deposit:

- $20

Trading platform:

- MetaTrader4

- 0%

LQDFX Review 2024

deposit:

- $20

Trading platform:

- MetaTrader4

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

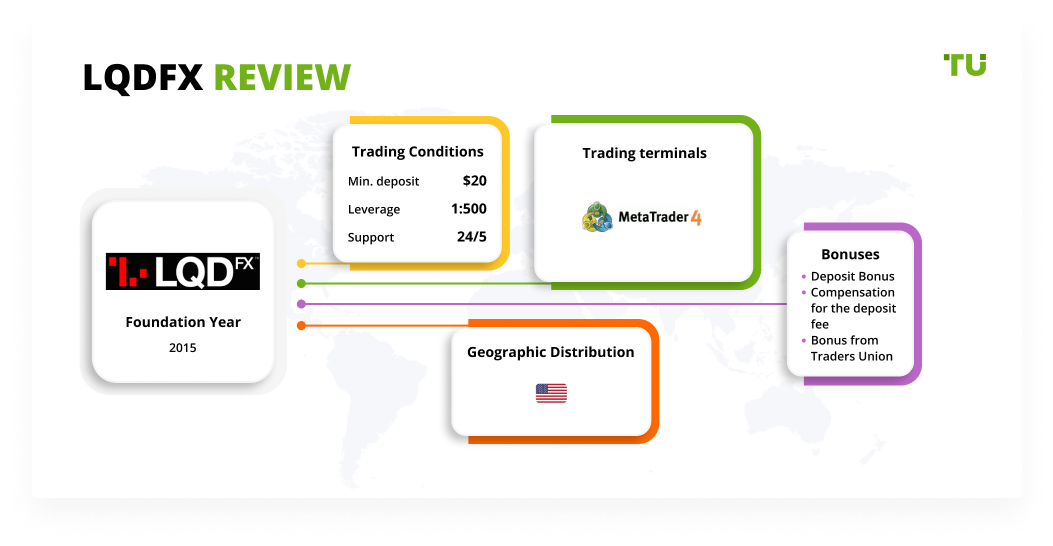

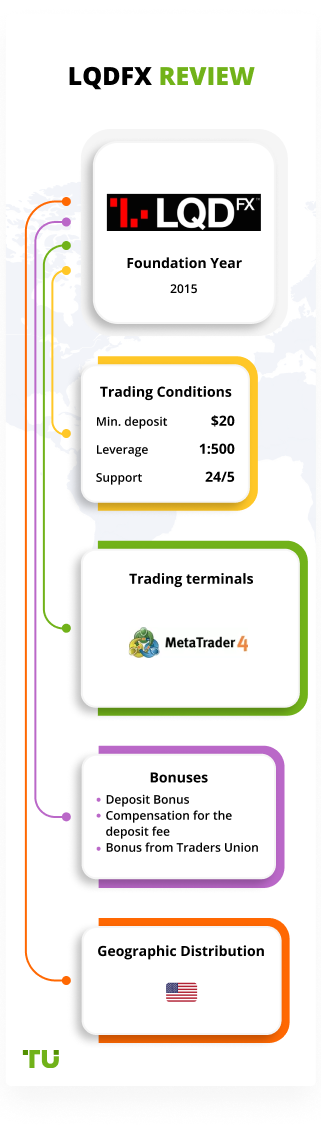

Summary of LQDFX Trading Company

LQDFX is a high-risk broker with the TU Overall Score of 2.42 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by LQDFX clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. LQDFX ranks 372 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

LQDFX is a broker for traders with any experience in the Forex market interested in trading CFDs and currencies with low spreads and high leverage.

