According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- CySEC

- FSC (Belize)

- FSA (Seychelles)

- JSC

- CMA

- 2010

Our Evaluation of Windsor Brokers

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Windsor Brokers is a moderate-risk broker with the TU Overall Score of 6.11 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Windsor Brokers clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Windsor Brokers is a broker that offers limited options for active and passive trading and is suited mainly for professionals.

Brief Look at Windsor Brokers

Windsor Brokers is a trading intermediary that is part of the Windsor Brokers Ltd corporation. The above group of companies, which has been operating since 1988, holds licenses from the CySEC 030/04 (Cyprus Securities and Exchange Commission), FSC 000153/391 (Belize International Financial Services Commission), JSC 1265 (Jordan Securities Commission), and FSA SD072 (Seychelles). Windsor Brokers offers high-quality services and has won more than 20 awards. According to the UK Forex Awards, the company was named the most reliable Forex broker in 2017, and International Business Magazine named it the “Best service provider for Forex Clients” in 2018.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- narrow spreads of 0.0 pips on professional Zero and VIP Zero accounts;

- no restriction on the use of trading advisors, scalping, and hedging;

- the ability to connect trading signals from the MQL5.community platform.

- the client cannot invest in trust management accounts or ready-made diversified portfolios;

- MT4 is the only trading platform;

- the lack of Russian on its website;

- no client support;

- no educational materials.

TU Expert Advice

Author, Financial Expert at Traders Union

Windsor Brokers offers trading services across 45 Forex currency pairs, stocks, indices, commodities, and metals with leverage up to 1:500 via the MT4 platform. Active traders benefit from tight spreads starting at 0.0 pips on a professional Zero account, no restrictions on scalping or using trading advisors, and the integration of MQL5 signals. The broker provides a mobile app to facilitate trading on-the-go.

However, the company presents some drawbacks, such as limited asset options, an absence of cryptocurrencies, and restrictions on trading platforms. Additionally, client support does not provide services in Russian. The broker suits experienced traders focusing on Forex who prioritize low spreads, but may not be suitable for beginners or those interested in cryptocurrency trading.

- You value narrow spreads of 0.0 pips on professional Zero and VIP Zero accounts. Low spreads can contribute to reduced trading costs, especially for active traders.

- You appreciate no restrictions on the use of trading advisors, scalping, and hedging. This flexibility allows you to implement various trading strategies based on your preferences and goals.

- You prefer brokers with low minimum deposit requirements. A high minimum deposit of $50 might be a deterrent if you are seeking a broker with lower entry requirements. Consider whether this aligns with your budget and trading preferences.

- If trading cryptocurrency is an essential part of your trading strategy. The absence of this option with the broker may limit your choices.

Windsor Brokers Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Prime, Zero, VIP Zero |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank Transfer, Credit/Debit Card, WebMoney, Skrill, Neteller, Union Pay, ZixiPay & various regional e-wallets |

