According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $300

- MT4

- JForex

- MFSA

- FCA

- BaFin

- ACP

- Consob

- CNMV

- 2010

Our Evaluation of NSFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

NSFX is a broker with higher-than-average risk and the TU Overall Score of 4.96 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by NSFX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

NSFX is a broker for those who appreciate innovation in trading and are ready to develop their trading skills with a reliable European partner.

Brief Look at NSFX

NSFX (pronounced as nsfx.com) is a brokerage firm that has been operating in the markets of Europe and Asia since 2012. The broker provides access to international financial markets for traders with any level of trading experience. NSFX offers such trading assets as currency pairs, CFDs on gold and silver, energies, and indices. The company is focused primarily on traders from Europe and the CIS countries, therefore it is mainly licensed by such European regulators as MFSA IS/56519 (Malta), BaFin 131055 (Germany), ACP 53102 (France), Consob 3597 (Italy), CNMV 3354 (Spain), and FINANSTILSYNET 9221 (Denmark).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- 6 licenses from European regulators, including a license from one of the most stringent regulatory authorities, BaFin;

- Tight spread is from 0.5-0.6 pips. It is achieved through the aggregation of liquidity from the largest providers, which are international banks operating through Tier-1 operators;

- There are support instruments, such as analytics from Trading Central and the Guardian Angel application for MetaTrader 4 (MT4). It is an add-on that allows traders to control trading risks, duly track spread widening, and receive instant feedback on transactions, avoiding unnecessary market noise;

- Optimal choice of platforms. There is the familiar MT4 platform with the opportunity to add user instruments. Also, there is the professional JForex platform with Depth of Market;

- Full transparency of work. The website provides the offer and terms of cooperation in the public domain. There are neither hidden fees nor brokerage fees for withdrawing profits.

- Relatively high initial fee. It starts from $300;

- There are limitations in the use of strategies. In particular, scalping is prohibited on the MT4 Fixed account;

- Relatively small selection of assets. The number of currency pairs is just over 50, metals are only gold and silver, 8 indices, and CFDs on oil of two brands.

TU Expert Advice

Author, Financial Expert at Traders Union

NSFX provides trading services utilizing the MT4 and JForex platforms, offering a selection of more than 50 currency pairs and CFDs on gold, silver, energies, and indices. With demo, MT4 Fixed, MT4 ECN, and JForex accounts, NSFX offers flexibility for various trading styles. The company prioritizes ease in trading by providing Trading Central analytics and the Guardian Angel application for risk management. Regulated by BaFin and MFSA, showcases a commitment to compliance, while leverage is capped at 1:50 per European standards.

On the drawbacks side, NSFX imposes a relatively high minimum deposit of $300, and strategies such as scalping are restricted on certain account types. The asset selection is notably limited compared to competitors, primarily offering only major currency pairs and CFDs. Additionally, trading fees are above average, impacting cost-effectiveness. NSFX may be suitable for European traders seeking a regulated environment but may not appeal to those prioritizing low entry costs or a broad asset range.

NSFX Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 and JForex |

|---|---|

| 📊 Accounts: | Demo, МТ4 Fixed, MT4 ECN, and JForex |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Deposit / Withdrawal: | Bank cards, bank transfers, Neteller, and Skrill |

| 🚀 Minimum deposit: | $300 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 1,0-3,0 pips |

| 🔧 Instruments: | Currency pairs (more than 50), CFDs on indices (more than 7), metals (2), and energies (2) |

| 💹 Margin Call / Stop Out: | 50%/20% |

| 🏛 Liquidity provider: | Barclays, CitiFX Pro, UBS, Dukascopy Bank SA, Currenex, Credit Suisse, and PrimeXM |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Instant execution and market execution |

| ⭐ Trading features: | Scalping is prohibited on the MT4 Fixed account |

| 🎁 Contests and bonuses: | No |

NSFX offers a standard set of trading instruments, including more than 50 currency pairs, CFDs on gold and silver, Brent and WTI oil, and 8 stock indices. Leverage in accordance with the requirements of European regulators is up to 1:50. It can be reduced for individual instruments (see the contract specifications). There is a demo account for training and testing.

NSFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

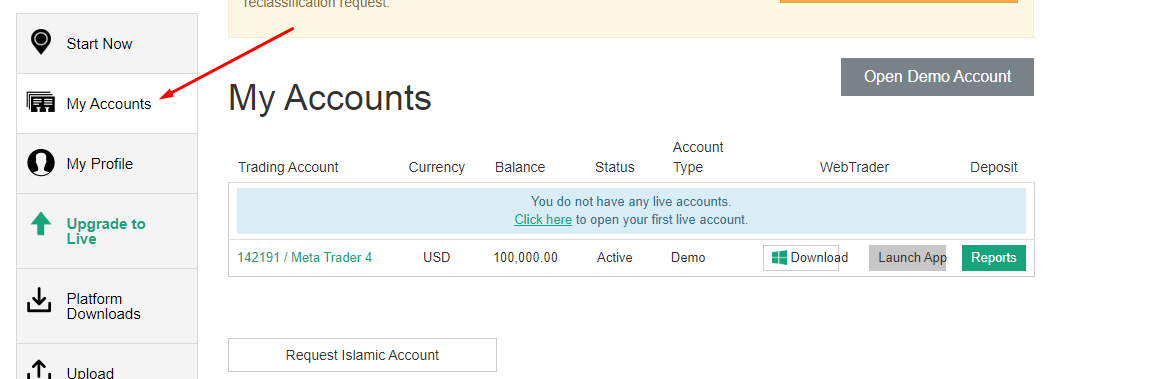

Trading Account Opening

To start trading with NSFX register on Traders Union’s website, where you will find a referral link. Follow it to the broker's website. It is free and will allow you to save on trading expenses in the future by receiving partial reimbursements for expenses.

