What Is The Best Forex EA For MT4

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best Forex EA is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Unbiased decision making

- Rapid response to market opportunities

Top Forex EAs in 2025:

- Forex Flex Robot. Monthly: +3.85% (verified by MyFXbook)

- Athena. Monthly: +2.83% (verified by MyFXbook)

- FX Charger. Monthly: +13.19% (verified by MyFXbook)

- FX Fortnite. Monthly: +7.1% (verified by FXBlue)

- 1000 Pip Builder. Monthly: +9.9% (verified by MyFXbook)

- Prop Firm Ready. Monthly: +28.8% (verified by MQL Signals)

Achieving consistent success n automated trading solutions, particularly Forex Expert Advisors (EAs) for MetaTrader 4 (MT4).

These sophisticated tools promise to revolutionize trading strategies, but their effectiveness hinges on informed usage and a deep understanding of their mechanics, which is exactly what will be explored in this article.

Which is the best Forex EA?

Identifying the "best" Forex EA is a complex task, as it largely depends on individual trading goals, risk tolerance, and market conditions. However, certain EAs have garnered attention for their performance and reliability.

Disclaimer Please note: This is not financial advice. The following reviews are based on data and experiences shared by users and market analysts. Forex trading involves significant risk, and the performance of an EA can vary greatly depending on market conditions and other factors. It is crucial to conduct your own research and consider seeking advice from a financial advisor before investing.

The MetaTrader 4 platform hosts a variety of ForexEAs, each boasting unique features and strategies. We have compiled a list of some noteworthy EAs based on their performance history, user reviews, and technological sophistication. This review aims to provide insights into their functionalities, helping traders make informed decisions about which EA might align best with their trading strategy.

Forex Flex Robot: Praised for its versatility and customizable features.

EA Athena: Known for its advanced algorithms and adaptability to different market conditions.

FX Charger: Offers a balance of risk management and profitability, suitable for a range of trading styles.

Fortnite EA: Focuses on high-frequency trading, appealing to traders looking for quick, small gains.

1000 Pip Builder: Targets long-term consistency, ideal for traders with a preference for steady growth.

Prop Firm Ready: Designed for those looking to meet the requirements of proprietary trading firms.

Each of these EAs has its own set of strengths and areas of focus, catering to various aspects of Forex trading. In the following sections, we will delve into a detailed review of each EA, examining their key features, performance, and suitability for different trading objectives.

Forex Flex Robot

The Forex Flex Robot, featured on Forexflexea.com, is a highly versatile and customizable Expert Advisor for MT4 and MT5. It employs a unique "virtual trade" strategy to determine optimal entry points, enhancing precision in trading.

This EA is designed to be user-friendly and suitable for a variety of trading styles, offering numerous strategies and settings for customization.

Additionally, it includes features like automatic updates, a money management system, and a news filter. The Forex Flex Robot has garnered positive feedback for its performance and adaptability, making it a notable choice for traders seeking a reliable and flexible trading tool.

