According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- MT4

- CloudTrade

- 2014

Our Evaluation of TradeDirect365

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TradeDirect365 is a broker with higher-than-average risk and the TU Overall Score of 4.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TradeDirect365 clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

TradeDirect365 has non-standard conditions. Among popular CFD brokers, only TD365 offers trading in a single currency, avoiding conversion costs. Narrow fixed spreads are a conceptual advantage, as the trader knows exactly how much they will pay for a trade, and the vicissitudes of the market do not affect the price. Otherwise, the conditions are equally comfortable: two trading platforms from which to choose, no trading commissions or withdrawal fees, a wide selection of assets, and high leverage. Unfortunately, the broker does not offer investment options or a referral program, and there are no promotions or special offers for traders. However, traders can start trading with bonuses in the form of rebates from Traders Union, which partially reimburses traders for the cost of spreads.

Brief Look at TradeDirect365

TradeDirect365 (“TD365”) is an Australian broker, which offers CFDs (contracts for difference) on various assets like currency pairs, indices, stocks, cryptocurrencies, and commodities. One unique feature of the platform is the ability for traders to work with selected currencies, regardless of the asset they are trading. For example, if the account currency is dollars, then when trading the DAX index (represented in EUR), the trader still trades in dollars. This approach eliminates conversion costs. TradeDirect365 allows trading through its proprietary CloudTrade CFD platform or on the classic MetaTrader 4 platform (and on their respective desktop and mobile versions). The broker stands out from its competitors by offering fixed spreads. For example, the spread for AUD/USD is always 0.6 pips, and there are no trading commissions. TD365 clients can open one of three account types: Personal, Corporate, or the Self-Managed Superannuation Fund (SMSF) account. The Personal account has the Pro option, which features increased leverage. For example, on a Personal account, the maximum leverage for indices is 1:20, while on the Pro account, it is 1:200.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Traders can choose from thousands of CFDs, categorized into five groups of the most popular assets.

- A narrow and fixed spread in most cases allows paying the lowest fee possible.

- All CFDs are traded without commission, the broker charges only the spread.

- Trading can be done on a personal computer or mobile device using convenient platforms.

- Leverage varies between 1:5 to 1:200, which increases the profit potential flexibly.

- Standard features such as stop-loss orders and advanced features like Negative balance protection (NBP) are available.

- Technical support is available through various communication channels and operates 24/5.

- The platform’s operations are limited in the United States, Japan, China, and some other countries.

- The broker offers a wide range of assets for trading, but traders should note that these are all CFDs.

- The Pro account has many competitive advantages, but it does not come with protection against NBP.

TU Expert Advice

Author, Financial Expert at Traders Union

TradeDirect365 is an Australian broker offering a range of CFDs on currencies, indices, stocks, cryptocurrencies, and commodities. Trading is facilitated through the CloudTrade and MetaTrader 4 platforms. Notably, the broker provides tight fixed spreads without trading fees. Account types available include Personal and Pro, with leverage up to 1:200, allowing for substantial profit potential. its clients benefit from a wide selection of tradable assets, negative balance protection, and 24/5 client support.

However, TradeDirect365 exhibits certain drawbacks, such as the absence of ETFs and investment options, and the Pro account lacks negative balance protection. The broker's services are unavailable in several major markets, including the U.S. and Japan. TradeDirect365 may suit traders interested in broad CFD offerings and cost-effective trading with fixed spreads. Nonetheless, those prioritizing account protection and investment features may need to explore other options.

- You are looking for wide range of CFDs. With this broker, traders can choose from thousands of CFDs, categorized into five groups of the most popular assets, providing a diverse range of trading opportunities.

- You would want a narrow and fixed spread in most cases, which allows you to pay the lowest fee possible. This can be advantageous for cost-conscious traders looking to minimize trading expenses. Further, all CFDs are traded without commission; the broker charges only the spread. This transparent fee structure may be appealing to traders who prefer commission-free trading.

- You belong from one of the broker’s restricted list of countries. The broker’s operations are limited in the United States, Japan, China, and some other countries.

- You are looking for Negative Balance Protection (NBP) as The Pro account, despite having competitive advantages, does not come with protection against NBP.

TradeDirect365 Trading Conditions

| 💻 Trading platform: | CloudTrade, MT4 |

|---|---|

| 📊 Accounts: | Personal, Pro, demo |

| 💰 Account currency: | USD, GBP, EUR, AUD, ZAR, NOK, DKK, SEK |

| 💵 Deposit / Withdrawal: | Visa/MC bank cards, bank transfer, TransferWise, POLI |

| 🚀 Minimum deposit: | $1 |

| ⚖️ Leverage: | 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3-0,5 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, indices, stocks, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | The available financial instruments are only CFDs, with a wide selection of assets. Spreads are fixed, and there are no trading commissions or withdrawal fees. The leverage is moderate, and there are no restrictions on trading strategies. |

| 🎁 Contests and bonuses: | Rebates from Traders Union |

If a broker provides multiple account types, the minimum deposit requirements for each account almost always differ. TradeDirect365 clients who are individuals can open a Personal or Pro account, and in both cases, they do not need to deposit a certain amount. They gain full access to the platform after registration and verification. Then, a trader can deposit $100, $500, $1000, or more and start trading. The trader also chooses their own leverage. Leverage depends on the asset type. For example, it can be 1:5 for stocks, while the maximum leverage for currency pairs is 1:30. If the trader upgrades to a Pro account, the leverage increases up to 1:200 for currency pairs. It’s not mandatory for a trader to use leverage. As for technical support, it operates 24/5. Technical support specialists can be contacted by phone, email, or LiveChat.

TradeDirect365 Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with this broker, you need to register and verify your account, and then make a deposit. TU’s experts have prepared the brief step-by-step guide below.

