According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- No

- WebTrader

- cTrader

- MetaTrader4

- MetaTrader5

- TradingView

- CySEC

- FSA

- ASIC

- FSC (Mauritius)

- 2006

Our Evaluation of GO Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

GO Markets is a moderate-risk broker with the TU Overall Score of 6.66 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by GO Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

GO Markets terms are more for experienced traders who prefer to trade CFDs with a little leverage.

Brief Look at GO Markets

GO Markets is an international investment company with several representative offices regulated by СySec 322/17 (Cyprus) and FSC GB19024896 (Mauritius). It specializes in CFD transactions on currency pairs, indices, commodities, and metals. It offers Standard and ECN accounts, MetaTrader 4 and MetaTrader 5 terminals, access to professional analytics, and free training webinars. The GO Markets parent company was founded in 2006 and is regulated by ASIC.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The parent company has been in operation for decades and its activities are under the control of several regulators.

- The ability to trade with both classic and ECN accounts.

- Low deposit size on professional accounts.

- Free access to Trading Central analytics and MetaTrader Genesis tools.

- Low trading fees on all account types.

- There are no limitations on trading strategies.

- Free deposit and withdrawal of funds.

- There are no cent accounts.

TU Expert Advice

Author, Financial Expert at Traders Union

GO Markets offers a diverse range of trading services, including CFDs on currency pairs, indices, commodities, and metals. Its clients can choose between Standard and ECN accounts, with MT4 and MT5 platforms available. The broker provides low trading fees and no minimum deposit requirements, while offering leverage up to 1:500. Traders benefit from free access to professional analytics and trading signals, a wide range of base currencies, and support for algorithmic trading.

Nevertheless, GO Markets has some drawbacks, such as the absence of cent accounts and limited leverage when compared to other Forex brokers. Additionally, a more comprehensive range of commodities and the unavailability of U.S. stock trading may not suit traders seeking direct ownership of these assets. Overall, GO Markets may be suitable for experienced traders looking to utilize low fees and advanced trading platforms, though beginners seeking minimal-risk accounts may consider other options.

- You want access to multiple platforms. GO Markets provides MetaTrader 4, MetaTrader 5, and their proprietary WebTrader platform, offering flexibility in trading choices.

- You value low spreads. GO Markets boasts competitive spreads, particularly on its GO Plus account. Tight spreads can reduce your trading costs, enhancing profitability.

- You prioritize regulation and security. GO Markets is regulated by ASIC (Australia), CySEC (Cyprus), FSA (Seychelles), and FSC (Mauritius), providing a level of trust and confidence in the broker's operations.

- You require US stock trading. GO Markets primarily offers CFDs on US shares, not direct ownership. If direct ownership of US stocks is essential for your trading strategy, consider alternative brokers that offer this service.

GO Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, Webtrader, Tradingview, cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, GO Plus |

| 💰 Account currency: | EUR, USD, PLN, GBP, AUD, CAD, SGD, HKD, CHF, NZD, etc. |

| 💵 Deposit / Withdrawal: | Visa, MasterCard, Maestro, bank transfer, Neteller, Skrill, FasaPay, Dotpay, Checkout.com, etc. |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFD on 50 currency pairs, CFD on commodities, indices, metals and crypto |

| 💹 Margin Call / Stop Out: | 80%/50% |

| 🏛 Liquidity provider: | Over 22 liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant execution |

| ⭐ Trading features: | No |

| 🎁 Contests and bonuses: | No |

GO Markets clients can trade over 70 CFDs (including currency pairs) in the classic MetaTrader 4 and 5 terminals. Transactions with leverage up to 1:30 can be made from both Standard and ECN accounts. The list of available account currencies and deposit/withdrawal options varies depending on the country of residence of the trader. The broker allows you to test the trading terms on demo accounts in any of the presented terminals.

