Will Ethereum Go Up? Latest Market Insights And Predictions

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A major factor influencing Ethereum’s price prediction is the ongoing uncertainty around crypto regulations. The long-awaited Ethereum ETF approval is still in limbo while rising competition from Solana and Avalanche continues to pressure Ethereum’s dominance. Despite these challenges, whales and institutional investors are quietly accumulating ETH. Recent data shows a significant drop in exchange reserves, hinting at Ethereum accumulation by long-term holders.

Ethereum has been one of the most debated crypto assets. After a volatile 2024, investors are wondering: Will Ethereum go up in 2025 or is it losing momentum? At the start of the year, Ethereum’s market position seemed strong. Institutional interest was rising, and on-chain data showed a surge in accumulation. However, price action has been sluggish, leaving traders frustrated.

In this article, we’ll analyze ETH’s market performance, explore why it has struggled, and break down whether an Ethereum price recovery is likely in 2025.

Ethereum’s market performance since January 2025: A data-driven analysis

In January 2025, ETH experienced notable volatility. The month began with ETH priced at $3,341.94 on January 1 and closed at $3,299.10 on January 31, marking a modest decline of about 1.3%. During this period, ETH reached a high of $3,666.98 on January 7 and a low of $3,121.46 on January 30.

As of February, 2025, Ethereum price stabilized below $2,800 resistance after two-week decline.