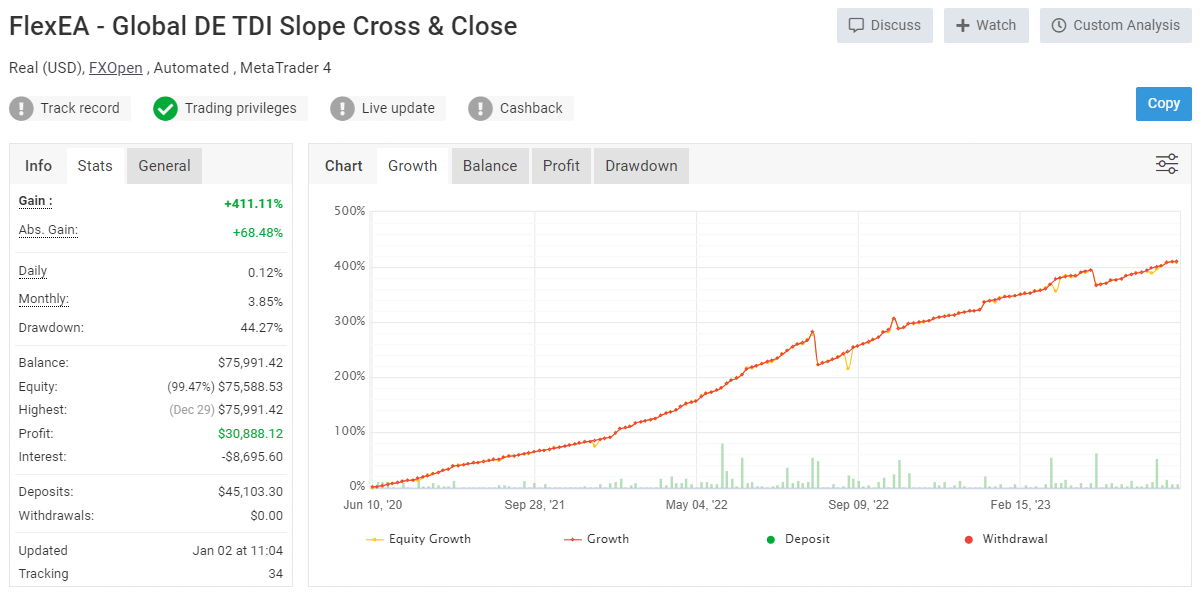

FlexEA Expert Advisor

FlexEA Expert AdvisorThe gains of 411% over roughly 3 years showcase both a high potential for profits and a strong level of consistency over time.

Athena

The Athena EA, offered by Elite CurrenSea, is a proprietary Expert Advisor for MetaTrader 4, notable for its grid trading method. Managed by a team including Chris Svorcik, the Head of Algo Trading, it focuses on the Forex market.

The Athena EA is designed to avoid closing a trading day at a loss, aiming for above-market returns through custom settings, reduced drawdown potential, and continuous monitoring. It boasts a targeted yearly net of 95% with an acceptable drawdown of 35%.

The Athena EA represents a blend of innovative algorithmic trading and risk management, aimed at delivering consistent performance in the Forex market.

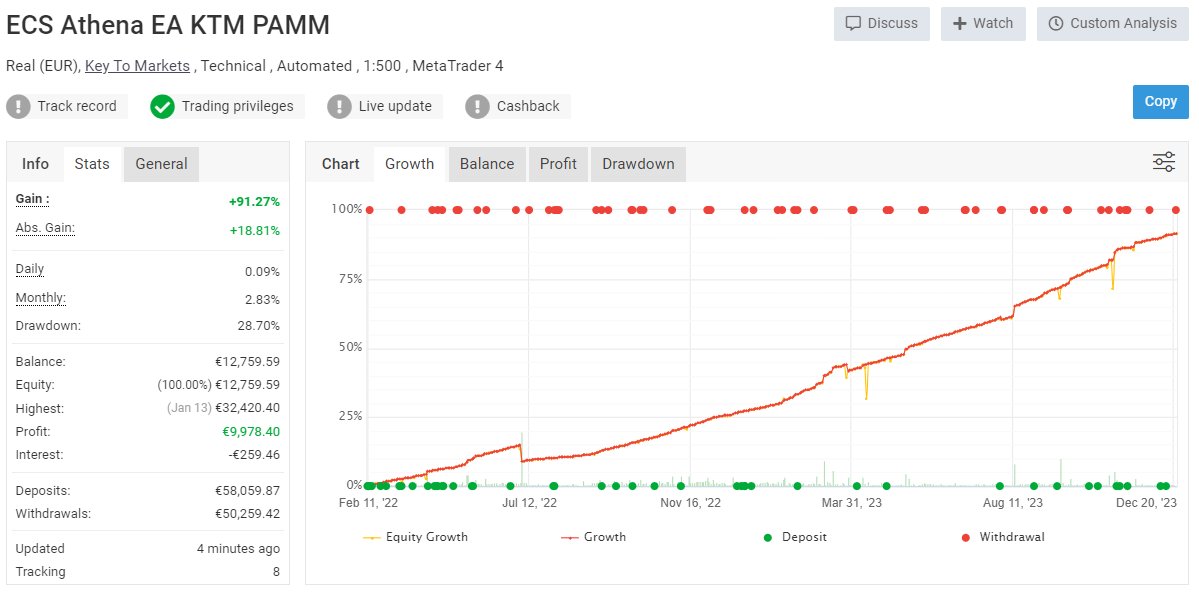

Athena Expert Advisor

Athena Expert AdvisorThe chart clearly shows substantial growth and an overall 91% gain from February 2023 to December 2023.

