According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- WebTrader

- MetaTrader4

- SVG FSA

- 2017

Our Evaluation of Core Liquidity Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Core Liquidity Markets is a moderate-risk broker with the TU Overall Score of 5.31 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Core Liquidity Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Core Liquidity Markets positions itself as a universal broker, but the lack of cent accounts and quality training suggests that it is focused on more experienced traders rather than novice ones.

Brief Look at Core Liquidity Markets

Core Liquidity Markets (also CLMForex) is a brokerage company that has been providing retail and institutional clients with a full range of financial services for Forex trading since 2013. The broker is focused on traders from Latin America but also serves clients all over the world. CLMForex offers favorable terms for active trading, as well as many investment solutions for generating passive income. It is registered and regulated by the SVGFSA 24750 — Financial Services Authority (Saint Vincent and the Grenadines).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The minimum deposit available on a standard account is $100.

- Availability of two types of accounts (Standard and ECN) with different spread levels and transaction processing models.

- Possibility to make trades using desktop and mobile terminals, as well as MT4 and WebTrader.

- Average trading commissions on standard accounts and virtually zero spreads on ECN.

- Free access to the DupliTrade social trading platform.

- High leverage — up to 1:500 on all types of accounts.

- Demo account availability, the operations of which completely track the functionality of the real accounts.

- The broker doesn’t provide Cent accounts, and use of the Demo is limited to 30 days.

- Access to the copy trades service of successful traders is possible only after depositing $2,000 to the account.

- Only a few training materials and analytics are available.

TU Expert Advice

Financial expert and analyst at Traders Union

The Core Liquidity Markets (CLMForex) brokerage has been operating in the online markets brokerage services niche for over eight years, and during that time it expanded its markets share significantly. Today it works with traders from 100 countries and serves over 100 thousand accounts. The broker is focused on both active market participants and passive investors. Clients can trade over 100 instruments, as well as invest in PAMM accounts and copy trades through the DupliTrade platform regardless of experience.

CLMForex offers professional analysis tools such as Trader's Edge and ForexAnalytix. Clients are provided with the world's most popular trading platform — MetaTrader 4. There are three versions available: desktop, mobile, and web terminal. Spreads, as determined by the broker, are competitive. For example, on the Standard account, the average spread is 1.3 pips for the EUR/USD pair.

However, Core Liquidity Markets have some disadvantages, also. First, the broker doesn’t cooperate with trade brokers in the USA, Australia, Spain, or Japan, and several other countries. Second, there are very few educational lessons on the official website. Moreover, the site itself is crude: some of its sections are still empty, but the company promises to add trading calculators and a currency converter soon.

Core Liquidity Markets Trading Conditions

| 💻 Trading platform: | MetaTrader 4 (desktop, mobile), WebTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, and ECN account |

| 💰 Account currency: | US$, €, £ |

| 💵 Deposit / Withdrawal: | Bank transfer, credit/debit cards Visa and Mastercard, Neteller, Skrill, VLoad, and Bitcoin |

| 🚀 Minimum deposit: | From $100 (Standard); from $500 (ECN) |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs (54), stock CFDs (10), indices (11), commodities (10), and cryptocurrencies (6) |

| 💹 Margin Call / Stop Out: | Stop-out: 50% |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Cryptocurrency trading is available; scalping, hedging, and auto trading are allowed with expert advisors |

| 🎁 Contests and bonuses: | No |

Core Liquidity Markets brokers offer classic Forex trading terms. Its clients can trade currency pairs and CFDs using MetaTrader 4, with tight floating spreads and high leverage. The company offers only two types of trading accounts as standard and ECN. They don’t differ in the number of assets available for trading, the order execution method, or the stop-out level. The difference between the accounts is the transaction processing technology (STP/ECN), as well as in the size of the spreads and the size of the minimum deposit.

Core Liquidity Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

NG Lagos

NG Lagos Trading Account Opening

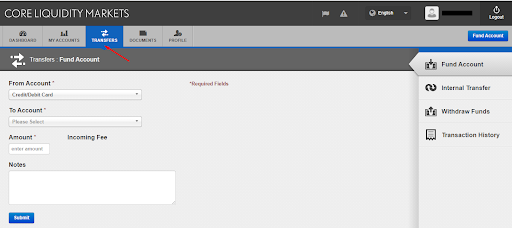

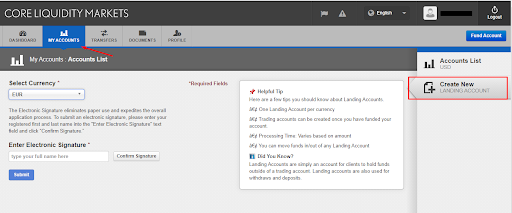

Become a Core Liquidity Markets client by opening a trading account to start trading with a broker. A quick guide looks as follows:

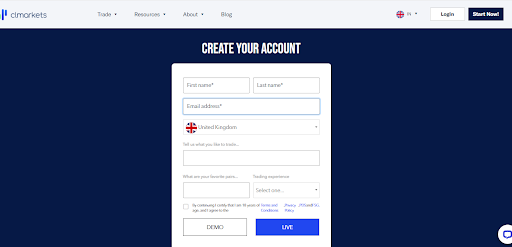

To start registration, click the Start Now! or Open Account button on the official website of the company.