LQDFX is an STP broker established in 2015. The broker offers access to online trading of currency pairs, commodity, index and metal CFDs. The company is registered in the territory of Marshall Islands and accepts clients from all across the world. LQDFX offers low commissions for trading, a wide selection of trading accounts and investment solutions for earning passive income. The broker provides the traders with MT4 platform, 24/5 customer support and allows the use of any trading strategy.

| 💰 Account currency: | USD, EUR |

|---|---|

| 🚀 Minimum deposit: | From $20 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | from 0.1 pips (ECN, VIP), from 0.7 pips (Gold, Islamic), from 1 pip (Micro) |

| 🔧 Instruments: | Currency pairs, indices, commodities, metals |

| 💹 Margin Call / Stop Out: | Micro, Gold, ECN, Islamic: 50%/20%VIP: 50%/30% |

👍 Advantages of trading with LQDFX:

- Different account types – educational, cent, ECN, Islamic and premium.

- Low entry threshold. The minimum deposit on Micro and Islamic accounts is USD 20.

- Access to trading on desktop and mobile versions of MetaTrader 4.

- High leverage – up to 1:500 on cent accounts and up to 1:300 on the other account types.

- Tight market spreads on all account types and no additional trading fees on Micro, Gold and Islamic accounts.

- Deposits and withdrawals not only with debit/credit cards and wire transfers, but also with crypto and electronic wallets.

- Wide choice of partnership programs, deposit bonus and compensation for the bank fee for depositing funds on the account.

👎 Disadvantages of LQDFX:

- Limited choice of trading assets. The broker’s clients do not have access to trading cryptocurrencies, stock CFDs, options and ETFs.

- The company does not hold a brokerage license.

- In order to withdraw the bonus, a trader must meet the trading volume requirement.

Evaluation of the most influential parameters of LQDFX

Trade with this broker, if:

- You want your broker to offer tight spreads and low commissions on ECN and Raw accounts, making it potentially attractive to traders conscious of costs.

- You want the trading platform to be user-friendly, as LQDFX provides popular platforms like MetaTrader 4 and 5, known for their ease of use and customization options, contributing to a user-friendly trading experience.

Do not trade with this broker, if:

- Regulatory clarity is crucial for you. LQDFX claims regulation in South Africa and Seychelles, but these jurisdictions may not offer the same level of investor protection as major authorities like the FCA or FINRA.

- If you prioritize protection against a negative balance, this broker's lack of such a feature may pose a higher level of risk to your trading account.

Geographic Distribution of LQDFX Traders

Popularity in

Video Review of LQDFX i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of LQDFX

LQDFX has been providing brokerage services in the Forex market since 2015. Over this period, the company opened several offices, was named the Best ECN Broker and signed agreements with the largest European banks. At the moment, active traders, passive investors and equity managers use the services of LQDFX all around the world.

The broker offers its clients a wide selection of trading accounts, including cent, Islamic, STP, ECN and PAMM accounts. Traders can test the company’s conditions using demo accounts. LQDFX offers trading on the world’s most popular trading platform – MetaTrader 4. Both desktop and mobile versions of the platform are available. The broker provides analytics, news and live quotes. Its website features an Education section with extensive useful information and several types of trading calculators.

LQDFX offers its clients beneficial trading conditions and quality service. However, the broker has one big drawback – its operation is presently not regulated by any regulatory authority. For this reason, traders planning to open an account on LQDFX should be aware of the possible financial risks the absence of the license involves.

Dynamics of LQDFX’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

LQDFX offers its clients several passive income investment solutions, i.e. earning profit without conducting market analysis and performing trades. The work in the PAMM system can bring additional profit not only to the investors, but also to the account managers – experienced traders, who use the funds of their subscribers to trade.

Passive income options at LQDFX

The broker provides MT4 platform to its clients, the features of which allow to work with the following investment instruments:

-

PAMM service. An investor offers their own equity into management by a professional trader, who uses it in trading together with their own funds. In case of a successful trader, the manager gets 50% of the investor’s profit. Asset managers set different requirements for the minimum investment amount: some allow to invest in a PAMM account a minimum of $1, while others set the minimum amount at $500.