FX Charger

The FX Charger EA, available on the FX Charger website, is a sophisticated automated trading solution for the Forex market, compatible with both MT4 and MT5 platforms. It focuses on a daily trading strategy, incorporating an intelligent take-profit system to maximize gains while minimizing risks.

The EA is also equipped with an advanced stop-loss mechanism to safeguard user investments. Notably, the FX Charger has undergone continuous enhancements, including the introduction of new trading algorithms and the addition of more currency pairs like USD/CAD and USD/JPY. This development reflects its adaptability to varying market conditions and commitment to performance improvement.

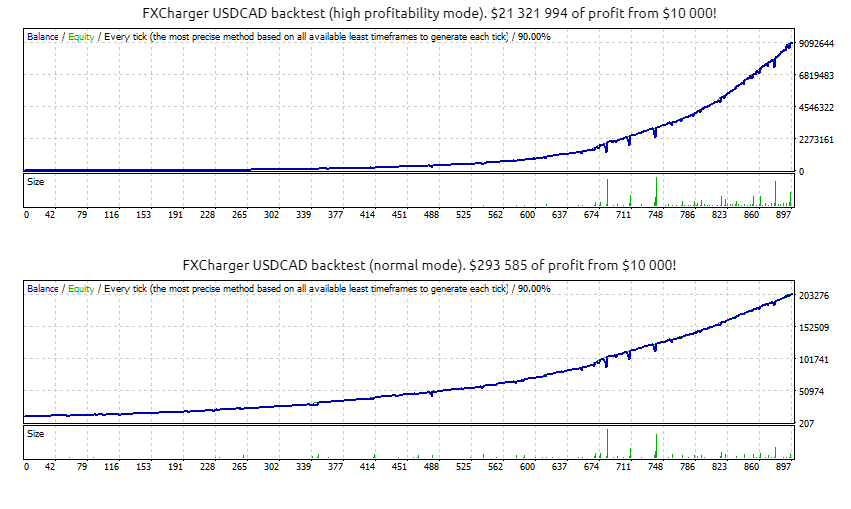

FX Charger Expert Advisor Testing

FX Charger Expert Advisor TestingThe image showcases two backtests using FXCharger for USD/CAD pair, one in high profitability mode and one in normal mode. As displayed in both cases, the returns were significant.

Fortnite

FX Fortnite is an automated Expert Advisor designed for MT4/MT5 platforms, primarily trading on the EUR/CHF pair. It employs a combination of trend and hedge strategies, offering settings for high, middle, and low-risk trading.

This EA aims to utilize market volatility to secure gains, providing flexibility for accounts as small as $10 on a cent account. It also emphasizes user-friendliness and 24/7 support services. FX Fortnite positions itself as a unique and powerful tool for the fast-paced Forex market, promising profitability and adaptability.

