How to buy/sell on Saxo Bank

Saxo Bank is a prestigious multi-asset brokerage with outstanding analysis, a first-rate trading network, and a fantastic variety of more than 60,000 marketable products. With a vast array of premium services, research, and tools, Saxo Bank offers an immersive trading experience for individuals or active traders who can manage to keep substantial account balance criteria.

Since it provides direct access to the interbank FX markets, various currency pairs, and low spreads, Saxo Bank is strongly advisable for forex trading. If you want to learn more about Saxo Bank's trading services, you can read about it in this post and learn about How to buy on Saxo Bank and How to sell on Saxo Bank.

Available trading instruments on Saxo Bank

Forex: Saxo Bank offers more than 180 currency pairs for trading, including principal, minor, and exotic pairs.

Stocks: Saxo Bank offers access to global stock markets, including the US, Europe, and Asia, with more than 38,000 stocks available for trading.

ETFs: Saxo Bank offers access to a wide range of exchange-traded funds (ETFs) covering various asset classes, including equities, fixed income, commodities, and real estate.

Futures: Saxo Bank offers futures contracts on various underlying assets, including commodities, currencies, indices, and bonds.

Options: Saxo Bank offers opportunities on various underlying assets, including equities, indices, currencies, and commodities.

Bonds: Saxo Bank offers a range of fixed-income instruments, including government bonds, corporate bonds, and high-yield bonds.

Commodities: Saxo Bank offers futures contracts and options on various items, including energy, metals, and agricultural products.

Indices: Saxo Bank offers futures and options on indices, including the primary stock market and sector indices.

Saxo Bank trading platforms

Platform & Features: how to trade on Saxo Bank

SaxoTraderGO: This is the leading trading platform offered by Saxo Bank, and it is available as a web-based platform and mobile app. SaxoTraderGO provides a range of features, including real-time quotes, advanced charting tools, and order types. It also includes a news feed and market analysis tools to help traders stay informed about market developments.

SaxoTraderPRO: It is a more advanced trading platform designed for professional traders and investors. It offers all of the features of SaxoTraderGO, as well as additional features such as advanced order management tools, customizable workspaces, and integrations with external software.

SaxoInvestor: This platform is designed for investors who want a simplified, easy-to-use interface to manage their investments. It offers a range of portfolio management tools and access to a wide range of investment products, including managed portfolios and structured products.

SaxoTraderPLUS: This is a platform designed specifically for trading options. It offers advanced options analytics tools, order types, and risk management tools.

SaxoBankAPI: This platform is for developers who want to build custom trading applications using Saxo Bank's APIs (Application Programming Interfaces). It allows developers to access Saxo Bank's trading and market data services and execute trades on behalf of their clients.

How much does it cost to trade on Saxo Bank?

Spreads: A spread is the difference between the bid and asks the price of a financial instrument. When you trade with Saxo Bank, you are typically required to pay the spread as a trade cost. The size of the spread will depend on the financial instrument you are trading and market conditions.

Swaps: A swap is a fee charged for holding a position overnight. Saxo Bank charges a swap fee for selected trades, including forex, futures, and options. The size of the swap fee will depend on the financial instrument you are trading and the direction of your trade (long or short).

Commissions: Saxo Bank charges a commission for specific trades, including stocks, ETFs, and bonds. The size of the commission will depend on the financial instrument you are trading and the size of your transaction.

How to start trading with Saxo Bank or how to buy/sell on Saxo Bank?

A demo account is a simulated trading account that allows you to practice trading using virtual funds. It can be a valuable way to learn about the platform, test different trading strategies, and get a feel for the markets without risking real money. Follow the steps below.