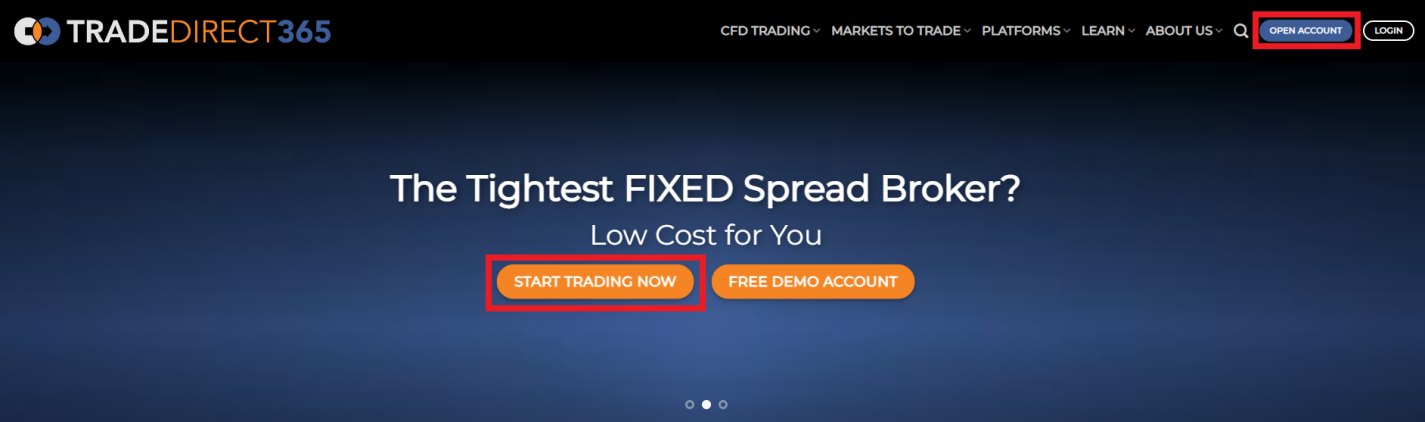

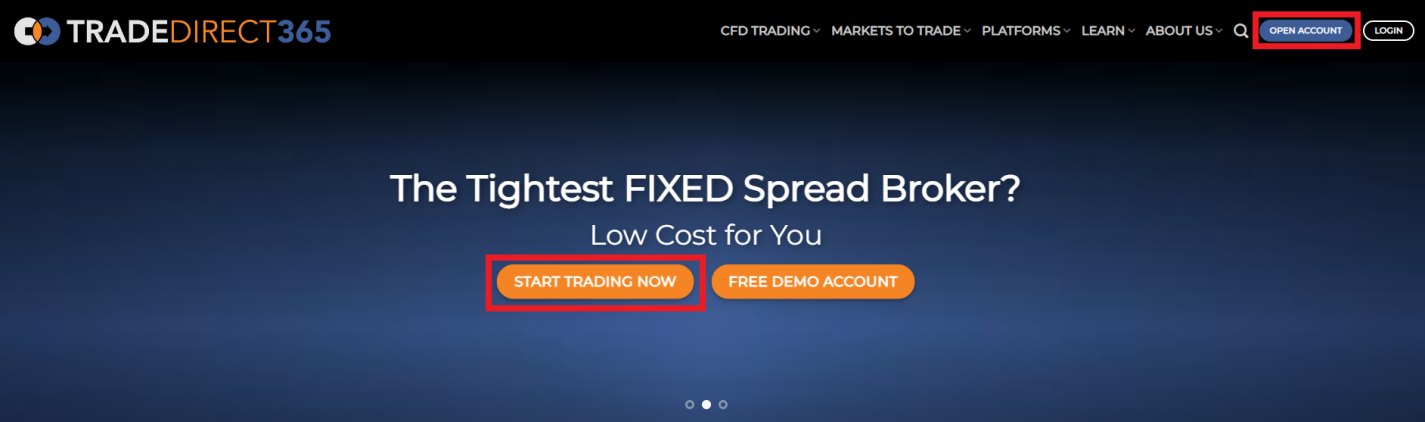

Go to the broker’s website and click on “Open Account”, you can also click “Start Trading Now”.

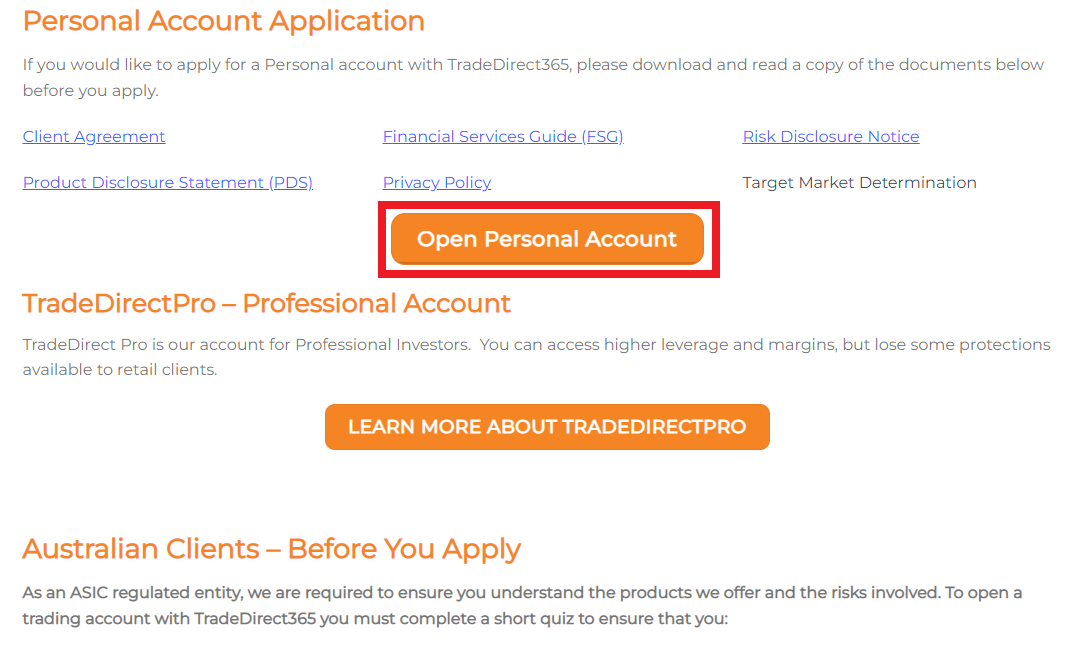

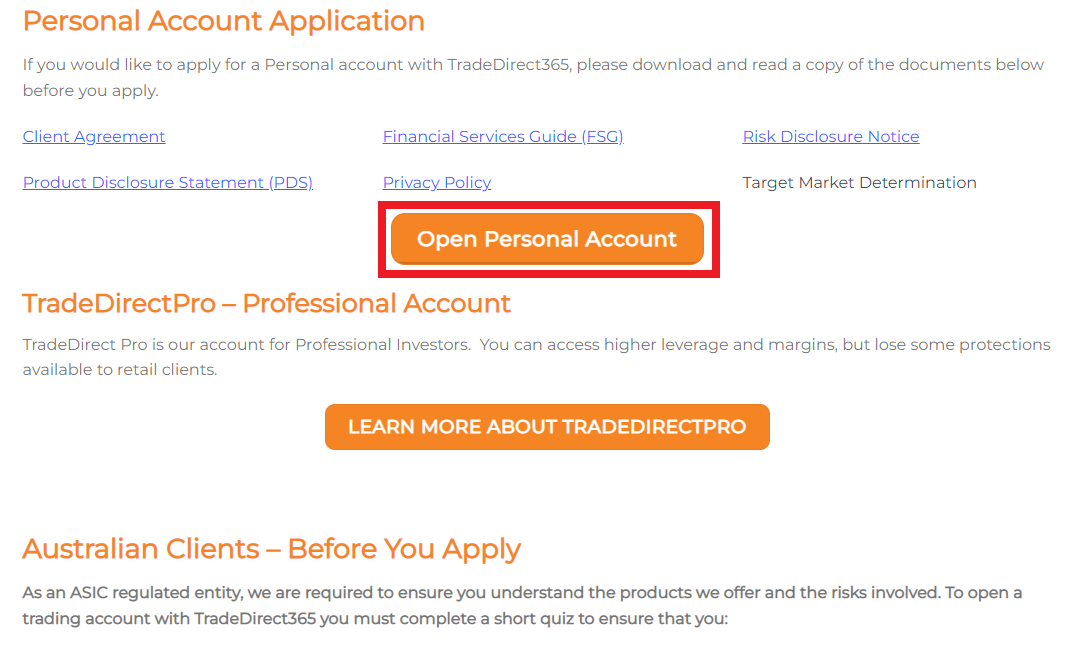

Read the comments on the page carefully and choose the account that suits you. In this example, Traders Union is opening a sample but real Standard account for an individual, so click “Open Personal Account”.

