Fortrade Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- ForTrader

- FCA

- ASIC

- CySEC

- FSC

- and CIRO

- 2004

Our Evaluation of Fortrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Fortrade is a moderate-risk broker with the TU Overall Score of 6.56 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Fortrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Fortrade has numerous licenses which promote it as a reliable broker. However, its trading conditions cannot be called the most profitable for its clients.

Brief Look at Fortrade

Fortrade is a multi-regulated Forex and CFD broker that has representative offices in five countries. In London in 2014, it was registered and licensed by FCA 609970 (Financial Conduct Authority), one of the world’s most reputable supervisory bodies. Over the following years, Fortrade obtained licenses from ASIC 493520 (Australian Securities and Investments Commission), CIRO (Canadian Investment Regulatory Organization), CySEC 385/20 (Cyprus Securities and Exchange Commission), FSC (Financial Services Commission | Mauritius), and NBRB (National Bank of the Republic of Belarus). Its clients can trade over 300 instruments with leverage up to 1:200 (for FSC clients) and variable or fixed spreads. The international office regulated by FSC doesn’t provide its services to traders from over 70 countries, including France, Germany, and the UK. A full list of countries is provided in the FAQs section. U.S. residents cannot open accounts with any of Fortrade’s offices.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Negative balance protection for all retail clients;

- Wide choice of trading instruments with leverage;

- Proprietary platform and classic MetaTrader 4 are available;

- Presence on the market since 2014 and regulation by reputable financial supervisory commissions;

- Professional market reviews, including analytics from Trading Central;

- Partnership programs for traders, bloggers, companies, and institutional clients;

- No deposit or withdrawal fees.

- High trading fees, including those for the most liquid currency pairs;

- No trust management services;

- The Fortrader trading platform runs with delays and freezes occasionally.

TU Expert Advice

Financial expert and analyst at Traders Union

Fortrade offers quite a diverse range of trading instruments, including currencies, indices, stocks, ETFs, and U.S. bonds. Cryptocurrencies are provided as futures on Micro Bitcoin and Ethereum. Available commodities are energies (oil, gas, and fuel oil), precious metals (silver, gold, platinum, and palladium), and agricultural products.

All the above instruments are traded on the Over-the-Counter (OTC) market in the CFD format. However, professional clients can ask for Direct Market Access (DMA) to trade stocks of famous companies listed on Nasdaq and NYSE. To get the Professional status, traders must comply with regulatory requirements for capital and experience.

The minimum deposit at Fortrade is $100 and the recommended amount is $500. The minimum deposit by a bank transfer is $250 and it takes up to 7 days. Residents of certain countries can deposit and withdraw cryptocurrencies. Major currency pairs, including EUR/USD, are traded with fixed spreads, which is not always profitable for traders. Overall, Fortrade’s fees are rather high, but deposit and withdrawal conditions are quite loyal.

- You seek a well-regulated broker authorized by the Financial Conduct Authority (FCA) and other reputable authorities, ensuring a secure trading environment.

- You are a Beginner or Intermediate Trader as this platform provides a user-friendly and intuitive platform, along with educational resources and demo accounts for learning and practice.

- You are a US Resident or Citizen as CFDs are not available in the USA due to local regulations. Consequently, Fortrade does not accept US citizens or US residents as clients.

- You are looking for low trading fees and spreads, as Fortrade charges higher than average commissions and overnight fees.

Fortrade Trading Conditions

Your capital is at risk. 77% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex and highly speculative instruments, which come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing all your invested capital. Be Aware: You can lose all, but not more than the balance of your Trading Account. These products may not be suitable for all clients, therefore ensure, that you understand the risks and seek independent advice. Should you proceed with investment in CFDs on virtual currencies, please note, that the values are highly volatile and may result in a significant loss for a short period of time.