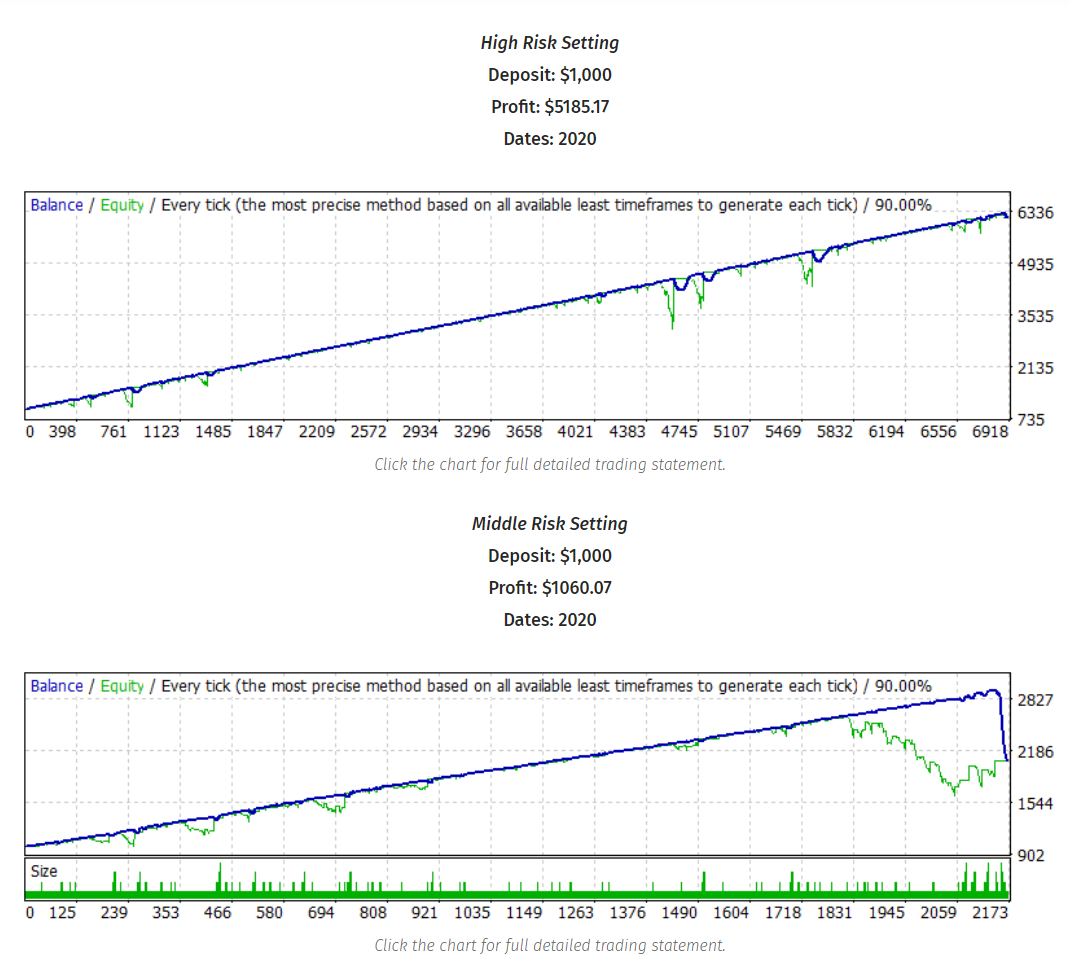

Fortnite Expert Advisor testing

Fortnite Expert Advisor testingThe image above displays Fortnite EA with two different settings; the high-risk and middle-risk setting. In both cases, the gains are consistent.

1000pip builder

The 1000 Pip Builder, managed by Bob James, offers a Forex signal service focused on providing high-quality, reliable trading signals. It caters to traders of various skill levels, with a strong emphasis on simplicity and education. The service prides itself on its transparent and verified performance records, adding an element of trustworthiness.

Additionally, the 1000 Pip Builder aims to assist traders in following professional trading strategies and improving their own trading skills. The approach combines practical trading guidance with educational support, making it a valuable resource for both novice and experienced Forex traders.