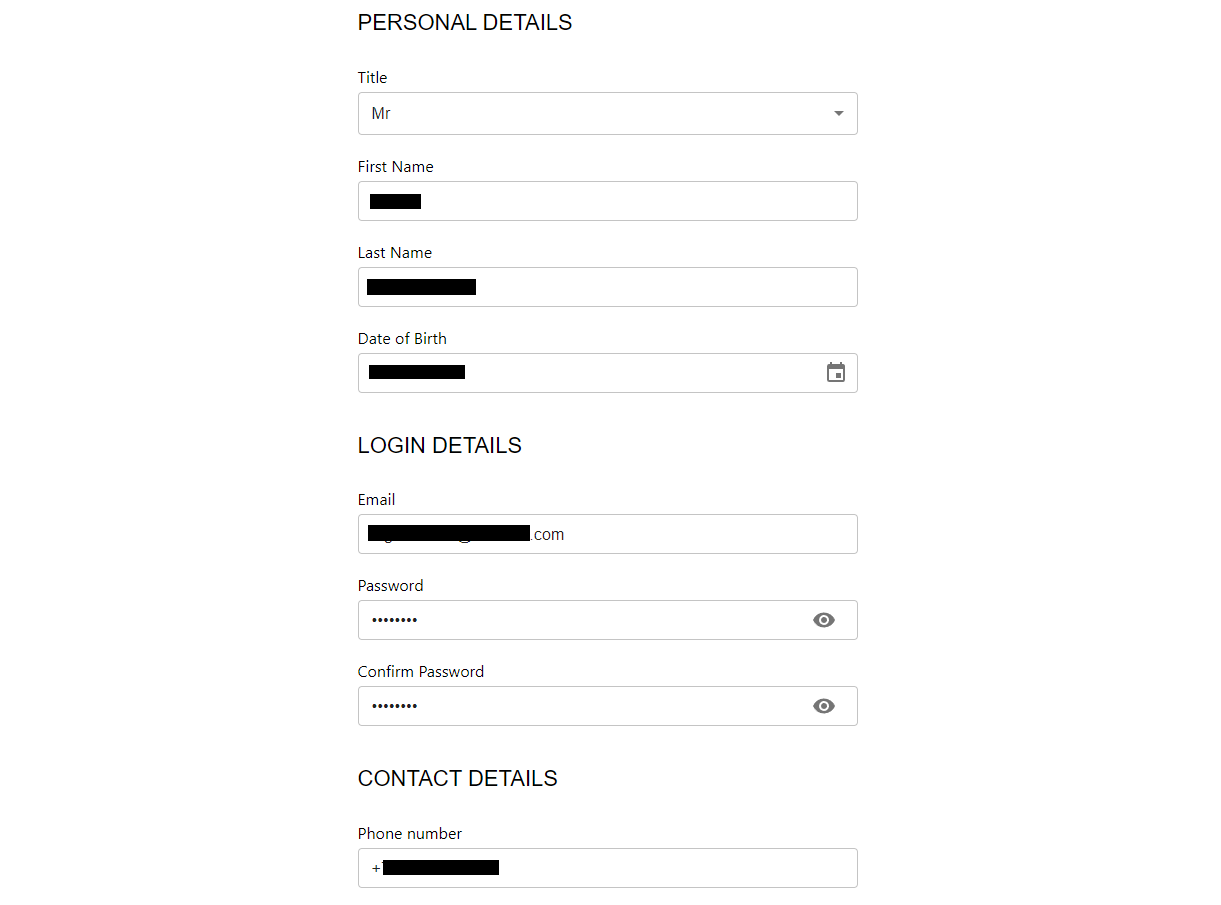

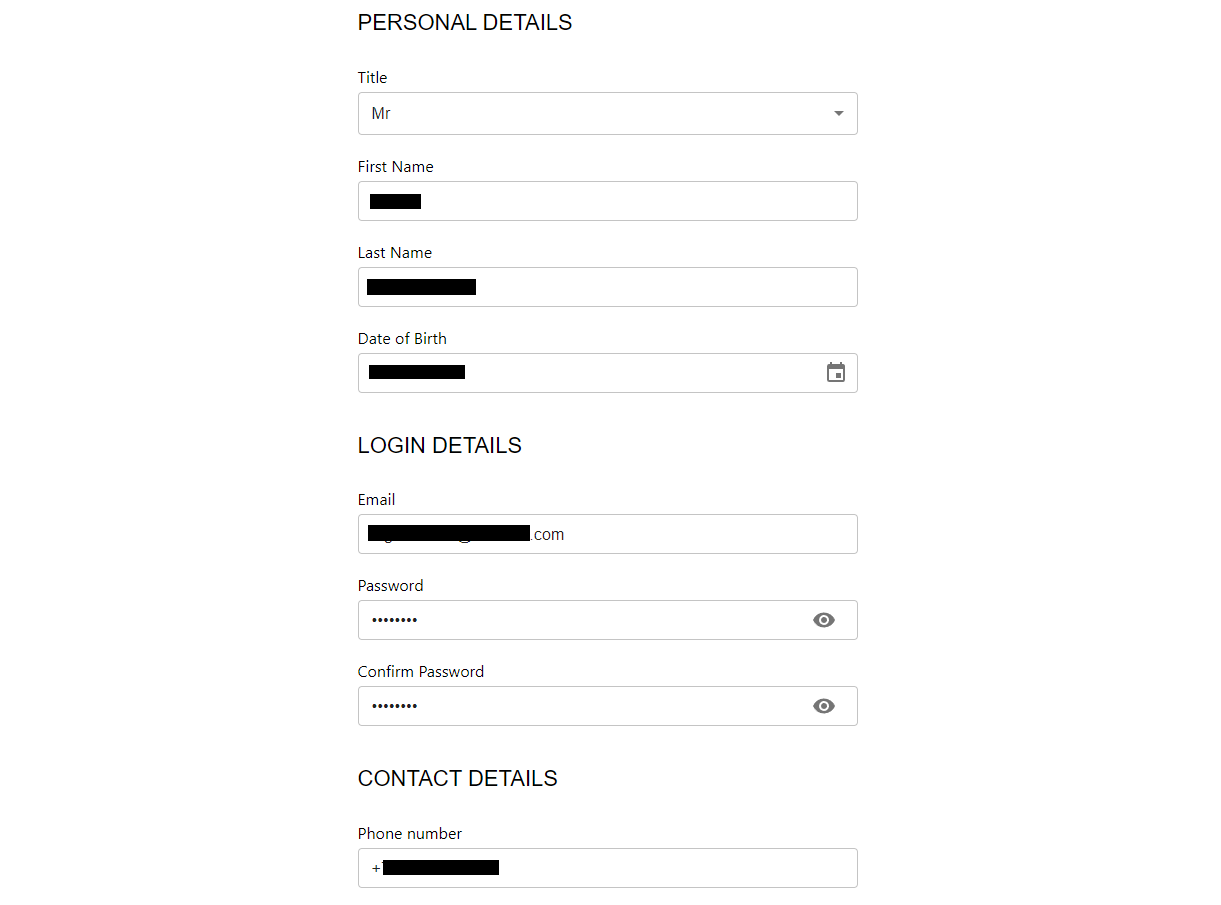

Specify how to address you. Enter your first and last name, date of birth, and email address. Think of a password and enter it twice. In the third block, enter your phone number, and information about your residence with the postal code. Click “Next”.

