Sharenet Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $3,500

- My Sharenet

- FSCA

- 1988

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $3,500

- My Sharenet

- FSCA

- 1988

Our Evaluation of Sharenet

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Sharenet is a broker with higher-than-average risk and the TU Overall Score of 4.13 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Sharenet clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Sharenet is one of the largest brokers in Africa. It is suitable for traders who wish to gain access to African markets.

Brief Look at Sharenet

Sharenet is a CFD and Forex broker that has been operating since 1988. The company was registered in South Africa, and its head office still operates there. The broker offers clients trading in five asset classes, including currency pairs, CFDs on indices, energy products, precious metals, and bonds. Spot shares are available to South African residents. The company provides access to the Johannesburg Stock Market (JSE). Sharenet is regulated by the Financial Sector Conduct Authority (FSCA, 41688), which is the financial regulator of South Africa.

- 150+ trading instruments, including 94 indices.

- Doorway to emerging African markets.

- Opportunity to invest in managed portfolios.

- Technical support works 24/7.

- Commission for deposits and withdrawals is 0%.

- Complicated registration procedure.

- Initial deposit from 3,500 USD.

- Limited number of ways to contact customer service.

TU Expert Advice

Financial expert and analyst at Traders Union

Sharenet is a good choice for clients looking for trading experience in African markets. The company provides access to the Johannesburg Stock Exchange (JSE), where traders have access to a variety of trading instruments related to the African economy. Traders receive all quotes, news, and other information from the JSE through a broker.

The company offers clients a single trading account, so everyone works with the same trading conditions, regardless of the amount of the deposit. Sharenet has a high entry threshold, from 3,500 USD. The platform offers tight spreads (from 1 pip for EUR/USD), the minimum trading lot is 0.01. The only downside is the very long and complicated registration procedure with the need to contact the broker’s representatives. Even a demo account cannot be opened without first contacting Sharenet.

The broker offers five classes of trading instruments, with a total of 150+ assets. They have a large number of African stock indices - 94. Passive investors can earn income using ready-made portfolios. The company provides the opportunity to subscribe to no more than five investment portfolios. The company provides many paid services for its clients. There are paid analytics and training courses. There is no free training on the platform but there are free analytical materials.

Sharenet Summary

| 💻 Trading platform: | My Sharenet (desktop, mobile, web) |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | USD, EUR, GBP, CHF |

| 💵 Replenishment / Withdrawal: | Wire transfer |

| 🚀 Minimum deposit: | from 3,500 USD |

| ⚖️ Leverage: | up to 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 1 pips (Standard) |

| 🔧 Instruments: | Currency pairs (41), CFDs on indices (94), metals (5), energy resources (1), bonds (2) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Instant execution, market execution |

| ⭐ Trading features: | To open a real or demo account, you need to contact the manager |

| 🎁 Contests and bonuses: | unavailable |

Sharenet is suitable for clients with a large initial deposit. The entry threshold is from 3,500 USD (50,000 ZAR). The platform does not offer leveraged trading. There are five classes of trading instruments available for trading. Potential Sharenet customers can test the company’s conditions on a demo account. The broker does not have swap-free trading.

Sharenet Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with Sharenet, you need to become a client of the broker by opening a trading account. A quick guide looks like this:

On the main page of the site, you need to click on the Login button.

Next, the broker will offer to open a real trading account, a demo account, or you will have to log in (for clients with an active account).