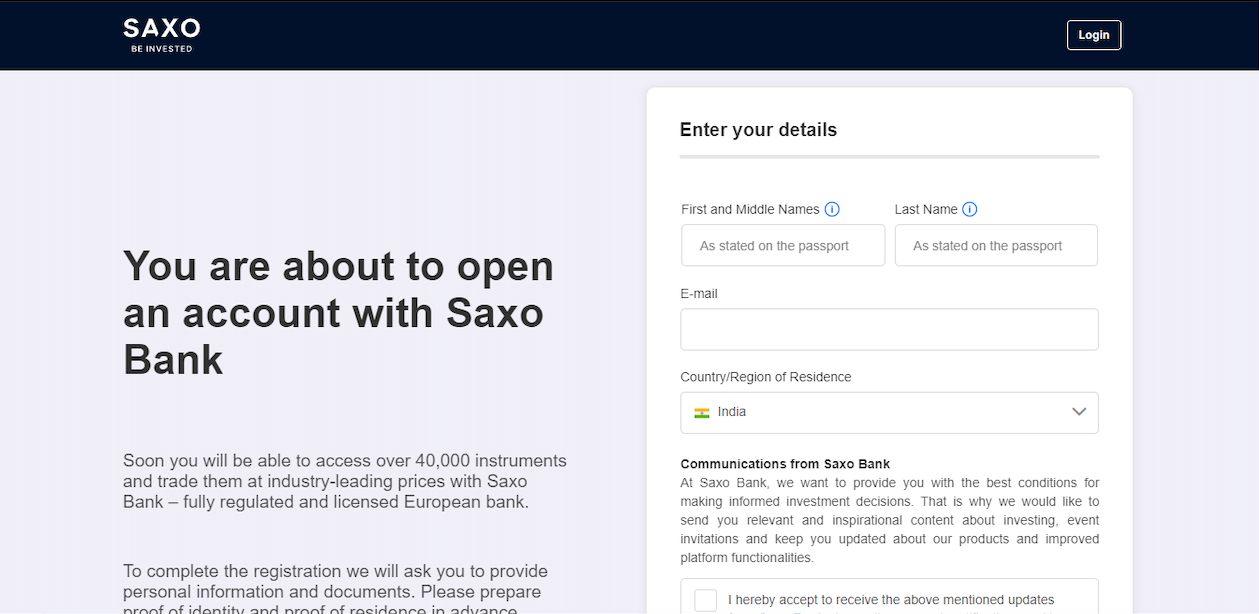

Visit the Saxo Bank website and click on the "Demo Account" button.

How to start trading with Saxo Bank

Fill out the form with your details and select the platform you want to use (e.g., SaxoTraderGO, SaxoTraderPRO).

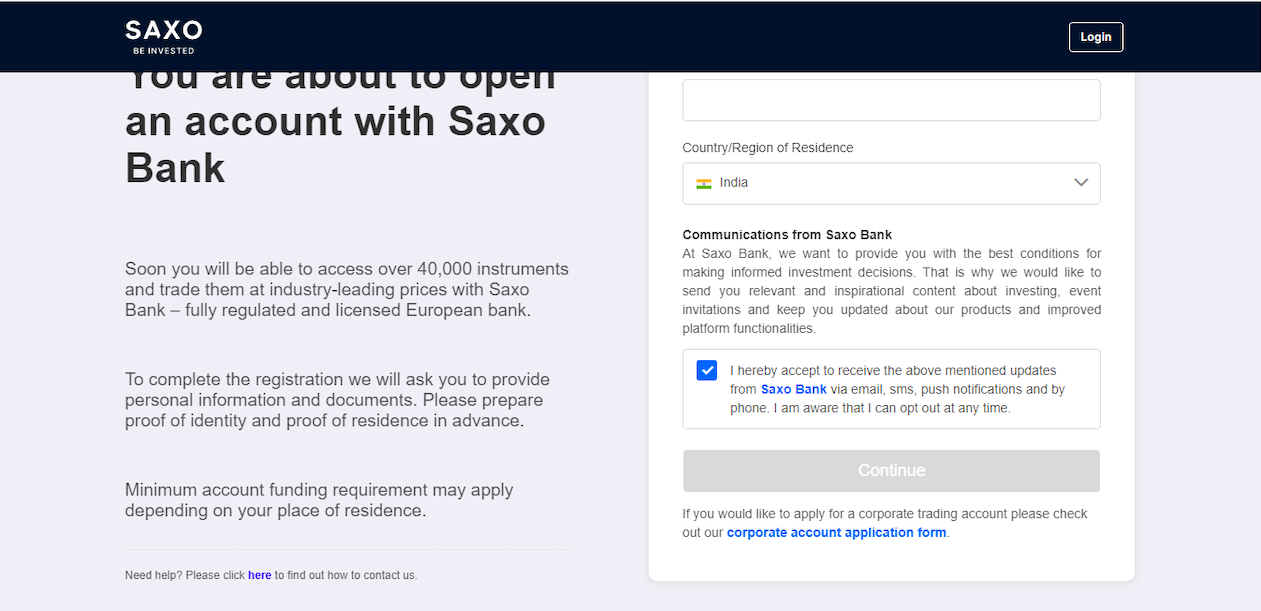

How to start trading with Saxo Bank

Verify your email address and phone number by following the instructions provided.

Tick to accept the terms and tap on the continue tab.

How to start trading with Saxo Bank

Once your demo account is activated, you can log in using the username and password provided.

You will be given a certain amount of virtual funds to use for trading. You can start practicing trading using the platform's various tools and features.

Let's do an example of how to trade on Saxo Bank.

Log in to your Saxo Bank account and select the platform you want to use (e.g., SaxoTraderGO, SaxoTraderPRO).

Please search for the asset you want to trade by typing its name or ticker symbol into the search bar.

Select the asset from the search results and click on the "Trade" button.

In the trade window that appears, enter the details of your trade, including the size of the position, the type of order (e.g., market, limit, stop), and any other relevant details.

Review the trade details to ensure everything is correct, and click on the "Confirm" button to place the trade.

Your trade will be executed at the next available price, and the trade details will be displayed in your account's trade history.

FAQ

What financial instruments does Saxo Bank offer for trading?

Saxo Bank offers a wide range of financial instruments for trading, including forex, stocks, ETFs, futures, options, bonds, commodities, and indices.

What are the main features of Saxo Bank's trading platforms?

Saxo Bank offers financial instruments, advanced charting and analysis tools, order types, and market news and research access.

What are the main costs of trading with Saxo Bank?

The main costs of trading with Saxo Bank include spreads, swaps, and commissions. The size of these costs will depend on the financial instrument you are trading and market conditions.

How do I open a demo account on Saxo Bank's platform?

To open a demo account on Saxo Bank's platform, you must visit the website, click on the "Demo Account" button, and follow the steps.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.