| 💻 Trading platform: | Fortrader (web and mobile) and MetaTrader 4 (desktop and mobile) |

|---|---|

| 📊 Accounts: | Demo and real (Forex & CFD Trading account and Swap Free Islamic account) |

| 💰 Account currency: | EUR, USD, GBP, and TYR |

| 💵 Deposit / Withdrawal: | Bank cards, Neteller, Skrill, PayPal, wire transfers/international telegraphic transfer (Swift), Google Pay, and cryptocurrencies (not all countries) |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:30 for CySEC, FCA, CIRO and ASIC. Up to 1:200 for FSC |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | 50 currency pairs, indices, stocks, commodities (precious metals, agricultural products, energies), U.S. bonds, ETFs, Micro Bitcoin futures, and Ethereum futures |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant |

| ⭐ Trading features: |

Any strategy is allowed; Variable and fixed spreads. |

| 🎁 Contests and bonuses: | Credit Bonus and Balance Bonus |

Leverage depends on the asset and the Fortrade representative office. The maximum leverage for major and minor currency pairs is up to 1:200; for exotic pairs, it is up to 1:20-1:50; for indices and commodities, it is up to 1:100; for stocks, it is up to 1:2-1:10; for ETFs, it is up to 1:5; for bonds, it is up to 1:20; and for Ethereum futures, it is 1:2. Traders must use their own funds to trade Bitcoin futures. Leverage for retail clients that work under the regulation of CySEC, FCA, and ASIC is not more than 1:30.