-

Expert Advisors. The broker allows you to connect robotic software and scripts for trading automation. Semi-automated advisors only analyze the market based on a set algorithm, while the investor makes the decision on whether to open an order or not. Also robots that do all the work for the person are allowed, i.e. they conduct the analysis and open/close trades.

-

Trading signals. Investors can copy trades of successful traders from all across the world, and not only LQDFX clients. For this, a trader needs to register on mql5.com, select a signal provider and follow them. After the trader deposits the amount specified by the provider, the provider’s trades will be automatically copied to the follower’s account.

LQDFX bears no responsibility for Expert Advisors and trading signals from the MT4 showcase, as they are the instruments of third-party resources. At the same time, the company monitors the trading of PAMM account managers, as they are the participants of the partnership program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

LQDFX’s affiliate program:

-

Fund Managers. The broker invites professional PAMM account managers to join. Account managers earn 50% of the profit of the investors who are connected to their accounts.

-

Introducing Brokers. IBs receive a reward in the form of a fee per each trade performed by the referred client.

-

White Labels. This is an offer for advanced IBs with a large client base. White Labels are provided with the trading platforms and extensive liquidity. They can also set their own mark-ups.

-

Regional Partners. This is a program for the companies who want to open a regional representative office of LQDFX to provide brokerage services to local traders.

The broker offers its advertising partners up to 70% of the revenue share from trades of the referred traders and up to 15% of the referral reward.

Trading Conditions for LQDFX Users

LQDFX clients have access to trading 95 Forex instruments – currency, metals, commodities and indices. All five account types have floating spreads, the value of which depends on the market situation. The company offers high leverage – up to 1:100-1:500 depending on the account type. The minimum deposit on different account types is $20, $500 or $25,000. LQDFX offers bonuses and several types of partnership programs.

$20

Minimum

deposit

1:500

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4 (Desktop, Mobile) |

|---|---|

| 📊 Accounts: | Demo, Micro, Gold, ECN, VIP, Islamic |

| 💰 Account currency: | USD, EUR |

| 💵 Replenishment / Withdrawal: | Wire transfer, Visa and Mastercard cards, Skrill, Neteller, FasaPay, VLoad, crypto wallets |

| 🚀 Minimum deposit: | From $20 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0.1 pips (ECN, VIP), from 0.7 pips (Gold, Islamic), from 1 pip (Micro) |

| 🔧 Instruments: | Currency pairs, indices, commodities, metals |

| 💹 Margin Call / Stop Out: | Micro, Gold, ECN, Islamic: 50%/20%VIP: 50%/30% |

| 🏛 Liquidity provider: | Large European banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Expert Advisors, scalping, hedging are allowed |

| 🎁 Contests and bonuses: | Yes |

Comparison of LQDFX with other Brokers

| LQDFX | RoboForex | Pocket Option | Exness | Deriv | Libertex | |

| Trading platform |

MetaTrader4, MetaTrader Web, MetaTrader Mobile | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Deriv bot, Deriv MT5, Derivix, Deriv Trader, SmartTrader | Libertex, MT5, MT4 |

| Min deposit | $20 | $10 | $5 | $10 | $1 | 100 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:30 for retail clients |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 1.00% | No |

| Spread | From 0.1 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

10% / 10% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 50% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| LQDFX | RoboForex | Pocket Option | Exness | Deriv | Libertex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Crypto | No | No | Yes | Yes | Yes | Yes (as CFDs) |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes (as CFDs) |

| Stock | No | Yes | Yes | Yes | Yes | Yes (tradable CFDs or Stocks for investment) |

| ETF | No | Yes | No | No | No | Yes (as CFDs) |

| Options | No | No | No | No | Yes | Yes (as CFDs) |

LQDFX Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Micro | From $0.1 | No |

| Gold | From $7 | No |

| ECN | From $1 | No |

| VIP | From $1 | No |

| Islamic | From $7 | No |

The company charges a commission for position rollover to the following day (Swap). Muslim traders can open an Islamic Account to avoid paying the commission.