| 🚀 Minimum deposit: | From $50 |

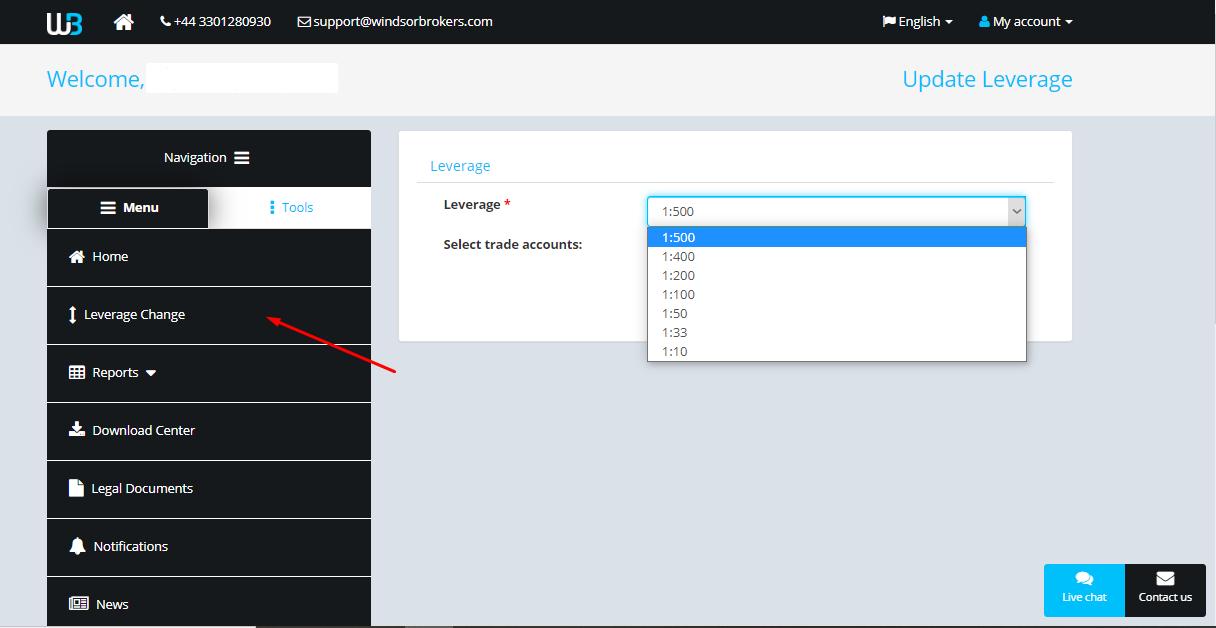

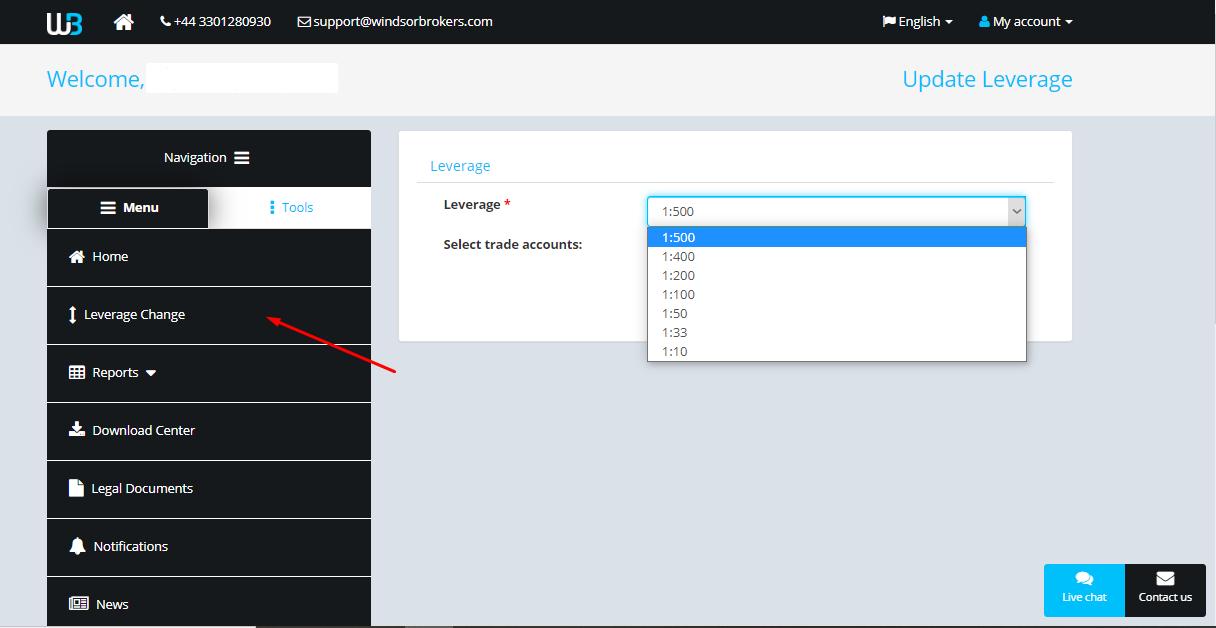

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | Currencies, spot metals, CFDs on stocks, indexes, commodities, energies, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100/20% |

| 🏛 Liquidity provider: | Confidential information |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Cryptocurrencies are not available |

| 🎁 Contests and bonuses: | A trading bonus of $30 for new clients, a trading bonus of 20% of the deposit amount (ended August 31, 2020) |

Windsor Brokers provides two types of accounts that, according to the company statement, are designed with its clients’ trading experiences in mind. However, the terms of the accounts are still not suitable for novice traders. The minimum deposit of $50 is too high for many Forex beginners. In addition, typical spreads on currency pairs range from 1.5-3.6 pips, which is a fairly high value.