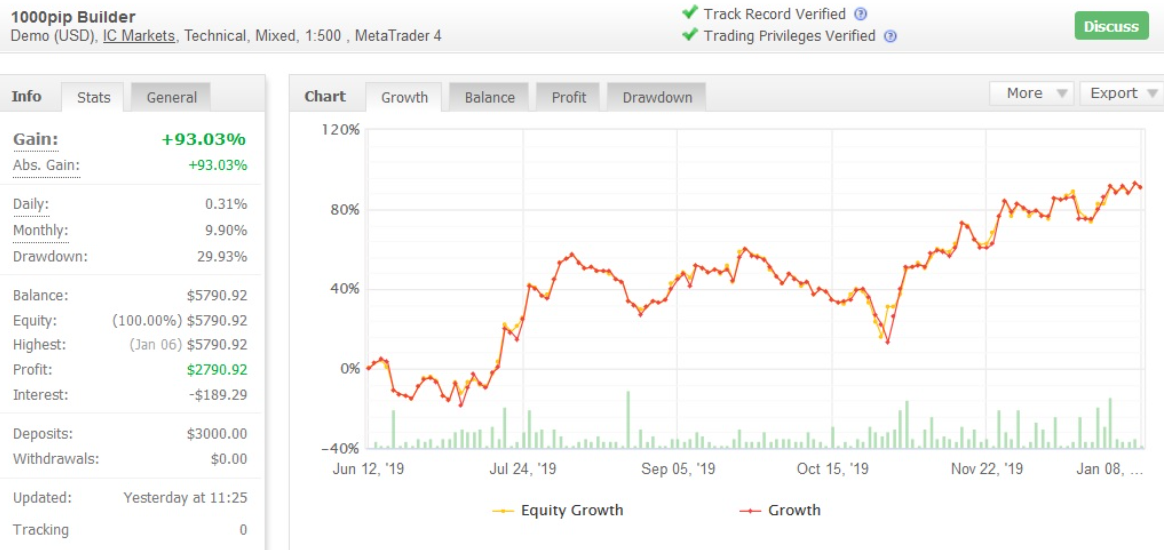

1000pip builder Expert Advisor

1000pip builder Expert AdvisorThe image displays gains of 93% in only 6 months. Although there are some short-term losses, the chart clearly shows that over time, the gains outweighed the losses.

Prop Firm Ready

The "Gold Trade Pro" EA, available under the name "Prop Firm Ready," distinguishes itself in the realm of Gold trading EAs by adopting a genuine trading strategy rather than common grid/martingale systems. Learn about how prop trading works in this article: What is Prop Trading? Top Pros and Cons

This strategy is particularly notable for its focus on trading based on daily support and resistance level breakouts, an approach well-suited to the volatility of the Gold market. Unlike systems that rely on risky strategies and often produce misleading backtests, Gold Trade Pro emphasizes a more stable, realistic growth curve with its seven integrated strategies.

It's designed with specific risk management features, including set take profit (TP) and stop loss (SL) for each trade, and a trailing SL to optimize risk and returns. The EA is recommended for the XAUUSD/GOLD pair on a daily timeframe and is suitable for accounts starting from $200. It's also advised to conduct backtesting and begin with a demo account to familiarize oneself with its performance.