GO Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

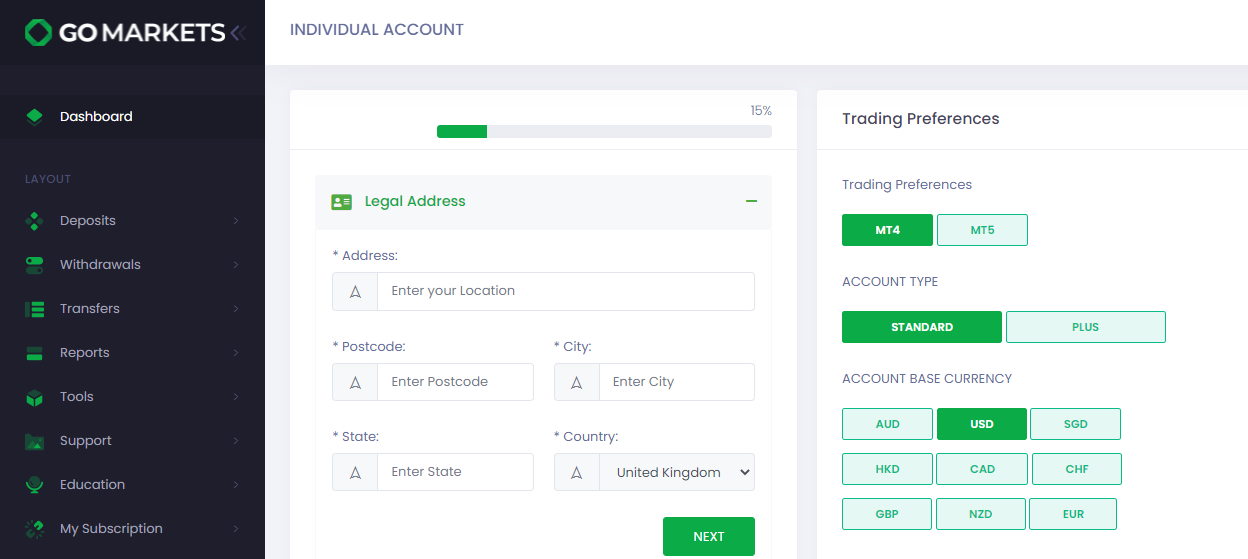

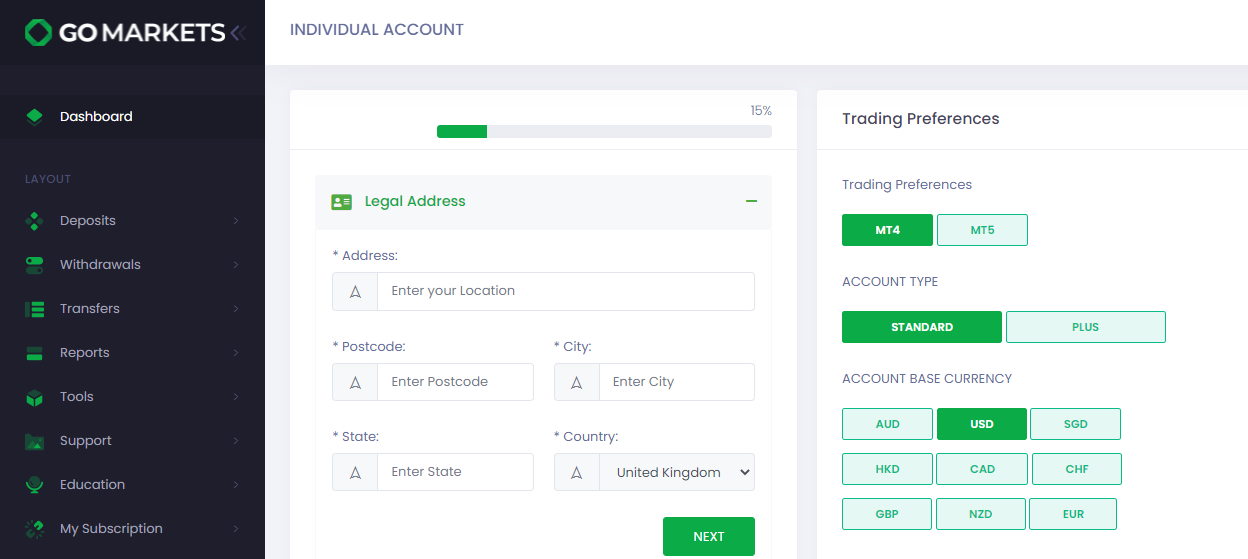

Trading Account Opening

The user’s account allows you to open a trading account, set up a platform, and make a deposit. Become a client of the broker to create an account. To do so, follow the instructions below:

Register with the Traders Union (to get the spread rebates), search for the GO Markets profile, and go to its website using the referral link. Click the Open an Account button on the main page of the site.

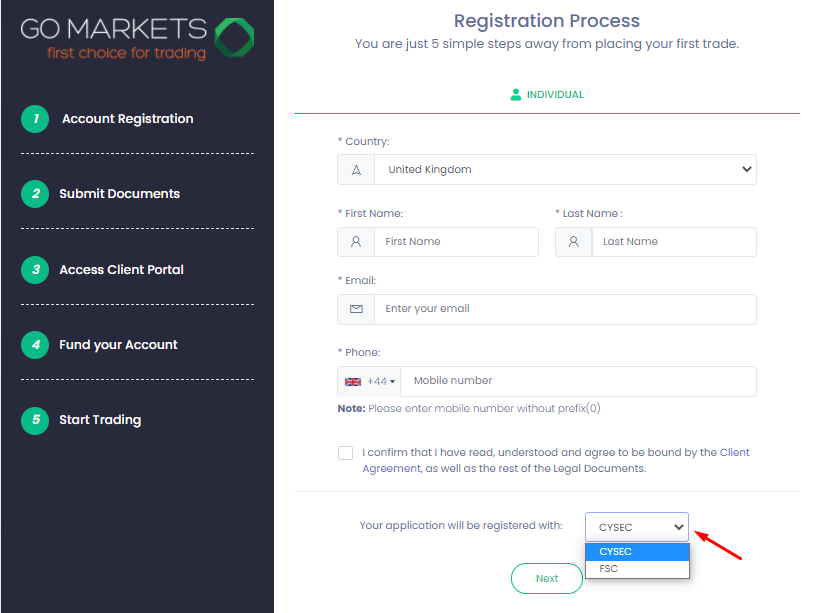

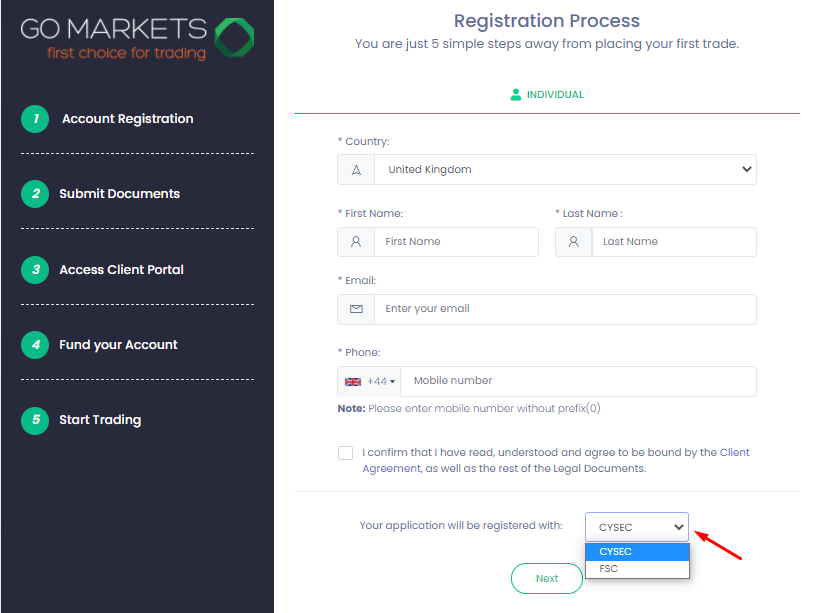

Fill out the registration form, indicate your full name, country of residence, email, and phone number. The name of the regulator (e.g., CySEC or FSC) will be displayed automatically depending on your country of residence.