Windsor Brokers Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

If you want to trade with Windsor Brokers and receive a refund of the spread from the Traders Union, you need to open a real account with the broker. To do this, follow the instructions below:

Register on the Traders Union website and follow the referral link to the broker’s website. On the main page, click the “Open account” button.

Fill out the registration form with the following information: country of residence, surname and first name, phone number, email address, and communication language (Russian is not supported). Come up with a strong password and choose “Live account”. After that, confirm the e-mail by following the link that came to your specified e-mail, and click on “Login.” In the window that appears, specify the e-mail and password used during registration. Complete the profile by answering financial questions. Before adding funds to your account, be sure to pass verification.

Features of the user account include:

The user account includes the following sections:

-

technical analysis of EUR/USD, GBP/USD, USD/JPY, GBP/JPY, AUD/USD, EUR/JPY, gold, silver, crude oil, and Dow Jones assets;

-

education with video tutorials, e-books, and a glossary of terms;

-

economic calendar and Forex calculators;

-

Download Center for downloading the trading platform;

-

an online chat where clients can ask a client service expert a question in real time and a form for sending a letter to the broker’s e-mail.

Regulation and safety

Windsor Brokers has a safety score of 7.3/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 15 years

- Not tier-1 regulated

Windsor Brokers Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

| CMA (Kenya) | The Capital Markets Authority | Kenya | KES 50,000 | Tier-2 |

| JSC (Jordan) | Jordan Securities Commission | Jordan | JOD 10,000 | Tier-2 |

Windsor Brokers Security Factors

| Foundation date | 2010 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Windsor Brokers have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Windsor Brokers with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Windsor Brokers’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Windsor Brokers Standard spreads

| Windsor Brokers | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,0 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,0 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Windsor Brokers RAW/ECN spreads

| Windsor Brokers | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Windsor Brokers. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Windsor Brokers Non-Trading Fees

| Windsor Brokers | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 3 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Windsor Brokers offers several types of accounts from which to choose. They differ in terms of the minimum deposit amount, spread, fees, and the availability of swap-free accounts.

Account types:

A demo account allows the client to test the broker’s trading terms without putting his money at risk.

Windsor Brokers’ terms are developed primarily for professional traders who want to trade with narrow spreads and are ready to make a deposit starting at $2,500.