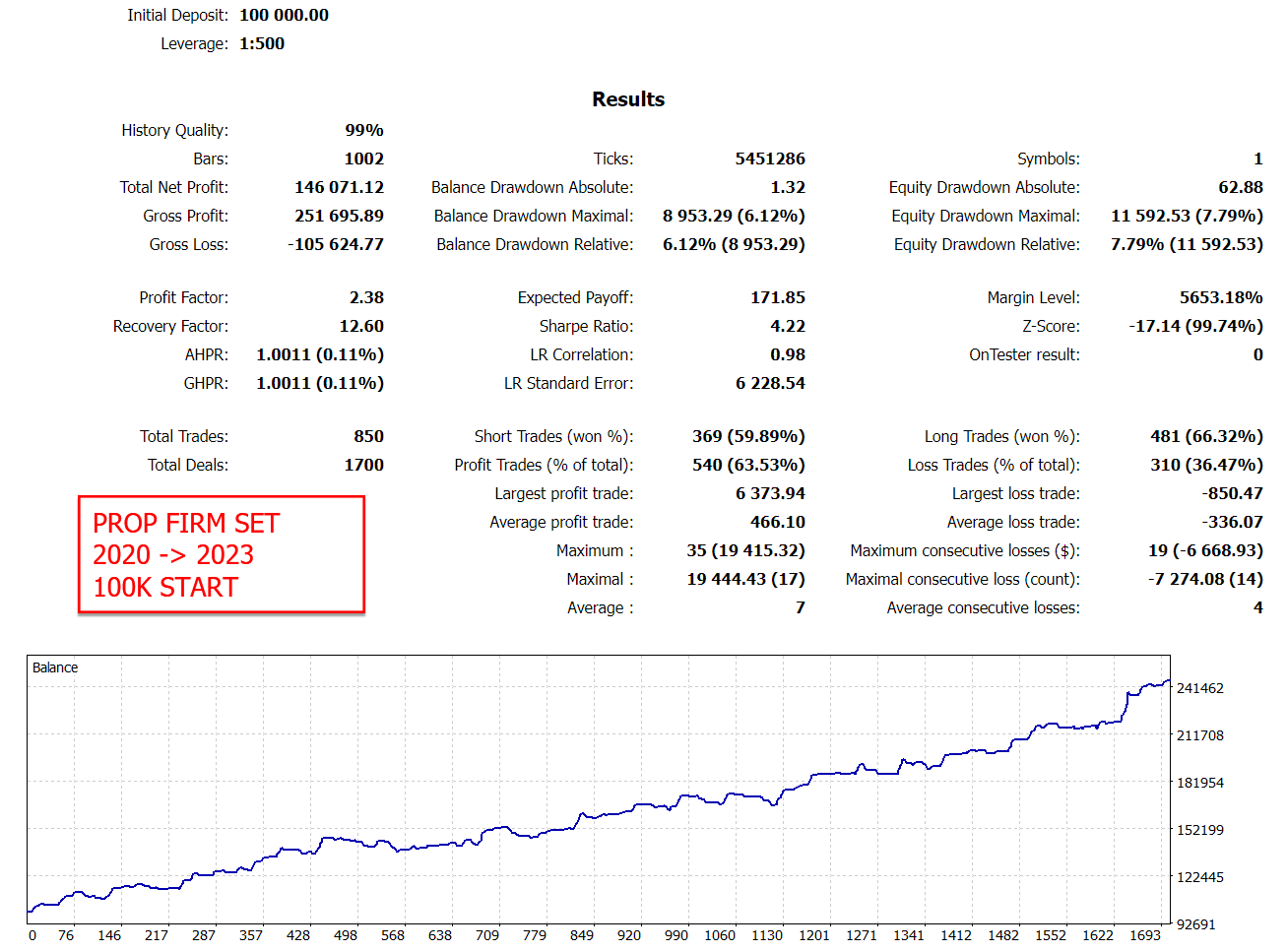

Prop Firm Ready EA

Prop Firm Ready EAThe image showcases all the relevant statistics, such as total net profit, profit factor, total trades, etc. In addition, we can also see the increase in balance, reflecting the efficacy of this EA.

What are the best Forex platforms for EAs?

The best Forex platforms for Expert Advisors (EAs) are those that provide a combination of low ECN spreads on EUR/USD, a robust trading platform like MT5 or cTrader, seamless API integration, and full support for trading bots (EAs). Additionally, these platforms should offer free VPS to ensure uninterrupted trading and an easy account opening process to get started quickly. These features are essential for optimizing the performance and efficiency of automated trading strategies.

| Plus500 | Pepperstone | OANDA | |

|---|---|---|---|

|

ECN Spread EUR/USD |

No | 0,1 | 0,15 |

|

Trading platform |

Mobile, Web, Desktop | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 |

|

API integration |

No | Yes | Yes |

|

Trading bots (EAs) are allowed |

Yes | Yes | Yes |

|

Free VPS |

No | Yes | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

How to use Forex EA for MT4

MetaTrader 4, a widely acclaimed trading platform, offers fertile ground for deploying Forex EAs, automated systems designed to execute trades. To leverage these tools effectively, it is crucial to understand their operation and integration with MT4. Here, a blend of technical proficiency and strategic insight is essential.

The following steps outline how to use Forex EAs for MT4:

Download and Unzip the EA Files: After acquiring the EA, unzip the files to access the program.

Copy the EA Files to Your MT4 Terminal: Move the EA files to the appropriate folder in your MT4 directory.

Check Your EA Settings: Ensure that the EA settings are configured according to your trading strategy. This may include parameters such as lot size, risk management, and other specific trading rules.

Enable Autotrading: In MT4, the " Autotrading" option must be enabled for the EA to execute trades automatically.

Adjust Other Parameters: Depending on the EA, you may need to set other parameters such as stop loss, take profit, and trading hours.

Activate the EA on a Chart: Drag the EA from the Navigator panel onto the chart of the financial instrument you want to trade.

Monitor the EA: Once the EA is running, monitor its performance and be prepared to troubleshoot any issues that may arise.

With the right elements in place, traders can harness the full potential of Forex EAs, turning them into powerful allies in their pursuit of trading excellence.

Pros and cons of using EA for MT4

- Pros

- Cons

- Automated Trade Execution: Forex EAs operate independently, executing trades without the need for constant trader oversight. This automation ensures that the trading strategy is consistently applied, freeing traders from the necessity of continuous monitoring.

- Enhanced Time Efficiency: Forex robots give traders the ability to manage multiple strategies and assets at once, freeing them up to focus on strategic refinement rather than the minutiae of trade execution.

- Swift Action on Market Opportunities: One of the strengths of Forex robots is their ability to act immediately based on predefined criteria. This rapid response is crucial in a market where timing can mean the difference between profit and loss.