Select the account type (Standard/Plus), trading and platform (MT4/MT5), and the base currency of the account.

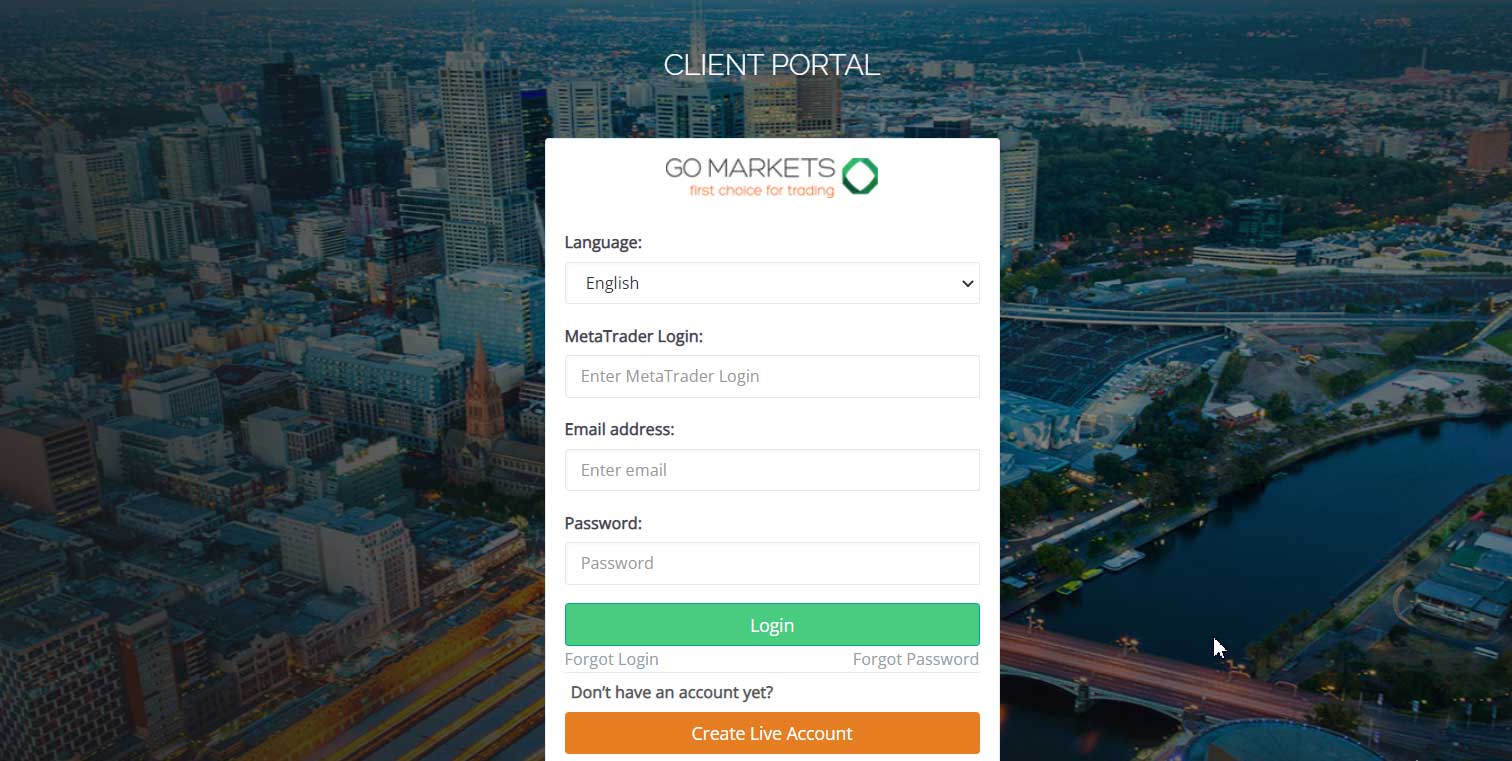

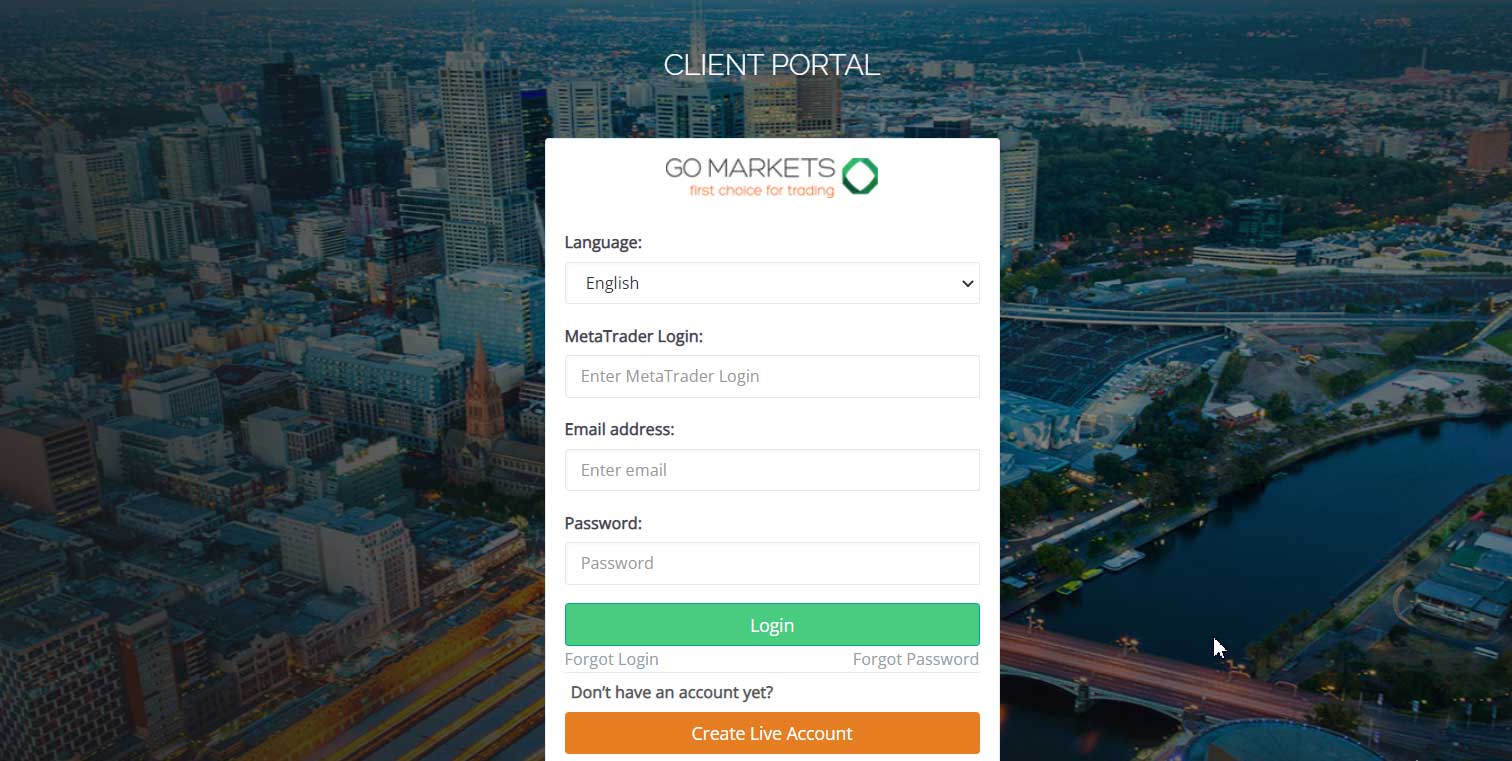

To log into the user’s account, click the Client Portal at the header of any page on the GO Markets website. Enter your MetaTrader login and password, which were sent to the email submitted earlier, as well as the email itself.