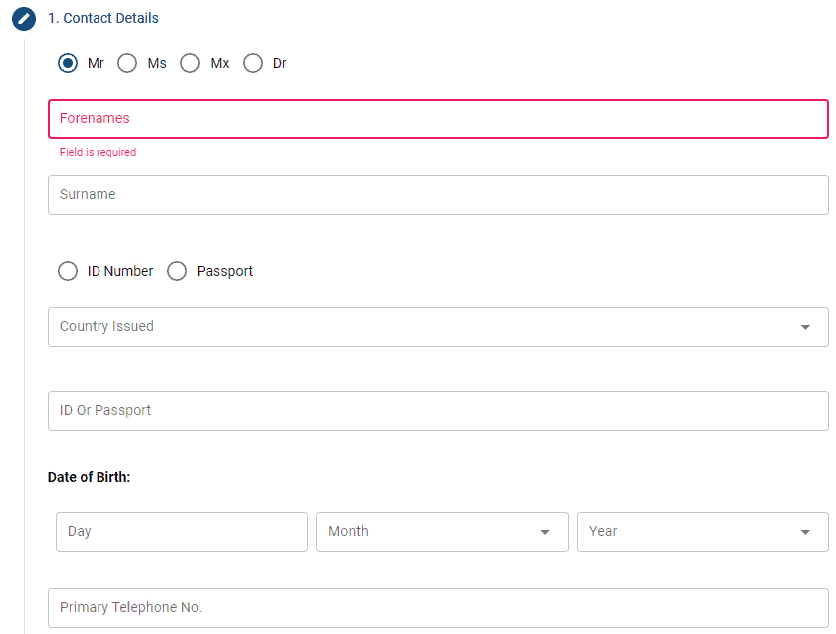

Then, you need to fill out the registration form. Registration with Sharenet is a bit complicated, it includes nine blocks. You need to provide detailed information about yourself, your residential address, financial details, employment status, trading experience, bank account number, and other required information.

After that, clients need to go through verification. You need to upload your ID, proof of residential address, and proof of bank details. After reviewing the documents, you need to talk to the broker’s representatives. Only then will the client will be able to fund the account and start trading.

Also in the personal account, traders have access to:

-

PowerChat. This is a large forum to which all registered clients of the broker have access. This is where the discussion of current news takes place, you can ask questions to experienced traders or contact technical support.

-

JSW Online. In this section, the broker provides up-to-date information about the trading instruments available on the exchange. You can quickly track the price and price changes, and dynamics of certain instruments, etc.

-

Charts. Here, clients can view charts of trading instruments, use technical analysis tools and indicators, and open transactions.

Regulation and Safety

Sharenet is a broker registered in the Republic of South Africa (South Africa). The company has two separate divisions, Sharenet Securities and Sharenet Wealth. Both are based in South Africa.

The broker carries out financial activities based on its licenses obtained in its jurisdiction. The company received a license from the financial regulator of South Africa - the Financial Sector Conduct Authority (FSCA). Sharenet Securities operates under FSCA FSP license No. 28430, while Sharenet Wealth operates under FSCA FSP, license No.41688.

Advantages

- Client funds are segregated from Sharenet’s capital and are kept in segregated bank accounts

- Negative balance protection in force

- In case of violation by the broker of the obligations described in the offer, the client can file a complaint with the regulator

Disadvantages

- To open an account, you must provide detailed financial information

- You cannot make a deposit or withdraw funds without verification,

- Limited choice of methods for making deposits and withdrawals

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | from $10 | Yes |

There are swaps (commission for moving a position to the next day).

The analysts of Traders Union also compared the size of the average trading commission of Sharenet, Admiral Markets, and FXPro. The comparison results are presented in the form of the below table.

| Broker | Average commission | Level |

|---|---|---|

|

$10 | |

|

$1 | |

|

$8.5 |

Account Types

Sharenet offers only one type of real trading account, so all clients work on the same terms. Users in the paid subscription format have access to additional options. There is also a demo account.

Account types:

The broker also offers clients a demo account. You can open it for free. To do this, you need to register on the platform and wait for the representatives of the company’s technical support to contact you. Sharenet provides clients with a demo account for 14 days, after this term you need to open a real account. A demo account can be opened on any platform - desktop, mobile or online.

Sharenet is a broker with attractive trading conditions and a single trading account for all traders. It is suitable for clients looking to discover African markets.

Deposit and Withdrawal

-

Sharenet processes withdrawal requests within 1-3 business days.

-

For non-residents of the Republic of South Africa, withdrawal of funds is possible only by bank transfer. Bank cards, e-wallets, and cryptocurrencies are not supported.

-

During registration, you have to provide details of the bank account from which you will make deposits and withdraw money to.

-

Financial transactions in Sharenet are not subject to commission. Depositing and withdrawing funds are free.

-

Verification is required for any financial transactions on the platform.

Investment Programs, Available Markets and Products of the Broker

Sharenet offers clients the possibility not only to trade independently but also to receive additional passive income from investments. The company’s clients have access to managed portfolios. The management is carried out by Sharenet specialists who work directly on the JSE exchange. The platform provides an opportunity to receive income from investments to both residents and non-residents of South Africa.

Sharenet’s managed portfolios

On Sharenet, clients can quickly and easily invest in managed portfolios. To do this, you need to log into your account, select the investment instruments you are interested in, select the amount you want to invest, and subscribe. Before subscribing, clients can read information about the assets and trading instruments included in the portfolio as well as about potential profitability and they can also assess the risk. Let’s take a look at some of the features of Sharenet’s managed portfolios.