Traders Union analysts also calculated and compared the average trading commission of three Forex brokers — LQDFX, RoboForex and FxPro. The results of the comparison are shown in the table below.

| Broker | Average commission | Level |

| LQDFX | $3.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of LQDFX

The business model of LQDFX is based on STP execution, which eliminates a possibility of conflict of interests with clients. The company guarantees complete non-interference of the dealing center and absence of requotes, and also lightning quick execution and professional 24h customer support. LQDFX works with over 265 banks all across the world, including top level large financial institutions, such as Barclays, HSBC and Deutsche Bank.

LQDFX in figures:

-

Has been providing access to online trading on Forex for over 6 years.

-

Offers 5 types of real accounts.

-

Provide access to trading 18 stock and commodity CFDs, 78 currency pairs and metals.

-

Has a minimum deposit of USD 20.

-

Awards 100% deposit bonus.

-

Provides customer support 24 hours a day five days a week.

LQDFX is a broker for active traders and passive investors with different trading demands

LQDFX aspires to become a universal STP and ECN broker and offer beneficial trading conditions to the beginners and experienced traders. The beginners can start trading micro-lots on cent accounts. ECN and VIP accounts with practically zero spreads are available for the professionals. All clients, regardless of their deposit amount, have access to free quotes in real time mode, market analytics, news and economic calendar. Traders who prefer passive strategies can connect to PAMM accounts, copy signals from the MetaTrader 4 showcase and connect Expert Advisors. LQDFX provides desktop and mobile versions of the MetaTrader 4 platform to its clients. Both versions support lightning quick execution, one-click trading, market depth, advanced charts and technical analysis. WebTrader is not available at the moment.

Useful services by LQDFX:

-

Trading calculators. Using them, a trader can calculate the deal size, Pivot point, Fibonacci levels.

-

Economic calendar. This is the service showing events and news that are important for the trader and their trading strategy.

-

Forex charts. This is a section featuring analysis of price changes for the popular currency pairs and indices.

-

News. This section features a review of the most important economic and financial events in the world.

Advantages:

There is negative balance protection on the client accounts.

The funds and assets of the traders are held separately from the company’s equity on segregated accounts at the European Union banks.

The broker uses STP (Straight Through Processing) transaction processing, i.e. sends the trading orders directly to the liquidity providers.

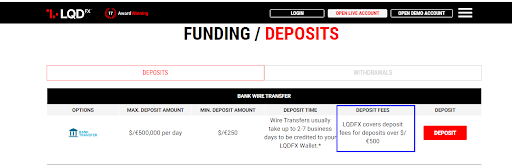

The company does not charge a withdrawal fee and also compensates for the fees related to depositing funds via a wire transfer.

Customer support operators respond in a live chat within 2-3 minutes after an enquiry has been made.

Upon opening an account, every client gets a personal manager, who provides free advice on technical issues, trading conditions and software.

All trading strategies are allowed, including scalping, hedging and algo trading.

Traders can open a cent account and trade micro-lots. This option is an important advantage of LQDFX, as the potential clients can use the Micro Account to test the platforms and trading conditions offered by the broker.

How to Start Making Profits — Guide for Traders

LQDFX offers accounts for different types of traders. Trading currency, metals, indices and commodities as well as support of the client manager and free educational materials are available for all types of accounts.

Account types:

The broker offers two types of educational accounts – demo versions of Gold and ECN.

LQDFX is an STP broker, offering different types of accounts for traders with different levels of expertise and capital.

Bonuses Paid by the Broker

Deposit Bonus

Every new client is awarded a 100% deposit bonus for the first deposit. The minimum deposit amount for receiving the bonus is USD 250. Every client can receive a bonus on three opened accounts, but the total bonus amount cannot exceed $20,000. Bonus can be withdrawn upon meeting the trading volume requirements: a trader can withdraw $5 per each traded lot on FX and metals.

Compensation for the deposit fee

LQDFX compensates every client who funded their trading account for an amount higher than USD/EUR 500 for the transaction fees.