Fortrade Key Parameters Evaluation

Video Review of Fortrade

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

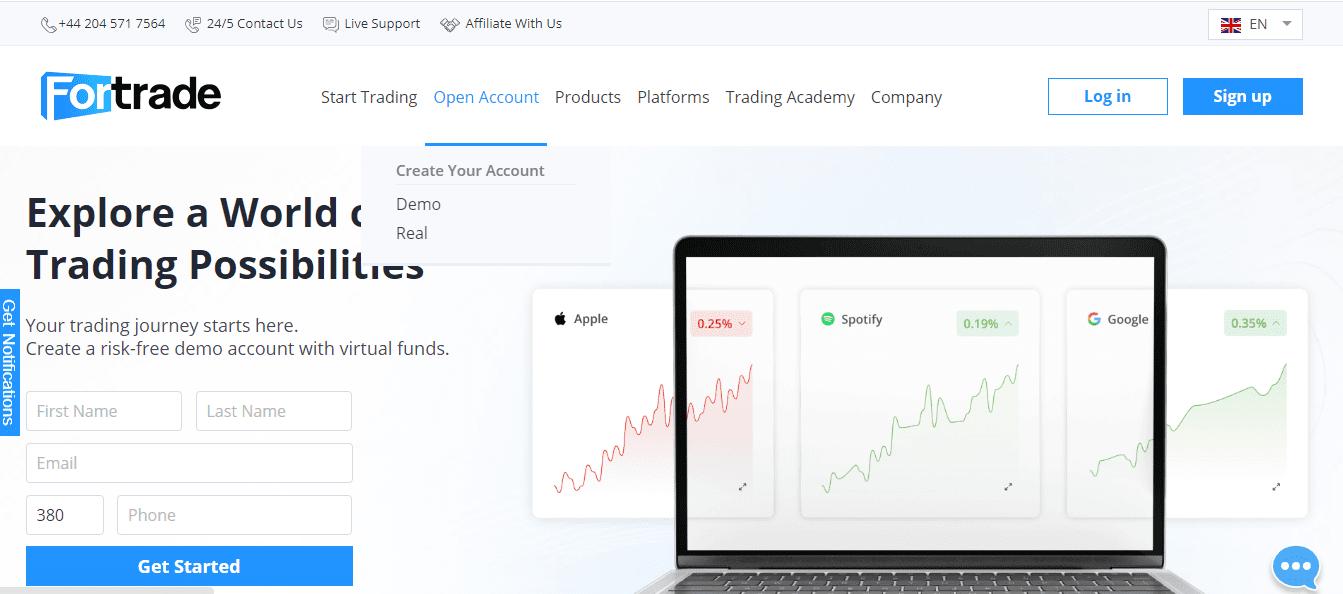

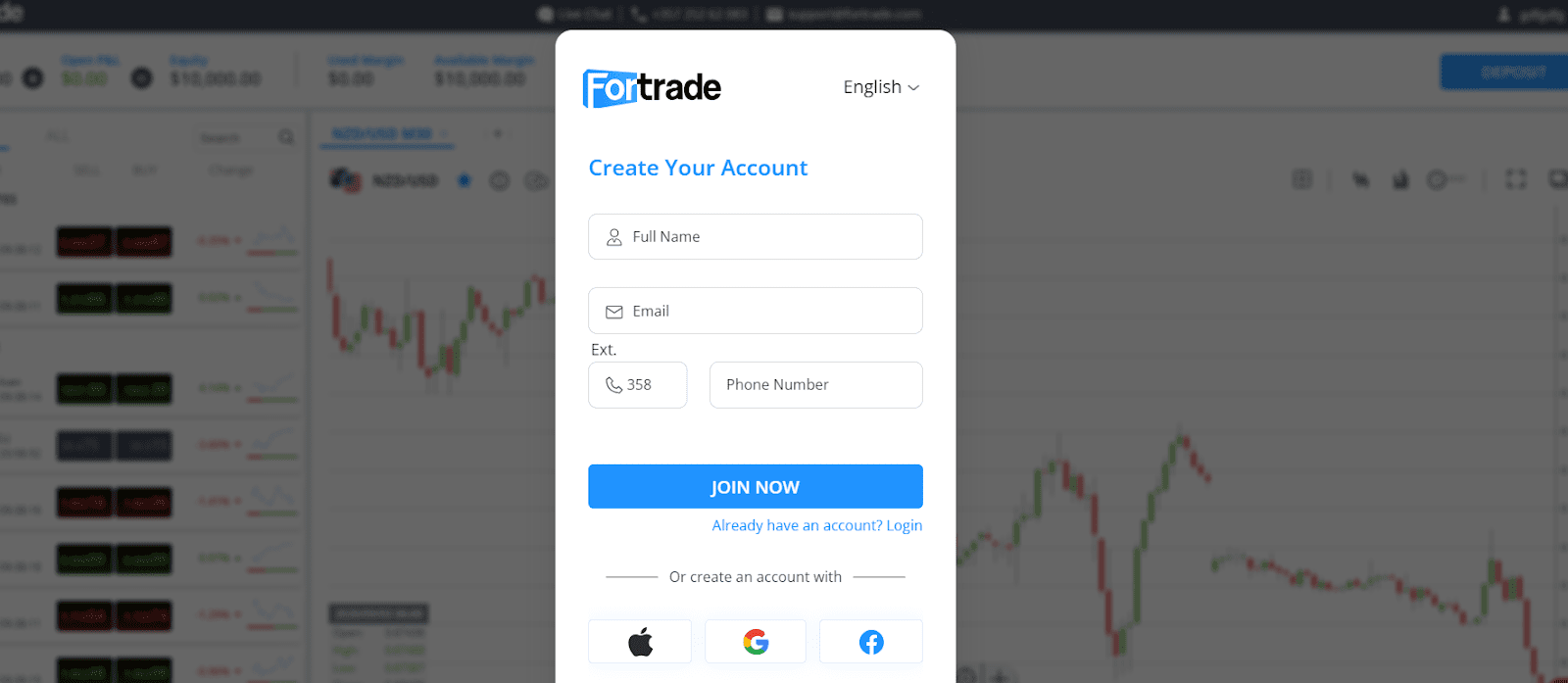

Only Fortrade clients can access user accounts with the broker. To become its client, do the following:

To quickly open demo or real account types, click the “Open Account” button to choose the necessary account type from the drop-down list.

The registration process includes three stages. The first stage requires your first and last names, phone number, and email. At the second stage, provide your residence address with a postal code. At the final stage, provide the data on your citizenship, choose the account currency, generate a password, and indicate your employment and income. Next, upload documents confirming your identity and residence address.

Use the Fortrade’s user account to:

Additional features of the user account that allow you to:

-

Use economic calendar;

-

Open additional trading accounts;

-

Submit withdrawal requests;

-

View statistics on open, closed, and pending orders;

-

View the history of monetary transactions;

-

Contact technical support;

-

Set up alerts.

Regulation and safety

Fortrade has a safety score of 10/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 21 years

- Strict requirements and extensive documentation to open an account

Fortrade Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

CIRO CIRO |

Investment Industry Regulatory Organization of Canada | Canada | CAD 1,000,000 | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

Fortrade Security Factors

| Foundation date | 2004 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Fortrade have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Fortrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Fortrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Fortrade Standard spreads

| Fortrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 2,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 2,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Fortrade RAW/ECN spreads

| Fortrade | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Fortrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Fortrade Non-Trading Fees

| Fortrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10 | 0 | 0 |

Account types

If traders are not Muslims, they can use two account types — demo and live STP (Straight Through Processing). For Islamic countries, Fortrade offers the Swap Free (Islamic) account.