Enter your first name, last name, email address, and country of residence in the application for opening an account. It is also necessary to select a class of trading assets while especially highlighting priority instruments, and indicate the level of trading experience. After that, agree to the terms of the offer and click Live.

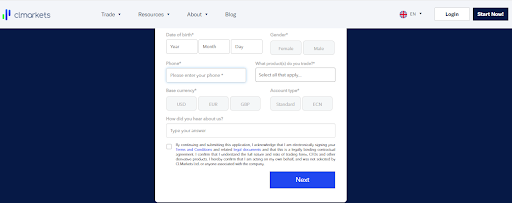

Specify the date of birth, gender, phone number, and select the base currency of the account, type of account, and finally, create a password in the form below.

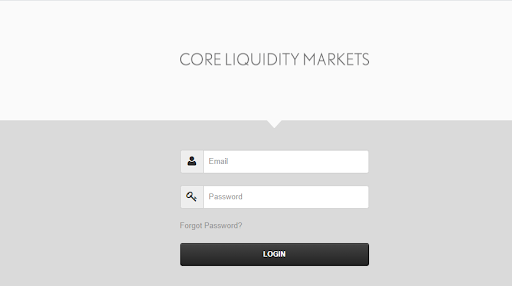

Log in to your personal account after receiving an email confirming the opening of your account. Enter your email address and the password entered in the registration form.

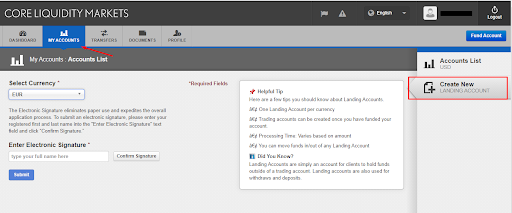

Also, in the user's personal account you can:

Sections of the personal account also provide the information below:

-

Daily account overview.

-

Market hours for London, New York, Sydney, and Tokyo.

-

Quick reports on deposits and withdrawals or account statement generation.

-

Market news in real-time.

-

Information about recent activity on open trading accounts.

-

Section for verification.

Regulation and safety

Core Liquidity Markets has a safety score of 4.2/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 8 years

- Not tier-1 regulated

Core Liquidity Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

Core Liquidity Markets Security Factors

| Foundation date | 2017 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Core Liquidity Markets have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- Above-average Forex trading fees

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Core Liquidity Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Core Liquidity Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Core Liquidity Markets Standard spreads

| Core Liquidity Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Core Liquidity Markets RAW/ECN spreads

| Core Liquidity Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Core Liquidity Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Core Liquidity Markets Non-Trading Fees

| Core Liquidity Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0-3 | 0 | 0 |

| Withdrawal fee, USD | 0-15 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

offer up to 1:500 leverage, market execution, micro lot trading, and access to a personal account manager. The stop-out level is 50%.

Types of accounts:

The company provides demo analogs of both account types. Their validity period is 30 days.

Core Liquidity Markets is a broker for traders of any trading experience who prefer high leverage trading and have $100 or more to invest in the Forex market.

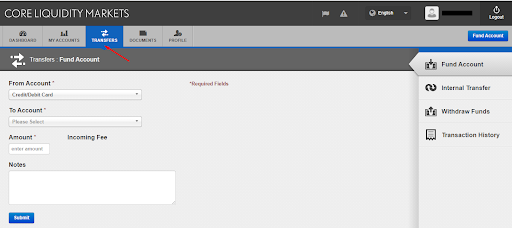

Deposit and withdrawal

Core Liquidity Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Core Liquidity Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank wire transfers available

- USDT (Tether) supported

- BTC available as a base account currency

- Minimum deposit below industry average

- Limited deposit and withdrawal flexibility, leading to higher costs

- Withdrawal fee applies

- PayPal not supported

What are Core Liquidity Markets deposit and withdrawal options?

Core Liquidity Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

Core Liquidity Markets Deposit and Withdrawal Methods vs Competitors

| Core Liquidity Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Core Liquidity Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Core Liquidity Markets supports the following base account currencies:

What are Core Liquidity Markets's minimum deposit and withdrawal amounts?

The minimum deposit on Core Liquidity Markets is $100, while the minimum withdrawal amount is $50. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Core Liquidity Markets’s support team.

Markets and tradable assets

Core Liquidity Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 52 Forex pairs.

