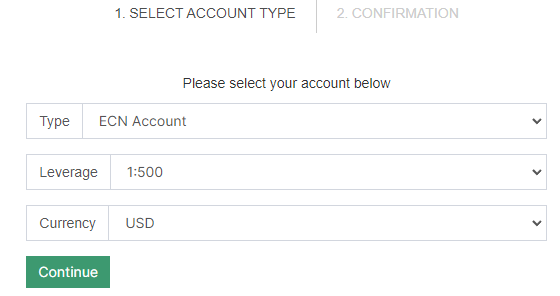

Go to the "Accounts" section. Click on "Open a Real Account." Specify the account type, leverage, and currency. Click on "Continue”.

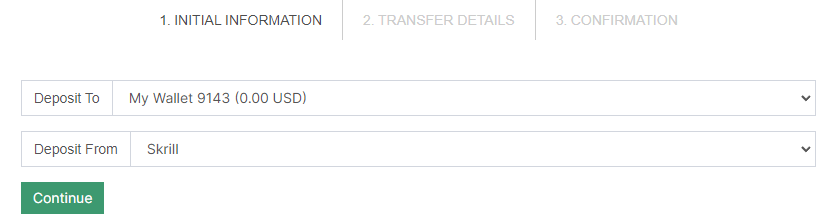

Go to the "Funds" section. Click on "Deposit." Choose the deposit method and follow the instructions on the screen.

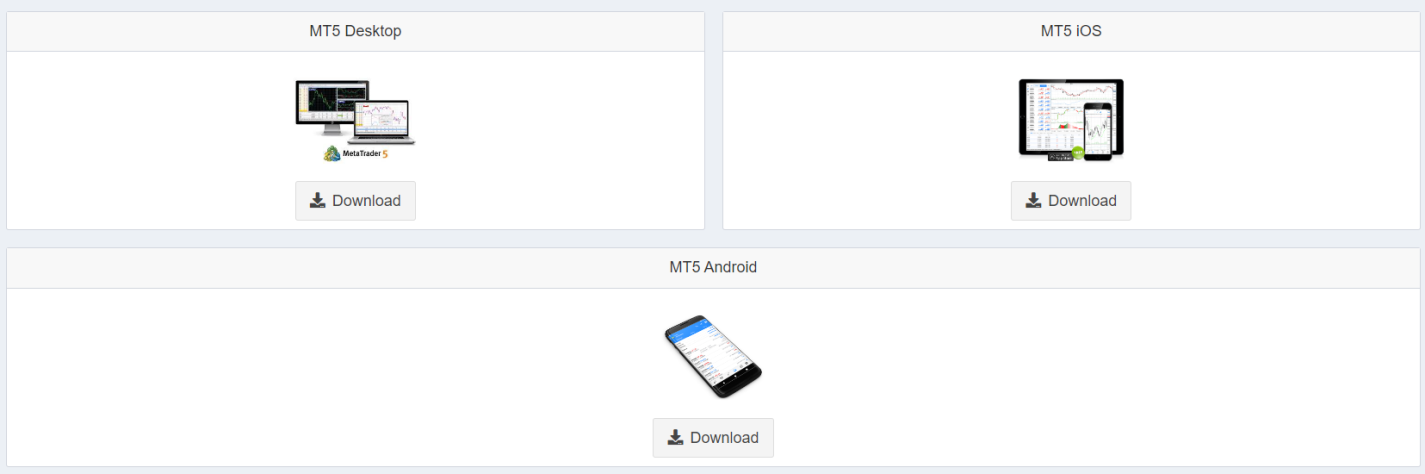

Go to the "Downloads" section. Choose the version of the MetaTrader 5 trading platform that you need. Download and install the software. Log in to the platform using the registration details you received when opening the real account. Start trading.

Your TenTrade user account also provides:

-

In the "Accounts" section, traders can open and close real and demo accounts.

-

The "Funds" section handles depositing, withdrawing, and internal transfers, as well as provides transaction histories.