-

A client can subscribe to as many as five managed portfolios at the same time.

-

Portfolios are based on stocks and ETFs available on the JSE (South Africa).

-

There is a one-time subscription fee. Clients don’t make any other payments.

The subscription price for working with managed portfolios on Sharenet is 9 USD (130 ZAR). The fee is charged monthly. The return on investment can vary depending on the degree of risk. The average yield is 15% per annum.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Sharenet’s affiliate program

Sharenet does not offer referral programs. The company is focused on providing brokerage services and does not support the policy of attracting new clients through referral programs.

Customer Support

Customer service operators are available 24 hours a day, 7 days a week. However, the response of technical support is rather slow. You have to wait more than two hours for an email response.

Advantages

- They work 24/7

- Assistance is in English only

Disadvantages

- Technical support response takes a lot of time, requests processing takes more than two hours

- No online chat

This broker provides the following communication channels:

-

phone number (can be found in Contact);

-

email;

-

PowerChat forum.

Both clients and traders without an active account can ask the company a question by phone or email. PowerChat is only available to registered users.

Contacts

| Foundation date | 1988 |

|---|---|

| Registration address | 301, 3rd Floor, Imperial Terraces, Tygervalley Waterfront, Bellville, Cape Town, 7530 |

| Regulation | FSCA |

| Official site | https://www.sharenet.co.za/ |

| Contacts |

Education

On the Sharenet website, there is a section that contains training materials comprising full-fledged training courses. However, they are all paid. For example, a broker’s technical analysis course will cost 90 USD.

The broker does not have cent accounts, so the only way to consolidate the knowledge gained in practice will be to train on a Demo account.

Comparison of Sharenet with other Brokers

| Sharenet | RoboForex | Pocket Option | Exness | Eightcap | FBS | |

| Trading platform |

My Sharenet | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MobileTrading |

| Min deposit | $3500 | $10 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:1 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 80% / 50% | 40% / 20% |

| Execution of orders | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $5 |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of Sharenet

Sharenet provides clients with access to the largest African market, the JSE. Non-residents of South Africa have the opportunity to work with five classes of trading instruments. Clients can choose the type of execution: instant execution or market execution. Traders can get access to free and paid analytical services. You can test Sharenet’s services using a free demo account.

Sharenet by the numbers:

-

More than 30 years on the market.

-

150+ trading instruments.

-

Spreads from 1 pip.

Sharenet is a broker for trading and investing in African markets

Sharenet carries out dealing through their own center. This ensures fast order execution and attractive spreads for traders. The platform provides clients with access to currency pairs, contracts for difference (CFDs) on stock indices, precious metals, energy products, and bonds. Sharenet does not impose restrictions on trading strategies, scalping, and intraday trading. Medium-term and long-term transactions are available to traders. The company offers its clients My Sharenet trading terminals. Users can work in the online version, on a desktop platform, or in a mobile application.

Also, the broker’s clients can earn passive income using managed portfolios. Users can select up to five portfolios, which differ in trading instruments, degree of risk, and potential return.

Sharenet’s useful services:

-

Economic calendar. Traders can receive up-to-date information about upcoming economic events in the world.

-

JSE Market Scanner. Provides information about the trading instruments that are traded on the Johannesburg Stock Exchange. Here you can quickly find out the current price, price changes as well as view the schedule. Stock indices are available for non-residents of South Africa in the JSE Market Scanner.

-

Newsletters. Traders can subscribe to the daily newsletters on the platform. They focus primarily on assets and trading instruments that are traded on the JSE. The broker sends letters to the email specified during registration.

-

Daily statistics. Sharenet publishes daily reviews with statistics on JSE trading instruments. There you can find major asset price changes, company reports, and dividend information as well as daily news on key assets, etc.

Advantages:

There are five asset classes available for trading.

To ensure the safety of client funds, the company stores them in segregated accounts.

Accounts have negative balance protection.

Ready-made trading portfolios are available to investors.

The broker provides free analytics and online tools to improve the quality of trading.

Doorway to promising African markets.

News, mailings, economic calendar, and the JSE Market Scanner are provided to users free of charge. There are also premium offers with trading signals, fundamental analysis, and advanced technical analysis tools. These services are paid, and they are charged monthly as a subscription. All clients have access to the free demo account.

User Satisfaction