Investment Education Online

There is a dedicated Education section on the LQDFX website with the materials on Forex trading. The section features articles to help the beginners learn the basics of trading. The theoretical part is split into blocks, which makes it easy to quickly find information.

Education section also features Trading Tools with basic and advanced technical analysis, principles of capital management and trading psychology.

Security (Protection for Investors)

LQDFX is registered in the territory of the Republic of the Marshall Islands. The legal name is LQD Limited.

At the moment, the company does not hold a license from any regulator. However, the broker works to ensure maximum security of the funds of its clients, holding the traders’ money in the segregated accounts at large EU banks.

👍 Advantages

- The funds of the clients are separated from the company’s equity

- There is negative balance protection

- Electronic and crypto wallets are available for deposits and withdrawals

👎 Disadvantages

- Deposits and assets of the company’s clients are not insured by compensation funds

- The broker’s operation is not regulated

- Traders cannot file a complaint with a regulatory authority in case the company seizes to full its obligations

Withdrawal Options and Fees

-

The money can be withdrawn to Visa and Mastercard cards, via a wire transfer, via electronic payment systems Neteller, Skrill, FasaPay, VLoad and to crypto wallets.

-

The minimum withdrawal amount: $/€100 for a wire transfer, $/€20 – for withdrawals to cards, $0 – FasaPay, $5 – Neteller and Skrill, $10 – Vload and Bitcoin, $50 – other crypto wallets.

-

The maximum withdrawal amount: $/€ 500,000 a day to a bank account, $10,000 (but not exceeding the initial deposit) – to cards, %50,000 – crypto wallets. The amount limits on withdrawals to EPS have not been set.

-

Processing period: Bank Transfer — 2-10 working days, crypto and electronic wallets – within one working day. Withdrawal requests are processed by LQDFX within the next working day; however an extra 5-10 days are required depending on the corresponding bank.

-

The broker and electronic payment systems do not charge withdrawal fees. A trader pays $/€10 to the bank for each withdrawal to a card. Wire transfer fees depend on the bank.

Customer Support Service

The live chat operators work 24h from Monday to Friday.

👍 Advantages

- Quick response at any time of day and night

- Customer support representatives respond to the questions of unregistered users

- Multilingual support in 5 languages

👎 Disadvantages

- Live chat is not available on Saturdays and Sundays

There are several ways for potential and active clients of the broker to contact customer support:

-

Ask a question on the live chat on the website or in the user’s Personal Account;

-

Make a phone call using the number specified on the broker’s website;

-

Send an email;

-

Order a callback;

-

Use the accounts on Facebook, Twitter, Instagram, LinkedIn.

In the Contact Us section, the broker provides emails of different company’s departments – partners, trading and financial.

Contacts

| Foundation date | 2014 |

| Registration address | LQD Limited, Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands |

| Official site | https://www.lqdfx.com/en/ |

| Contacts |

Email:

support@lqdfx.com,

|

Review of the Personal Cabinet of LQDFX

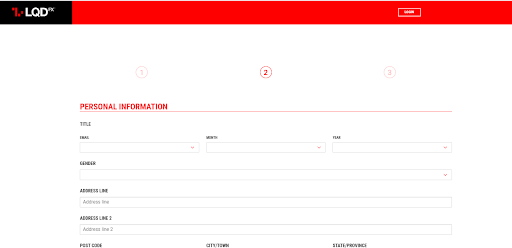

In order to create a Personal Account on the LQDFX website, you need to register and open a trading account. The algorithm of actions is as follows:

Visit the broker’s official website. On the Home page, there is a quick registration form. Fill it out providing your First and Last Name, Email and Phone and click on Open Live Account.

A new window will open with another form, where you will need to provide your personal information: gender, date of birth, address, and also come up with a reliable password.