Account types:

A demo account on Fortrader has a virtual deposit of €10,000 and is not limited in time. A demo account on MT4 is available for 30 days.

Fortrade’s trading conditions vary subject to the regulator, financial instrument, and client residency.

Deposit and withdrawal

Fortrade received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Fortrade provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bitcoin (BTC) accepted

- Bank card deposits and withdrawals

- Bank wire transfers available

- No withdrawal fee

- PayPal not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

What are Fortrade deposit and withdrawal options?

Fortrade provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

Fortrade Deposit and Withdrawal Methods vs Competitors

| Fortrade | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

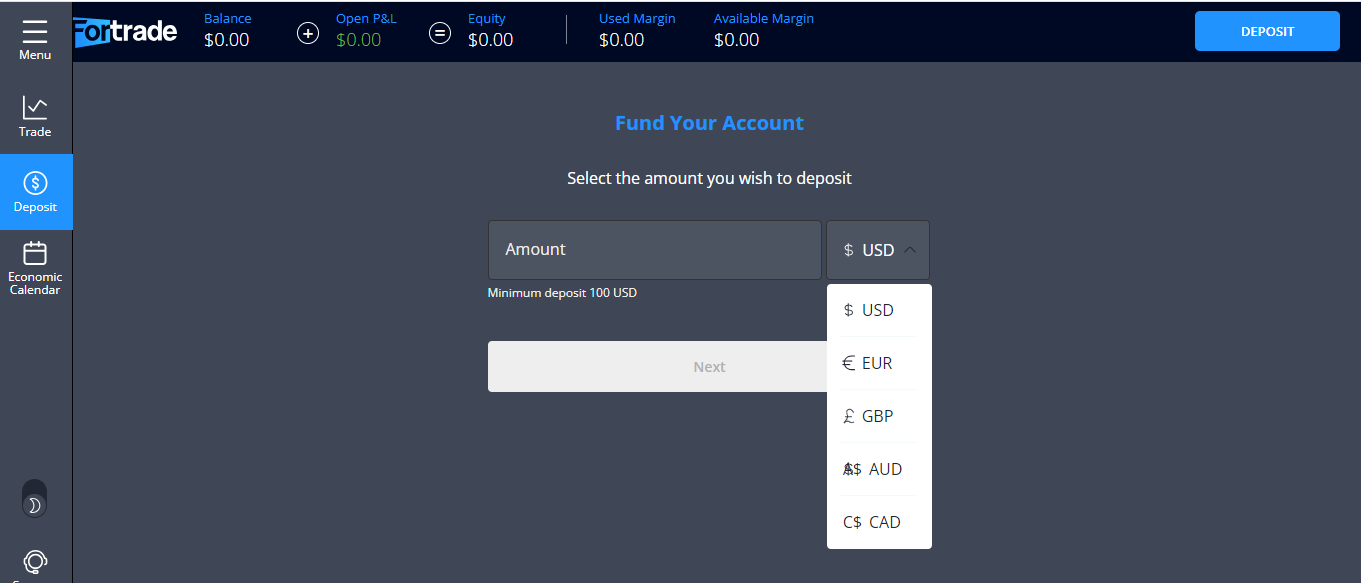

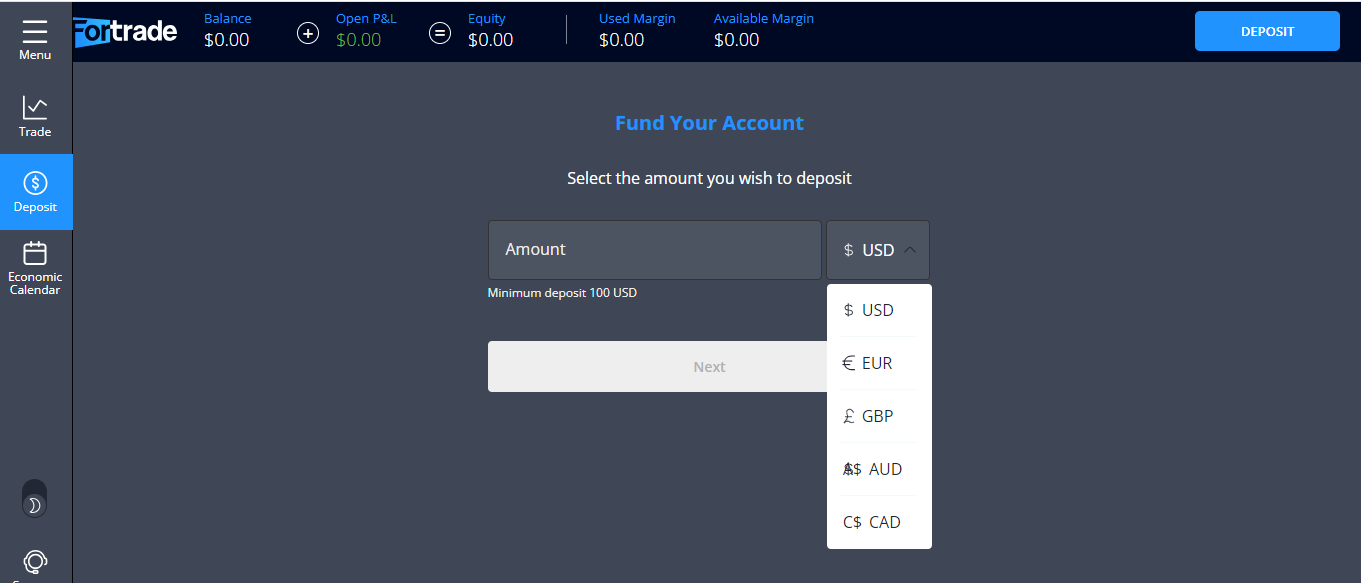

What are Fortrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Fortrade supports the following base account currencies:

What are Fortrade's minimum deposit and withdrawal amounts?

The minimum deposit on Fortrade is $100, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Fortrade’s support team.

Markets and tradable assets

Fortrade offers a limited selection of trading assets compared to the market average. The platform supports 300 assets in total, including 60 Forex pairs.

- 60 supported currency pairs

- Passive income with bonds

- Indices trading

- Futures not available

- Crypto trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Fortrade with its competitors, making it easier for you to find the perfect fit.

| Fortrade | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 300 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Fortrade offers for beginner traders and investors who prefer not to engage in active trading.

| Fortrade | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Fortrade received a score of 4.05/10, indicating a limited selection of trading platforms and tools. This reflects the absence of advanced platform options or a lack of additional features that could enhance the overall trading experience.

- MetaTrader is available

- Multiple funding options

- No access to Free VPS

- No access to cTrader and its advanced tools.