- Objective Decision Making: Forex EAs remove the emotional biases often associated with human trading. Decisions made devoid of emotions like fear or greed tend to be more consistent and potentially more profitable.

- Limited Scope in Analysis: While adept at technical analysis, Forex EAs may not effectively incorporate fundamental market changes. Economic events or decisions by market movers can sometimes be overlooked, impacting trading outcomes.

- Risk Management Challenges: Inadequate understanding of the Forex EA's mechanics or poor risk management settings can lead to significant financial losses. It's crucial for traders to have a firm grasp of their EA’s operation.

- Potential for Technical Failures: No system is foolproof, and Forex robots are susceptible to technical glitches or malfunctions. These issues can result in missed trading opportunities or mismanaged trades.

- Risks of Over-Automation: In certain market conditions, excessive reliance on automation can be detrimental. Human traders are sometimes better equipped to recognize subtle market nuances, which can be crucial for making informed trading decisions in complex scenarios.

Best Forex Brokers To Work With EAs

How to find your best Forex EA

Choose a Reliable Broker:

For algotrading, the reliability of a broker is paramount. Ensure the broker has a history of providing quality quotes. One such recommended broker is RoboForex, known for its credibility and robust trading environment (you can find more information in our RoboForex Review 2025). Additionally, utilizing the built-in market of Expert Advisors on trading platforms can offer a plethora of options for automated trading.Understand the Limitations of Historical Testing:

Historical test results do not guarantee future profits. Market conditions are dynamic, and past performance cannot always predict future results. Algotraders must be aware of this and use historical data as a guide rather than a definitive forecast.Implement Robust Risk Management:

Effective risk management is crucial. This includes avoiding strategies like Martingale, which can exponentially increase risk. Understanding the impact of slippages and commissions on trading performance is also vital. These tools help in mitigating losses and protecting capital.Beware of Scammers:

The Forex market, like any financial market, is not immune to scams. Algotraders should be vigilant and research thoroughly. To learn more about Forex scammers and how to avoid them, especially in platforms like Telegram, refer to our article, How do Forex Scammers Work in Telegram?Diversify Your Portfolio:

Diversification is key in trading. Create a portfolio with different types of EAs across various markets. This approach helps spread risk without being overly dependent on a single strategy or market condition. Multiple Expert Advisors (EAs) enable traders to deploy various automated trading strategies simultaneously, enhancing their ability to navigate different market conditions and asset classes. By running multiple EAs on platform like MetaTrader 4 traders can diversify their trading approaches, mitigating risk and optimizing performance.Leverage AI Technology:

Consider using AI technologies like ChatGPT or other AI tools to build or enhance your trading bot. AI can analyze vast amounts of data and recognize patterns that might be invisible to human traders, offering a significant edge in trading.

These tips for algotraders are designed to guide you in finding the best Forex EA suited to your trading style and goals, emphasizing the importance of research, risk management, and the use of advanced technology in today's trading landscape.

Conclusion

Expert Advisors (EAs) offer a blend of efficiency and strategy in Forex trading. However, finding the best EA requires careful consideration of one's trading objectives, risk tolerance, and market conditions.

Remember, no EA guarantees success, and the importance of a balanced approach, including thorough research, risk management, and technological leverage, cannot be overstated. As the Forex market evolves, so should the strategies and tools used by traders to navigate it successfully.

FAQs

What is the best Expert Advisor for MT4?

The best Expert Advisor for MT4 depends on individual trading preferences and goals. Popular choices include Athena, Forex Flex Robot, and FX Charger, each with unique features suited to different trading strategies.

Does an EA work on Forex trading?

Yes, EAs (Expert Advisors) work on Forex trading. They are automated trading systems designed to execute trades based on predefined criteria without the need for constant human intervention.

Can I use MT4 without a broker?

MT4 requires a connection to a broker to execute trades. While you can use MT4's various tools and charts without a broker, actual trading cannot be done independently of a brokerage account.

Is EA good for Forex?

EAs can be beneficial for Forex trading as they automate the trading process, reduce emotional decision-making, and can operate 24/7. However, their effectiveness depends on the quality of their algorithm and the trader's understanding of their operation and market conditions.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.