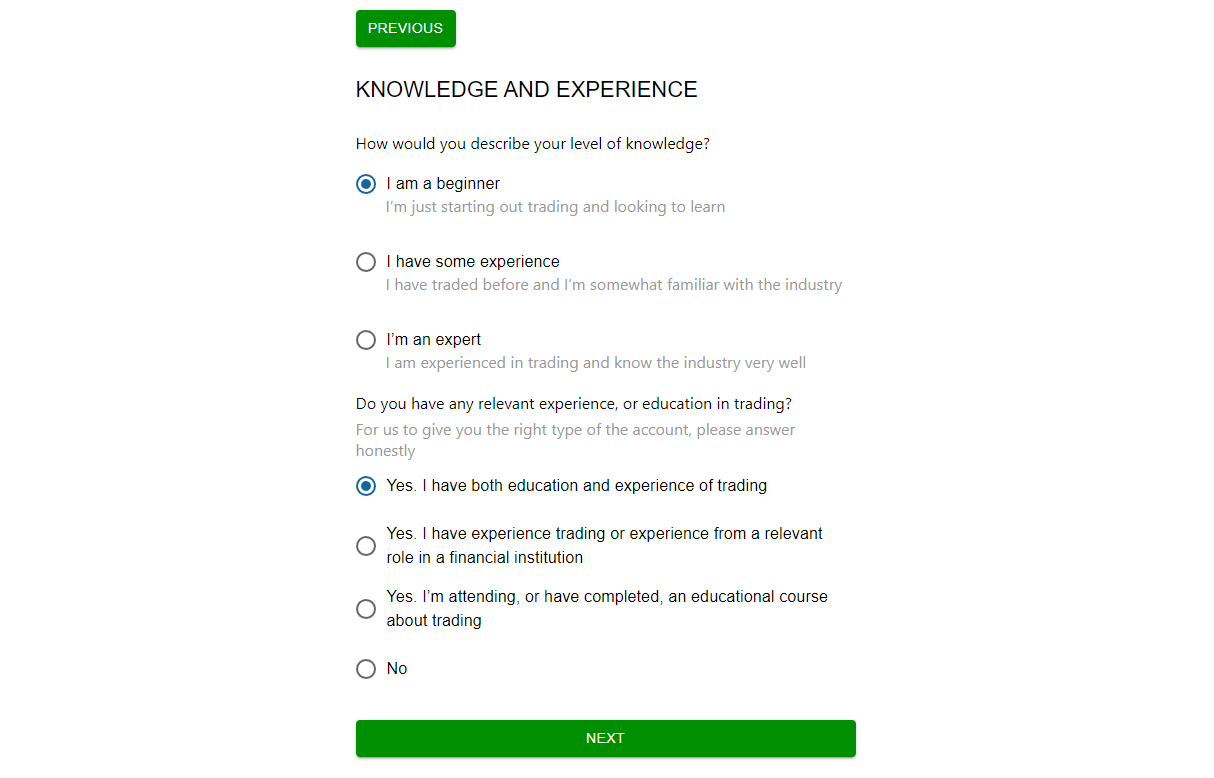

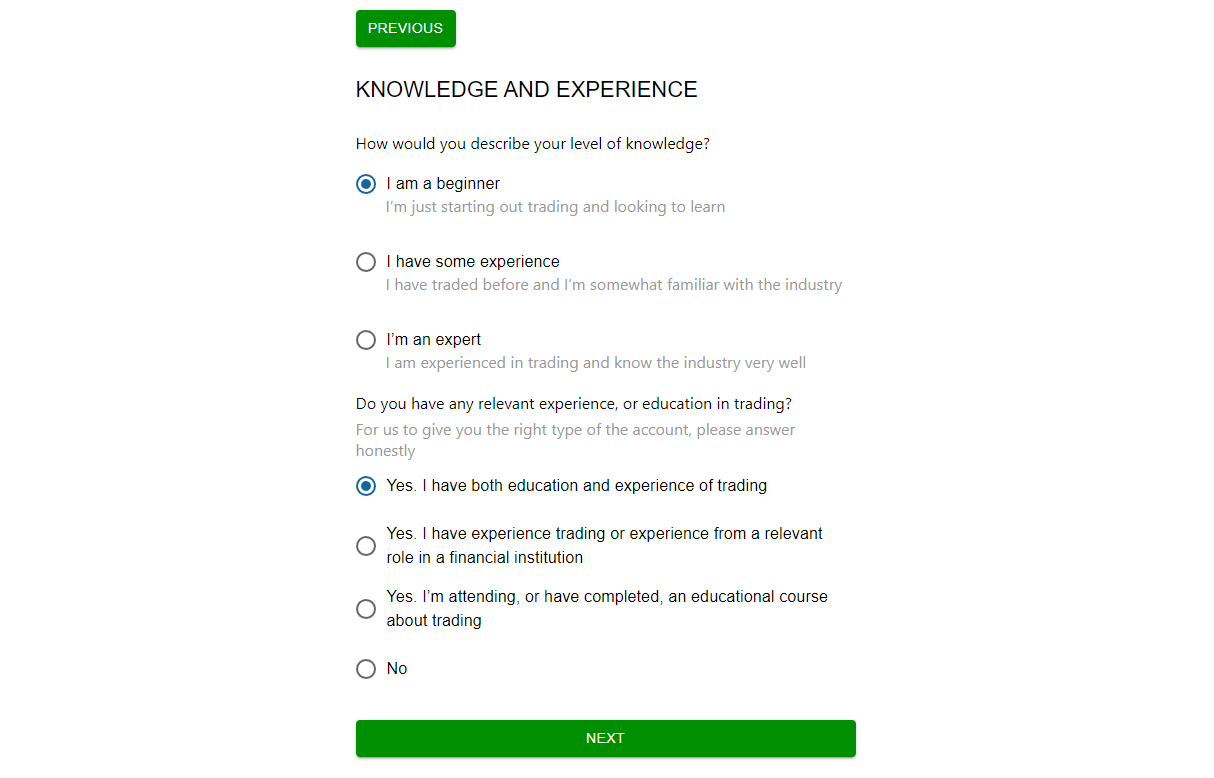

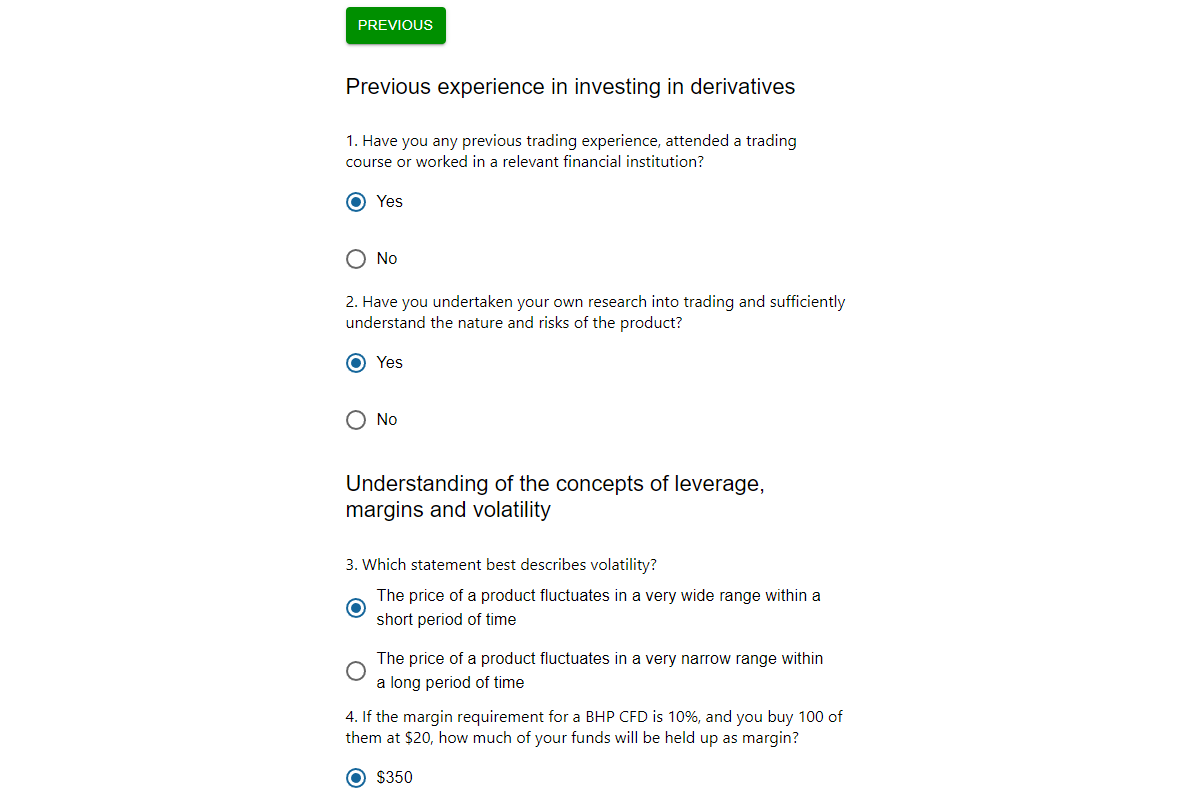