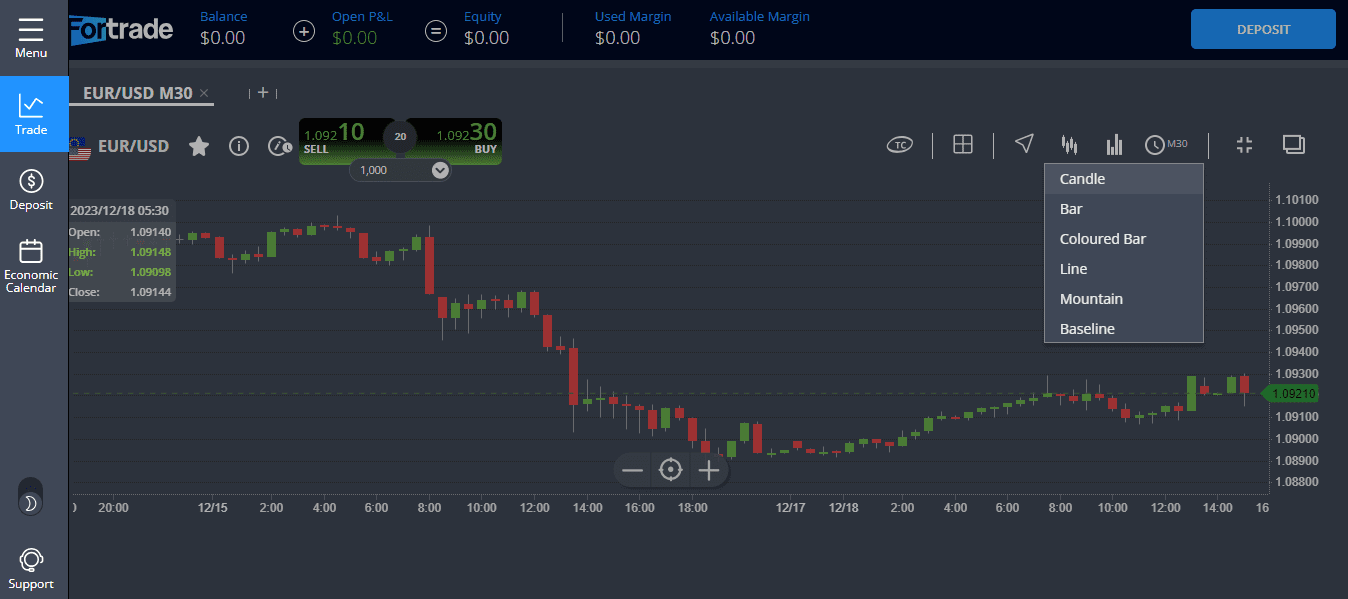

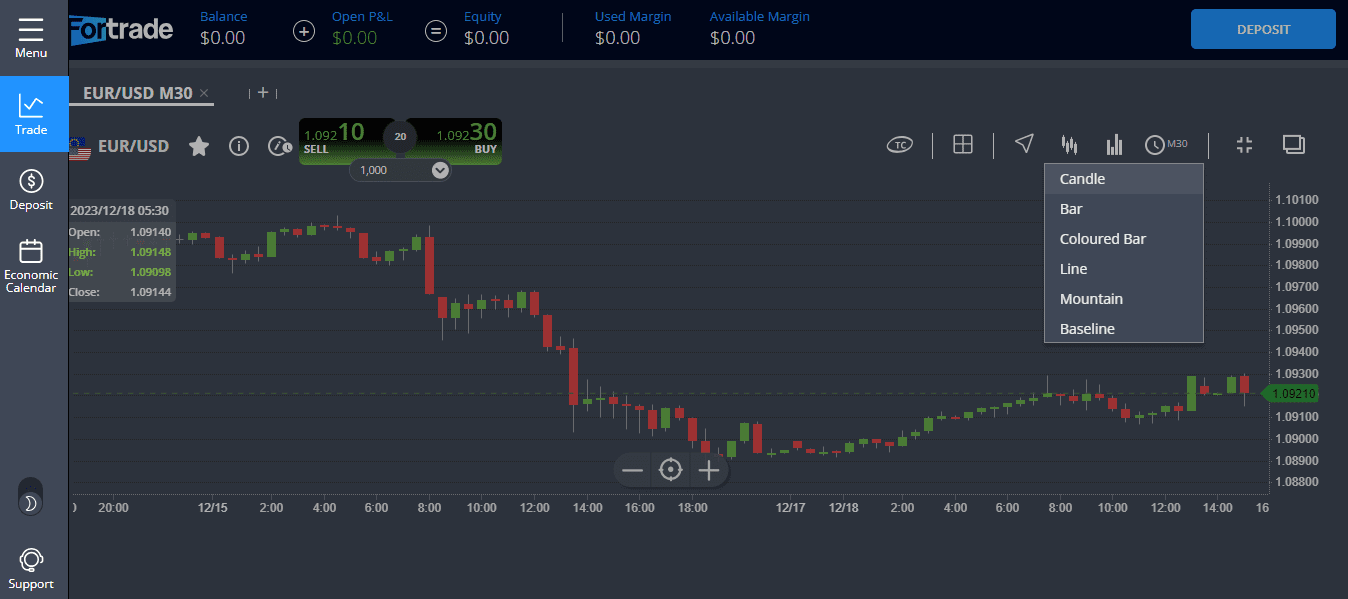

Supported trading platforms

Fortrade supports the following trading platforms: MT4, WebTrader. This selection covers the basic needs of most retail traders. We also compared Fortrade’s platform availability with that of top competitors to assess its relative market position.

| Fortrade | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | No | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Fortrade’s trading platform features

We also evaluated whether Fortrade offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | No |

| One-click trading | No |

| Scalping | Yes |

| Supported indicators | 30 |

| Tradable assets | 300 |

Additional trading tools

Fortrade offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Fortrade trading tools vs competitors

| Fortrade | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | No | No | Yes |

| Free VPS | No | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

Fortrade supports mobile trading, offering dedicated apps for both iOS and Android. Fortrade received a score of 6.56/10 in this section, indicating a generally acceptable mobile trading experience.