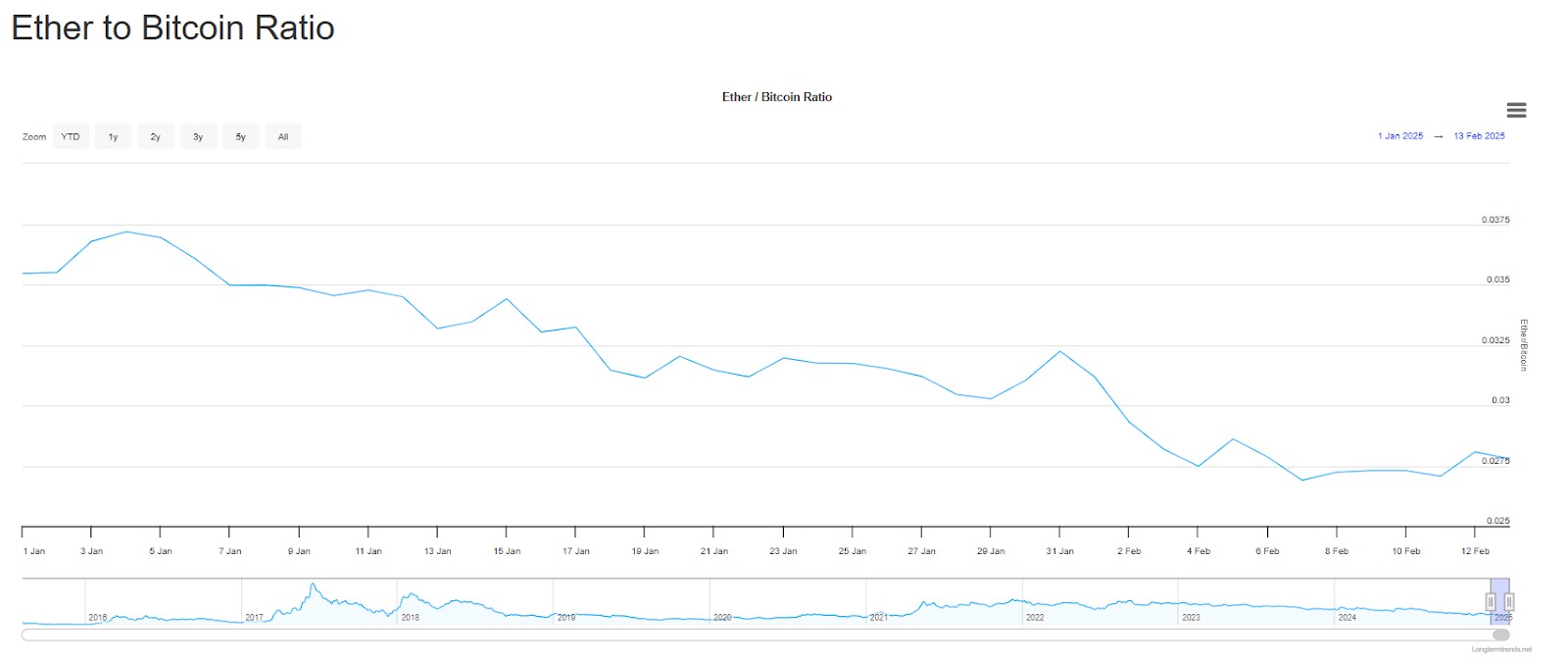

Comparatively, Bitcoin (BTC) has demonstrated significant strength, recently surpassing the $100,000 mark. This surge has led to a decline in the ETH/BTC ratio, indicating Ethereum's underperformance relative to Bitcoin.

Several events have influenced ETH's market dynamics. Notably, Goldman Sachs has invested approximately $2 billion in Bitcoin and Ethereum exchange-traded funds (ETFs), signaling growing institutional interest. Additionally, the U.S. Consumer Price Index (CPI) data released in January indicated a 3% rise in inflation, impacting both Bitcoin and Ethereum prices.

Despite these developments, Ethereum has faced challenges in matching Bitcoin's recent performance, leading investors to question, "Why is Ethereum not going up?" Factors such as regulatory uncertainties and competition from other blockchain platforms may contribute to this trend.

Looking ahead, analysts are divided on Ethereum's prospects. Some predict that ETH could reach new highs, while others remain cautious due to prevailing market conditions.

Latest eth News

Crypto analyst Lark Davis signals a potential price target of $3,300 for Ethereum as it consolidates within a bullish pattern. Ethereum has experienced a major breakout from a prolonged multi-month range, presenting an opportunity for traders. Davis...

-

Ethereum supply shrinks as ETF inflows top $900 million

1 day ago

-

Bitcoin ETF inflows push total assets above $158 billion

1 day ago

-

Weekly forecast: Ethereum breaks $3,000, investors eye $4,000 amid bullish momentum

1 day ago

Why is Ethereum not going up? Factors behind its recent struggles

Ethereum has struggled to maintain momentum since the start of the year. Several factors have contributed to its lackluster performance.

Macroeconomic and geopolitical impact

At the start of February, the U.S. administration imposed significant tariffs on imports from Mexico, Canada, and China. This led to heightened market volatility, pushing investors away from riskier assets like cryptocurrencies. Within 24 hours of the announcement, over $2 billion in liquidations occurred across the crypto market, with Ethereum suffering a sharp decline. Market uncertainty driven by global economic policies has continued to put downward pressure on ETH.

Uncertain regulatory environment

While the U.S. government has expressed support for digital assets, its actions have created instability. Tariffs, regulatory scrutiny, and ongoing discussions about crypto taxation have left investors unsure about the long-term landscape for Ethereum. Many institutional players are hesitant to increase their exposure until clearer guidelines emerge.

Bitcoin’s dominance and capital shift

Ethereum has also been affected by Bitcoin’s market strength. Bitcoin continues to attract the majority of capital inflows, with many investors consolidating their holdings into the largest cryptocurrency rather than spreading funds across altcoins. Ethereum, along with other major altcoins, has underperformed relative to Bitcoin, limiting its upward potential.

Network changes and investor uncertainty

Ethereum underwent major upgrades in January 2025 aimed at improving scalability and efficiency. While these updates are beneficial in the long run, they introduced short-term uncertainty. A decline in large whale transactions suggests that major holders are waiting on the sidelines rather than increasing their ETH positions. This cautious approach has contributed to Ethereum’s struggle to regain previous price levels.

Growing competition from alternative networks

Ethereum is no longer the only choice for developers and users. Blockchain platforms like Solana have gained significant traction due to their speed, lower fees, and improved scalability. Many decentralized applications (dApps) and projects are diversifying across multiple blockchains, reducing Ethereum’s dominance in the space.