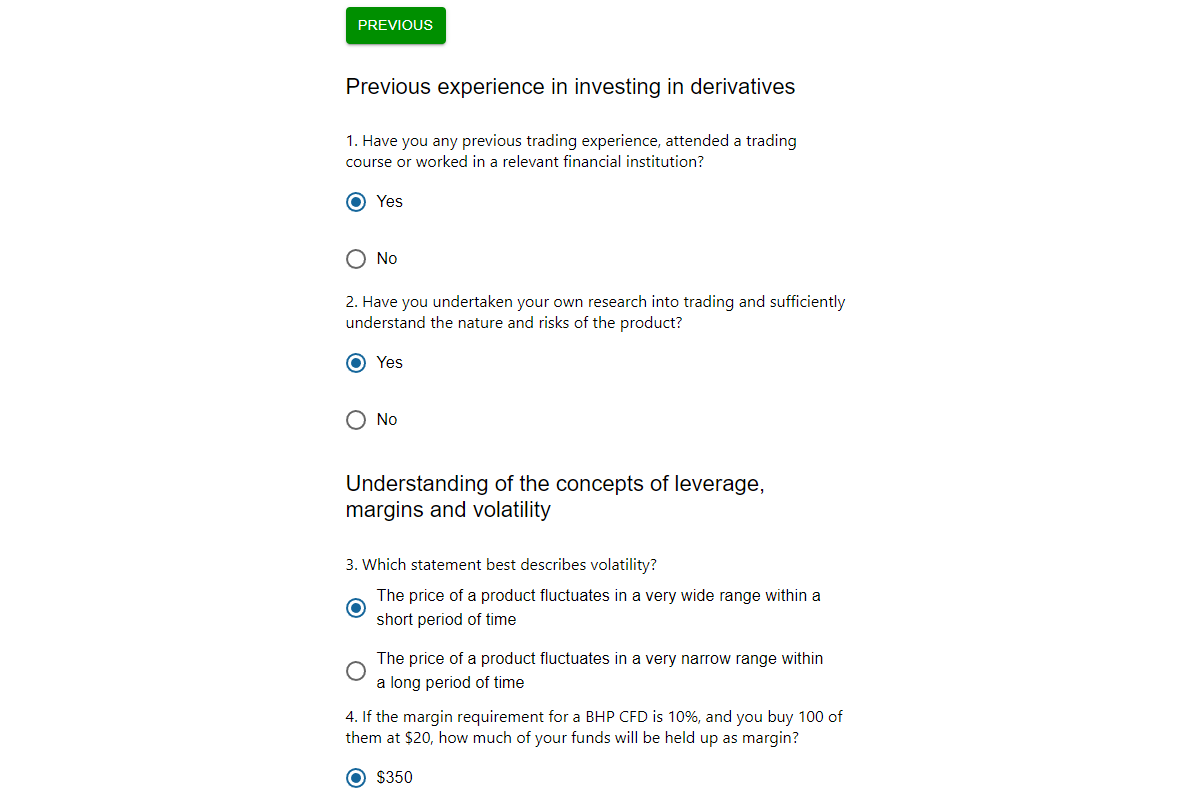

Answer a few questions about your trading experience and practical skills. Click “Next”.