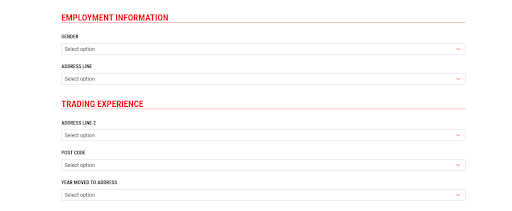

Next, the company will ask you to provide information about your employment, sphere of professional activity and your trading experience.

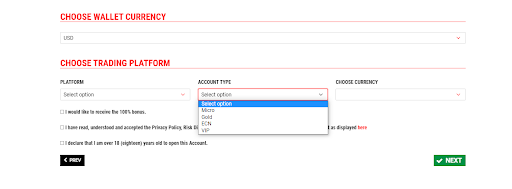

Next you will need to choose the currency of your wallet and your account, account type and the platform.

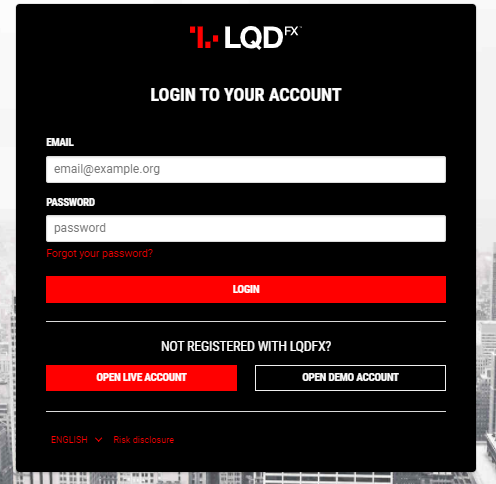

After you register, you need to access your Personal Account. For this, enter your email and password.

The actions a trader can take in their Personal Account on LQDFX:

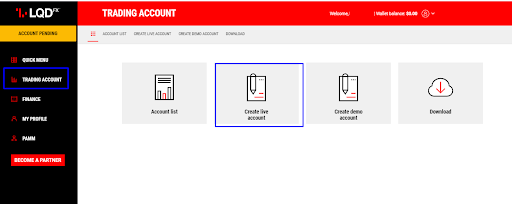

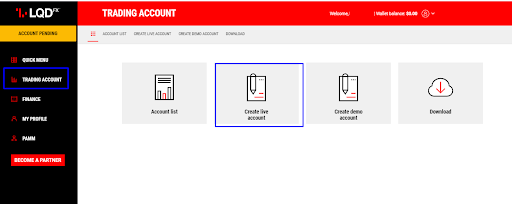

1. Open a new trading account:

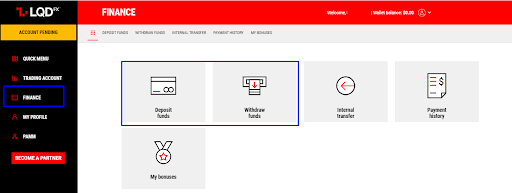

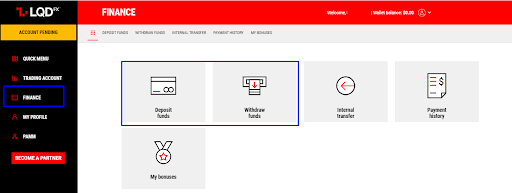

2. Deposit and withdraw funds:

1. Open a new trading account:

2. Deposit and withdraw funds:

The features of the Personal Account allow the traders to:

-

View the list of opened accounts and payment history.

-

Open demo or PAMM accounts.

-

Pass verification.

-

Transfer funds between opened accounts (internal transfer).

-

Generate statistics on PAMM accounts.

-

Download the desktop platform.

-

Submit an application on joining a partnership program.

-

Got to the section featuring information of accrued bonuses and conditions of their withdrawal.

Articles that may help you

FAQs

Do reviews by traders influence the LQDFX rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about LQDFX you need to go to the broker's profile.

How to leave a review about LQDFX on the Traders Union website?

To leave a review about LQDFX, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about LQDFX on a non-Traders Union client?

Anyone can leave feedback about LQDFX on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.