Technical resistance and price levels

Ethereum’s price dropped below key support at $3,000 and continued to decline, reaching as low as $2,125. While it briefly recovered to $2,921, it faces strong resistance around $3,000. Unless it can break through this level with sustained buying volume, any rallies are likely to be short-lived.

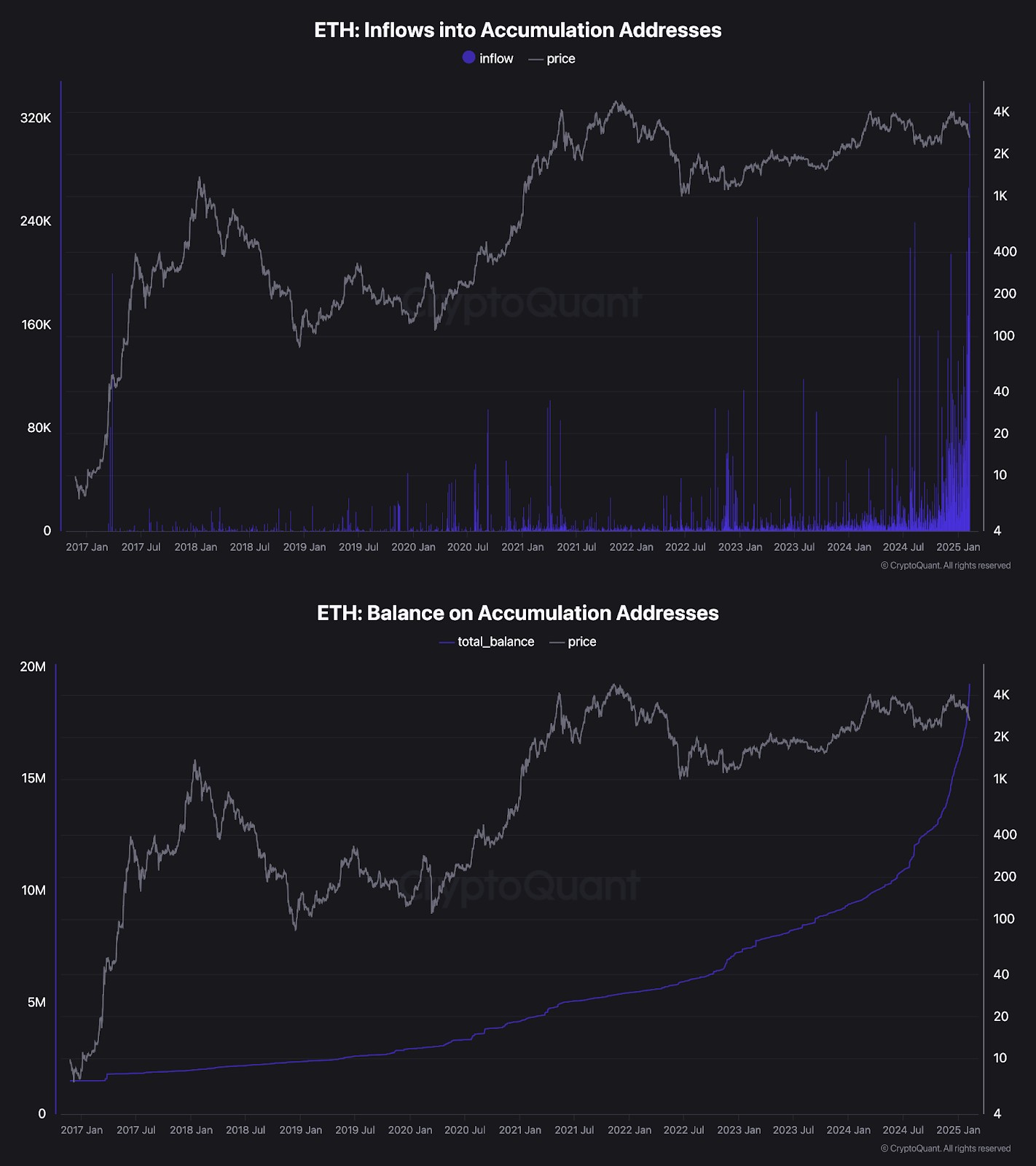

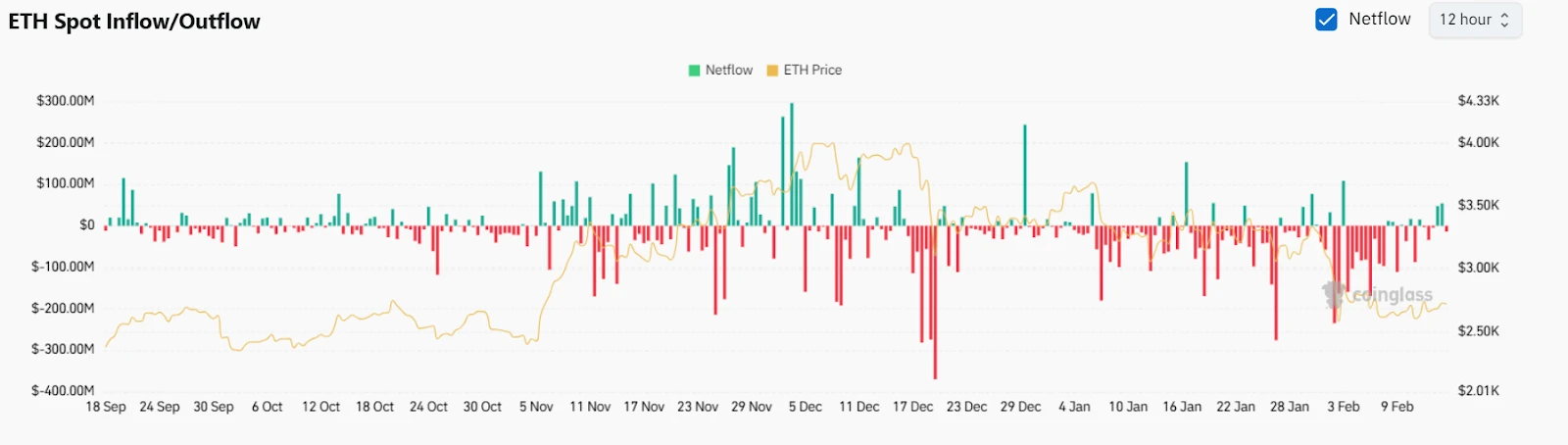

Ethereum accumulation: Smart money buying the dip?

Recent market data indicates a significant accumulation of Ethereum by large investors, often referred to as "whales." Since February 1, 2025, the number of wallets holding over 10,000 ETH has increased by 2.3%, suggesting that these entities are capitalizing on the current price levels to enhance their positions. This trend is further supported by substantial withdrawals from centralized exchanges; notably, on February 11, a single transaction saw 56,909 ETH (approximately $151.6 million) moved off Binance, indicating a shift towards long-term holding strategies.

Institutional interest in Ethereum is also on the rise. World Liberty Financial, a cryptocurrency platform backed by President Donald Trump, recently acquired 1,917 ETH for $5 million during a market dip. This move underscores a growing confidence among institutional investors in Ethereum's long-term potential.

Conversely, some early investors are liquidating portions of their holdings. In February 2025, an Ethereum ICO participant sold 6,672 ETH (valued at $18.08 million) after holding the assets since the initial coin offering. While such sales might introduce short-term volatility, they also reflect the realization of long-term gains.

In summary, the current market dynamics reveal a dichotomy: while early investors are capitalizing on their gains, institutional entities and large holders are actively accumulating Ethereum, signaling robust confidence in its future prospects.

The Trump family’s crypto holdings: Why Ethereum is their main bet

The Trump family has made a significant move into the cryptocurrency market, with Ethereum accumulation becoming the core of their investment strategy. Their holdings highlight growing institutional and high-net-worth investor confidence in ETH’s long-term potential.

Trump’s $420 million Ethereum position

In early February 2025, World Liberty Financial (WLF), a decentralized finance project backed by the Trump family, purchased 86,000 ETH for approximately $220 million at a discounted price. This latest acquisition brought their total Ethereum holdings to around $420 million, making ETH their largest crypto investment.