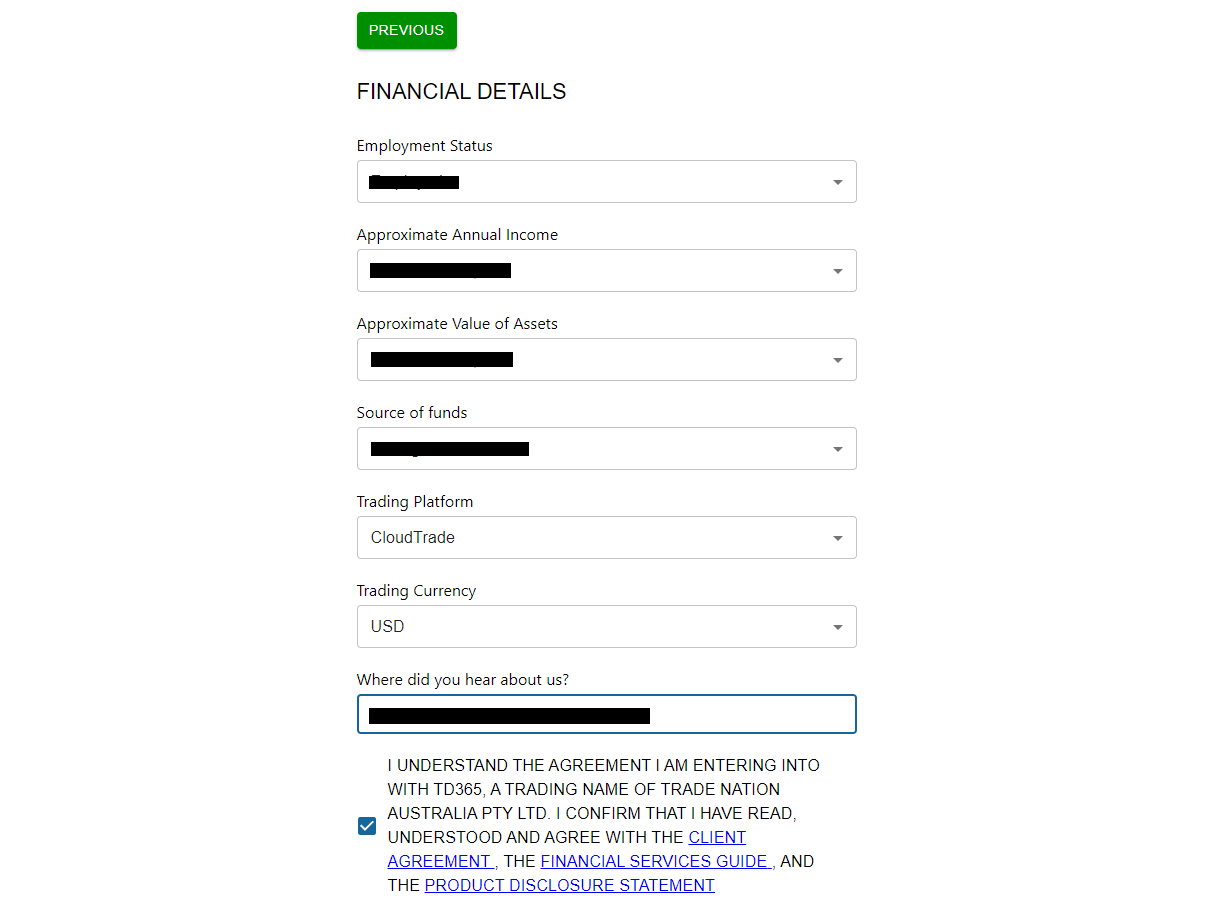

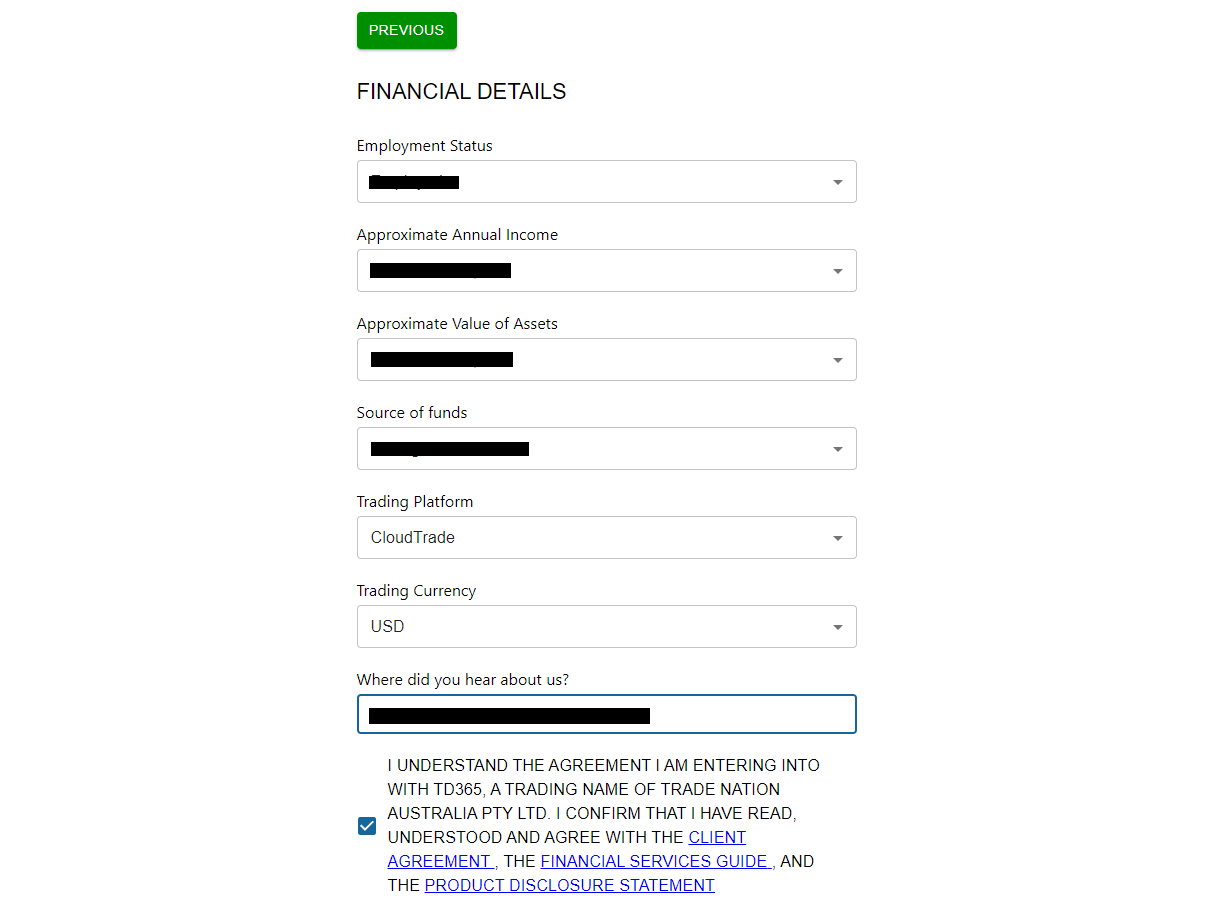

Next, a few words about your income. This information will not be obtained by third parties, it is needed to individualize the offer. Select the account currency and trading platform. Then check the boxes, agreeing to the terms and conditions of cooperation. Click “Next”.

Answer a few more simple questions, this is mostly about trading theory. Your answers will help the broker to understand how prepared you are to trade. Click “Finish”.