-

In the "Profile" section, traders can enter or update personal information and communicate with support.

-

The "TenTrade Academy" block offers educational courses and analytical tools. The "Downloads" block contains the latest MetaTrader 5 trading platform distributions.

-

The "Economic calendar" section provides an analytical tool.

-

Through the "WebTrader 5" section, users can access the web version of the MT5 platform.

-

The "Funded Trader" section allows participation in the corresponding program.

-

The "CopyTrading" section enables becoming a signal provider or investor and accessing the copy trade service.

Regulation and safety

TenTrade has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

TenTrade Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

TenTrade Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TenTrade have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TenTrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TenTrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TenTrade Standard spreads

| TenTrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,6 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TenTrade RAW/ECN spreads

| TenTrade | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,50 | 3 | 3,5 |

| EUR/USD avg spread | 0,10 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TenTrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TenTrade Non-Trading Fees

| TenTrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If a broker offers multiple real accounts that differ significantly, it is worth carefully studying their conditions. However, with TenTrade, it's simpler, because the real accounts have mostly the same trading conditions, with differences in spreads and trading commissions only. In this regard, traders rely more on personal preferences. There are no questions about the trading platform either, as this broker's clients can only work with MetaTrader 5.

However, it is worth noting that the platform has three versions – web, desktop, and mobile. If a trader has never worked with a smartphone, it may be worth trying it, as it is the most convenient option for many. Regarding the account currency, there are usually no questions as traders choose between USD, EUR, or GBP, based on their everyday currency usage. Lastly, clients can select leverage size ranging from 1:1 to 1:500. As leverage increases, profit potential grows, but so does the risk.

Account types:

Usually, if a trader has not worked with a platform before, they first open a demo account. On the demo account, they can trade with virtual funds without financial risk. This is an excellent opportunity to explore the platform's features and refine trading strategies. Then, the user transitions to a real account, making a choice based on individual preferences. Upon request, any account type can be converted to swap-free (Islamic).

Deposit and withdrawal

TenTrade received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TenTrade provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- No withdrawal fee

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- Wise not supported

- PayPal not supported

- USDT payments not accepted

What are TenTrade deposit and withdrawal options?

TenTrade provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

TenTrade Deposit and Withdrawal Methods vs Competitors

| TenTrade | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are TenTrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TenTrade supports the following base account currencies:

What are TenTrade's minimum deposit and withdrawal amounts?

The minimum deposit on TenTrade is $100, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TenTrade’s support team.

Markets and tradable assets

TenTrade offers a limited selection of trading assets compared to the market average. The platform supports 135 assets in total, including 40 Forex pairs.

- 40 supported currency pairs

- Crypto trading

- Indices trading

- Bonds not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by TenTrade with its competitors, making it easier for you to find the perfect fit.

| TenTrade | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 135 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TenTrade offers for beginner traders and investors who prefer not to engage in active trading.

| TenTrade | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Client support is essential for any broker, as traders often encounter situations where they need assistance. Support needs to be prompt and competent. Otherwise, clients may become disappointed and switch to a competitor, especially if unresolved issues lead to financial losses that occur repeatedly. That's why brokers, for the most part, carefully monitor the performance of their support teams and strive to maintain a high level of service. At TenTrade, client service operates 24/5, meaning it is available around the clock but only on weekdays. Communication channels include email, live chat, and tickets. Clients have no complaints regarding the competence and responsiveness of this broker's support team.

Pros

- There are various ways to contact client support.

- Specialists are available not only during the day but also at night.

- You don't need to be a client of this broker to seek assistance.

Cons

- The company does not have a call center.

- Client support is unavailable on weekends.

Whether you are already working with this broker or are considering starting a partnership, reach out to support with your relevant questions. Current communication channels include:

Email.

Live chat on the website and in the user account.

Tickets are on this broker’s website.