- Mobile alerts supported

- Indicators supported

- Weak user feedback on iOS

- Mobile 2FA not supported

We compared Fortrade with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Fortrade | Plus500 | Pepperstone | |

| Total downloads | 500,000 | 10,000,000 | 100,000 |

| App Store score | 3.5 | 4.7 | 4.0 |

| Google Play score | 3.6 | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

The Trading Academy section of the broker’s website allows traders to get basic trading skills and improve their professional level. It is divided into three blocks. Useful Info includes market analysis, a blog with useful articles, and answers to popular questions about trading. Trading Tools offers Forex calculators. Online Academy provides the basics of trading financial instruments.

The broker provides access to webinars on third-party sites. Any guest of the Fortrade website can participate in them for free. To do this, submit an application providing your name, phone number, and email. To get practical trading skills, use a demo account.

Customer support

Technical support is available round the clock from Monday to Friday.

Advantages

- Live chat is available on the website

- Traders can ask for assistance in their languages

Disadvantages

- Support isn’t available on holidays and weekends

- Only Fortrade clients can get high-quality responses

When clients or website guests need help, they can use any of these communication channels:

-

Live chat on the website or on the trading platform;

-

Telephone (numbers are provided on the website);

-

Facebook or X (formerly Twitter).

The broker’s website has a feedback form to contact support. Users can receive answers by email or telephone.

Contacts

| Foundation date | 2004 |

|---|---|

| Registration address | Fortrade Cyprus Ltd, office 302, Abbey Tower, Block A, 34, Kosta Partasides Street, 3030 Limassol, Cyprus |

| Regulation |

FCA, ASIC, CySEC, FSC, and CIRO

Licence number: 493520, 193075810, 385/20, 609970 |

| Official site | https://www.fortrade.com/ |

| Contacts |

+44 203 966 4505

|

Comparison of Fortrade with other Brokers

| Fortrade | Eightcap | XM Group | RoboForex | Pocket Option | InstaForex | |

| Trading platform |

MT4, MobileTrading, WebTrader, ForTrader for PC, Mobile Fortrader, Fortrader online | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $100 | $100 | $5 | $10 | $5 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 2 points | From 0 points | From 0.8 points | From 0 points | From 1.2 point | From 0 points |

| Level of margin call / stop out |

100% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 30% / 50% | 30% / 10% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of Fortrade

Fortrade’s services are in demand worldwide due to reliable regulation and a wide range of trading instruments. The broker provides its services to over 120,000 retail traders and more than 10,000 institutional clients. Trading over 300 CFDs, including 50 currency pairs, allows traders to choose interesting markets, while margin trading expands opportunities for traders even with small deposits. Fortrade complies with MiFID II requirements, holds client funds in segregated bank accounts, and applies reliable SSL (Secure Socket Layer) protocols.

Fortrade by the numbers:

-

10+ years of regulated operation;

-

5 licenses in different jurisdictions;

-

Over 119,000 followers on Facebook;

-

130,000+ registered traders.

Fortrade is a broker for active trading

The broker offers trading on two trading platforms — MetaTrader 4 and its in-house Fortrader platform. Assets and fees on both platforms are similar, but only MT4 is available for mobile trading. Web trading is possible only on Fortrader. To protect their deposits from big losses in case of market movement in the opposite direction, Fortrade clients can hedge their trades. However, this option is available only on Fortrader.

Most assets are traded with floating spreads. The exceptions are EUR/USD, GBP/USD, USD/JPY, crude oil, gold, and silver. Fixed Standard and Night spread types are applied to these assets. Night spreads are higher and are charged from 22:01 for currency pairs, and from 22:30 to 05:00 (GMT) for metals and oil.

Useful services offered by Fortrade:

-

Weekly reviews of global financial markets are provided as short videos;

-

Push messages on the website provide real-time Fortrade news and offers;

-

YouTube channel with over 720 useful videos in different languages;

-

Daily market analysis, weekly updates, microanalysis, and special reports on different asset classes;

-

Unlimited demo account, as well as educational webinars and seminars.

Advantages:

Popular strategies like hedging, social and arbitrary trading, are allowed;

To open a demo account, uploading documents isn’t required;

24/5 technical support;

The company participates in compensation schemes of European regulators;

Bonus programs to expand trader’s opportunities are offered.

The user account verification takes up to 24 hours. Also, instant deposits like Google Pay and popular payment systems are available.

Latest Fortrade News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i