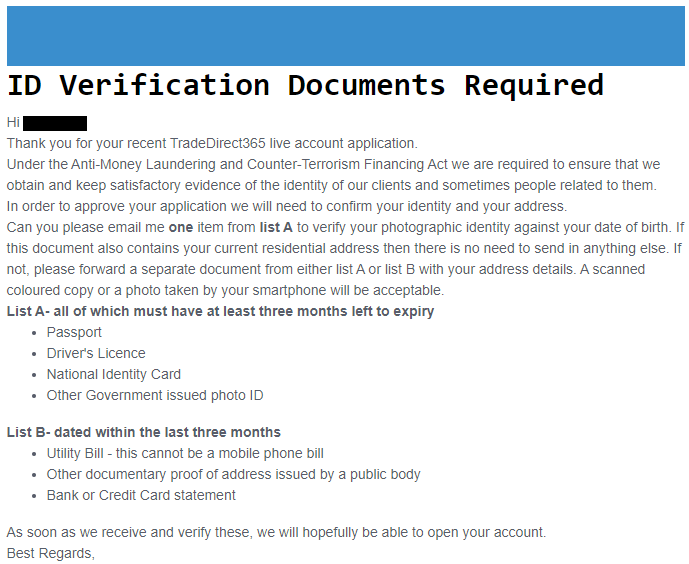

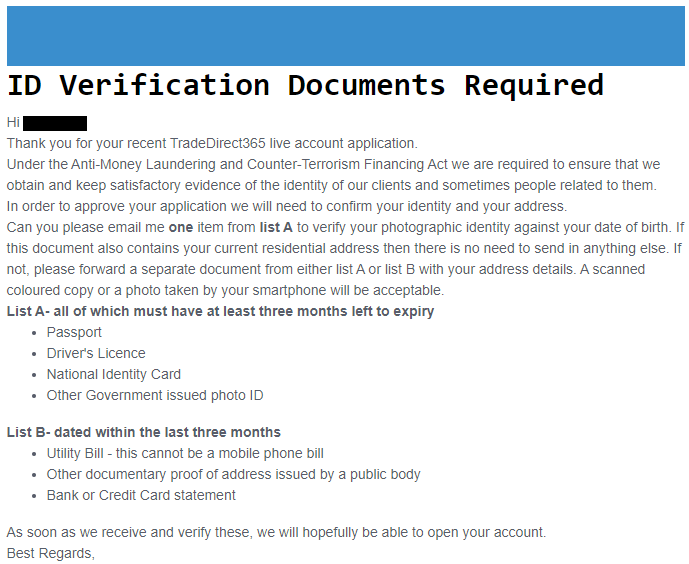

Enter your email address that you provided during registration. You will receive an from the broker. Read the instructions and send scans/photos of documents confirming your identity. Once the managers verify the authenticity of the documents, you will gain full access to the functionality of your user account. The verification status is displayed in “My Profile”, under the “Legal documents” tab.

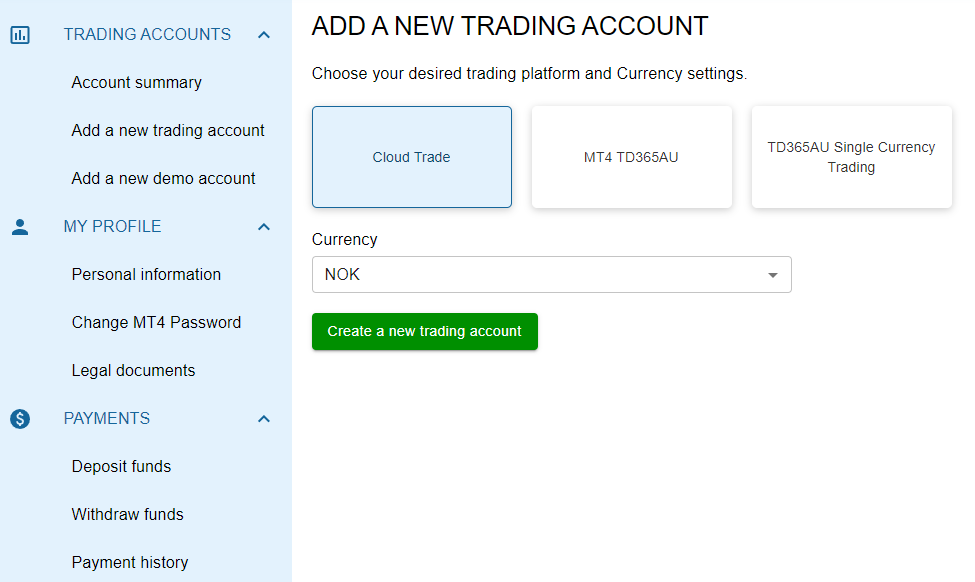

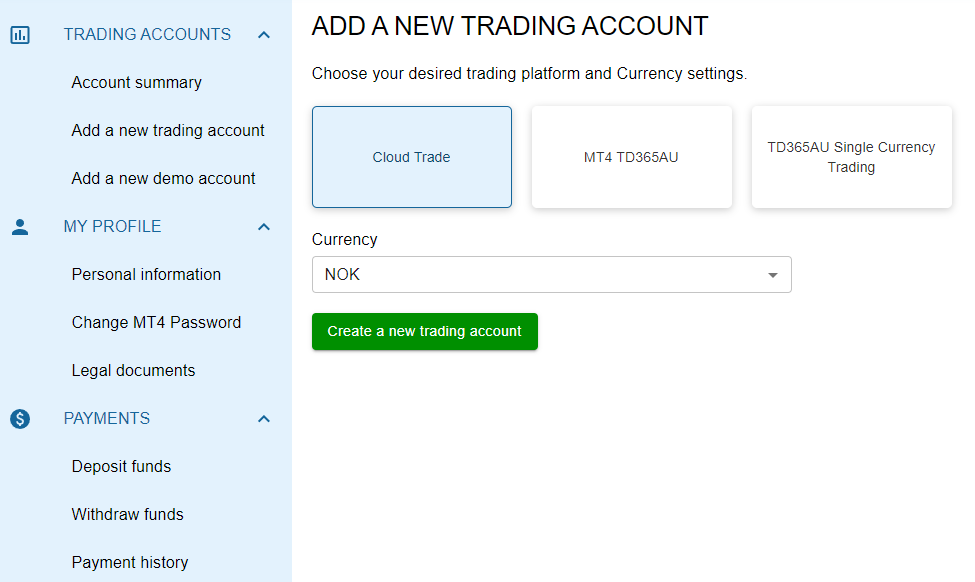

Click “Add a new trading account” in the left menu. Choose an account type and preferred trading platform. Click “Create a new trading account”. Follow the on-screen instructions to make a deposit and download the platform. Once the funds are received by the broker, you will be able to start trading.

Your TradeDirect365 user account also provides access to:

Trading accounts. The section provides a dashboard for the trader’s active trading accounts, as well as functionality for opening a new demo or real trading account.

My profile. Here, the trader can update personal information, view verification status, and change the password for the MT4 trading platform.

Payments. As the name suggests, this menu has three features — deposit funds, withdraw funds from the account balance, and view the payment history.

Regulation and safety

TradeDirect365 has a safety score of 9/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 11 years

- Strict requirements and extensive documentation to open an account

TradeDirect365 Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

TradeDirect365 Security Factors

| Foundation date | 2014 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TradeDirect365 have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TradeDirect365 with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TradeDirect365’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TradeDirect365 Standard spreads

| TradeDirect365 | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,3 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

Does TradeDirect365 support RAW/ECN accounts?