The main sections of the user account:

-

Reports.

-

Instruments.

-

Education.

-

My subscription.

-

Customer service.

Regulation and safety

GO Markets has a safety score of 9.9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 19 years

- Strict requirements and extensive documentation to open an account

GO Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

GO Markets Security Factors

| Foundation date | 2006 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker GO Markets have been analyzed and rated as Low with a fees score of 10/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of GO Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, GO Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

GO Markets Standard spreads

| GO Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,4 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

GO Markets RAW/ECN spreads

| GO Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with GO Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

GO Markets Non-Trading Fees

| GO Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Traders can trade in GO Markets on one of two account types such as Standard or GO Plus. The minimum trade size is 0.01 lot, the leverage is 1:5-1:30, depending on the asset class. A user account manager shall be assigned to all accounts opened with the company.

Account types:

You can open a demo account in any version of MT4 and MT5 terminals. The validity period of the demo account is 30 days.

The GO Markets broker offers Standard and professional accounts for trading different CFD classes, as well as demo accounts and access to advanced analytics from reputable third-party market data providers.

Deposit and withdrawal

GO Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

GO Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- BTC available as a base account currency

- Bank wire transfers available

- Bitcoin (BTC) accepted

- No deposit fee

- PayPal not supported

- Wise not supported

- Limited deposit and withdrawal flexibility, leading to higher costs

What are GO Markets deposit and withdrawal options?

GO Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

GO Markets Deposit and Withdrawal Methods vs Competitors

| GO Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are GO Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. GO Markets supports the following base account currencies:

What are GO Markets's minimum deposit and withdrawal amounts?

The minimum deposit on GO Markets is $100, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact GO Markets’s support team.

Markets and tradable assets

GO Markets provides a standard range of trading assets in line with the market average. The platform includes 1000 assets in total and 60 Forex currency pairs.

- Copy trading platform

- Crypto trading

- Indices trading

- Regional restrictions are possible

Supported markets vs top competitors

We have compared the range of assets and markets supported by GO Markets with its competitors, making it easier for you to find the perfect fit.

| GO Markets | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 1000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products GO Markets offers for beginner traders and investors who prefer not to engage in active trading.

| GO Markets | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

GO Markets received a score of 8.9/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- MetaTrader is available

- Free VPS for uninterrupted trading

- Trading bots (EAs) allowed

- cTrader with advanced tools and Level II pricing

- No access to a proprietary platform

- No access to API

- No TradingView integration

Supported trading platforms

GO Markets supports the following trading platforms: MT4, MT5, cTrader, WebTrader. This selection covers the basic needs of most retail traders. We also compared GO Markets’s platform availability with that of top competitors to assess its relative market position.

| GO Markets | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key GO Markets’s trading platform features

We also evaluated whether GO Markets offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 168 |

| Tradable assets | 1000 |

Additional trading tools

GO Markets offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

GO Markets trading tools vs competitors

| GO Markets | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

GO Markets supports mobile trading, offering dedicated apps for both iOS and Android. GO Markets received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- User-friendly interface

- Weak user feedback on iOS

- Low app installs across iOS and Android

We compared GO Markets with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| GO Markets | Plus500 | Pepperstone | |

| Total downloads | 1,000 | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

The Education section on the website is for traders who need training in Forex trading. It describes the main points of working with currency pairs and offers video tutorials on MT4.

Also, there are forms for signing up for free webinars by specialists from the GO Markets Training Center in the Education block. A demo account is available to solidify theory in practice.

Customer support

GO Markets' multilingual team is available to help traders around the clock, Monday through Friday.

Advantages

- Chat operators respond within a few minutes

- Telephone numbers for Cyprus, UK, and international calls are listed

Disadvantages

- Here you can only get answers to general questions.

- Personal manager ignores questions sent by email

- For more information about the trading terms, you can only contact your personal manager by phone

A representative of the company can be contacted via:

-

online chat on the website and in the user account;

-

telephone.

-

email;

-

the broker's LinkedIn, Facebook, Twitter, and Instagram profiles.