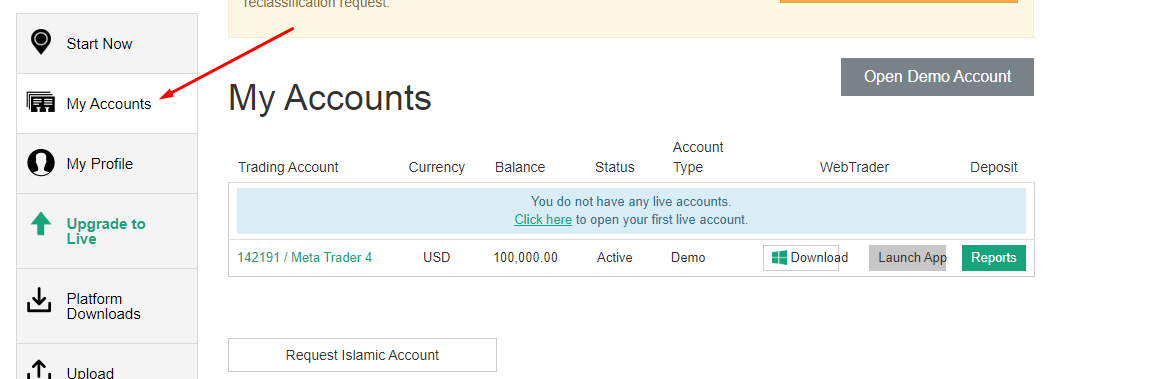

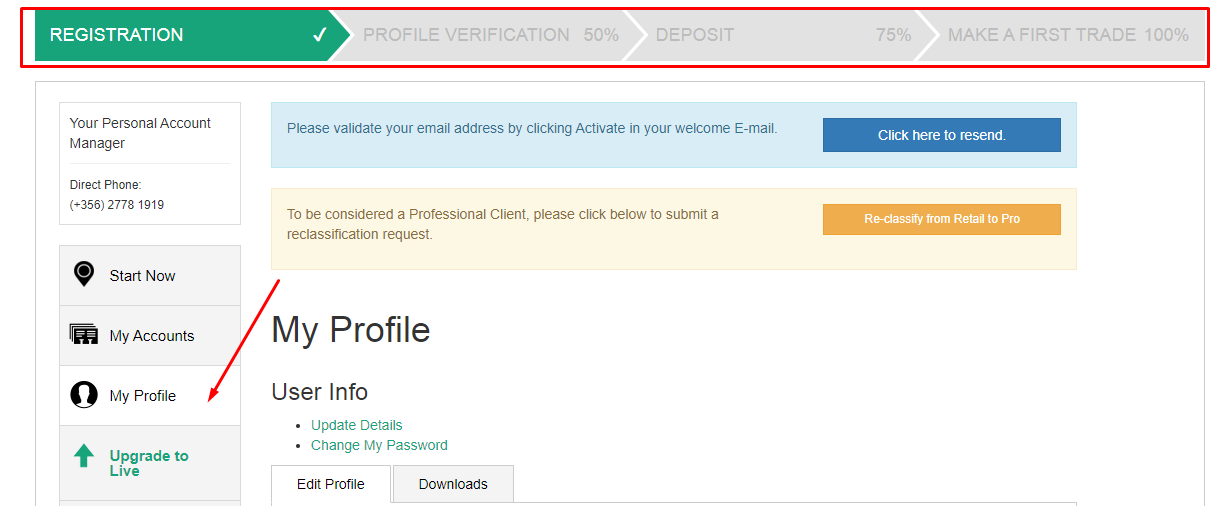

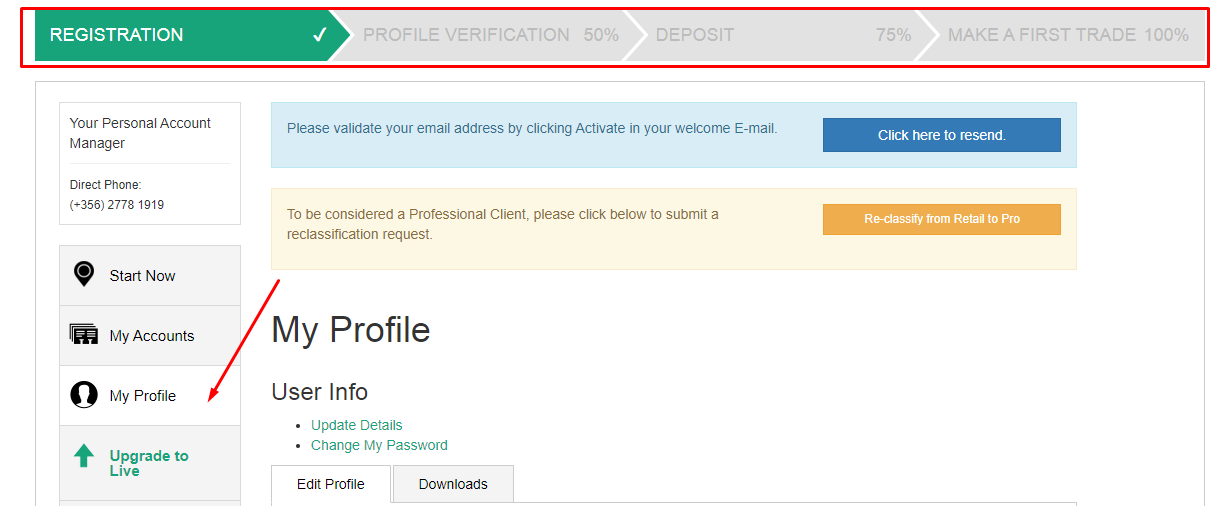

The procedure of opening an account with NSFX:

On the main page of the NSFX website, click the Open Live Account or the Open Demo Account buttons. These options are also available on other pages.

Fill out the registration form with your first and last names, email address, and phone number. Also, select the account type and currency. If you open a live account, enter reliable data only, this way you will avoid problems with subsequent verification.

Services of the NSFX user account:

Available opportunities in the user account:

-

Download platforms for any OS, mobile, and stationary devices;

-

Access to the Academy training section;

-

Access to Trading Central analytics and the economic calendar;

-

Deposit management: withdrawal of profits, review of statistics, and internal transfers.

NSFX - How to Open an Account | Firsthand Experience of Traders Union

Regulation and safety

NSFX has a safety score of 6.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 15 years

- Not tier-1 regulated

NSFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

NSFX Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker NSFX have been analyzed and rated as High with a fees score of 2/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of NSFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, NSFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

NSFX Standard spreads

| NSFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 3,0 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 5,0 | 1,4 | 0,5 |

Does NSFX support RAW/ECN accounts?

As we discovered, NSFX does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with NSFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

NSFX Non-Trading Fees

| NSFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 2,9 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 1 | 0 | 0 |

Account types

NSFX offers 3 account types. MT4 provides two account types. They are STP with a fixed spread account and ECN with a floating spread account. JForex provides 1 floating spread account. The maximum leverage for all accounts is 1:50.

Account types at NSFX:

To gain experience and test strategies, a demo account with free registration without verification is provided.

NSFX is a broker that combines STP and ECN order execution technologies. It is recommended for all strategy types including scalping, swing trading, and long-term investing.