As we discovered, TradeDirect365 does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TradeDirect365. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TradeDirect365 Non-Trading Fees

| TradeDirect365 | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

If you are a legal entity, you need to open a corporate account. If you want to establish a Self-Managed Superannuation Fund (SMSF), register a Trust account. For all other cases, individuals can open Personal or Pro accounts. These accounts are similar in basic parameters: all assets are available, and trading with leverage is possible on MT4 or the CloudTrade trading platforms. The difference is that with the Pro account, the leverage is much higher, and the margin stop out level is set at 50%. However, clients who choose the Pro account lose protection from a negative balance and are unable to trade U.S. stocks. Also, their complaints are not considered by the AFCA (Australian Financial Complaints Authority). Therefore, private traders should choose an account type based on their understanding of the optimal risk-to-profit ratio.

Account types:

The standard practice is to first open a demo account, trade on it for a while, and then switch to a real account. All account types are available for the MT4 platform, however, the demo account is not available in CloudTrade. The number of traded assets is not determined by the account type.

Deposit and withdrawal

TradeDirect365 received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TradeDirect365 provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank wire transfers available

- Supports 5+ base account currencies

- Minimum deposit below industry average

- No deposit fee

- PayPal not supported

- USDT payments not accepted

- BTC not available as a base account currency

What are TradeDirect365 deposit and withdrawal options?

TradeDirect365 provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Wise.

TradeDirect365 Deposit and Withdrawal Methods vs Competitors

| TradeDirect365 | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | Yes | No | No |

| BTC | No | No | No |

What are TradeDirect365 base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TradeDirect365 supports the following base account currencies:

What are TradeDirect365's minimum deposit and withdrawal amounts?

The minimum deposit on TradeDirect365 is $10, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TradeDirect365’s support team.

Markets and tradable assets

TradeDirect365 offers a limited selection of trading assets compared to the market average. The platform supports 500 assets in total, including 80 Forex pairs.

- 500 assets for trading

- 80 supported currency pairs

- Copy trading platform

- Futures not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by TradeDirect365 with its competitors, making it easier for you to find the perfect fit.

| TradeDirect365 | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 500 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TradeDirect365 offers for beginner traders and investors who prefer not to engage in active trading.

| TradeDirect365 | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support is needed by every broker, as it is one of the most crucial infrastructures. The fact is that all traders sooner or later encounter situations that they cannot resolve on their own. The quality of the FAQs section, the intuitiveness of the website interface, and other advantages of the broker are sometimes simply not sufficient. When a trader faces a disputed issue, he contacts support. If the specialists work only limited hours, are difficult to reach, slow to respond, or incompetent, the trader becomes disappointed with the broker and will most likely switch to a competitor. TradeDirect365 understands this well, which is why they offer 24/5 support via phone, email, and LiveChat.

Advantages

- Users can contact customer support even if they are not registered on the website

- All the most popular and efficient communication methods are available.

- Broker’s specialists respond even during nighttime on weekdays

Disadvantages

- On weekends a trader is alone with his problem

So, if you already work with TradeDirect365 or are only planning to register with this broker, you can use the following contact options to receive competent answers to your question:

-

Phone numbers for residents of Australia.

-

Phone numbers for non-residents of Australia.

-

Email.

-

LiveChat on the website, or in the user account.

If you live in Sydney, visiting the company’s office may be convenient for you. However, it is better to check the working hours in advance, preferably by phone.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address | Level 17 123 Pitt Street, Sydney, NSW 2000 |

| Official site | https://tradedirect365.com.au |

| Contacts |

1800 886 514 (+2)

+61 2 8310 4713 |

Education

A successful trader is constantly developing. He actively trades different instruments, reads books on trading, and participates in webinars. It allows him to meet the dynamically changing demands of the market. For additional support, many brokers offer educational programs to their clients, ranging from simple FAQs to comprehensive courses. TradeDirect365 follows a similar approach, the company’s website has a “Learn” section where text materials dedicated to working with CFDs are regularly published. It also includes a “Glossary of CFD Terms”, its “Platform User Guide”, as well as “Video User Guides” that explain the specifics of working with the platform.

As you can see, TD365 offers quite a lot of practical and useful information. However, this is more important for beginners, as professionals are unlikely to find anything unique for themselves.

Comparison of TradeDirect365 with other Brokers

| TradeDirect365 | Eightcap | XM Group | RoboForex | TeleTrade | LiteFinance | |

| Trading platform |

CloudTrade, MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $1 | $100 | $5 | $10 | $10 | $10 |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | 7.00% |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0.5 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 50% / 20% |

| Order Execution | No | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of TradeDirect365

TradeDirect365 is a CFD broker, which means it offers CFDs (contracts for difference) instead of actual assets. The maximum trading leverage on a Personal account is 1:30 with margin requirements of 3.33%. First-tier organizations, primarily large banks operating internationally, act as liquidity providers. The broker ensures high execution speed through the use of an advanced technology stack, such as dedicated virtual servers. The same applies to the CloudTrade trading platform, developed by TradeDirect365 specialists. The platform competes confidently, with MT4/5 in terms of simplicity, functionality, and adaptability to the specific needs of the user.

TradeDirect365 by the numbers:

-

9 years in brokerage business.

-

Minimum deposit is $1.

-

5 asset groups.

-

Minimum trade is $0.10.

-

Technical support is available 24/5.

TradeDirect365 is a convenient broker for working with CFDs

Platforms that offer only CFDs are CFD brokers. These financial instruments have many advantages like CFDs are traded with leverage, you can access any market from one platform, both long and short positions are available, and it offers protection against negative balance (NBP). The uniqueness of trading CFDs with TradeDirect365 lies in the use of a pre-selected currency, which avoids conversion costs. For example, if a trader uses dollars, but trades indices that support EUR, all his transactions are conducted in dollars without the need for conversion (avoiding exchange rate differences). Additionally, TradeDirect365 offers CFDs from different asset groups, allowing the usage of various strategies and confidently diversifying risks.

TradeDirect365’s analytical services:

-

Dividend Projections. A unique feature that allows tracking of dividend payments for stocks included in the selected index. Dividend payments always impact stock prices, so it is important to consider them in advance.

-

Market Expiries. Periodically, contracts for specific assets expire. If the expiration is acceptable to the trader and the position is automatically settled, no action is required. However, if the trade needs to roll over the contract to the next cycle, they need to contact the broker. The contract expiration tracking service helps to not miss the moment.

-

Market Closures. Sometimes, regional markets may be closed due to major national holidays or other significant events, this service allows the trader to take such situations into account when planning to trade.

Advantages:

This broker offers two account types for individuals, with the only conceptual difference being increased leverage for the Pro account. A trader does not need to worry about which account to choose, as they get comfortable trading conditions in either.

The company offers thousands of CFDs on five asset groups: currencies, cryptocurrencies, stocks, indices, and commodities.

Fixed spreads are often very profitable. In addition, the broker does not charge trading commissions.

The MetaTrader 4 trading platform is a classic and is suitable for both beginners and professionals due to its simplicity and convenient functions. The broker’s cloud-based solution, CloudTrade, is also practical and some traders even believe it is better than the other alternatives.

Withdrawals can be made through major channels such as bank cards, bank transfers, and online payment systems. The broker does not charge commissions and there is no minimum limit, giving the trader full control over their financial decisions.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i