Further confirming their commitment to Ethereum accumulation, WLF recently transferred over $212 million worth of ETH to Coinbase Prime, a major institutional crypto custody and trading platform. This move suggests that the family is actively managing their holdings rather than merely holding for speculation.

Strategic investments and market Influence

Beyond direct acquisitions, WLF has launched a strategic token reserve aimed at stabilizing market volatility and investing in decentralized finance projects. This initiative reflects the Trump family's intent to play a pivotal role in the evolving DeFi landscape.

The family's involvement has also influenced market dynamics. Notably, Eric Trump publicly endorsed Ethereum, leading to a 25% surge in its price. Such endorsements underscore the impact of high-profile figures on cryptocurrency markets.

Ethical considerations and market impact

While the Trump family's investments have brought attention to Ethereum and the broader cryptocurrency market, they have also raised ethical questions. Critics express concerns over potential conflicts of interest, given the family's political influence and substantial financial stakes in the crypto sector. The intertwining of political positions with personal financial interests in cryptocurrencies like Ethereum has sparked debates about the propriety and implications of such engagements.

Why is the Trump family betting on Ethereum?

The Trump family’s Ethereum investment aligns with several bullish catalysts:

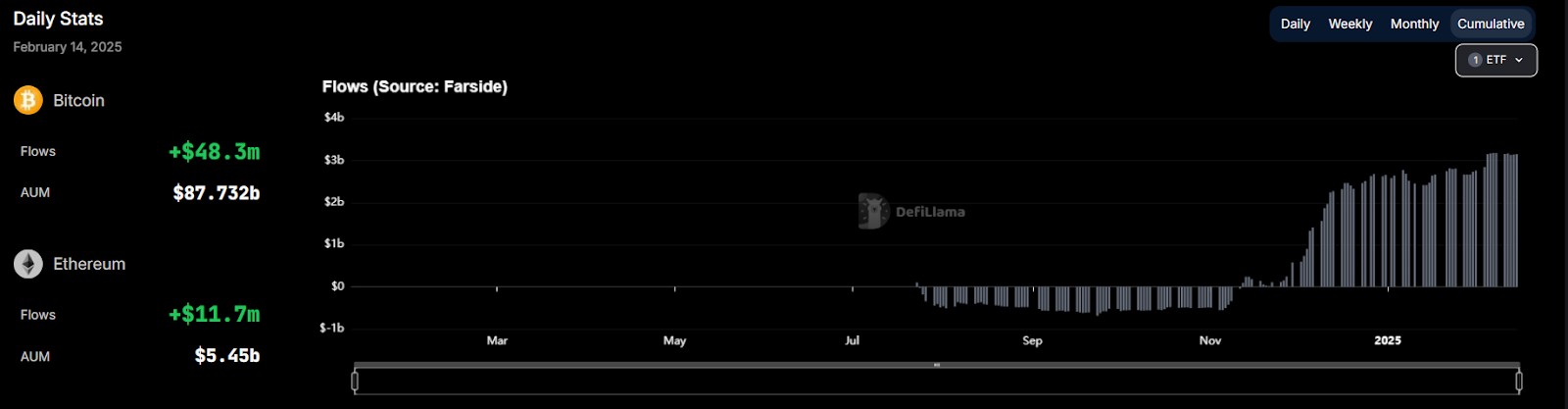

Ethereum ETF momentum. The approval of Ethereum ETFs has significantly increased institutional participation, making it easier for hedge funds, asset managers, and retirement funds to gain exposure to ETH. This institutional demand adds liquidity and stability to Ethereum's market. Additionally, ETFs reduce barriers for traditional investors who may have been hesitant to invest in crypto directly. Over time, this increased adoption could lead to stronger price support and long-term appreciation.

Smart contract dominance. The Trump family aims to leverage Ethereum's robust smart contract capabilities to promote decentralized finance solutions. WLF's mission includes promoting the widespread use of stablecoins and DeFi applications, particularly those that strengthen the U.S. dollar's position in the global financial system. By building on the Ethereum network, WLF seeks to capitalize on its established infrastructure and developer community to advance these initiatives.