Deposit and withdrawal

NSFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

NSFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Bank card deposits and withdrawals

- BTC available as a base account currency

- Low minimum withdrawal requirement

- Only major base currencies available

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

What are NSFX deposit and withdrawal options?

NSFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

NSFX Deposit and Withdrawal Methods vs Competitors

| NSFX | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are NSFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. NSFX supports the following base account currencies:

What are NSFX's minimum deposit and withdrawal amounts?

The minimum deposit on NSFX is $300, while the minimum withdrawal amount is $100. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact NSFX’s support team.

Markets and tradable assets

NSFX offers a limited selection of trading assets compared to the market average. The platform supports 50 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Indices trading

- Crypto trading not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by NSFX with its competitors, making it easier for you to find the perfect fit.

| NSFX | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 50 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | No | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products NSFX offers for beginner traders and investors who prefer not to engage in active trading.

| NSFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

You can contact the broker’s support team at any time except for days off and holidays.

Advantages

- None

Disadvantages

- No response from support in a live chat

The broker provides the following communication channels:

-

email;

-

live chat on the broker's website;

-

phone numbers listed on the website.

It is better to contact a personal manager after verification, but not the support without registration.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | 168 St Christopher Street, Valletta VLT 1467, MALTA |

| Regulation |

MFSA, FCA, BaFin, ACP, Consob, CNMV

Licence number: IS/56519, 595195, 131055, 74397, 3597, 3354 |

| Official site | nsfx.com |

| Contacts |

(+44) 330 8080 098, (+34) 9 3220 0491, (+49) 696 4350 0009

|

Education

The NSFX website provides a separate section with training materials and analytics. There are answers to the most frequently asked questions, a trading base, courses, and eBooks.

It is possible to apply the acquired knowledge on a demo account. Registration is free and takes up to 10 minutes; verification is not required.

Comparison of NSFX with other Brokers

| NSFX | Eightcap | XM Group | RoboForex | Exness | VT Markets | |

| Trading platform |

JForex, MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ |

| Min deposit | $300 | $100 | $5 | $10 | $10 | $50 |

| Leverage |

From 1:1 to 1:50 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | Yes | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.5 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | 60% / No | No / 50% |

| Order Execution | Market Execution, Instant Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of NSFX

NSFX is a broker operating on a combined STP/ECN model. The STP (Straight Through Processing) model allows you to keep a fixed spread without widening even when volatility is abnormal and there is a deficit of liquidity, which is supplied by Barclays, UBS, Dukascopy, and Credit Suisse banks. The broker's markup is already included in the fixed spread. The ECN (Electronic Communication Network) model offers the best minimum floating spread. Users' trades are entered through the end-to-end method into the Currenex network, which unites millions of traders and market makers. The Depth of Market built into the JForex platform allows you to see the volume of the market at individual price levels and trade at the best prices.

NSFX by the numbers:

-

Floating spread for the EUR/USD pair is from 0.5 pips (five-digit quotes). Spreads for exotic pairs and cross-rates are from 1.1-1.3 pips;

-

90% compensation of up to €20,000, which is how much traders will receive in case of force majeure from the insurance fund of the Malta regulator.

NSFX is a reliable broker for calm trading

The mission of NSFX is based on three prongs, which are: success in the financial markets depends on the implementation of innovative solutions, the development of new trading instruments, and the provision of quality services. Taking into account the almost complete absence of negative reviews, the company manages to cope with the task.

In addition to the classic MT4 platform, NSFX offers the JForex platform with the possibility of opening an ECN account with floating spreads. Its language is Java, which can be used to write users’ indicators and expert advisors. The platform works with Linux OS. It has more than 200 built-in basic indicators and graphical instruments, a tester for algorithmic trading systems, and more than 5 chart types. Also, non-standard market and pending order types have been added.

Useful services offered by NSFX:

-

Guardian Angel. The Guardian Angel system is a support add-on for MT4. Its task is to simplify user control over individual trading processes, such as changes in volatility, deposit and margin levels, changes in trading performance, and spread widening;

-

Economic calendar. It provides information about major future market events;

-

Fundamental analysis from NSFX experts. It is a brief overview and daily forecast for the main trading instruments.

Advantages:

Account types for different trading styles with fixed and floating spreads.

Hedging and trading using algorithmic systems is allowed;

Relatively small spreads and fees;

Transparent trading conditions;

Order execution speed is up to 50 ms.

A daily free analysis of the main trading instruments subject to the market mood is available.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i