There is also a contact form in the Contact Us section. Enter your full name, email, phone number, and your question to a GO Markets representative.

Contacts

| Foundation date | 2006 |

|---|---|

| Registration address | GO Markets Ltd., 73 Agias Zonis and Tertaiou Corner, Dena House 3rd floor, 3090 Limassol, Cyprus |

| Regulation | CySEC, FSA, ASIC, FSC (Mauritius) |

| Official site | https://www.gomarkets.eu/ |

| Contacts |

+61 3 8566 7680

|

Comparison of GO Markets with other Brokers

| GO Markets | Eightcap | XM Group | RoboForex | Markets4you | 4XC | |

| Trading platform |

MobileTrading, MT5, MT4, WebTrader, TradingView | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT5, MT4, WebTrader |

| Min deposit | No | $100 | $5 | $10 | No | $50 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0 points |

| Level of margin call / stop out |

80% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | 100% / 50% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed Review of GO Markets

GO Markets broker broadcasts prices of 22 liquidity providers. Its trading servers are located in London. This ensures order execution at high speed and low spreads on ECN accounts. GO Markets provides services all over the world, however, it doesn’t serve traders from the USA (because of the prohibition on cooperation with foreign brokers established by the CFTC Commission). The company offers several channels for an instant deposit, as well as extra commission-free ones.

GO Markets by the numbers:

-

The parent company has been operating for over 15 years.

-

Clients can trade 70+ financial instruments.

-

The broker offers two of the most popular trading platforms among currency traders.

-

The company broadcasts 9-12 trading signals daily for the most liquid currency pairs.

GO Markets is a broker for leveraged CFD trading

GO Markets is a broker that allows you to trade CFDs on different asset classes not only with your funds but also with borrowed ones. Forex is represented by 50 currency pairs. The leverage on the major currency pairs is 1:30; on secondary and exotic, it’s 1:20. Gold and silver are available: XAU/USD leverage is 1:20, and it is 1:10 for XAG/USD. You can also trade Spot Crude Oil (WTI and Brent), US and UK oil futures with leverage of 1:5-1:10. The GO Markets provides access to stock index trading via 12 Cash Index CFDs and 2 Futures CFDs. The leverage on major indices is 1:20, and 1:5-1:10 for non-major indices.

GO Markets clients can open an account and trade on the MetaTrader 4 and MetaTrader 5 platforms. There are Windows and Mac versions. The broker allows the use of expert advisors (EAs) and algorithmic trading, using applications and scripts from third-party software developers. Mobile applications for Android and iOS devices are available.

GO Markets’ useful services:

-

Genesis. This is a comprehensive set of trading tools, which allows you to increase the efficiency of standard MT4 and MT5 platforms using market sentiment indicators, interactive session maps, Alarm Manager trade alerts, economic calendar, and other services that are available to all traders with deposits from €250.

-

Daily Strategies. The a-Quant trading signals are based on algorithms of machine prediction and artificial intelligence. Subscribers receive 9-12 signals for the 10 most popular currency pairs daily by email.

-

The news section of the site. It publishes market reviews, daily, and weekly summaries of events. There is also an economic calendar in this block.

-

VPS. Free access to virtual private servers for MT4 is available to clients with a minimum trading volume of $1 million per calendar month (approximately 5 FX lots with a complete turnover).

-

Forecasts and analytics from Trading Central. Every day traders receive technical and fundamental analysis, proven trading strategies, current market news, and other important information that allows them to stay in the loop of market movements.

Advantages:

Company clients can participate in free training webinars.

You can trade from desktop and mobile MT4 and MT5 applications.

Two-factor authentication is used to log in to the user account.

Client funds are protected by a compensation fund, which is controlled by CySEC.

Investment solutions such as PAMMs, social and algorithmic trading are available.

You can deposit by bank transfer, bank cards, and popular e-wallets.

The broker doesn’t prohibit any style of trading. Clients can open and close their positions as often as they want.

Latest GO Markets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i