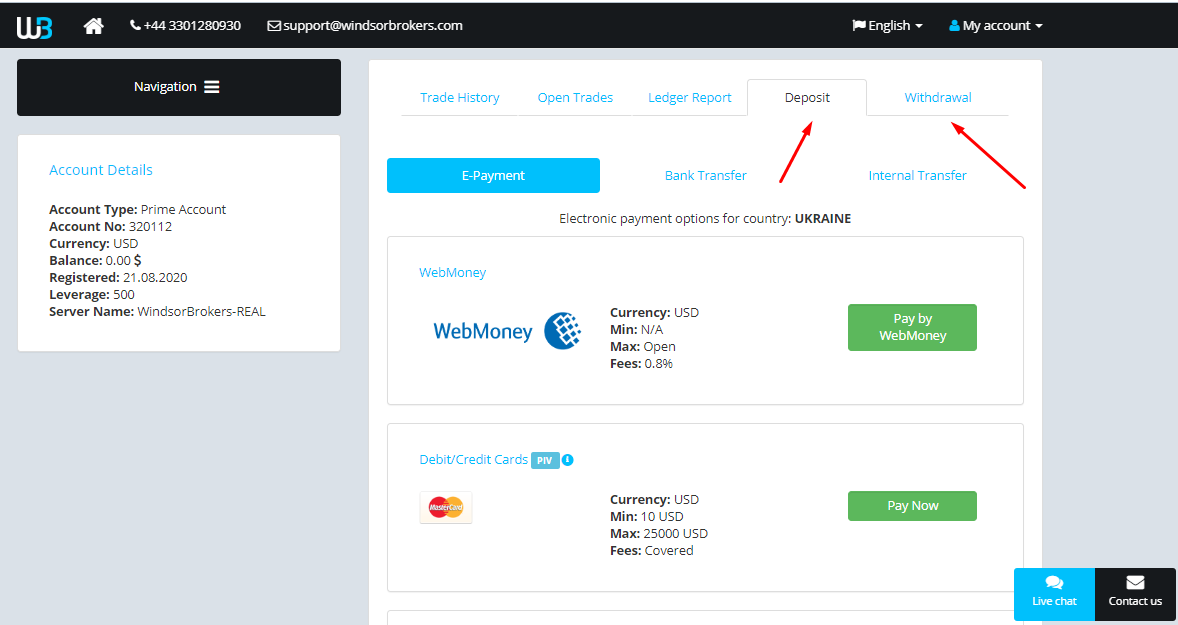

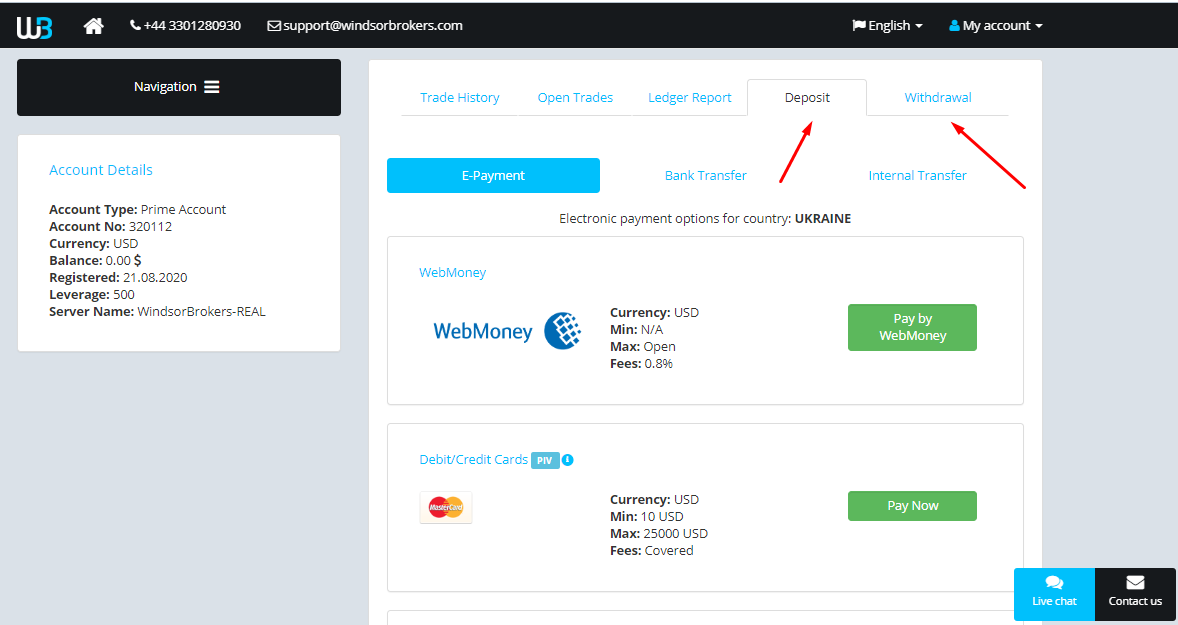

Deposit and withdrawal

Windsor Brokers received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Windsor Brokers provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bitcoin (BTC) accepted

- No withdrawal fee

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- Only major base currencies available

- Wise not supported

- PayPal not supported

What are Windsor Brokers deposit and withdrawal options?

Windsor Brokers provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

Windsor Brokers Deposit and Withdrawal Methods vs Competitors

| Windsor Brokers | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are Windsor Brokers base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Windsor Brokers supports the following base account currencies:

What are Windsor Brokers's minimum deposit and withdrawal amounts?

The minimum deposit on Windsor Brokers is $50, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Windsor Brokers’s support team.

Markets and tradable assets

Windsor Brokers offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 45 Forex pairs.

- 45 supported currency pairs

- Indices trading

- Crypto trading

- Copy trading not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Windsor Brokers with its competitors, making it easier for you to find the perfect fit.

| Windsor Brokers | Plus500 | Pepperstone | |

| Currency pairs | 45 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Windsor Brokers offers for beginner traders and investors who prefer not to engage in active trading.

| Windsor Brokers | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

Windsor Brokers received a score of 7.2/10, reflecting an average offering in terms of trading platforms and tools. The broker covers essential functionality but may fall short in some advanced features or platform diversity compared to leading competitors.

- MetaTrader is available

- One-click trading

- Free VPS for uninterrupted trading

- Trading bots (EAs) allowed

- No access to cTrader and its advanced tools.