Deflationary tokenomics. Ethereum’s burn mechanism, introduced through EIP-1559, reduces the total supply of ETH by permanently removing a portion of transaction fees from circulation. As network activity grows, more ETH is burned, creating a deflationary effect that could increase scarcity. With staking further reducing circulating supply, Ethereum's long-term value proposition strengthens. If demand remains steady or grows, this declining supply dynamic may contribute to sustained price appreciation.

Market Influence and public perception. Public endorsements from family members, such as Eric Trump, have also played a role in influencing market dynamics. For instance, Eric's positive remarks about Ethereum have been associated with notable price surges, indicating the impact of their public support on investor sentiment and market trends.

Political and economic ideology. The family's investment in Ethereum aligns with their broader political and economic goals. By embracing Ethereum and DeFi technologies, they aim to revolutionize traditional banking and finance, providing more equitable access to capital and promoting financial independence for Americans. This approach reflects a desire to modernize the financial system and reduce bureaucratic inefficiencies.

What this means for Ethereum’s price

When high-profile investors accumulate Ethereum, it signals broader market confidence. The Trump family’s aggressive accumulation, along with institutional Ethereum accumulation trends, could serve as a strong indicator that ETH’s price recovery is imminent. While some traders still ask, "Why is Ethereum not going up?" moves like these suggest the market is positioning for a future breakout.

With whales, institutions, and now political figures betting big on ETH, the question isn't, "Is Ethereum gonna go back up?" but rather, "How high will Ethereum go?"

Is Ethereum going to go back up? Bullish arguments for ETH recovery

Despite recent challenges, several factors suggest that Ethereum (ETH) may be poised for a resurgence:

1. Ethereum ETF approvals

The U.S. Securities and Exchange Commission's approval of multiple spot Ethereum exchange-traded funds (ETFs) in July 2024 marked a significant milestone. These ETFs, launched by major asset managers like BlackRock and Fidelity, provide traditional investors with easier access to ETH, potentially increasing demand and positively impacting its price.

2. Ethereum 2.0 and layer-2 solutions

The transition to Ethereum 2.0, culminating in "The Merge" in September 2022, shifted the network from proof-of-work to proof-of-stake, reducing energy consumption by 99%. Subsequent upgrades, such as the "Dencun" update in March 2024, have further improved scalability and reduced transaction fees. Layer-2 solutions like rollups also enhance transaction throughput and efficiency, making the network more attractive to users and developers.

3. Deflationary tokenomics

Ethereum's implementation of a fee-burning mechanism through EIP-1559 has introduced deflationary pressure on the supply of ETH. As network activity increases, more ETH is burned, potentially leading to a decrease in total supply over time, which could support price appreciation.

4. DeFi and NFT growth

Ethereum remains the leading platform for decentralized finance (DeFi) applications and non-fungible tokens (NFTs). The continued expansion of these sectors drives demand for ETH, as it is required for transaction fees and as collateral within various protocols.

In summary, the approval of Ethereum ETFs, ongoing network upgrades, deflationary mechanisms, and the growth of DeFi and NFTs contribute to a positive outlook for Ethereum. These developments suggest that Ethereum accumulation by investors could be a strategic move, anticipating potential price recovery and growth.

Is there any future in Ethereum? Long-term outlook

Ethereum's integration into traditional finance is gaining momentum. Major financial institutions are exploring blockchain solutions, with initiatives like the Enterprise Ethereum Alliance (EEA) leading the way. The EEA boasts over 200 member organizations, including industry giants such as J.P. Morgan, Mastercard, and Microsoft, all experimenting with private versions of Ethereum for enterprise purposes.

Smart contracts are at the forefront of this adoption, offering automation and efficiency across various sectors. In supply chain management, for instance, Ethereum-based smart contracts provide transparency and real-time updates, streamlining processes and reducing the need for intermediaries.