TenTrade has profiles on social media platforms such as Facebook, LinkedIn, Instagram, Twitter, and YouTube. You can also contact the managers through those channels. It's worth subscribing to this broker's accounts to stay updated on their news.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address | 23 Raith Avenue, Southgate, London N14 7DU, England |

| Regulation |

FSA Seychelles

Licence number: SD082 |

| Official site | https://tentrade.com/en/ |

| Contacts |

Education

For a trader to succeed, it is not enough to practice constantly. Theoretical preparation is needed, which includes electronic books, lectures, webinars by experts, video guides, and various educational formats. Some brokers even offer comprehensive educational programs in their physical offices. TenTrade does not have such programs, but they have an online academy called Ten Academy. The academy offers interactive learning with tips and life hacks. It provides newsfeeds with filters and expert comments. The academy includes video guides and written materials for traders of all levels. Traders can also take advantage of the services of a professional coach, an experienced market participant who will accompany their trades and provide commentary on their decisions. Only a few brokerage platforms can boast such a variety and depth of educational resources.

While most brokers focus their education primarily on beginners, TenTrade implements a different approach by offering educational resources for users with different levels of experience. For example, experts conduct lectures covering both the basics of trading and advanced topics that cater to professionals.

Comparison of TenTrade with other Brokers

| TenTrade | Eightcap | XM Group | RoboForex | VT Markets | AMarkets | |

| Trading platform |

MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4, MT5, AMarkets App |

| Min deposit | $25 | $100 | $5 | $10 | $50 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of TenTrade

This company has been operating for many years, focusing solely on brokerage activities. It implements modern solutions and uses an advanced technological stack, from virtual VPS servers to SSL cryptographic protocols, which ensures a secure internet connection. This broker collaborates with first-tier liquidity providers, which is reflected not only in relatively low spreads but also in order execution speeds measured in milliseconds. The company independently maintains its infrastructure components, including its proprietary copy trading service. The conceptual advantage is provided by the Ten Academy, which offers education in various formats.

TenTrade by the numbers:

The minimum deposit is $25.

The minimum spread on its ECN account is 0 pips.

The commission fee is $3.5.

The maximum leverage is1:500.

Prop funding is up to $500,000.

TenTrade is a convenient Forex, NFT, and CFD broker

The working convenience with the platform is determined primarily by the user-friendly interface and the transparent trading conditions. In addition, trading is conducted through the MetaTrader 5 platform, which is one of the most popular solutions due to its ease of use, high functionality, and extensive customization options. With dozens of currency pairs, NFTs, and hundreds of CFDs from various groups, there is enough variety to successfully diversify the risks of one’s investment portfolio. Furthermore, the abundance of trading instruments expands the strategic opportunities for traders, while the 1:500 leverage increases profit potential.

TenTrade’s analytical services:

Copy trading. The proprietary copy trading service allows traders to register as signal providers or investors. Signal providers trade as usual, and their trades are transmitted to interested users, earning them commissions. Investors generate passive income with reduced risk and gain valuable experience.

Ten Academy. This broker's educational programs are highly valuable, with materials presented in various formats, including text, video, and lectures. Personal coaching is also available for a fee. The service provides dozens of tools for fundamental and technical analyses, as well as calculators, asset charts, and newsfeeds.

Prop trading. This broker funds traders who can pass the challenge. Users make a one-time contribution (starting from $300) and receive a trading account with funding ranging from $10,000 to $500,000. The profit distribution ratio of 70/30 is standard in the industry, and there are no trading restrictions.

Advantages:

Traders with limited experience have a low entry barrier, thanks to the free demo account and a minimum deposit of only $25 for a real account. They also have immediate access to educational resources.

All market participants can rely on an impressive pool of assets, moderate leverage, and the versatility of the MetaTrader 5 trading platform, which offers many customization options.

The Ten Academy is beneficial for all users, providing a wide range of diverse tools, including filtered newsfeeds, asset and trend charts, and specialized calculators.

If a trader has sufficient skill and wants to trade with substantial capital, the company is ready to provide funding up to $500,000 through proprietary trading arrangements.

The copy trading service serves as an additional source of income. It is implemented at a high technical level, with a user-friendly interface.

Latest TenTrade News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i