- No access to API

- No access to a proprietary platform

Supported trading platforms

Windsor Brokers supports the following trading platforms: MT4, MT5, WebTrader. This selection covers the basic needs of most retail traders. We also compared Windsor Brokers’s platform availability with that of top competitors to assess its relative market position.

| Windsor Brokers | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key Windsor Brokers’s trading platform features

We also evaluated whether Windsor Brokers offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | No |

| Supported indicators | 30 |

| Tradable assets | 200 |

Additional trading tools

Windsor Brokers offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

Windsor Brokers trading tools vs competitors

| Windsor Brokers | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

Windsor Brokers supports mobile trading, offering dedicated apps for both iOS and Android. Windsor Brokers received 8/10 in this section, reflecting strong user engagement and well-developed functionality. High ratings, solid download numbers, and the presence of advanced mobile features contributed to the high score.

- Solid iOS user feedback, with a rating of 4.5/5

- Strong Android user ratings, currently at 4.1/5

- Supports mobile 2FA

- Limited features vs desktop

We compared Windsor Brokers with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| Windsor Brokers | Plus500 | Pepperstone | |

| Total downloads | 100,000 | 10,000,000 | 100,000 |

| App Store score | 4.5 | 4.7 | 4.0 |

| Google Play score | 4.1 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

The company’s website has a dedicated Education section. In this section, traders can find theoretical courses as well as sign up for upcoming webinars from Windsor Brokers experts.

Clients can use a free demo account to assess their level of knowledge.

Customer support

The broker’s client support service is available 24/5.

Advantages

- The quick response of operators in online chat

Disadvantages

- The support service is not available on weekends

- The support service does not provide answers in Russian

- The client can make a call only to the of Belize and Jordan numbers

- No callback option

Ways to reach client’s support service:

-

by phone via the numbers listed on the website;

-

by email;

-

in an online chat on the broker’s website;

-

via the client’s user account.

The company has pages on Facebook, Twitter, YouTube, and LinkedIn.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | 35 Barrack Road, 2nd Floor, Unit 204, Belize City, Belize |

| Regulation |

CySEC, FSC (Belize), FSA (Seychelles), JSC, CMA

Licence number: CYSEC - 030/04 |

| Official site | windsorbrokers.com |

| Contacts |

+44 1145519650 ,+44 3301280930, +962 6 550 9090, +254 205029240

|

Comparison of Windsor Brokers with other Brokers

| Windsor Brokers | Eightcap | XM Group | RoboForex | Bybit | FBS | |

| Trading platform |

MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader5 | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $50 | $100 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 1 point |

| Level of margin call / stop out |

100% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of Windsor Brokers

Windsor Brokers is an international broker with more than 30 years of experience that strives to make investing accessible to everyone. The company offers its clients narrow spreads, a diverse range of trading assets, and high-quality educational materials for beginners who know English. After registering with a broker, traders gain access to useful tools and services for optimizing trading, as well as several methods for depositing and withdrawing funds at reasonable fees.

Windsor Brokers by the numbers:

-

more than 30 years of work in the global financial market;

-

insurance for each client up to 5,000,000 euros;

-

more than 20 international awards.

Windsor Brokers is a broker for active and passive trading

The management of Windsor Brokers believes that everyone should be able to trade on financial markets under fair, efficient, and safe terms. The broker offers several types of accounts, including one with a $50 deposit and professional education for novice traders, and one with a floating spread of 0.0 pips for professionals. The company’s clients get access to market analysis, expert analytical materials, trading ideas, and technical reviews. The broker offers to connect to signals from the MQL5.com website and take part in the referral program for passive income without independent trading.

The broker’s clients trade on MetaTrader 4, the most popular platform among traders. In addition to the desktop trading platform, there is a web version and mobile applications for Android smartphones and tablets, iPhones, and iPads. The broker also provides a multiplatform which serves as an online service for the simultaneous management of multiple accounts.

Useful Windsor Brokers services:

-

analytics, which is a section with in-depth market analysis and a daily technical review from the industry’s leading financial analysts;

-

the economic calendar shows world news and events in real time that may influence the results of trading;

-

calculators for determining profit, margin, spread, reversal point, and Fibonacci levels.

Advantages:

licenses from international regulators, including CySEC, FSC, and JSC;

fast order execution speeds;

free access to market analysis and educational materials.

Although the broker does not forbid scalping or hedging, it does establish a restriction of 50 lots per ticket for Forex.

Latest Windsor Brokers News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i