- Crypto trading

- 52 supported currency pairs

- Indices trading

- Copy trading not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Core Liquidity Markets with its competitors, making it easier for you to find the perfect fit.

| Core Liquidity Markets | Plus500 | Pepperstone | |

| Currency pairs | 52 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Core Liquidity Markets offers for beginner traders and investors who prefer not to engage in active trading.

| Core Liquidity Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The professional Core Liquidity Markets support team works twenty-four/five online.

Advantages

- Contact via chat is available not only to clients but also to unregistered traders

- Chat operators answer in English, Spanish, and Portuguese

Disadvantages

- Technical support does not work on Saturday or Sunday

- There is no callback order form

This broker provides the following communication channels for its clients:

-

by calling the phone number specified in the Support section;

-

by email to support@clmforex.com;

-

via online chat on the website;

-

via a ready-made contact form.

There is also a special window for quick communication with representatives of Core Liquidity Markets in the company's Facebook messenger.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | CLMarkets Ltd., Suite 305, Griffith Corporate Centre Beachmont, Kingston, St. Vincent and the Grenadines |

| Regulation |

SVG FSA

Licence number: 24750-IBC-2018 |

| Official site | https://clmforex.com/ |

| Contacts |

+44 2 035 146 538

|

Education

There is no tutorial section on the Core Liquidity Markets website. There are practically no educational articles here either, but there is a smidgen of trading theory in its Blog section. However, this information will not be enough for high-quality training about the Forex marketplace.

The broker provides access to the Trader's Edge tool, which offers analytics and trading insights, but also training data. Clients can use two types of demo accounts to transfer theory into practice.

Comparison of Core Liquidity Markets with other Brokers

| Core Liquidity Markets | Eightcap | XM Group | RoboForex | Pocket Option | AMarkets | |

| Trading platform |

MT4, MobileTrading, WebTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | MT4, MT5, AMarkets App |

| Min deposit | $100 | $100 | $5 | $10 | $5 | $100 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point | From 0 points |

| Level of margin call / stop out |

80% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 30% / 50% | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of Core Liquidity Markets

Since 2013, Core Liquidity Markets, d/b/a the CLMForex broker, has been providing a full range of brokerage services to retail traders and institutional clients. The company was founded in the USA and currently has offices around the world. Its clients have access to analytics prepared by leading financial data resources, a wide range of powerful research tools, and low trading fees. CLMForex is not focused on a specific group of traders and seeks to provide favorable terms for both novice traders to Forex and more experienced market participants.

Core Liquidity Markets by the numbers:

-

Over 8 years of experience providing online brokerage services.

-

Over 100,000 clients.

-

Over 100 trading instruments.

-

Cooperation with traders from 100 countries.

Core Liquidity Markets is a broker with a wide variety of Forex trading assets

The company offers its clients five asset classes to trade among standard and ECN accounts. Traders can trade 54 currency pairs, including crosses, all the basics, as well as minor and exotic instruments. The broker provides a wide range of digital assets such as 14 cryptocurrency pairs with BTC (₿), BCH, LTC (Ł), ETH (Ξ), DSH (Ð), and XRP. Its clients can trade in all major global indices (such as: Nasdaq 100, Dow Jones, S&P500, and the GER30) and stocks such as Apple, Facebook, Amazon, and Tesla. Commodities available include precious metals (gold, silver, copper, platinum, palladium), natural gas, WTI, and Brent Crude oil.

Clients of Core Liquidity Markets can only trade through MetaTrader 4. However, the broker provides three iterations of the MT4 trading platform: desktop, WebTrader, as well as mobile applications for iPhone/iPad and Android devices. All platforms support one-click trading and automated expert advisor (EA) strategies.

Useful Core Liquidity Markets services:

-

Economic calendar. An essential tool for every trader with a schedule for the release of the most important economic news and events. The current actual data for the company is supplied by Myfxbook.com.

-

Trader's Edge. A set of tools that can help you achieve success in Forex trading. These include step-by-step videos on trading set up, robots for professional trading, proprietary indicators for the US markets, regular analytical market reviews, and trading ideas.

-

ForexAnalytix. A comprehensive analysis platform that scans the Forex market throughout the trading day, identifying chart patterns to predict further price movement in the course of a continuous market. Clients of the broker get free access for three months, subject to a deposit of $500 or more.

-

Currency converter and trading calculators. They are currently in development, but the company promises to add them to the website shortly.

Advantages:

A wide range of assets such as currency pairs, CFDs on stocks, indices, metals, energy resources, and cryptocurrencies.

PAMM accounts for passive investment.

You can use not only cards and wire transfers, but also popular payment systems such as Neteller, Skrill, and Bitcoin to deposit and withdraw funds.

Ultra-fast order execution with an average speed of 40ms.

Chat operators who work twenty-four/five.

Each client gets a personal manager, regardless of the size of his deposit.

Traders are allowed to use various strategies, such as hedging positions and conducting high-frequency and automated trading.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i