Analysts remain optimistic about Ethereum's future. The approval of Ethereum ETFs is expected to attract significant institutional capital, potentially enhancing market liquidity and reshaping perceptions of cryptocurrency as an asset class.

| Month | Minimum Price, $ | Average Price, $ | Maximum Price, $ |

|---|---|---|---|

| August 2025 | 2,870.58 | 3,189.53 | 3,508.48 |

| September 2025 | 2,899.29 | 3,221.43 | 3,543.57 |

| October 2025 | 2,928.28 | 3,253.64 | 3,579. |

| November 2025 | 2,957.56 | 3,286.18 | 3,614.8 |

| December 2025 | 2,987.14 | 3,319.04 | 3,650.94 |

Investor strategy: best approaches to capitalize on Ethereum’s market moves

Given the current market dynamics, investors might consider the following strategies:

Diversification. Allocating investments across various assets can mitigate risk.

Staking participation. Engaging in Ethereum staking can provide passive income, especially as staking becomes more accessible through ETFs.

Long-term perspective. Focusing on Ethereum's long-term potential rather than short-term price fluctuations may yield better returns.

We also recommend finding a reliable cryptocurrency exchange for trading Ethereum:

| Coins Supported | Demo | Min. Deposit, $ | Spot leverage | Spot Maker Fee, % | Spot Taker fee, % | Tier-1 regulation | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 329 | Yes | 10 | 1:10 | 0,08 | 0,1 | No | Open an account Your capital is at risk. |

|

| 278 | No | 10 | 1:5 | 0,25 | 0,4 | Yes | Open an account Your capital is at risk. |

|

| 250 | No | 1 | 1:3 | 0,25 | 0,5 | Yes | Open an account Your capital is at risk. |

|

| 72 | Yes | 1 | 1:5 | 0,1 | 0,2 | Yes | Open an account Your capital is at risk. |

|

| 1817 | No | No | No | 0 | 0 | No | Open an account Your capital is at risk. |

Influx of institutional money not only boosts market liquidity but also solidifies Ethereum

Ethereum's prospects for 2025 look bright, thanks to some key developments. The introduction of Ethereum ETFs has opened doors for big players in finance to get involved, making it easier for traditional investors to add ETH to their portfolios. This influx of institutional money not only boosts market liquidity but also solidifies Ethereum's standing as a credible investment.

Moreover, Ethereum's new mechanism that burns a portion of transaction fees is gradually decreasing the overall supply of ETH. As more people use the network, more ETH gets burned, which could make existing tokens more valuable over time.

If you're new to this and want to take advantage of these trends, consider a steady approach to building your Ethereum holdings. Rather than trying to predict market highs and lows, you might invest a set amount regularly — a strategy known as dollar-cost averaging. This can help smooth out the effects of market fluctuations and reduce the risk of investing a large sum at an inopportune time.

Additionally, look into staking your ETH. By doing so, you can earn rewards over time, increasing your total holdings. Staking not only offers potential financial gains but also plays a part in maintaining and securing the Ethereum network.

Conclusion

Ethereum has faced multiple hurdles, from regulatory roadblocks to increased competition from faster, more cost-effective blockchains. Despite these challenges, its long-term fundamentals remain strong. Institutional adoption is on the rise, Ethereum ETFs have opened doors to traditional investors, and the network's deflationary tokenomics continue to reduce supply over time. While short-term price movements may be unpredictable, Ethereum's role in decentralized finance (DeFi), NFTs, and smart contracts positions it as a core pillar of the blockchain ecosystem.

For investors, the key is to focus on Ethereum’s long-term potential rather than getting caught up in short-term volatility. Strategies like dollar-cost averaging, staking, and keeping an eye on whale accumulation trends can help maximize gains while mitigating risk. Whether Ethereum will reach new highs in 2025 depends on multiple factors, but its continued adoption and innovation suggest that it is far from losing relevance.

FAQs

Will Ethereum go up in 2025?

Ethereum has strong long-term potential, but its price depends on market conditions, regulations, and institutional demand.

Why is Ethereum not going up?

Ethereum faces challenges like Bitcoin dominance, regulatory uncertainty, network congestion, and rising competition from Solana and Avalanche.

Is Ethereum gonna go back up?

Whale accumulation, ETF approvals, and Ethereum 2.0 upgrades suggest ETH could recover, but short-term volatility remains.

Is there any future in Ethereum?

Yes, Ethereum’s role in DeFi, NFTs, and institutional finance ensures its long-term relevance in the crypto ecosystem.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.